Professional Documents

Culture Documents

Play Time Toy Financial Analysis

Uploaded by

chungdebyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Play Time Toy Financial Analysis

Uploaded by

chungdebyCopyright:

Available Formats

Play Time Toy Company

Maria Lorena Adum Deby Maritza Chung Xing Yanghao1

Financial Analysis

18/04/2011

Exchange student from HKUST

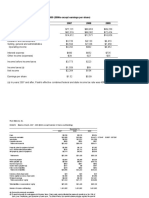

Introduction By switching from seasonal to level production, Jonathan King can adapt Play Time Toy Companys production to a more smooth production plan without causing significant up and down movements. At first, it seems to be a good idea because under a level production schedule there is no need to wait for clients to make orders. Idle time during slack seasons could be fully utilized to bring down the opportunity cost. Most importantly, there would be a considerable amount of savings from training temporary workers and repairing overloaded machines during peak seasons. However, risks under level production should not be ignored. As level production indicates, production occurs before real sales take place. If the company were to apply such policy, it should demonstrate enough confidence that all the products added to inventory during the low-sales season are to be fully digested when demand flourishes, that is in peak seasons. If this is not the case, there would be a serious issue of inventory hoarding, and the company could be facing liquidity crisis in no time. Also, the cost of storage needs to be taken into consideration, and if it is an influential figure, we should think twice whether to implement level production. Under seasonal production, in 1991 Play Time Toy Company would need around $6 million to support its operations (see Appendix 1). Mr. King assured that Bay Trust Company would be willing to extend a credit line of up to 1.9 million, this accounts for an approximate of one third of the credit needed. If Play Time Toy Company were to change its production plan, and if in order to do so it required a higher amount of credit, it may not be feasible to change it due to a limitation on credit. Comparison of Seasonal and Level Production Relevant financial reports have been generated under two kinds of assumptions, seasonal and level production. By comparing relatively the income statements, we find that level production would double the amount of net profit through a significant decline in COGS (cost of goods sold). Less maintenance cost of machines and overtime payment has brought down the COGS rate from 70% to an average of 65.16%. However, a storage cost of $100,000 has to be included in the operating cost of level production because of the accumulation of inventory, but this cost is not influential compared with the huge benefit of COGS savings. If we look closer into the DuPont analysis, under level production, ROS (return on sales) almost doubles, while an outstanding increase in ROA (return on assets) and ROE (return on equity) occurs. Meanwhile, turnover ratio stays the same with leverage ratio going down slightly from 1.50 to 1.40 (see Appendix 2). Level production also enlarges the asset scale brought by an expansive accumulation of inventory. The production level is supported by an increase in the amount of debt, although debt ratio relatively decreases. If the company were to follow seasonal production, an amount of $6 million would be needed; on the other hand, the pro forma balance sheet and the short term financial needs both show that if the company followed level production, the amount of credit needed would increase to an approximate of $18 million. That is, almost 3 times the credit needed under seasonal production and approximately 10 times the credit limitation set by Bay Trust Company. Such increase would not make negotiations easy for Play Time Toy

Company, and the company would have to look for other sources of financing. As the peak season arrives, so will the urgent need of credit to sustain operations in the company. Under level production, the amount of accounts receivable would increase significantly along with the need of credit during peak season. Accounts receivable would vary from a starting point of less than $1,000,000 to a sudden increase of more than $4,000,000. Play Time Toy Company would face the problem of collecting cash from its customers to pay back the debts and hold on its liquidity. Historical data indicates that customers would pay after 60 days, and the balance sheet of 1990 shows that the average collection time is even !/!!"# !,!"#!"# more, up to 127.28 days (!"# !"#$% = !,!"" = 127.28). If the company were to make no

improvement or any adjustment in its policies, it would soon face inventory hoarding plus the accumulation of accounts receivable, which would raise a liquidity issue (see Graph 1).

