Professional Documents

Culture Documents

In Defense of Space Prizes

Uploaded by

Ian FichtenbaumCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Defense of Space Prizes

Uploaded by

Ian FichtenbaumCopyright:

Available Formats

SPECIALISTS IN SATELLITE, TELECOM AND AEROSPACE INVESTMENT BANKING

In Defense of Space Prizes

The success Hyperinflation record of prizes aside, real valuefor accelerating creation has to be innovation and constrained at leveraging scarce least partially by funds is quite the boundary remarkable conditions of the economic system

During a speech as part of the Republican Florida primary, Newt Gingrich proposed setting aside 10% of NASAs annual budget (roughly $1.8 Billion) to support prize competitions to encourage greater commercial activity and investment in space. While some may think this idea is unaffordable or even zany, it has many supporters in the space industry and, if scored appropriately against its annual budget, could even have considerable support within NASA. By scoring I mean that it would hardly be fair to deduct the full amount of the hypothetical prize amount from NASAs budget as the prize may not be won for many years, if at all. The success record of prizes for accelerating innovation and leveraging scarce funds is quite remarkable. The primary obstacle to more and larger prizes has not been that they do not work, but that Congress for the most part does not like them. As it was explained to me by a leading space policy analyst on the Hill, Congressmen do not like to vote money for something unless they know what district will benefit from it and when. An open ended commitment on future tax dollars that Congressmen cannot have a hand in allocating is just too much for many politicians to stomach. Prizes, therefore, end up being difficult to protect during budget negotiations and are often the first to go. And yet the prizes do work. Here are three recent examples: Ansari X PRIZE. On October 4, 2004, the X PRIZE Foundation awarded a $10 million prize to Scaled Composites for building and launching a spacecraft capable of carrying three people to 100 kilometers above the earth's surface, twice within two weeks. This $10 million prize inspired Burt Rutan and Paul Allen of Microsoft fame to invest a much greater amount in their effort, not counting the many other teams that raised money and tried, but failed to win the prize. After winning this prize, Scaled Composite was able to attract Virgin Galactic to become its strategic partner. Virgin Galactic is aggressively pursuing a space tourism business plan. In 2009, less than five years after the prize award, Virgin Galactic raised $380 million from Aabar Investments for a 31.8% stake in the company, an $875 million valuation. In 2001, Aabar invested another $110 million to increase its stake to 37.8%, a $1.8 Billion

can now work out what NASA calls the ilities, meaning repeatability, reliability, maintainability

SPECIALISTS IN SATELLITE, TELECOM AND AEROSPACE INVESTMENT BANKING

valuation. One may dismiss all of this as mere thrill rides for the 1%ers, but the benefit to space development is a business that can now work out what NASA calls the ilities, meaning repeatability, reliability, maintainability versus the status quo of costly and infrequent expendable rocket launches. some entrants will spend as much as 5 times the prize amount in their efforts with expenditures of 2.5 times the prize purse being relatively common Google Lunar X PRIZE. Google has sponsored a $30 million X PRIZE to be won by the first privately funded teams to safely land a robot on the surface of the Moon, have that robot travel 500 meters, and send video and data back to the Earth. To date, there are 26 active teams around the world competing for this prize. The X PRIZE Foundation estimates that, based on its and other groups experiences with prize competitions, some entrants will spend as much as 5 times the prize amount in their efforts with expenditures of 2.5 times the prize purse being relatively common. Just do the math and you will quickly see the enormous leveraging of tax dollars prizes could achieve. But then there is the snicker factor. Who cares if a bunch of space cadets blow their money on a pipe dream? What does that have to do with the real world? Well, here is a partial list of some of the most recognizable academic and industry partners involved: Carnegie Mellon, MIT, Penn State, University of Alabama, Aerojet, Alcoa, Caterpillar, Dynetics, Draper Laboratories, Lockheed Martin, MacDonald Dettwiler & Associates, Pratt & Whitney Rocketdyne, Sierra Nevada Corp., and Teledyne Brown Engineering, not to mention a few wealthy Silicon Valley entrepreneurs. Well, okay, so perhaps its not a big joke, what about an actual lunar market? According to a 2009 report conducted by Futron Corporation, the market for commercial services to support pre-cursor scientific and exploratory missions, as well as unmanned cargo delivery and logistical services to the lunar surface, is estimated to be in excess of $1.5 billion over the next decade. Additionally, an internal study presented to the NASA Commercial Lunar Working Group at the Lunar Science Forum on July 2009 predicted that the commercial lunar services market for NASA-related surface activities alone will be closer to $3 billion over the next decade. A NASA robotic lunar exploration program study concluded that at least 20 unmanned surface missions would be required to provide reliable ground truth on the Moons surface composition. While this may be a moot point for NASA if the U.S. does not decide to return to the Moon, a number of other nations have stated aspirations for missions to the surface of the Moon in the 20152030 time frame.

