Professional Documents

Culture Documents

Derivatives Final

Uploaded by

Azim SamnaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives Final

Uploaded by

Azim SamnaniCopyright:

Available Formats

DERIVATIVES

RECEIVED GUIDENCE: PROF JIGAM GANDHI

DERIVATIVES

Royal College of Arts, Science and Commerce SUBJECT: 4.6

PROJECT ON :DERIVATIVES S.Y.BANKING & INSURANCE SEMESTER 4 (2010-2011)

BHAGYALAXMI (10)

DIVYA (6)

AFTAB (32)

SANIF (36)

DERIVATIVES

We would like to express our profound gratitude to our project guide Prof JIGAM GANDHI, who has so ably guided our research project with her vast fund of knowledge, advice and constant encouragement, which made us, think past the difficulties and lead us to successful completion of the project. We have tried to cover all the aspects of the project & every care has been taken to make the project faultless. We have tried to write the project in our words as far as possible and simplified all the concepts by presenting it in a different form. Well be looking forward in future for such type of project. We are eagerly waiting for fruitful comments & constructive suggestions.

DERIVATIVES

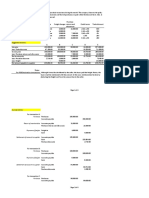

SR.NO 1 2 3 4 5 6 7 8

TOPIC INTRODUCTION TO DERIVATIVE THE TYPES OF DERIVATIVE MARKET EXCHANGE-TRADED V/S OTC DERIVATIVES MARKETS TYPES OF TRADERS IN A DERIVATIVES MARKET DERIVATIVE MARKET EQUITY HOW TO TRADE STOCK DERIVATIVES? TYPES OF DERIVATIVE INSTRUMENTS WHAT ARE THE DIFFERENCES BETWEEN A FUTURES AND A FORWARD CONTRACT? CASH V/S DERIVATIVE MARKET THE DERIVATIVE MARKETS PERFORM A NUMBER OF ECONOMIC FUNCTIONS:

PAGE NO 5 9 10 11 13 14 15 19

9 10

20 21

11 12 13 14 15 16 17 18

Dos and Donts DERIVATIVE MARKET AND FINANCIAL RISK WHAT ARE THE RISK ASSOCIATED WITH DERIVATIVES? NEED FOR DERIVATIVES IN INDIA TODAY MYTHS AND REALITIES ABOUT DERIVATIVES ARTICLE CONCLUSION WEBLIOGRAPHY

24 24 25 31 33 39 41 42

DERIVATIVES

INTRODUCTION TO DERIVATIVES

Derivative instruments are used as financial management tools to enhance investment returns and to manage such risks relative to interest rates, exchange rates, and financial instrument and commodity prices. Several local and international banks, businesses, municipalities, and others have experienced significant losses with the use of derivatives. However, their use has increased as efforts to control risk in complex situations are perceived to be wise strategic decisions. Primary market is used for raising money and secondary market is used for trading in the securities, which have been used in primary market. But derivative market is quite different from other markets as the market is used for minimizing risk arising from underlying assets. The Derivatives Market is meant as the market where exchange of derivatives takes place. Derivatives are one type of securities whose price is derived from the underlying assets. And value of these derivatives is determined by the fluctuations in the underlying assets. These underlying assets are most commonly stocks, bonds, currencies, interest rates, commodities and market indices. As Derivatives are merely contracts between two or more parties, anything like weather data or amount of rain can be used as underlying assets. The Derivatives can be classified as Future Contracts, Forward Contracts, Options, Swaps and Credit Derivatives. A financial derivative is a product that derives value from the market of another product. Hence derivative market has no independent existence without an underlying asset. The price of the derivative instrument is contingent on the value of underlying assets. As a tool of risk management we can define it as, "a financial contract whose value is derived from the value of an underlying asset/derivative security". All derivatives are based on some cash product. The underlying assets can be: 1. Any type of agriculture product of grain (not prevailing in India) 2. Price of precious and metals gold

5

DERIVATIVES

3. Foreign exchange rates 4. Short term as well as long-term bond of securities of different type issued by govt. and companies etc. 5. O.T.C. money instruments for example loan & deposits. Example: Wheat farmers may wish to sell their harvest at a future date to eliminate the risk of change in price by that date. The price of these derivatives is driven from spot price of wheat. Derivatives markets attract three main types of participants: hedgers, speculators, and arbitrageurs. Hedgers reduce the risk that they face in terms of asset prices by using futures or options markets. Speculators focus on future price movements, for which futures and options contracts provide them with extra leverage. Such investors speculate on potential gains and losses and help to make the market more liquid. Arbitrageurs, on the other hand, take advantage of price differences in different markets. For example, they use the discrepancy between cash prices and future prices to make a profit. The derivatives market can be seen as providing a number of economic benefits. Being speculative in nature, it provides the investor with a perception of the market not only in terms of current prices, but also in terms of the future. A further function is that derivatives markets transfer risks from those who have no appetite for them to those who do. Finally, the underlying cash market enjoys higher trading volumes from more players as a result of risk mitigation.

DEFINITION OF DERIVATIVE

In the Indian context the Securities contracts (Regulation), Act 1956 defines "Derivative" to include: (1) A security derived from a debt instrument, Share, Loan whether secured or unsecured, Risk instrument or contract for difference or any other form of security. A contract, which derives its value from the prices of underlying securities.

DERIVATIVES

HISTORICAL ASPECT OF DERIVATIVES

The need for derivatives as hedging tool was first felt in the commodities market. Agricultural F&O helped farmers and PROCESSORS hedge against commodity price risk. After the fallout of BRITAIN WOOD AGREEMENT, the financial markets in the world started undergoing radical changes, which give rise to the risk factor. This situation led to development of derivatives as effective "Risk Management tools". Derivative trading in financial market started in 1972 when "Chicago Mercantile Exchange opened its International Monetary Market Division (IMM). The IMM provided an outlet for currency speculators and for those looking to reduce their currency risks. Trading took place on currency. Futures, which were contracts for specified quantities of given currencies, the exchange rate was fixed at time of contract later on commodity future contracts was introduced then followed by interest rate futures. Looking at the liquidity market, derivatives allow corporate and institutional investors to effectively manage their portfolios of assets and liabilities through instruments like stock index futures and options. An equity fund e.g. can reduce its exposure to the stock market and at a relatively low cost without selling of part of its equity assets by using stock index futures or index options. Therefore the stock index futures first emerged in U.S.A. in 1982.

DERIVATIVES

HISTORY OF DERIVATIVES TRADING IN INDIA

Before derivatives trading began, NSE and BSE were all-electronic equity spot markets. By international standards, they were small markets. Derivatives trading, which started in June 2000, was a turning point in many ways. And after all the changes had fallen into place, NSE and BSE were both amongst the top 10 exchanges in the world by the number of transactions. At NSE, at the outset, there was only one contract: Nifty futures. A full set of equity derivatives products was only available by November 2001. The 9/11 attacks on the World Trade Centre in the US were the first important event surrounding which index derivatives trading came to be of interest. Starting from November 2001, the growth in the number of contracts traded at NSE has been remarkable: an average compounded growth of 5.1% per month. Few derivatives exchanges worldwide have obtained such a hectic pace of growth in the early years after launch. In early 2002, the market had a new technique (options and futures) for expressing old ideas (views on individual stocks). The idea of trading an index was something new. Gradually, knowledge about the index percolated (to spread slowly and gradually) within the community, and the share of index derivatives went up to over 80% of the overall equity derivatives trading. There has also been a shift away from equity derivatives. Currency derivatives trading commenced at NSE in August 2008 with a limited form of currency futures trading. At the time, trading was permitted in only futures on the rupee-dollar rate, options and swaps were banned, participations by FIIs and NRIs was banned. Yet, currency derivatives trading rapidly gained prominence at NSE, rising to above 10% of the overall NSE derivatives business within six months.

