Professional Documents

Culture Documents

Vol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..Dp

Uploaded by

babak1897Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..Dp

Uploaded by

babak1897Copyright:

Available Formats

Islamic Economic Studies Vol.5, No.1, December 1997 & No.

2, April 1998

PERFORMANCE AUDITING FOR ISLAMIC BANKS

MUHAMMAD AKRAM KHAN** Although the Islamic finance is making continuous progress, yet the Islamic banks still face criticism from keen observers that they have adopted such techniques of financing which closely resemble interest-based finance. The difficulty with Islamic banks is that they feel hesitant to adopt profit-loss sharing in the contemporary environment. They are afraid that their clients may misreport or mismanage their funds leading to large-scale losses. Being trustees of public funds they think the risk in profit-loss sharing is very high. In this situation, development of appropriate accounting and auditing standards is the need of the day. Performance auditing, being a recent expansion in the scope of auditing holds a promise. The paper introduces the concept of performance auditing and shows how the Islamic banks can use it to their advantage. The paper also proposes a set of strategic measures for the Islamic banks to put performance auditing in practice. 1. BACKGROUND There are over one hundred and fifty Islamic financial institutions, handling billions of dollars and employing thousands of persons and providing financial services to Muslims and non-Muslims all over the world. The pace of development of these institutions is commendable. These institutions are busy in innovating new methods of business and experimenting with shariah-supported financial instruments. Despite that, there is a valid criticism on their current approach of concentrating mainly on those modes of finance which bring them a relatively riskflee fixed return such as murabahah and ijara. The original thinking that Islamic banking should be based on the concept of profit-loss sharing or mudarabah has attracted a very small percentage of the business of the Islamic banks. The Islamic banks feel hesitant to adopt profit-loss sharing as it involves monitoring of the clients performance very closely which is both expensive and cumbersome. They feel that the present state of accounting, integrity and moral training of their clients leaves much to be desired. In these circumstances, they would be invoking a very

The author is thankful to two anonymous referees for giving highly valuable comments on an earlier draft. However, responsibility for any errors or omissions remains that of the author. ** Deputy Auditor General, Department of the Auditor General of Pakistan, Islamabad.

24

Khan: Performance Auditing for Islamic Banks

high risk. As a result, the Islamic banks have devoted most of their attention to those modes of finance, which bring them an assured return. Another criticism on Islamic banks is that they are very much like conventional banks so far as their role in the uplift of the society is concerned. The original rationale of the Islamic banks entailed a very active role for these institutions in promoting equitable distribution of wealth, industrialization, self-reliance and moral values in financial matters. But they have not paid much attention to these higher objectives. Instead they become indifferent to the end-use of funds, once they have provided the finance and remain concerned with their mark-up or return. This makes them very much similar to the conventional banks. The Islamic banks, in their turn contend that they do not have enough means to play the proposed higher role. In the absence of sufficient data and analytical tools they are forced to depend on the conventional methods of control and management. It is in this background that the present paper visualizes a positive and active role for performance auditing in promoting Islamic banking. Performance auditing, as we shall see subsequently operates in a broad framework. It covers, besides financial integrity such issues as achievement of physical targets, performance of the management in relation to social objectives, environmental protection and adherence to the shariah precepts in the business operations. The Islamic banks can adopt performance auditing in two areas: They can review their own performance against a broader criteria which covers physical, financial, social and shariah considerations. This will help them improve their efficiency and effectiveness and make them more competitive in the international market. They can use this technique to review the performance of their clients with relation to the planned outputs. The Islamic banks need not do this on their own. They can agree with their clients for arranging performance audits at the end of a fiscal period by practicing firms of auditors. Part of the cost of performance audits can also be borne by the investors. The report of auditors can focus on the fact that the client used the finances of the bank with due regard for economy, efficiency and effectiveness. Such an assurance from an independent auditor will be more satisfying to the savers whose funds the banks supplied to the entrepreneurs as well as to the banks themselves whose concern remains supreme about the proper utilization of funds. The investors who take funds on the basis of musharakah or mudarabah may be honest people. They may have maintained all books of account properly. But they may have been negligent in managing the businesses, leading to waste or resources or diminution of profits. Performance audit of such business concerns who take money on the basis of profit-loss sharing or mudarabah will disclose their diseconomies and inefficiencies. At this stage, it will be possible for the banks to identify cases where the negligence was willful. In such

