Professional Documents

Culture Documents

Abatement in Service Tax 2010

Uploaded by

Pankaj MaggoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abatement in Service Tax 2010

Uploaded by

Pankaj MaggoCopyright:

Available Formats

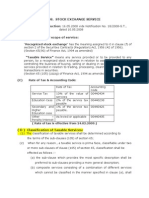

ABATEMENT RATE VARIOUS SERVICES UNDER SERVICE TAX 47

Sl.No

Sub clause of section 65(105)

Description service

of

taxable

Conditions

Percentage amount of value on which ST is required to be paid

(m)

(1) The use of mandap, including the facilities provided to [any person]5 in relation to such use and also for the catering charges. (2) Taxable service provided by a hotel as mandap keeper in such cases where services provided include catering services, that is, supply of food alongwith any service in relation to use of a mandap.

This exemption shall apply only in such cases where the mandapkeeper also provides catering services, that is, supply of food and the invoice, bill or challan issued indicates that it is inclusive of the charges for catering service. The invoice, bill or challan issued indicates that it is inclusive of charges for catering services. Explanation.-The expression hotel means a place that provides boarding and lodging facilities to public on commercial basis. The bill issued for this purpose indicates that it is inclusive of charges for such a tour. (a) The invoice, bill or challan issued indicates that it is towards charges for such accommodation, and (b) this exemption shall not apply in such cases where the invoice, bill or challan issued by the tour operator, in relation to a tour, only includes the service charges for arranging or booking accommodation for any person and does not include the cost of such accommodation.

60

(n)

(i) Services provided or to be provided to any person, by a tour operator in relation to a package tour. Explanation.The expression package tour means a tour wherein transportation,accommodation for stay, food, tourist guide, entry to monuments and other similar services in relation to tour are provided by the tour operator as part of the package tour to the person undertaking the tour. (ii) Services provided or to be provided to any person, by a tour operator in relation to a tour, if the tour operator is providing services solely of arranging or booking accommodation for any person in relation to a tour. (iii) Services, other than services specified in (i) and (ii) above, provided or to be provided to any person, by a tour operator in relation to a tour.

25

10

The bill issued indicates that the amount charged in the bill is the gross amount charged for such a tour.

40

3 4 (o)

(zc)

Renting of a cab

Holding of a convention, where service provided includes catering service

--The gross amount charged from the [recipient of service]5 is inclusive of the charges for the catering service.

40 60

http://www.simpletaxindia.org/

ABATEMENT RATE VARIOUS SERVICES UNDER SERVICE TAX 48

4A2

(zzb)

Business auxiliary service in relation to production or processing of parts and accessories used in the manufacture of cycles, cycle rickshaws and hand-operated sewing machines, for, or on behalf of, the client.

The gross amount charged from the client is inclusive of the cost of inputs and input services, whether or not supplied by the client

70

4A6

(zm)

Services provided in relation to chit. Explanation.- Chit means a transaction whether called chit, chit fund, chitty, kuri, or by any other name by or under which a person enters into an agreement with a specified number of persons that every one of them shall subscribe a certain sum of money (or a certain quantity of grain instead) by way of periodical installments over a definite period and that each subscriber shall, in his turn, as determined by lot or by auction or by tender or in such other manner as may be specified in the chit agreement, be entitled to the prize amount.

------

70

(zzd)

Erection, commissioning or installation, under a contract for supplying a plant, machinery or equipment and erection, commissioning or installation of such plant, machinery or equipment.

This exemption is optional to the commissioning and installation agency. Explanation.- The gross amount charged from the [recipient of service]5 shall include the value of the plant, machinery, equipment, parts and any other material sold by the commissioning and installation agency, during the course of providing erection, commissioning or installation service.

33

64

(zzp)

Transport of goods by road in a goods carriage. Commercial or Industrial Construction

--This exemption shall not apply in such cases where the taxable services provided are only completion and finishing services in relation to building or civil structure, referred to in sub-clause (c) of clause (25b) of section 65 of the Finance Act. Explanation.- The gross Amount charged shall include the value of goods and materials supplied or provided or used by the provider of the construction service

25

(zzq)

33

http://www.simpletaxindia.org/

ABATEMENT RATE VARIOUS SERVICES UNDER SERVICE TAX 49

for providing such service.

(zzt)

Catering

This exemption shall apply in cases where,(i) the outdoor caterer also provides food; and (ii) the invoice, bill or challan issued indicates that it is inclusive of charges for supply of food.

50

(zzw)

Services in relation to pandal or shamiana in any manner, including services rendered as a caterer.

