Professional Documents

Culture Documents

Accounting Theory

Uploaded by

Dedew VonandaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Theory

Uploaded by

Dedew VonandaCopyright:

Available Formats

Overview of Capital Markets Research in Accounting Kothari provides an excellent review of the literature on capital market research in accounting.

The main areas of interest for capital markets research in accounting deal with fundamental analysis and valuation, tests of market efficiency relating to accounting information, and the value relevance of financial reporting. We focus on the first two areas. In an efficient market, the value of the firm is equal to the present value of the future expected net cash flow. From a valuation perspective, the firms financial statements are useful to the extent that they are helpful in forecasting future cash flows. Fundamental analysis deals with using economic information, including the information contained in the firms financial statements, to forecast future cash flow and estimate the firms intrinsic value (inherent economic value). Given that security prices serve as a mechanism to allocate resources, the informational efficiency of financial markets is of utmost importance. Short-term event studies have long been the staple for analyzing the degree to which markets are efficient. Long-horizon event studies and cross-sectional tests have increased the number of research opportunities. Association studies test for correlation between some accounting performance measure and stock returns. In general, the point of these tests is to determine if and how rapidly accounting information is reflected in security prices. As we have mentioned previously, it is sometimes difficult to attribute a market reaction to a piece of accounting information as market participants may have access to other, timelier sources of information. For example, some of the information contained in annual reports is revealed long before the report is published. Early studies provided evidence that there is information content in earnings announcements, but the markets reaction may not be fully and immediately reflected in security prices. Furthermore, accounting information is not necessarily the timeliest source of data affecting security prices. Later research focused on methodological research, alternative performance measures, valuation and fundamental analysis, and tests of market efficiency. There is evidence that accounting information is not always immediately and fully reflected in security prices. From both an academic and investor perspective, the research in the area of fundamental analysis is particularly intriguing owing to the economic implications of mounting evidence that suggests capital markets might be informational inefficient and the prices might take years before they fully reflect available information. However, Kothari notes that additional work must be done to improve research design and develop refutable theories of market inefficiency. The null hypothesis for much of the capital markets research in accounting has been that the market fully and instantaneously adjusts to new information; the market price is equal to the securitys intrinsic value. This umpire view of the market is an extreme view and may not hold up.

The Value of Accounting Information: Evidence From Return Data Information Contents of Earnings Announcements The strongest evidence from capital market research concerns the information content of annual accounting earnings numbers. The seminal study, published in 1968, showed that the direction of change in reported accounting earnings (from the prior year) was positively correlated with security price movements. The study also found that the price movements anticipated the earnings results and that there was virtually no abnormal price movement one month after the earnings were announced. This is consistent with the semi strong form of the efficient-markets hypothesis. A later study showed that the magnitude as well as direction of unexpected earnings are associated with changes in security prices. Quarterly earnings announcements have also shown the same general results. These results are not surprising. We would expect accounting income to be part of the information used by investors in assessing risk and return. Capital market research has confirmed an almost self-evident proposition. The findings are important, though, in formally linking accounting information with investment decisions and hence with usefulness to investors.

Market Reaction to Alternative Accounting Policies A more complex type of securities-price research has examined the effect of alternative accounting policies on security prices. The initial purpose of these tests was to investigate the socalled nave-investor hypothesis. Research has found that security prices respond to accounting income numbers. Alternative accounting policies---for example, flexibility in the choice of depreciation and inventory methods---can affect net income. Although these methods affect reported earnings, there is no apparent impact on company cash flows. These types of accounting alternatives simply represent different patterns of expense recognition or cost allocations. The question of interest to researchers is whether alternative accounting policies have a systematic effect on security prices. If security prices do respond to income levels that differ solely because of alternative accounting methods, with no cash flow consequences, then there is support for the nave-investor hypothesis. On the other hand, if security prices do not respond to such artificial book-income differences, then there is evidence that investors in the market are sophisticated and able to see through such superficial bookkeeping differences. Virtually all the initial research was interpreted as rejecting the nave-investor hypothesis. However, some research findings have challenged some of the earlier conclusions and reopened what was once considered a closed issues in accounting research.

Alternatives With No Known Cash Flow Consequences Several studies have compared companies using different accounting methods. One of the earliest studies compared companies using accelerated versus straight-line depreciation methods. The two groups of companies had different accounting income numbers because they used alternative depreciation methods; thus there were differences in income between the two groups of companies owing to the use of alternative depreciation accounting methods. There were also differences in prices-earnings multiples between the two groups. Companies using accelerated methods had lower earnings but higher price-earnings multiples than companies using straightline. However, when earnings of companies using accelerated methods were adjusted to a straight-line depreciation basis, the price-earnings multiple between the two groups of companies was not significantly different. The assessments of the companies in the market did not appear to be affected by arbitrary and alternative accounting income numbers. This finding is often expressed as the market not being fooled by arbitrary accounting differences. Other similar research has supported this conclusion. Additional areas tested include purchase versus pooling accounting, expensing versus capitalizing research and development costs, and recognition versus deferral of unrealized holding gains on marketable securities. A related area of investigation concerns security price responses to a reported change in accounting policy by a company. Changes in depreciation policy have been researched, and there is no evidence that the change per se affects security prices. Another area tested has been a change from the deferral to flow-through method of accounting for the investment credit. Again, no price effects were found. Although changes in accounting policies may cause the income number to change (solely because of the policy change), these research studies have not found that security prices respond to the changes. Higher accounting income achieved solely from a change in accounting policy with no apparent real changes in underlying cash flows does not appear to fool the market. Evidence from the type of research discussed in the preceding paragraphs supports the claim that there is no information content in accounting policy changes, at least where there are no apparent underlying changes in cash flows. This finding has also been interpreted as a rejection of the nave-investor hypothesis. Investors appear to adjust accounting income to compensate for artificial bookkeeping differences with no real substance. That is, investors do not appear to respond mechanistically and naively to changes in reported accounting income numbers. Thus, early research appeared to be in line with the semi strong form of the EMH.

