Professional Documents

Culture Documents

LIC Jeevan Vriddhi

Uploaded by

kirang gandhiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LIC Jeevan Vriddhi

Uploaded by

kirang gandhiCopyright:

Available Formats

www.fpindia.

in ( Financial planning in India )

LICs JEEVAN VRIDDHI (UIN: 512N268V01) LICs Jeevan Vriddhi is a single premium plan wherein the risk cover is a multiple of premium chosen by you. On maturity this plan offers a Guaranteed Maturity Sum Assured and Loyalty Addition, if any. 1. Benefits i) Death benefit: On death, Basic Sum Assured shall be payable. The Basic Sum Assured shall be 5 times the Single Premium excluding extra premium, if any. ii) Maturity Benefit: On maturity, the Guaranteed Maturity Sum Assured along with Loyalty Addition, if any, shall be payable. iii) Loyalty Addition: Depending upon the Corporations experience the policy will be eligible for Loyalty Addition on date of maturity at such rate and on such terms as may be declared by the Corporation. 2. ELIGIBILITY CONDITIONS AND OTHER RESTRICTIONS: a) b) c) d) e) Minimum Entry Age Maximum Entry Age Minimum Basic Sum Assured Maximum Basic Sum Assured Minimum Premium : 8 years (completed) : 50 years (nearest birthday) : Rs.150, 000/: No Limit : Rs. 30,000/-

Premium shall be available in multiples of Rs. 1,000/-. f) g) Policy Term Premium payment mode : 10 years : Single premium only

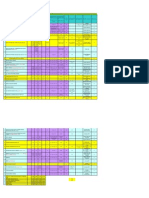

h) Guaranteed Maturity Sum Assured : The Guaranteed Maturity Sum Assured will depend on the single premium payable and the age at entry of the life to be assured. 3. GUARANTEED MATURITY SUM ASSURED: Guaranteed Maturity Sum Assured for each age at entry per Rs.100000/- Single Premium (exclusive of Service Tax) is as under:

www.fpindia.in ( Financial planning in India )

LIC Jeevan Vriddhi Entry age ( Inv.Rs.100000/-) Guaranteed Maturity Sum Assured After 10 years 198400.60/198200.10/197900.15/197500.55/197200.10/196800.90/196600.35/196400.05/196100.09/196000.00/195800.03/195600.80/195500.50/195400.40/195300.45/195200.65/195100.85/195000.95/194900.90/194800.55/194600.85/194400.55/194100.60/193700.70/193200.80/192700.00/192000.40/191200.85/190400.30/189400.60/188300.65/187100.20/185700.10/184100.45/182300.95/180300.90/Service tax 1.54% Annualised YieldAfter 10 years

8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43

101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/-

6.93% 6.92% 6.90% 6.88% 6.86% 6.85% 6.83% 6.82% 6.81% 6.80% 6.79% 6.78% 6.77% 6.77% 6.76% 6.76% 6.75% 6.75% 6.74% 6.73% 6.73% 6.71% 6.70% 6.68% 6.65% 6.62% 6.58% 6.54% 6.49% 6.44% 6.37% 6.30% 6.22% 6.13% 6.03% 5.91%

www.fpindia.in ( Financial planning in India )

44 45 46 47 48 49 50 178100.05/175500.30/172600.55/169400.95/165900.95/162200.60/158200.25/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/101500.45/5.78% 5.63% 5.45% 5.26% 5.04% 4.80% 4.53%

4. INCENTIVE FOR HIGHER PREMIUM: Incentive for higher single premium by way of increase in the Guaranteed Maturity Sum Assured is as under: Premium (excluding extra premium) Below Rs.50,000 Rs.50,000 to Rs. 99,000 Rs.1,00,000 and above Increase in Guaranteed Maturity Sum Assured Nil 1.25% 3.00%

5. LOAN: Loan facility will be available under this plan, after completion of one policy year. 6. SURRENDER VALUE: The policy can be surrendered for cash after the policy has run for at least one year. The minimum Guaranteed Surrender Value allowable is equal to 90% of the Single premium paid excluding extra premium, if any. Corporation may however pay Special Surrender value as applicable on the date of surrender provided the same is higher than the Guaranteed Surrender Value. The Special Surrender Value will be the discounted value of the Guaranteed Maturity Sum Assured as on date of surrender. 7. SERVICE TAX: Service tax, if any, shall be as per the Service Tax laws and the rate of service tax as applicable from time to time. The amount of service tax as per the prevailing rates shall be payable by the policyholder on the premium.

www.fpindia.in ( Financial planning in India )

