Professional Documents

Culture Documents

Case3Team4 v2

Uploaded by

Peter SteinerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case3Team4 v2

Uploaded by

Peter SteinerCopyright:

Available Formats

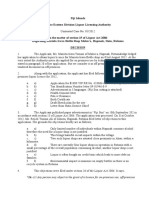

Case 3 Team 4: Jesse Galindo, Sulabh Gupta, Maggie Jones, Wale Olukanmi

FIN500

Dividend Policy at FPL Group, Inc.

Executive Summary 1. Why do firms pay dividends? What, in general, are the advantages and disadvantages of paying cash dividends? Taking into account the many theories of dividend policy including the Dividend Irrelevance Theorem, the Information Effect, The Clientele Effect and Corporate Control Issues, firms should pay out as dividends any cash flow that is surplus after the firm has invested in all available positive net present value projects.i In some cases, this may be a way of showing that the company is financially stable and capable of fulfilling dividend obligations. It may also be a way for companies to mitigate agency problems when they have excess cash. Advantages of paying cash dividends include: A signal of the value and stability of the business A means of distributing excess cash The tendency to increase stock prices when announced A way of keeping managers in check and mitigating agency problems when high retained earnings dont max out shareholders value Higher proportion of pension funds/ tax exempt institutions are the shareholders Disadvantages of paying cash dividends include: Taxation at a higher rate than capital gains Limits on the growth the company if dividends are paid instead of completing a positive NPV project. Once established they are difficult to eliminate and doing so will often affect the price of the stock They have no impact on the value of a company and the stockholders can create dividends by simply selling the stock 2. Suppose FPL will pay an annual dividend of $2.48 in 1994, and assume the market risk premium (RM Rf) is 7.5% and the risk free interest rate is 7.3% (the current yield on 30-year Tbonds from Exhibit 8), and FPL Group Inc. stock is selling at $34 per share, what is the expected capital gains yield of FPL stock? Expected capital gains yield = expected rate of return - dividend yield Expected rate of return = i = Rf + (RM - Rf) = 0.60 (RM - Rf) = 7.5% Rf = 7.3% i = Rf + (RM - Rf) = 7.3% + 0.60 * 7.5% = 7.3% + 4.5%= 11.8%

Page 1

Case 3 FPL Group Team 4: Jesse Galindo, Sulabh Gupta, Maggie Jones, Wale Olukanmi Dividend yield = dividend/ price = $2.48/$34.00 = 0.073 = 7.3% Expected capital gains yield = expected rate of return - dividend yield = 11.8% - 7.3% = 4.5%

FIN500

3. From FPLs perspective, is the current payout ratio appropriate? Would a higher or lower payout ratio more appropriate? Explain and justify your answer based on information in the case. From FLP group perspective the current payout is too high based on the information provided in the case. The case notes that the company was paying out in the range 90% of its earning. FPL will be better off saving those extra earnings for the purposes of reinvestment, future expansion, or unforeseen future competition. Another area of future concern for FPL is retail wheeling, which has a chance of being adopted by Florida, especially since it can potentially cut into their future earning, it will allow customers to be able to buy energy from other suppliers other than the monopoly supplier. So it would be in there best interest to maintain a high reserve in order to protect themselves from future vulnerability. 4. From an investors perspective, is the FPLs payout ratio appropriate? Explain and justify your answer based on information in the case. Well according to the case, the payout by FPL is appropriate, the case further emphasized that investors are use to getting high payout from the utility companies. Looking at the case, it was reported that after FPL announced of the change in dividend policy on March 3rd, 1994, that it would be difficult to increase the dividend. Then on May 9th, 1994 FPL announced the dividend cut with the stock repurchase program and the stock price fell $4.375 to $27.50 . Then on May 31st, FPL's stock closed at $32.17, or about 30 cents higher than the pre-announcement price. One year later, FPL's stock price closed at $37.75, giving stockholders a return of 23.8%. Finally, almost two years later on April 1, 1996 FPL's stock was trading at $45.25, which provided stockholders with a postannouncement return of 52.9%. Investors ran for cover because they were not used to this type of announcement for this sector, so such news is considered a negative news, especially for a company that has steadily increased dividends payout for the past 48yrs. On the other hand once investors see that FPL was repurchasing its stocks, this gave them the information that the stocks are healthy and will be increasing in the near future or else why would they be repurchasing if FPL is not stable. It's also possible that this was a strategic move on FPL's part to cut dividend which brought the stock's price down, and then repurchase the stocks which gives investors that are waiting on the fence the confidence to jump in and buy the company's stocks, whereas in actuality the company is undergoing financial trouble. 5. As Kate Stark, what would you recommend regarding investment in FPLs stock buy, sell, or hold?