DERIVATIVES

THE TYPES OF DERIVATIVE MARKET

The Derivative Market can be classified as Exchange Traded Derivatives Market and Over the Counter Derivative Market. Exchange Traded Derivatives are those derivatives which are traded through specialized derivative exchanges whereas Over the Counter Derivatives are those which are privately traded between two parties and involves no exchange or intermediary. Swaps, Options and Forward Contracts are traded in Over the Counter Derivatives Market or OTC market. The main participants of OTC market are the Investment Banks, Commercial Banks, Govt. Sponsored Enterprises and Hedge Funds. The investment banks markets the derivatives through traders to the clients like hedge funds and the rest. In the Exchange Traded Derivatives Market or Future Market, exchange acts as the main party and by trading of derivatives actually risk is traded between two parties. One party who purchases future contract is said to go long and the person who sells the future contract is said to go short. The holder of the long position owns the future contract and earns profit from it if the price of the underlying security goes up in the future. On the contrary, holder of the short position is in a profitable position if the price of the underlying security goes down, as he has already sold the future contract. So, when a new future contract is introduced, the total position in the contract is zero as no one is holding that for short or long. The trading of foreign exchange traded derivatives or the future contracts has emerged as very important financial activity all over the world just like trading of equity-linked contracts or commodity contracts. The derivatives whose underlying assets are credit, energy or metal, have shown a steady growth rate over the years around the world. Interest rate is the parameter which influences the global trading of derivatives, the most.

DERIVATIVES

EXCHANGE-TRADED MARKETS

V/S

OTC

DERIVATIVES

The OTC derivatives markets have witnessed rather sharp growth over the last few years, which have accompanied the modernization of commercial and investment banking and globalization of financial activities. The recent developments in information technology have contributed to a great extent to these developments. While both exchange-traded and OTC derivative contracts offer many benefits, the former have rigid structures compared to the latter. It has been widely discussed that the highly leveraged institutions and their OTC derivative positions were the main cause of turbulence in financial markets in 1998. These episodes of turbulence revealed the risks posed to market stability originating in features of OTC derivative instruments and markets. The OTC derivatives markets have the following features compared to exchange-traded derivatives: 1. The management of counter-party (credit) risk is decentralized and located within individual institutions, 2. There are no formal centralized limits on individual positions, leverage, or margining, 3. There are no formal rules for risk and burden-sharing, 4. There are no formal rules or mechanisms for ensuring market stability and integrity, and for safeguarding the collective interests of market participants, and 5. The OTC contracts are generally not regulated by a regulatory authority and the exchanges self-regulatory organization, although they are affected indirectly by national legal systems, banking supervision and market surveillance. Some of the features of OTC derivatives markets embody risks to financial market stability. The following features of OTC derivatives markets can give rise to instability in institutions, markets, and the international financial system: (i) the dynamic nature of gross credit exposures; (ii) information asymmetries; (iii) the effects of OTC derivative.

10

DERIVATIVES

TYPES OF TRADERS IN A DERIVATIVES MARKET

1. Hedgers:

Hedgers are those who protect themselves from the risk associated with the price of an asset by using derivatives. A person keeps a close watch upon the prices discovered in trading and when the comfortable price is reflected according to his wants, he sells futures contracts. In this way he gets an assured fixed price of his produce. In general, hedgers use futures for protection against adverse future price movements in the underlying cash commodity. Hedgers are often businesses, or individuals, who at one point or another deal in the underlying cash commodity. Take an example: A Hedger pay more to the farmer or dealer of a produce if its prices go up. For protection against higher prices of the produce, he hedge the risk exposure by buying enough future contracts of the produce to cover the amount of produce he expects to buy. Since cash and futures prices do tend to move in tandem(all facing in the same direction), the futures position will profit if the price of the produce rise enough to offset cash loss on the produce.

2. Speculators:

Speculators are some what like a middle man. They are never interested in actual owing the commodity. They will just buy from one end and sell it to the other in anticipation of future price movements. They actually bet on the future movement in the price of an asset. They are the second major group of futures players. These participants include independent floor traders and investors. They handle trades for their personal clients or brokerage firms. Buying a futures contract in anticipation of price increases is known as going long. Selling a futures contract in anticipation of a price decrease is known as going short. Speculative participation in futures trading has increased with the availability of alternative methods of participation. Speculators have certain advantages over other investments they are as follows:

If the traders judgement is good, he can make more money in the futures market faster because prices tend, on average, to change more quickly than real estate or stock prices.

11

DERIVATIVES

Futures are highly leveraged investments. The trader puts up a small fraction of the value of the underlying contract as margin, yet he can ride on the full value of the contract as it moves up and down. The money he puts up is not a down payment on the underlying contract, but a performance bond. The actual value of the contract is only exchanged on those rare occasions when delivery takes place.

3. Arbitrators:

According to dictionary definition, a person who has been officially chosen to make a decision between two people or groups who do not agree is known as Arbitrator. In commodity market Arbitrators are the person who take the advantage of a discrepancy between prices in two different markets. If he finds future prices of a commodity edging out with the cash price, he will take offsetting positions in both the markets to lock in a profit. Moreover the commodity futures investor is not charged interest on the difference between margin and the full contract value.

12

DERIVATIVES

DERIVATIVE MARKET EQUITY

The derivative market equity includes the financial instruments such as futures, options and swaps. The equity derivatives are stocks or stock indices whose prices depend on the prices of the underlying equity instrument. The equity derivatives are traded in the futures and options exchanges or in the over the counter markets. The most common forms of the derivative market equity are the futures and the options market.

The options and futures market

Options are contracts that give the buyer or seller the right and not the obligation to buy or sell the underlying asset at a fixed price at a future date. the call option gives the right to buy while the put option gives the right to sell. The buyer of the call option can gain by an increase in the price of the underlying asset without buying the underlying asset. Conversely the put option holder benefits from the fall in the price level of the underlying asset. Contrast to the option market the person who goes long or short in the futures market is bound to buy or sell the contract at the specified price and date. Hence the futures contracts are much more standardized in comparison to the options and hence they are traded in accredited exchanges.

Warrants

Unlike the options and the futures which are exchange traded financial instruments, the warrants are equity derivatives that are traded over the counter. Warrants are used sometimes to increase the yield of bonds. Warrants are similar to the equity options but are an exception since they are traded by private parties.

Convertible Bonds

Convertible bonds are a combination of bonds and equity. The convertible bonds provide asset protection, high equity returns and they are of less volatile nature. The investors in the equity derivative can hedge their risk. The equity derivatives are also used as a speculative instrument. The derivative market equity traders use the data on stock and their derivatives. They also need, in addition, the factors that may affect the equity prices. To analyze the data the equity market traders need appropriate statistical tools.

13

DERIVATIVES

HOW TO TRADE STOCK DERIVATIVES?

Stock derivatives can offer investors a very good opportunity to make money from the fluctuations of the stock market. The good news is that trading derivatives on stocks requires small capital. Options is the most widely traded derivatives instruments in the stock market today. This article will illustrate the needed steps to begin trading stock options. Things youll need are Small capital, options brokerage account, internet access.

