Professional Documents

Culture Documents

Film Production - Financing Investment Issues

Uploaded by

Michael GaughanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Film Production - Financing Investment Issues

Uploaded by

Michael GaughanCopyright:

Available Formats

Film Production: Financing and Investment Issues by Art Smith and Nicole Weaver Film financing is one of the

most difficult and least understood challenges facing a producer and it is fraught with perils for the unwary. Many independent film producers find themselves caught in the Producers Paradox namely: You cant sign talent and develop your screenplay without financing, but you cant obtain financing without talent and a polished script. Given that most film producers do not want to use their personal assets to fund their films, the most important issue for many producers is how to finance their film project with other peoples money. The methods of financing film projects are as diverse as the film projects themselves, the most common ways being; debt (such as borrowing money); equity (such as selling membership interests); or a combination of both (such as a production support agreement or film finance agreement). If the producer has a track record of successful film production, then additional sources such as pre-sale of film distribution rights or studio financing are available. There are producers who merely package a project and assign the rights to another, better financed, production company. However, for most independent producers film financing is limited to debt and equity. The problem with financing a project with debt is that such agreements require the payment of a sum-certain, with interest, on or before a specific date. A credit card is a simple form of debt, and is the worst possible way of financing your film (except, perhaps, using a home-equity line of credit secured with a mortgage on your home) for the reason that the debt usually must be repaid, and often many years before the film is commercially viable and money begins to flow back to the production company. If you have a day job, then incurring a small amount of debt (in the amount of $5,000) may be an acceptable option to finance a short film. Additionally, there are state-sponsored programs, such as the Florida Film, Television and Digital Media Incentive and tax exemptions which can provide assistance on reasonable terms and conditions, but generally debt financing has to be used, and should only with great care. The other major source of funds, equity financing, is problematic because a securities offering memorandum (or disclosure document commonly referred to as a Private Placement Memorandum or PPM) is required to raise money from investors outside of your family no matter how small the amount involved. Full disclosure is required under the securities laws and notice filings are required by the federal Securities and Exchange Commission (the SEC) and by the laws of each state in which investors reside (commonly known in some states as Blue Sky Laws). Violations of the SEC requirements and the applicable state securities laws carry both criminal and civil penalties. A business plan IS NOT a Private Placement Memorandum. A business plan and a securities offering memo serve very different functions. A business plan is a marketing document created from a selling point of view, which necessarily contains optimistic information, forward-looking statements, hopes and dreams, and possibly financial projections. A securities offering memo, on the other hand, is a full disclosure document,

which must contain all the bad news, risks, and must list and comment upon all possibilities that could go wrong so that each investor is fully aware of the risks involved. In order to safely comply with these laws, a producer should work with an attorney who is familiar with both entertainment and securities regulation. This is not a do-it-yourself type of project nor is it wise to cut and paste portions of other PPM documents that you find on the web because the producer, without help of securities counsel, has very little notion of what provisions and information are needed. The following is a summary of some of issues that arise when preparing a private placement investment offering under this exemption: 1. No General Solicitation. The producer may not engage in any general solicitation. This basically means that investors are limited to people that the producer actually knows, such as business associates, friends and family. The producer may not advertise for investors in a newspaper, or use a general mailing list or any other means of mass communication. There are specific rules regarding general solicitation, and an attorney can help to clarify exactly what a producer may and may not do when approaching potential investors. 2. Accredited investor requirements. Most investors should be accredited investors. An accredited investor is a person of high net worth, or certain kinds of banks or corporations. There are exact numbers and specific requirements that a person, bank, or corporation must meet in order to be considered accredited. These rules are complex and change from time to time as the laws are updated. When making an initial pitch, a producer can target people or corporations who probably have high net worth. However, before finalizing the deal, the producer should coordinate with an attorney, and review the investors financial statements, in order to make sure the investor is indeed accredited. Most states limit the number of unaccredited and accredited investors that a single offering may have. In Florida, a non-public offering not registered with the state is limited to 35 investors. 3. Disclosure requirements. A producer should present potential investors with a private placement memorandum or a PPM. The PPM is a document that discusses the business plan, the nature and structure of the investment, and the potential risks involved. While some states securities laws do not specifically require a PPM under a certain dollar amount, it is nonetheless a critical document to prove that the producer has disclosed everything the producer is required to disclose by law. By communicating with investors through a PPM, a producer can significantly reduce the possibility of lawsuits or criminal charges down the road. A PPM is more than just a business plan; it is a carefully drafted legal document and should be prepared by an attorney. 4. Filings. There are certain documents that the producer must file with the state and Federal governmental authorities when issuing securities. Securities laws require these filings, and the filings act to alert the relevant governing bodies that the producer is conducting an exempt securities offering.

