Professional Documents

Culture Documents

Tamweel Sukuk Prospectus

Uploaded by

Nipun AgrawalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tamweel Sukuk Prospectus

Uploaded by

Nipun AgrawalCopyright:

Available Formats

Level: 5 From: 5 Wednesday, July 16, 2008 11:28 eprint3 3989 Intro : 3989 Intro

Tamweel Sukuk Limited (incorporated in the Cayman Islands with limited liability) AED 1,100,000,000 Trust Certificates due 2013

The issue price of the AED 1,100,000,000 Trust Certificates due 2013 (the Certificates or the Sukuk), each of which represents an undivided ownership interest in the Trust Assets (as defined herein) of Tamweel Sukuk Limited (the Issuer) is 100 per cent. of their face amount. The Certificates will be constituted by a declaration of trust (the Declaration of Trust) dated on or about 21 July 2008 (the Closing Date) made by the Issuer, the Issuer in its capacity as trustee (the Trustee), Tamweel PJSC (Tamweel) and BNY Corporate Trustee Services Limited (the Delegate). Pursuant to the Declaration of Trust, the Issuer will declare that it will hold certain assets (the Trust Assets), primarily consisting of its rights, title and interest in and to certain assets purchased from Tamweel pursuant to a purchase agreement (the Purchase Agreement) and (by way of istisna) under the istisna agreement (the Istisna Agreement), both dated on or about the Closing Date and entered into between the Issuer and Tamweel, any investments made by Tamweel as Service Agent under the Service Agency Agreement (each as defined below) and certain rights under the other Transaction Documents (as defined herein), all moneys which may now be or hereafter from time to time are standing to the credit of the Transaction Account (as defined herein) and all proceeds of the foregoing, upon trust absolutely for the holders of the Certificates (the Certificateholders and each, a Certificateholder)) pro rata according to the face amount of Certificates held by each Certificateholder. On 21 July, 21 October, 21 January and 21 April in each year commencing on 21 October 2008 up to and including 21 July 2013 (or if any such day is not a Business Day (as defined herein), the following Business Day, unless it would thereby fall into the next calendar month, in which event such day should be the immediately preceding Business Day (each, a Periodic Distribution Date), the Issuer will pay the Periodic Distribution Amount (as defined herein) to Certificateholders. The Issuer shall pay the Periodic Distribution Amount solely from the proceeds received in respect of the Trust Assets pursuant to the service agency agreement (the Service Agency Agreement) dated on or about the Closing Date and entered into between Tamweel and the Trustee, pursuant to which Tamweel is appointed as service agent (the Service Agent) in respect of the Portfolio Assets (as defined herein). Unless previously redeemed, the Certificates will be redeemed in full by the Issuer at the Redemption Amount (as defined herein) on the Periodic Distribution Date falling in July 2013 (the Maturity Date). Investing in the Certificates involves certain risks as more fully described in the section Risk Factors beginning on page 11. Application has been made for the Certificates to be listed on the primary exchange of the Dubai International Financial Exchange (the DIFX). There can be no assurance that the listing of the Certificates on the DIFX will take effect on the Closing Date or at all. The DIFX takes no responsibility for the contents of this document, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon any part of the contents of this document. There will be no application for admission to trading of the Certificates on the DIFX. The Certificates will be traded over-the-counter and cleared and settled through Euroclear Bank S.A./N.V. (Euroclear) and Clearstream Banking, socit anonyme (Clearstream, Luxembourg). The Certificates are expected to be assigned a rating of A3 by Moodys Investor Services Inc. (Moodys) and A by Fitch Ratings Ltd (Fitch). A rating is not a recommendation to buy, sell or hold securities, does not address the likelihood or timing of repayment and may be subject to revision, suspension or withdrawal at any time by the assigning rating organisation. No offer of the Certificates may be made to any person in the Dubai International Financial Centre unless such offer is (a) deemed to be an Exempt Offer in accordance with the Offered Securities Rules (the Rules) of the Dubai Financial Services Authority (the DFSA) and (b) made to Qualified Investors (as defined in the Rules). Persons into whose possession this Prospectus or any Certificates may come must inform themselves about the nature of the Certificates as Restricted Securities as defined in the Rules, and observe any applicable restrictions in any relevant jurisdiction on the distribution of this Prospectus and the offering, purchase and sale of the Certificates. A copy of this Prospectus has been filed with the DFSA in accordance with the Markets Law 2004 and the Rules. In accordance with the Rules, the DFSA has no responsibility for the contents of the Prospectus and has not approved this Prospectus nor has it reviewed or verified the information in it, nor has it determined whether it is Sharia compliant. If you do not understand the contents of this document you should consult an authorised financial adviser. The Certificates have not been and will not be registered under the United States Securities Act of 1933, as amended (the Securities Act) or with any securities regulatory authority of any state or other jurisdiction of the United States and may not be offered, sold or delivered within the United States or to the account or benefit of U.S. Persons (as defined in Regulation S of the Securities Act (Regulation S)) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Accordingly, the Certificates are being offered, sold or delivered solely to non-U.S. Persons (as defined in Regulation S) outside the United States in reliance on Regulation S. Each purchaser of the Certificates is hereby notified that the offer and sale of Certificates to it is being made in reliance on the exemption from the registration requirements of the Securities Act provided by Regulation S. Delivery of the Certificates in book-entry form will be made on the Closing Date. The Certificates may only be offered, sold or transferred in registered form in minimum denominations of AED 500,000 and integral multiples of AED 100,000 in excess thereof and as such will qualify as Restricted Securities within the meaning of the Listing Rules of the DIFX. Certificates will be represented at all times by interests in a registered form global certificate without coupons attached (the Global Certificate), deposited on or about the Closing Date with a common depositary for Euroclear and Clearstream, Luxembourg. Interests in the Global Certificate will be shown on, and transfers thereof will be effected only through, records maintained by Euroclear and Clearstream, Luxembourg. Individual Certificates evidencing holdings of interests in the Certificates will be issued in exchange for interests in the Global Certificate only in certain limited circumstances described herein.

