Professional Documents

Culture Documents

Chapter One

Uploaded by

MahingeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter One

Uploaded by

MahingeCopyright:

Available Formats

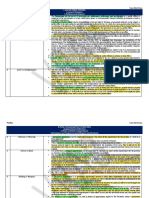

CHAPTER ONE 1.0 INTRODUCTION This chapter introduces the whole concept of the study 1.

1 Background of the Study The banking sector in Kenya is one of the most important sectors necessary for the functioning of any economy. In Kenya, the sector has experienced enormous growth which can be attributed to an expansion in their asset base, returns from loans and advances, investment in government securities, reduction in non-performing loans, growth of capital and reserves and an increase in profitability. Research by World Bank report (2005) reveals that banking institutions are very important to the development of the economy. Economics would screech to a halt without them because they perform a series of functions including; facilitating payments and granting credits that grease the wheels of commerce, accepting deposit, financing foreign trade, advancing loans, credit creation and agency services. Good institutions provide a framework for understanding better the development process, including who the key actors are, what shapes their interest, what influences their goals and what constrains their options open to them to achieve those goals. Currently companies in the banking industry have not been spared since they have to become customer driven. They must examine the needs and expectations of the individual customer and produce their product and services accordingly. With an ever more competitive future, flexibility, adaptability and customer oriented approach are vital to an organizations survival. The future is customer driven. Without customers the business does not exist, no jobs no salaries (http/Articlebase.com) Banks play an important role in the growth and development of a country's economy all over the world. This is done through mobilization of savings by accepting deposits at an interest, funding commercial activities through advancing loans to their clients. Lately the banking industry, in order to keep up the good name has been involved in corporate social responsibility hence a tool that has been used for marketing the bank. In global economic and social liberalization, service providers in the banking industry, must now complete over a wide range of their traditional market product and segments.

When there is poor service delivery customer will always shift to other organizations offering similar services. Customers now have a wider range of choice of products and services providers to choose from and satisfaction by one provider will bring repeat purchase. However dissatisfaction will not only cause the customer to move to another provider, but will move along with other customers. This therefore calls for good customer service that will offer total satisfaction. According to Garson (1994) talks of customer satisfaction as being achieved when a customer's expectation has been met or surpassed. According to Kotler (2000), the key to customer retention is customer satisfaction. There is need to understand the institutional incentives and arrangements within which customers operate. Good institutions provide a framework for action and service delivery thereby they should improve human welfare not reduce it. Thus banking institutions must reorganize their activities to achieve their corporate mission through customer orientation and good service delivery. The banking environment is continuously changing. The comfort of an insulated environment offered by regulating uncertainties is calling for risk identification, measurement and service delivery; one such all- pervasive risk that banks face is operational risk. It is one of the oldest risks in banking that has been managed all along quite informally but of late has suddenly caught everybodys attention. This increased attention could be owing to the expansion in the range of activities being pursued in the recent past; perceived increase in operational risk itself, reaction to major loss events that have occurred internally, threat increased competition by virtue of blurring boundaries among financial services providers and the resulting, falling spreads service delivery commitment for enterprise - wide risk service delivery, regulatory attention etc. Currently the world's banking industry has become extensively since the services and products being offered and marketed are homogeneous, therefore the environment upon which a bank operate highly affects the performance in terms of provision of services as well as profit making. This affects its public appearance as well as its goodwill and later impacts greatly on the choice that a customer make's with regards on whether or not to bank with it. Consumers are sensitive towards any offer made to them whenever it comes to their money and their views hence choices are highly influenced by the marketing tools used by the bank and the approach that is used in order to reach a certain target a market (Monitor 2006). 2

Currently in Kenya the banking industry is so competitive in that a lot of banks are coming up each with a unique marketing tool. With the constant increase in competition especially in the banking industry business sector, most of the banks fail to realize that good service delivery is the determining factor in regard to the current and future performance. They are unable to realize how their different services affect their customers and what their customers say to the general public. This in turn may cause harm to the organizations objective of profit making as the level of customers willing to reside with the bank thereby affecting the performance of the particular bank. This is part of the reason why banks, unlike other businesses; attract such close scrutiny and regulation from government. For the authorities, stability is the watchword. In todays globalized and networked world, the failure of a bank in one country will generally have repercussions beyond those borders. The only thing that a bank can do is to differentiate itself by having a good service delivery, providing superior quality customer services, accuracy, safety of deposits, speed of delivery and general service quality. In order to sustain itself in the dynamic in nature that keep on changing market. Environmental factors are dynamic in nature thus keep on changing which in turn affect the service delivery of the bank. The shape and character that a bank industry reside with, depends on the perception of the observer. The objective normally seen as a development aspect or an opportunity by the banking industry may be seen as a threat by other organizations this may in turn cause different interpretations down by the customers as well as by the general public.

