Professional Documents

Culture Documents

BBB Case Write-Up

Uploaded by

Neal KarskiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBB Case Write-Up

Uploaded by

Neal KarskiCopyright:

Available Formats

BBB Case I.

Statement of Problem Bed Bath & Beyond appears to have a large amount of excessive cash remaining that sits idle, and is not being re-invested back into the company for capital expenditures, or distributed in the form of dividends to its shareholders. The companys capital structure looks problematic, as it does not have any debt and the interest rates are at its record lows, i.e. there is no leverage in comparison to a copious figure of shareholders equity (which causes the ROE to decrease over time, if SE gets bigger). II. Statement of Facts and Assumptions Bed Bath & Beyonds shows sustained growth in: Earnings-per-share, return on common stock, net income, as well as sales. See Exhibit 3. Statement of Cash Flows also indicates a large net increase in cash in year 2004. See Exhibit 4. The company has lines of credit open for $125 million, but does not have any outstanding debt. The company did not borrow money in the last four years Expected leasing rates are projected to rise substantially with time. Bed Bath & Beyonds financial position is stronger than its competitors judging from the Comparable Data Sets. Analysis

III.

The varieties of financial statements, as well as the Comparable Data exhibit, indicate that Bad Bath & Beyond carries a low business risk and has sound operations. Also, it appears that the company is doing very well in comparison to its industry competitors a positive sign seen by the over-exceeding operating margin percentage. If BBB was to change their capital structure and take on debt, it would face potentially face financial risk in the near future. Given the proposed 40% debt-to-value ratio, which would amount to $636.6 million, would provide for a slight increase in EPS from 1.35 to 1.41, but a decrease in the net income. Secondly, given the proposed 80% debt-to-value ratio, which amount to $1.27 billion, would provide for a slight increase in EPS to 1.43 (marginally better than 40%), but would cause the NI to go down even further due to the greater interest expense.

IV.

Recommendation

Bed Bath & Beyond should not finance its company through borrowing, even if the interest rates remain low and the tax benefit is present. The additional financing through borrowing could potentially decrease the companys net income and pose as hazardous liabilities that could cause financial distress, even if the EPS goes up. The company can revert to buying back some of the stock to increase its return on equity and also increase the share price by doing so. Also, the excess cash should be used as internal funding for capital expenditures used to sustain the good performance and provide opportunities for growth in the newly build stores. This will allow for zero interest expense. Bed Bath & Beyond could also issue corporate bonds to finance its activities another alternative to leverage financing.

Exhibit 3: Income Statement for Bed Bath & Beyond, FYE 20012003 ($ in thousands)

29-Feb-2004 1-Mar-2003 2-Mar-2002 Net sales 4,477,981 3,665,164 2,927,962 Cost of sales 2,601,317 2,146,617 1,720,396 Gross profit 1,876,664 1,518,547 1,207,566 Selling, general, and administrative expenses 1,237,321 1,038,490 861,466 Operating profit 639,343 480,057 346,100 Interest income 10,202 11,291 10,972 Earnings before provision for income taxes 649,545 491,348 357,072 Provision for income taxes 250,075 189,169 137,473 Net earnings 399,470 302,179 219,599 Net earnings per sharebasic 1.35 1.03 0.76 Net earnings per sharediluted 1.31 1.00 0.74 Weighted average shares outstandingbasic 296,854 292,927 289,877 Weighted average shares outstandingdiluted 304,690 301,147 298,667 Exhibit 4: Statement of Cash Flows for Bed Bath & Beyond, FYE 20012003 ($ in thousands) 29-Feb-2004 1-Mar-2003 2-Mar-2002 Cash flows from operating activities: Net earnings 399,470 302,179 219,599 Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation and amortization 84,645 74,825 62,547 Amortization of bond premium 1,185 985 Tax benefit from exercise of stock options 64,832 31,176 31,980 Deferred income taxes (3,061) (13,291) 1,733 (Increase) decrease in assets, net of effects of acquisitions: Merchandise inventories (27,058) (145,789) (147,268) Other current assets (2,055) (7,927) 644 Other assets 5,466 190 206 Increase (decrease) in liabilities, net of effects of acquisitions: Accounts payable 19,341 86,144 78,516 Accrued expenses and other current liabilities 36,628 52,891 62,123 Income taxes payable (37,993) 20,378 17,450 Deferred rent and other liabilities 7,042 17,556 10,426 Net cash provided by operating activities $548,442 $419,317 $337,956 Cash flows from investing activities: Purchase of investment securities (361,013) (368,008) (51,909) Redemption of investment securities 357,020 170,000 Payments for acquisitions, net of cash acquired (175,487) (24,097) Capital expenditures (112,999) (135,254) (121,632) Net cash used in investing activities $(292,479) $(357,359) $(173,541) Cash flows from financing activities: Proceeds from exercise of stock options 74,597 24,216 25,753 Prepayment of acquired debt (21,215) Net cash provided by financing activities $53,382 $24,216 $25,753 Net increase in cash and cash equivalents 309,345 86,174 190,168 Cash and cash equivalents: Beginning of period 515,670 429,496 239,328 End of period 825,015 515,670 429,496 Exhibit 8: Pro Forma 2003 Results for Alternative Capital Structures ($ in thousands) Actual 2003 Pro Forma 2003 40% Debt to Total Capital d Sales 4,477,981 $ 4,477,981 Operating profit 639,343 639,343 Interest income a 10,202 5,493 EBIT 649,545 644,836 Interest expense b 28,635 Profit before taxes 649,545 616,201 Taxes c 250,075 237,237 Profit after tax 399,470 378,964 EPSbasic 1.35 1.41 EPSdiluted 1.31 1.37 Average shares outstandingbasic 296,854 268,845 Average shares outstandingdiluted 304,690 276,681 Cash and equivalents e 866,595 466,595 Total debt 636,328 Total repurchase amount f 1,036,328 Shareholders' equity 1,990,820 954,492 Common stock price (4/30/04) 37.00 Market value of common stock 10,983,598 Shares repurchased 28,009