Khan: Performance Auditing for Islamic Banks

25

cases, part of the losses can be transferred to such entrepreneurs. An arrangement of this sort will enable the Islamic banks to adopt musharakah and mudarabah on an increasing scale. This will also scale down criticism on the Islamic banks regarding the choice of the modes of financing. The main objective of the paper is to briefly discuss the salient features of performance auditing and to show how Islamic banks can make use of this innovative method of auditing. So far, the performance auditing has been applied in the public sector. But gradually the private sector is also realizing its need. There is growing demand from the private sector firms to practice performance auditing because of the rich dividends that it brings to the organizations. The scheme of the paper is as follows. Part two of the paper introduces the concept of performance auditing. Part three explains its application in the field of Islamic banking. Part four proposes certain strategic measures for Islamic banks and draws conclusions. 2. PERFORMANCE AUDITING - AN 1NTRODUCTION 2.1 Historical Development Performance auditing is a recent expansion in the scope of financial auditing. Traditionally, financial auditing has been concerned with financial control and accuracy of accounts. Usually a single auditor used to check the accounts. The scope of audit was also one hundred per cent checking. For centuries, it has been like that. With the advent of Industrial Revolution and Joint Stock Company, it became difficult for a single person to check hundred percent transactions. It led to at least two changes. First, the single-person auditing gave way to teams of auditors. Second, hundred per cent checking became impossible and the auditors adopted sample testing. Simultaneously, the auditors realized that it is not possible to certify accuracy of accounts without hundred per cent checking. Gradually the role of auditors came to be perceived as expression of opinion on the fairness and truth of accounts rather than on their accuracy. These developments were quite slow by themselves. But they were all the more slow in the government auditing. In government sector, the auditors had been concerned with regularity of expenditure and compliance to rules and regulations. They had also been reporting to the rulers about any leakage in revenue collection and any wastage of public funds. But this role remained in its rudimentary form for centuries. The government auditors did not react to the developments, which were taking place in the private sector accounting and auditing. There was a state of complacency. But then early seventies of this century noticed beginning of a period of turbulence and change in the role of government auditors.

26

Khan: Performance Auditing for Islamic Banks

It began from USA, Canada and some countries of Europe like Sweden and West Germany. The elected representatives of the people of these countries started demanding information on the efficacy and effectiveness of the public expenditure. They started expressing their dissatisfaction on the traditional role of audit, which focused merely on compliance to rules, and regularity of expenditure. They wanted to know the extent to which value for the money spent had been received. They expected a greater accountability of the public managers in the collection, respond to this challenge by expanding the scope of their work. They started developing performance auditing. The initial years were very difficult. The conceptual base was very thin. The auditing profession itself was not quite sure of its role. The auditees were skeptical of the ability of the auditors to undertake audit of their operations. The traditional auditing procedures did not help and new ones had not yet come up. There was no consensus on the scope, approach, criteria and reporting format of this new type of auditing. But the idea of performance auditing spread like a wild fire. The government auditors who had not innovated in their scope, approach and procedures of work for centuries found themselves wrestling with this gigantic challenge. They left the private sector auditors far behind in this field. There was a general awareness among the government auditors that they should come out of their cocoons and respond to the expectations of their people. The first such manifestation came in 1977 when Ninth Congress of the International Organization of Supreme Audit Institutions (INTOSAI) - a UN-supported body in its Lima Declaration drew attention to performance auditing although only a few countries were involved in it by then. After that the Audit Acts of many developed countries were amended to expand the scope of audit to include value-for-money (VFM) examinations by the Supreme Audit Institutions (SAIs). Several developing countries also followed suit. Korea, Malaysia, the Philippines, Sri Lanka, to name a few, were among those few developing countries which amended their audit laws to incorporate VFM examinations. Several other countries, prominent among them India, Pakistan, and the United Kingdom started performance auditing without a formal change in their laws. The British law was subsequently amended in 1984. In brief, performance auditing caught the attention of the legislators and the auditors of governments almost everywhere within a short span of twenty years. During the last two decades, there had been hardly any international moot of the government auditors where performance auditing was not discussed. These two decades saw immense intellectual activity in the field of methodology development and research in the field of performance auditing. The initial years of uncertainty are over. Gradually, consensus is emerging in the areas of scope, approach, methodology, reporting format and the role of performance auditors. INTOSAI auditing standards and the auditing standards issued by several individual countries incorporate standards of work for the performance auditors.

