Professional Documents

Culture Documents

SAMPLE Dissertation Proposal by Adekunle Ilori A

Uploaded by

Chanh XinhOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAMPLE Dissertation Proposal by Adekunle Ilori A

Uploaded by

Chanh XinhCopyright:

Available Formats

Page |1

DISSERTATION PROPOSAL ON POVERTY ALLEVIATION IN NIGERIA: THE MICROFINANCE APPROACH

A CASE STUDY OF SAGAMU LOCAL GOVERNMENT AREA, OGUN STATE, NIGERIA.

BY ADEYINKA ADEKUNLE ILORI

ID: 77072937

CFAO NIGERIA PLC RESEARCH METHODS 9323 200910: BTH430034

19th OCTOBER, 2009.

Page |2

Table of contents

1.1.0 Background of study 1.1.1 Structure of literature review 1.2.0 Significance of study 1.3.0 Research questions and objectives 1.3.1 Research questions 1.3.2 Research objectives 1.4.0 Research methodology 1.4.1 Research design 1.4.2 Data collection 1.4.3 Ethical permission 1.5.0 Time scale

4 7 8 9 9 10 11 11 12 13 14 15 17-18

1.6.0 Resources References Appendix 1: 19 Appendix 2: Ethics Form

Map showing Sagamu Local Government Area

20

Page |3

POVERTY ALLEVIATION IN NIGERIA: THE MICROFINANCE APPROACH

A CASE STUDY OF SAGAMU LOCAL GOVERNMENT AREA, OGUN STATE, NIGERIA.

1.1.0 Background

Page |4

The term microfinance is often used interchangeably with microcredit and connotes a financial venture with interest in rendering services to the poor although with profit-making in view. (Elahi and Danopoulos, 2004) Schreiner and Colombel (2001: 339) and McGuire and Conroy (2000: 90) define microfinance as the attempt to improve access to small deposits and small loans for poor households neglected by the banks. Microcredit, on the other hand is viewed as a development tool, essentially the dispersion of small collateral-free loans to groups of jointly liable borrowers in order to foster income generations and poverty reduction through enhancing self-employment and health. (Ahmed, 2009; Chowdhury, 2005) Proponents of microfinance agree that it has the tendency to break povertys vicious cycle; it is a win-win programme. (Chemin, 2008). On the other hand are critics such as Dale Adams of Ohio State University, who described the microfinance industry as microdebt industry and Gonzalez-Vega, who questioned the rationale behind the goals and expectations put in place by the Microcredit Summit. (McGuire and Conroy, 2000: 94-95) The stakeholders of microfinance include donors, government, Nongovernmental Organisations (NGOs), microfinance banks, government banks, commercial banks, non-bank financial institutions, thrift societies (credit and loan cooperatives), credit unions, microentrepreneurs, and other individual beneficiaries. Most studies on poverty alleviation and microfinance concentrated on women (Elahi and Danopoulos, 2004: 62). The rationale being that they are prone to rural poverty than their male counterpart. (Anyanwu, 2005) That women are given primary consideration in microfinance programmes does not suggest that the male gender is discriminated upon. This, however, raises moral questions bordering on who handles finance profitably and who has the capacity to repay credits received and responds to policy changes better than the other sex. (Johnson, 2000) McCarther (2006) posits that women are the reason behind the success of microfinance as they are better clients and key drivers of development.

Page |5

Bangladesh, being the traditional home of microfinance development, has witnessed increased studies. One such study concentrated on both objective and subjective poverty with emphasis on the number of times participants have had access to microcredit. The results of the study show that microcredit is linked with poverty and its impact is only strong for about 6 years with subsequent decline. (Chowdhury et al, 2005) Another Bangladeshi study conducted by Haque and Yamao (2008) focused on determining how capably microcredit can alleviate poverty in Bangladesh. The study posits that 40% of Bangladeshi citizens live below the poverty line. Women members of reputable Non-governmental Organisations and Microfinance Institutions including Grameen Bank, Bangladesh Rural Advancement Committee, Association for Social Advancement, Thengamara Mohila Sabuj Sangha among others who had been borrowing from institutions for more than 6 years were sampled. The outcome of the study showed that credit disbursed was not sufficient for profitable economic activities let alone paying back the weekly installments. The credit defaulters had to borrow from other sources to repay the loans, and in consequence fell into further, prolonged indebtedness. However, without indebtedness, the study showed that proper utilization of microcredit can improve the livelihood of Bangladeshis. (Haque and Yamao, 2008) A closely related work was also done in Bangladesh by Ahmed (2009) In the case of Vietnam, a similar research was conducted in the Mekong Delta by Rajula et al (2008). The objective of the study was to examine if microfinance contributes to the reduction of poverty in the Mekong Delta region of Vietnam. Second and third objectives were to investigate if it leads to the accumulation of assets and how poor women are enabled to adopt livelihood strategies that lead to poverty reduction. The finding of the research suggests that the process of the accumulation of assets, leads to the creation of livelihoods that result in increased household income and poverty reduction. (Rajula et al, 2008: 191)