This exemption shall apply only in cases where,(i) the pandal or shamiana contractor also provides catering services, that is, supply of food; and ii)the invoice, bill or challan issued indicates that it is inclusive of charges for catering service.

70

(ii)

10

(zzzh)

Construction of Complex This exemption shall not apply in cases where the taxable services provided are only completion and finishing services in relation to residential complex, referred to in sub-clause (b) of clause (30a) of section 65 of the Finance Act. Explanation.- The gross amount charged shall include the value of goods and materials supplied or provided or used for providing the taxable service by the service provider.

33

111

(zzzp)

Transport of goods containers by rail

in

---

30

Provided that this notification shall not apply in cases where, (i) the CENVAT credit of duty on inputs or capital goods or the CENVAT credit of service tax on input services, used for providing such taxable service, has been taken under the provisions of the CENVAT Credit Rules, 2004; or (ii) the service provide r has availed the benefit under the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.12/2003-Service Tax, dated the 20th June, 2003[G.S.R. 503 (E), dated the 20th June, 2003]. Explanation.- For the purposes of this notification, the expression food means a substantial and satisfying meal and the expression catering service shall be construed accordingly. 1 Inserted by Notification No.20/2006 dated 25.04.2006 2 Inserted by Notification No.23/2006 dated 02.06.2006 3 Substituted by Notification No.38/2007 dated 23.08.2007 4 Omitted vide Notification No. 12/2008 dated 01.03.2008 5 Substituted vide Notification No. 22/2008 dated 10.05.2008 effective from 16.05.2008

http://www.simpletaxindia.org/

You might also like

- S. No Sub-Clause of Clause (105) of Section 65 Description of Taxable Service Conditions Perce - NtageDocument3 pagesS. No Sub-Clause of Clause (105) of Section 65 Description of Taxable Service Conditions Perce - NtageAks SomvanshiNo ratings yet

- TPT RoadDocument13 pagesTPT RoadLakhan PatidarNo ratings yet

- TH TH: Explanation.-For The Purposes of This ClauseDocument4 pagesTH TH: Explanation.-For The Purposes of This ClauseAks SomvanshiNo ratings yet

- Site Info ClearanceDocument9 pagesSite Info ClearanceAnuppur Amlai RangeNo ratings yet

- Taxation of Financial Services Sybbi FinalDocument24 pagesTaxation of Financial Services Sybbi Finalsheenu152005No ratings yet

- ST Determtn Value Rules PDFDocument4 pagesST Determtn Value Rules PDFKumarvNo ratings yet

- Service Tax RulesDocument4 pagesService Tax RulesSURYA SNo ratings yet

- Works Contract ServicesDocument13 pagesWorks Contract ServicesSreedhar EtrouthuNo ratings yet

- Insurance Auxiliary Services GuideDocument9 pagesInsurance Auxiliary Services GuidePunit GuptaNo ratings yet

- TRAVEL TAX TITLEDocument9 pagesTRAVEL TAX TITLEAPI SupportNo ratings yet

- IDT SupplemantaryDocument77 pagesIDT SupplemantarykanchanthebestNo ratings yet

- GST Amendement Act 2018Document6 pagesGST Amendement Act 2018Nitesh KumarNo ratings yet

- ST Determtn Value Rules 1Document4 pagesST Determtn Value Rules 1Poonam GuptaNo ratings yet

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- (A) Date of Introduction: (B) Definition and Scope of ServiceDocument6 pages(A) Date of Introduction: (B) Definition and Scope of ServicePradeep JainNo ratings yet

- Service Tax Abatement Rate Chart 01.04.2015 PDFDocument11 pagesService Tax Abatement Rate Chart 01.04.2015 PDFkumar45caNo ratings yet

- Notification No. 30/2012-Service TaxDocument4 pagesNotification No. 30/2012-Service TaxReview UdaipurNo ratings yet

- Government of TelanganaDocument16 pagesGovernment of TelanganakatkamshivakumarNo ratings yet

- Chapter 7 - Value of Supply - NotesDocument16 pagesChapter 7 - Value of Supply - NotesPuran GuptaNo ratings yet

- Short Title, Extent and Commencement. - : (28/2012-Service Tax Dated 20.06.2012)Document4 pagesShort Title, Extent and Commencement. - : (28/2012-Service Tax Dated 20.06.2012)Kanishk YadavNo ratings yet

- Bundled Service ValuationDocument7 pagesBundled Service ValuationSushant SaxenaNo ratings yet