Khan: Performance Auditing for Islamic Banks

27

The SAIs of a number of countries has undertaken research in the methodology of performance auditing. Although, the terrain of performance auditing is still rough, the difficulty of initial days when performance auditors would take a leap almost in the dark is over. 2.2 The Terminology Jungle The expansion in the scope of government auditing though took place in a very short span of time, yet it manifested itself in a spurt of terms and expressions. A jungle of terms grew up. People started talking of performance auditing in different words. Some of the more common expressions were: Performance auditing Comprehensive auditing Value-for-money auditing Management auditing Operations auditing Efficiency auditing Effectiveness auditing Preventive auditing System-oriented effectiveness auditing Performance evaluation Project auditing Program auditing Program evaluation

No doubt, there are minor differences in the precise meaning, scope and methods of these concepts. But all these terms agree on at least two basic premises: First, public business should be conducted in a way that makes the best possible use of public funds. Public managers should ensure that their decisions are not only legal and ethical but also done with due regard for economy, efficiency and effectiveness. It means that the persons responsible for managing public resources should adopt generally accepted management practices. Second, the people who conduct public business should be accountable for prudent and effective management of resources entrusted to them. The legislatures confer responsibility upon public managers to perform certain activities. The public managers get legal authority to manage some resources for delivering the services and functions entrusted to them. In return, the legislatures expect the public managers to account for the use of the public resources and activities performed. Auditing is a super-imposed activity on this

28

Khan: Performance Auditing for Islamic Banks

relationship. Auditors provide assurance to the legislatures that the account rendered by the public managers is fair and tree. In the context of financial auditing this assurance is provided to the extent of financial accounts. But in the context of performance auditing this assurance also extends to operational reports rendered by the public managers. These principles help us to delineate the precise role of performance auditing. In developed countries, private sector corporations invite practicing auditors to undertake consultancy work in the field of VFM examination. Their objective is to get an independent assessment of their operations, systems and procedures to improve their organizational effectiveness. Such work though in the nature of performance auditing cannot be termed as "audit" since it does not serve any accountability relationship. 2.3 Definition of Performance Auditing There is no universally accepted definition of performance auditing. A sample of definitions is as follows. These definitions use different terms for performance auditing. Let us ignore these terminological differences for a while. "A comprehensive audit is an examination that provides an objective and constructive assessment of the extent to which: financial, human and physical resources are managed with due regard to economy, efficiency and effectiveness, and accountability relationships are served.

The comprehensive audit examines both financial and management controls, including information systems and reporting practices, and recommends improvements where appropriate."1 "Performance audits include economy and efficiency and program audits. a) Economy and efficiency audits include determining: i) whether the entity is acquiring, protecting and using its resources (such as personnel, property, and space) economically and efficiently,

Comprehensive Auditing: Concepts, Components and Characteristics, Ottawa: Canadian Comprehensive Auditing Foundation, n.d. pp.8.

Khan: Performance Auditing for Islamic Banks

29

ii)

the causes of inefficiencies or uneconomical practices, and iii) whether the entity has complied with laws and regulations concerning matters of economy and efficiency. b) Program audits include determining: i) the extent to which the desired results or benefits established by the legislature or other authorizing body are being achieved, ii) the effectiveness of organizations, programs, activities or functions, and iii) whether the entity has compiled with laws and regulations applicable to the program.2 "efficiency audits involve an evaluation of the effectiveness of the administrative actions and decisions taken by officials in achieving program objectives, within the policy guidelines and legislative framework provided by the Government and the Parliament.''3 "Performance Audit: Audit embracing all management levels from the point of view of economy, efficiency and effectiveness at the planning, implementing and monitoring stages.''4 "Performance auditing is an assessment of the activities of an organization to see if the resources are being managed with due regard for economy, efficiency and effectiveness and accountability requirements are being met reasonably."5 It is obvious from the above definitions that the hard core of performance auditing is the framework of economy, efficiency and effectiveness. While a detailed discussion of these terms will wait till the next chapter a brief explanation is as follows:

2 3

Government Auditing Standards (1988), Washington D.C.: GAO, pp.2-3.

Selected Addresses on Public Sector Auditing (Vol. II), (1986), Sydney: Australian

Audit Office, pp.75. 4 Everard, P. & D. Wolter (1989), Selection of Terms and Expressions used in the External Audit of the Public Sector, Vienna: INTOSAI Secretariat, (Working Paper distributed during XIIIth INCOSAI at Berlin). 5 M. Akram, Khan (1989), Elements of Performance Auditing, Lahore: Department of the Auditor-General of Pakistan, pp.6.

30

Khan: Performance Auditing for Islamic Banks

Economy refers to acquisition of resources at the lowest cost keeping in view the objectives of the organization. It implies that the resources should be acquired at the right cost, at right time, at right place in right quantity and of right quality. Efficiency means optimum utilization of resources keeping in view the objectives of the organization. It implies maximizing output from given resources or minimizing input for given outputs. Effectiveness refers to the achievement of objectives. It involves assessment of outcomes of program s and projects, which are usually external to the organization. 2.4 Objectives of Performance Auditing Twelfth Congress of the INTOSAI held at Sydney in April 1986 defined the objectives of performance auditing as follows: Provision of a basis for the improvement of public sector management. Improvement in the quality of information on the results of public sector management that is available to policy makers, legislators and the general community. Encouragement of public sector management introduces process for reporting on performance. Provision for more adequate accountability.