Page |6

A study was conducted in South Africa by Kim et al (2007) with an objective to prove that women empowerment leads to significant reduction in intimate partner violence, according to the clusterrandomised trial conducted in rural South Africa by the Intervention for Microfinance for AIDS and Gender Equity (IMAGE). Results show that empowering women economically and socially can contribute significantly to intimate gender violence reduction. Still in Africa, a study was conducted in Uganda by Agha et al (2004) and centred on client perception of the quality of care provided by midwives. The study verified the impact of a microfinance scheme that provided relevant business skills and revolving loans on client loyalty. Result shows that midwives were very interested in microfinance. It further shows that microfinance have the capacity of strengthening private sector health services. From the Nigerian perspective, Ewhrujakpor (2008) emphasized that poverty in Nigeria is the direct consequence of decreased investments, output, income purchasing power and savings. His review of the Poverty Alleviation programme, National Economic Empowerment and Development Strategy (NEEDS) shows that reducing poverty in Nigeria is the most difficult challenge and obstacle in her pursuit of sustainable economic growth. The implementation of government policies is left in the hands of people who betray the confidence of the masses. This is a research gap identified by this researcher that formed the basis for his choice of research topic. According to Shola (2008: 496), the pervasiveness and persistence of poverty in [Nigeria] is a massive betrayal of her rich resource base. The failure of antipoverty initiatives, with its attendant negative implications may not be unconnected with the pervasiveness of perverse incentive structures that engender and nourish opportunism at the expense of a fairly even distribution of income and wealth. The study conducted by Irobi Nnenna Christiana in 2008, a degree thesis of the Sveriges Lantbruksuniversitet, Uppsala, Sweden entitled Microfinance and Poverty Alleviation, A Case Study of Obazu Progressive Women Association, Mbieri, Imo State, Nigeria focused on women, the beneficiaries of microfinance, and how it affects the welfare of different groups of individuals and

Page |7

households. Mbieri, in Imo State, was chosen because it is one of the villages that rural women, which engage in microfinance activities, live. Empirical data were collated using informant interview and questionnaire methods. The researchers objective was to determine the rural womens (the beneficiaries) experiences in business (such as farming, dress making, trading etc.) with the assistance from the credits received from the association. The findings of the study showed that the microfinance intervention has a positive impact on the alleviation of poverty among women of this association. Interestingly, this study found that most women in this association experienced increased income and therefore improved their economic status, political and social conditions after receiving the loans. (Irobi, 2008: vii) Another study was conducted by Fasoranti Mary Modupe in 2008, entitled Economic Implication of Poverty Alleviation Programs on Rural Women in Ondo State, A Case Study of Country Women Association of Nigeria (COWAN). The study examined the economic implication of COWAN poverty alleviation programme on rural women. Multistage sampling technique was used to select 100 respondents from Ikare and Ugbe from Akoko NorthEast and Oka and Okungba from Akoko South-West. The researcher focused on loans (by COWAN) granted to poor women who dont have two dollars of their own to start any meaningful business and who do menial jobs. Result showed that loan facilities from COWAN has positive influence on the level of income; the result of the return to scale analysis showed efficient utilisation of the loans. (Fasoranti, 2008: 352)

1.1.1 Structure of literature review The review of literature of this study will take the following format: 1. Understanding the concept of poverty o What is poverty? o Causes of poverty

Page |8

o Measuring poverty 2. Poverty alleviation o Issues and challenges o Interventions 3. The concept of microfinance o History of microfinance outside Nigeria The Shore Bank case The Gramen Bank case The Bangladesh Rural Advancement Committee case o History and challenges of microfinance in Nigeria o Differences between microfinance and global banks o Objectives and roles of microfinance 4. Alleviating poverty through micro-financing o Stakeholders o Legal frameworks 5. World Bank poverty alleviation initiatives in Nigeria 6. Understanding the study area o Nigeria o Ogun State o Sagamu local government area