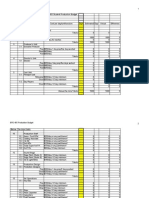

As you might expect, an essential part of any request for financing is for the producer to develop a credible budget and production timeline. Without both of these documents, prepared by someone with experience in film production, the producer should not undertake any serious fundraising.

You might also like

- Guide. How To Produce Your Independent Film and Actually Make Money.Document38 pagesGuide. How To Produce Your Independent Film and Actually Make Money.Buffalo 886% (21)

- Cinematographer ContractDocument2 pagesCinematographer ContractMarius G.Mihalache100% (4)

- Gaffer Deal MemoDocument2 pagesGaffer Deal Memowsg875253No ratings yet

- Actor Deferred Standard ContractDocument3 pagesActor Deferred Standard Contractmothgod50% (2)

- Film/TV Distribution AgreementsDocument10 pagesFilm/TV Distribution Agreementslonghornsteve100% (3)

- Getting Ready For Distribution by Designing The Digital Storefront - Buffalo 8 DistributionDocument2 pagesGetting Ready For Distribution by Designing The Digital Storefront - Buffalo 8 DistributionBuffalo 8100% (1)

- Crew ContractDocument2 pagesCrew ContractSei-Kai Leung100% (7)

- Film Project Package Prospectus (Template)Document3 pagesFilm Project Package Prospectus (Template)Neil BrimelowNo ratings yet

- Flow Chart On Film ProductionDocument1 pageFlow Chart On Film Productionkimberley2911100% (1)

- Development Budget Template For Feature FilmDocument1 pageDevelopment Budget Template For Feature FilmPankaj Johar100% (1)

- Film Production Lecture Notes PDFDocument12 pagesFilm Production Lecture Notes PDFAlbaSanchezVelazquez33% (3)

- Cast and Crew Release FormDocument1 pageCast and Crew Release FormTin AngusNo ratings yet

- BS 25999-1 - 2006 - Business Continuity Management - Part 1 Code of PracticeDocument18 pagesBS 25999-1 - 2006 - Business Continuity Management - Part 1 Code of Practiceurias90No ratings yet

- Case Study - Minimum Guarantee Financing - King CobraDocument1 pageCase Study - Minimum Guarantee Financing - King CobraBuffalo 8No ratings yet

- Indie Budget BuddyDocument16 pagesIndie Budget BuddyAmish Schulze100% (6)

- Bank Roll, 2nd Edition by Tom Malloy... Sample PDFDocument21 pagesBank Roll, 2nd Edition by Tom Malloy... Sample PDFMichael Wiese Productions100% (3)

- A Sample Film and Video Production Business Plan TemplateDocument16 pagesA Sample Film and Video Production Business Plan TemplateToluwalope Sammie-Junior BanjoNo ratings yet

- Film&TvCrew Alliance ContractDocument4 pagesFilm&TvCrew Alliance ContractAvon PsicorpsNo ratings yet

- Understanding Film Making - Production ProcessDocument25 pagesUnderstanding Film Making - Production Processr_poynor08No ratings yet

- Film FinancingDocument10 pagesFilm Financingjaikishan86100% (2)

- Film Business PlanDocument9 pagesFilm Business PlancreativeaddaNo ratings yet

- Actor Employment Agreement (Low-Budget, Non-Union Day Player)Document4 pagesActor Employment Agreement (Low-Budget, Non-Union Day Player)urchineNo ratings yet

- BondIt Case Study Sheet - Project: The OutsiderDocument1 pageBondIt Case Study Sheet - Project: The OutsiderBuffalo 8100% (1)

- Film TreatmentTemplateDocument1 pageFilm TreatmentTemplatewdmukaNo ratings yet

- The Art of Film Funding, 2nd EditionDocument23 pagesThe Art of Film Funding, 2nd EditionMichael Wiese Productions71% (7)

