Professional Documents

Culture Documents

Market Outlook 26th March 2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook 26th March 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

Market Outlook

India Research

March 26, 2012

Dealers Diary

The Indian markets are expected to open in the negative today tracing flat to negative opening in most of the Asian bourses. Asian stocks fell after U.S. home sales unexpectedly fell last week, damping the outlook for global economic growth. US markets traded choppily on Friday and ended slightly in the positive territory after overcoming an early dip. The morning slide came on the heels of disappointing new home sales data, which showed an unexpected decline for February. New government data released showed that new home sales fell 1.6 percent in February, dropping to a pace of 313,000 homes. Prices were up, however, climbing 8.3% to US$233,700. Meanwhile Indian markets rebounded sharply on Friday, as investors considered Thursday's sell-off a bit overdone after government auditor Controller and Auditor General clarified that its draft report on coal acreage allocation was at a very preliminary stage. Data showing renewed FII buying in recent sessions and an uptrend in European shares after a four-day losing trend also helped lift investor sentiment to a certain extent.

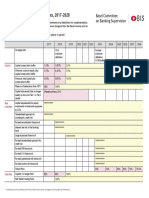

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%)

(Pts)

(Close)

1.0 1.0 0.6 0.4 0.8 0.2 1.3 0.9 (0.5) 0.6 1.4

Chg (%)

165.3 17,362 49.8 38.3 26.7 50.4 17.5 90.7 46.9 83.0

(Pts)

5,278 6,351 6,626 6,467 7,383 9,999 8,059 6,095

(Close)

148.3 11,860 (57.5) 11,223

0.3 0.2 0.2

(1.1) (1.1) 0.4 (1.1)

34.6 13,081 4.6 9.2 3,068 5,855

Markets Today

The trend deciding level for the day is 17,333 / 5,270 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 17,487 17,612 / 5,320 5,362 levels. However, if NIFTY trades below 17,333 / 5,270 levels for the first half-an-hour of trade then it may correct up to 17,208 17,054 / 5,228 5,178 levels.

Indices SENSEX NIFTY S2 17,054 5,178 S1 17,208 5,228 PIVOT 17,333 5,270 R1 17,487 5,320 R2 17,612 5,362

(115.6) 10,011 (232.8) 20,669 10.8 (26.2) 2,990 2,350

Indian ADRs

Chg (%)

(Pts)

(Close)

INFY WIT IBN HDB

Advances / Declines Advances Declines Unchanged

1.0 0.2 0.5 1.6

0.6 0.0 0.2 0.5

BSE

$57.0 $10.7 $35.8 $33.4

NSE

News Analysis

detailed news analysis on the following page

Maruti hikes car prices by up to `17,000 JP Associates wins orders worth `913cr

1,429 1,484 115

765 666 74

Net Inflows (March 21, 2012)

` cr FII MFs Purch 3,488 484 Sales 2,836 518 Net 652 (34) MTD 8,466 (1,102) YTD 44,764 (5,129)

Volumes (` cr) BSE NSE

2,372 11,445

FII Derivatives (March 23, 2012)

` cr

Index Futures Stock Futures

Purch 3,382 3,820

Sales 3,773 3,610

Net (391) 210

Open Interest 16,702 30,570

Gainers / Losers

Gainers Company

Century Tex Unitech ADANI POWER Punj Lloyd Dish TV India

Losers Company

Engineers India Voltas Rajesh Exports Indiabulls Fin Mangalore Ref

Price (`)

359 30 68 55 58

chg (%)

9.7 6.9 5.6 4.9 4.6

Price (`)

255 116 114 232 63

chg (%)

(4.0) (4.0) (3.5) (3.4) (3.3)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