1.2.0 Significance of the study

Page |9

Following the presence of microfinance institutions in Sagamu Local Government Area in Nigeria, this study is significant to deciphering their roles in alleviating poverty within the local government, seeing that the dwellers continue to deteriorate toward penury, neglect, poverty, and non-support. This study will include both economically capable men and women the beneficiaries of poverty alleviation programmes, and will examine the concept of microfinance in Nigeria, in answer to the research questions. The study will, therefore, be useful to the micro and medium scale enterprises that require or use microfinance banks, the poor in Nigeria (especially Sagamu settlers) who may not be aware of the microfinance options available to them and have missed out on several opportunities to lift themselves out of the poverty rot, and by extension the microfinance institutions which serves this fundamental purpose. 1.3.0 Research questions and objectives The following research questions and objectives will be treated in this study: 1.3.1 Research questions

P a g e | 10

1.

How do microfinance schemes alleviate poverty in Nigeria? How do microfinance institutions understand the concept of microfinance in Nigeria?

2.

The researcher intends to explore ways that microfinance schemes have alleviated poverty in Sagamu local government area of Ogun State, Nigeria borrowing insight from Bangladesh and select third world countries, for comparative analysis of the Nigerian situation. The researcher will also take a cursory look on the extent of understanding of the strategic roles expected of microfinance institutions and how much (or little) these

institutions understand their socio-economic role. To achieve the above, interview questions and questionnaire items will be tailored to the issues raised above and data analysed using SPSS. 1.3.2 Research objectives:

1.

To examine the role of microfinance schemes in poverty alleviation in Nigeria.

2.

To clarify the concept of microfinance for a better understanding by institutions and beneficiaries.

P a g e | 11

The first objective will be achieved through guided interviews, personal observation, and relevant records obtained through permission from agencies and beneficiaries. Data gathered through the questionnaire will be examined using SPSS. On the other hand, the concept of microfinance will be comprehensively explored in the review of literature. Cases of countries in, Asia, South/Latin America, and Africa will be comparatively reviewed to better understand the concept of microfinance. Interview and questionnaire items will be

structured to capture data on corporate understating of the microfinance concept. 1.4.0 Research methodology This section focuses on the procedures to be used in this study to examine the role of microfinance schemes in poverty alleviation in Nigeria and the comprehension of its concepts. It restricts the study to the description of the methods used in data collection and analysis in order to arrive at research conclusions. It further describes the procedures that were followed and instruments used in relevant data collection and analysis. 1.4.1 Research design

P a g e | 12

To achieve the objectives of this research, the researcher will undertake a tour of Sagamu local government, to visibly isolate the microfinance institutions represented in the local government, their areas of focus and modes of operation so as to measure each microfinance institutions impact on poverty alleviation through the many schemes they implement. The study will be conducted in Sagamu local government, Nigeria. The researchers interest in Sagamu arises from his many trips to the local government in recent times. The researcher found out that although there exist microfinance institutions, a significant number of Sagamu dwellers continue to live in poverty. There is no middle class, just a hollowed gap between the super-rich and the poor. The researcher will sample officials of microfinance institutions, local government officials and beneficiaries (expected and

current) of poverty alleviation programmes. The choice of these samples is to ensure that no detail within the reach of the researcher is left out. 1.4.2 Data collection

P a g e | 13

The

researcher

will

interview

fifty

(50)

carefully

selected

respondents (beneficiaries and institutional); administer forty (40) questionnaires on respondents (beneficiaries and institutional). Data (records) detailing the modes of operations in poverty alleviation schemes embarked upon will be sought from the local government and ten (10) microfinance institutions. The aim of applying these methods is to explore individual and corporate opinions about the success or failure rate of

microfinance schemes as well as to explore the concept and workings of microfinance. The researcher will creatively interact with people of the communities in order to gather interesting data to facilitate this study. To achieve this, he plans to pay personal visits to selected respondents (beneficiaries and institutional) at their business places. It is projected that data collection will be concluded in four (4) weeks: four (4) interviews/day plus questionnaire administration (3 weeks); secondary data collected from two (2) institutions/day (1 week). The interviews will be recorded using an electronic storage device and subsequently analysed using Nvivo software. Statistical