An Alternative With Cash Flow Consequences: The LIFO Choice

One type of change in accounting policy that does produce a security price response is a change from FIFO to LIFO inventory accounting. Changes to LIFO have been associated with a positive security price movement, even though LIFO lowers accounting income in a period of rising inventory prices. Given the apparent sophistication of investors in other areas of accounting policy differences, what can be the logical explanation for these price responses? The suggested reason for the price response is that LIFO must be adopted for financial statement purposes if the tax benefit is desired. In a period of rising prices, tax expense will be lower for companies that use LIFO, in which case there are real cash flow consequences owing to the change in accounting policy. Even though book income is lowered by the use of LIFO, cash flows are higher because the taxable income is lower. Positive security price responses are therefore consistent with an increase in the value of the firm due to tax savings. Later studies, however, contradicted these findings concerning the effect of the changes. These studies either found no evidence of price response or found evidence of a negative price response. The more recent studies suggest that the earlier research may have failed to isolate the real effect of the LIFO change because of a self-selection bias. Since LIFO lowers accounting book income, a negative price response could be interpreted as a mechanistic response to a lower accounting number by nave investors, who did not consider the positive cash flow consequences of lower taxes. More recent studies find support for a positive security price movement when LIFO was adopted. Pincus and Wasley examined LIFO adoptions from 1978 to 1987 and found evidence for the possibility that LIFO is a good news signaling event that could account for the positive security price movement presumably resulting from its adoption. On the other hand, Kang brings up the possibility of potentially high adoption costs relative to LIFO, such as accounting system changes and a higher probability of violating debt contract provisions and renegotiation of management contracts involving bonus arrangements. These factors might account for some of the negative price reactions since they might offset the future tax savings. As discussed at the beginning of this section, security price research is extremely difficult to conduct. The LIFO choice issue amply illustrates this point. The early LIFO research rejected the nave-investor hypothesis. Later research on the LIFO question reopened what was once thought to be a closed issue with respect to market efficiency. However, more recent research shows how complex the issue of LIFO adoption may be. The more recent research on LIFO adoption has begun focusing on indirect cash flow consequences, which we examine next.

Alternatives With Indirect Cash Consequences Security price research has been probing a more subtle issue referred to as indirect consequences. An indirect consequence occurs when an accounting policy change affects the value of the firm through an indirect effect on owners rather than a direct effect on company cash

flows. One such study was motivated by an attempt to explain why securities prices of certain oil and gas companies responded negatively to a mandatory change in accounting policy. The required change from full costing to successful efforts was regarded as simply a change in how exploration costs are allocated to the income statement. Therefore, it was expected that no security price response would be evident since there was no direct cash flow consequence to the companies. However, security price responses were found to exist. Since previous research had predominantly rejected the nave-investor hypothesis, a search was made for the existence of some indirect cash flow consequences to explain the price response. The study posited that a change to successful efforts accounting for oil and gas exploration costs lowered firms ability to pay dividends in the short term because of restrictive debt covenants. Therefore, even though the change in accounting policy appeared to affect only book income on the surface, there were indirect cash flow consequences to investors, which might explain the negative price response. This explanation derives from agency theory. When accounting numbers are used to monitor agency contracts, there can be indirect consequences from changes in accounting policies. In the case of debt covenants restricting dividend payments, accounting numbers are used to protect the security of bondholders at the expense of stockholders. If an accounting policy change lowers accounting income, present or future cash dividends could be reduced, causing a negative price response. A similar type of study found negative security price responses for firms using purchase accounting when pooling was restricted by the Accounting Principles Board (APB) in favor of purchase accounting for combinations. Differences between purchase and pooling accounting appear on the surface to affect only book income, with no real cash effects. However, the reduced use of pooling accounting could affect dividend distribution because of debt covenants. Income would normally be lower under purchase accounting than pooling, and the same effect of dividend restrictions as argued in the oil and gas study were also argued in the purchase/pooling study. Another study along these lines examined the requirement to capitalize leases that had previously been reported as operating leases. Although there was some evidence of negative price responses for certain companies, the price response could have been caused by the constraints imposed by the existence of debt covenants.