Joint Lead Managers and Bookrunners Badr Al Islami, Mashreqbank psc Dubai Islamic Bank PJSC Joint Lead Managers Emirates Islamic Bank PJSC

Standard Chartered Bank

United Bank Limited

The date of this Prospectus is 16 July 2008

Level: 5 From: 5 Wednesday, July 16, 2008 11:28 eprint3 3989 Intro : 3989 Intro

Each of Tamweel and the Issuer, having taken all reasonable care to ensure that such is the case, confirms that the information contained in this Prospectus is, to the best of its knowledge, in accordance with the facts and contains no omission likely to affect its import. Accordingly, each of Tamweel and the Issuer accepts responsibility for the information contained in this Prospectus. No person has been authorised to give any information or to make any representation regarding the Issuer or Tamweel or the Certificates other than as contained in this Prospectus. Any such representation or information should not be relied upon as having been authorised by the Issuer, Tamweel or Badr Al Islami, Islamic Banking Division of Mashreqbank psc, Dubai Islamic Bank PJSC, Standard Chartered Bank, Emirates Islamic Bank PJSC and United Bank Limited (each a Joint Lead Manager and together, the Joint Lead Managers). Neither the delivery of this document nor the offering, sale or delivery of any Certificate shall in any circumstances constitute a representation or create any implication that the information contained herein is correct at any time subsequent to the date hereof or that there has been no adverse change, nor any event reasonably likely to involve any adverse change, in the condition (financial or otherwise) of the Issuer or Tamweel since the date of this Prospectus. To the fullest extent permitted by law, none of the Joint Lead Managers, the Trustee, the Delegate or any Agent (as defined herein) nor any of their respective affiliates accept any responsibility for the contents of this Prospectus or for any other statement made, or purported to be made, by a Joint Lead Manager, the Trustee, the Delegate or any Agent, or any of their respective affiliates, or on its behalf in connection with the Issuer or Tamweel or the issue and offering of the Certificates. Each Joint Lead Manager, the Trustee, the Delegate and each Agent accordingly disclaims all and any liability whether arising in tort or in contract or otherwise which it might otherwise have in respect of this Prospectus or any such statement. This Prospectus does not constitute an offer of, or an invitation to subscribe for or purchase, any Certificates. This Prospectus is intended only to provide information to assist potential investors in deciding whether or not to subscribe for or purchase Certificates in accordance with the terms and conditions specified by the Joint Lead Managers. The Certificates may not be offered or sold, directly or indirectly, and this Prospectus may not be circulated, in any jurisdiction except in accordance with the legal requirements applicable to such jurisdiction. The distribution of this Prospectus and the offering, sale and delivery of Certificates in certain jurisdictions may be restricted by law. Persons into whose possession this Prospectus comes are required by the Issuer, Tamweel, the Joint Lead Managers, the Trustee, the Delegate and the Agents to inform themselves about and to observe any such restrictions. This Prospectus may not be used for the purpose of an offer to, or a solicitation by, anyone in any jurisdiction or in any circumstances in which such an offer or solicitation is not authorised or is unlawful. For a description of certain restrictions on offers, sales and deliveries of Certificates and on distribution of this Prospectus and other offering material relating to the Certificates, see Subscription and Sale. Save as mentioned under Subscription and Sale, no action has been or will be taken to permit a public offering of the Certificates in any jurisdiction where any act would be required for that purpose. Neither this Prospectus nor any other information supplied in connection with the Certificates is intended to provide the basis of any credit or other evaluation or should be considered as a recommendation by the Issuer, Tamweel, the Joint Lead Managers, the Trustee, the Delegate or the Agents that any recipient of this Prospectus should purchase any of the Certificates. Each investor contemplating purchasing any Certificates should make its own independent investigation of the financial condition and affairs, and its own appraisal of the creditworthiness, of the Issuer and Tamweel. Notice to Cayman Islands Residents No invitation may be made to the public in the Cayman Islands to subscribe for the Certificates. Notice to United Kingdom Residents The Certificates represent interests in a collective investment scheme (as defined in the Financial Services and Markets Act 2000 (the FSMA)) which has not been authorised, recognised or otherwise approved by the United Kingdom Financial Services Authority (the FSA). Accordingly, this Prospectus is not being distributed to, or promoted to and must not be passed on to persons in the United Kingdom by any person authorised under the FSMA except in circumstances which could not constitute a contravention of Section 21 of the FSMA.