Instructions:

1. The first thing is to put your financial capital together. Stock Option trading does not require large amounts of money. Between $1,000 and $2,000 is enough to begin. 2. Identify a discount options brokerage company. Most regular stock brokerage companies also offer option trading. Select the firms with the lowest commissions, as lower commissions would allow you to maximize your profit potentials. 3. Contact the company and ask them about their requirements to operate an options trading account. Option trading requires some basic knowledge and understanding of the option trading guidelines. The company would qualify you based on the information you filled out on the application. 4. Open your options account, signature verifications are required with all stock and stock derivatives options trading accounts. 5. Start trading the basic stock option derivatives such as calls and puts. A call allows you to make money if the underlying stock advances in price. A put will allow you make money if the underlying stock drops in value.

Tips & Warnings

The best way to begin trading stock option derivatives is to research the stocks with good and bad fundamentals. Stocks with good fundamentals, such as strong sales and data, are usually good for call option derivatives trading. On the other hand companies with bad fundamentals and data such as dropping sales and other problems are ripe for put trading. Options trading is risky. You may loose some or all of the money you used in buying a stock option. Options are described as decaying instruments, meaning that with time the value of your option may decline as the expiration date approaches, unless such option is "in the money".

14

DERIVATIVES

TYPES OF DERIVATIVE INSTRUMENTS

Derivative instruments are classified as:

Forward Contracts Futures Contracts Options Swaps

Derivatives can also be classified as either forward-based (e.g., futures, forward contracts, and swap contracts), option-based (e.g., call or put option), or combinations of the two. A forward-based contract obligates one party to buy and a counter party to sell an underlying asset, such as foreign currency or a commodity, with equal risk at a future date at an agreed-on price. Option-based contracts (e.g., call options, put options, caps and floors) provide the holder with a right, but not an obligation to buy or sell an underlying financial instrument, foreign currency, or commodity at an agreed-on price during a specified time period or at a specified date. Forward Contracts: Forward contracts are negotiated between two parties, with no formal regulation or exchange, to purchase (long position) and sell (short position) a specific quantity of a specific quantity of a commodity (i.e., corn and gold), foreign currency, or financial instrument (i.e., bonds and stock) at a specified price (delivery price), with delivery or settlement at a specified future date (maturity date). The price of the underlying asset for immediate delivery is known as the spot price. Forward contracts may be entered into through an agreement without a cash payment, provided the forward rate is equal to the current market rate. Forward contracts are often used to hedge the entire price changed of a commodity, a foreign currency, or a financial instrument. Irrespective of a price increase or decrease. A cash market transaction in which a seller agrees to deliver a specific cash commodity to a buyer at some point in the future. Unlike futures contracts (which

15

DERIVATIVES

occur through a clearing firm), cash forward contracts are privately negotiated and are not standardized. Further, the two parties must bear each other's credit risk, which is not the case with a futures contract. Also, since the contracts are not exchange traded, there is no marking to market requirement, which allows a buyer to avoid almost all capital outflow initially (though some counterparties might set collateral requirements). Given the lack of standardization in these contracts, there is very little scope for a secondary market in forwards. The price specified in a cash forward contract for a specific commodity. The forward price makes the forward contract have no value when the contract is written. However, if the value of the underlying commodity changes, the value of the forward contract becomes positive or negative, depending on the position held. Forwards are priced in a manner similar to futures. Like in the case of a futures contract, the first step in pricing a forward is to add the spot price to the cost of carry (interest forgone, convenience yield, storage costs and interest/dividend received on the underlying). Unlike a futures contract though, the price may also include a premium for counterparty credit risk, and the fact that there is not daily marking to market process to minimize default risk. If there is no allowance for these credit risks, then the forward price will equal the futures price Futures Contracts: Futures are standardized contracts traded on a regulated exchange to make or take delivery of a specified quantity of a commodity, a foreign currency, or a financial instrument at a specified price, with delivery or settlement at a specified future date. Futures contracts involve U.S. Treasury bonds, agricultural commodities, stock indices, interest-earning assets, and foreign currency. A futures contract is entered into through an organized exchange, using banks and brokers. These organized exchanges have clearinghouses, which may be financial institutions or part of the futures exchange. They interpose themselves between the buyer and the seller, guarantee obligations, and make futures liquid with low credit risk. Although no payment is made upon entering into a futures contract, since the underlying (i.e. interest rate, share price, or commodity price) is at-the-market, subsequent value changes require daily mark-to-marking by cash settlement (i.e. disbursed gains and daily collected losses). Similarly, margin requirements involve deposits from both parties to ensure any financial liabilities.

16

DERIVATIVES

Futures contracts are used to hedge the entire price change of a commodity, a foreign currency, or a financial instrument since the contract value and underlying price change symmetrically. A standardized, transferable, exchange-traded contract that requires delivery of a commodity, bond, currency, or stock index, at a specified price, on a specified future date. Unlike options, futures convey an obligation to buy. The risk to the holder is unlimited, and because the payoff pattern is symmetrical, the risk to the seller is unlimited as well. Dollars lost and gained by each party on a futures contract are equal and opposite. In other words, futures trading is a zero-sum game. Futures contracts are forward contracts, meaning they represent a pledge to make a certain transaction at a future date. The exchange of assets occurs on the date specified in the contract. Futures are distinguished from generic forward contracts in that they contain standardized terms, trade on a formal exchange, are regulated by overseeing agencies, and are guaranteed by clearinghouses. Also, in order to insure that payment will occur, futures have a margin requirement that must be settled daily. Finally, by making an offsetting trade, taking delivery of goods, or arranging for an exchange of goods, futures contracts can be closed. Hedgers often trade futures for the purpose of keeping price risk in check. also called futures. Options contracts: Option contracts give trade hedgers and investors a more flexible alternative to futures as a means of trading on the Exchange. When buying an options contract, the purchaser (taker) is not entering into a firm obligation. They are simply buying a choice of action. This choice allows the genuine trade hedger the opportunity of locking in a fixed price while maintaining the ability to abandon the option in order to take advantage of favourable price movements. This would be forfeited with a straight futures hedge. The two types of options are calls and puts:

Call Option: A call gives the holder the right to buy an asset at a certain price within a specific period of time. Calls are similar to having a long position on a stock. Buyers of calls hope that the stock will increase substantially before the option expires. Put Option: A put gives the holder the right to sell an asset at a certain price

17

DERIVATIVES

within a specific period of time. Puts are very similar to having a short position on a stock. Buyers of puts hope that the price of the stock will fall before the option expires.

Swaps:

A swap is a flexible, private, forward-based contract or agreement, generally between two counter parties to exchange streams of cash flows based on an agreedon (or notional) principal amount over a specified period of time in the future. Swaps are usually entered into at-the-money (i.e. with minimal initial cash payments because fair value is zero), through brokers or dealers who take an upfront cash payment or who adjust the rate to bear default risk. The two most prevalent swaps are interest rate swaps and foreign currency swaps, while others include equity swaps, commodity swaps, and swaptions. Swaptions are options on swaps that provide the holder with the right to enter into a swap at a specified future date at specified terms (stand-alone option in a swap) or to extend or terminate the life of an existing swap (embedded option on a swap). Swap contracts are used to hedge entire price changes (symmetrically) related to an identified hedged risk, such as interest rate or foreign currency risk, since both counter parties gain or lose equally. Traditionally, the exchange of one security for another to change the maturity (bonds), quality of issues (stocks or bonds), or because investment objectives have changed. Recently, swaps have grown to include currency swaps and interest rate swaps. If firms in separate countries have comparative advantages on interest rates, then a swap could benefit both firms. For example, one firm may have a lower fixed interest rate, while another has access to a lower floating interest rate. These firms could swap to take advantage of the lower rates.