Anomalies Over longer periods of time, financial markets appear to be informational efficient. How rapidly and completely they respond to new information is an open question. While it is difficult to prove with certainty, there is convincing that markets may not be as efficient as postulated in the semi strong form of the efficient-markets hypothesis.

Lags in Processing Fundamental Data In a very extensive study, Ou and Penman examined the utility of fundamental analysis. Fundamental analysis assumes that securities markets are inefficient and that underpriced shares can be found by means of financial statement analysis. This view is directly opposed to the efficient-markets view that prices of securities fully and rapidly reflect all publicly available information. Ou and Penman used traditional accounting measures such as return on total assets, gross margin ratio, and percentage change in current assets in a multivariate model to predict whether the following years income would increase or decrease. Using data for the period between 1965 and 1977, the model included almost 20 accounting measures and reflected approximately 23,000 observations. Ou and Penman were able to describe the following years earnings changes correctly almost 80% of the time. The key point concerns whether their predictors were capturing information that was already reflected insecurity prices or were predicting future earnings based on analysis of the accounting measures previously mentioned. The latter situation would result in abnormal security returns if investment were based on their predictions. Ou and Penmans analysis did indeed produce abnormal returns. They also believed that the excess security returns were not attributable to excess risk factors. Ou and Penmans research thus suggest that markets are not as efficient as efficient-markets advocates would like to believe; fundamental analysis is still important for investment purposes. This study also suggest that better accounting standards might improve the predictive ability of accounting information.

Low Correlation Between Earnings and Stock Returns Lev concentrated on an issue that is complementary to the factors in the Ou and Penman study. Specifically, his point is that both over time and within years, the correlation earnings numbers and stock returns has been exceedingly low. In other words, earnings have very little explanatory power relative to changes in stock prices. Lev and the Ou and Penman papers are complementary. Lev finds a low explanatory relationship between earnings and stock returns while Ou and Penman see a predictive role for accounting data in an imperfectly efficient market. Lev focuses directly on the issue of improving accounting measurements while the Ou and Penmans work seems to imply this point.

Post-Earnings-Announcement Drift

Further questions concerning market efficiency have arisen over the phenomenon known as post-earnings-announcement drift. While markets do react significantly at the time of the earnings announcement, it takes up to 60 days for the full effect of earnings announcements to be impounded in security prices. This effect appears to be more pronounced for smaller firms. It also appears that earnings surprises have a more persistent effect when the earnings surprise is due to higher revenue surprises than to lower expense surprises. This anomaly has not escaped the notice of professional investors. Transient institutions--those actively trading to maximize short-term profits---appear to be able to exploit postearnings-announcement drift. Ke and Ramalingegowda find that these institutions are able to earn a three-month mean abnormal return of 5.1% (or 22% annually) net of transactions costs from their arbitrage trades. At least part of the blame for post-earnings-announcement drift has been laid at the feet of financial analysts. Abarbanell and Bushee concluded that financial analysts under react to very fundamental signals stemming from securities, which in turn lead to forecast errors and incomplete security price adjustments. Sloan found evidence that shareholders do not distinguish well between cash flow portions of earnings and the accrual segment thereof. The cash flow portion persists longer into the future and is less subject to manipulation than the accrual part of earnings. Another possibility is that in some cases, transaction costs are too high relative to the potential gain that can be earned from the mispricing of the securities. Although securities markets may be efficient, they may not be as efficient as once believed. This suggests that it is even more important to attempt to improve the quality of accounting standard.

Mispricing Related to Accruals Richardson et al. focus on the reliability of accounting numbers. They develop a comprehensive definition and categorization of accruals, decomposing accruals into broad balance sheet categories. They use their knowledge of the measurement issues underlying each accrual category to make qualitative assessments concerning the relative reliability of each category. They then analyze the persistence of the cash flow and accrual components of earnings. Finally, they analyze the abnormal returns for the firms common stock to determine if the market impounds the information contained in various accruals as it relates to earnings persistence. If the information contained in accrual reliability is impounded in stock prices, accruals and future abnormal stock returns should be independent of each other. Interestingly, they find that the less reliable the accruals, the lower the earnings persistence. More importantly, and somewhat unsettling, they find that the market does not fully price the less reliable accruals: Overall, the result are consistent with the nave investor hypothesis. Future stock returns are negatively related to accruals, and the negative relation is stronger for less reliable accruals.

The Incomplete Revelation Hypothesis Questions concerning market efficiency have coalesced into a new hypothesis, the incomplete revelation hypothesis (IRH). Bloomfield sees two principal reasons for the IRH. First, some accounting numbers or relationship are more difficult or costly to uncover and their effects may not be fully revealed in security prices. For example, historically, information about stock option expense was revealed in footnote information only as opposed to being in the body of the income statement. Hence, the information and its import may be more difficult to extract in footnote form, and it might take longer for this information to fully impact security prices. This is diametrically opposed to the efficient-markets hypothesis that disclosure---in whatever---is all that is needed to fully impact security prices. The second factor of the IRH is the presence of noise traders in the market. Noise traders are individuals who do not necessarily respond in a completely rational way to new information. They may be rebalancing their portfolios, responding to liquidity shocks, or even acting upon whims. Thus, from the perspective of information effects on security prices, we have a group of individuals who are responding to a different set of criteria. This distraction impedes the market from responding in a fully efficient manner. Finally, notice that the IRH is not only fully consistent with post-earnings-announcement drift. However, it may help to explain that particular phenomenon.