ii

Level: 5 From: 5 Wednesday, July 16, 2008 11:28 eprint3 3989 Intro : 3989 Intro

The distribution in the United Kingdom of this Prospectus and any other marketing materials relating to the Certificates (A) if effected by a person who is not an authorised person under the FSMA, is being addressed to, or directed at, only the following persons: (i) persons who are Investment Professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Financial Promotion Order), (ii) overseas recipients under Article 12(1)(a) of the Financial Promotion Order and (iii) persons falling within any of the categories of persons described in Article 49 (High net worth companies, unincorporated associations, etc.) of the Financial Promotion Order and (B) if effected by a person who is an authorised person under the FSMA, is being addressed to, or directed at, only the following persons: (i) persons falling within one of the categories of Investment Professional as defined in Article 14(5) of the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) Order 2001 (the Promotion of CISs Order), (ii) overseas recipients under Article 8(1)(a) of the Promotion of CISs Order, (iii) persons falling within any of the categories of person described in Article 22 (High net worth companies, unincorporated associations, etc.) of the Promotion of CISs Order and (iv) any other person to whom it may otherwise lawfully be made in accordance with the Promotion of CISs Order. Persons of any other description in the United Kingdom may not receive and should not act or rely on this Prospectus or any other marketing materials in relation to the Certificates. Potential investors in the United Kingdom are advised that all, or most, of the protections afforded by the United Kingdom regulatory system will not apply to an investment in the Certificates and that compensation will not be available under the United Kingdom Financial Services Compensation Scheme. The contents of this Prospectus as amended or supplemented from time to time have not been approved by an authorised person in accordance with the rules of the FSA. Individuals intending to invest in any investment described in this Prospectus should consult their professional advisers and ensure that they fully understand all risks associated with making such an investment and have sufficient financial resources to sustain any loss that may arise from it.

iii

Level: 5 From: 5 Wednesday, July 16, 2008 11:28 eprint3 3989 Intro : 3989 Intro

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

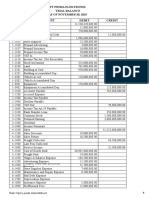

Presentation of Financial Information Unless otherwise indicated, the financial information herein has been derived from the audited financial statements of Tamweel for the three years ended 31 December 2005 to 31 December 2007 (the Audited Accounts) and the unaudited interim condensed financial statements for the 3 months ended 31 March 2008. The Audited Accounts have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board, and relevant federal laws of the UAE, consistently applied. Certain Defined Terms and Conventions References to Dubai herein are references to the Emirate of Dubai; and references to the UAE herein are to the United Arab Emirates. Certain figures and percentages included in this Prospectus have been subject to rounding adjustments; accordingly figures shown in the same category presented in different tables may vary slightly and figures shown as totals in certain tables may not be an arithmetic aggregation of the figures which precede them. All references in this Prospectus to U.S. dollars, U.S.$ and $ refer to United States dollars being the legal currency for the time being of the United States of America, all references to UAE dirham and AED refer to the United Arab Emirates dirham, being the legal currency for the time being of the United Arab Emirates. The UAE dirham has been pegged to the U.S. dollar since 22 November 1980. The mid point between the official buying and selling rates for the UAE dirham is at a fixed rate of AED 3.6725 = U.S.$1.00. Certain Publicly Available Information Certain statistical data and other information appearing in this Prospectus have been extracted from public sources. Neither the Issuer nor Tamweel accepts responsibility for the factual correctness of any such statistics or information but the Issuer and Tamweel accept responsibility for accurately extracting and transcribing such statistics and information and believe, after due inquiry, that such statistics and information represent the most current publicly available statistics and information from such sources at and for the periods with respect to which they have been presented and do not omit anything which would render the reproduced information inaccurate or misleading.

iv

Level: 5 From: 5 Wednesday, July 16, 2008 11:28 eprint3 3989 Intro : 3989 Intro

SERVICE OF PROCESS AND ENFORCEMENT OF LIABILITIES Tamweel is incorporated in the UAE and all of its operations and assets are located outside the United Kingdom. As a result, it may not be possible for investors to effect service of process within the United Kingdom upon Tamweel or to enforce against it, in courts located in the United Kingdom, judgments obtained in courts located in the United Kingdom. Currently, the majority of Tamweels assets are located in the UAE. The Emirate of Dubais courts are unlikely to enforce an English judgment without re-examining the merits of the claim and may not observe the choice by the parties of English law as the governing law of the transaction. In addition, even if English law is accepted as the governing law, this will only be applied to the extent that it is compatible with the Emirate of Dubai law and public policy. Moreover, judicial precedent in the UAE has no binding effect on subsequent decisions and there is no formal system of reporting court decisions in the UAE. These factors create greater judicial uncertainty than would be expected in certain other jurisdictions.

Level: 5 From: 5 Wednesday, July 16, 2008 11:28 eprint3 3989 Intro : 3989 Intro

FORWARD LOOKING STATEMENTS Some statements in this Prospectus may be deemed to be forward looking statements. Forward looking statements include statements concerning Tamweels plans, objectives, goals, strategies, future operations and performance and the assumptions underlying these forward looking statements. When used in this Prospectus, the words anticipates, estimates, expects, believes, intends, plans, aims, seeks, may, will, should and any similar expressions generally identify forward looking statements. These forward looking statements are contained in Overview of the Offering, Risk Factors, Business Description of Tamweel PJSC and other sections of this Prospectus. In each case these forward looking statements have been based on the current view of Tamweels management with respect to future events and financial performance. Although Tamweel believes that the expectations, estimates and projections reflected in Tamweels forward looking statements are reasonable as of the date of this Prospectus, if one or more of the risks or uncertainties materialise, including those which Tamweel has identified in this Prospectus, or if any of Tamweels underlying assumptions prove to be incomplete or inaccurate, the actual results of operations may vary from those expected, estimated or predicted. These forward looking statements speak only as at the date of this Prospectus. Without prejudice to any requirements under applicable laws and regulations, Tamweel expressly disclaims any obligation or undertaking to disseminate after the date of this Prospectus any updates or revisions to any forward looking statements contained herein to reflect any change in expectations thereof or any change in events, conditions or circumstances on which any such forward looking statement is based.