Graph 1: Inventory, Accounts Receivable and Cash under level production

Play Time Toy Company Financial Analysis Looking at the companys results, we can see that its profit margin varying from 4.35%, 1.19% to 3.28% respectively in 1988, 1989 and 1990 (see Appendix 2). Based on these positive figures we can conclude that the company is making profit, but not a steady one as 1989 shows a huge decline in profit margin. The condensed income statements show operating expenses growing steadily from 1988 to 1989 and 1989 to 1990, but sales vary remarkably. From 1988 to 1989 the incremental rate is 14.47%, while from 1989 to 1990 sales grows at 24.92%, a difference of more than 10% (see Appendix 2). Thus in this term we can say that sales uncertainty is causing an unpredictable movement of future profit. Through the analysis of historical data, we discovered that the average profit margin of the company is around 2.94%, while the SD (standard deviation) is 1.60%. The coefficient of variation generated from these two results by using SD divided by mean is 54.56%, which indicates that variation in sales is so large that it influences more than half of the companys profit margin. We can conclude that Play Time Toy Company faces a risk of market volatility that should not be ignored. The assumption of predictable and stable

demand under level production is contradicted by the financial situation of the company, where sales vary strongly. Whats more, according to the detailed descriptions of the plastic toys, there are a lot of negative factors that may threat the survival of companies in this industry. Low entry barriers and low technology involvement allow a big amount of competitors. Price war is likely to take place and product life is short with numerous fad products that can only be sold out within a restriction of several months. On the other side, demand for products fluctuates due to the temporal public affection towards them. Therefore, sales and profit margin are drawn to jump fiercely from year to year, and from this context, a level production plan would bring in fatal problem. Play Toy Company would get a severe strike if, say, the real seasonal demand of 1991 is much smaller than what has been projected. Then the company would face significant hoarding of inventory and low liquidity, putting its survival to the edge of bankruptcy. Bay Trust Company Mr. King should be aware that it is unlikely that Bay Trust Company will agree on a credit loan that can satisfy the needs of the change in the production plan to level production. As mentioned before, the total amount pended is too high compared with the credit limitation (18 million vs. 1.9 million). Also, judging from industrial background and the possible projection of Play Time, its operations would be confronted with severe liquidity problems due to the uncertainty of market demand and its inefficient collection of customer money. Recommendation Based on the analysis on the company, we can see that there is a tradeoff between higher return and liquidity. Seasonal production saves storage costs but implies higher production costs. However, since it is based on order-and-produce model, the production can be adjusted with more flexibility to changes in market demand, thus reducing the risk of inventory accumulation and increasing liquidity. Under seasonal production the amount of total credit needed for 1991 operations $6 million is significantly lower compared to the credit needed under level production 17 million. Therefore, it would be better for Play Time to continue with the current production plan. The specific attribution of toymanufacturing industry makes it arduous to implement the level production. Still, some modifications can be applied to increase the profitability of the company. First of all, Play Time Toy Company can classify its clients into several groups. For those with long-term solid business relationships, it is feasible to apply level production since the demand is very steady. However, for those new clients or orders of fad toys, it is better to continue implementing seasonal production. If Play Time Toy Company were to implement level production, it needs to invest in marketing to fight against market demand fluctuations, so that it can be more capable of selling out its inventories. In conclusion, it is not appropriate for Mr. King to switch the companys production plan to level production, at most, it just needs a partial adjustment to improve its ROA, but not a thorough change that can put the company at a higher risk position.

You might also like

- Play Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)Document12 pagesPlay Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)cpsharma15No ratings yet

- Play Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Document16 pagesPlay Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Brian Balagot100% (3)

- PLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEDocument15 pagesPLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEjtang512100% (3)

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaNo ratings yet

- Polar SportsDocument7 pagesPolar SportsShah HussainNo ratings yet

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Polar SportDocument4 pagesPolar SportKinnary Kinnu0% (2)

- Polar Sports Inc.Document4 pagesPolar Sports Inc.Talia100% (1)

- Consolidated Income and Cash Flow StatementsDocument30 pagesConsolidated Income and Cash Flow StatementsrooptejaNo ratings yet

- Surecut Shears, Inc.: AssetsDocument8 pagesSurecut Shears, Inc.: Assetsshravan76No ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Dhahran RoadsDocument5 pagesDhahran Roadssumit_bhagat_440% (5)

- Polar Sports Level Production AnalysisDocument15 pagesPolar Sports Level Production Analysisjordanstack0% (1)

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Flash Memory IncDocument7 pagesFlash Memory IncAbhinandan SinghNo ratings yet

- Polar Sports, IncDocument15 pagesPolar Sports, IncJennifer Jackson91% (11)

- Polar SportsDocument15 pagesPolar SportsjordanstackNo ratings yet

- Hampton Machine Tool CompanyDocument2 pagesHampton Machine Tool CompanySam Sheehan100% (1)

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersenkay12100% (3)

