Professional Documents

Culture Documents

Answer 1

Uploaded by

kadem27Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer 1

Uploaded by

kadem27Copyright:

Available Formats

Answer I: During the World War II, many new scientific and quantitative techniques were developed in order

to assist military through finding solutions to the effective usage of radar and to the other issues of wartime logistics. Success of these new approaches urged many companies to use same techniques in managerial decision making and planning (Barry et al 2009). Also, in this way, economists, mathematicians and statisticians occupied the scope of decision making and thus optimization techniques were introduced to the management science and very soon after, Rational Decision Making Theory settled down to the literature. At its core, the theory was introducing the Homo Economicus man of Classic Economic Theory, as a rational decision maker who is struggling to maximize his/her or his/her organizations utility through making choices from all the possible policy alternatives. But with the very publicizing of theory it took substantial criticism from a great deal of scholars. HA Simon, Daniel and Amos Tversky are to name but a few. Simon emphasized that rationality is bounded and satisficing is more logical and credible than optimization (Bazerman and Moore 2009).Kahneman and Tversky promulgated Heuristics which can basically be defined as cognitive simplifying strategies that hinder rationality (1974). Recently Richard Thaler stated that also our willpower and self-interest are bounded (2000). In brief, reviews increased day by day. In this context, this paper will firstly explain the assumptions and elements of the Rational Model. And then, it will try to determine the circumstances where the applications of rational models are most appropriate and, also in the second part, will mention about tools and techniques which can be used to make rational decisions. In the third part, it will discuss application of rational models to the decision making. Assumptions and Elements of Rational Decision Making: First of all, the proponents of the Rational Model consider the individuals as homo economicus. This means that people are rational; they know what they want and how to make best choices amongst the alternatives in that they are always in search of maximizing utility. Another crucial assumption is that they believe that individuals have the ability to use statistical methods and the ability to make any kind of

mathematical calculations. Besides, they regard certainty, which means that variables and relationships are known, always exists. Under these circumstances Rational Model posits that individuals follow six steps in a fully rational manner when they are making decisions. (Bazerman and Moore 2009)These steps are briefly explained below. Problem Definition: The first step in the Rational Approach is to develop a clear, concise statement of the problem. Indeed, in many cases, problem definition is the most essential and complicated step. For this reason, symptom of the problem must be discovered to identify true causes of the problem regarding that one problem may be concerned with other problems; solving one problem without regard to other problems can make the entire situation worse ( Barry et al. 2009) Identifying the Criteria: In many cases, decisions are made to attain more than one goal. So, rational man determines all the criteria regarding what he aspires to achieve (Bazerman and Moore 2009). Weighting the Criteria: Each criterion may have different levels of importance for the decision maker. Therefore, criteria must be ranked according to their significance and then any type of a scoring system which makes sense for the decision maker must be employed to specify the values (Bazerman and Moore 2009). Generating Alternatives: Within this step, all possible courses of action must be clarified. This requires considerable amount of search. The model assumes that the Rational Man knows where to give up search in that he exactly knows where the cost of adding information becomes equal to cost of search (Bazerman and Moore 2009). Rating each alternative on each criterion: Such as the first step, this step involves a very difficult task because to be able to rate alternatives one must make precise forecast upon the future events. But the model assumes that the rational man does (Bazerman and Moore 2009).

Computing the Optimal Decision: this step requires a reasonable mathematical ability because alternatives should have been rated according to the identified criteria in the preceding five steps so decision maker only multiplies the ratings by the weight of each criterion and adds up the weighted ratings across all of the criteria for each alternative and lastly chooses the solution with the highest sum of the weighted ratings.