- Comments On Sindh Finance Bill - 2015: Haroon Zakaria & Company Chartered AccountantsDocument12 pagesComments On Sindh Finance Bill - 2015: Haroon Zakaria & Company Chartered AccountantsssssNo ratings yet

- Bos 62625Document34 pagesBos 62625nerises364No ratings yet

- 2006SRO560 - Sales Tax K-ElectricDocument67 pages2006SRO560 - Sales Tax K-ElectricAtifNo ratings yet

- Statutory Update For GSTDocument52 pagesStatutory Update For GSTMd zaidNo ratings yet

- Service Tax 2008Document12 pagesService Tax 2008Prakash BatwalNo ratings yet

- Bimal Jain BGM Service Tax 051014Document67 pagesBimal Jain BGM Service Tax 051014Aayushi AroraNo ratings yet

- CGST Act Section 17 on Apportionment of CreditDocument3 pagesCGST Act Section 17 on Apportionment of CreditSaurabh RaoNo ratings yet

- Input ServiceDocument1 pageInput ServiceRajiv NautiyalNo ratings yet

- IDT ICAI AmendmentsDocument38 pagesIDT ICAI Amendmentsgvramani51233No ratings yet

- Service Tax Credit RulesDocument4 pagesService Tax Credit Rulesgauravbarthwal123No ratings yet

- Supp PCC Stax 2007Document20 pagesSupp PCC Stax 2007P VenkatesanNo ratings yet

- Service Tax Rules, 1994Document75 pagesService Tax Rules, 1994Gens GeorgeNo ratings yet

- WWW - Servicetax.gov - in Value RulesDocument4 pagesWWW - Servicetax.gov - in Value Rulesmn_sundaraamNo ratings yet

- Service Tax Rules AmendedDocument4 pagesService Tax Rules AmendedDipesh Chandra BaruaNo ratings yet

- GST Notification 13 2018 CGST Rate EnglishDocument3 pagesGST Notification 13 2018 CGST Rate EnglishAkbar ShaikNo ratings yet

- SAC Codes & GST Rates For Services - Chapter 99Document26 pagesSAC Codes & GST Rates For Services - Chapter 99mn_sundaraam67% (3)

- ST Determination RulesDocument7 pagesST Determination Rulesmahajanamol89No ratings yet

- Notification No 15/2012Document2 pagesNotification No 15/2012Ankit GuptaNo ratings yet

- Service Tax - Pop RulesDocument5 pagesService Tax - Pop RulesSuman ParialNo ratings yet

- Service TaxDocument15 pagesService TaxSaleemNo ratings yet

- Amendments in The Sindh Sales Tax On Services Rules 2011Document8 pagesAmendments in The Sindh Sales Tax On Services Rules 2011Ali AkberNo ratings yet

- Place of Provision of Services Rules, 2012Document7 pagesPlace of Provision of Services Rules, 2012Suppy PNo ratings yet

- Service Tax on Air TravelDocument15 pagesService Tax on Air TravelvijaykoratNo ratings yet

- Amendments Applicable For Nov 2018 Exam: Income TaxDocument4 pagesAmendments Applicable For Nov 2018 Exam: Income TaxKrishna DasNo ratings yet

- Refunds: After Studying This Chapter, You Will Be Able ToDocument62 pagesRefunds: After Studying This Chapter, You Will Be Able ToAdventure TimeNo ratings yet

- Refunds: After Studying This Chapter, You Will Be Able ToDocument59 pagesRefunds: After Studying This Chapter, You Will Be Able Toarohi guptaNo ratings yet

- Meaning and Scope of Supply Under GSTDocument5 pagesMeaning and Scope of Supply Under GSTRohit BajpaiNo ratings yet

- Government of India notifies taxable services under Service TaxDocument2 pagesGovernment of India notifies taxable services under Service TaxAMIT GUPTANo ratings yet

- Export of Service Rules, 2005Document2 pagesExport of Service Rules, 2005mads70No ratings yet

- Notes RCM 66F Reimbursement 29-5-15Document22 pagesNotes RCM 66F Reimbursement 29-5-15Prabhat BhatNo ratings yet

- Export of ServicesDocument9 pagesExport of ServicesshantX100% (1)

- FB Mytashanfb348#$Document9 pagesFB Mytashanfb348#$RatanaRoulNo ratings yet

- 8 Value of Supply - TYBCOM FinalDocument13 pages8 Value of Supply - TYBCOM FinalNew AccountNo ratings yet

- GST: Value of Supply Under Section 15Document13 pagesGST: Value of Supply Under Section 15New AccountNo ratings yet

- Sindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFDocument64 pagesSindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFrohail51No ratings yet