9. COOLING-OFF PERIOD: If you are not satisfied with the Terms and Conditions of the policy, you may return the policy to the Corporation within 15 days from the date of receipt of the policy stating the reason of objections. On receipt of the same the Corporation shall cancel the policy and return the amount of single premium deposited after deducting the risk premium, expenses incurred on medical examination and stamp duty. 10. EXCLUSIONS: The policy shall be void if the Life Assured (whether sane or insane at the time) commits suicide at any time within one year from the date of commencement of risk and the Corporation will not entertain any claim under this policy except to the extent of a maximum of (i) 90% of the single premium paid excluding any extra premium paid or (ii) third partys bonafide beneficial interest acquired in the policy for valuable consideration (but limited to applicable death benefit of this policy) of which notice has been given in writing to the branch where the policy is being presently serviced (where the policy records are kept) at least one calendar month prior to death. Statutory warning: "Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. If your policy offers guaranteed returns then these will be clearly marked guaranteed in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed investment returns. These assumed rates of return are not guaranteed and they are not upper or lower limits of what you might get back as the value of your policy is dependant on a number of factors including future investment performance."

www.fpindia.in ( Financial planning in India )

Notes :

www.fpindia.in ( Financial planning in India )

i) This illustration is applicable to a standard (from medical, life style and occupation point of view) life. ii) The non-guaranteed benefits (1) and (2) in above illustration are calculated so that they are consistent with the Projected Investment Rate of Return assumption of 6% p.a.(Scenario 1) and 10% p.a. (Scenario 2) respectively. In other words, in preparing this benefit illustration, it is assumed that the Projected Investment Rate of Return that LICI will be able to earn throughout the term of the policy will be 6% p.a. or 10% p.a., as the case may be. The Projected Investment Rate of Return is not guaranteed. iii) The main objective of the illustration is that the client is able to appreciate the features of the product and the flow of benefits in different circumstances with some level of quantification.

Investment Solution to : Individual, Corporate, HNI, Trust,NRI, HUF etc... Write Us your Query for any kind of Investment to kirang.gandhi@gmail.com or Kirang_gandhi@yahoo.co.in

Expert Advice : Financial Literacy and Knowledge Coaching Personal Financial Planning, Comprehensive Financial Planning Financial Health check up, Net worth Analysis, Asset Allocation strategy, Cash flow Planning, Budget Planning, Tax Planning, Emergency Fund Planning, Insurance Planning, Health Insurance Planning, Child Future / Retirement Planning,

www.fpindia.in ( Financial planning in India )

Other Financial Goals, Emergency Fund Planning, Risk Analysis ( Investment ), Investment Review, Investment Planning, Estate Planning, Debt Advisory, Insurance Policy Analysis

Note : Meeting priority to appt. only

Investment with Education

For Further Details kindly Contact :

Thanks And Regards, Kirang Gandhi Independent Financial Planner www.fpindia.in www.kgandhi.anindia.in M-9028142155,9271267305

You might also like

- European Central Bank Deposit Rates Are Now Negative.Document2 pagesEuropean Central Bank Deposit Rates Are Now Negative.kirang gandhiNo ratings yet

- Income Tax Calculator FY 2014/15 in ExcelDocument4 pagesIncome Tax Calculator FY 2014/15 in Excelkirang gandhiNo ratings yet

- FII Inflows After ElectionDocument2 pagesFII Inflows After Electionkirang gandhiNo ratings yet

- Common Money MistakesDocument3 pagesCommon Money Mistakeskirang gandhiNo ratings yet

- Free Advice Vs Fees Based AdviceDocument4 pagesFree Advice Vs Fees Based Advicekirang gandhiNo ratings yet

- With Marriage Comes Greater Responsibilities - 1Document4 pagesWith Marriage Comes Greater Responsibilities - 1kirang gandhiNo ratings yet

- Sensex Cross 100,000 by 2020Document2 pagesSensex Cross 100,000 by 2020kirang gandhiNo ratings yet

- Reality of Real EstateDocument2 pagesReality of Real Estatekirang gandhiNo ratings yet

- Invite Finacial DisasterDocument5 pagesInvite Finacial Disasterkirang gandhiNo ratings yet

- FMPDocument2 pagesFMPkirang gandhiNo ratings yet

- FCNR AccountsDocument2 pagesFCNR Accountskirang gandhiNo ratings yet

- Uncertainty On LiquidityDocument2 pagesUncertainty On Liquiditykirang gandhiNo ratings yet

- FCNR DepositsDocument2 pagesFCNR Depositskirang gandhiNo ratings yet

- Market at High What To DoDocument2 pagesMarket at High What To Dokirang gandhiNo ratings yet

- Invite Finacial DisasterDocument5 pagesInvite Finacial Disasterkirang gandhiNo ratings yet

- FIIs Invest $1 BN in Debt MarketDocument1 pageFIIs Invest $1 BN in Debt Marketkirang gandhiNo ratings yet

- Health Insurance Comparison Chart NEWDocument10 pagesHealth Insurance Comparison Chart NEWkirang gandhiNo ratings yet

- Eurozone Debt CrisisDocument2 pagesEurozone Debt Crisiskirang gandhiNo ratings yet

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Document2 pagesFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNo ratings yet

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Document2 pagesFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNo ratings yet

- Few Days Are Left To Finish The EuroDocument2 pagesFew Days Are Left To Finish The Eurokirang gandhiNo ratings yet