The above statement clarifies that the performance auditing is a means for (1) improving management practices in the public sector and (2) sharpening the accountability process of public managers. 2.5 Performance Audit Approach a) Reasonable manager: Performance auditing uses the concept of a reasonable manager. The performance auditors look at the operations of the auditee, as an ordinary good manager would do. The managers make everyday decisions in the light of imperfect information. They undertake risks in the hope of achieving positive results. The managers are also exposed to all sorts of pressures and compulsions both internal and external to the organization. They have to bear certain amounts of political constraints. The auditors appreciate the environments in which the managers operate. They ask the basic question: what would a reasonable manager do in the given circumstances? They do not try to take the benefit of hindsight wisdom.

Khan: Performance Auditing for Islamic Banks

31

b)

External evidence: Performance auditors carry out their examination in the light of economy, efficiency and effectiveness. For this purpose their fieldwork is not restricted to the examination of documents. They go out in the field and see the operations for themselves. They interview the operational staff as well as top management. They reach out to the clients for ascertaining the quality of service being provided by the public agencies. Financial auditors seldom collect data from external sources except for verification of debtors and creditors balances and reconciliation with the banks. c) Normative: The performance auditors identify instances of waste, inefficiency and ineffective operations, systems and procedures. They try to analyze causes for these phenomena and make recommendations to improve the situation. Thus performance auditing has a nonnative approach. But the recommendations made by the performance auditors are not specific. For example, if they note that certain controls are missing they will point out the direction in which action is needed rather than specifically describing all the details of the control. Such an action is legitimately the prerogative of the management. d) Audit of Policies: Performance auditors do not directly comment on the suitability of the executive policies. However, they do point out if the results of certain policies lead to uneconomical or inefficient operations or if they defeat the very purpose for which the policy was made in the first instance. Thus the performance auditors comment on the implementation of the policies. But such a comment sometimes does call into question the policy itself. e) Balance: Performance auditing takes a balanced view of the auditee operations. It reports on the successes of the management with equal emphasis as it points out its failures. The traditional image of the auditor who is happy in pointing out mistakes and deficiencies undergoes a change in the performance audit framework. In fact, performance audit reports start with the achievements of the management rather than its failures.

2.6 Performance Audit Criteria Performance audit criteria consist of the standards laid down by the auditee management itself. For example, the most common criteria are the planned outputs, planned costs per unit, planned number of clients to be served, planned hours to work, planned operational costs etc. The auditors start with the mandate and objectives of the organization, program or project and try to identify, in quantifiable terms as far as possible, the way management itself has translated

32

Khan: Performance Auditing for Islamic Banks

these objectives. For measuring efficiency, for example, they look for any measuring standards the management itself has laid down. But sometimes, the management has not done so. In such situations, the auditors refer to the generally accepted management practices in the particular area trader study. For this they also seek the help of specialists, technical experts and consultants. Once they are able to determine good management practice in the field of their examination they sit down with the management and discuss the criteria for measuring the performance. At that time the management has an opportunity to get the criteria modified, in case it is not realistic. 3. APPLICATION OF PERFORMANCE AUDIT1NG TO ISLAMIC BANKS 3.1 Need for Adjusting the Framework The Islamic banks have two avowed objectives: eliminating interest from financial transactions and promoting values of an Islamic society. Of these the latter objectives requires that the contemporary concept of performance auditing be revised. We think that the Islamic banks should innovate the concept of performance auditing by adopting Islamic ethical values as an essential component of the concept of performance auditing. It means that the Islamic banks, while adopting performance auditing as a tool of analysis and evaluation should incorporate the Islamic economic values, besides economy, efficiency and effectiveness. It immediately raises the question: how do we operationalize the Islamic economic values to make them useful for performance auditing? Some of the suggestions are as follows: While providing finance to a client the Islamic banks should apply the Islamic value of promoting competition and discouraging monopolies. While auditing the performance of the client later, they can then see whether in fact they were successful in promoting competition and discouraging monopoly. b) The Islamic banks should examine the purpose of funding and see that they are not used for any objective prohibited by the shari'ah. c) The Islamic banks should see that the business, which they have financed, has been instrumental in promoting environmental protection. d) The Islamic banks can see that the organizations they have supported have, generally observed their commitments with the society in terms of promoting human resource development, fulfilling their commitments and contracts, honest advertising, maintaining quality standards, avoiding dealings in interest, treating a)

