Professional Documents

Culture Documents

Accounting For Depreciation

Uploaded by

danookyereOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Depreciation

Uploaded by

danookyereCopyright:

Available Formats

DEPRECIATION "Depreciation may be defined as the permanent continuous diminution in the quality, quantity or value on an asset.

" (By Pickles) "Depreciation is the gradual permanent decrease in the value of an asset from any cause." (By Carter) "Depreciation may be defined as a measure of the exhaustion of the effective life of an asset from any cause during a given period." (By Spicer & Pegler) Depreciation is the diminution in intrinsic value of an asset due to use and/or the lapse of time." (By Institute of Cost and Management Accountants, England) "Depreciation is the reduction in the value of a fixed asset occasioned by physical wear and tear, obsolescence or the passage of time." (Northcott & Forsyth) "Depreciation is the diminution in the value of assets owing to wear and tear, effluxion of time, obsolescence or similar causes." (Cropper) From the above definitions, it follows that an asset gradually declines on account of use and passage of time and this causes permanent reduction in the value and utility of asset. Such reduction in the value or utility of asset is called depreciation. In other words, expired cost or utility of asset is depreciation. CHARACTERISTICS OF DEPRECIATION Depreciation has the following characteristics: 1. Depreciation is charged in case of fixed assets only. e.g., building, plant and machinery, furniture etc. There is no question of depreciation in case of current assets - such as stock, debtors, bills receivable etc. 2. Depreciation causes perpetual, gradual and continual fall in the value of assets. 3. Depreciation occurs till the last day of the estimated working life of the asset. 4. Depreciation occurs on account of use of asset. In certain cases, however, depreciation may occur even if the assets are not used, e.g., leasehold, property, patent, copyright etc. 5. Depreciation is a charge against revenue of an accounting period.

6. Depreciation does not depend on fluctuations in market value of assets 7. The amount of depreciation of an accounting year cannot be determined precisely - it has to be estimated. In certain cases, however, it may be ascertained exactly, e.g., leasehold property, patent right, copyright etc. 8. Total depreciation of an asset cannot exceed its depreciable value (cost less scrap value). CAUSES OF DEPRECIATION INTERNAL CAUSES Depreciation which occurs for certain inherent normal causes, is known as internal depreciation. The main causes of internal depreciation are: Wear and Tear Some assets physically deteriorate due to wear and tear in use. More and more use of an asset, the greater would be the wear and tear. Physical deterioration of an asset is caused from movement, strain, friction, erosion etc. An obvious example of this is motor car which rapidly wears out. Other assets like this are building, plant, machinery, furniture, etc. The wear and tear is general but primary cause of depreciation. Depletion Some assets declines in value proportionate to the quantum of production, e.g. mine, quarry etc. With the raising of coal from coal mine the total deposit reduces gradually and after sometime it will be fully exhausted. Then its value will be reduced to nil.

EXTERNAL CAUSES Depreciation caused by some external reasons is called external depreciation. The main external causes are as follows: Obsolescence Some assets, although in proper working order, may become obsolete. For example, old machine becomes obsolete with the invention of more economical and sophisticated machine

whose productive capacity is generally larger and cost of production is therefore less. In order to survive in the competitive market the manufacturers must must install new machines replacing the old ones. Again, it may happen that the articles produced by old machine are no longer saleable in the market on account of change of habit and taste of the people. In such a case the old machine, although in good working condition, must be discarded and the new one purchased. Effluxion of Time Some assets diminish in value on account of sheer passage of time, even though they are not used e.g., leasehold property, patent right, copyright etc. Suppose we take a lease of a house for 10 years for $10,000. Its annual depreciation will be $1,000 (10,000/10), irrespective of whether the house has been used or not. Because with the end of lease after 10 years, the house will go out of possession. Accident Assets may be destroyed by abnormal reasons such as fire, earthquake, flood etc. In such a case the destroyed asset must be written off as loss and a new one purchased. THE NEED FOR DEPRECIATION ARISES FOR THE FOLLOWING REASONS To Ascertainment of True Profit or Loss Depreciation is a loss. So Unless it is considered like all other expenses and losses, true profit or loss cannot be ascertained. In other words, depreciation must be considered in order to into out true profit or loss of a business. Ascertainment of True Cost of Production Goods are produced with the help of plant and machinery which incurs depreciation in the process of production. This depreciation must be considered as a part of the cost of production of goods. Otherwise, the cost f production would be shown less than the true cost. Sales price is fixed normally on the basis of cost of production. So, if the cost of production is shown less by ignoring depreciation, the sale price will also be fixed at low level resulting in a loss to the business.

