Professional Documents

Culture Documents

Fundamentals of Financial Management: The Role of FM

Uploaded by

Manarotul FatatiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Financial Management: The Role of FM

Uploaded by

Manarotul FatatiCopyright:

Available Formats

Fundamentals of Financial Management

Chapter 1: The Role of FM Study Objectives What is FM The goal of the firm Organization of the FM A brief history about the role of a financial manager Until around the first half of the 1900s, financial managers primarily raised funds and managed their firms cash positions As the scale of the firm is on the rising, money is always in great need. In the 1950s, the increasing acceptance of present value concept encouraged financial managers to expand their responsibilities and to become concerned with the selection of capital investment projects Why? The severe competition has rendered some project to low level of profit, even spell loss to firms Today, external factors have an increasing impact on the financial manager. As a result, finance is required to play an even more vital strategic role within the corporation Case: Kelon Financial Failure: Expand too rapidly, exhaust all its resources with slow return The Responsibility of Contemporary Financial Manager Forecasting and Planning: The financial manager must interact with other executives as they look ahead and lay the plans which will shape the firms future Major Investment and Financing Decisions A successful firm usually has rapid growth in sales, which requires investments in plant, equipment, and inventory. The financial manager must help decide the optimal sales growth rate, and he or she must help decide what specific assets to acquire and the best way to finance those assets Coordination and control The financial manager must interact with other executives to ensure that the firm is operated as efficiently as possible. All business decisions have financial implications, and all managers--financial and otherwise---need to take this into account Dealing with the financial markets The firms securities are traded in the financial markets Financial markets offers opportunities for the firm Useful information Risk management All businesses face risks, however, many of these risks can be reduced by purchasing insurance or by hedging in the derivatives markets. The financial manager is usually responsible for the firms overall risk management program, including identifying the risks that should be hedged and hedging them in the most efficient manner What is FM? Why we need FM? How to use funds to maximize the value of the firm with limited resource. It is not a problem of manufacturing efficiency and minimizing cost. (2)FM is concerned with the acquisition, financing and management of assets with some overall goals in mind Acquisition of assets---investment decision

Two problems to be solved: how much dollar of amount is needed and what is the composition of these assets The investment decision is the most important of the firms three major decisions when it comes to value creation The value creation of the firm is determined to a great extent by the investment decisions, compared to the financing and assets management Case of Jiuyao Corporation Financing decision: concerned with the problem of raising money to meet the need of investment decision Financing decision is also very important: it concerns with capital cost, investment opportunities, and the existence of a firm Asset management decision The main task of asset management is how to use the acquired assets as efficiently as possible--to speed up the turnover of the asset Here financial managers are concerned more with current assets than fixed assets, why? Financial policies affect the turnover of current asset, and fixed assets are largely determined by operation needs It is also very important, for speeding up asset turnover can increasing the profit level in a certain period What do others say about FM? CPA Examination Textbook FM is a management job concerning the raising, using and distributing of funds The object of FM is the recycle and turnover of cash The main contents of FM is financing, investment, and dividend distribution The main function of FM is deciding, planning and controlling The Goal of the Firm Why do we need a goal? Because judgement as to whether or not a financial decision is efficient must be made in light of some standards Profit maximizing is chosen by classic economist as the best goal However, it is not the case in the real life because it is shaded by a little flaw: it may induce a manager to increase profit by issuing more stock and using the proceeds to invest in Treasury Bills, so the earning per share will fall and this will harm the shareholders interest Maximizing EPS is not a fully appropriate goal either, because : It does not specify the timing or duration of expected returns It does not consider the risk of the firm Maximizing the market value of the firm---the stock price is by far the best MV(market value)=present value of net cash flow/(1+risk) Why that? Because investors will consider a firms current and future earnings, risks, and other factors which will influence a firm before he decides to make a investment decision, and the market price of the stock will reflect all the information about these factors Why maximizing the MV is the best goal? It takes into account present and future EPS, the timing, the duration, and the risk of these earnings It also considers the dividend policy of the firm, and the other factors that bear on the market price