What are the circumstances where the applications of rational models are most appropriate? What are the techniques and tools available to support and enhance rational decision making? As can be inferred, certainty is a sine qua non requirement for the application of Rational Models seeing that it assumes that all the variables and relationships are known. Worded differently, all of the alternatives must be clear and attitudes of other actors must be identified to compensate for the assumption of the Model. Hence, it seems quite plausible to remark that rational models can be appropriate only when certainty is provided. Nevertheless, it is not the only precondition. Application of Rational Model also requires sufficient time, resources, intelligence especially for mathematical and statistical computations and sufficient information. As for tools required for the rational model, as mentioned above, optimization techniques were conveyed to management science from economics (Simon 1979). This implies that mathematic, calculus and statistics, and likewise the desk calculators, became indispensable tools for the Rational Model in order to be able to make highly quantitative calculations those are required for computing the optimization point. Also very soon after the occupation of the field by the economists, new techniques such as linear programming were invented and developed (Simon 1979). Additionally, with the groundbreaking inventions and developments in computer technology, high-skilled computers were introduced to the field and rendered the scholars to cope with tremendously quantitative problems. And thus, the computers became vital tools for enhancement of rational model. Moreover, Simon predicted that computers would be programmed to make decisions. Today we are witnessing his justness. As for techniques that are needed for enhancing rational decision making, Bazerman and Moore suggests six strategies. These can be counted as; (1) Using decision analysis tools such as linear programming, (2)

Acquiring expertise,(3) Debiasing judgment,(4) Reasoning analogically, (5) Taking an outsider view, (6) Understanding biases in others (2009). Critiques of the Rational Model: The Rational perspective has been extensively criticized, mainly because of its assumptions that define how a decision should be made rather than reporting how a decision is made (Bazerman and Moore 2009). The most influential and powerful review was that of Herbert Simons. Simon basically claimed that the concept of optimization was distanced from the realities of life. And, he maintained that administrative theory must choose logic and psychology of human choice as the very source to derive its terminology (Simon 1979) rather than coining florid words which implies tremendously difficult, or even impossible, tasks for individuals and organizations to attain with their limited capabilities. The latter is what exactly the Rational Model does. Simon also contended that the requirements of classic model, which can be counted as; knowledge of all the alternatives that are open to choice, perfect ability to compute the consequences that will follow on each of the alternatives, certainty in the decision makers present and future evaluation of these consequences, no matter how diverse and heterogeneous, in terms of some consistent measure of utility, are beyond the ability of man to acquire because of limited computational power of humankind, uncertainty in the external world , time and cost constraints that limit the quantity and quality of available information, and because of the fact that no one could have a general and persistent utility function for comparing alternatives that are no longer homogeneous. Hence, he coined the term Bounded

Rationality, which basically implicates that the abovementioned limitations block decision makers for making the optimal decisions in that decision makers would prefer to stop searching alternatives at a reasonable and acceptable point (1979). To say differently, instead of scrutinizing all the possible alternatives we simply search until we find a satisfactory solution that will suffice seeing that it attains an acceptable level of performance. In brief, we satisfice. Another impressive criticism to the Rational Model came from Kahneman and Tversky. In fact, they furthered the debate especially with their two groundbreaking studies; Judgment under Uncertainty:

Heuristics and Biases in 1974 and Prospect Theory: An Analysis of Decision Under Risk in 1979. In the former, they mentioned about Heuristics which people tend to apply under uncertainty and alleged that certain biases which are caused by heuristics influence our judgments and these do not influence only average individuals but even experienced researchers are often prone to be biased because of heuristics. However, practically these heuristics are very economical and in many cases effective (or even beneficial according to Gigerenzer et al. They claim that less is more) but they have the potential to culminate in systematic and predictable errors (1974). In the latter they publicized the Prospect Theory in order to replace Expected Utility Theory of the Rational Model (EUT), concerning decision making under risk, in that the EUT is not consistent with the realities of life. They posited that people prefer certainty even if the alternative situations may have the potential to be more fruitful. Worded differently, people believe that losses hurt more than gains feel good (1979). Consequently, Simon and Kahneman and Tversky introduced new concepts to the scope those of which wounded the Rational Model from its Heart: The former; Bounded Rationality and Satisfice the latter; Heuristics, Biases and the Prospect Theory. Nevertheless, there have been even further criticisms that seem to be beneficial to summarize. Cohen et al, after their study of some university organizations, claimed that situations generally do not fit to the conditions of Rational Models particularly in three ways: preferences are problematic, technology is unclear and participation is fluid. Hence they developed a model called Garbage Can Decision Process which basically contends that organizational decision making is done in a garbage can when the three abovementioned deficiencies exist (1972). Lipshitz et al. asserts that classic model is flawed, for instance, certainty rarely exists in reality. In this context they propose applying experience in order to cope with uncertainty (2001). Lindblom argues that rationalistic models are highly demanding and he suggests an incrementalist approach which, at its core, recommends benefiting from past experiences and thus less commanding over environment (1959). Etzioni advocates mixed-scanning which implies that drawbacks of rational models and incrementalist model could be removed if these models are employed together (1967). Furthermore, Thaler claims that decision making is bounded in two ways other than what