- Fixing Ownership of A Patent After The FactDocument12 pagesFixing Ownership of A Patent After The Factbodong408100% (1)

- Film Distribution ProcessDocument23 pagesFilm Distribution ProcessBrain FartNo ratings yet

- Documentary Film Pitching Deck ContentsDocument2 pagesDocumentary Film Pitching Deck ContentsDyan LuceroNo ratings yet

- MBFW - Crew Welcome LetterDocument10 pagesMBFW - Crew Welcome LetterSei-Kai LeungNo ratings yet

- Film Distribution: HandbookDocument21 pagesFilm Distribution: HandbookIoana-Claudia MateiNo ratings yet

- Distribution and AdvertisingDocument4 pagesDistribution and AdvertisingIrina SamsonNo ratings yet

- B8 Case Study - Project: FreewaterDocument4 pagesB8 Case Study - Project: FreewaterBuffalo 8No ratings yet

- Bondit OneSheets WhyBondit 01b PDFDocument1 pageBondit OneSheets WhyBondit 01b PDFBuffalo 8No ratings yet

- B8 Case Study - Project: Jimmy VestvoodDocument1 pageB8 Case Study - Project: Jimmy VestvoodBuffalo 8No ratings yet

- Film Production ScheduleDocument2 pagesFilm Production ScheduleGabriella Fenton100% (2)

- Budget For Post Production FilmDocument2 pagesBudget For Post Production FilmMayank Singh100% (1)

- Location Release Form PDFDocument1 pageLocation Release Form PDFCynthia DukeNo ratings yet

- Selling Film Outside PDFDocument86 pagesSelling Film Outside PDFSenna Hegde100% (1)

- Film Business Plan Edit111Document13 pagesFilm Business Plan Edit111Kelvin SilverNo ratings yet

- Actor ContractDocument1 pageActor ContractlatymermediaNo ratings yet

- Analyzing ROI of Independent Film FinanceDocument25 pagesAnalyzing ROI of Independent Film FinanceGNS100% (1)

- China - Film IndustryDocument39 pagesChina - Film IndustrySimon Kai T. WongNo ratings yet

- Production BudgetDocument7 pagesProduction BudgetAmish Schulze100% (10)

- 10 Practical Considerations For Film Production ContractsDocument4 pages10 Practical Considerations For Film Production ContractsBrian M. Rowland90% (10)

- B8 Case Study - Project: The InfiltratorsDocument1 pageB8 Case Study - Project: The InfiltratorsBuffalo 8No ratings yet

- Film& VideoBudgets5thedtionsample PDFDocument23 pagesFilm& VideoBudgets5thedtionsample PDFMichael Wiese Productions100% (1)

- Film CrewDocument16 pagesFilm Crewpghatak85100% (1)

- Film Production Call SheetDocument4 pagesFilm Production Call SheetJJW12345100% (1)

- Film Prod BudgetDocument5 pagesFilm Prod BudgetRdwen100% (5)

- Clarius Film Financing OverviewDocument4 pagesClarius Film Financing OverviewPropertywizzNo ratings yet

- Crew Deal MemoDocument2 pagesCrew Deal Memonqwj qwfh2jnrNo ratings yet

- Sample PDF of BankrollDocument25 pagesSample PDF of BankrollMichael Wiese Productions100% (1)

- Sample PDF Getting The MoneyDocument22 pagesSample PDF Getting The MoneyMichael Wiese Productions86% (7)

- Film Marketing and PublicityDocument39 pagesFilm Marketing and PublicitySudhanshu Shekhar PandeyNo ratings yet

- Film&VideoBudgets4thEd SampleDocument20 pagesFilm&VideoBudgets4thEd SampleMichael Wiese Productions67% (3)

- B8 Case Study - Project: As You AreDocument1 pageB8 Case Study - Project: As You AreBuffalo 8No ratings yet

- Indie Film ResourcessDocument8 pagesIndie Film ResourcessunlimitedtiresNo ratings yet

- Location Release FormDocument3 pagesLocation Release Formapi-356035364No ratings yet

- Marketing and Distribution PlanDocument9 pagesMarketing and Distribution Planapi-510507562No ratings yet

