Professional Documents

Culture Documents

Microecon Chapter Three Notes

Uploaded by

VictoriaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microecon Chapter Three Notes

Uploaded by

VictoriaCopyright:

Available Formats

Chapter Three: The Economy: Myth and Reality

The American Economy: A Thumbnail Sketch Inputs/Factors of Production: Labor, machinery, buildings, and natural resources used to make outputs. Outputs: Goods and services that consumers want to acquire. The United States has the biggest national economy on Earth because: We have a large population We are a very rich country. Our population is very productive in the production of goods and services. A Private Enterprise Economy Gross Domestic Product (GDP): The standard measure of the total output of an economy Americas success can be attributed to the fact that free markets and private enterprises flourish in America. Ex. Utility companies are privatized and not owned by the government like Russia. Direct government production of goods is rare in our society. They amount to about 11% of GDP A Relatively Closed Economy Open Economy: Exports and imports constitute a large share of its GDP Closed Economy: A country that does not trade with other nations in goods or assets Imports exceed exports in the U.S. $900 billion vs. $1000 billion The U.S. produces most of what we consume and consumes most of what we produce The U.S. does not important most products from other countries. Only 13% of U.S. GDP is imported A Growing EconomyBut with Inflation The U.S. economy gets bigger almost every year Must consider the population size and price inflation when graphing GDP growth. Must divide the real GDP by the size of the population to obtain real per capita GDP Bumps Along the Growth Path: Recessions Recessions: Some periods of declining economic activity A consequence in the ups and downs in economic growth is that unemployment varies greatly year to year. The American Workforce: Who is in it? The expanding role of women in the labor has grown from 29% in the 1950s to 46% of the workforce in 1999. It has raised many controversial questions such as: Are they discriminated against Maternity leave The American Workforce: What does it do? The majority of American workers produce services, not goods All industrial nations have become service economies. This has resulted because of an increased demand for labor by the service sector and reduced demand for manufacturing. The American Work Force: What it Earns Workers wages account for nearly three quarters of the income that the production process generates Average wage rate is $13 an hour for the U.S. and many other rich countries Capital and Its Earnings

The rest of the national income mainly accrues to the owners of capitalthe machines and buildings that make up the nations industrial plant

The Outputs: What does America produce? Consumer spending accounts for about 70% of GDP About 1/3 of the GDP goes for nonconsumption uses. Government services take up about 17% of GDP. Business purchases and industrial structures are about 12% Consumer purchases on homes is about 4% The Central Role of Business Firms About 80,000 businesses fail every year. However, the desire for riches entices Americans to start new businesses every year. Firms compete with other companies in their industry. Most economists believe that this competition is the key to industrial efficiency. Measuring Economic Progress The American economy has achieved progress through increased American labor productivity. The increase in productivity has allowed products such as computers, TVs, etc. to also decresase since we can make them more efficiently. Whats missing from the picture? Government Firms use their receipts from sales to pay employee wages and interest and profits to people who provide capital. These income flows, in turn, enable consumers to purchase the goods and services that companies produce. Government lies in the center of the circular flow. The traditional role of government in a free market economy revolves around five jobs: Providing certain goods and services such as national defense Levying taxes to pay for these goods and services Redistributing income Regulating business Making and enforcing laws The Government as Referee Congress and state/local legislators pass laws that define rules of the economic game Executive branches share a level of responsibility for enforcing them Courts interpret the laws and give a ruling to disputes The Government as Business Regulator The government must intervene in some parts of the free market economy in order to make it run effectively. Ex. Antitrust laws against monopolies Government Expenditures & Taxes in America Americans are among some of the least taxed people in the world Personal income tax federal governments biggest revenue source Payroll tax flat-rate tax on wages and salaries up to a certain limit Corporate income tax rest of federal revenue comes from here The Government as a Redistributor Transfer Payments: Sums of money that certain individuals receive as outright grants from the government rather than payments for services rendered