True Valuation of Assets Value of assets gradually decreases on account of depreciation, if depreciation is not taken into account, the value of asset will be shown in the books at a figure higher than its true value and hence the true financial position of the business will not be disclosed through balance sheet. Replacement of Assets After sometime an asset will be completely exhausted on account of use. A new asset must then be purchased requiring a large sum of money. If the whole amount of profit is withdrawal from business each year without considering the loss on account of depreciation, necessary sum may not be available for buying the new asset. In such a case the required money is to be collected by introducing fresh capital or by obtaining loan or by selling some other assets. This is contrary to sound commerce policy. Keeping Capital Intact Capital invested in buying an asset, gradually diminishes on account of depreciation. If loss on account of depreciation is not considered in determining profit or loss at the year end, profit will be shown more. If the excess profit is withdrawal, the working capital will gradually reduce, the business will become weak and its profit earning capacity will also fall.

Depreciation The term depreciation is used with reference to tangible fixed assets because the permanent continuing and gradual fall in book value is possible only in the case of fixed asset. Depletion The term depletion is used for the depreciation of wasting assets such as mines, oil wells, timber trees etc.

Amortization The term amortization is used in respect of intangible assets like patents, copyrights, leasehold and goodwill which are recorded at cost. Some intangible assets have limited useful life and are, therefore, written off. The process of their writing off is called amortization. For calculation depreciation the basic factors are: 1. The original cost of the asset. 2. The estimated working life of the asset or the number of years the asset is expected to last. 3. The estimated residual or scrap value at the end of its life. It is the value which the asset will fetch when discarded as useless. 4. The amount to be spent periodically for repairs and renewals. If the repairs necessary to keep the asset in a proper state of efficiency are regularly carried out, the life of the asset is prolonged and the amount of annual depreciation is proportionately lowered. 5. The possibility of the asset becoming obsolete. If there are great chances of improvements being made in a particular asset on account of inventions, higher depreciation should be written off such an asset. Usually engineers and experts give their opinion about these and they are accepted by businessmen. After getting information on all these points, it is easy to access the rate of depreciation.

DEPRECIATION METHODS 1. Fixed installment or Straight line or Original cost method; 2. Diminishing Balance Method or Written down value method or Reducing Installment method; 3. Annuity Method; 4. Depreciation fund method or Sinking fund amortization fund method; 5. Insurance policy method; 6. Revaluation method; 7. Sum of the year's digits method (SYD);

8. Double declining balance method; 9. Depletion method; 10. The basis of use system; FIXED INSTALLMENT METHOD Fixed installment method is also know as straight line method or original cost method. Under this method the expected life of the asset or the period during which a particular asset will render service is the calculated. The cost of the asset less scrap value, if any, at the end f its expected life is divided by the number of years of its expected life and each year a fixed amount is charged in accounts as depreciation. The amount chargeable in respect of depreciation under this method remains constant from year to year. This method is also know as straight line method because if a graph of the amounts of annual depreciation is drawn, it would be a straight line. Formula The following formula or equation is used to calculate depreciation under this method: Annual Depreciation = [(Cost of Assets - Scrap Value)/Estimated Life of Machinery] Journal Entries: The journal entries that will have to be made under this method are very simple. The journal entries will be as under: 1. Depreciation account To Asset account (Being the depreciation of the asset)

2.

Profit and loss account To Depreciation account (Being the amount of depreciation charged to Profit and Loss account)

These entries will be passed at the end of each year so long as the asset lasts. In the last year, the scrap will be sold and with the amount that realised by the sale the following entry will be passed: 3. Cash account To Asset account (Being the sale price of scrap realised.) Advantages: 1. Fixed installment method of depreciation is simple and easy to work out 2. The book value of the asset can be reduced to zero. Disadvantages: 1. This method, in spit of its being simplest is not very popular because of the fact that whereas each year's depreciation charge is equal, the charge for repairs and renewals goes on increasing as the asset becomes older. The result is that the profit and loss account has to bear a light burden in the initial years of the asset but later on this burden becomes heavier. 2. Interest on money is locked up in the asset is not taken into account as is done in some other methods. 3. No provision for the replacement of the asset is made. 4. Difficulty is faced in calculation of depreciation on additions made during the year.

Scope of Application: On account of the above mentioned advantages and disadvantages of fixed installment method, it is generally applied in case of those assets which have small value or which do not require many repairs and renewals for example copyright, patents, short leases etc. Example: On 1st January 1991 X purchased a machinery for $21,000. The estimated life of the machine is 10 years. After it its break up value will be $1,000 only. Calculate the amount of annual

depreciation according to fixed installment method (straight line method or original cost method) and prepare the machinery account for the first three years.