bounded rationality involves. Firstly our willpower is bounded on the grounds that we have an inclination to consider present issues more than that of future. Our method of approach to the retirement system obviously illustrates this. Secondly, our self-interest is bounded seeing that different from the homo economicus man of classic theory we heed other peoples earnings (2000). Overall, Rational Decision Making Theory seems flawed from many aspects.

BIBLIOGRAPHY: Barry Render, Ralph Stair & Michael Hanna. 2009. Quantitative Analysis for Management, 10th Eds. New York: Prentice Hall. Cohen, Michael, James March and Johan Olsen. 1972. A Garbage Can Model of Organizational Choice. Administrative Science Quarterly 17(1): 1-25. Etzioni. Amitai. 1967. Mixed Scanning: A Third Approach to Decision-Making. Public Administration Review 27(5): 385-392. Gigerenzer, Gerd and Henry Brighton. 2009. Homo Heuristicus: Why Biased Minds Make Better Inferences. Topics in Cognitive Science 1(1): 107-143. Kahneman, Daniel and Amos Tversky. 1974. Judgment under Uncertainty: Heuristics and Biases. Science, New Series, Vol. 185, No. 4157 (Sep. 27, 1974), pp. 1124-1131 Kahneman, Daniel and Amos Tversky. 1979. Prospect Theory: An Analysis of Decision under Risk. Econometrica 47( 2):263-292. Lindblom, Charles. 1959. The Science of Muddling Through. Public Administration Review 19(2): 7988. Lipshitz, R., G. Klein, J. Orasanu and E. Salas. 2001. Focus Article: Taking Stock of Naturalistic Decision Making. Journal of Behavioral Decision Making 14: 331-352 Max H. Bazerman and Don A. Moore. 2009. Judgment in Managerial Decision Making. 7th ed. New York, NY: John Wiley and Sons. Simon, Herbert A. 1979. Rational Decision Making in Business Organizations. The American Economic Review 69(4): 493-513. Thaler, R. H. 2000. From Homo Economicus to Homo Sapiens. The Journal of Economic Perspectives Vol. 14, No. 1 (Winter, 2000), pp. 133-141

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chap1-Geometrical Optics - ExercisesDocument3 pagesChap1-Geometrical Optics - ExercisesReema HlohNo ratings yet

- Damage To Stern Tube Bearing and SealsDocument4 pagesDamage To Stern Tube Bearing and SealsJoão Henrique Volpini MattosNo ratings yet

- Artikel Jurnal - Fundamental Differences of Transition To Industry 4.0 From Previous Industrial RevolutionsDocument9 pagesArtikel Jurnal - Fundamental Differences of Transition To Industry 4.0 From Previous Industrial RevolutionsJohny DoelNo ratings yet

- Milenium BypassDocument1 pageMilenium BypassdinotecNo ratings yet

- A1.2.3 Method Statement 4a Redacted Version2Document98 pagesA1.2.3 Method Statement 4a Redacted Version2ChanelNo ratings yet