18

DERIVATIVES

WHAT ARE THE DIFFERENCES BETWEEN FUTURES AND A FORWARD CONTRACT?

Futures contracts are highly standardized, while each Forward contract is personalized and unique. Futures are settled at the end on the last trading date of the contract with the settlement price; whereas, the Forwards are settled at the start with a forward price. The profit or loss on a Futures position is exchanged in cash every day. With the Forwards contract, the profit or loss is realized only at the time of settlement so the credit exposure can keep increasing. The Futures contract does not specify to whom the delivery of a physical asset must be made; in a Forwards contract it is clearly specified who receives the delivery Futures are traded on an exchange, while Forwards are traded over-thecounter.

DIFFERENCE BETWEEN FUTURES AND OPTIONS

A future is a contract which is governed by a pre-determined price for selling and buying at a future period. In options, there is the right to sell or purchase of underlying assets without any obligation. A future trading has open risk. The risk in option is limited. The size of the underlying stock is usually huge in future trading. Option trading is of normal size. Futures need no advance payment. Options have the advance payment system of premiums.

19

DERIVATIVES

CASH V/S DERIVATIVE MARKET

The basis differences between these two may be noted as follows. 1. In cash market tangible asset are traded whereas in derivatives market contract based on tangible assets or intangible like index or rates are traded. 2. The value of derivative contract is always based on and linked to the underlying asset. Though, this linkage may not be on point-to point basis. 3. Cash market contracts are settled by delivery and payment or through an offsetting contract. The derivative contracts on tangible may be settled through payment and delivery, offsetting contract or cash settlement, whereas derivative contracts on intangibles are necessarily settled in cash or through offsetting contracts. 4. The cash market always has a net long position, whereas the net position in derivative market is always zero. 5. Cash asset may be meant for consumption or investment. Derivatives are used for hedging, arbitration or speculation. 6. Derivative markets are highly leveraged and therefore could be much more riskier.

20

DERIVATIVES

THE DERIVATIVE MARKETS PERFORM A NUMBER OF ECONOMIC FUNCTIONS:

1. Prices in organized derivative markets reflect the perception of market participants about the future and lead the prices of underlying to perceived future level. The prices of derivatives converge with the prices of the underlying at the expiration of the derivative contract. Thus derivatives help in discovery of future as well current prices. 2. The derivative market helps to transfer the risks from those who have them but may like them those who have an appetite for them. 3. Derivatives due to their inherent nature are linked to the underlying cash markets. With the introduction of derivative, the underlying market, witness higher trading volumes because of participation by more players who would not otherwise participate for lack of an arrangement to transfer risk. 4. Derivatives have a history of attracting many bright, creative, well- educated people with an entrepreneurial attitude. They often energize others to create new business, new products and new employment opportunities, the benefits of which are immense. 5. Derivatives market helps increase savings and investments in the long run Transfer of risk enables market participants to expand their volume of activities.

RISK CHARACTERISTICS OF DERIVATIVES

The main types of risk characteristics associated with derivatives are:

Basis Risk: This is the spot (cash) price of the underlying asset being hedged, less the price of the derivative contract used to hedge the asset. Credit Risk: Credit risk or default risk evolves from the possibility that one of the parties to a derivative contract will not satisfy its financial obligations under the derivative contract. Market Risk: This is the potential financial loss due to adverse changes in the fair value of a derivative. Market risk encompasses legal risk, control risk, and accounting risk.

21

DERIVATIVES

OBJECTIVES OF DERIVATE TRADING

1) HEDGING:

You own a stock and you are confident about the prospects of the company. However at the same time you feel that overall market may not perform as good and therefore price of your stock may also fall in line with overall marked trend. You expect that some adverse economic or political event might affect the market sentiments, though fundamentals of the company will remain good, therefore, it is good to retain the stock. In both these situations you would like to insure your portfolio against any such market fall. Such insurance is known as hedging. Hedging is a tool to reduce the inherent risk in an investment. Various strategies designed to reduce investment risk using call option, put options, short selling, and futures are used for hedging. The basic purpose of a hedge is to reduce the risk of loss.

(2) ARBITRAGE:

The future price of an underlying asset is function of spot price and cost of carry adjusted for any return on investment. However, due to uncertainty about interest rates, distortions in spot prices, or uncertainty about future income stream, prices in futures market may not truly reflect the expected spot price in future. This imbalance in future and spot price gives rise to arbitrage opportunities. Transactions made to take advantage of temporary distortions in the market are known as arbitrage transactions.

(3) SPECULATION:

You may have very strong opinion about the future market price of a particular asset based on past trends, current information and future expectation. Likewise you may also have an opinion about the overall market trend. To take advantage of such opinion, individual asset or the entire market (index) could be sold or purchased. Position taken either in cash market of derivative market on the basis of personal opinion is known as speculation.

22

DERIVATIVES

ADVANTAGES OF DERIVATIVES:

1. Flexibility: Derivatives can be used with respect to commodity price, interest and exchange rates and equity price. They can be used in many ways. 2. Risk Reduction: Derivatives can protect your business from huge losses. In fact, derivatives allow you to cut down on non-essential risks. 3. Stable Economy: Derivatives have a stabilizing effect on the economy by reducing the number of businesses that go under due to volatile market forces.

DISADVANTAGES OF DERIVATIVES:

If derivatives are misused, they can boomerang on the company. 1. Credit Risk: While derivatives cut down on the risks caused by a fluctuating market, they increase credit risk. Even after minimizing the credit risk through collateral, you still face some risk from credit protection agencies. 2. Crimes: Derivatives have a high potential for misuse. They have been the caused the downfall of many companies that used trade malpractices and fraud. 3. Interest Rates: Wrong forecasts can result in losses amounting to millions of dollars for large companies; it can wipe out small businesses. You need to accurately forecast the long term and short term interest rates, something that many businesses cannot do.

23

DERIVATIVES

Dos and Donts Do

Investigate your options in this market thoroughly. Ensure that you are fully aware of the risks you will be taking, and of what level of risk you are comfortable with. Make an informed choice, particularly where risk is concerned. Make sure that you continually review your risk level and modify it if and when necessary.

Dont

Dont take unnecessary risks. Dont forget to check regularly that you are not exceeding the risk level at which you are comfortable. Dont approach the derivatives market with a careless attitude. Make sure that you are always aware of trends and speculations in the market. Dont invest if you are not completely comfortable with participating in a speculative market.

DERIVATIVE MARKET AND FINANCIAL RISK

Derivatives play a vital role in risk management of both financial and nonfinancial institutions. But, in the present world, it has become a rising concern that derivative market operations may destabilize the efficiency of financial markets. In todays world the companies the financial and non-financial firms are using forward contracts, future contracts, options, swaps and other various combinations of derivatives to manage risk and to increase returns. It is true that growth of derivatives market reveal the increasing market demand for risk managing instruments in the economy. But, the major concern is that, the main components of Over the Counter (OTC) derivatives are interest rates and currency swaps. So, the economy will suffer surely if the derivative instruments are misused and if a major fault takes place in derivatives market.

24

DERIVATIVES

WHAT ARE THE DERIVATIVES?