- Pacific Grove Spice Company SpreadsheetDocument7 pagesPacific Grove Spice Company SpreadsheetAnonymous 8ooQmMoNs10% (1)

- Polar SportsDocument9 pagesPolar SportsAbhishek RawatNo ratings yet

- Hilton Case1Document2 pagesHilton Case1Ana Fernanda Gonzales CaveroNo ratings yet

- SCOTTDocument20 pagesSCOTTOliviaNo ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- Polar Sports: Where Does Polar Sports Fit in The Course?Document21 pagesPolar Sports: Where Does Polar Sports Fit in The Course?Hugo100% (1)

- Financial Management Case Study of O.M. Scott & Sons Company (YP50BDocument3 pagesFinancial Management Case Study of O.M. Scott & Sons Company (YP50BMurni Fitri FatimahNo ratings yet

- Jackson Automotive Systems ExcelDocument5 pagesJackson Automotive Systems Excelonyechi2004No ratings yet

- 128,000 forecasted sales in 2012Document8 pages128,000 forecasted sales in 2012chopra98harsh3311100% (4)

- Pacific Grove Spice CompanyDocument7 pagesPacific Grove Spice CompanySajjad Ahmad100% (1)

- Pacific Grove Spice's acquisition of High Country Seasonings and TV show sponsorshipDocument9 pagesPacific Grove Spice's acquisition of High Country Seasonings and TV show sponsorshipdiddiNo ratings yet

- 454K Loan for Cartwright Lumber CoDocument5 pages454K Loan for Cartwright Lumber CoRushil Surapaneni50% (2)

- Lecture 7-Toy WorldDocument5 pagesLecture 7-Toy Worldonlyur44100% (2)

- Pacific Grove Spice Company Case Write UpDocument3 pagesPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- PGSC Debt obj. income statement ratios 2006-2010Document68 pagesPGSC Debt obj. income statement ratios 2006-2010Jose Luis ContrerasNo ratings yet

- Uncle Grumps' Budgeting ChallengesDocument17 pagesUncle Grumps' Budgeting Challengesmanya100% (1)

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionCharleneNo ratings yet

- Toy World - ExhibitsDocument9 pagesToy World - Exhibitsakhilkrishnan007No ratings yet

- Flash Memory Income Statements 2007-2009Document10 pagesFlash Memory Income Statements 2007-2009sahilkuNo ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Sure CutDocument37 pagesSure Cutshmuup1100% (4)

- Jones Electrical Line of Credit DecisionDocument6 pagesJones Electrical Line of Credit DecisionShak Uttam100% (2)

- New Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceDocument5 pagesNew Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceRahul LalwaniNo ratings yet

- The Case Solution of AES Tiete: Expansion Plant in BrazilDocument19 pagesThe Case Solution of AES Tiete: Expansion Plant in BrazilParbon Acharjee0% (1)

- Polar Sports X Ls StudentDocument9 pagesPolar Sports X Ls StudentBilal Ahmed Shaikh0% (1)

- Jackson Auto Motives ReportDocument12 pagesJackson Auto Motives ReportNajat Muna100% (1)

- Case Analysis Toy WorldDocument11 pagesCase Analysis Toy WorldNiketa Jaiswal100% (1)

- Caso Jackson Automotive SystemDocument7 pagesCaso Jackson Automotive SystemDiego E. Rodríguez100% (2)

- Butler Lumber Company Financials 1988-1991Document7 pagesButler Lumber Company Financials 1988-1991Sam Rosenbaum100% (1)

- Toy World 2014 JPSDocument14 pagesToy World 2014 JPSp13tejpNo ratings yet

- Toy World Inc. Case AnalysisDocument6 pagesToy World Inc. Case AnalysisAnonymous EBlYNQbiMyNo ratings yet

- Higgins Chapter 2 Problems Solutions PDFDocument11 pagesHiggins Chapter 2 Problems Solutions PDFJaninelaraNo ratings yet

- 1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesDocument2 pages1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesJane SmithNo ratings yet

- PolarSports Solution PDFDocument8 pagesPolarSports Solution PDFaotorres99No ratings yet

- Star River Electronics.Document5 pagesStar River Electronics.Nguyen Hieu100% (3)

- Toy World Inc. Financial AnalysisDocument10 pagesToy World Inc. Financial AnalysisHàMềm100% (1)

- Greenlight Q1 15Document6 pagesGreenlight Q1 15marketfolly.com100% (2)

- Working with Financial Statements MCQsDocument89 pagesWorking with Financial Statements MCQskwathom1100% (2)