vi

Level: 5 From: 5 Wednesday, July 16, 2008 11:28 eprint3 3989 Intro : 3989 Intro

TABLE OF CONTENTS STRUCTURE DIAGRAM .......................................................................................................... OVERVIEW OF THE OFFERING ................................................................................................ RISK FACTORS ........................................................................................................................ TERMS AND CONDITIONS OF THE CERTIFICATES.................................................................... GLOBAL CERTIFICATE ............................................................................................................ PRONOUNCEMENT ................................................................................................................ USE OF PROCEEDS ................................................................................................................ BUSINESS DESCRIPTION OF TAMWEEL PJSC .......................................................................... DESCRIPTION OF THE ISSUER.................................................................................................. OVERVIEW OF THE EMIRATE OF DUBAI .................................................................................. OVERVIEW OF THE PROPERTY AND HOME FINANCE MARKET IN DUBAI................................ SUMMARY OF THE PRINCIPAL TRANSACTION DOCUMENTS .................................................. TAXATION .............................................................................................................................. CLEARANCE AND SETTLEMENT .............................................................................................. SUBSCRIPTION AND SALE ...................................................................................................... GENERAL INFORMATION ........................................................................................................ APPENDIX - FINANCIAL INFORMATION .................................................................................. 1 3 11 20 38 40 41 42 61 63 65 67 74 76 78 81 83

vii

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 01 : 3989 Section 01

STRUCTURE DIAGRAM The following is an overview of the structure and cashflows relating to the Certificates. This overview and in particular the very simplified structure diagram does not purport to be complete and is qualified in its entirety by reference to, and must be read in conjunction with, the detailed information appearing elsewhere in this Prospectus. Potential investors should read this entire Prospectus, especially the risks in relation to investing in the Certificates discussed under Risk Factors.

Tamweel as seller/sani of its rights, title and interest in and to the Original Leased Assets and the Original Istisna Assets Return on Portfolio Assets Purchase / Istisna Agreement Tamweel as Service Agent Tamweel as Obligor

Service Agency Agreement Purchase Undertaking/ Sale Undertaking

Exercise Price

Issuer Proceeds Periodic Distribution Amounts and Redemption Amount

Declaration of Trust

Certificateholders

Cashflows Set out below is a simplified description of the principal cashflows underlying the transaction. Potential investors are referred to Terms and Conditions of the Certificates and the detailed descriptions of the relevant Transaction Documents set out elsewhere in this Prospectus for a fuller description of certain cashflows and for an explanation of the meaning of certain capitalised terms used herein. Payments by the Certificateholders and the Issuer On the Closing Date, the initial subscribers of the Certificates will pay the issue price in respect of the Certificates to the Issuer who, in its capacity as Trustee, will: (a) (b) apply at least one third of the proceeds of the Certificates to purchase Tamweels rights, title and interest in and to the Original Leased Assets (as defined herein); and apply the remainder of the proceeds of the Certificates to purchase (by way of istisna) Tamweels rights, title and interest in and to the Original Istisna Assets (as defined herein).

Under the Service Agency Agreement, Tamweel as Service Agent will provide certain services with respect to the Portfolio Assets (as defined herein), as more particularly described in the Service Agency Agreement.

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 01 : 3989 Section 01

The Service Agent shall distribute Portfolio Profit (as defined herein) generated by the Portfolio Assets to the Trustee. Pursuant to the Declaration of Trust, the Issuer in its capacity as Trustee, will declare a trust for the benefit of the Certificateholders over all of its rights, title, interest, present and future, in, to and under the Portfolio Assets and each of the Transaction Documents, all moneys which may now be, or hereafter from time to time are, standing to the credit of the Transaction Account and all proceeds of the foregoing. Periodic Payments by the Issuer On the second Business Day prior to each Periodic Distribution Date (each a Distribution Date), the Service Agent shall distribute Portfolio Profit generated by the Portfolio Assets to the Trustee. The Trustee shall apply such Portfolio Profit on each Periodic Distribution Date to pay the Periodic Distribution Amount due on such date. If the Portfolio Profit payable to the Trustee on each Distribution Date is greater than the relevant Periodic Distribution Amount, that surplus Portfolio Profit will be recorded as a reserve amount and shall be credited by the Service Agent into the Profit Reserve Account (as defined herein) which may be used to fund future payments of Periodic Distribution Amounts. Any amount standing to the credit of the Profit Reserve Account on the Maturity Date will be due and payable to the Service Agent as an incentive fee for its performance. The Service Agent may, however, prior to the Maturity Date, use the amounts standing to the credit of the Profit Reserve Account (Advance Incentive Fee) so long as any amounts deducted from the Profit Reserve Account prior to the Maturity Date are re-credited to fund any shortfall in the Periodic Distribution Amount, if so required. If the amounts standing to the credit of the Profit Reserve Account are insufficient (after the Service Agent has re-credited any Advance Incentive Fee) to fund any shortfall in any Periodic Distribution Amount, the Service Agent may meet the shortfall through the provision of Sharia compliant financing and if this is not possible, for any reason, it may provide a loan on a qard basis to the Trustee to meet such shortfall which, in each case, shall be repayable in the manner set out in the Service Agency Agreement. Redemption Payments Within a specified period prior to the Maturity Date, the Issuer, in its capacity as Trustee, will have the right to require Tamweel (as Obligor under the Purchase Undertaking (as defined herein)) to purchase all of the Trustees rights, title and interest in and to the Portfolio Assets. The Exercise Price payable by the Obligor in respect of such purchase is intended to fund the Redemption Amount payable by the Issuer under the Certificates on the Maturity Date. The Certificates may be redeemed prior to the Maturity Date following a Dissolution Event, a Rating Downgrade Event or a Tax Event (each, as defined herein). The amounts payable under the Certificates on any Redemption Date will be funded by the Obligor paying for the acquisition of all of the Trustees right, title and interest in and to the Portfolio Assets, (i) following a Dissolution Event or a Rating Downgrade Event, pursuant to the exercise by the Trustee of its right under the Purchase Undertaking to require the Obligor to purchase all of the Trustees rights, title and interest in and to the Portfolio Assets or, (ii) following a Tax Event, pursuant to the exercise by Tamweel of its right under the Sale Undertaking to require the Trustee to sell all of the Trustees rights, title and interest in and to the Portfolio Assets.