Accounting Information and Risk Assessment Capital market research has also investigated the usefulness of accounting numbers for assessing the risk of securities and portfolios. These studies have found high correlations between the variability of accounting earnings and beta, the market-risk measure. The high correlations imply that accounting data may be useful for assessing risk, or at least confirming it. Other research has tried to determine if alternative accounting policies have any effect on risk. The purpose of this type of research is to identify how alternative accounting policies or disclosures may affect the usefulness of accounting numbers for assessing risk. For example, one study tried to determine if unfunded pension benefits (reported in footnotes) affected beta. There was no significant impact. From this evidence, it might be concluded that pension information is not useful for risk assessments. However, other studies found that supplemental segment (line of business) disclosures resulted in a revision of systematic risk, which suggests that such information is useful for risk assessments. Other studies have tested the association of financial ratios with beta. Some of the ratios and computations tested include dividend payout ratio, leverage, growth rates, asset size,

liquidity, and pretax interest coverage, as well as earnings and earnings variability. In general, these tests indicate a strong association between the accounting-based ratios and beta.

Summary of Capital Market Research We draw the following conclusions from the empirical evidence provided by capital market research: Accounting earnings appear to have information content and to affect security prices. Alternative accounting policies with no apparent direct or cash flow consequences to the firm do not seem to affect security prices. Alternative accounting policies that have direct or indirect cash flow consequences to the firm (or its owners) do affect security prices. There is evidence that security markets do not react fully and instantaneously to certain types of accounting data in certain situations. There are incentives to choose certain accounting policies, where choice exists, owing to indirect cash consequences. Accounting-based risk measures correlate with market risk measures, suggesting that accounting numbers are useful for risk assessment.

Capital market research continues to be useful in empirically evaluating economic consequences of accounting policies vis-a-vis security prices and the usefulness of accounting numbers for risk-and-return assessments. Perhaps more than anything else, though, the impact of capital market research is that it brought a different perspective to accounting theory and policy at a time when the emphasis was primarily on deductively based theory.

Evidence From Survey Data Another way of determining the usefulness of accounting information is to directly ask investors how (if at all) they use annual reports. Surveys of investors have been undertaken in several countries and generally have shown a rather low readership of accounting information. Approximately one-half of the investors surveyed indicated they read financial statements. Institutional investors have shown a much higher level of readership. These surveys, particularly of individual investors, should be interpreted cautiously, however. Individual investors may rely on investment analyst to process accounting information. It would be simplistic to assume accounting information has no usefulness to investors merely because many individual stockholders do not read annual reports in detail.

Another type of survey research has asked investors to weigh the importance of different types of investment information, including accounting information. Several studies of this type have been reported. Accounting information ranks fairly high in importance in these surveys, though not at the top. This status seems to be attributable to the historical nature of accounting information and the reporting-lag effect. More timely accounting information from company press releases, and non-accounting information such as general economic conditions and company announcements on product and markets, rank ahead of annual reports in perceived importance.

The Value of Accounting Information: Evidence From Direct Valuation The research discussed in the previous section primarily examined the relationship between accounting data and unexpected changes in stock prices, measured as abnormal returns. Another approach has been to examine the association between accounting data reported in annual financial statements and the levels of stock prices. Conceptually, this approach, which is referred to as cross-sectional valuation, attempts to empirically estimate the theoretical model of equity valuation describe at the beginning of this chapter. This approach has been used to investigate how (if at all) specific components of the financial statements are priced in the sense of being associated with the market valuation of the firm. If an item is priced as an asset/revenue, it should normally have a positive relation to market value, whereas if the item is priced as a liability/expense it should normally have a negative relation with market value. A number of authors have expressed enthusiasm for this methodology as a framework for evaluating the merits of alternative accounting methods/valuations.

Evidences From Pensions Several studies have used this framework to determine that a firms pension plan assets and liabilities are consistent with their being viewed as on-balance-sheet assets and liabilities, respectively. Another study determined that components of pension expense (per SFAS No. 87) are not weighted equally in terms of their association with market valuation. Of particular interest is that the transitional asset amortization component of pension expense was implicitly valued at zero, which is consistent with the fact that there are no cash flows associated with the item. One may debate whether poor operating performance and suboptimal investment decisions leads to severe underfunding, or whether poor management of the pension fund in the form of serve underfunding eventually leads to poor operating performance and suboptimal

investment decisions. In any case, it appears that investors do not fully recognize that the severe underfunding has negative valuation effects. Why this happens is yet to be resolved.