- DuPont Analysis On JNJDocument7 pagesDuPont Analysis On JNJviettuan91No ratings yet

- Research Methods 2021Document44 pagesResearch Methods 2021DallendysheNo ratings yet

- JAIIB Capsule PDF Paper 4 RBWM New Syllabus Ambitious Baba PDFDocument208 pagesJAIIB Capsule PDF Paper 4 RBWM New Syllabus Ambitious Baba PDFPoorna chandranNo ratings yet

- Blockbuster Strategy PresentationDocument26 pagesBlockbuster Strategy PresentationJMcDon1007100% (1)

- Babson Classic Collection: Starbucks CorporationDocument18 pagesBabson Classic Collection: Starbucks CorporationgogojamzNo ratings yet

- 2002 Financial Analysis in Excel (QuickBooks DataDocument6 pages2002 Financial Analysis in Excel (QuickBooks DataYL GohNo ratings yet

- Accor Financial Analysis Reveals Strengths and OpportunitiesDocument32 pagesAccor Financial Analysis Reveals Strengths and OpportunitieshuzhuoNo ratings yet

- Financial Applications For Eicher Motors PDFDocument43 pagesFinancial Applications For Eicher Motors PDFLogesh KumarNo ratings yet

- Engy Samy OthmanDocument11 pagesEngy Samy OthmanEngy SamyNo ratings yet

- Principles of Finance and Balance Sheets of Engro Chemical Pakistan LimitedDocument59 pagesPrinciples of Finance and Balance Sheets of Engro Chemical Pakistan Limitedsazk07No ratings yet

- IDX LQ45 February 2017Document187 pagesIDX LQ45 February 2017pohoNo ratings yet

- Tax Equity Financing and Asset RotationDocument38 pagesTax Equity Financing and Asset RotationShofiul HasanNo ratings yet

- Universal Robina Corporation FsDocument21 pagesUniversal Robina Corporation FsPierre100% (1)

- Financial Ratio Analysis Infosys PresentationDocument44 pagesFinancial Ratio Analysis Infosys PresentationSushanth VarmaNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisKana jillaNo ratings yet

- FIN 254 ASSIGNMENT PROJECT: RATIO ANALYSIS OF UNILEVER, P&G AND RECKITT BENCKISERDocument42 pagesFIN 254 ASSIGNMENT PROJECT: RATIO ANALYSIS OF UNILEVER, P&G AND RECKITT BENCKISERMuntasir Sizan100% (1)

- GROUP ASSIGNMENT - FIN420 (Ratio Analysis) (Nestle Vs Dutch Lady)Document28 pagesGROUP ASSIGNMENT - FIN420 (Ratio Analysis) (Nestle Vs Dutch Lady)Zamil AimanNo ratings yet

- Fundamental Analysis WorkbookDocument4 pagesFundamental Analysis WorkbookMuaz saleemNo ratings yet

- Case 26 Star River Electronics - Group Thạch Trung Chương HiểnDocument12 pagesCase 26 Star River Electronics - Group Thạch Trung Chương HiểnTrương ThạchNo ratings yet

- PBRXDocument29 pagesPBRXMoe EcchiNo ratings yet

- Kapco LTD: For The Year Ended 2007Document10 pagesKapco LTD: For The Year Ended 2007Zeeshan AdeelNo ratings yet

- 3 Financial Reporting and Analysis QuestionsDocument74 pages3 Financial Reporting and Analysis QuestionsAishwarya BansalNo ratings yet

- Financial Analysis Harley DavidsonDocument5 pagesFinancial Analysis Harley DavidsonAyu Eka Putri50% (2)

- Accounting For Managers: Financial Statement Analysis ofDocument25 pagesAccounting For Managers: Financial Statement Analysis of21AD01 - ABISHEK JNo ratings yet

- Black BookDocument49 pagesBlack BookKiran PatilNo ratings yet

- Air Asia CompleteDocument18 pagesAir Asia CompleteAmy CharmaineNo ratings yet

- What Are The Best Stocks To Invest in India For 2017 - QuoraDocument94 pagesWhat Are The Best Stocks To Invest in India For 2017 - QuoraAchint KumarNo ratings yet

- Single 287967086580186410492Document13 pagesSingle 287967086580186410492carlNo ratings yet

- Fsa - Formula SheetDocument2 pagesFsa - Formula SheetJustine JacksonNo ratings yet