Level: 5 From: 5 Wednesday, July 16, 2008 4:01 pm mac5 3989 Section 02 : 3989 Section 02

OVERVIEW OF THE OFFERING The following overview does not purport to be complete and is qualified in its entirety by reference to, and must be read in conjunction with, the detailed information appearing elsewhere in this Prospectus. Reference to a Condition is to a numbered condition of the Terms and Conditions of the Certificates. Terms defined under Terms and Conditions of the Certificates or elsewhere in this Prospectus shall have the same respective meanings in this overview. Certificateholders should note that through a combination of the Service Agency Agreement, the Purchase Undertaking and the Sale Undertaking, the ability of the Issuer to pay amounts due under the Certificates will depend on payments made by the Service Agent and payments made by the Obligor and the Certificateholders recourse to the Issuer is limited to the Trust Assets. See Limited Recourse below. Parties Issuer Tamweel Sukuk Limited an exempted company with limited liability incorporated in the Cayman Islands on 12 May 2008 (the Issuer). The authorised share capital of the Issuer is U.S.$50,000 consisting of 50,000 shares with a nominal value of U.S.$1.00 each. 250 of the Issuers shares have been issued and are held by Maples Finance Limited under the terms of a trust for charitable purposes. Trustee The Issuer will act as trustee in respect of the Trust Assets (as defined below) (in such capacity, the Trustee) for the benefit of Certificateholders in accordance with a declaration of trust dated on or about the Closing Date (the Declaration of Trust) and the conditions of the Certificates (the Conditions). Under the Declaration of Trust, the Trustee will delegate certain powers, duties and authorities to the Delegate (as defined below), including the power and authority to enforce or realise the Trust Assets. Tamweel PJSC (in such capacity, the Seller) will sell to the Trustee, at a price equal to no less than one third of the proceeds of the issue of the Certificates, its rights, title and interest in and to a portfolio of leased assets (the Original Leased Assets) pursuant to the terms of the Purchase Agreement (as defined below). Tamweel PJSC (in such capacity, the Sani) will sell (by way of istisna) to the Trustee, at a price equal to the remainder of the proceeds of the issue of the Certificates (after having made the purchase of the Original Leased Assets), its rights, title and interest in and to a portfolio of istisna assets (the Original Istisna Assets) pursuant to the terms of the Istisna Agreement (as defined below). Tamweel PJSC (in such capacity, the Service Agent) shall be appointed to act as Service Agent and, in that capacity, to provide certain services to the Trustee pursuant to the terms of the Service Agency Agreement (as defined below). Tamweel PJSC (in such capacity, the Obligor) shall execute the Purchase Undertaking (as defined below) in favour of the Trustee, pursuant to which the Obligor shall undertake to, in certain circumstances, purchase all of the Trustees rights, title and interest in and to the Portfolio Assets. Badr Al Islami, Islamic Banking Division of Mashreqbank psc, Dubai Islamic Bank PJSC and Standard Chartered Bank.

Seller

Sani

Service Agent

Obligor

Joint Lead Managers and Bookrunners

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 02 : 3989 Section 02

Delegate Principal Paying Agent, Calculation Agent and Replacement Agent Registrar and Transfer Agent Summary of the Trust Purchase Agreement

BNY Corporate Trustee Services Limited. The Bank of New York Mellon, acting through its London Branch.

The Bank of New York (Luxembourg) S.A.

Pursuant to the purchase agreement (the Purchase Agreement) dated on or about the Closing Date and entered into between Tamweel, as Seller, and the Trustee, the Trustee will purchase Tamweels rights, title and interest in and to the Original Leased Assets. Pursuant to the istisna agreement (the Istisna Agreement) dated on or about the Closing Date and entered into between Tamweel, as Sani, and the Trustee, as Mustasni, the Trustee will purchase (by way of istisna) Tamweels rights, title and interest in and to the Original Istisna Assets. The Portfolio Assets shall comprise the Original Leased Assets and the Original Istisna Assets and any assets at any time replacing the Portfolio Assets in accordance with the Service Agency Agreement, including Sharia compliant income generating assets. The Trust Assets comprise the Trustees rights, title, interest and benefit, present and future, in, to and under the Portfolio Assets, each of the Transaction Documents, all moneys from time to time standing to the credit of the Transaction Account and all proceeds of the foregoing. Pursuant to the Service Agency Agreement, Tamweel shall be appointed to act as Service Agent and, in that capacity, to provide certain services to the Trustee with respect to the Portfolio Assets. See section Summary of the Principal Transaction Documents Service Agency Agreement. The Service Agent shall create a UAE dirham denominated account in its books for the purpose of recording the crediting of any reserve amounts in respect of Portfolio Profit and, if applicable, re-crediting of any Advance Incentive Fee in accordance with the terms of the Service Agency Agreement (the Profit Reserve Amount) which will be used to fund payments of Periodic Distribution Amounts to the extent that there is insufficient Portfolio Profit to pay such amount. Any amount standing to the credit of the Profit Reserve Account on the Maturity Date will be due and payable to the Service Agent by way of an incentive fee (the Incentive Fee). Portfolio Profit means the amount by which all rental, sale proceeds or other income or consideration, damages, insurance proceeds, compensation, or other sums received by the Service Agent in connection with the Portfolio Assets (the Portfolio Revenues) exceed the aggregate of (i) Portfolio Revenues required to be reinvested in accordance with the terms of the Service Agency Agreement and (ii) any claims, losses, costs and expenses properly incurred by the Service Agent in providing the services under the Service Agency Agreement (Portfolio Liabilities).