Progressive Taxation: A tax where the average tax rate is the same at all income levels Mixed Economies: One with some public influence over the workings of free markets. There may also be some public ownership mixed in with private property. In a market economy, people earn incomes according to what they have to sell

You might also like

- Cagayan de Oro Revenue Code of 2015Document134 pagesCagayan de Oro Revenue Code of 2015Jazz Adaza67% (6)

- Amul TransportDocument2 pagesAmul TransportCharles Wood83% (6)

- Public Economics - Part 1Document46 pagesPublic Economics - Part 1Roberta DGNo ratings yet

- Introduction To Public FinanceDocument32 pagesIntroduction To Public FinanceClaudine Aguiatan55% (11)

- (Chapter 2) Understanding Economics and How It Affects BusinessDocument6 pages(Chapter 2) Understanding Economics and How It Affects BusinessTommyArnzenNo ratings yet

- SAP PM Fiori AppsDocument16 pagesSAP PM Fiori AppsVijayaw Vijji100% (1)

- Customer Satisfaction Report on Peaks AutomobilesDocument72 pagesCustomer Satisfaction Report on Peaks AutomobilesHarmeet SinghNo ratings yet

- Paper 5 PDFDocument529 pagesPaper 5 PDFTeddy BearNo ratings yet

- Overview of Economic EnvironmentDocument33 pagesOverview of Economic EnvironmentRanju katochNo ratings yet

- Major Assignment #3Document17 pagesMajor Assignment #3Elijah GeniesseNo ratings yet

- Economic Factors that Impact Business PerformanceDocument33 pagesEconomic Factors that Impact Business PerformanceUdit Chauhan100% (2)

- Nations WealthDocument49 pagesNations WealthwomabaNo ratings yet

- Backup of Backup of Economics Lesson 23Document66 pagesBackup of Backup of Economics Lesson 23benicebronzwaer0No ratings yet

- Fundamental Principles of Public Finance: Next PageDocument60 pagesFundamental Principles of Public Finance: Next PageKiambisNo ratings yet

- Backup of Economic Readings SummaryDocument21 pagesBackup of Economic Readings Summarybenicebronzwaer0No ratings yet

- Using Supply and Demand: - Chapter 5Document93 pagesUsing Supply and Demand: - Chapter 5Aditi SinghNo ratings yet

- Session 16: Understanding Economics and How Its Affects BusinessDocument36 pagesSession 16: Understanding Economics and How Its Affects BusinessJennifer CarliseNo ratings yet

- Unit 13 Economic Fluctuations and UnemploymentDocument36 pagesUnit 13 Economic Fluctuations and Unemploymentzeus catNo ratings yet

- PROs and CONs of GlobalizationDocument30 pagesPROs and CONs of GlobalizationElaine Riñon100% (1)

- International BusinessDocument43 pagesInternational BusinessJames Carrel GolosindaNo ratings yet

- Chapter 1 MacroeconomicsDocument12 pagesChapter 1 MacroeconomicsIra Dale ValdezNo ratings yet

- Introduction to MacroeconomicsDocument35 pagesIntroduction to MacroeconomicsArjeune Victoria BulaonNo ratings yet

- Power Point Circular FlowDocument30 pagesPower Point Circular FlowRoselle Perez- Bariuan75% (4)

- Answers To ReviewDocument2 pagesAnswers To ReviewSara MolinaroNo ratings yet

- Economic Factors Impacting International BusinessDocument29 pagesEconomic Factors Impacting International BusinessRana Ankita100% (1)

- Stages of Development of EconomicsDocument37 pagesStages of Development of Economicsaditya mhatreNo ratings yet

- ECON 305 Lecture 1 Macroeconomy OverviewDocument26 pagesECON 305 Lecture 1 Macroeconomy OverviewKevin BaoNo ratings yet

- Module 1 MacroeconomicsDocument12 pagesModule 1 MacroeconomicsGagan H PNo ratings yet