You might also like

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- Corp Fin CaseDocument5 pagesCorp Fin Caselogicat1989100% (4)

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Blaine SolutionDocument4 pagesBlaine Solutionchintan MehtaNo ratings yet

- Yell Case Exhibits Growth RatesDocument12 pagesYell Case Exhibits Growth RatesJames MorinNo ratings yet

- CasoDocument20 pagesCasoasmaNo ratings yet

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87No ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Sampa Video Case SolutionDocument6 pagesSampa Video Case SolutionRahul SinhaNo ratings yet

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataVishal VermaNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- Arundel Case SolDocument14 pagesArundel Case SolRohan RustagiNo ratings yet

- BBBY VlmaDocument5 pagesBBBY VlmaDaniel MedeirosNo ratings yet

- Sampa Video Case ExhibitsDocument1 pageSampa Video Case ExhibitsOnal RautNo ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- CongoleumDocument16 pagesCongoleumMilind Sarambale0% (1)

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Daktronics E Dividend Policy in 2010Document26 pagesDaktronics E Dividend Policy in 2010IBRAHIM KHANNo ratings yet

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoNo ratings yet

- AirThread ValuationDocument6 pagesAirThread ValuationShilpi Jain0% (6)

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuNo ratings yet

- Blaine Excel HWDocument5 pagesBlaine Excel HWBoone LewisNo ratings yet

- Energy GelDocument4 pagesEnergy Gelchetan DuaNo ratings yet

- Case #1: Blaine Kitchenware, IncDocument6 pagesCase #1: Blaine Kitchenware, IncKenyaYetu100% (1)

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- Tire City Case Study SolutionDocument2 pagesTire City Case Study SolutionPrathap Sankar0% (1)

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Sampa Video IncDocument4 pagesSampa Video IncarnabpramanikNo ratings yet

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- PlanetTran EvaluationDocument18 pagesPlanetTran EvaluationNATOEENo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisTheicon420No ratings yet

- Airthread Connections Case Work SheetDocument45 pagesAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- PepsiCo's Quaker BidDocument54 pagesPepsiCo's Quaker Bidarjrocks23550% (2)

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarNo ratings yet

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Coursehero 40252829Document2 pagesCoursehero 40252829Janice JingNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Sampa Case SolutionDocument4 pagesSampa Case SolutionOnal RautNo ratings yet

- Case Submission - Stone Container Corporation (A) ' Group VIIIDocument5 pagesCase Submission - Stone Container Corporation (A) ' Group VIIIGURNEET KAURNo ratings yet

- Owens and Minor TemplateDocument22 pagesOwens and Minor TemplatePrashant Pratap Singh0% (1)

- Questions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Document5 pagesQuestions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Cuong NguyenNo ratings yet

- Assignment #2 Workgroup E IttnerDocument8 pagesAssignment #2 Workgroup E IttnerAziz Abi AadNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- DeluxeDocument4 pagesDeluxeshielamaeNo ratings yet

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Blaine Kitchenware: Case Exhibit 1Document15 pagesBlaine Kitchenware: Case Exhibit 1Fahad AliNo ratings yet

- Monmouth IncDocument7 pagesMonmouth Incdineshjn20000% (2)

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Class Case 3 - There's More To Us Than Meets The EyeDocument11 pagesClass Case 3 - There's More To Us Than Meets The EyeHannahPojaFeria50% (2)

- Ceres+Gardening+Company+Submission Shradha PuroDocument6 pagesCeres+Gardening+Company+Submission Shradha PuroShradha PuroNo ratings yet

- Blaine Kitchenware 3Document8 pagesBlaine Kitchenware 3Chris100% (1)

- Cash FlowDocument24 pagesCash FlowMadhupriya DugarNo ratings yet

- Tutorial 7 FAT SolutionDocument13 pagesTutorial 7 FAT SolutionAhmad FarisNo ratings yet