DIMINISHING BALANCE METHOD Definition and Explanation: Diminishing balance method is also known as written down value method or reducing installment method. Under this method the asset is depreciated at fixed percentage calculated on the debit balance of the asset which is diminished year after year on account of depreciation. Journal Entries: The entries in this case will be identical to those discussed in the case of the fixed installment method. Only the amount will be differently calculated. Advantages of Diminishing Balance Method: 1. The strongest point in favor of this method is that under it the total burden imposed on profit an loss account due to depreciation and repairs remains more or less equal year after year since the amount after depreciation goes on diminishing with the passage of time whereas the amount of repairs goes on increasing an asset grow older. 2. Separate calculations are unnecessary for additions and extensions, though in the first year some complications usually arise on account of the fact that additions are generally made in the middle of the year. Disadvantages of Diminishing Balance method: 1. This method ignores the question of interest on capital invested in the asset and the replacement of the asset. 2. This method cannot reduce the book value of an asset to zero if it is desired. 3. Very high rate of depreciation would have to be adopted other wise it will take a very long time to write an asset down to its residual value

Scope of Application: Diminishing balance method of depreciation is most suited to plant and machinery where additions and extensions take place so often and where the question of repairs is also very important. Written down value method or reducing installment method does not suit the case of lease, whose value has to be reduced to zero. Example: On 1st January, 1994, a merchant purchased plant and machinery costing $25,000. It has been decided to depreciate it at the rate if 20 percent p.a. on the diminishing balance method (written down value method). Show the plant and machinery account in the first three years.

Annuity Method of Depreciation: Learning Objectives: 1. What is annuity method of depreciation? Where is it adopted? According to this method, the purchase of the asset concerned is considered an investment of capital, earning interest at certain rate. The cost of the asset and also interest thereon are written down annually by equal installments until the book value of the asset is reduced to nil or its bread up value at the end of its effective life. The annual charge to be made by way of depreciation is found out from annuity tables. The annual charge for depreciation will be credited to asset account and debited to depreciation account, while the interest will be debited to asset account and credited to interest account. Journal Entries: Under annuity method, journal entries have to be made in respect of interest and depreciation. As regards interest, it has to be calculated on the debit balance of the asset account at the commencement of the period, at the given rate. The entry that is passed: 1. Asset account

To Interest account (Being interest on capital sunk in asset) With regard to depreciation the amount found out from the depreciation annuity table, the following entry is passed: 2. Depreciation account To Asset account (Being the depreciation of asset) It should be remembered that the interest is charged on the diminishing balance of the asset account, the amount of interest goes on declining year after year. But the amount of depreciation remains the same during the life time of the asset. Example: A firm purchased a 5 years' lease for $40,000 on first January. It decides to write off depreciation on the annuity method. Presuming the rate of interest to be 5% per annum. Show the lease account for the first 3 years. Calculations are to be made to the nearest dollar. Annuity Table Amount required to write off $1 by the annuity method. Years 3 4 5 6 7 8 Solution: 3% 0.353530 0.269027 0.218355 0.184598 0.160506 0.142456 3.5% 0.359634 0.272251 0.221418 0.187668 0.163544 0.145477 4% 0.360349 0.275490 0.224627 0.190762 0.166610 0.148528 4.5% 0.363773 0.278744 0.227792 0.193878 0.169701 0.151610 5% 0.367209 0.282012 0.230975 0.197017 0.172820 0.154722

According to the annuity table given above, the annual charge for depreciation reckoning interest at 5 percent p.a. would be: 230975 40,000 = $9,239 Lease Account Debit Side Date 1st Year Jan. 1 To Cash Dec. 31 To Interest 40,000 2,000 $ Date 1st Year Dec. 31 By Depreciation By Balance c/d 9,239 32,761 Credit Side $

42,000

42,000

2nd Year Jan. 1 To Balance b/d Dec. 31 To Interest 32,761 1,638

2nd Year Dec. 31 By Depreciation By Balance c/d 9,239 25,160

34,399

34,399

3rd Year Jan. 1 To Balance b/d Dec. 31 To Interest 25,160 1,258 Dec. 31 By Depreciation By Balance c/d 9,239 17,179

26,418

26,418

3rd Year Jan. 1 To Balance b/d Advantages: 1. This method takes interest on capital invested in the asset into account. 2. It is regarded as most exact and precise from the point of view of calculations; and is therefore most scientific. Disadvantages: 1. The system is complicated. 2. The burden on profit and loss account goes on increasing with the passage of time whereas the amount of depreciation charged each year remains constant. The amount of interest credited goes on diminishing as years pass by, the ultimate consequence being that the net burden on profit and loss account grows heavier each year. 3. When the asset requires frequent additions and extensions, the calculation have to be changed frequently, which is very inconvenient. Scope of Application: This method is best suited to those assets which require considerable investment and which do not call for frequent additions e.g., long lease. 17,170

Depreciation Fund Method or Sinking Fund Method of Depreciation: Learning Objectives: 1. What is depreciation fund method or sinking fund method of depreciation? 2. What are its advantages and disadvantages?