- Political Environment and Economic SystemsDocument71 pagesPolitical Environment and Economic SystemsKaushik ShettyNo ratings yet

- Path To ProsperityDocument33 pagesPath To ProsperitySEIUOnline100% (2)

- 3 Major Types of Economic SystemsDocument21 pages3 Major Types of Economic SystemsShaira BartidoNo ratings yet

- Chapter 1 Introduction To MacroeconomicsDocument59 pagesChapter 1 Introduction To MacroeconomicsOrn Phatthayaphan67% (3)

- Measuring A Nation's IncomeDocument76 pagesMeasuring A Nation's Incomeمدرسة حوارة الاساسيةNo ratings yet

- US Economy SeminarDocument42 pagesUS Economy SeminarKsenia MakhyniaNo ratings yet

- Economic Factors Affecting International BusinessDocument25 pagesEconomic Factors Affecting International BusinesscooolashubNo ratings yet

- Macroeconomics Review: Mr. Remigio G. TiambengDocument25 pagesMacroeconomics Review: Mr. Remigio G. TiambengPamela EuniseNo ratings yet

- President Trump's Amazing AccomplishmentsDocument19 pagesPresident Trump's Amazing AccomplishmentsAnonymous QcqECkzChNo ratings yet

- Unit 2 Circular FlowDocument62 pagesUnit 2 Circular FlowAnshumaan PatroNo ratings yet

- Unit 2 Circular FlowDocument62 pagesUnit 2 Circular Flowk pradeepaNo ratings yet

- Week5 Monday SlidesDocument31 pagesWeek5 Monday SlidesSiham BuuleNo ratings yet

- Taxation and Government Intervention: Mark Jayson C. Agarin Dyrick Marl M. Mata Sherwin N. BeltranqtyDocument45 pagesTaxation and Government Intervention: Mark Jayson C. Agarin Dyrick Marl M. Mata Sherwin N. BeltranqtySherwIn BeltRanNo ratings yet

- Sher QTYhistoryDocument45 pagesSher QTYhistorySherwIn BeltRanNo ratings yet

- Eco EnvDocument23 pagesEco EnvJaved AliNo ratings yet

- Macro EconomicsDocument53 pagesMacro Economicsgetcultured69No ratings yet

- Notes - Chapter 3Document4 pagesNotes - Chapter 3Walaa Al-BayaaNo ratings yet

- It Deals With Three Key IssuesDocument4 pagesIt Deals With Three Key IssuesarunNo ratings yet

- Classification of BusinessesDocument13 pagesClassification of BusinessesBhoomi ShahNo ratings yet

- Chapter 2-2Document25 pagesChapter 2-2Tanner MelleNo ratings yet

- Lecture OneDocument9 pagesLecture OnejdnchsmNo ratings yet

- 4.1. Keynesianism NeoliberalismDocument45 pages4.1. Keynesianism NeoliberalismSimon GubbensNo ratings yet

- Blueprint For An America Built To LastDocument8 pagesBlueprint For An America Built To LastShawna ThomasNo ratings yet

- Blueprint For An America Built To LastDocument8 pagesBlueprint For An America Built To LastThe White HouseNo ratings yet

- Nature of MacroeconomicsDocument16 pagesNature of MacroeconomicsRegina LintuaNo ratings yet

- International Business - Unit 2 - Portion For ISA2Document29 pagesInternational Business - Unit 2 - Portion For ISA2KarthikNo ratings yet

- Canadas Economy Power PointDocument32 pagesCanadas Economy Power PointNisha ThalvarNo ratings yet

- Economics and Financial Accounting Module: By: Mrs - Shubhangi DixitDocument22 pagesEconomics and Financial Accounting Module: By: Mrs - Shubhangi DixitGladwin JosephNo ratings yet

- ch4 Government and The MacroeconomyDocument21 pagesch4 Government and The MacroeconomyNeeha KaziNo ratings yet