P a g e | 14

Package for Social Sciences (SPSS) will be used to analyse the returned questionnaires using descriptive statistics. The

objectives will be tested using simple regression method. Responses to questions would be coded, tabulated and processed using the Statistical Package for Social Sciences (SPSS) software and will be analyzed using frequencies with mean, mode and median indicated. Percentages will be worked out to indicate positions with measures of central tendencies and measures of dispersions. Dependent and independent variables will be used for regression analysis. Other data will be statistically treated for scientific, objective interpretations. Deriving from the above, data will be presented in tables, graphs, charts, etc. Findings will be deduced from these followed by logical conclusions which will form the basis for appropriate recommendations. 1.4.5 Ethical Permission Before embarking on interviews, administering the research instrument (questionnaire), and other data collection method suitable for this study, permission will be sought from relevant

P a g e | 15

individuals and departments of agencies to be sampled. This is to avoid unauthorised acquisition of data and rights infringement. The researcher intends to avoid request for names of

respondents, as this will not form the basis for analysing the research instruments. Commercially sensitive data will be

handled with utmost discretion and for analytical purpose only. This will form part of my proposal to relevant agencies whose staff I intend to seek data and documents for analysis so as to facilitate my findings. Please find attached a copy of ethics form as instructed by the school authority.(see Appendix 2) 1.5.0 Time Scale To guarantee viability, the researcher has divided this study into phases, to give a clear idea of the duration of study. Stages 1. 2. 3. 4. Study Review of literature Data collection Data analysis and presentation Research publication conclusion Duration 4 weeks 4 weeks 4 weeks

and 2 weeks

P a g e | 16

Due to unforeseen occurrences, it is possible for this study to take longer than expected. However, some slippage time has been designed into this study to ensure viability. 1.6.0 Resources The researcher will require the following resources, to ensure the timely success of the research project: A laptop computer for publishing reports A functional mobile internet modem for online research

Assistance from staff of local government and microfinance agencies to gain access to data

An electronic voice recording device for the conduct of interviews

Two (2) adhoc staff for questionnaire administration Writing materials Finance to facilitate mobility In addition, Mr. Sunday Nse, a Researcher at ValueFronteira Limited, Lagos, Nigeria and a part-time Strategic Management Lecturer at Strategic Business School, Lagos, Nigeria has been

P a g e | 17

contacted to train me on questionnaire design and the use of Nvivo and Statistical Package for Social Sciences (SPSS) software for data analysis. However well planned the resources put in place to facilitate this research are the researcher expects some limitations. These limitations will in no way adversely affect data collection, analysis, and research conclusions.

References

P a g e | 18

Agha, S., Balal, A. and Ogojo-Okello, F. (2004). The impact of a microfinance programme on clients perceptions of the quality of care provided by private sector midwives in Uganda, Health Services Research, Part 2, 39(6), pp. 2081-2098. Ahmed, S. M. (2009). Capability development among the ultrapoor in Bangladesh: A case study, Journal of Health, Population and Nutrition, International Centre for Diarrhoeal Disease Research, Bangladesh, 27(4), pp. 528. Anyanwu, J. C. (2005). Rural poverty in Nigeria: Profile, determinants and exit paths, African Development Bank, pp 435458. Chemin, M. (2008). The benefits and cost of microfinance: Evidence from Bangladesh, Journal of Development Studies, 44(4), pp. 463-484. Chowdhury, M. J. A., Ghosh, D. and Wright, R. E. (2005). The impact of microcredit on poverty: Evidence from Bangladesh, Progress in Development Studies, 5(4), pp. 298-309. Elahi, K. Q. and Danopoulos, C. P. (2004). Microfinance and third world development: A critical analysis, Journal of Political and Military Sociology, 32(1), pp. 61-77. Ewhrujakpor, C. (2008). Poverty and its alleviation: The Nigerian Experience, International Social work, 51 (4), pp 519-531. Fasoranti, M. M. (2008). Economic implication on poverty alleviation programs on rural women in Ondo State, a case study of Country Women Association of Nigeria, Journal of Social Sciences, 4 (4), pp 352-356. Haque, M. S. and Yamao, M. (2008). Can microcredit alleviate rural poverty? A case study of Bangladesh, Proceedings of World Academy of Science, Engineering and Technology, Vol. 36. Irobi, N. C. (2008). Microfinance and poverty alleviation: A case study of Obazu Progressive Women Association, Mbieri, Imo State, Nigeria. Master, Uppsala, Sveriges Lantbruksuniversitet, pp 2-5. Johnson, S. (2000). Gender impact assessment in microfinance and microenterprise: Why and how, Development in Practice, 10(1), pp. 89-93.