Definition and Explanation: Depreciation fund method is also know as sinking fund method or amortization fund method. Under this method, a fund know as depreciation fund or sinking fund is created. Each year the profit and loss account is debited and the fund account credited with a sum, which is so calculated that the annual sum credited to the fund account and accumulating throughout the life of the asset may be equal to the amount which would be required to replace the old asset. In order that ready funds may be available at the time of replacement of the asset an amount equal to that credited to the fund account is invested outside the business, generally in gilt-edged securities. The asset appears in the balance sheet year after year at its original cost while depreciation fund account appears on the liability side. Journal Entries: The following entries are necessary to record the depreciation and replacement of an asset by this method. (a). First year (at the end) (1). Debit profit and loss account and credit depreciation fund account with the amount of the annual depreciation charge. (2). Also debit depreciation fund investment account and credit cash account with an equal amount. (b). In subsequent years. (1). Debit depreciation fund investment account and credit depreciation fund account with the amount of interest earned and reinvested. (2). Debit profit and loss account and credit depreciation fund account with the annual depreciation installment. (3). Debit depreciation fund investment account and credit cash account with an equal amount. (c). On replacement of asset. (1). Debit cash account and credit depreciation fund investment account with the amount realized by the sale of investment. (2). Transfer any profit or loss on sale of investment to profit and loss account.

(3). Debit the new asset purchased and credit cash account. (4). Debit depreciation fund account and credit the account of the old asset which has become useless. The amount of annual depreciation to be provided for by the depreciation fund method will be ascertained from sinking fund table. Sinking Fund Table Annual sinking fund installment to provide $1. Years 3 4 5 6 7 8 Example: On 1st January, 1990 a four years lease was purchased for $20,000 and it is decided to make provision for the replacement of the lease by means of a depreciation fund, the investment yielding 4 percent per annum interest. Show the necessary ledger account. Solution: To get $1 at the end of 4 years at 4 percent an annual investment of $2,35,490 is necessary. Therefore, for $20,000 an annual investment of $4,709.80 i.e., 2,35,490 20,000 will be necessary. Lease Account 1990 Jan.1 To Cash 20,000 1990 Dec. By Depreciation fund 20,000 3% 0.323540 0.239027 0.188350 0.154598 0.130506 0.112446 3.5% 0.321934 0.237251 0.186481 0.152668 0.128544 0.110477 4% 0.320349 0.235490 0.184627 0.150762 0.126610 0.108528 4.5% 0.318773 0.233741 0.182792 0.148878 0.124701 0.106610 5% 0.317208 0.232012 0.180975 0.147017 0.122820 0.104722

31

Depreciation Fund Account 1990 Dec. 31 To Balance c/d 4,709.80 1990 Dec. 31 By P & L account 4,709.80

1991 Dec. 31 To Balance c/d 9607.99

1991 Jan. 1 Dec. 31 " By Balance c/d By Depreciation 4709.80 fund 188.39 4709.80

investment By P&L account

9607.99

9607.99

1992 Dec. 31 To Balance c/d 14702.11

1992 Jan. 1 Dec. 31 " By Balance b/d By Depreciation 9607.99 fund 384.32 4709.80

investment By P & L account

14702.11

14702.11

1993 Dec. 31 To Lease account 20,000

1993 Jan. 1 Dec. 31 By Balance b/d By Depreciation 14702.11 fund 588.9 4,709.80

investment By P & L

20,000

20,000

Depreciation Fund Account 1990 Dec. 31 To Cash 4709.80 1990 Dec. 31By Balance c/d 4709.80

1991 Jan. 1 To Balance b/d 4709.80 188.39 4,709.80

1991 Dec. 31By Balance c/d 9,607.99

Dec. 31 To Depreciation fund Dec. 31 To Cash

9,607.99

9,607.99

1992 Jan. 1 To Balance b/d 9,607.99 384.32 4709.80

1992 Dec. 31By Balance c/d 14,702.11

Dec. 31 To Depreciation fund Dec. 31 To Cash

1993 Jan. 1 Dec. 31 Dec. 31 14,702.11 588.9 4709.80

1993 Dec. 31By Cash 20,000.00

20,000

20,000

Note: The cash installment at the end of the last year will not be invested because there is no point in buying the investment and selling them on the same date.

Advantages of Depreciation Fund Method Or Sinking Fund Method: The most important advantages of this method is that it makes available a sum of money for the replacement of the asset, which has become useless. If separate provision was not made, the sum required to purchase the new asset will have to be drawn from the business which might effect the financial position of the concern adversely. Disadvantages of the Depreciation Fund Method Or Sinking Fund Method: 1. The burden on profit and loss account goes on increasing as years pass by since the amount of depreciation every year remains same but the amount spent on repairs goes on increasing as the asset becomes old. 2. It can also be said that the work of investing money is complicated. 3. Prices of securities may fall at the time when they are to be realized as a result of which loss may have to be suffered.

