Professional Documents

Culture Documents

1295763212151562502058092466

Uploaded by

Dishan MandalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1295763212151562502058092466

Uploaded by

Dishan MandalCopyright:

Available Formats

FORM L-22 ANALYTICAL RATIOS RELIANCE LIFE INSURANCE COMPANY LIMITED FOR THE QUARTER UPTO THE QUARTER

FOR THE QUARTER UPTO THE QUARTER ENDED ON ENDED ON ENDED ON ENDED ON Sr. No Particular 30TH JUNE, 2011 1 New business premium income growth rate Participating Non Link - Group Non Link - Individual Non Link - Pension Non Link - Health Link - Life Link - Pension Link - Group Net Retention Ratio Expense of Management to Gross Direct Premium Ratio Commission Ratio (Gross commission paid to Gross Premium) Ratio of policy holder's liabilities to shareholder's funds Growth rate of shareholders' fund Ratio of surplus to policyholders' liability Change in net worth (` 000) Profit after tax / Total income (Total real estate + loans) / (Cash & invested assets) Total Investments / (Capital + Surplus) Total Affiliated Investments / (Capital + Surplus) Investment Yield (Annualised) Policy Holders Fund Non-linked Linked Shareholder's Funds Conservation Ratio Participating Non Link - Group Non Link - Individual Non Link - Pension Non Link - Health Link - Life Link - Pension Link - Group Persistency Ratio* For 13th month(based on policies issued during 1st June (X-2) to 30th May (X-1) For 25th month(based on policies issued during 1st June (X-3) to 30th May (X-2) For 37th month(based on policies issued during 1st June (X-4) to 30th May (X-3) For 49th month(based on policies issued during 1st June (X-5) to 30th May (X-4) For 61st month(based on policies issued during 1st June (X-6) to 30th May (X-5) NPA Ratio Gross NPA Ratio Net NPA Ratio 30TH JUNE, 2011 30TH JUNE, 2010 30TH JUNE, 2010

2 3 4 5 6 7 8 9 10 11 12 13

6.43 0.10 (0.89) (0.96) NA (0.78) (0.99) 0.00 0.996 0.33 0.07 57.78 19.18% 0.01 482,147 0.88% 0.00 5.73 -

6.43 0.10 (0.89) (0.96) NA (0.78) (0.99) 0.00 0.996 0.33 0.07 57.78 19.18% 0.01 482,147 0.88% 0.00 5.73 -

0.50 0.80 176.98 NA NA (0.42) 0.10 (0.27) 0.997 0.49 0.11 55.98 -16.77% 0.00 (506,463) 0.00 4.74 -

0.50 0.80 176.98 NA NA (0.42) 0.10 (0.27) 0.997 0.49 0.11 55.98 -16.77% 0.00 (506,463) 0.00 4.74 -

1.9% -6.6% 2.1% 0.82 NA 0.42 0 42 0.42 NA 0.84 0.67 0.02 53.1% 80.7% 34.5% 74.7% 81.7% -

1.9% -6.6% 2.1% 0.82 NA 0.42 0 42 0.42 NA 0.84 0.67 0.02 53.1% 80.7% 34.5% 74.7% 81.7% -

8.7% 11.2% 9.9% 0.69 NA 0.53 0 53 NA NA 0.74 0.53 0.01 52.5% 85.5% 36.1% 73.7% 84.8% -

8.7% 11.2% 9.9% 0.69 NA 0.53 0 53 NA NA 0.74 0.53 0.01 52.5% 85.5% 36.1% 73.7% 84.8% -

14

15

16

Equity Holding Pattern for Life Insurers 1 (a) No. of shares 1,165,844,900 1,165,844,900 1,165,344,900 2 (b) Percentage of shareholding Indian 100% 100% 100% Foreign 0% 0% 0% (c) Percentage of Government holding (in case of public 3 NA NA NA sector insurance companies) (a) Basic and diluted EPS before extraordinary items 4 0.07 0.07 (1.05) (net of tax expense) (`) (b) Basic and diluted EPS after extraordinary items 5 0.07 0.07 (1.05) (net of tax expense) (`) 2.57 2.57 2.16 6 (iv) Book value per share (`) * Persistency ratios are computed on reducing balance basis. ** The Non-Linked Individual health product was launched in 3rd Quarter of FY 2010-11, hence the related ratios are not applicable.