P a g e | 19

Kim, J. C., Watts, C. H., Hargreaves, J. R., Ndhlovu, L. X., Phetia, G., Morison, L. A., Busza, J., Porter, J., D., H., and Pronyk, P. (2007). Understanding the impact of a microfinance-based intervention on womens empowerment and the reduction of intimate partner violence in South Africa, American Journal of Public Health, 97(10), pp. 1794-1801. McCarther, E. (2006). Women and microfinance: Why we should do more, University of Maryland Law Journal of Race, Religion, Gender and Class, 6, P. 353-366. McGuire, P. B. and Conroy, J. D. (2000). The microfinance phenomenon, Asia-Pacific Review, 7(1), pp. 90-106. Rajula, B. S., Nguyen V. S., and Vo V. T. (2008). Microfinance and poverty reduction in the Mekong Delta in Vietnam, African and Asian Studies, 7, pp. 191-215. Schreiner, M. and Colombel, H. H. (2001). From urban to rural: Lessons for microfinance from Argentina, Development Policy Review, 19(3), pp. 339-354. Shola, J. O. (2008). Combating poverty for sustainable human development in Nigeria: The continuing struggle, Journal of poverty, 12 (4), pp 496-517.

P a g e | 20

APPENDIX 1: Map Showing Sagamu Local Government Area

Map data 2009 Europa Technologies (Powered by Google)

P a g e | 21

APPENDIX 2: Research Ethics Release Forms LOCAL LEVEL AUTHORISATION: POSTGRADUATE RESEARCH PROJECT

Project not involving human participants

Name : ADEYINKA ADEKUNLE ILORI

Programme :

MSc Contemporary Accounting

Project Title :- POVERTY ALLEVIATION IN NIGERIA: THE MICROFINANCE APPROACH (A CASE STUDY OF SAGAMU LOCAL GOVERNMENT AREA, OGUN STATE, NIGERIA.) Sources to be used

Agha, S., Balal, A. and Ogojo-Okello, F. (2004). The impact of a microfinance programme on clients perceptions of the quality of care provided by private sector midwives in Uganda, Health Services Research, Part 2, 39(6), pp. 2081-2098. Ahmed, S. M. (2009). Capability development among the ultrapoor in Bangladesh: A case study, Journal of Health, Population and Nutrition, International Centre for Diarrhoeal Disease Research, Bangladesh, 27(4), pp. 528. Anyanwu, J. C. (2005). Rural poverty in Nigeria: Profile, determinants and exit paths, African Development Bank, pp 435458.

P a g e | 22

Chemin, M. (2008). The benefits and cost of microfinance: Evidence from Bangladesh, Journal of Development Studies, 44(4), pp. 463-484. Chowdhury, M. J. A., Ghosh, D. and Wright, R. E. (2005). The impact of microcredit on poverty: Evidence from Bangladesh, Progress in Development Studies, 5(4), pp.

Student Undertaking I confirm that I am proposing to undertake this research project in the manner described. I understand that I may not approach any human participants or involve human subjects in the course of this work. I also understand that I am required to abide by the terms of this authorisation throughout the life of the project; and that if I subsequently wish to involve human participants or human subjects I will seek approval for this immediately, and will not undertake such research unless and until approval is granted. I understand that if I infringe the terms of this authorisation my work may not be marked.

Signed

Date

ILORI ADEYINKA ADEKUNLE

October 1, 2009

Supervisors agreement Name Signature Date

..

Authorisation Research Ethics Co-ordinator Name Signature Date

...

P a g e | 23

This form will be retained for the purposes of assurance of compliance and audit for the duration of the research project and for five calendar years thereafter.