Maruti hikes car prices by up to `17,000

Maruti Suzuki India Ltd. (Maruti) has increased the prices of its vehicles by up to `17,000 following the rise in excise duty in Union Budget 2012-13. The increase in prices will affect the company's models ranging from small car M800 to mid-size sedan SX4. Under the new pricing, the company's model Alto (800 cc) will cost `4,200 to `5,900 more. The price of Alto K10 has been increased by `5,500 to `5,700. It is priced at `3.14lakh and `3.30lakh (ex-showroom Delhi). Price of Wagon R will be increased by `6,000 to `7,600. It is priced at `3.47lakh to `4.37lakh (exshowroom Delhi). Marutis premium hatchback, Swift, will cost `7,700 to `11,900 more depending on the variant. It is priced between `4.44lakh and `6.76lakh (ex-showroom Delhi). Swift Dzire will cost `8,500 to `12,700 more. It is priced at `4.8lakh and `7.51lakh (ex-showroom Delhi). Mid-size sedan SX4 will cost `9,400 to `17,000 more. Its price will range from `7.11lakh to `9.39lakh (ex showroom Delhi). The price rise will also affect the company's other models, such as Estillo, A-Star, Ritz, Omni, Ecco and Gypsy, which will now cost higher by `3,700 to `10,000, depending on the model. We maintain our Neutral view on the stock.

JP Associates wins orders worth `913cr

JP Associates (JAL) has been awarded two contracts worth `913cr by Mangdechhu Hydroelectric Project Authority, Bhutan. These orders pertain to construction of 720MW Mangdechhu hydro-electric project located in Trongsa district in Bhutan. We have valued JALs cement and construction business at 6x EV/EBITDA (`62.2/share) and (`31.2/share), respectively. We have valued its power and real estate businesses on mcap basis (giving 15% holding company discount), which contributes `66.1/share to our target price. The hotel segment contributes `0.8/share. Treasury shares (`7.7/share) have been valued at the current market price, whereas net debt is accounted for on a per share basis in our valuation at `68.6. We recommend our Buy rating on the stock with an SOTP target price of `99, implying an upside of 24.3% from current levels.

March 26, 2012

Market Outlook | India Research

Economic and Political News

No new gas-based power plant to be set up till 2015-16: CEA CPSE reserves up 10% at `6.65 lakh cr in FY2011 CBDT sets up panel for tax-avoidance

Corporate News

BHEL commissions power gear with 7,900MW capacity Kingfisher to pay only `10cr of its `76cr service tax dues till March-end SKS raises `321cr from four banks

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

March 26, 2012

Market Outlook | India Research

Research Team Tel: 022 - 39357800

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

March 26, 2012

You might also like

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 27th March 2012Document4 pagesMarket Outlook 27th March 2012Angel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingNo ratings yet

- Market Outlook 6th January 2012Document4 pagesMarket Outlook 6th January 2012Angel BrokingNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook 23rd February 2012Document4 pagesMarket Outlook 23rd February 2012Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 21st February 2012Document4 pagesMarket Outlook 21st February 2012Angel BrokingNo ratings yet

- Market Outlook 29th December 2011Document3 pagesMarket Outlook 29th December 2011Angel BrokingNo ratings yet

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook 18th August 2011Document3 pagesMarket Outlook 18th August 2011Angel BrokingNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingNo ratings yet

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingNo ratings yet

- Market Outlook 24th February 2012Document4 pagesMarket Outlook 24th February 2012Angel BrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Market Outlook 20th September 2011Document4 pagesMarket Outlook 20th September 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 26th August 2011Document3 pagesMarket Outlook 26th August 2011Angel BrokingNo ratings yet

- Market Outlook 19th August 2011Document3 pagesMarket Outlook 19th August 2011Angel BrokingNo ratings yet

- Market Outlook 22nd August 2011Document4 pagesMarket Outlook 22nd August 2011Angel BrokingNo ratings yet

- Market Outlook 17.11.11Document3 pagesMarket Outlook 17.11.11Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Market Outlook 23rd December 2011Document4 pagesMarket Outlook 23rd December 2011Angel BrokingNo ratings yet

- Market Outlook 5th September 2011Document4 pagesMarket Outlook 5th September 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Document4 pagesDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- Technical Format With Stock 13.09Document4 pagesTechnical Format With Stock 13.09Angel BrokingNo ratings yet

- Market Outlook 11th January 2012Document4 pagesMarket Outlook 11th January 2012Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 20th December 2011Document4 pagesMarket Outlook 20th December 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 4th October 2011Document3 pagesMarket Outlook 4th October 2011Angel BrokingNo ratings yet

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingFrom EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- CryptoempireDocument8 pagesCryptoempiremohamed ouldNo ratings yet