- Actor Employment Agreement: Performer'S Personal InformationDocument2 pagesActor Employment Agreement: Performer'S Personal InformationpragnendraNo ratings yet

- AoA and Its AlterationDocument4 pagesAoA and Its AlterationAnushka SharmaNo ratings yet

- PD 957 Irr PDFDocument100 pagesPD 957 Irr PDFAnna Katrina Jorge0% (1)

- Statutory Auditors' IndependenceDocument51 pagesStatutory Auditors' IndependenceIshidNo ratings yet

- Lecture 5 - Acceptance, CommunicationDocument70 pagesLecture 5 - Acceptance, CommunicationMuhammad Farid Ariffin100% (1)

- Avon Insurance PLC Vs CA DigestDocument1 pageAvon Insurance PLC Vs CA DigestMaggieNo ratings yet

- GDP GUI 0069 CanadaDocument9 pagesGDP GUI 0069 Canadace19peraltaNo ratings yet

- Force MajeureDocument11 pagesForce MajeuremrlobboNo ratings yet

- University of The Philippines College of LawDocument4 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- 7 Steps Operational Excellence PexDocument11 pages7 Steps Operational Excellence PexManuel EstradaNo ratings yet

- 2-Integrated Strategy Market and Non-Market ComponentsDocument21 pages2-Integrated Strategy Market and Non-Market ComponentsMalaika KhanNo ratings yet

- Unit 4 5 PDFDocument23 pagesUnit 4 5 PDFHrithik RajNo ratings yet

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- Good Manufacturing Practice (GMP) : History, Structure and Its SignificanceDocument7 pagesGood Manufacturing Practice (GMP) : History, Structure and Its SignificanceShivam VinothNo ratings yet

- COMPANY LAW (Companies Act, 1956) : Rakesh Singamsetti 09102008Document39 pagesCOMPANY LAW (Companies Act, 1956) : Rakesh Singamsetti 09102008Spandana Alapati0% (1)

- ISO-CASCO - ISO - IEC 17060 (2022) - Conformity Assessment - Code of Good PracticeDocument23 pagesISO-CASCO - ISO - IEC 17060 (2022) - Conformity Assessment - Code of Good PracticeKatherine chirinosNo ratings yet

- Jai GaneshDocument17 pagesJai GaneshPiyush TyagiNo ratings yet

- BOC CMO-4-2016 Maximum No. of Transactions To Be Transmitted To E2M Systems Thru Facility of The Value Added Service Providers (VASP)Document2 pagesBOC CMO-4-2016 Maximum No. of Transactions To Be Transmitted To E2M Systems Thru Facility of The Value Added Service Providers (VASP)PortCallsNo ratings yet

- Istantanea Schermo 2020-05-19 (15.54.06)Document1 pageIstantanea Schermo 2020-05-19 (15.54.06)ALI BANOURNo ratings yet

- Bernas vs. CincoDocument35 pagesBernas vs. CincoKrizia FabicoNo ratings yet

- Communications Act 2016Document96 pagesCommunications Act 2016Edmond KachaleNo ratings yet

- Company Registration in EthiopiaDocument121 pagesCompany Registration in Ethiopiadegu kassaNo ratings yet

- Blastmax 50 EngDocument96 pagesBlastmax 50 EngIslenaGarciaNo ratings yet

- Pipeline Compliance Standard Summary Checklist Pipeline Owners and OperatorsDocument3 pagesPipeline Compliance Standard Summary Checklist Pipeline Owners and OperatorsTiffany DavisNo ratings yet

- Master Circular On AIFsDocument113 pagesMaster Circular On AIFsIshani MukherjeeNo ratings yet

- Jarus Sora Doc - 14 - Ops - Cat - ADocument44 pagesJarus Sora Doc - 14 - Ops - Cat - AvilifiednunNo ratings yet

- US Internal Revenue Service: rp-07-32Document28 pagesUS Internal Revenue Service: rp-07-32IRSNo ratings yet

- Group 5 - Guidelines For Work ImmersionDocument4 pagesGroup 5 - Guidelines For Work ImmersionJanzen Karen AvilaNo ratings yet

- Interaction of Supply and DemandDocument19 pagesInteraction of Supply and DemandSarah Jane Greso100% (1)