Insurance Policy Method of Depreciation: Definition and Explanation: Insurance policy method is a slight modification of the depreciation fund method or sinking fund method. Under this method the amount represented by the depreciation fund, instead of being used to buy securities, is paid to an insurance company as premium. The insurance company issues a policy promising to pay a lump sum at the end of the working life of the asset for its replacement. The advantage of insurance policy method is that risk of loss on the sale of investment and the trouble and expense of buying investment are avoided, while disadvantage lies that the interest received on the premiums paid is comparatively very low. When insurance policy method is employed the policy account will take the place of the depreciation fund investment account and no interest will be received at the end of each year, but the total interest on the premiums will be received when the policy matures.

Entries: Every years two entries will be made: 1. In the beginning: Depreciation insurance policy account To Cash account (Being the payment of premium on depreciation policy) 2. At the end of the year: Profit and loss account To Depreciation fund account (Being the amount of depreciation charged to profit and loss account) When the policy will mature i.e., to say the amount of the policy will be received. The entry is: 3. Cash account To Depreciation insurance policy account (Being the policy amount realized) The depreciation insurance policy account will show some profit. This will be transferred to depreciation fund account, the entry being. 4. Depreciation insurance policy account To Depreciation fund account (Being the policy amount realized) The asset account will have been shown throughout at its original cost. It now be written off by transfer to depreciation fund account. The entry is: 5. Depreciation fund account To Asset account Insurance Policy Method Example: On 1st January, 1990 a business purchases a three year lease of premises for $20,000 and it is decided to make a provision for replacement of the lease by means o an insurance policy purchased for annual premium. Show the ledger accounts dealing with this matter.

Solution: Leasehold Account Dr. Side 1990 Jan. 1 To Cash Depreciation Fund Account Dr. Side 1990 Dec. 31 Cr. Side 1990 Dec. 31 By Profit and a/c loss6,400 20,000 Cr. Side 1990 Dec. 31 By Depreciation fund 20,000

To Balance c/d

6,400

1991 Dec. 31 Jan. 1 By Balance 6,400 b/d By Profit and a/c loss6,400

To Balance c/d

12,800

Dec. 31

12,800

12,800

1992 Dec. To 31 Property Leasehold

1992 Jan. 1 By Balance 12,800 b/d By Profit and a/c loss6,400

20,000

Dec. 31

"

By Leasehold

800

20,000

20,000

Leasehold Policy Account Dr. Side 1990 Dec. 31 Cr. Side 1990 Dec. 31 By Balance 6,400 c/d

To Cash

6,400

1991 Jan. 1 Dec. 31

1991 Dec. 31 By Balance 12,800 c/d

To Balance b/d

6,400

To Cash

6,400

12,800

12,800

To Balance b/d To Cash

12,800 6,400 800

By Cash 20,000

20,000

20,000

REVALUATION METHOD OF DEPRECIATION As the name implies under revaluation method, the assets are valued at the end of each period so that the difference between the old value and the new value, which represents the actual depreciation can be charged against the profit and loss account. This method is mostly used in case of assets like bottles, horses, packages, loose tools, casks etc. On rare occasions when on revaluation the value of an asset is found to have increased, it being of temporary nature not taken into account. Revaluation method is open to various objections. Firstly, the method do not specify as to which is the value that the experts are to estimate at the end of each year. It however appears that this is the market value. If so, to assess depreciation with reference to market value is against the basic principles and theory of depreciation. A fixed asset has nothing to do with market value. Secondly, the charge against profit and loss account on account of depreciation will vary year to year through the asset renders the same service throughout of its life time. Thirdly, this method is unscientific, because there are great chance of manipulations.

Sum of the Years' Digits Method of Depreciation: Learning Objectives: 1. Explain the sum of the years' digits method of depreciation. Definition and Explanation: Sum of the Years' Digits Method an accelerated method of depreciation which is also based on the assumption that the loss in the value of the fixed asset will be greater during the earlier years and will go on decreasing gradually with the decrease in the life of such asset. The SYD is found by estimating an asset's useful life in years, then assessing consecutive numbers to each year, and totaling these numbers. For n years:

SYD = 1 + 2 + 3 + 4 + ...... + n For example if the useful life of an asset is 5 years, the SYD would be 1 + 2 + 3 + 4 + 5 = 15. Determining the SYD factor by simple addition can be somewhat laborious for long-lived assets. For these assets the formula n (n + 1) / 2 where n = the number of periods in the asset's useful life can be applied to derive the SYD. In our example, we have: 5(5 + 1) = 2 2 30 =15

The yearly depreciation is then calculated by multiplying the total depreciable amount for the life of the asset by a fraction whose numerator is the remaining useful life and whose denominator is the SYD. Thus in our example the calculation would: First year depreciation Second year depreciation Third year depreciation Fourth year depreciation Fifth year depreciation = = = = = 5/15 4/15 3/15 2/15 1/15 Depreciation cost Depreciation cost Depreciation cost Depreciation cost Depreciation cost