i

Cornett, Marcia, Adair, Troy, and Nofsinger, John. Finance: Theory and Applications. 2009: United States. McGraw-Hill Irwin. p. 495.

Page 2

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Cargas Termicas HapDocument2 pagesCargas Termicas HapArq Alfonso RicoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- From 1-73Document95 pagesFrom 1-73Shrijan ChapagainNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Snubbing PDFDocument134 pagesSnubbing PDFNavin SinghNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Rubric AutocadDocument2 pagesRubric Autocadros maria100% (6)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- High Speed PCB DesignDocument8 pagesHigh Speed PCB DesignMonal Bhoyar100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Review of Polyurea Coating ResearchesDocument12 pagesReview of Polyurea Coating ResearchesDineshNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hypochlorous AcidDocument25 pagesHypochlorous AcidDirector Research100% (2)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- ABSTRACT (CG To Epichlorohydrin)Document5 pagesABSTRACT (CG To Epichlorohydrin)Amiel DionisioNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Railway CircularsDocument263 pagesRailway CircularsDrPvss Gangadhar80% (5)

- CH03 HKM Law Investigation and EthicsDocument32 pagesCH03 HKM Law Investigation and Ethicsmilkikoo shiferaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- EXHIBIT 071 (B) - Clearfield Doctrine in Full ForceDocument4 pagesEXHIBIT 071 (B) - Clearfield Doctrine in Full ForceAnthea100% (2)

- Economics: PAPER 1 Multiple ChoiceDocument12 pagesEconomics: PAPER 1 Multiple ChoiceigcsepapersNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- COEN 252 Computer Forensics: Incident ResponseDocument39 pagesCOEN 252 Computer Forensics: Incident ResponseDudeviswaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- GSM Controlled RobotDocument33 pagesGSM Controlled RobotAbhishek KunalNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Solar Smart Irrigation SystemDocument22 pagesSolar Smart Irrigation SystemSubhranshu Mohapatra100% (1)

- IS301 P1 Theory June 2021 P1 TheoryDocument20 pagesIS301 P1 Theory June 2021 P1 Theory50902849No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Fault Tree AnalysisDocument23 pagesFault Tree Analysiskenoly123No ratings yet

- Coreapb3: Nivin PaulDocument19 pagesCoreapb3: Nivin PaulNivin PaulNo ratings yet

- ACLU Letter of ConcernDocument5 pagesACLU Letter of ConcernRyan FinnertyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 01 FundamentalsDocument20 pages01 FundamentalsTay KittithatNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Belgian Overseas Chartering and Shipping NDocument2 pagesBelgian Overseas Chartering and Shipping NMXKatNo ratings yet

- Create New Project CodeVision AVR (LED)Document5 pagesCreate New Project CodeVision AVR (LED)calvinNo ratings yet

- Boat, Time Speed and DistanceDocument5 pagesBoat, Time Speed and DistanceAnmol AswalNo ratings yet

- Supplier Relationship Management As A Macro Business ProcessDocument17 pagesSupplier Relationship Management As A Macro Business ProcessABCNo ratings yet

- Reading #11Document2 pagesReading #11Yojana Vanessa Romero67% (3)

- Forging 2Document17 pagesForging 2Amin ShafanezhadNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- in Re Irava Bottle ShopDocument10 pagesin Re Irava Bottle ShopCYMON KAYLE LubangcoNo ratings yet

- MBridgeDocument50 pagesMBridgeTsila SimpleNo ratings yet

- Gendex 9200 enDocument204 pagesGendex 9200 enArturo Jimenez Terrero80% (5)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)