RISK

ASSOCIATED

WITH

The biggest risk in trading derivatives is the fact that you can lose a lot of money, and very quickly, when the event that you thought was going to happen failed to occur. A derivative is an investment contract that depends upon prices or rates of other financial securities. For example, a computer manufacturer that buys component parts from Japan, would want to protect the component's prices against a rise in the value of the Japanese Yen against the U.S. dollar. That manufacturer would likely purchase a currency option. In order to manage risk, investors must keep a careful watch on their positions. Another factor affecting the risk exposure in derivatives is a trend toward participants signing net agreements that require only the net value of all parties' positions to be replaced if there is a default. As an example, A owes B $150 million in one derivative contract; B owes A $100 million in a different contract. If A should go under and B is forced by contract to pay the $100 million it owes, B would still be exposed to the $150 million owed to it by A. This would create a gross credit exposure here of $150 million. On the other hand, suppose B and A have agreed that if either defaults, only the net of all contracts will be owed, not the gross. In this case the net exposure of B is only $50 million. Many business schools are preparing students to deal with derivatives by offering MBA students one core course and five electives that include the topic. In addition, ongoing work by faculty members and doctoral students add to the understanding of the field. Today, the concepts of value at risk and volatility of options are becoming standard industry practice. One of the most interesting things about derivatives is that they are a very risky tool that is, itself, used to manage risk. Of all the derivatives, futures contracts are probably the riskiest. When you buy a futures contract, you are obligated to purchase or sell a specific commodity by a set time and for a set price. The commodities involved usually include agricultural products (crops and animals), precious metals (gold and silver), oil and other energy products, and financial products (financial instruments and foreign currency). You can purchase futures contracts from the same brokerage firms you purchase stocks from, and you should expect to pay substantial commission fees.

25

DERIVATIVES

Futures contracts are similar to stock option contracts, but they are much riskier because you have an obligation rather than an option to purchase or sell something. Therefore, you run the risk of losing a lot more than what you paid for your contract if you predict incorrectly on the way prices are going! And as difficult as it may be to predict the rise and fall of a stock, it's child's play compared to predicting commodity prices. The bottom line is, unless you have great knowledge about a certain item and the market it moves in, or you have absolute, total faith that your broker knows what he's doing, this is not, we repeat, not, the place to put your investment dollars, no matter what age or stage of life you are in. While the profits are huge based on a small investment if the market moves your way, if it doesn't, your loss can easily be astronomical!

MINIMIZING RISKS WITH DERIVATIVES:

So how do you minimize the above-mentioned risks with derivatives? Here are some suggestions.

1) Future Exchanges:

Arrange the derivatives through future exchanges. You may need to put in a lot of work here; you must keep track of all adjustments in the market worth of the underlying asset.

2) Asset and Liability driven Transactions:

The transactions should be driven by asset and liability management. You should not speculate based on future forecasts.

3) Derivative Policy:

A good derivative policy focuses more on cost management and less on forecasting. It should aim for cutting down expenses and costs. While dabbling in derivatives is risky if you choose to speculate, derivatives can be an important tool for financial structuring and cost management if you use them correctly. If you do not know how to start investing in derivatives, you can consult a small business advisor or financial consultant. Remember, if you do go for derivatives, always play by the book and never try anything illegal.

26

DERIVATIVES

REASON FOR STARTING DERIVATIVES

1.

2. 3. 4. 5.

Counter party risk on the part of broker, in case it ask money from us but before giving delivery of shares goes bankrupt. Liquidity risk in the form that the particular scrip might not be traded on exchange. Unsystematic risk in the form that the price of scrip may go up or down due to Company Specific Reasons. Mutual funds may find it difficult to invest the funds raised by them properly as the scrip in which they want to invert might not be available at the right price. Systematic risk in the form that the price of scrip may go up or down due to reason affecting the sentiment of whole market.

THE REQUIREMENTS FOR SETTING UP FUTURE AND OPTION TRADING ARE OUTLINED BELOW:

1. Creation of an Options Clearing Corporation (OCC) as the single guarantor of every traded option. In case of default by a party to a contract, the clearing house has to bear the cost necessary to carry out the contract. 2. Creation of a strong cash market (secondary market). This is because after the exercise of an option contract, the investors move to the secondary market to book profits. 3. Creation of paper-less trading and a book-entry transfer system. 4. Careful selection of the securities may be listed on a National securities exchange, have a wider capital base, be actively traded, and so on. 5. Uniformity of rules and regulation in all the stock exchanges. 6. Standardization of the terms governing the options contracts. This would decrease the transaction costs, For a given underlying security, all contracts on the options exchange should have an expiry date, a strike price, and a contract price, only the premium should be negotiated on the floor of the exchange. 7. Large, financially sound institutions, members and a number of market makers, who can write the options contracts. Strict capital adequacy norms to be laid out and followed.

27

DERIVATIVES

STRENGTH OF INDIAN CAPITAL MARKET FOR INTRODUCTION OF DERIVATIVES

1. LARGE MARKET CAPITALIZATION: India is one of the largest market capitalized country in Asia with a market capitalization of more than 7,65,000 corers. 2. HIGH LIQUIDITY : In the underlying securities the daily average traded volume in Indian capital market today is around 7,500 crores. Which means on an average every month 14% of the country market capitalization gets traded, shows high liquidity. 3. TRADER GUARANTEE: The first "clearing corporation" (CCL) guaranteeing trades has become fully functional from July 1996 in the form of National Securities Clearing Corporation (NSCCL) for which it does the clearing. 4. STRONG DEPOSITORY : A strong depository National Securities Depositories Ltd.(NSDL), which started functioning in the year 1997, has strengthen the securities settlement in our country. 5. A GOOD LEGAL GUARDIAN : SEBI is acting as a good legal guardian for Indian Capital market.

IMPORTANCE OF DERIVATIVE TRADING

Reduction of borrowing cost. Enhancing the yield on assets. Modifying the payment structure of assets to correspond to investor market view. No physical delivery of share certificate so reduction in cost by stamp duty. Increase in hedger, speculator and arbitrageurs. It does not totally eliminate speculation, which is basic need of Indian investors.

28

DERIVATIVES

DERIVATIVES TRADING IN INDIA

The first step towards introduction of derivatives trading in India was the promulgation of the securities laws (amendment) ordinance, 1995 which withdrew the prohibition on options in securities. The market for derivatives, however, did not take off, as there was no regulatory framework to govern trading of derivatives. SEBI set up a 24 members committee under the Chairmanship of Dr. L.C. Gupta on 18th November, 96 to develop appropriate regulatory framework for derivatives trading in India. The committee submitted its report on 17th March, 98 prescribing necessary pre- conditions for introduction of derivatives trading in India. the committee recommended that derivatives should be declared as 'securities' so that regulatory framework applicable to trading of 'securities' could also govern trading of securities. SEBI also set up a group in June 1998 under the Chairmanship of Prof. J.R. Varma, to recommend measures for risk containment in derivatives market in India. The report, which was submitted in October, 1998, worked out the operational details of margining system, methodology for charging initial margins, broker net worth, deposit requirement and real time monitoring requirements. The SCRA was amended in Dec. 1999 to include derivatives within the ambit of 'securities' and the regulatory framework was developed for governing derivatives trading. The act also made it clear that derivative shall be legal and valid only it such contract are traded on a recognized stock exchange, thus precluding OTC derivative. The government also rescinded in March 2002, the three decade old notification, which prohibited forward trading in securities. Derivatives trading commenced in India in June 2000 after SEBI granted the final approval to this effect in May 2000. SEBI permitted the derivative segments of two stock exchanges. NSE and BSE, and their clearing house/corporation to commence trading and settlement in approved derivatives contracts. To begin with, SEBI approved trading in index

29

DERIVATIVES

futures contracts based on S & P CNX Nifty and BSE-30 (Sensex) index. This was followed by approval, for trading in options based on these two indexes and options on individual securities. The trading in index options commenced in June 2001. Futures contracts on individual stocks were launched in November 2001. Trading and Settlement in derivatives contracts is done in accordance with the rules, bye-laws, and regulations of the respective exchanges and their clearing house/corporation duly approved by SEBI and notified in the official gazette. Thus, the following five types of Derivatives are now being traded in the India Stock Market. * Stock Index Futures * Stock Index Options * Futures on Individual Stocks * Options on Individual Stocks * Interest Rate Derivatives

INDEX FUTURES:

Index futures are financial contracts for which the underlying is the cash market index like the Sensex, which is the brand index of India. index futures contract is an agreement to buy or sell a specified quantity of underlying index for a future date at a price agreed upon between the buyer and seller. The contracts have standardized specifications like market lot, expiry day, tick size and method of settlement.