The formula for depreciation for this method is: Depreciation = Depreciation cost (Remaining useful life/SYD) Example: ABC Ltd. purchased a truck for $65,000 on 1st January 1991. The expected life was 5 years and salvage value $5,000. Calculate the annual depreciation expense by applying sum-of-theyears' digits (SYD) method. Solution: Amount to be written of = $65,000 - 5,000 = 60,000 SYD = 1 + 2 + 3 + 4 + 5 = 15

The annual depreciation is: First year depreciation Second year depreciation Third year depreciation Fourth year depreciation Fifth year depreciation = = = = = 5/15 4/15 3/15 2/15 1/15 60,000 60,000 60,000 60,000 60,000 = = = = = 20,000 16,000 12,000 8,000 4,000

Total

60,000

When the asset is acquired during the year, the depreciation expense may be determined by dividing the fractional multipliers between the current and succeeding year. Using the data in the above example suppose the truck is purchased on 30thJune 1991, the depreciation is computed as follows:

End of theDepreciable year 1. 2. cost 60,000 60,000 60,000 3. 60,000 60,000 4. 60,000 60,000 5. 60,000 60,000 6. 60,000

Years' fraction

Years' depreciation 10,000

Accumulated depreciation 1,000

Cost

Book value

5/15 (1/2) ]5/15 4/15 (1/2) ]4/15 3/15 (1/2) 3/15 2/15 (1/2) ]2/15 1/15 (1/2) 1/15 (1/2)

65,000 55,000

(1/2)10,000 8,000 (1/2)8,000 6,000 (1/2)6,000 4,000 (1/2)4,000 2,000 2,000 58,000 60,000 65,000 7,000 65,000 5,000 52,000 65,000 13,000 42,000 65,000 23,000 28,000 65,000 37,000

Scope of the Sum of Years' Digits Method (SYD): As an accelerated depreciation method, the SYD approach is most appropriate for those situations in which the asset is judged to render greater utility during its earlier life and less in its later life.

Double Declining Balance Method of Depreciation: Learning Objectives: 1. Define and explain the double declining balance method of depreciation. Double declining balance method is another type of accelerated depreciation method followed generally in USA. The depreciation expense is computed by multiplying the asset cost less accumulated depreciation by twice the straight line rate expressed in percentage. No provision is made for salvage value of the asset. Double declining balance rate is found by using the following formula: Double Declining Balance Rate = (100%/Years of Useful Life) 2 Example: A printing machine is purchased for $20,000 on January 1991. The scrap value is estimated at $2,000 at the end of 5 years useful life of the asset. Required: Calculate the annual depreciation charge by applying double declining balance method Solution: Depreciation rate (100%/5) 2 = 40% The following table shows the depreciation for the five year period:

End of Year

Asset Cost

Rate

Amount

accumulated

Book Value

depreciation 1 2 3 4 5 20,000 20,000 20,000 20,000 20,000 40% 40% 40% 40% 40%

depreciation 8,000 4,800 2,880 1,728 1,037

depreciation 8,000 12,800 15,680 17,408 18,445 12,000 7,200 4,320 2,592 1,555

In applying this method the entire original cost can never be depreciated. There is bound to be some balance though only a small one. In this example, a salvage value of $1,555 is automatically provided for. However, an asset should not be depreciated below it salvage value of $2,000. Therefore the depreciation expenses at the end of fifty year should be $592 and not $1,037

Depletion Method of Depreciation: Learning Objectives: 1. What is depletion method of depreciation? Explain with example. Depletion method of depreciation is especially suited to mines, quarries, sand pits, etc. According to it the cost of the asset is divided by the total workable deposits. In this way, rate of depreciation per unit of output is ascertained. Depreciation in any particular year is charged on the basis of the output during that year. Example: A mine was acquired at a cost of $20,00,000 the quantity of minerals expected to be mined is 5,00,000 tons, the rate of depreciation per unit will be $4 i.e., (20,00,000 / 5,00,000). If during the year 25,000 tons minerals is extracted, the amount of depreciation will be 25,000 4 = $1,00,000.

Basis of Use System of Depreciation of Depreciation: Learning Objectives: 1. Define and explain the basis of use system of depreciation. One of the chief factors causing depreciation is use. For example in the case of plant and machinery, it is the total number of hours for which the machines work is the main factor and not their life. Therefore, depreciation should be charged on the basis of use. In order to calculate, the total number of hours for which the machine is estimated to work is ascertained. The net cost of the asset is divided by the number of hours estimated and the result would give the amount of depreciation per hour. Each year depreciation would be written off at this rate on the number of hours worked during the year. Example: A machine is bought for $40,000 and its life is estimated at 20,000 hours. The hourly rate of depreciation will be $2. If in a year machine is used for 1,000 hours, depreciation will be $2,000 (1,000 2).