Khan: Performance Auditing for Islamic Banks

33

their employees fairly, promoting equitable distribution of wealth through proper pay scales and benevolence through charitable deeds. These are mere examples of the possible innovations, which the Islamic banks can adopt in adjusting the framework of performance auditing to their objectives. It does not mean that the Islamic banks can follow these innovations in one go or immediately. It is to indicate the direction to which they will have to move ultimately. 3.2 Mechanism for Practicing Performance Auditing by Islamic Banks Basically, the Islamic banks can adopt performance auditing at two stages: At the time of examining a financing proposal, the banks can require, along with the feasibility study of the proposed investment, a performance audit report on the past operations of the clients. This will give the banks an idea about the track record of the client. In fact, some such information is submitted by the clients even now. But that information is usually relates to financial performance of the client. The performance auditing adds another dimension physical achievements. It can also give the bank an idea about the managerial ability of the client. b) Secondly, the Islamic banks can adopt performance auditing at the close of the fiscal period or at the time of settlement of accounts. The objective at this stage will be to measure the performance of their clients against the agreed criteria. At both the stages, banks need to discuss the purpose of performance auditing with their clients and negotiate with them the criteria for evaluating their performance. Since the concept of performance auditing is quite new, most of the clients will resist it and even show suspicions. They might think that this type of exercise would mean an undue encroachment in their management function. This will require extensive dialogue with the client. It may also mean educating them about the macro-economic and social benefits of performance auditing as well as the greater efficiency or effectiveness that it will bring to their own organization. Once the client organization is willing to accept performance auditing and agrees to its criteria, the Islamic banks can engage auditors for actual audits. The focus of these audits will be as follows: a) Have the clients used the resources in most economical manner? a)

34

Khan: Performance Auditing for Islamic Banks

b)

Have the client carried out its operations in an efficient manner? c) To which extent the client organization has achieved its objectives? d) What has been the impact of the organization on the society? It will include broader issues as environment, equitable distribution of income and wealth, promotion of competition, sponsoring of charities, development of human resources, etc.

Khan: Performance Auditing for Islamic Banks

35

3.3 Applying Performance Auditing to Banks' Own Operations The Islamic banks adopt performance auditing to evaluate their own operations. The objective of such exercise will be as follows: They will try to derive the satisfaction that there had been no wastage and inefficiency in the day to day operations of the bank and that the operational management performed within the overall policy framework. b) They shall be able to satisfy the savers that their funds were put to the best use. In case the results of performance audit reveal any willful negligence on the part of the investors, the banks will be able to transfer some of the losses to them rather than to the savers. In is in this area that the Islamic banks will reap the reward for extra cost of performance auditing. c) The banks will be able to demonstrate to the shareholders as well as other stakeholders that the funds of the savers had been deployed within the broader framework of the shariah and that best management and ethical practices were adopted. d) The Islamic banks will be able to analyze their own performance in different modes of finance adopted by them. For example, the banks will be able to compare their return from mudarabah, ijara, ijara wa iktina, murabahah, or equity participation. 3.4 Enabling Environments for Performance Auditing It implies that the scope of banks' performance audits will be much wider than the scope of not only financial audits but also the scope of prevalent performance auditing. But this is easy said than done. It will require at least the following: a) b) c) d) e) Pressure from the banks ' savers and investors to audit the performance of the banks' clients. Willingness of the clients to operate with the banks to provide information to the banks. Generation of suitable information by the clients to meet the information needs of the performance auditors. Development of methodology of performance auditing suitable to the needs of the Islamic banks. Development of audit criteria for different types of clients with provision for adjusting it according to the individual needs of each client. a)

36

Khan: Performance Auditing for Islamic Banks

f) g)

Training of auditors in the methodology. An understanding that performance auditing is a learning process and is focused on improvement and not on finger pointing. h) A code of ethics for the auditors which gives satisfaction to the auditee about the quality of the auditors' work and their competence. i) A research and development institution which promotes excellence in performance auditing. 3.5 Institutional Impediments to Performance Auditing It is also instructive to note the conditions, which make performance auditing a difficult exercise. Following conditions impede the implementation of performance audit: An exclusive preoccupation with the financial control on the part of funding or implementing agency. Undue focus on the legal fulfillment of a contract rather than the successful outcome of the project. Absence of a clear, objective and agreed audit criteria. Inadequate or non-comprehensive performance indicators. A management preoccupied with the enforcement of regulations rather than optimization of the resource use. Perception that performance auditing is an unnecessary nuisance or obstruction in the day to day operations. Inadequate documentation in the auditee office. 4. CONCLUDING REMARKS 4.1 Benefits of Performance Auditing The above framework of performance auditing would involve significant costs. Will it be worthwhile to incur this cost and how can this be minimized? These are quite relevant questions. The cost of any activity can be judged to be excessive or otherwise in the light of the objectives we intend to achieve. The benefits of performance auditing for Islamic banks will be as follows: It will provide a mechanism to the banks to determine the tree profits or losses of the client organizations. b) It will help the banks determine whether the client organizations have used their funds prudently. a)