Istisna Agreement

Portfolio Assets

Trust Assets

Service Agency Agreement

Profit Reserve Account

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 02 : 3989 Section 02

Purchase Undertaking

The Obligor shall execute a purchase undertaking (the Purchase Undertaking) in favour of the Trustee on or about the Closing Date under which the Obligor undertakes to purchase: (i) upon the Trustee exercising its option in accordance with the terms of the Purchase Undertaking by delivering an Exercise Notice to the Obligor specifying the Dissolution Redemption Date (as defined in Condition 10), such Dissolution Redemption Date being a minimum of 3 Business Days following the delivery of such Exercise Notice; or upon the Trustee exercising its option in accordance with the terms of the Purchase Undertaking by delivering an Exercise Notice to the Obligor specifying a Rating Downgrade Redemption Date (as defined in Condition 19.1), such Rating Downgrade Redemption Date, being the next Periodic Distribution Date falling no earlier than 45 days after the date of such Exercise Notice; or upon the Trustee exercising its option in accordance with the terms of the Purchase Undertaking by delivering an Exercise Notice to the Obligor. Any such Exercise Notice must be delivered no later than 3 and no earlier than 30 Business Days prior to the Maturity Date,

(ii)

(iii)

all of the Trustees rights, title and interest in and to the Portfolio Assets on an as is basis (without any warranty express or implied as to condition, fitness for purpose, suitability for use or otherwise and if any warranty is implied by law, it shall be excluded to the full extent permitted by law) at the Exercise Price, on the terms and subject to the conditions of the Purchase Undertaking. See section Summary of the Principal Transaction Documents Purchase Undertaking. Sale Undertaking Early Redemption following a Tax Event The Trustee shall execute a sale undertaking (the Sale Undertaking) in favour of Tamweel dated on or about the Closing Date. Pursuant to the Sale Undertaking, on exercise of Tamweels option under, and in accordance with, the Sale Undertaking following the occurrence of a Tax Event (as defined in Condition 6.2), the Trustee shall sell all of its rights, title and interest in and to the Portfolio Assets on an as is basis (without any warranty express or implied as to condition, fitness for purpose, suitability for use or otherwise and if any warranty is implied by law, it shall be excluded to the full extent permitted by law) at the Exercise Price (as defined in Condition 19.1) on the terms and subject to the conditions of the Sale Undertaking. Substitution of Portfolio Assets If Tamweel wants to purchase any of the Portfolio Assets then held by the Trustee which are the subject of an istisna agreement, a forward lease agreement or an ijara contract (the Original Portfolio Assets) by payment in kind with other assets (the Replacement Portfolio Assets), the Trustee undertakes pursuant to the Sale Undertaking to sell the same to Tamweel on an as is basis (without any warranty express or implied as to the condition, fitness for purpose, suitability for use or otherwise and if any warranty is implied by law, it shall be excluded to the full extent permitted by law), subject to satisfaction of certain conditions. See section Summary of the Principal Transaction Documents Sale Undertaking. 5

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 02 : 3989 Section 02

Summary of the Certificates Certificates AED 1,100,000,000 Trust Certificates due 2013 (the Certificates), each of which represents an undivided ownership interest in the Trust Assets. 21 July 2008. The Periodic Distribution Date falling in July 2013. 100 per cent. of the aggregate face amount of the Certificates. Each Certificate represents an undivided ownership interest in the Trust Assets and will rank pari passu, without any preference, with the other Certificates. The Certificates will be limited recourse obligations of the Issuer. 21 July, 21 October, 21 January and 21 April in each year, commencing on 21 October 2008 up to and including 21 July 2013 (or if any such day is not a Business Day (as defined herein) the following Business Day unless it would thereby fall into the next calendar month, in which event such day shall be the immediately preceding Business Day) (each, a Periodic Distribution Date). On each Periodic Distribution Date, Certificateholders will be entitled to receive a periodic distribution amount equal to the product of 2.25 per cent. per annum plus EIBOR (as defined in Condition 19.1) on the Aggregate Face Amount as at the end of the relevant Periodic Distribution Period (as defined in Condition 19.1) on an actual/360 basis (the Periodic Distribution Amount) from moneys received in respect of the Trust Assets (representing the Portfolio Profit in respect of the Portfolio Assets derived from payments made to the Trustee by the Service Agent under the Service Agency Agreement). Unless previously redeemed, the Certificates shall be redeemed in full by the Issuer on the Maturity Date for an amount equal to the Redemption Amount (as defined below) as of such date and the Trust shall be dissolved following such payment in full. Redemption Amount means, as of any date, the aggregate face amount of the Certificates then outstanding plus all unpaid accrued Periodic Distribution Amounts and all other unpaid accrued amounts (if any) due and payable under the Conditions as of the relevant Redemption Date (including, without limitation, Condition 8). Redemption for Taxation Reasons Following the occurrence of a Tax Event (as defined in Condition 6.4) and the exercise, in accordance with the Sale Undertaking, by Tamweel of its right to require the Trustee to sell all of its rights, title and interest in and to the Portfolio Assets to Tamweel, the Issuer shall, having given not less than 30 nor more than 65 days notice to the Certificateholders (which notice shall be irrevocable), redeem all, but not some only, of the Certificates at the Redemption Amount on the Tax Redemption Date (each, as defined in Condition 19.1) and the Trust shall be dissolved following such payment in full. Following the occurrence of a Rating Downgrade Event (as defined in Condition 19.1), the Certificates may be redeemed in full on the Rating Downgrade Redemption Date (as defined in Condition 6.3) at the Redemption Amount, and the Trust shall be dissolved following such payment in full.