1.1.1 Profile of Cooperative Bank of Kenya Cooperative Bank of Kenya is a commercial bank in Kenya. It is one of the forty-four (44) licensed commercial banks in the country. The bank is one of the largest Kenyan banks by assets. Cooperative Bank is a large financial services institution. As of December 2010, it was the thirdlargest financial services provider in Kenya, by market value, behind Kenya Commercial Bank and Barclays Bank Kenya. At that time its total assets were valued at approximately US$1.76 3

billion (KES:141.1 billion).The shareholders' equity in the institution was valued in excess of US$240 million (KES:20.2 billion) The bank serves the banking needs of individuals, small businesses and large corporations, focusing on the needs of cooperative societies in Kenya. The bank was established in 1965, initially as a cooperative society. The banking license was granted in 1968. The Kenya Government directed all cooperative societies in the country to transfer their deposits to the Cooperative Bank of Kenya and that all cooperatives buy the bank's shares. In 1977, the bank opened its first subsidiary: Cooperative Finance Limited. In 1989, the bank converted to a fully fledged commercial bank and increased its products menu. In 1998 the bank's headquarters were relocated following destruction of the original premises by the bombing targeting the nearby Embassy of the United States of America although it later moved back to its initial location in 2002. That same year, the bank became an agent of the moneytransfer service company Money gram. In 2002, the bank's headquarters returned to Cooperative Bank House following renovations.[8] In 2008, the bank listed on the Nairobi Stock Exchange, where its shares trade under the symbol: COOP. 1.2 Statement of the Problem The researcher sought to identify the factors affecting service delivery in the banking industry in Kenya. The Banking Industry in Kenya experienced vast growth in the last decade and especially so in the last five years. With good economic prospects, the sector had over the years improved its asset quality and retained high capita; adequacy ratio's. The sector had also registered growth in deposits and profitability, In the wake of this growth and development however, however the commercial banks continued to experience a loss in their market share and a decline in the competitive edge, Most importantly this was being experienced in an atmosphere of general economic growth, It was worthwhile to note that commercial banks being the major financial interim diaries, offer liquidity needed to corporate clients small and medium enterprises as well as individuals. Currently banks have grown from being mere deposit taking and credit lending institution to being fund and asset managers and they perform other high edge integrated financial services such as investment banking, E-Banking products and M-banking among others, 1.3 Objectives of the Study 4

1.3.1 General Objective The general objective of the study is to investigate on the factors affecting service delivery in the banking industry in Kenya. This is with reference to Cooperative Bank of Kenya. 1.3.2 Specific Objectives

The specific objectives of the study were; i. To find out the effect of technology on service delivery in the banking industry ii. To determine how training affect service delivery in the banking industry iii. To investigate how motivation affects service delivery in the banking industry iv. The find out the effect of competition on service delivery in the banking industry.

1.4 Research Questions i. How does technology affect service delivery in the banking industry? ii. How does training affect the service delivery in the banking industry? iii. To what extent does motivation affect the service delivery in the banking industry? iv. How does the increase in competition affect the service delivery in the banking industry? 1.5 Significance of the Study

This study aims at benefiting the following key people in several ways. Among them is;

1.5.1

The management of the Bank.

The study aims at helping the top management on service delivery of Cooperative Bank of Kenya in evaluating their strategies that are in place, whether they have been effective in the market as well as help them to highlight prevalent area on its strongholds hence creating more difficulties on pathways of entrance by interested partners in the industry. Therefore the bank will be able to reorganize its activities to achieve its corporate mission through good service delivery since in the competitive market, consumer is sovereign and therefore the bankers must re-engineer their views and recognize the predilection and tang of the retail customers. 5

1.5.2 Employees The development of banks creates employment opportunities and job security for the employees. This improves their standards of living and quality of life. 1.5.3 Customers The banks helps the customers to access services like; make bank deposits, withdraws and gave them loans. The study is also geared towards encouraging new entrants to ensure access to a wide range of high and financial products by the customers. This is because customers for the backbone for the existence, operation and success of banks. 1.6 Limitations of the study The following were the constraints may be met in the process of conducting my research study. Corporation: This greatly hinders the researcher to point out adequate measure to identify and improve the problem at stake. The respondents may not cooperative in supplying adequate information on time. Ignorance: Most of those involved in providing information may ignore especially when it comes to some issues of questionnaires. This greatly affects data analysis. Accessibility: Due to secrecy of banking operations, it is difficult to get access to sources of information in the bank. Credibility: This arises due to the fact that some of the sources of information do not provide the actual information rather paints a rosy picture to protect the companys image hence information gaps arise when compiling the information. 1.7 Scope of the study Cooperative Bank of Kenya being a regional organization has branches located in various parts of the country and beyond. However due to geographical distance between them and the financial constraint, study in all of the branches was not to be possible thus my concentration mainly was forecast on the branch in Nairobi, Cooperative House along Haille sellasie Avenue. The study concentrates on the management, staff members and the customers of COOP.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Industrial Policy of IndiaDocument29 pagesIndustrial Policy of IndiaHeavy Gunner100% (22)

- ABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsDocument9 pagesABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsArchimedes Arvie Garcia100% (1)

- Dashain-Tihar Vacation AssignmentDocument4 pagesDashain-Tihar Vacation AssignmentSandesh ThapaNo ratings yet

- Behavior Based SafetyDocument51 pagesBehavior Based SafetysixejoNo ratings yet

- Quantity Surveying BookDocument79 pagesQuantity Surveying BookHarold Jackson Mtyana100% (3)

- Indus InfrastructureDocument14 pagesIndus InfrastructureSubbarao TallaNo ratings yet

- Final Year ProjectDocument61 pagesFinal Year ProjectSorry BroNo ratings yet

- ADocument38 pagesASubham AgarwalNo ratings yet

- HRM Individual AssignmentDocument7 pagesHRM Individual AssignmentTghusna FatmaNo ratings yet

- BATA PAKISTAN LIMITED As An OrganisationDocument14 pagesBATA PAKISTAN LIMITED As An OrganisationTajammul HussainNo ratings yet

- Chapter 1 Introduction To Human Resource ManagementDocument9 pagesChapter 1 Introduction To Human Resource ManagementShahalam AnsariNo ratings yet

- Using "Beyond The Quick Fix Model" Identify The Challenges of PTCL and Suggest As OD Consultant For The Development of This OrganizationDocument17 pagesUsing "Beyond The Quick Fix Model" Identify The Challenges of PTCL and Suggest As OD Consultant For The Development of This OrganizationSamiullah SarwarNo ratings yet

- OB Case StudyDocument16 pagesOB Case Studybadri srinivasanNo ratings yet

- Complaint - Terrana v. Cantor FitzgeraldDocument11 pagesComplaint - Terrana v. Cantor FitzgeraldpospislawNo ratings yet

- Labor Relations & Negotiations MODULE 1: Jurisdiction Labor RelationsDocument4 pagesLabor Relations & Negotiations MODULE 1: Jurisdiction Labor RelationsJaymark BombitaNo ratings yet

- Internship Report On KsicDocument63 pagesInternship Report On Ksicvinodksrini007100% (6)

- MS-24Document5 pagesMS-24Bableen KaurNo ratings yet

- Heritage Hotel v. Secretary, July 23, 2014Document18 pagesHeritage Hotel v. Secretary, July 23, 2014bentley CobyNo ratings yet

- Basic Employability Skill Training - OutlineDocument3 pagesBasic Employability Skill Training - OutlineOscar Gordon WongNo ratings yet

- Oracle: Oracle Global Human Resources Cloud 2019 Implementation EssentialsDocument43 pagesOracle: Oracle Global Human Resources Cloud 2019 Implementation EssentialsDuy Nguyen100% (1)

- Foreign-Affiliate-Issues-in-Troubled TimesDocument17 pagesForeign-Affiliate-Issues-in-Troubled TimesMelly AnastasyaNo ratings yet

- Bid Documents NIMS Latest - CompressedDocument38 pagesBid Documents NIMS Latest - CompressedHari GSFNo ratings yet

- De Luna v. Albert Preciado and The Mortgage GuyDocument23 pagesDe Luna v. Albert Preciado and The Mortgage GuyAlan RomeroNo ratings yet

- "HRM at Dominos": A Project Report OnDocument8 pages"HRM at Dominos": A Project Report OnkristokunsNo ratings yet

- Document Reference ISMS06005: ISO/IEC 27001:2013 Statement of ApplicabilityDocument15 pagesDocument Reference ISMS06005: ISO/IEC 27001:2013 Statement of ApplicabilityLyubomir GekovNo ratings yet

- PoliRev Case Doctrines MidtermsDocument21 pagesPoliRev Case Doctrines MidtermsLou LaguardiaNo ratings yet

- Recruitment and Retention Strategy 2014 - 2017 PDFDocument33 pagesRecruitment and Retention Strategy 2014 - 2017 PDFMiha68No ratings yet

- IJSSHR Published PaperDocument14 pagesIJSSHR Published PaperNus BunNo ratings yet

- IDBI Federal Annual Report 2015-2016 PDFDocument204 pagesIDBI Federal Annual Report 2015-2016 PDFJavaniNo ratings yet

- Chase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestDocument3 pagesChase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestCristhian ValverdeNo ratings yet