Khan: Performance Auditing for Islamic Banks

37

c) d)

e)

f)

g)

It will help in assessing the extent to which the client organizations moved towards creating an Islamic society. It will reinforce the accountability mechanism of management of large scale incorporated organization which obtain funds from the Islamic banks. It will provide an incentive to the business organizations to maintain accounting records, as well a lot of other information required for the measurement of their performance. It will provide an effective tool to banks for assessing the performance of their clients and thus rehabilitate their confidence in profit-sharing mechanism. The Islamic banks will be able to get an independent opinion on their own performance and identify ways and means to improve their effectiveness. In a highly competitive financial market, this could be a worthwhile objective for the Islamic banks.

It is only if we take a global view of the benefits of performance auditing that it will be possible to justify. Pursuing performance auditing by a single Islamic bank may not be cost effective. Therefore, we need to explore the strategy to cut down its cost. 4.2 Cutting Costs of Performance Auditing The costs of performance auditing can be reduced significantly if the Islamic banks join hands in the following areas: a) b) c) Development of methodology. Training of auditors. Promoting the concept of performance auditing among client organizations through seminars, conferences. d) Joint research and sharing of information on performance of different sectors of the economy. In the final analysis it will be pressure from the public that will persuade both the Islamic banks as well as their client organizations to adopt performance auditing. A wide spread application of performance auditing by Islamic banks will bring the goal of achieving true Islamic banking nearer.

You might also like

- Auditing As An Aid To Accountability in The Public SectorDocument47 pagesAuditing As An Aid To Accountability in The Public SectorDaniel Obasi100% (2)

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Chapter 1Document10 pagesChapter 1Салтанат МакажановаNo ratings yet

- Century Bank - I II IIIDocument33 pagesCentury Bank - I II IIIMADHU KHANALNo ratings yet

- Chapter 1 - AACA P1Document7 pagesChapter 1 - AACA P1Toni Rose Hernandez LualhatiNo ratings yet

- Essay On AuditingDocument9 pagesEssay On AuditingAtis Madri AmandaNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Effects of Credit Management On The Profitability of Small and Medium Enterprices in KitaleDocument7 pagesEffects of Credit Management On The Profitability of Small and Medium Enterprices in KitaleElias NgeiywaNo ratings yet

- June 2016: BY: ZEWGE DANIAL R/2221/06 Advisor: Abdul Walli (Ba)Document30 pagesJune 2016: BY: ZEWGE DANIAL R/2221/06 Advisor: Abdul Walli (Ba)Reta TolesaNo ratings yet

- Axis Bank NPADocument101 pagesAxis Bank NPAArun SavukarNo ratings yet

- AbstractDocument13 pagesAbstractKhooshal Yadhav RamphulNo ratings yet

- Contemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaDocument5 pagesContemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaJERRALYN ALVANo ratings yet

- ALM Management in Icici BankDocument85 pagesALM Management in Icici BankSrikanth BheemsettiNo ratings yet

- The Effect of Client Appraisal On The Efficiency of Micro Finance BankDocument13 pagesThe Effect of Client Appraisal On The Efficiency of Micro Finance BankaijbmNo ratings yet

- Auditing I-Chapter 1 MLCDocument13 pagesAuditing I-Chapter 1 MLCHilew TSegayeNo ratings yet

- Assessment of Account Receivable Management (In Case of Moringa Soft Drinks) Riftvalley UniversityDocument24 pagesAssessment of Account Receivable Management (In Case of Moringa Soft Drinks) Riftvalley UniversityReta TolesaNo ratings yet

- Corporate Governance - An Introduction: Chapter-IDocument43 pagesCorporate Governance - An Introduction: Chapter-IFalakNo ratings yet

- Solution Manual For Financial Accounting in An Economic Context 10th Edition Pratt PetersDocument6 pagesSolution Manual For Financial Accounting in An Economic Context 10th Edition Pratt PetersEdna Steward100% (43)

- FSA Group AssDocument16 pagesFSA Group AssFirdows SuleymanNo ratings yet

- Bank Reconciliation Statements, Accountability and Profitability of Small Business OrganisationDocument10 pagesBank Reconciliation Statements, Accountability and Profitability of Small Business OrganisationSalla CheaclyNo ratings yet

- Non Performing Assets in Allahabad Bank MBA Banking ProjectsDocument68 pagesNon Performing Assets in Allahabad Bank MBA Banking Projectsmallikarjun nayak50% (2)

- Chapter One Accounting Principles and Professional PracticeDocument22 pagesChapter One Accounting Principles and Professional PracticeHussen Abdulkadir100% (1)