Evidence From Research and Development Another study examined the association of research and development expenditures with firm value. The major finding was that, on average, each dollar of R&D was associated with a five-dollar increase in market value. This result provides evidence that the market is implicitly capitalizing R&D outlays even though SFAS No.2 prohibits explicit capitalization. In other words, the market interprets R&D as an asset (investment) rather than an expense, contrary to the accounting treatment required by SFAS No.2.

Evidence From Financial Services The financial services industry is another area in which cross-sectional valuation models have been used. Studies have examined supplemental disclosures of nonperforming loans (default risk) and interest rate risk in bank and thrifts. Nonperforming loans are negatively associated with firm value, though this effect is greater for banks than for thrifts. Interest rate risk was negatively associated with firm value only for banks. Another study reported that banks supplemental disclosure of the fair market value of investment securities is associated with market value over and above that explained by historical costs alone. This finding gives credence to the SECs and FASBs recent push for mark-to-market accounting and eventually to fair value measurement in SFAS No. 157.

Accounting Data and Creditors Theories underlying the usefulness of accounting to creditors are not as well development as is the role of accounting numbers vis--vis stock prices. Part of the problem is that interestbearing debt securities trade infrequently. It is, however, generally agreed that the price of interest-bearing debt is based on the default risk premium, which is defined as the premium in excess of the risk-free interest rate on otherwise identical debt. Thus, firm-specific information, including accounting data, aids creditors in assessing default risk. Several distinct lines of research have emerged: (a) the usefulness of accounting data in predicting corporate bankruptcy (which encompasses loan default); (b) the association of accounting data with bond ratings wherein such rating are presumed to proxy for default risk; (c) the association of accounting data with estimates of interest-rate risk premiums on debt; and (d)

experimental studies of the role of accounting data in lending decisions. We will present a brief overview of the research finding for the first two.

Evidence From Bankruptcies Accounting-based ratios have been very useful in discriminating between firms that subsequently went bankrupt and those that did not. Bankrupt companies tend to have financial ratios prior to bankruptcy that differ from non-bankrupt companies. Predictability up to five years prior to bankruptcy has been demonstrated. These findings do not mean that companies with bad ratios will necessarily go bankrupt in the future, but rather that bankruptcy is more probable.

Evidence From Credit Ratings Accounting data are also associated with both ratings and default risk premiums. Among the important ratios are profitability, earnings variability, and leverage. Research has also been used to evaluate which of alternative sets of accounting data are more highly associated with bankruptcy prediction, bond ratings, and risk premiums. Among the issues examined have been historical costs versus price-level adjusted income, the effect of lease capitalization versus noncapitalization, and recognition of pension liabilities versus footnote-only disclosure. Experimental (laboratory) studies have also tested the usefulness of accounting data for creditors. Accounting data in the context of a loan-related decision are provided to subject to determine how, if at all, it affects their hypothetical decisions. In these experiments, the accounting data are manipulated to see if the judgments are sensitive to whatever manipulations take place. For example, changes are made to the magnitudes of accounting ratios or financial statements prepared under alternative policies. Generally, these studies support the sensitivity of loan-related decision making to key accounting data and, in this sense, complement the findings based on economic field data.

Importance of Earnings Forecasting Copeland and Dolgoff examine the relationship between the annual total return to shareholders and several commonly used performance measures. They used data about analyst expectations as a proxy for investor expectations. As we noted previously, the residual income model provides a central role for future earnings forecasts in determining the intrinsic value of a stock. Accurate estimates might lead to abnormal stock returns. Indeed, there is evidence that better earnings forecasts make for wealthier investors. Loh and Mian examine the usefulness of

accurate earnings forecasts from security analysts. Each firm-year, they sort analysts based on the accuracy of their forecasts of annual earnings. If analysts with the best earnings forecasts provide the best returns, there is support for fundamental analysis of accounting data. They find that the recommendations of superior earnings forecasters significantly outperform the recommendations of inferior forecasts. This is consistent with the value of fundamental accounting analysis. It also raises questions about the informational efficiency of financial markets. They hypothesize that changing accounting conservatism might play a role. In any case, we note that the value of a stock is dependent on much more than a one-year cash flow forecast. Clearly, more work needs to be done. Gulliver provides an analysts perspective on financial analysis, forecasting, and stock underperformance. He identifies five causes of stock price underperformance: aggressive accounting, financial deterioration, change in the industry or competitive situation, bad acquisitions, and overvaluation. Finally, in some cases, the financial rules are used to conceal the truth.

Empirical Research and Standard Setting In the early 1970s, some argued that capital market research could be used as a basis for choosing the best accounting policies and evaluating the economic consequence of alternative accounting policies on security prices. Accounting policies that most affected security prices were thought to be most useful. In other words, such policies would have had the most information content. The argument had intuitive appeal, particularly since deductively based research had proved unable to resolve the normative accounting theory debate about the most desirable form of accounting. However, the early advocates of security price research now recognize the limitations of this research for such a use. Reasons for these limitations are the public-good nature of accounting information, the existence of free riders, and the resultant market failure in terms of optimal resource allocation. The potential impact of empirical research on the standard-setting issue recently arose again. Opinions are mixed on whether empirical research can aid standard setting. Hence, they see empirical studies examining different alternatives and their effect on valuation and cash flow predictions as not providing useful information for standard setters. Holthausen and Watts also believe that before empirical research can be used as inputs for standard-setting purposes, a theory of accounting and standard setting must be set. What the role of such a theory might be is not made explicit. We would also question whether a theory of this type could ever be developed. Barth, Beaver, and Landsman take the opposite tack. They believe that multiple user groups and diverse uses of accounting information do not prevent empirical research from being useful for standard setters.