of the stock Why should managers work hard to maximize stock price? If they do not work hard to maximize stock price, they will be removed by the firms board of directors or by outside forces Others said that managers are forced by product and labor markets to work hard for the firm, why? Agency Problems What is agency problem? The agent do not act in the interest of the principal, but in his own interest (2)Why does this happen? We assume that people are always self-interested The object of the agent may differ from that of the principal, so when the behavior of the agent cannot be closely watched, agent may choose to act in his own interest In the case of a firm, this can also be the case: Chu Shijian Phenomenon (a good example of agent problem) Shareholders---Principal, managers---agent Wolfgun said that the failure of socialist is due to too much agency problems How can shareholders solve the agent problem? Monitor Motivate---surplus share Bear loss All these can bring about contract cost, this cost is also called agency cost The shareholders objective is to minimize agency cost Social Responsibility What is social responsibility? Some responsibility carried on the firm according to social ethics (2)Why shall the firm carry out social responsibility? Carrying out social responsibility can create a good environment for the firm In our modern market economy, social responsibility will be more appreciated by the society. Paper industry, Coal-mining industry, food and drug industry are all the issues we watch on. For example, poisonous milk powder event. The goal of the firm---a linear program Maximize shareholders interest Subject to: Minimize agency cost Meet social responsibility Organization of the FM Function Fig. 1-1, Page 7

You might also like

- Chapter 1 - Overview of Financial ManagementDocument4 pagesChapter 1 - Overview of Financial Management132345usdfghjNo ratings yet

- CH 05 Alt ProbDocument10 pagesCH 05 Alt ProbxlovemadnessNo ratings yet

- CA Intermediate Paper-5Document306 pagesCA Intermediate Paper-5Anand_Agrawal19100% (2)

- Toby Crabel - Opening Range Breakout (Part1-8)Document39 pagesToby Crabel - Opening Range Breakout (Part1-8)saisonia75% (8)

- Marks and Spencer Marketing MixDocument27 pagesMarks and Spencer Marketing MixTushar Sharma50% (4)

- Role of Financial ManagerDocument5 pagesRole of Financial ManagerShahzad Asghar Arain100% (5)

- FINANCE MANAGEMENT FIN420chp 1Document10 pagesFINANCE MANAGEMENT FIN420chp 1Yanty IbrahimNo ratings yet

- EMBA Managerial Finance Class NotesDocument68 pagesEMBA Managerial Finance Class Notesperananthan vartarajooNo ratings yet

- Nature of Financial ManagementDocument6 pagesNature of Financial ManagementCjhay MarcosNo ratings yet

- Financial Managment m1-2010Document29 pagesFinancial Managment m1-2010pavithragowtham100% (1)

- According To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions ThatDocument26 pagesAccording To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions Thataneesh arvindhanNo ratings yet

- Financial ManagementDocument8 pagesFinancial Managementmandeep_kaur20No ratings yet

- FINP1 Financial Management FunctionsDocument8 pagesFINP1 Financial Management FunctionsChristine Jane LumocsoNo ratings yet

- Financial management objectives and sources of financeDocument9 pagesFinancial management objectives and sources of financeJie Yin SiowNo ratings yet

- Chapter 1 Introduction - Chapter 2 Industrial ProfileDocument74 pagesChapter 1 Introduction - Chapter 2 Industrial Profilebalki123No ratings yet

- MB0045 - Financial Mgmt.Document16 pagesMB0045 - Financial Mgmt.poonamhasijaNo ratings yet

- Chapter 1: Introduction To Corporate Finance: Nasrat UllahDocument21 pagesChapter 1: Introduction To Corporate Finance: Nasrat UllahMasood khanNo ratings yet

- Lecture 1 - Nature and Scope of Financial ManagementDocument6 pagesLecture 1 - Nature and Scope of Financial ManagementAli DoyoNo ratings yet

- UNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocument15 pagesUNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNo ratings yet

- Module 3 FINP1 Financial ManagementDocument6 pagesModule 3 FINP1 Financial ManagementkimmheanNo ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementSarah SarahNo ratings yet

- Fin420 Financial Management NotesDocument286 pagesFin420 Financial Management NotesAthirah RoslanNo ratings yet

- FM 101 SG 1Document5 pagesFM 101 SG 1Evalend SaltingNo ratings yet

- An Overview of Finance Functions and ObjectivesDocument38 pagesAn Overview of Finance Functions and ObjectivesDhanalakshmi MurugesanNo ratings yet

- ShoaibDocument2 pagesShoaibAxam FareedNo ratings yet

- Aims of Finance FunctionDocument56 pagesAims of Finance FunctionBV3S100% (1)

- Lesson 2: Relationship of Financial Objectives To Organizational Strategy and Objectives Learning ObjectivesDocument5 pagesLesson 2: Relationship of Financial Objectives To Organizational Strategy and Objectives Learning ObjectivesAngelyn MortelNo ratings yet