You might also like

- It Assignment Mobile and Technology.Document13 pagesIt Assignment Mobile and Technology.Selwin GeorgeNo ratings yet

- Online Survey LimitationsDocument4 pagesOnline Survey LimitationslucinatkoNo ratings yet

- Thesis ProposalDocument10 pagesThesis ProposalAtitat RattanachataNo ratings yet

- Critical Review of Literature On Workforce DiversityDocument5 pagesCritical Review of Literature On Workforce DiversityShubham PandeyNo ratings yet

- Improving Public Transport Passenger InformationDocument22 pagesImproving Public Transport Passenger Informationklm klmNo ratings yet

- Strategic Management of British AirwaysDocument23 pagesStrategic Management of British AirwaysKADİR KOÇNo ratings yet

- Research ProposalDocument4 pagesResearch Proposalapi-461300868No ratings yet

- Crisis Communications Management On The WebDocument12 pagesCrisis Communications Management On The Webpdaa8896No ratings yet

- Google 2010 Report On Global Diversity and InclusionDocument51 pagesGoogle 2010 Report On Global Diversity and InclusionSumit PatelNo ratings yet

- MQBS3010 - Reflective Essay 2Document7 pagesMQBS3010 - Reflective Essay 2KaitlinNo ratings yet

- TQM in Real EstateDocument10 pagesTQM in Real EstateAgam Reddy MNo ratings yet

- Myers Qualitative ResearchDocument19 pagesMyers Qualitative ResearchMuhammad Asroruddin100% (2)

- Glasgow University's Internationalisation StrategyDocument13 pagesGlasgow University's Internationalisation StrategyAdeel Saeed MirNo ratings yet

- Kinnaird College For Women (KCW) : Mam Kiran Karamat (Hod)Document18 pagesKinnaird College For Women (KCW) : Mam Kiran Karamat (Hod)nihalNo ratings yet

- Proposals For ResearchDocument6 pagesProposals For ResearchJayman Tamang0% (1)

- Mini Assignment #1: Deborah de LangeDocument3 pagesMini Assignment #1: Deborah de LangeKate SandersNo ratings yet

- ELF Eflection Eport: Beatriz Mena (z5049785) Tue: 11-12amDocument3 pagesELF Eflection Eport: Beatriz Mena (z5049785) Tue: 11-12amBeatriz MenaNo ratings yet

- Digitization and Its Futuristic Approach in ProsthodonticsDocument10 pagesDigitization and Its Futuristic Approach in ProsthodonticsManjulika TysgiNo ratings yet

- MKT4009 Dissertation Proposal Form: KV176@Live - Mdx.ac - UkDocument18 pagesMKT4009 Dissertation Proposal Form: KV176@Live - Mdx.ac - UkniravNo ratings yet

- The Importance of Project Management For Project Success: 1. IntoductionDocument4 pagesThe Importance of Project Management For Project Success: 1. IntoductionAgustinus Hartanto HarefaNo ratings yet

- Research Proposal 2 Annotated Bibliography Template 201960Document7 pagesResearch Proposal 2 Annotated Bibliography Template 201960জয়দীপ সেনNo ratings yet

- Observational Research Techniques in Child DevelopmentDocument6 pagesObservational Research Techniques in Child DevelopmentBushra MumtazNo ratings yet

- Engaging Consumers and Building Relationships in Social Media - How Social Relatedness Influences Intrinsic vs. Extrinsic Consumer MotivationDocument10 pagesEngaging Consumers and Building Relationships in Social Media - How Social Relatedness Influences Intrinsic vs. Extrinsic Consumer MotivationfutulashNo ratings yet

- The Uppsala Internationalization Process Model RevisitedDocument40 pagesThe Uppsala Internationalization Process Model RevisitedAfzaal Ali Asst. DirectorNo ratings yet

- 09 Chapter1 PDFDocument20 pages09 Chapter1 PDFRobert CostalesNo ratings yet

- ICT Enhancing The Quality and Accessibility of EducationDocument7 pagesICT Enhancing The Quality and Accessibility of Educationclover12302312No ratings yet

- Personal Statement - Eilidh NorrisDocument2 pagesPersonal Statement - Eilidh NorrisEilidh NorrisNo ratings yet

- Leadership InterviewDocument4 pagesLeadership InterviewWenli LiuNo ratings yet

- Digital Transformation A Digital Learning Case StudyDocument6 pagesDigital Transformation A Digital Learning Case StudyCarlos KasperskyNo ratings yet

- Emotional IntelligenceDocument26 pagesEmotional IntelligenceNisha MalhotraNo ratings yet

- Marketline - Pestle AnalysisDocument19 pagesMarketline - Pestle AnalysisBopzilla ReddyNo ratings yet

- Critical Success Factors in Destination MarketingDocument19 pagesCritical Success Factors in Destination MarketingNUR AFINA NADHIRAHNo ratings yet