Hence, the different between the groups involves an empirical issues, which is presently unresolved: the multiple-user-group problem. On the question of diverse user groups with somewhat different purpose, we believe that a complementary rather than conflict among users results. Indeed, if extreme conflict among users groups and uses existed, we doubt that empirical research would be useful for any purpose.

You might also like

- Usefulness of AccountingDocument17 pagesUsefulness of AccountingMochamadMaarifNo ratings yet

- The Relationship Between Accounting Information and Stock PricesDocument12 pagesThe Relationship Between Accounting Information and Stock PricesMahmoudElbehairyNo ratings yet

- 1255-Article Text-3796-1-10-20130709Document6 pages1255-Article Text-3796-1-10-20130709AbdullahNo ratings yet

- Topic: Implications of Fair Value Accounting: The Case of Fiji Sugar Corporation 1.0Document8 pagesTopic: Implications of Fair Value Accounting: The Case of Fiji Sugar Corporation 1.0ashmeeta_singh0% (1)

- Case Study - 1Document5 pagesCase Study - 1Jordan BimandamaNo ratings yet

- Accounting Conservatism, Financial Reporting and Stock ReturnsDocument21 pagesAccounting Conservatism, Financial Reporting and Stock ReturnsChosy FangohoiNo ratings yet

- Beaver 1968Document27 pagesBeaver 1968lightirinaNo ratings yet

- Capital Markets Research in Accounting 2020-2Document13 pagesCapital Markets Research in Accounting 2020-2muhammadnoor zainuddinNo ratings yet

- Limited Attention Information DisclosureDocument59 pagesLimited Attention Information Disclosureanon_154643438No ratings yet

- Chapter 6: The Measurement Perspective On Decision UsefulnessDocument15 pagesChapter 6: The Measurement Perspective On Decision UsefulnessPujangga AbdillahNo ratings yet

- Accounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions Manual Full Chapter PDFDocument40 pagesAccounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions Manual Full Chapter PDFmaximusnhator1100% (13)

- Research TopicsDocument10 pagesResearch Topicspgk242003No ratings yet

- Chapter 2 SolutionsDocument12 pagesChapter 2 SolutionsaurelliasabelaNo ratings yet

- Accounting Policy Caveat Market ReactionDocument4 pagesAccounting Policy Caveat Market ReactionKristian TronikNo ratings yet

- 1 SMDocument9 pages1 SMlongNo ratings yet

- Wiley, Accounting Research Center, Booth School of Business, University of Chicago Journal of Accounting ResearchDocument12 pagesWiley, Accounting Research Center, Booth School of Business, University of Chicago Journal of Accounting ResearchSafira DhyantiNo ratings yet

- Fair Value Accounting-Pros and ConsDocument9 pagesFair Value Accounting-Pros and ConsLuh ayuNo ratings yet

- Xiong 2008Document28 pagesXiong 2008gogayin869No ratings yet

- Transfer Pricing Research PaperDocument7 pagesTransfer Pricing Research Papergvzcrpym100% (1)

- An Introduction To Accounting Theory: Learning ObjectivesDocument25 pagesAn Introduction To Accounting Theory: Learning ObjectivesAngels HeartNo ratings yet

- Efficient Markets TheoryDocument4 pagesEfficient Markets Theoryanindyta kusumaNo ratings yet

- CHAPTER 1.an Introduction To Accounting TheoryDocument15 pagesCHAPTER 1.an Introduction To Accounting TheoryIsmi Fadhliati100% (2)

- Topic:Implications of Fair Value Accounting: The Case of Fiji Sugar Corporation1.0 IntroductionDocument6 pagesTopic:Implications of Fair Value Accounting: The Case of Fiji Sugar Corporation1.0 IntroductionShazia MohammedNo ratings yet

- Earnings and Cash Flow Performances Surrounding IpoDocument20 pagesEarnings and Cash Flow Performances Surrounding IpoRizki AmeliaNo ratings yet

- Financial AccountingDocument11 pagesFinancial AccountingBunga putri PraseliaNo ratings yet

- Chapter Fifteen: Positive Accounting Theory: Summary, Valuation, and ProspectsDocument8 pagesChapter Fifteen: Positive Accounting Theory: Summary, Valuation, and Prospectsmuhammadikrams27No ratings yet

- An Alternative Approach For Mergers and Acquistions Accounting and Its Use For Predicting AcquirersDocument46 pagesAn Alternative Approach For Mergers and Acquistions Accounting and Its Use For Predicting AcquirersWayyeessaa MargaaNo ratings yet