- RCE Unpacking Ebook (Translated by LithiumLi) - UnprotectedDocument2,342 pagesRCE Unpacking Ebook (Translated by LithiumLi) - Unprotecteddryten7507No ratings yet

- Auto BestBuys MAKATI CITY September ListingDocument5 pagesAuto BestBuys MAKATI CITY September ListingWill GeronaNo ratings yet

- Touch Panel Debug Info Register ValuesDocument17 pagesTouch Panel Debug Info Register ValuesAlghazyNo ratings yet

- Nord Motors Manual BookDocument70 pagesNord Motors Manual Bookadh3ckNo ratings yet

- Human Plus Machine A New Era of Automation in ManufacturingDocument8 pagesHuman Plus Machine A New Era of Automation in ManufacturingDuarte CRosaNo ratings yet

- Turkle Sherry What Does Simulation Want PDFDocument11 pagesTurkle Sherry What Does Simulation Want PDFmonterojuNo ratings yet

- CHEST Workout Structure and Training Log PREVIEWDocument3 pagesCHEST Workout Structure and Training Log PREVIEWgaurav singhNo ratings yet

- Smart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsDocument5 pagesSmart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsEko Hadi Susanto100% (1)

- Suparco+ KRL Test Ques For Electrical EngrzDocument5 pagesSuparco+ KRL Test Ques For Electrical Engrzمحمد فصیح آفتابNo ratings yet

- Astm D-2361Document4 pagesAstm D-2361Claudia Da Rolt0% (1)

- Understand Centrifugal CompressorDocument16 pagesUnderstand Centrifugal Compressorramanathan72-1100% (2)

- 176Document3 pages176Karthik AmigoNo ratings yet

- Data Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewDocument14 pagesData Visualization Q&A With Dona Wong, Author of The Wall Street Journal Guide To Information Graphics - Content Science ReviewSara GuimarãesNo ratings yet

- Process Sizing CriteriaDocument91 pagesProcess Sizing CriteriaMohammad BadakhshanNo ratings yet

- SPW3 Manual Rev 5Document713 pagesSPW3 Manual Rev 5JPYadavNo ratings yet

- Holux M-1000C Bluetooth GPS Logger Manual GuideDocument22 pagesHolux M-1000C Bluetooth GPS Logger Manual Guidenabiloo2003No ratings yet

- Slurry Flo BrochureDocument4 pagesSlurry Flo BrochureChristian Andres Campa HernandezNo ratings yet

- Air Pak SCBA Ordering Specifications (HS 6701)Document8 pagesAir Pak SCBA Ordering Specifications (HS 6701)QHSE ManagerNo ratings yet

- Total Drill Cost CalculatorDocument3 pagesTotal Drill Cost CalculatorRenéAlvarezPolo100% (2)

- Eaton Tb09500001e PDFDocument62 pagesEaton Tb09500001e PDFJuan E Torres MNo ratings yet

- Write Like An Academic: Designing An Online Advanced Writing Course For Postgraduate Students and ResearchersDocument9 pagesWrite Like An Academic: Designing An Online Advanced Writing Course For Postgraduate Students and ResearchersLexi TronicsNo ratings yet

- Microstructures and Mechanical Properties of Ultrafine Grained Pure Ti Produced by Severe Plastic DeformationDocument10 pagesMicrostructures and Mechanical Properties of Ultrafine Grained Pure Ti Produced by Severe Plastic Deformationsoni180No ratings yet

- Software Hardware Tech x86 VirtDocument9 pagesSoftware Hardware Tech x86 VirtwyfwongNo ratings yet

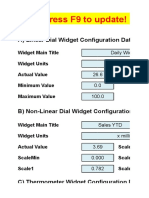

- Excel Dashboard WidgetsDocument47 pagesExcel Dashboard WidgetskhincowNo ratings yet

- Automotive Control SystemsDocument406 pagesAutomotive Control SystemsDenis Martins Dantas100% (3)