- Master of Business Administration-MBA Semester 2 Financial Management - MB0045 (Book ID: B1134)Document18 pagesMaster of Business Administration-MBA Semester 2 Financial Management - MB0045 (Book ID: B1134)Nitesh AgarwalNo ratings yet

- Management Accounting and Finance II Module 1 IntroductionDocument12 pagesManagement Accounting and Finance II Module 1 IntroductionKarabo CollenNo ratings yet

- Corprate Finance BBM 312Document53 pagesCorprate Finance BBM 312jemengich100% (1)

- Chapter 1 - Overview of Financial ManagementDocument11 pagesChapter 1 - Overview of Financial ManagementJoyluxxiNo ratings yet

- (FM02) - Chapter 1 The Role and Environment of Financial ManagementDocument12 pages(FM02) - Chapter 1 The Role and Environment of Financial ManagementKenneth John TomasNo ratings yet

- Financial ManagementDocument34 pagesFinancial Managementma carol fabraoNo ratings yet

- Busime BUS-FIN-WEEK-2Document8 pagesBusime BUS-FIN-WEEK-2John Rey BusimeNo ratings yet

- FINANCIAL MANAGEMENT OBJECTIVES AND SCOPEDocument3 pagesFINANCIAL MANAGEMENT OBJECTIVES AND SCOPEZeyNo ratings yet

- Introduction To Finance - Week 1Document20 pagesIntroduction To Finance - Week 1Jason DurdenNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementJohnykutty JosephNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementDijen ChingNo ratings yet

- 1.1 What Is Financial Management?: 1.1.1 Investment DecisionDocument20 pages1.1 What Is Financial Management?: 1.1.1 Investment DecisionTasmay EnterprisesNo ratings yet

- MB0045 Financial ManagementDocument4 pagesMB0045 Financial ManagementAbhinav SrivastavaNo ratings yet

- Module 1 Financial ManagementDocument7 pagesModule 1 Financial Managementfranz mallariNo ratings yet

- Bba FM Notes Unit IDocument15 pagesBba FM Notes Unit Iyashasvigupta.thesironaNo ratings yet

- FM MaterialDocument32 pagesFM MaterialSree Harsha VardhanNo ratings yet

- Introduction To Financial ManagementDocument18 pagesIntroduction To Financial ManagementPratham SharmaNo ratings yet

- ACC19 Financial Management: College of Accountancy and Business AdministrationDocument4 pagesACC19 Financial Management: College of Accountancy and Business Administrationjelyn bermudezNo ratings yet

- Financial Management: Unit IDocument72 pagesFinancial Management: Unit Isubhash_92No ratings yet

- Financial Management: Unit IDocument72 pagesFinancial Management: Unit IE-sabat RizviNo ratings yet

- Financial ManagementDocument22 pagesFinancial ManagementRk BainsNo ratings yet

- Financial MGT Module 1Document24 pagesFinancial MGT Module 1Anjelika ViescaNo ratings yet

- Sbaa 3004Document71 pagesSbaa 3004mohanrajk879No ratings yet

- Module 1 FINP1 Financial ManagementDocument9 pagesModule 1 FINP1 Financial ManagementkimmheanNo ratings yet

- CH 1Document41 pagesCH 1bjr_shagyounNo ratings yet

- Af 212 Financial ManagementDocument608 pagesAf 212 Financial ManagementMaster KihimbwaNo ratings yet

- Financial Management Chapter 1Document11 pagesFinancial Management Chapter 1Ruiz, CherryjaneNo ratings yet

- Module 1 - Nature, Basic Concepts and Scope of Financial ManagementDocument11 pagesModule 1 - Nature, Basic Concepts and Scope of Financial ManagementMarjon DimafilisNo ratings yet

- 1.introduction To Finance Management - Jan 2012-1Document9 pages1.introduction To Finance Management - Jan 2012-1Moud KhalfaniNo ratings yet

- Arihant CADocument42 pagesArihant CAmanojNo ratings yet

- Bus.-Finance LAS Qtr1Document36 pagesBus.-Finance LAS Qtr1Matt Yu EspirituNo ratings yet

- Introduction to Financial ManagementDocument15 pagesIntroduction to Financial ManagementHayes MartinNo ratings yet

- ACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyDocument3 pagesACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyAdrienne Nicole MercadoNo ratings yet

- Tutorial 1 QuestionsDocument4 pagesTutorial 1 QuestionshrfjbjrfrfNo ratings yet