- FIN 500 TEST # 1 (CHAPTER 2-3-4) : Multiple ChoiceDocument11 pagesFIN 500 TEST # 1 (CHAPTER 2-3-4) : Multiple ChoicemarkomatematikaNo ratings yet

- What Are Quantitative FactorsDocument5 pagesWhat Are Quantitative FactorsJunaid CheemaNo ratings yet

- Blain Kitchenware CF CaseDocument25 pagesBlain Kitchenware CF CaseAnurag Chandel67% (3)

- Eng 111 S20 HW2Document6 pagesEng 111 S20 HW2Edward LuNo ratings yet

- Ceres Gardening Company Submission TemplateDocument8 pagesCeres Gardening Company Submission TemplateAstha AgrawalNo ratings yet

- Payment of GratuityDocument5 pagesPayment of Gratuitypawan2225No ratings yet

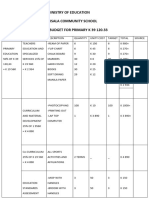

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- Review of Accounting Process 1Document2 pagesReview of Accounting Process 1Stacy SmithNo ratings yet

- (ACYFAR2) Toribio Critique Paper K36.editedDocument12 pages(ACYFAR2) Toribio Critique Paper K36.editedHannah Jane ToribioNo ratings yet

- In Partial Fulfillment of The Requirements For The Award of The Degree ofDocument66 pagesIn Partial Fulfillment of The Requirements For The Award of The Degree ofcicil josyNo ratings yet

- Aluminium Extrusion Industry in IndiaDocument3 pagesAluminium Extrusion Industry in Indiakalan45No ratings yet

- BSBOPS601 Develop Implement Business Plans - SDocument91 pagesBSBOPS601 Develop Implement Business Plans - SSudha BarahiNo ratings yet

- Different Software Life Cycle Models: Mini Project OnDocument11 pagesDifferent Software Life Cycle Models: Mini Project OnSagar MurtyNo ratings yet

- Kayako Support Suite User Manual PDFDocument517 pagesKayako Support Suite User Manual PDFallQoo SEO BaiduNo ratings yet

- Data Sheet: Elcometer 108 Hydraulic Adhesion TestersDocument3 pagesData Sheet: Elcometer 108 Hydraulic Adhesion TesterstilanfernandoNo ratings yet

- Unit 5 Andhra Pradesh.Document18 pagesUnit 5 Andhra Pradesh.Charu ModiNo ratings yet

- Effects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese WhiteDocument5 pagesEffects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese Whitepranjals8996No ratings yet

- Dr. Li Li Prof. Feng Wu Beijing Institute of TechnologyDocument20 pagesDr. Li Li Prof. Feng Wu Beijing Institute of TechnologyNarasimman NarayananNo ratings yet

- Project Management: Chapter-2Document26 pagesProject Management: Chapter-2Juned BhavayaNo ratings yet

- VISCOROL Series - Magnetic Level Indicators: DescriptionDocument4 pagesVISCOROL Series - Magnetic Level Indicators: DescriptionRaduNo ratings yet

- ECO 101 Assignment - Introduction To EconomicsDocument5 pagesECO 101 Assignment - Introduction To EconomicsTabitha WatsaiNo ratings yet

- Residential BuildingDocument5 pagesResidential Buildingkamaldeep singhNo ratings yet

- A Survey On Multicarrier Communications Prototype PDFDocument28 pagesA Survey On Multicarrier Communications Prototype PDFDrAbdallah NasserNo ratings yet

- Bismillah SpeechDocument2 pagesBismillah SpeechanggiNo ratings yet

- ArpitResumeISM PDFDocument1 pageArpitResumeISM PDFchethan rNo ratings yet

- Kicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonDocument8 pagesKicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonYudyChenNo ratings yet

- Manuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Document46 pagesManuscript - Batallantes &Lalong-Isip (2021) Research (Chapter 1 To Chapter 3)Franzis Jayke BatallantesNo ratings yet

- U.S. Pat. 9,514,727, Pickup With Integrated Contols, John Liptac, (Dialtone) Issued 2016.Document39 pagesU.S. Pat. 9,514,727, Pickup With Integrated Contols, John Liptac, (Dialtone) Issued 2016.Duane BlakeNo ratings yet

- Ms Microsoft Office - WordDocument3 pagesMs Microsoft Office - WordFarisha NasirNo ratings yet

- Case Notes All Cases Family II TermDocument20 pagesCase Notes All Cases Family II TermRishi Aneja100% (1)

- Class 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIDocument66 pagesClass 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIPathan KausarNo ratings yet

- tdr100 - DeviceDocument4 pagestdr100 - DeviceSrđan PavićNo ratings yet

- Delta PresentationDocument36 pagesDelta Presentationarch_ianNo ratings yet

- T3A-T3L Servo DriverDocument49 pagesT3A-T3L Servo DriverRodrigo Salazar71% (7)

- Exoskeleton ArmDocument5 pagesExoskeleton Armc214ocNo ratings yet