- Times Study Claims That The Clearest Winners of The TPPDocument8 pagesTimes Study Claims That The Clearest Winners of The TPPBharatShethNo ratings yet

- Understanding the Circular Flow of an Open EconomyDocument15 pagesUnderstanding the Circular Flow of an Open EconomyDJAY TIDO-KNo ratings yet

- Economic Environment in International BusinessDocument26 pagesEconomic Environment in International BusinessAshish kumar ThapaNo ratings yet

- Economic Challenges Facing Global and Domestic Business: Learning Goal SDocument25 pagesEconomic Challenges Facing Global and Domestic Business: Learning Goal Stqt10No ratings yet

- African Economies 2Document51 pagesAfrican Economies 2619254No ratings yet

- Gross Domestic ProductDocument18 pagesGross Domestic ProductABBAS ANo ratings yet

- IBT NotesDocument18 pagesIBT NotesCarlito DiamononNo ratings yet

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItFrom EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItNo ratings yet

- Microecon Chapter Fourteen NotesDocument3 pagesMicroecon Chapter Fourteen NotesVictoriaNo ratings yet

- CIS Microeconomics Exam ThreeDocument4 pagesCIS Microeconomics Exam ThreeVictoriaNo ratings yet

- Microecon Chapter Ten NotesDocument3 pagesMicroecon Chapter Ten NotesVictoriaNo ratings yet

- Microecon Chapter Seven NotesDocument2 pagesMicroecon Chapter Seven NotesVictoriaNo ratings yet

- Microecon Chapter Nine NotesDocument2 pagesMicroecon Chapter Nine NotesVictoria100% (1)

- Microecon Chapter Six NotesDocument2 pagesMicroecon Chapter Six NotesVictoriaNo ratings yet

- Microecon Chapter Twelve NotesDocument2 pagesMicroecon Chapter Twelve NotesVictoriaNo ratings yet

- Microecon Chapter Eight NotesDocument3 pagesMicroecon Chapter Eight NotesVictoriaNo ratings yet

- ROG BibliographyDocument2 pagesROG BibliographyVictoriaNo ratings yet

- Microecon Chapter Eleven NotesDocument3 pagesMicroecon Chapter Eleven NotesVictoriaNo ratings yet

- CIS Microeconomics Exam Two ReviewDocument4 pagesCIS Microeconomics Exam Two ReviewVictoriaNo ratings yet

- Microecon Chapter Thirteen NotesDocument3 pagesMicroecon Chapter Thirteen NotesVictoriaNo ratings yet

- Microecon Chapter Five NotesDocument3 pagesMicroecon Chapter Five NotesVictoriaNo ratings yet

- Microecon Chapter Four NotesDocument2 pagesMicroecon Chapter Four NotesVictoriaNo ratings yet

- CIS Microeconomics Exam One ReviewDocument5 pagesCIS Microeconomics Exam One ReviewVictoriaNo ratings yet

- CIS Microeconomics Exam One ReviewDocument5 pagesCIS Microeconomics Exam One ReviewVictoriaNo ratings yet

- Examen 3 Vocabulary NotecardsDocument21 pagesExamen 3 Vocabulary NotecardsVictoriaNo ratings yet

- Microecon Chapter One NotesDocument1 pageMicroecon Chapter One NotesVictoriaNo ratings yet

- CIS Examen 3 Study GuideDocument22 pagesCIS Examen 3 Study GuideVictoriaNo ratings yet

- Health Care Core Semester One ReviewDocument4 pagesHealth Care Core Semester One ReviewVictoriaNo ratings yet

- World History Conflagration NotesDocument2 pagesWorld History Conflagration NotesVictoriaNo ratings yet

- CIS Human Anatomy Exam One PART 2/2 Study GuideDocument7 pagesCIS Human Anatomy Exam One PART 2/2 Study GuideVictoria100% (1)

- World History Revolutions Study GuideDocument7 pagesWorld History Revolutions Study GuideVictoriaNo ratings yet