Closing Date Maturity Date Issue Price Status

Periodic Distribution Dates

Periodic Distributions

Scheduled Redemption

Redemption for Rating Downgrade

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 02 : 3989 Section 02

Redemption and Dissolution following a Dissolution Event

Following the occurrence of a Dissolution Event (as defined below), the Certificates may be redeemed in full on the Dissolution Redemption Date (as defined in Condition 10) at the Redemption Amount, and the Trust shall be dissolved following such payment in full. A Dissolution Event occurs upon the occurrence of any of the following events: (a) a default is made in the payment of any Periodic Distribution Amount or the Redemption Amount on the date fixed for payment thereof and such default continues unremedied for a period of three Business Days; or the Issuer defaults in the performance or observance of any of its other obligations under or in respect of the Declaration of Trust and (except in any case where the failure is incapable of remedy) such default remains unremedied for 30 days after written notice thereof, addressed to the Issuer by the Delegate, has been delivered to the Issuer; or an Event of Default occurs under the Purchase Undertaking; or at any time it is or will become unlawful for the Issuer to perform or comply with any of its obligations under the Transaction Documents to which it is a party or any of the obligations of the Issuer under the Transaction Documents to which it is a party are not, or cease to be, legal, valid, binding and enforceable; or either (i) the Issuer becomes insolvent or is unable to pay its debts as they fall due; (ii) an administrator or liquidator of the whole or substantially the whole of the undertaking, assets and revenues of the Issuer is appointed (or application for any such appointment is made); (iii) the Issuer takes any action for a readjustment or deferment of any of its obligations or makes a general assignment or an arrangement or composition with or for the benefit of its creditors; or (iv) the Issuer ceases or threatens to cease to carry on all or substantially the whole of its business (otherwise than for the purposes of or pursuant to an amalgamation, reorganisation or restructuring whilst solvent); or an order or decree is made or an effective resolution is passed for the winding up, liquidation or dissolution of the Issuer; or any event occurs which under the laws of the Cayman Islands has an analogous effect to any of the events referred to in paragraphs (e) and (f) above.

(b)

(c) (d)

(e)

(f) (g)

Role of Delegate

Pursuant to the Declaration of Trust, the Trustee shall delegate all of its rights and powers, authorities, duties and discretions to the Delegate. In particular, the Delegate shall be entitled to: (a) deliver an Exercise Notice to the Obligor in accordance with the Purchase Undertaking after the occurrence of a Dissolution Event or a Rating Downgrade Event; and following a Dissolution Event, take any enforcement action in the name of the Trustee against either the Obligor or the Service Agent.

(b)

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 02 : 3989 Section 02

The Trustee will act in accordance with the directions and instructions given to it by the Delegate in the exercise of the relevant delegated powers, following the delegation of such powers becoming effective. The Delegate is entitled to various protections and limitations on its liability, as set out in the Declaration of Trust. The Delegate is not obliged to take any action in connection with the Declaration of Trust and the Certificates unless it is reasonably satisfied that Tamweel will be able to indemnify it against all Liabilities (as defined in the Declaration of Trust) which may be incurred in connection with such action. Transaction Account All payments by any of the Service Agent or the Obligor to the Trustee under each Transaction Document to which it is party will be deposited into an account of the Trustee maintained for such purpose (the Transaction Account). Distributions of monies deriving from the Trust Assets will be made to Certificateholders from funds standing to the credit of the Transaction Account in the order of priority set out below. Priority of Distributions On each Periodic Distribution Date, or on a Redemption Date, the Trustee shall apply the moneys standing to the credit of the Transaction Account in the following order of priority: (i) first, to pay the Delegate an amount equal to any sum payable to it on account of its properly incurred fees, costs, charges and expenses and to pay or provide for the payment or satisfaction of any Liability incurred (or reasonably expected to be incurred) by the Delegate pursuant to the Declaration of Trust or in connection with any of the other Transaction Documents or the Conditions; second, only if payment is due on a Periodic Distribution Date, to the Principal Paying Agent for application in or towards payment pari passu and rateably of all Periodic Distribution Amounts due but unpaid; and third, only if such payment is due on a Redemption Date, to the Principal Paying Agent for application in or towards payment pari passu and rateably of the Redemption Amount; and fourth, only if such payment is due on a Redemption Date, in payment of the surplus (if any) to the Issuer.

(ii)

(iii)

(iv) Limited Recourse

No payment of any amount whatsoever shall be made in respect of the Certificates by the Issuer or any agents thereof except to the extent that funds are available therefor from the Trust Assets. In addition, no Certificateholder will be able to petition for, or join any other person in instituting proceedings for, the reorganisation, liquidation, winding up or receivership of the Issuer or the Obligor (to the extent that each fulfils all of its obligations under the relevant Transaction Documents to which it is a party), or any of the Trustee, the Delegate, the Agents or any of their affiliates as a consequence of such shortfall or otherwise. The Certificates will be represented on issue by interests in a Global Certificate, in registered form, which will be deposited with, and registered in the name of The Bank of New York Depository (Nominees) Limited, as nominee for The Bank of New York Mellon, acting through its London Branch in its capacity as the common depositary for Euroclear and Clearstream, Luxembourg.