- Ethical issues in private banks of PakistanDocument5 pagesEthical issues in private banks of PakistanRajib RoyNo ratings yet

- Slide Presentasi Ketua KNKG - Kuliah Umum UMS (Juni 2023)Document41 pagesSlide Presentasi Ketua KNKG - Kuliah Umum UMS (Juni 2023)Wahyu Sekar WijayaningtyasNo ratings yet

- Audit and Review: Exam FocusDocument12 pagesAudit and Review: Exam FocusPhebieon MukwenhaNo ratings yet

- AAS CH1 2 1 - MergedDocument19 pagesAAS CH1 2 1 - MergedRoel PaisteNo ratings yet

- Non Performing Assets in Allahabad BankDocument69 pagesNon Performing Assets in Allahabad BankGotham RamNo ratings yet

- Credit Risk Management in Karnataka State Credit Risk Management in Karnataka StateDocument98 pagesCredit Risk Management in Karnataka State Credit Risk Management in Karnataka StatePrashanth PBNo ratings yet

- BC PreExploration Oct09Document48 pagesBC PreExploration Oct09Prashant KhadeNo ratings yet

- 15 - Chapter 6 PDFDocument30 pages15 - Chapter 6 PDFRukminiNo ratings yet

- 214-Kotak Bank-Non Performing Assets at Kotak Mahindra BankDocument70 pages214-Kotak Bank-Non Performing Assets at Kotak Mahindra BankPeacock Live ProjectsNo ratings yet

- Meaning of Islamic AccountingDocument19 pagesMeaning of Islamic Accountingturk66650% (2)

- A Study On Financial Performance Analysis For Sri Murugan CreditsDocument59 pagesA Study On Financial Performance Analysis For Sri Murugan CreditsJayaprabhu PrabhuNo ratings yet

- CHAPTER 1 (Under Revision Wahahaha) The Problem and Its BackgroundDocument6 pagesCHAPTER 1 (Under Revision Wahahaha) The Problem and Its BackgroundAira TantoyNo ratings yet

- Icici Bank ProjectDocument82 pagesIcici Bank ProjectiamdarshandNo ratings yet

- Financial Statement Analysis of Madhucon ProjectsDocument8 pagesFinancial Statement Analysis of Madhucon Projectsmohammed khayyumNo ratings yet

- Final Financial Assessment - 2023Document9 pagesFinal Financial Assessment - 2023Weldu GebruNo ratings yet

- Tabarsum NON PERFORMING ASSETS AXIS BANKDocument73 pagesTabarsum NON PERFORMING ASSETS AXIS BANKSagar Paul'g100% (4)

- Reaction Paper On Ethical Issues in AccountingDocument4 pagesReaction Paper On Ethical Issues in AccountingJessica Rabo100% (1)

- Irma Kasri Dan N. LukviarmanDocument29 pagesIrma Kasri Dan N. Lukviarmanjaharuddin.hannoverNo ratings yet

- Importanct of Audit in Corporate FirmsDocument32 pagesImportanct of Audit in Corporate FirmssmartlordartNo ratings yet

- A Study On The Effectiveness of Remedies AvailableDocument35 pagesA Study On The Effectiveness of Remedies AvailableMitali ChaureNo ratings yet

- CreditDocument37 pagesCreditpetalingstreetNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument46 pagesChapter One: 1.1. Back Ground of The StudyBobasa S AhmedNo ratings yet

- Rabin Dissertation 2019Document57 pagesRabin Dissertation 2019Rabindra paridaNo ratings yet

- Chapter - 01: Intern Report On Evaluation of Job Satisfication of Social Islami Bank LimitedDocument73 pagesChapter - 01: Intern Report On Evaluation of Job Satisfication of Social Islami Bank LimitedRedwan FerdousNo ratings yet

- Limitations of Balance SheetDocument6 pagesLimitations of Balance Sheetshoms_007No ratings yet

- Isbf - Research Paper - 2021Document22 pagesIsbf - Research Paper - 2021Hurmat Ayub SardarNo ratings yet

- Effect of NPAs on profitability of public sector banksDocument12 pagesEffect of NPAs on profitability of public sector banksVishesh SharmaNo ratings yet

- 13 - Summary Findings and ConclusionDocument9 pages13 - Summary Findings and ConclusionUtkarsh BajpaiNo ratings yet

- 4.inter Journal Macro - Micro-Factors-Affecting-the-Bad-Debt-of-Commercial-Banks-in-Ho-Chi-Minh-City-dikonversiDocument27 pages4.inter Journal Macro - Micro-Factors-Affecting-the-Bad-Debt-of-Commercial-Banks-in-Ho-Chi-Minh-City-dikonversilisa amaliaNo ratings yet