- World History Political Revolutions Lesson 3 ChartDocument2 pagesWorld History Political Revolutions Lesson 3 ChartVictoriaNo ratings yet

- World History Chapter 24 NotesDocument3 pagesWorld History Chapter 24 NotesVictoriaNo ratings yet

- World History Middle Ages (Unit 4) Study GuideDocument3 pagesWorld History Middle Ages (Unit 4) Study GuideVictoriaNo ratings yet

- World History 16.1-16.3 NotesDocument2 pagesWorld History 16.1-16.3 NotesVictoriaNo ratings yet

- World History Semester Two Self-TestDocument11 pagesWorld History Semester Two Self-TestVictoriaNo ratings yet

- World History Semester One Self-TestDocument11 pagesWorld History Semester One Self-TestVictoriaNo ratings yet

- Mba-Cm Me Lecture 1Document17 pagesMba-Cm Me Lecture 1api-3712367No ratings yet

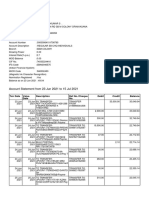

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- AdvancingDocument114 pagesAdvancingnde90No ratings yet

- APSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Document28 pagesAPSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Arvic LauNo ratings yet

- SGI Monthly Newsletter Title Under 40 CharactersDocument13 pagesSGI Monthly Newsletter Title Under 40 Charactersgj4uNo ratings yet

- Hotel Functions & Rooms Division GuideDocument6 pagesHotel Functions & Rooms Division GuideSean PInedaNo ratings yet

- MD - Nasir Uddin CVDocument4 pagesMD - Nasir Uddin CVশুভবর্ণNo ratings yet

- Human Right Note For BCADocument2 pagesHuman Right Note For BCANitish Gurung100% (1)

- Marketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDocument7 pagesMarketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDisha MathurNo ratings yet

- Managing Human Resources at NWPGCLDocument2 pagesManaging Human Resources at NWPGCLMahadi HasanNo ratings yet

- Sample Income StatementDocument1 pageSample Income StatementJason100% (34)

- Session 5Document2 pagesSession 5Angelia SimbolonNo ratings yet

- QSP 7.1. Control of Personnel (Preview)Document3 pagesQSP 7.1. Control of Personnel (Preview)Centauri Business Group Inc.No ratings yet

- Yuri Annisa-Olfa Resha - Int - Class - Financial StatementsDocument16 pagesYuri Annisa-Olfa Resha - Int - Class - Financial StatementsolfareshaaNo ratings yet

- Cyber Security Assignment - Patent BasicsDocument6 pagesCyber Security Assignment - Patent BasicsTatoo GargNo ratings yet

- Jesd 48 BDocument10 pagesJesd 48 BLina GanNo ratings yet

- 3.cinthol "Alive Is Awesome"Document1 page3.cinthol "Alive Is Awesome"Hemant TejwaniNo ratings yet

- Settlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFDocument4 pagesSettlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFkkka TtNo ratings yet

- SAVAYA The Martinez-Brothers PriceListDocument2 pagesSAVAYA The Martinez-Brothers PriceListnataliaNo ratings yet

- Analisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Document25 pagesAnalisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Fauzan C LahNo ratings yet

- Congson Vs NLRCDocument2 pagesCongson Vs NLRCDan Christian Dingcong CagnanNo ratings yet

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- New Ideas, Technologies To Support "Build, Build, Build": Position PaperDocument8 pagesNew Ideas, Technologies To Support "Build, Build, Build": Position PaperCloudKielGuiangNo ratings yet

- The Seven Stages of the Entrepreneurial Life CycleDocument17 pagesThe Seven Stages of the Entrepreneurial Life Cycleshruti latherNo ratings yet

- How industrial engineering can optimize mining operationsDocument6 pagesHow industrial engineering can optimize mining operationsAlejandro SanchezNo ratings yet