The value of just knowing which techniques and technologies do not work was worth far more than [the] small investment.

SPECIALISTS IN SATELLITE, TELECOM AND AEROSPACE INVESTMENT BANKING

NASAs Centennial Challenges. None of this leveraging effect is lost on NASA. Its experience with competitions has been very successful despite extremely modest budgets for prizes. Still, even at these modest prize levels, NASAs Centennial Challenge program has been very successful at attracting large numbers of competitors from a wide range of participants and NASA has benefited greatly and cost effectively from this program. To date, NASA has paid out roughly $4 million in four of the challenges it has offered. Others have yet to be won. For instance, in the Lunar Lander competition won by Masten Space and Armadillo Aerospace, NASA gained access to lunar landers as test beds saving tremendous development time and money and also helped move forward a reusable sub-orbital rocket vehicle with the potential for future off-the-shelf availability for NASAs needs. In the Regolith Excavation challenge, over 40 robotic solutions were tested for a total cost to NASA of $750,000. The value of just knowing which techniques and technologies do not work was worth far more than that small investment. This challenge was also notable in that a group of students beat out the professionals. The Astronaut Glove competition not only generated significantly improved glove designs for NASA, but has also generated two companies founded by the winning and runner-up teams to pursue commercial opportunities. In this case, Peter Homer the winner was an individual inventor and virtually unknown to NASA. Prizes work. Challenges work. Commercial competition works Prizes work. Challenges work. Commercial competition works. Prizes not only significantly leverage scarce tax dollars, they also greatly expand participation, accelerate innovation and create breakthroughs and affordable solutions that a top down government contracting methodology can never hope to duplicate. Prize awards are also likely to be spread over many years, and some may never be won, yet the benefits will still be generated from the commercial activity they inspire. As for the prize winners, they not only recoup part of their expenditures, they also receive NASAs seal of approval and a very public acknowledgement that their solution was best. The credibility this gives the winning team allows them to more easily raise capital from skeptical investors and more effectively compete for follow-on commercial and government projects. I cannot imagine a more obvious way to win the future than using prizes to unleash the entrepreneurial fervor of American ingenuity.

By Hoyt Davidson Near Earth LLC

SPECIALISTS IN SATELLITE, TELECOM AND AEROSPACE INVESTMENT BANKING

IMPORTANT DISCLOSURES AND INFORMATION ABOUT THE USE OF THIS DOCUMENT: Near Earth, LLC ("Near Earth") has published this report solely for informational purposes. The report is aimed at institutional investors and investment professionals, and satellite, media and telecom industry professionals. This report is not to be construed as a recommendation or solicitation to buy or sell securities. The report was written without regard for the investment objectives, financial situation, or particular needs of any specific recipient, and it should not be regarded by recipients as a substitute for the exercise of their own judgment. The content contained herein is based on information obtained from sources believed to be reliable, but is not guaranteed as being accurate, nor is it a complete statement or summary of any of the markets or developments mentioned. The authors of this report are employees of Near Earth, LLC, which is a member of FINRA. The opinions expressed in this report accurately reflect the personal views of the authors but do not necessarily reflect the opinions of Near Earth itself or its other officers, directors, or employees. The portions of this report produced by non-Near Earth employees are provided simply as an accommodation to readers. Near Earth is under no obligation to confirm the accuracy of statements written by others and reproduced within this report. Near Earth and/or its directors, officers and employees may have, or have had, interests in the securities or other investment opportunities related to the companies or industries discussed herein. Employees and/or directors of Near Earth may serve or have served as officers or directors of companies mentioned in the report. Near Earth does, and seeks to do, business with companies mentioned in this report. As a result, Near Earth may have conflicts of interest that could affect the objectivity of this report. This report is subject to change without notice and Near Earth assumes no responsibility to update or keep current the information contained herein. Near Earth accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this report. No part of this report may be reproduced or distributed in any manner, via the Internet or otherwise, without the specific written permission of Near Earth. Near Earth accepts no liability whatsoever for the actions of third parties in this respect.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- That's Quadrillion With A QDocument5 pagesThat's Quadrillion With A QIan FichtenbaumNo ratings yet