- Chapter 1 AuditDocument13 pagesChapter 1 AuditMisshtaC100% (1)

- Solutions For Chapter 1 Auditing: Integral To The Economy: Review QuestionsDocument26 pagesSolutions For Chapter 1 Auditing: Integral To The Economy: Review QuestionsStefany Mie MosendeNo ratings yet

- Uti BankDocument86 pagesUti BankMohit kolliNo ratings yet

- General Questions 4.0Document8 pagesGeneral Questions 4.0Benzon Agojo OndovillaNo ratings yet

- Compilation ReportDocument4 pagesCompilation ReportFlorivee EreseNo ratings yet

- Firms cannot use deceased partners' namesDocument2 pagesFirms cannot use deceased partners' namesSharon G. BalingitNo ratings yet

- RRB Exam Previous Year ModelDocument3 pagesRRB Exam Previous Year ModelShijumon XavierNo ratings yet

- Companies ListDocument83 pagesCompanies ListVamsi Hashmi0% (1)

- Kap 4 Parimet EkontabilitetitDocument18 pagesKap 4 Parimet EkontabilitetitEdmond KeraNo ratings yet

- Subic Bay Trading Company ProfileDocument4 pagesSubic Bay Trading Company ProfileNaomi Gimenez BisnarNo ratings yet

- GM - OEM Quick Reference Guide - Dec2016 1 PDFDocument2 pagesGM - OEM Quick Reference Guide - Dec2016 1 PDFSelvaraj Simiyon0% (1)

- NO Company NameDocument26 pagesNO Company Namepravinpatil4643No ratings yet

- G.R. No. L-22493 - Island Sales, Inc. VDocument4 pagesG.R. No. L-22493 - Island Sales, Inc. Vabc defNo ratings yet

- 73ac4horizontal & Vertical IntegrationDocument5 pages73ac4horizontal & Vertical IntegrationOjasvee KhannaNo ratings yet

- Venture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedDocument8 pagesVenture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedShuvro Rahman75% (12)

- Gravita Corporate Presentation - 2017 PDFDocument32 pagesGravita Corporate Presentation - 2017 PDFPALRAJ100% (1)

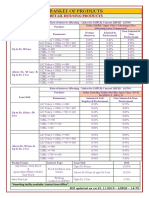

- BASKET OF RETAIL PRODUCTS RATESDocument3 pagesBASKET OF RETAIL PRODUCTS RATESVirendra K VermaNo ratings yet

- Thirdpartyrep Brand Guide 052314Document39 pagesThirdpartyrep Brand Guide 052314Tasfin HabibNo ratings yet

- Tvs Motor Company LimitedDocument4 pagesTvs Motor Company LimitedSiddu KambleNo ratings yet

- Production Cost Management & MIS FormulationDocument23 pagesProduction Cost Management & MIS FormulationSrikanth Kumar KonduriNo ratings yet

- CadburyDocument11 pagesCadburyAnkita RajNo ratings yet

- Audit Procedures For CashDocument24 pagesAudit Procedures For CashGizel Baccay100% (1)

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- Intermediate Accounting I IntroductionDocument6 pagesIntermediate Accounting I IntroductionJoovs JoovhoNo ratings yet

- Financial DocsDocument6 pagesFinancial DocsMaryroseNo ratings yet

- Tutorial 1 Q ADocument5 pagesTutorial 1 Q AKelvin LeongNo ratings yet

- HANSSON CASE Individual AssignmentDocument2 pagesHANSSON CASE Individual AssignmentWawerudasNo ratings yet

- Moschino - Hermes - Comparative Positioning and Consumer Analysis - Dorothy Arhin - AcademiaDocument18 pagesMoschino - Hermes - Comparative Positioning and Consumer Analysis - Dorothy Arhin - AcademiaEnt Qa NepalNo ratings yet

- Fake Nigerian Offer For Petrol IPCCDocument16 pagesFake Nigerian Offer For Petrol IPCCDani NIANGNo ratings yet

- Request For Quotation (RFQ) : Form-ADocument5 pagesRequest For Quotation (RFQ) : Form-ADayanandSonawaneNo ratings yet

- Finance and the Multinational Firm: The New Role of Firms AbroadDocument13 pagesFinance and the Multinational Firm: The New Role of Firms AbroadFatin AfifaNo ratings yet

- Investment Banking Project ReportDocument84 pagesInvestment Banking Project ReportSohail Shaikh64% (14)

- Atlas Copco and Sandvik Shank Adapter GuideDocument11 pagesAtlas Copco and Sandvik Shank Adapter GuideSubhash KediaNo ratings yet

- Saln 2012 Blank FormDocument3 pagesSaln 2012 Blank FormGel KorlanNo ratings yet