- IA1 Cash and Cash EquivalentsDocument20 pagesIA1 Cash and Cash EquivalentsJohn Rainier QuijadaNo ratings yet

- Internship ReportDocument66 pagesInternship ReportAditya GangwarNo ratings yet

- The Weekly Profile 01Document65 pagesThe Weekly Profile 01Devie ChristianNo ratings yet

- Indian Debt MarketDocument32 pagesIndian Debt MarketProfessorAsim Kumar Mishra0% (1)

- IBIG 04 Questions Files ToCDocument3 pagesIBIG 04 Questions Files ToCіфвпаіNo ratings yet

- FM16 Ch25 Tool KitDocument35 pagesFM16 Ch25 Tool KitAdamNo ratings yet

- Marketing - The Essentials and The Trend Drivers Assignment SubmissionDocument13 pagesMarketing - The Essentials and The Trend Drivers Assignment SubmissionshowNo ratings yet

- Recent Financial Crisis and Market Efficiency An Empirical Analysis of Indian Stock Market PDFDocument13 pagesRecent Financial Crisis and Market Efficiency An Empirical Analysis of Indian Stock Market PDFsonali bhosaleNo ratings yet

- Angel Vs VentureDocument1 pageAngel Vs VentureYna MacaspacNo ratings yet

- R&R in Banking SecurityDocument53 pagesR&R in Banking SecuritySudipa RouthNo ratings yet

- MCQ's For Midterm Test - 7th April 2012Document6 pagesMCQ's For Midterm Test - 7th April 2012Nalin Indika KumaraNo ratings yet

- Chapter 11 Risk and Return in Capital MarketsDocument14 pagesChapter 11 Risk and Return in Capital MarketsshuNo ratings yet

- Principles of Banking: Sample Questions and AnswersDocument15 pagesPrinciples of Banking: Sample Questions and AnswersvanamamalaiNo ratings yet

- Foundations of Marketing Pride 4thDocument20 pagesFoundations of Marketing Pride 4thSoriaNo ratings yet

- AKD ResearchDocument10 pagesAKD ResearchjibranqqNo ratings yet

- Assess Hutchison WhampoaDocument4 pagesAssess Hutchison WhampoaAyesha KhalidNo ratings yet

- Basel III Transitional Arrangements, 2017-2028: Basel Committee On Banking SupervisionDocument1 pageBasel III Transitional Arrangements, 2017-2028: Basel Committee On Banking SupervisiongoonNo ratings yet

- Transactions For The Month of June WereDocument3 pagesTransactions For The Month of June WereErica Mae GuzmanNo ratings yet

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 1: Introduction Multiple Choice Test BankDocument4 pagesHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 1: Introduction Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- The Securitzation of Commodities - RitterDocument6 pagesThe Securitzation of Commodities - RitterCervino InstituteNo ratings yet

- Accenture Unlocking Infinite ValueDocument11 pagesAccenture Unlocking Infinite ValueJeffrey BahnsenNo ratings yet

- The Books of Binkerton Corporation Carried The Following Account Balances PDFDocument1 pageThe Books of Binkerton Corporation Carried The Following Account Balances PDFFreelance WorkerNo ratings yet

- Acct Statement - XX5423 - 25102023Document20 pagesAcct Statement - XX5423 - 25102023Praveen SainiNo ratings yet

- Macquarie Infrastructure and Real AssetsDocument28 pagesMacquarie Infrastructure and Real AssetsOon KooNo ratings yet

- Cox Ross 1976 - The Valuation of Options For Alternative Stochastic ProcessesDocument22 pagesCox Ross 1976 - The Valuation of Options For Alternative Stochastic ProcessesxeperiaNo ratings yet

- Finance Chapter 19Document29 pagesFinance Chapter 19courtdubs50% (2)

- Orient Finance PLC IPO 2016 Share Valuation ReportDocument48 pagesOrient Finance PLC IPO 2016 Share Valuation ReportClaudiu OprescuNo ratings yet

- Foreign Exchange Management Policy in IndiaDocument6 pagesForeign Exchange Management Policy in Indiaapi-371236767% (3)

- Leverage For The Long Run - SSRN-id2741701Document24 pagesLeverage For The Long Run - SSRN-id2741701Bob HaleNo ratings yet