- Assignment of Financial ManagementDocument7 pagesAssignment of Financial ManagementPRACHI DASNo ratings yet

- Business FinanceDocument91 pagesBusiness FinanceIStienei B. EdNo ratings yet

- Mediobanca Securities Report - 17 Giugno 2013 - "Italy Seizing Up - Caution Required" - Di Antonio GuglielmiDocument88 pagesMediobanca Securities Report - 17 Giugno 2013 - "Italy Seizing Up - Caution Required" - Di Antonio GuglielmiEmanuele Sabetta100% (1)

- There Are Different Types of SharesDocument2 pagesThere Are Different Types of SharesMadhu Sudan PandeyNo ratings yet

- Keyman Insurance Policy-White PaperDocument12 pagesKeyman Insurance Policy-White PaperbeingviswaNo ratings yet

- Model Answers Economics Igcse Paper 2Document25 pagesModel Answers Economics Igcse Paper 2KarenNo ratings yet

- The Personal MBA (Summary)Document13 pagesThe Personal MBA (Summary)Boy BearishNo ratings yet

- VAT and SD Rules 2016 EnglishDocument59 pagesVAT and SD Rules 2016 EnglishSadia Yasmin100% (3)

- Rice Mill Detailed Project Report - 9t Per Hour - For Finance, Subsidy & Project Related Support Contact - 9861458008Document49 pagesRice Mill Detailed Project Report - 9t Per Hour - For Finance, Subsidy & Project Related Support Contact - 9861458008Radha Krishna SahooNo ratings yet

- Banking Company Final Accounts: Profit, Loss, Assets, LiabilitiesDocument20 pagesBanking Company Final Accounts: Profit, Loss, Assets, LiabilitiesPaulomi LahaNo ratings yet

- Maf 630 Chapter 1Document3 pagesMaf 630 Chapter 1Pablo EkskobaNo ratings yet

- Primavera PERT Master Risk Analysis ToolDocument22 pagesPrimavera PERT Master Risk Analysis ToolPallav Paban BaruahNo ratings yet

- Inherent Powers of The StateDocument15 pagesInherent Powers of The StateCyris Aquino NgNo ratings yet

- Estate Tax Return 1801: Actual Funeral Expenses or 5% of Gross EstateDocument2 pagesEstate Tax Return 1801: Actual Funeral Expenses or 5% of Gross EstateMauro Cabading IIINo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Training Manual on Business Management SkillsDocument46 pagesTraining Manual on Business Management SkillsBlesse Anne BlacerNo ratings yet

- RN170907113212734 RpuDocument13 pagesRN170907113212734 RpunadiaNo ratings yet

- Inventory Accounting Entries GuideDocument8 pagesInventory Accounting Entries GuideMuhammad Javed IqbalNo ratings yet

- Corporate Overview and Key Financial Highlights of Food Manufacturer Driving Growth Through InnovationDocument2 pagesCorporate Overview and Key Financial Highlights of Food Manufacturer Driving Growth Through InnovationBlueHexNo ratings yet

- Bab1014 Financial Accounting AssignmentDocument28 pagesBab1014 Financial Accounting AssignmentAinaasyahirah RosidanNo ratings yet

- The Capital Asset Pricing ModelDocument43 pagesThe Capital Asset Pricing ModelTajendra ChughNo ratings yet

- Lesson 3d Preparation of Statement of Comprehensive Income - Manufacturing BusinessDocument8 pagesLesson 3d Preparation of Statement of Comprehensive Income - Manufacturing BusinessBenedict CladoNo ratings yet

- Sample Trust DeedDocument12 pagesSample Trust Deedfaizysyed100% (2)

- Palepu 3e ch4Document21 pagesPalepu 3e ch4Nadine SantosNo ratings yet

- Merchandising OperationsDocument39 pagesMerchandising OperationsRyan Jeffrey Padua Curbano50% (2)

- Organization Theory and Methodology: Michael C. Jensen Harvard Business SchoolDocument37 pagesOrganization Theory and Methodology: Michael C. Jensen Harvard Business SchoolNeo4u44No ratings yet

- Global LCC Outlook v2Document310 pagesGlobal LCC Outlook v2JcastrosilvaNo ratings yet

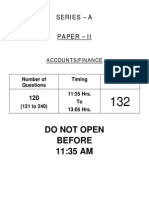

- Fci 132 Accounts - Finance PaperDocument15 pagesFci 132 Accounts - Finance PapersukanyaNo ratings yet