- Quantitative Research: Presented By: Rodrigo C. Licayan, JR., LPT, Mba Academic Program Head, BsbaDocument26 pagesQuantitative Research: Presented By: Rodrigo C. Licayan, JR., LPT, Mba Academic Program Head, BsbaRod Jr Licayan100% (1)

- Reflective Report UGDocument14 pagesReflective Report UGCrystal MaidenNo ratings yet

- A Level Example QuestionsDocument7 pagesA Level Example Questionsapi-263853267No ratings yet

- 07 g3 ReadingDocument7 pages07 g3 Readingapi-404789172100% (1)

- Extending The Marketing Myopia Concept To Promote Strategic AgilityDocument11 pagesExtending The Marketing Myopia Concept To Promote Strategic AgilityLakmal HimbutugodaNo ratings yet

- Management Dissertation Proposal Proforma - FinalDocument8 pagesManagement Dissertation Proposal Proforma - FinalJohn N. Constance100% (2)

- Research ProposalDocument17 pagesResearch Proposalmartain maxNo ratings yet

- Reflection Paper PDFDocument3 pagesReflection Paper PDFryanadamgrayNo ratings yet

- Online Influencer QuestionnaireDocument9 pagesOnline Influencer QuestionnairefaryalNo ratings yet

- Consul Personality (ESFJ, - A - T) - 16personalitiesDocument6 pagesConsul Personality (ESFJ, - A - T) - 16personalitiesGsjsjskNo ratings yet

- Electronic Reverse Auction and The Public Sector: Factors of Success Moshe E. Shalev & Stee AsbjorensenDocument25 pagesElectronic Reverse Auction and The Public Sector: Factors of Success Moshe E. Shalev & Stee Asbjorensenalmeda777100% (3)

- Barclays Hospitality Report UKDocument20 pagesBarclays Hospitality Report UKfollow0my0footstepsNo ratings yet

- Supplier Relationship Management Thesis Korthals Wouter S3762335Document51 pagesSupplier Relationship Management Thesis Korthals Wouter S3762335Cristian Paul Bolimbo PalgaNo ratings yet

- Diversification Strategy AssignmentDocument6 pagesDiversification Strategy Assignmentisra robinsonNo ratings yet

- A3 Research Proposal Example 1Document20 pagesA3 Research Proposal Example 1Nishu JainNo ratings yet

- Article Annotated BibliographyDocument5 pagesArticle Annotated BibliographyImani ImaniNo ratings yet

- Determinants of Adoption of Improved Agricultural Technology and Its Impact On Income of Smallholder Farmers in Chiro District West Hararghe Zone, Oromia National Regional State, EthiopiaDocument10 pagesDeterminants of Adoption of Improved Agricultural Technology and Its Impact On Income of Smallholder Farmers in Chiro District West Hararghe Zone, Oromia National Regional State, EthiopiaPremier Publishers100% (1)

- Research ProposalDocument3 pagesResearch Proposalapi-372127240100% (1)

- Google SWOT 2013: Strengths, Weaknesses, Opportunities, ThreatsDocument1 pageGoogle SWOT 2013: Strengths, Weaknesses, Opportunities, Threatsneha aggarwalNo ratings yet

- ICT Students' Autonomous Learning Relationship with Computing SkillsDocument24 pagesICT Students' Autonomous Learning Relationship with Computing SkillsJay Marie S. MaratasNo ratings yet

- Costello Qut Project Management Plan PHD Research ProposalDocument17 pagesCostello Qut Project Management Plan PHD Research Proposalcostello_danielNo ratings yet

- Annotated BibliographyDocument3 pagesAnnotated BibliographyElisa BenitezNo ratings yet

- The Retail Strategy of The Kroger CompanyDocument9 pagesThe Retail Strategy of The Kroger Companybeatrice100% (1)

- Annotated BibliographyDocument7 pagesAnnotated BibliographyRebecca MickelsonNo ratings yet

- Dissertation Proposal Draft 5Document17 pagesDissertation Proposal Draft 5Damian Aston100% (1)

- BMG935 International HRM Assignment: Attracting & Retaining Skilled Employees in ChinaDocument2 pagesBMG935 International HRM Assignment: Attracting & Retaining Skilled Employees in ChinaMaryam TariqNo ratings yet

- IJBSSPAPER2011Document5 pagesIJBSSPAPER2011Ajidara titilayo margaretNo ratings yet