- Near Earth's Investment Thesis For Today's MarketDocument12 pagesNear Earth's Investment Thesis For Today's MarketIan FichtenbaumNo ratings yet

- Building Blocks of The FutureDocument7 pagesBuilding Blocks of The FutureIan FichtenbaumNo ratings yet

- Small Aerospace Companies - Space Activities in North America and EuropeDocument50 pagesSmall Aerospace Companies - Space Activities in North America and EuropeIan Fichtenbaum100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Passive Voice HomeworkDocument2 pagesPassive Voice HomeworkE.RNo ratings yet

- Life Science Result Mducee 2019 PDFDocument55 pagesLife Science Result Mducee 2019 PDFSumit ChauhanrjNo ratings yet

- Bokk 021 Ok 2Document62 pagesBokk 021 Ok 2Rupesh GuravNo ratings yet

- John AshberyDocument3 pagesJohn Ashberyapi-23461844100% (1)

- EDD July N Aug 2020Document10 pagesEDD July N Aug 2020phc kallumarriNo ratings yet

- Heroclix Marvel - 1 Infinity Challenge Quickstart RulesDocument2 pagesHeroclix Marvel - 1 Infinity Challenge Quickstart RulesmrtibblesNo ratings yet

- Dept - Exam Final Results From LDC To UdcDocument62 pagesDept - Exam Final Results From LDC To UdcvadrevusriNo ratings yet

- Very God Data Hyd - xlsx2Document13 pagesVery God Data Hyd - xlsx2Real Estates100% (3)

- Pe List StudentsDocument42 pagesPe List StudentsAritraDasNo ratings yet

- Dance Australia - April-May 2016Document68 pagesDance Australia - April-May 2016RagagaNo ratings yet

- Comedk PCMDocument1,007 pagesComedk PCMPavan KumarNo ratings yet

- PSA Centre ListDocument400 pagesPSA Centre ListAkshat GroverNo ratings yet

- Repertoar SvadbaDocument12 pagesRepertoar SvadbaAmanda JarvisNo ratings yet

- 2NE1 - Falling in LoveDocument3 pages2NE1 - Falling in LoveCebokanNo ratings yet

- Group 1 A - It Skills Lab - 1 S.No. Rollno Name Fathername MarksDocument4 pagesGroup 1 A - It Skills Lab - 1 S.No. Rollno Name Fathername MarksAjit MauryaNo ratings yet

- Yellow - ColdplayDocument1 pageYellow - ColdplayJosé Astinza100% (1)

- Valentina TereskovaDocument11 pagesValentina TereskovaChitrangada ChakrabortyNo ratings yet

- DT Results With Names Go - Nov 2012Document98 pagesDT Results With Names Go - Nov 2012api-215249734No ratings yet

- Jolie Louise - Daniel LanoisDocument1 pageJolie Louise - Daniel LanoisbenNo ratings yet

- Q - SecDocument2 pagesQ - SecB P VINEETH KRISHNANo ratings yet

- Cash and GunsDocument8 pagesCash and GunsUdruga Igranje100% (1)

- Static GK NotesDocument99 pagesStatic GK NotesTarique HassanNo ratings yet

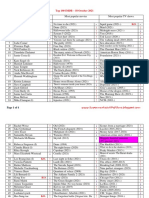

- Top 100 IMDB - 18 October 2021Document4 pagesTop 100 IMDB - 18 October 2021SupermarketulDeFilmeNo ratings yet

- Kevin RocheDocument2 pagesKevin RocheAvadhut ShindeNo ratings yet

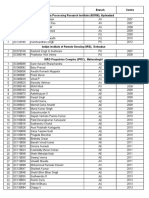

- Isro CentrewiseDocument15 pagesIsro CentrewisePratibha NegiNo ratings yet

- Pritzker Architecture Prize AwardeesDocument29 pagesPritzker Architecture Prize AwardeesMelannie OcampoNo ratings yet

- PGs List 15-16, 16-17Document62 pagesPGs List 15-16, 16-17veera bhadramNo ratings yet

- Trumpet Mouthpiece Brand Comparison ChartDocument6 pagesTrumpet Mouthpiece Brand Comparison ChartMartin Cruz100% (3)

- Girl From Ipanema Leadsheet With English Lyrics - Antonio Carlos Jobim PDFDocument1 pageGirl From Ipanema Leadsheet With English Lyrics - Antonio Carlos Jobim PDFHamilton DurantNo ratings yet

- BALLB (H) VIII SemDocument28 pagesBALLB (H) VIII SemAmanNo ratings yet