1,165,344,900 100% 0% NA (1.05) (1.05) 2.16

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Discover Mecosta 2011Document40 pagesDiscover Mecosta 2011Pioneer GroupNo ratings yet

- Perkins 20 Kva (404D-22G)Document2 pagesPerkins 20 Kva (404D-22G)RavaelNo ratings yet

- 4 Bar LinkDocument4 pages4 Bar LinkConstance Lynn'da GNo ratings yet

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDocument9 pagesInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenNo ratings yet

- Jerome4 Sample Chap08Document58 pagesJerome4 Sample Chap08Basil Babym100% (7)

- JAZEL Resume-2-1-2-1-3-1Document2 pagesJAZEL Resume-2-1-2-1-3-1GirlieJoyGayoNo ratings yet

- Functions of Commercial Banks: Primary and Secondary FunctionsDocument3 pagesFunctions of Commercial Banks: Primary and Secondary FunctionsPavan Kumar SuralaNo ratings yet

- Underwater Wellhead Casing Patch: Instruction Manual 6480Document8 pagesUnderwater Wellhead Casing Patch: Instruction Manual 6480Ragui StephanosNo ratings yet

- Food and Beverage Department Job DescriptionDocument21 pagesFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- The Electricity Act - 2003Document84 pagesThe Electricity Act - 2003Anshul PandeyNo ratings yet

- Office Storage GuideDocument7 pagesOffice Storage Guidebob bobNo ratings yet

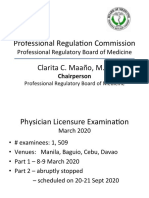

- Professional Regula/on Commission: Clarita C. Maaño, M.DDocument31 pagesProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartNo ratings yet

- 1.1. Evolution of Cloud ComputingDocument31 pages1.1. Evolution of Cloud Computing19epci022 Prem Kumaar RNo ratings yet

- How To Control A DC Motor With An ArduinoDocument7 pagesHow To Control A DC Motor With An Arduinothatchaphan norkhamNo ratings yet

- Banjara EmbroideryDocument34 pagesBanjara EmbroideryKriti Rama ManiNo ratings yet

- Vinera Ewc1201Document16 pagesVinera Ewc1201josue1965No ratings yet

- Hotel Reservation SystemDocument36 pagesHotel Reservation SystemSowmi DaaluNo ratings yet

- Reference Template For Feasibility Study of PLTS (English)Document4 pagesReference Template For Feasibility Study of PLTS (English)Herikson TambunanNo ratings yet

- BMA Recital Hall Booking FormDocument2 pagesBMA Recital Hall Booking FormPaul Michael BakerNo ratings yet

- Maths PDFDocument3 pagesMaths PDFChristina HemsworthNo ratings yet

- GR L-38338Document3 pagesGR L-38338James PerezNo ratings yet

- Prachi AgarwalDocument1 pagePrachi AgarwalAnees ReddyNo ratings yet

- Low Cost Building ConstructionDocument15 pagesLow Cost Building ConstructionAtta RehmanNo ratings yet

- HSBC in A Nut ShellDocument190 pagesHSBC in A Nut Shelllanpham19842003No ratings yet

- Role of The Government in HealthDocument6 pagesRole of The Government in Healthptv7105No ratings yet

- Asphalt Plant Technical SpecificationsDocument5 pagesAsphalt Plant Technical SpecificationsEljoy AgsamosamNo ratings yet

- Datasheet Qsfp28 PAMDocument43 pagesDatasheet Qsfp28 PAMJonny TNo ratings yet

- Tivoli Performance ViewerDocument4 pagesTivoli Performance ViewernaveedshakurNo ratings yet

- PVAI VPO - Membership FormDocument8 pagesPVAI VPO - Membership FormRajeevSangamNo ratings yet

- Uppsc Ae GSDocument18 pagesUppsc Ae GSFUN TUBENo ratings yet