Depreciation of Various Assets: Learning Objectives: 1. How should the depreciation on various assets be calculated?. We discuss below the problem of depreciating some given assets. Freehold Land and Building: It means that land and building which has been purchased out right and not on lease. In the case of building it will be seen that in its early life, few repairs will be needed. These repairs will keep the building in proper order. But after sometime the building will begin to decay and even the repairs will not succeed in keeping it in proper working order. Efficient repairs, no doubt, add to the life of the building, but they cannot make it everlasting. After some considerable time the building will practically fall in spite of all the repairs. Hence it is absolutely necessary to charge depreciation on such building, so that by the time it falls down, its book value also

disappears from the books of accounts. As this asset possesses a long life, the method of depreciation employed should be such as it provides a fund for its reconstruction on its dilapidation. Thus either of the straight line method or reducing installment method may be adopted to depreciate this asset. One of the peculiarly of the land is that it does not generally depreciate. Its value may and does fluctuate from time to time, but such fluctuations do not influence depreciation in any way. Consequently older accountants were of the opinion that land should be left at the cost price in the books. According to modern opinion the idea of the depreciation with regard to land cannot be ruled out entirely. Agricultural land may loss its fertility. Brick land may depreciate. as such, in some cases at least land must be depreciated. Leasehold Land and Building: By leasehold is meant the land that is taken on lease for a certain number of years. The most general duration is 99 years, but may of course be less or much more. If the lease under which the property is acquired is short, the fixed installment method or straight line method of depreciation can be applied conveniently. If on the other hand, it be a long lease, the annuity method of depreciation would be more suitable. The value of the leasehold property should be written off during the term of the lease and the rate of depreciation should be fixed accordingly. Plant and Machinery: This term includes machinery of different kinds e.g., engines, boilers, fixed plant, running machinery, etc. As the working life of each one of them is different, the rate of depreciation should also be different. Though fixed installment method or straight line method can be suitably applied to depreciating plant and machinery but owing to the difficulty of calculating depreciation on additions made during the year, the diminishing balance method is generally employed to depreciate this asset. Loose Tools: As this asset is liable to breakage and pilferage, it should be annually valued. The difference between the present value and the value as per last balance sheet should be treated as depreciation.

Furniture and Fixture: The diminishing balance method is usually employed to depreciate this asset. The rate of depreciation should be high enough to reduce it to its residual value at the end of its working life. Patents and Copyrights: There is a maximum legal life of such assets but the commercial life (during which such assets can be effectively exploited) may even be shorter. The assets should be depreciated by the straight line method so that it is written off within the legal or commercial life whichever is shorter. Mines, Oil Well, Quarries, Etc: The depreciation should be estimated by the depletion method. Goodwill: Goodwill has been defined as the benefit or advantage arising from regular public patronage on account of facilities offered. The name under which the business is carried on acquires a reputation and consequently a saleable value. It can be sold only when entire business is sold off. It is an intangible asset. Though goodwill is a fixed asset it does not depreciate on account of wear and tear like plant and machinery etc. As goodwill is not consumed in the process of earning income, it is not necessary to depreciate it. But as no business, howsoever well established, can have perpetual life, it is advisable to create a reserve from the profit and loss account in prosperous years because when profits fall and goodwill depreciates it may be difficult to write it off.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Basic Financial Econometrics PDFDocument167 pagesBasic Financial Econometrics PDFdanookyereNo ratings yet

- Newtech Advant Business Plan9 PDFDocument38 pagesNewtech Advant Business Plan9 PDFdanookyereNo ratings yet

- BoA CFE-CMStatistics 2017 PDFDocument272 pagesBoA CFE-CMStatistics 2017 PDFdanookyereNo ratings yet

- Customer Satisfaction Theories PDFDocument34 pagesCustomer Satisfaction Theories PDFdanookyereNo ratings yet

- Joshua 1:9: Bible Quotations For The Bible Reading MarathonDocument5 pagesJoshua 1:9: Bible Quotations For The Bible Reading MarathondanookyereNo ratings yet

- Consumer Buying DecisionsDocument2 pagesConsumer Buying DecisionsdanookyereNo ratings yet

- The Role of Communication in Contemporary MarketingDocument4 pagesThe Role of Communication in Contemporary MarketingdanookyereNo ratings yet

- Importance of A Trial BalanceDocument1 pageImportance of A Trial Balancedanookyere100% (3)

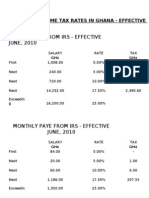

- Personal Income Tax Rates in GhanaDocument2 pagesPersonal Income Tax Rates in GhanadanookyereNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Practice Skills Assessment Type ADocument13 pagesPractice Skills Assessment Type Asybell8No ratings yet