- Lic Jeevan Sugam 5.59% After 10 YearsDocument2 pagesLic Jeevan Sugam 5.59% After 10 Yearskirang gandhiNo ratings yet

- Investors Lost Rs.1.5 Lakh CroreDocument7 pagesInvestors Lost Rs.1.5 Lakh Crorekirang gandhiNo ratings yet

- April F.D.Document14 pagesApril F.D.kirang gandhiNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- How Life Insurance Agents Fools Me Due To My Laziness.Document7 pagesHow Life Insurance Agents Fools Me Due To My Laziness.kirang gandhiNo ratings yet

- Finland Prepares For Expected Euro Zone Break UpDocument1 pageFinland Prepares For Expected Euro Zone Break Upkirang gandhiNo ratings yet

- The Countdown Has Begun Euro Is The HistoryDocument2 pagesThe Countdown Has Begun Euro Is The Historykirang gandhiNo ratings yet

- Common Mistakes To Avoid The Situation of Financial CrisesDocument5 pagesCommon Mistakes To Avoid The Situation of Financial Criseskirang gandhiNo ratings yet

- Points To Consider When Buying Health InsuranceDocument7 pagesPoints To Consider When Buying Health Insurancekirang gandhiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ub23m03 561476Document1 pageUb23m03 561476Ratul KochNo ratings yet

- An Agile Organization in A Disruptive EnvironmentDocument14 pagesAn Agile Organization in A Disruptive EnvironmentPreetham ReddyNo ratings yet

- Wholesale Juice Business PlanDocument25 pagesWholesale Juice Business PlanKiza Kura CyberNo ratings yet

- My Tax Espresso Newsletter Feb2023Document21 pagesMy Tax Espresso Newsletter Feb2023Claudine TanNo ratings yet

- Business OrganisationsDocument3 pagesBusiness OrganisationsAnca PandeleaNo ratings yet

- 12BIỂU MẪU INVOICE-PACKING LIST- bookboomingDocument7 pages12BIỂU MẪU INVOICE-PACKING LIST- bookboomingNguyễn Thanh ThôiNo ratings yet

- Umang PDF Fo MathDocument24 pagesUmang PDF Fo MathAlok RajNo ratings yet

- Energy CrisesDocument17 pagesEnergy CrisesMuhammad MuzammalNo ratings yet

- Form 26AS Annual Tax StatementDocument4 pagesForm 26AS Annual Tax StatementAnish SamantaNo ratings yet

- Multinational E-CommerceDocument60 pagesMultinational E-CommerceLong KimQuyNo ratings yet

- Presented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantDocument17 pagesPresented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantSagar ShahNo ratings yet

- Risk Appetite Framework for South African InstituteDocument19 pagesRisk Appetite Framework for South African Institutemuratandac3357No ratings yet

- Income From SalariesDocument24 pagesIncome From SalariesvnbanjanNo ratings yet

- Executive SummaryDocument49 pagesExecutive SummaryMuhsin ShahNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- TRINIDAD MUNICIPAL COLLEGE OFC AD 8: SALES LAWDocument3 pagesTRINIDAD MUNICIPAL COLLEGE OFC AD 8: SALES LAWLaura RodriguezNo ratings yet

- Children's Book Financials for Year Ended May 1997Document3 pagesChildren's Book Financials for Year Ended May 1997fazatiaNo ratings yet

- Republic Act No 10607Document7 pagesRepublic Act No 10607Romel TorresNo ratings yet

- ECON2113 Microeconomics Final Exam QuestionsDocument2 pagesECON2113 Microeconomics Final Exam QuestionsNamanNo ratings yet

- SFA Exam Notice FAQ Apr 2019Document5 pagesSFA Exam Notice FAQ Apr 2019Lei JianxinNo ratings yet

- TUTDocument2 pagesTUTNadia NatasyaNo ratings yet

- BCG Matrix ModelDocument10 pagesBCG Matrix ModelGiftNo ratings yet

- Unit 2 Income From SalariesDocument21 pagesUnit 2 Income From SalariesShreya SilNo ratings yet

- Answer-06-Activity-1-ARG STramaDocument2 pagesAnswer-06-Activity-1-ARG STramaErin AvestruzNo ratings yet

- A2 Sample Chapter Inventory Valuation PDFDocument19 pagesA2 Sample Chapter Inventory Valuation PDFRafa BentolilaNo ratings yet

- Worksheet - Rectification of ErrorsDocument3 pagesWorksheet - Rectification of ErrorsRajni Sinha VermaNo ratings yet

- Chapter 6Document7 pagesChapter 6Erika GueseNo ratings yet

- School Improvement Plan - Enabling MechanismsdocxDocument4 pagesSchool Improvement Plan - Enabling MechanismsdocxKilangi Integrated SchoolNo ratings yet

- Human Capital December 11 Issue - Low ResDocument65 pagesHuman Capital December 11 Issue - Low RessunilboyalaNo ratings yet

- Sikdar Mukopadhyay 2016Document21 pagesSikdar Mukopadhyay 2016Rumi AzimNo ratings yet