INDEX OPTIONS:

Index Options are financial contracts whereby the right is given by the option seller in consideration of a premium to the option buyer to buy or sell the underlying index at a specific price (strike price) on or before a specific date (expiry date).

30

DERIVATIVES

STOCK FUTURES:

Stock Futures are financial contracts where the underlying asset is an individual stock. Stock futures contract is an agreement to buy or sell a specified quantity of underlying equity share for a future date at a price agreed upon between the buyer and seller. Just like Index derivatives, the specifications are pre-specified.

STOCK OPTIONS:

Stock Options are instruments whereby the right of purchase and sale is given by the option seller in consideration of a premium to the option buyer to buy or sell the underlying stock at a specific price (strike price) on or before a specific date (expiry date).

INTEREST RATE DERIVATIVES:

An interest rate derivative is a derivative where the underlying asset is the right to pay or receive a notional amount of money at a given interest rate. These structures are popular for investors with customized cash flow needs or specific views on the interest rate movements (such as volatility movements or simple directional movements) and are therefore usually traded OTC; see financial engineering.

NEED FOR DERIVATIVES IN INDIA TODAY

In less than three decades of their coming into vogue, derivatives markets have become the most important markets in the world. Today, derivatives have become part and parcel of the day-to-day life for ordinary people in major part of the world. Until the advent of NSE, the Indian capital market had no access to the latest trading methods and was using traditional out-dated methods of trading. There was a huge gap between the investors aspirations of the markets and the available means of trading. The opening of Indian economy has precipitated the process of integration of Indias financial markets with the international financial markets. Introduction of risk management instruments in India has gained momentum in last few years thanks to Reserve Bank of Indias efforts in allowing forward contracts, cross currency options etc. which have developed into a very large market.

31

DERIVATIVES

DERIVATIVES MARKET GROWTH

The Derivatives Market Growth was about 30% in the first half of 2007 when it reached a size of $US 370 trillion. This growth was mainly due to the increase in the participation of the bankers, investors and different companies. The derivative market instruments are used by them to hedge risks as well as to satisfy their speculative needs. The derivative market growth for different derivative market instruments may be discussed under the following heads.

Derivative Market Growth for the Exchange-traded-Derivatives The Derivative Market Growth for equity reached $114.1 trillion. The open interest in the futures and options market grew by 38 % while the interest rate futures grew by 42%. Hence the derivative market size for the futures and the options market was $49 trillion.

Derivative Market Growth for the Global Over-the-Counter

Derivatives

The contracts traded through Over-the-Counter market witnessed a 24 % increase in its face value and the over-the -counter derivative market size reached $70,000 billion. This shows that the face value of the derivative contracts has multiplied 30 times the size of the US economy. Notable increases were recorded for foreign exchange, interest rate, equity and commodity based derivative following an increase in the size of the Over-the Counter derivative market. The Derivative Market Growth does not necessitate an increase in the risk taken by the different investors. Even then, the overshoot in the face value of the derivative contracts shows that these derivative instruments played a pivotal role in the financial market of today.

32

DERIVATIVES

Derivative Market Growth For The Credit Derivatives

The credit derivatives grew from $4.5 trillion to $0.7 trillion in 2001. This derivative market growth is attributed to the increase in the trading in the synthetic collateral Debt obligations and also to the electronic trading systems that have come into existence. The Bank of International Settlements measures the size and the growth of the derivative market. According to BIS, the derivative market growth in the over the counter derivative market witnessed a slump in the second half of 2006. Although the credit derivative market grew at a rapid pace, such growth was made offset by a slump somewhere else. The notional amount of the Credit Default Swap witnessed a growth of 42%. Credit derivatives grew by 54%. The single name contracts grew by 36%. The interest derivatives grew by 11%. The OTC foreign exchange derivatives slowed by 5%, the OTC equity derivatives slowed by 10%. Commodity derivatives also experienced crawling growth pattern.

MYTHS AND REALITIES ABOUT DERIVATIVES

In less than three decades of their coming into vogue, derivatives markets have become the most important markets in the world. Financial derivatives came into the spotlight along with the rise in uncertainty of post-1970, when US announced an end to the Bretton Woods System of fixed exchange rates leading to introduction of currency derivatives followed by other innovations including stock index futures. Today, derivatives have become part and parcel of the day-to-day life for ordinary people in major parts of the world. While this is true for many countries, there are still apprehensions about the introduction of derivatives. There are many myths about derivatives but the realities that are different especially for Exchange traded derivatives, which are well regulated with all the safety mechanisms in place. What are these myths behind derivatives? What is the underlying truth behind such myths? The myths and the realities behind them are:

33

DERIVATIVES

1. Derivatives increase speculation and do not serve any economic purpose

Numerous studies of derivatives activity have led to a broad consensus, both in the private and public sectors that derivatives provide numerous and substantial benefits to the users. Derivatives are a low-cost, effective method for users to hedge and manage their exposures to interest rates, commodity prices, or exchange rates. The need for derivatives as hedging tool was felt first in the commodities market. Agricultural futures and options helped farmers and processors hedge against commodity price risk. After the fallout of Bretton wood agreement, the financial markets in the world started undergoing radical changes. This period is marked by remarkable innovations in the financial markets such as introduction of floating rates for the currencies, increased trading in variety of derivatives instruments, on-line trading in the capital markets, etc. As the complexity of instruments increased many folds, the accompanying risk factors grew in gigantic proportions. This situation led to development derivatives as effective risk management tools for the market participants. Looking at the equity market, derivatives allow corporations and institutional investors to effectively manage their portfolios of assets and liabilities through instruments like stock index futures and options. An equity fund, for example, can reduce its exposure to the stock market quickly and at a relatively low cost without selling off part of its equity assets by using stock index futures or index options. By providing investors and issuers with a wider array of tools for managing risks and raising capital, derivatives improve the allocation of credit and the sharing of risk in the global economy, lowering the cost of capital formation and stimulating economic growth. Now that world markets for trade and finance have become more integrated, derivatives have strengthened these important linkages between global markets, increasing market liquidity and efficiency and facilitating the flow of trade and finance.