- Bos 62607Document79 pagesBos 62607Alan JosephNo ratings yet

- 1 Hedging MechanismDocument7 pages1 Hedging MechanismPankaj MaggoNo ratings yet

- Japanese FashionDocument8 pagesJapanese FashionPankaj MaggoNo ratings yet

- India Bazaar Retail LTDDocument2 pagesIndia Bazaar Retail LTDPankaj MaggoNo ratings yet

- Business Proposal GarimaDocument4 pagesBusiness Proposal GarimaPankaj MaggoNo ratings yet

- Japanese FashionDocument8 pagesJapanese FashionPankaj MaggoNo ratings yet

- Ecb FCCB FinalDocument83 pagesEcb FCCB FinalPankaj MaggoNo ratings yet

- Audit Related FAQDocument2 pagesAudit Related FAQPankaj MaggoNo ratings yet

- StatementOfAccount 3092378518 Jul17 141113.csvDocument49 pagesStatementOfAccount 3092378518 Jul17 141113.csvOur educational ServiceNo ratings yet

- The Correct Answer Is: P105,000Document5 pagesThe Correct Answer Is: P105,000cindy100% (2)

- Bank Reconciliation (Practice Quiz)Document4 pagesBank Reconciliation (Practice Quiz)MoniqueNo ratings yet

- Nedbank Pricing 2020Document55 pagesNedbank Pricing 2020BusinessTech100% (1)

- Managerial Economics and Organizational Architecture SolutionsDocument3 pagesManagerial Economics and Organizational Architecture SolutionsjbyuriNo ratings yet

- Syllabus Mls Part 1 2Document18 pagesSyllabus Mls Part 1 2Fanatic AZNo ratings yet

- LN09Titman - 449327 - 12 - LN09 - Debt Valuation and Interest-WideDocument116 pagesLN09Titman - 449327 - 12 - LN09 - Debt Valuation and Interest-WideGhozi Akhyarul IlmiNo ratings yet

- Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueDocument66 pagesConsolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueNadeem TahaNo ratings yet

- Portfolio Management at ICICI Bank LtdDocument13 pagesPortfolio Management at ICICI Bank LtdkhayyumNo ratings yet

- Yukitoshi Higashino MftaDocument29 pagesYukitoshi Higashino MftaSeyyed Mohammad Hossein SherafatNo ratings yet

- Accounts - Past Years Que CompilationDocument393 pagesAccounts - Past Years Que CompilationSavya SachiNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- Renewal Premium Receipt - 00755988Document1 pageRenewal Premium Receipt - 00755988Tarun KushwahaNo ratings yet

- Tutorial Letter 102/3/2020: Question BankDocument303 pagesTutorial Letter 102/3/2020: Question Bankdivyesh mehtaNo ratings yet

- Limited Companies Financial StatementsDocument4 pagesLimited Companies Financial Statementskaleem khanNo ratings yet

- Investment Decision MakingDocument16 pagesInvestment Decision MakingDhruvNo ratings yet

- Subramanian Cibil ReportDocument13 pagesSubramanian Cibil ReportManish KumarNo ratings yet

- Market MetricsDocument3 pagesMarket MetricsMichael KozlowskiNo ratings yet

- Grade 7 Practice: Calculating Percent Changes and DiscountsDocument3 pagesGrade 7 Practice: Calculating Percent Changes and DiscountsRizky HermawanNo ratings yet

- Chapter 1 History and Development of Banking System in MalaysiaDocument18 pagesChapter 1 History and Development of Banking System in MalaysiaMadihah JamianNo ratings yet

- Chapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Document38 pagesChapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Sarah G100% (1)

- RFBT-04: LAW ON Credit Transactions: - T R S ADocument10 pagesRFBT-04: LAW ON Credit Transactions: - T R S AAdan Nada100% (1)

- Philippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentDocument2 pagesPhilippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentGeralyn GabrielNo ratings yet

- Financial Accounting P 1 Quiz 3 KeyDocument6 pagesFinancial Accounting P 1 Quiz 3 KeyJei CincoNo ratings yet

- Settings 1000 Pip Climber System EADocument11 pagesSettings 1000 Pip Climber System EAMUDRICK ACCOUNTSNo ratings yet

- Class 1 - Introduction The Foundation of Islamic EconomicsDocument22 pagesClass 1 - Introduction The Foundation of Islamic EconomicsBayu MurtiNo ratings yet

- Chapter 16 - Management of Current AssetsDocument7 pagesChapter 16 - Management of Current Assetslou-924No ratings yet

- VaucheDocument1 pageVauchedepazzaidaNo ratings yet