- Ghaziabad - 7503448221 - Call Girls in Noida Sector 62Document1 pageGhaziabad - 7503448221 - Call Girls in Noida Sector 62Rahul SharmaNo ratings yet

- Theory and Practice in Language StudiesDocument170 pagesTheory and Practice in Language StudiesHossam Abd-ElghafarNo ratings yet

- E-Goverment Opportunities and ChallengesDocument24 pagesE-Goverment Opportunities and ChallengesMikaye WrightNo ratings yet

- Century Plan BrochureDocument28 pagesCentury Plan Brochuresandeepgiri71No ratings yet

- Tendernotice - 1 (4) 638043623175233354Document5 pagesTendernotice - 1 (4) 638043623175233354Ar Shubham KumarNo ratings yet

- Community Participation in Development ProjectsDocument52 pagesCommunity Participation in Development ProjectsRuby GarciaNo ratings yet

- IBT Sample Paper Grade 6 EnglishDocument7 pagesIBT Sample Paper Grade 6 Englishppats50% (10)

- Etoken Anywhere 8.1 Admin Guide Rev ADocument101 pagesEtoken Anywhere 8.1 Admin Guide Rev Atall27100% (1)

- Nicomachean Ethics AristotleDocument14 pagesNicomachean Ethics AristotleNathaniel BaldevinoNo ratings yet

- (Routledge Research in Higher Education) Jenny L. Small - Critical Religious Pluralism in Higher Education - A Social Justice Framework To Support Religious Diversity-Routledge (2020)Document105 pages(Routledge Research in Higher Education) Jenny L. Small - Critical Religious Pluralism in Higher Education - A Social Justice Framework To Support Religious Diversity-Routledge (2020)yakadimaya43No ratings yet

- Wasilah DoaDocument1 pageWasilah DoaFiqhiFajarNo ratings yet

- Mif M3Document32 pagesMif M3MorvinNo ratings yet

- RF 4cs of 432nd TRWDocument25 pagesRF 4cs of 432nd TRWpepepatosNo ratings yet

- Lis Rhodes - Whose HistoryDocument4 pagesLis Rhodes - Whose HistoryevaNo ratings yet

- G.R. No. 122058. May 5, 1999 Ignacio R. Bunye Vs SandiganbayanDocument2 pagesG.R. No. 122058. May 5, 1999 Ignacio R. Bunye Vs SandiganbayanDrimtec TradingNo ratings yet

- Computer Forensics - An: Jau-Hwang Wang Central Police University Tao-Yuan, TaiwanDocument27 pagesComputer Forensics - An: Jau-Hwang Wang Central Police University Tao-Yuan, TaiwanDESTROYERNo ratings yet

- "Successful Gigging and Freelancing": by Dr. Adrian DalyDocument12 pages"Successful Gigging and Freelancing": by Dr. Adrian DalyKevinPaceNo ratings yet

- Medieval MusicDocument25 pagesMedieval MusicMis Gloria83% (6)

- Tampuhan PaintingDocument2 pagesTampuhan PaintingtstbobbyvincentbentulanNo ratings yet

- LESSON 1 - Geographic Linguistic and Ethnic Dimensions of Philippine Literary History From Pre Colonial To The ContemporaryDocument86 pagesLESSON 1 - Geographic Linguistic and Ethnic Dimensions of Philippine Literary History From Pre Colonial To The ContemporaryJuryz PinedaNo ratings yet

- HR Audit ChecklistDocument4 pagesHR Audit Checklistpielzapa50% (2)

- GladiatorDocument1 pageGladiatorRohith KumarNo ratings yet

- Members Group: Indah Rahmadini M.Isra Nurcahya Koncoro Marsyandha WidyanurrahmahDocument11 pagesMembers Group: Indah Rahmadini M.Isra Nurcahya Koncoro Marsyandha WidyanurrahmahkeringNo ratings yet

- Tugas KevinDocument3 pagesTugas KevinSherlyta AlexandraNo ratings yet

- ResearchDocument8 pagesResearchMitchele Piamonte MamalesNo ratings yet

- Narmada Bachao AndolanDocument12 pagesNarmada Bachao AndolanAryan SinghNo ratings yet

- Therapeutic Relationship - 2Document45 pagesTherapeutic Relationship - 2Zaraki yami100% (1)

- Life Cycle Assessment of Electricity Generation in Mauritius - SIMAPRO PDFDocument11 pagesLife Cycle Assessment of Electricity Generation in Mauritius - SIMAPRO PDFLeonardo Caldas100% (1)

- Ajahn Brahm Ups and Downs in LifeDocument16 pagesAjahn Brahm Ups and Downs in LifeTomas GenevičiusNo ratings yet