34

DERIVATIVES

2. Indian Market is not ready for derivative trading

Often the argument put forth against derivatives trading is that the Indian capital market is not ready for derivatives trading. Here, we look into the prerequisites, which are needed for the introduction of derivatives and how Indian market fares: Large market Capitalization - India is one of the largest market-capitalized countries in Asia with a market capitalization of more than Rs.765000 crores. High Liquidity in the underlying - The daily average traded volume in Indian capital market today is around 7500 crores. Which means on an average every month 14% of the country's Market capitalization gets traded. These are clear indicators of high liquidity in the underlying. Trade guarantee - The first clearing corporation guaranteeing trades has become fully functional from July 1996 in the form of National Securities Clearing Corporation (NSCCL). NSCCL is responsible for guaranteeing all open positions on the National Stock Exchange (NSE) for which it does the clearing. A Strong Depository - National Securities Depositories Limited (NSDL) which started functioning in the year 1997 has revolutionalised the security settlement in our country. A Good legal guardian - In the Institution of SEBI (Securities and Exchange Board of India) today the Indian capital market enjoys a strong, independent, and innovative legal guardian who is helping the market to evolve to a healthier place for trade practices.

35

DERIVATIVES

3. Disasters prove that derivatives are very risky and highly leveraged instruments

Disasters can take place in any system. The 1992 Security scam is a case in point. Disasters are not necessarily due to dealing in derivatives, but derivatives make headlines. Some of the reasons behind disasters related to derivatives are: 1. Lack of independent risk management 2. Improper internal control mechanisms 3. Problems in external monitoring done by Exchanges and Regulators 4. Trader taking unauthorized positions 5. Lack of transparency in the entire process

4. Derivatives are complex and exotic instruments that Indian investors will have difficulty in understanding

Trading in standard derivatives such as forwards, futures and options is already prevalent in India and has a long history. Reserve Bank of India allows forward trading in Rupee-Dollar forward contracts, which has become a liquid market. Reserve Bank of India also allows Cross Currency options trading. Forward Markets Commission has allowed trading in Commodity Forwards on Commodities Exchanges, which are, called Futures in international markets. Commodities futures in India are available in turmeric, black pepper, coffee, Gur (jaggery), hessian, castor seed oil etc. There are plans to set up commodities futures exchanges in Soya bean oil as also in Cotton. International markets have also been allowed (dollar denominated contracts) in certain commodities. Reserve Bank of India also allows, the users to hedge their portfolios through derivatives exchanges abroad. Detailed guidelines have been prescribed by the RBI for the purpose of getting approvals to hedge the user's exposure in international markets.

36

DERIVATIVES

Derivatives in commodities markets have a long history. The first commodity futures exchange was set up in 1875 in Mumbai under the aegis of Bombay Cotton Traders Association (Dr.A.S.Naik, 1968, Chairman, Forwards Markets Commission, India, 1963-68). A clearinghouse for clearing and settlement of these trades was set up in 1918. In oilseeds, a futures market was established in 1900. Wheat futures market began in Hapur in 1913. Futures market in raw jute was set up in Calcutta in 1912. Bullion futures market was set up in Mumbai in 1920. History and existence of markets along with setting up of new markets prove that the concept of derivatives is not alien to India. In commodity markets, there is no resistance from the users or market participants to trade in commodity futures or foreign exchange markets. Government of India has also been facilitating the setting up and operations of these markets in India by providing approvals and defining appropriate regulatory frameworks for their operations. Approval for new exchanges in last six months by the Government of India also indicates that Government of India does not consider this type of trading to be harmful albeit within proper regulatory framework. This amply proves that the concept of options and futures has been well ingrained in the Indian equities market for a long time and is not alien as it is made out to be. Even today, complex strategies of options are being traded in many exchanges which are called teji-mandi, jota-phatak, bhav-bhav at different places in India (Vohra and Bagari, 1998) In that sense, the derivatives are not new to India and are also currently prevalent in various markets including equities markets.

5. The existing capital market is safer than Derivatives?

World over, the spot markets in equities are operated on a principle of rolling settlement. In this kind of trading, if you trade on a particular day (T), you have to settle these trades on the third working day from the date of trading (T+3).

37

DERIVATIVES

Futures market allow you to trade for a period of say 1 month or 3 months and allow you to net the transaction taken place during the period for the settlement at the end of the period. In India, most of the stock exchanges allow the participants to trade during one-week period for settlement in the following week. The trades are netted for the settlement for the entire one-week period. In that sense, the Indian markets are already operating the futures style settlement rather than cash markets prevalent internationally. In this system, additionally, many exchanges also allow the forward trading called badla in Gujarati and Contango in English, which was prevalent in UK. This system is prevalent currently in France in their monthly settlement markets. It allowed one to even further increase the time to settle for almost 3 months under the earlier regulations. This way, a curious mix of futures style settlement with facility to carry the settlement obligations forward creates discrepancies. The more efficient way from the regulatory perspective will be to separate out the derivatives from the cash market i.e. introduce rolling settlement in all exchanges and at the same time allow futures and options to trade. This way, the regulators will also be able to regulate both the markets easily and it will provide more flexibility to the market participants. In addition, the existing system although futures style, does not ask for any margins from the clients. Given the volatility of the equities market in India, this system has become quite prone to systemic collapse. This was evident in the MS Shoes scandal. At the time of default taking place on the BSE, the defaulting member of the BSE Mr.Zaveri had a position close to Rs.18 crores. However, due to the default, BSE had to stop trading for a period of three days. At the same time, the Barings Bank failed on Singapore Monetary Exchange (SIMEX) for the exposure of more than US $ 20 billion (more than Rs.84,000 crore) with a loss of approximately US $ 900 million ( around Rs.3,800 crore). Although, the exposure was so high and even the loss was also very big compared to the total exposure on MS Shoes for BSE of Rs.18 crores, the SIMEX had taken so much margins that they did not stop trading for a single minute.

38

DERIVATIVES

ARTICLE:

SEBI allows Indian investors to trade derivatives contracts in global indices

MUMBAI: Indian investors will now be able to trade in derivatives contracts in global indices, after capital market regulator the Securities and Exchange Board of India (SEBI) allowed stock exchanges to introduce the products in their equity derivatives segments. The market regulator, however, said that stock exchanges would have to submit their application along with the risk management framework for approval before the regulatory bodies of the countries concerned. Stock exchanges will cash in on this opportunity to launch futures contracts, as they have been trying to increase their market share by selling global products to Indian investors, say brokers. The National Stock Exchange (NSE) has entered into cross-listing agreements with Chicago Mercantile Exchange (CME) and the London Stock Exchange (LSE). As part of the agreement with CME, the NSE has exclusive rights for trading in the S&P 500 and the Dow Jones Industrial Average rupeedenominated futures contracts for trading in India. The SEBI move is positive as it will allow Indian investors to diversify their allocation across global asset classes in a controlled environment , said Ashish Kumar Chauhan , deputy CEO, the Bombay Stock Exchange. The advantage of this move is that it can be traded and settled in rupee terms, he said. The exchanges could introduce derivatives in the indices traded on Chicago Board Options Exchange, CME Group, Nasdaq OMX PHLX, the Singapore Exchange, among others. While the overseas index should have a minimum market capitalization (m-cap ) of $100 billion , there should be at least 10 stocks in the

39

DERIVATIVES

index.

Further, no single stock should have more than 25% of the weight, computed in terms of free float m-cap , the circular stated. Also, in terms of trading volumes (number of contracts), derivatives on that index should figure among the top 15 derivatives index globally. It also stated that if the stock index failed to meet any of the above criteria for three months consecutively, no fresh contract will be introduced on that index. The position limits as well as the disclosure requirements for clients whose position exceed 15% of the open interest of the market as applicable to domestic stock index derivatives shall be applicable on foreign stock indices. According to Alex Matthews, head-research , Geojit BNP Paribas, it would be a very useful hedging tool and will keep the volatility in check. Also, for instance, if the domestic indices remain range-bound and trading opportunities dry up, traders can trade in other indices as variety of instruments will be available. This is being made available to NSE through sub-licenses from the CME Group, Standard & Poors and Dow Jones, respectively. While the market capitalization of S&P 500 is $11.83 trillion, DJIA has a m-cap of $3.71 trillion and London based FTSE 100 commands a m-cap of $2.58 trillion, according to data available on Bloomberg.