- Accounting Disclosures, Accounting Quality and Conditional and Unconditional ConservatismDocument39 pagesAccounting Disclosures, Accounting Quality and Conditional and Unconditional ConservatismNaglikar NagarajNo ratings yet

- (Beaver) Perspectives On Recent Capital Market ResearchDocument23 pages(Beaver) Perspectives On Recent Capital Market ResearchWilliam Friendica MapNo ratings yet

- Maping JurnalDocument5 pagesMaping JurnalFadli Muhammad FauziNo ratings yet

- Investment AnalysisDocument9 pagesInvestment AnalysisEric AwinoNo ratings yet

- Review of LiteratureDocument4 pagesReview of LiteratureYogeshWarNo ratings yet

- 7c.beisland Mersland - FormatDocument32 pages7c.beisland Mersland - FormatSoni WardeNo ratings yet

- EventDocument14 pagesEventVenkatesh VNo ratings yet

- Fair Value Accounting For FinancialDocument4 pagesFair Value Accounting For FinancialAashie SkystNo ratings yet

- On The Usefulness of Earnings and Earnings Research: Lessons and Directions From Two Decades of Empirical ResearchDocument41 pagesOn The Usefulness of Earnings and Earnings Research: Lessons and Directions From Two Decades of Empirical Researchsoha mahmoudNo ratings yet

- Beaver, W.H., 2002, Perspectives On Recent Capital Market Research, Accounting Review 77 (2), 453-474Document23 pagesBeaver, W.H., 2002, Perspectives On Recent Capital Market Research, Accounting Review 77 (2), 453-474ryzqqqNo ratings yet

- Summary Mba525Document27 pagesSummary Mba525navjot2k2No ratings yet

- Next 4Document10 pagesNext 4Nurhasanah Asyari100% (1)

- The Impact of Mergers and Acquisitions On Acquirer PerformanceDocument10 pagesThe Impact of Mergers and Acquisitions On Acquirer Performancemadnansajid87650% (1)

- Value Relevance of Accounting Information and Its Impact On Stock Prices: Case Study of Listed Banks at Karachi Stock ExchangeDocument4 pagesValue Relevance of Accounting Information and Its Impact On Stock Prices: Case Study of Listed Banks at Karachi Stock ExchangeViviane BarbosaNo ratings yet

- Market Valuation of Intangible Assets: Evidence from Matched Portfolio Analysis and RegressionDocument11 pagesMarket Valuation of Intangible Assets: Evidence from Matched Portfolio Analysis and RegressionFilip JuncuNo ratings yet

- Beaver 1968Document27 pagesBeaver 1968aimran_amirNo ratings yet

- 1 Ijafmrdec20181Document10 pages1 Ijafmrdec20181TJPRC PublicationsNo ratings yet

- An Introduction To 2Document5 pagesAn Introduction To 2sanjuladasanNo ratings yet

- Fundamental Analysis Predicts Stock ReturnsDocument6 pagesFundamental Analysis Predicts Stock Returnsmanoj_mmmNo ratings yet

- Jawaban Assigment CH 1Document5 pagesJawaban Assigment CH 1AjiwNo ratings yet

- Accounting Information and Value Relevance in An Economy Under Recession: The Nigeria ExperienceDocument13 pagesAccounting Information and Value Relevance in An Economy Under Recession: The Nigeria ExperienceInternational Journal of Accounting & Finance ReviewNo ratings yet

- Advantages and Disadvantages of Historical Cost AccountingDocument3 pagesAdvantages and Disadvantages of Historical Cost AccountingBhaskar MallubhotlaNo ratings yet

- CHAPTER 4 N 3Document7 pagesCHAPTER 4 N 3Naurah Atika DinaNo ratings yet

- Unearned Revenue Liability and Firm ValueDocument33 pagesUnearned Revenue Liability and Firm Valuethịnh hưngNo ratings yet

- Accounting Theory Conceptual Issues in A Political and Economic EnvironmentDocument486 pagesAccounting Theory Conceptual Issues in A Political and Economic EnvironmentSyifa100% (1)

- Capital Market Research and Positive Accounting TheoryDocument28 pagesCapital Market Research and Positive Accounting Theoryuci ratna wulandariNo ratings yet

- Critical Accounting Policy Disclosures: C B. L M J. SDocument38 pagesCritical Accounting Policy Disclosures: C B. L M J. SmaddenwythNo ratings yet

- 2016 Arkan Roa Der PerDocument14 pages2016 Arkan Roa Der PerBunga DarajatNo ratings yet

- Principles-Based Accounting Standards: A Message From The Ceos of The International Audit NetworksDocument23 pagesPrinciples-Based Accounting Standards: A Message From The Ceos of The International Audit NetworksdeividtobonNo ratings yet

- Accounting Accruals and Information Asymmetry in Europe: Antonio Cerqueira, Claudia PereiraDocument24 pagesAccounting Accruals and Information Asymmetry in Europe: Antonio Cerqueira, Claudia PereiraSimonNisjaPutraZaiNo ratings yet

- Financial Accounting Theory and Reporting Practices (BKAF5053)Document13 pagesFinancial Accounting Theory and Reporting Practices (BKAF5053)hajiagwaggo100% (2)