- Adekunmi A.O and B.O Adisa 2011-1Document9 pagesAdekunmi A.O and B.O Adisa 2011-1ismaildejiNo ratings yet

- Lighthouse Point News July IssueDocument76 pagesLighthouse Point News July IssueJon FrangipaneNo ratings yet

- ACI Dealing Certificate: SyllabusDocument12 pagesACI Dealing Certificate: SyllabusKhaldon AbusairNo ratings yet

- BPD AssignmentDocument2 pagesBPD AssignmentSoniya ShahuNo ratings yet

- Analysis of Cash Flow Statement Havard Case StudyDocument22 pagesAnalysis of Cash Flow Statement Havard Case StudyPrashant JainNo ratings yet

- Optimal Risky PortfolioDocument25 pagesOptimal Risky PortfolioAlexandra HsiajsnaksNo ratings yet

- NEA Vs MORALES (Case Digest by Buenaventura)Document2 pagesNEA Vs MORALES (Case Digest by Buenaventura)NocQuisaotNo ratings yet

- Principles of Mine Economics: Basic Mine Investment AnalysisDocument56 pagesPrinciples of Mine Economics: Basic Mine Investment AnalysisRahmat SpentibelNo ratings yet

- Module 2 Market StructuresDocument108 pagesModule 2 Market StructuresAEDRIAN LEE DERECHONo ratings yet

- Guide To: Credit Rating EssentialsDocument19 pagesGuide To: Credit Rating EssentialseduardohfariasNo ratings yet

- AnnuityDocument6 pagesAnnuitymasyatiNo ratings yet

- History of Ghana Institution of SurveyorsDocument18 pagesHistory of Ghana Institution of Surveyorsrookie100% (1)

- MCQ for IOV: Key concepts and valuation approachesDocument7 pagesMCQ for IOV: Key concepts and valuation approachesGunjan Rajdev50% (2)

- Revised SWORN Statement of Assets, Liabilities and Net WorthDocument10 pagesRevised SWORN Statement of Assets, Liabilities and Net WorthJeanrichel Quillo LlenaresNo ratings yet

- Solution of Tata Gold Plus Case StudyDocument11 pagesSolution of Tata Gold Plus Case Studykushalgpt75100% (5)

- L1 Retail Banking v1.1Document130 pagesL1 Retail Banking v1.1ahasolkar2009No ratings yet

- Rbi 1Document27 pagesRbi 1Nishant ShahNo ratings yet

- Credit Sharks in SuitsDocument16 pagesCredit Sharks in SuitsedwardoughNo ratings yet

- Goldman Sachs QuestionsDocument1 pageGoldman Sachs Questionspatrick-searle-3544No ratings yet

- LIC Customer SatisfactionDocument51 pagesLIC Customer Satisfactionnikunj_shahNo ratings yet

- BCom PDFDocument67 pagesBCom PDFSwathi Nandhagopal100% (1)

- EG2P PhilippinesDocument40 pagesEG2P PhilippinespuppeteyesNo ratings yet

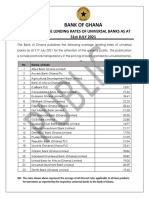

- Average Lending Rates As at July 2021Document1 pageAverage Lending Rates As at July 2021Fuaad DodooNo ratings yet

- PAL ActDocument8 pagesPAL ActsudumalliNo ratings yet

- Conflictofinterest AGDocument204 pagesConflictofinterest AGbonecrusherclanNo ratings yet

- Eton Properties Philippines, IncDocument10 pagesEton Properties Philippines, IncraefsNo ratings yet

- J.P. Morgan - Taking EM Asia's Pulse PDFDocument7 pagesJ.P. Morgan - Taking EM Asia's Pulse PDFkumarrajdeepbsrNo ratings yet

- Fears and Lobbying in Colli..Document9 pagesFears and Lobbying in Colli..spudgun56No ratings yet

- Josefina M. Oncuangco Trading Corp v Judge PinlacDocument2 pagesJosefina M. Oncuangco Trading Corp v Judge Pinlacaudreydql5No ratings yet

- Bajaj Finance Fixed Deposit ReviewDocument35 pagesBajaj Finance Fixed Deposit ReviewAlok ShuklaNo ratings yet

- Mnitest Chapter 18Document2 pagesMnitest Chapter 18An DoNo ratings yet