40

DERIVATIVES

Conclusion :

Derivatives are the innovative tradable financial instruments derived from an underlying asset. Major institutional borrowers and investors use derivatives. Derivatives are responsible for not only increasing the range of financial products but also fostering more precise ways of understanding, quantifying and managing financial risk. SEBI has established a derivatives cell for supervision and regulation of derivatives market. Indian environment is also suitable for the introduction of asset-liability based derivatives such as strips and asset-backed securities. A deep cash market is imperative before derivative product are introduced in the market.

41

DERIVATIVES

http://www.enotes.com/business-finance-encyclopedia/derivatives http://www.citeman.com/5371-traders-in-derivatives-market/ http://www.keralawyer.com/murtiPers/sub.asp?pageval=ajfjfgyh6g87hkg&pageID=15&grpID=UYRghkg 8585

42

You might also like

- AuditingDocument24 pagesAuditingAzim SamnaniNo ratings yet

- Insurance ProjectDocument47 pagesInsurance ProjectAzim SamnaniNo ratings yet

- Marketing Mix in ICICI BankDocument24 pagesMarketing Mix in ICICI BankAzim SamnaniNo ratings yet

- Various Instruments in Capital MarketDocument31 pagesVarious Instruments in Capital MarketAzim SamnaniNo ratings yet

- HDFC Bank Final ProjectDocument48 pagesHDFC Bank Final ProjectAzim SamnaniNo ratings yet

- Risk Management in Banking Sector Main01Document42 pagesRisk Management in Banking Sector Main01Azim Samnani0% (1)

- Bancassurance: Under The Guidance of Prof. JalpaDocument37 pagesBancassurance: Under The Guidance of Prof. JalpaAzim SamnaniNo ratings yet

- Time Value of MoneyDocument29 pagesTime Value of MoneyAzim Samnani100% (1)

- Marginal Costing FinalDocument29 pagesMarginal Costing FinalAzim Samnani50% (2)

- Wires Assisting Financial Markets & Banking - For MergeDocument25 pagesWires Assisting Financial Markets & Banking - For MergeAzim SamnaniNo ratings yet

- Ministry of Corporate AffairsDocument10 pagesMinistry of Corporate AffairsAzim SamnaniNo ratings yet

- HDFC Bank Final ProjectDocument48 pagesHDFC Bank Final ProjectAzim SamnaniNo ratings yet

- James H Hyslop - Life After Death (1918)Document346 pagesJames H Hyslop - Life After Death (1918)anon-412166100% (4)

- Organisational Culture and ClimateDocument53 pagesOrganisational Culture and ClimateAzim Samnani100% (3)

- BR Act - 3.1Document42 pagesBR Act - 3.1Azim SamnaniNo ratings yet

- Income Tax in IndiaDocument59 pagesIncome Tax in IndiaAzim Samnani100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ch02 SolutionDocument56 pagesCh02 Solutioncyrine chahbaniNo ratings yet

- Accounting For Labor CostDocument28 pagesAccounting For Labor CostStp100% (1)

- No36 (8) /09-Estt./110 Dated: 24.11.2009: National Buildings Construction Corporation LTDDocument9 pagesNo36 (8) /09-Estt./110 Dated: 24.11.2009: National Buildings Construction Corporation LTDSoundar RajNo ratings yet

- Management of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasDocument11 pagesManagement of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasprabindraNo ratings yet

- Hamburg Eco City and The Creative Inustrial CoDocument3 pagesHamburg Eco City and The Creative Inustrial CoEvan SchoepkeNo ratings yet

- The Channel Tunnel An Ex Post Economic Evaluation PDFDocument37 pagesThe Channel Tunnel An Ex Post Economic Evaluation PDFpirotte0% (1)

- Australian Optometry TAM Stands at $4.2bnDocument5 pagesAustralian Optometry TAM Stands at $4.2bnabeNo ratings yet

- PT RulesDocument47 pagesPT RulesdewanibipinNo ratings yet

- 2016BTW3153 Lecture 3 - Income Tax LawDocument65 pages2016BTW3153 Lecture 3 - Income Tax LawGwyneth YsNo ratings yet

- (Reyes) Portal of Installment LiquidationDocument16 pages(Reyes) Portal of Installment LiquidationChe NelynNo ratings yet

- Journalizing TransactionsDocument38 pagesJournalizing TransactionsPratyush mishraNo ratings yet

- Hedging For Profit - Constructing Robust Risk-Mitigating PortfoliosDocument6 pagesHedging For Profit - Constructing Robust Risk-Mitigating Portfoliosandremdm2008No ratings yet

- Calgary Cooperative Funeral Services - Business PlanDocument21 pagesCalgary Cooperative Funeral Services - Business PlanastuteNo ratings yet

- Chapter 03 PPT 3Document39 pagesChapter 03 PPT 3kjw 2No ratings yet

- Defining Business Ethics Chapter SummaryDocument4 pagesDefining Business Ethics Chapter SummarySeng TheamNo ratings yet

- Analisis BCG PDFDocument10 pagesAnalisis BCG PDFPuspa PuspitasariNo ratings yet

- Temporary Employment ContractDocument2 pagesTemporary Employment ContractLancemachang Eugenio100% (2)

- Handout No. 03 - Purchase TransactionsDocument4 pagesHandout No. 03 - Purchase TransactionsApril SasamNo ratings yet

- VRF ComplemntryTools-100621bDocument11 pagesVRF ComplemntryTools-100621bPorshe56No ratings yet

- Doing Business in Lao PDR: Tax & LegalDocument4 pagesDoing Business in Lao PDR: Tax & LegalParth Hemant PurandareNo ratings yet

- Limitations of Mfrs 136Document3 pagesLimitations of Mfrs 136Ros Shinie BalanNo ratings yet

- Business Plan - Potato MilkDocument29 pagesBusiness Plan - Potato MilkTania TahminNo ratings yet

- FPA Candidate HandbookDocument32 pagesFPA Candidate HandbookFreddy - Marc NadjéNo ratings yet

- Franchise AccountingDocument17 pagesFranchise AccountingCha EsguerraNo ratings yet

- Tên Học Phần: Tiếng Anh Thương Mại 1 Thời gian làm bài: 45 phútDocument4 pagesTên Học Phần: Tiếng Anh Thương Mại 1 Thời gian làm bài: 45 phútUyên HoangNo ratings yet

- Lessons From 5000 Years of Shipping Mlu1.7-SlidesDocument5 pagesLessons From 5000 Years of Shipping Mlu1.7-SlidesWah KhaingNo ratings yet

- Standard Project Execution Plan PEP TemplateDocument35 pagesStandard Project Execution Plan PEP TemplateecaterinaNo ratings yet

- AE12 Module 1 Economic Development A Global PerspectiveDocument3 pagesAE12 Module 1 Economic Development A Global PerspectiveSaclao John Mark GalangNo ratings yet

- Proceedings of The Thirteenth Meeting of The Working Group On Human Resource Development (WGHRD-13)Document190 pagesProceedings of The Thirteenth Meeting of The Working Group On Human Resource Development (WGHRD-13)Asian Development Bank ConferencesNo ratings yet

- MithunDocument4 pagesMithunvipin HNo ratings yet