- Can Asset Revaluation Manipulate Financials? A Case StudyDocument12 pagesCan Asset Revaluation Manipulate Financials? A Case Studyaryogo restu kuncoroNo ratings yet

- Chapter 7 Trustees HandbookDocument214 pagesChapter 7 Trustees Handbookbeluved2010No ratings yet

- Exhibit 1 CNAM China Armco Metals Securites Fraud LawsuitDocument19 pagesExhibit 1 CNAM China Armco Metals Securites Fraud LawsuitAdam LemboNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 1301, Docket 81-5009Document13 pagesUnited States Court of Appeals, Second Circuit.: No. 1301, Docket 81-5009Scribd Government DocsNo ratings yet

- Notice of Watershed Meeting of Air Mauritius LimitedDocument3 pagesNotice of Watershed Meeting of Air Mauritius LimitedPeople's PressNo ratings yet

- Benjamin Packwood - Great Great Grandfather of Barry McAllisterDocument24 pagesBenjamin Packwood - Great Great Grandfather of Barry McAllisterAndrew Riches100% (2)

- 9 - The Relationship Between CEO Characteristics and Leverage - The Role of Independent CommissionersDocument10 pages9 - The Relationship Between CEO Characteristics and Leverage - The Role of Independent Commissionerscristina.llaneza02100% (1)

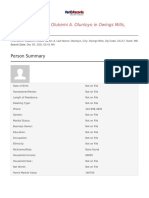

- Background Report On Olukemi A. Olunloyo in Owings Mills, 21117 MDDocument17 pagesBackground Report On Olukemi A. Olunloyo in Owings Mills, 21117 MDDavid HundeyinNo ratings yet

- IBC (Edition 3)Document369 pagesIBC (Edition 3)Kinnar ShahNo ratings yet

- Bankruptcy Complaint Against Alan Spiegel & Steven Spiegel of 26MGMT LLCDocument44 pagesBankruptcy Complaint Against Alan Spiegel & Steven Spiegel of 26MGMT LLCLoron DurondNo ratings yet

- Annual Rate Contract for Supply of Potable Water at WRPL KandlaDocument4 pagesAnnual Rate Contract for Supply of Potable Water at WRPL KandlaVijay RauljiNo ratings yet

- Gerard Amedio Chapter 7 BankruptcyDocument56 pagesGerard Amedio Chapter 7 BankruptcyWendy LiberatoreNo ratings yet

- Manila Surety Vs Almeda Assoc Insurance Vs BacolodDocument5 pagesManila Surety Vs Almeda Assoc Insurance Vs BacolodColeenNo ratings yet

- BA 297 Final Exam The Bankruptcy of Lehman BrothersDocument3 pagesBA 297 Final Exam The Bankruptcy of Lehman BrothersChristian Paul BonguezNo ratings yet

- Request For QuotationDocument20 pagesRequest For QuotationSumit BhardwajNo ratings yet

- Oblicon - Extinguishment of ObligationDocument9 pagesOblicon - Extinguishment of ObligationBeejay BenitezNo ratings yet

- Docket 17710Document1,634 pagesDocket 17710ranjith123No ratings yet

- Hungary - 2018 Fact SheetDocument24 pagesHungary - 2018 Fact Sheethag zolpatNo ratings yet

- Philippine Export and Foreign Loan Guarantee Corp. v. CADocument3 pagesPhilippine Export and Foreign Loan Guarantee Corp. v. CAmichelle zatarainNo ratings yet

- Pac CarbonDocument172 pagesPac CarbonBob MackinNo ratings yet

- IBC Conference - IBBI and ISB-2nd and 3rd July 2024Document4 pagesIBC Conference - IBBI and ISB-2nd and 3rd July 2024Atul LalNo ratings yet

- Living in The PrivateDocument31 pagesLiving in The Privatepanamahunt2292% (26)

- Trade Credit Clearinghouse Reduces RiskDocument91 pagesTrade Credit Clearinghouse Reduces RiskJurica ZRncNo ratings yet

- David Staral ComplaintDocument24 pagesDavid Staral Complaintdannyecker_crainNo ratings yet

- Inslvency and Bankruptcy Code 2016Document47 pagesInslvency and Bankruptcy Code 2016Ananya ShivaniNo ratings yet

- Fair Debt Collection Practices ActDocument14 pagesFair Debt Collection Practices ActEzekiel Kobina100% (1)

- ESPD Request enDocument29 pagesESPD Request enBensmatElHouariNo ratings yet

- Manthan Report - Banking and FinanceDocument31 pagesManthan Report - Banking and FinanceAtul sharmaNo ratings yet

- Bank Attorney RevealsDocument71 pagesBank Attorney Revealsbuggiemeggie100% (4)

- How To Sign Signature-Short VersionDocument7 pagesHow To Sign Signature-Short VersionBilly NojobNo ratings yet

- United States Court of Appeals Second Circuit.: No. 403, Docket 26362Document9 pagesUnited States Court of Appeals Second Circuit.: No. 403, Docket 26362Scribd Government DocsNo ratings yet