Form and Delivery of the Certificates

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 02 : 3989 Section 02

Definitive Certificates evidencing holdings of Certificates will be issued in exchange for interests in the Global Certificate only in certain limited circumstances. See section Global Certificate. Clearance and Settlement Certificateholders must hold their interest in the Global Certificate in book-entry form through either Euroclear or Clearstream, Luxembourg. Transfers within Clearstream, Luxembourg or Euroclear will be in accordance with the usual rules and operating procedures of the relevant clearing system. The Certificates will be issued in registered form in face amounts of AED 500,000 and integral multiples of AED 100,000 in excess thereof. All payments by each of Tamweel and the Trustee under the Transaction Documents to which it is a party and all payments in respect of the Certificates shall be made in full without withholding or deduction for, or on account of, any present or future taxes, levies, duties, fees, assessments or other charges of whatever nature, imposed or levied by or on behalf of a Relevant Jurisdiction (as defined in Condition 19.1) (Taxes), unless the withholding or deduction of the Taxes is required by law. In such event, (a) where Tamweel is required to make such a withholding or deduction, Tamweel will be required, pursuant to the relevant Transaction Document, to pay to the Trustee, and/or (b) where the Trustee is required to make such a withholding or deduction, the Trustee will be required to pay in respect of the Certificates, additional amounts so that, subject to certain exceptions, the full amount which otherwise would have been due and payable is received by the parties entitled thereto. See Condition 8 (Taxation). Application has been made for the Certificates to be listed on the primary exchange of the Dubai International Financial Exchange (the DIFX). There can be no assurance that the listing of the Certificates on the DIFX will take effect on the Closing Date or at all. The Certificates are expected to be assigned a rating of A3 by Moodys and A by Fitch. A rating is not a recommendation to buy, sell or hold securities, does not address the likelihood or timing of repayment and may be subject to revision, suspension or withdrawal at any time by the assigning rating organisation. A summary of the provisions for convening meetings of Certificateholders to consider matters relating to their interests as such are set forth under Condition 14. See section Taxation for a description of certain United Arab Emirates, Cayman Islands and European Union taxation considerations applicable to the Certificates. There are certain restrictions on the offer, sale and transfer of the Certificates which are set forth in section Subscription and Sale. The Transaction Documents are the Purchase Agreement, the Istisna Agreement, the Purchase Undertaking, the Sale Undertaking, the Service Agency Agreement, the Declaration of Trust, the Agency Agreement, the Costs Undertaking, the Certificates and any other agreements and documents designated as such by the Issuer and the Obligor.

Denominations Withholding Tax

Listing

Rating

Certificateholder Meetings

Tax Considerations

Selling Restrictions Transaction Documents

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 02 : 3989 Section 02

Governing Law and Jurisdiction

The Transaction Documents (other than the Purchase Agreement and the Istisna Agreement) will be governed by English law and subject to the jurisdiction of the English courts. The Purchase Agreement and the Istisna Agreement will be governed by the laws of the Emirate of Dubai and applicable federal laws of the United Arab Emirates and subject to the jurisdiction of the courts of Dubai. In respect of any dispute under the Service Agency Agreement, the Declaration of Trust, the Agency Agreement, the Costs Undertaking and the Purchase Undertaking, Tamweel has consented to arbitration in accordance with the Rules of the International Chamber of Commerce if the Trustee so requires.

Waiver of Sovereign Immunity

Tamweel acknowledges in the Transaction Documents to which it is a party that to the extent that it may in any jurisdiction claim for itself or its assets or revenues immunity from suit, execution, before judgment or otherwise or other legal process and to the extent that such immunity (whether or not claimed) may be attributed to it or its assets or revenues, Tamweel represents and agrees that it will not claim and irrevocably and unconditionally waives such immunity in relation to any proceedings.

10

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 03 : 3989 Section 03

RISK FACTORS The purchase of Certificates may involve substantial risks and is suitable only for sophisticated investors who have the knowledge and experience in financial and business matters necessary to enable them to evaluate the risks and merits of an investment in the Certificates. Before making an investment decision, prospective purchasers of Certificates should consider carefully, in the light of their own financial circumstances and investment objectives, all of the information in this Prospectus. Neither the Issuer nor Tamweel represents that the statements below regarding the risks of holding any Certificates are exhaustive and the Issuer may be unable to pay amounts on or in connection with any Certificate for reasons other than those described below. Prospective investors should also read the detailed information set out elsewhere in this Prospectus and reach their own views prior to making any investment decision. Words and expressions defined in the Terms and Conditions shall have the same meanings in this section. RISKS RELATING TO THE ISSUER No operating history The Issuer is a newly formed entity and has no operating history. The Issuers only material assets, which will be held on trust for Certificateholders, will be the Trust Assets, including the obligation of Tamweel to make payments under the Transaction Documents to which it is a party. Therefore, the Issuer is subject to all the risks to which Tamweel is subject, to the extent that such risks could limit Tamweels ability to satisfy in full and on a timely basis its obligations under the Transaction Documents to which it is a party. See section Risk Factors relating to Tamweel for a further description of certain of these risks. Limited Recourse Recourse to the Issuer is limited to the Trust Assets and proceeds of the Trust Assets are the sole source of payments on the Certificates. Upon the occurrence of a Dissolution Event, the only remedy available to the Trustee or the Delegate, as the case may be, on behalf of the Certificateholders will be to exercise the right under the Purchase Undertaking to require Tamweel to purchase all of the Trustees rights, title and interest in and to the Portfolio Assets at the Exercise Price. Certificateholders will otherwise have no recourse to any assets of Tamweel (to the extent it fulfils all of its obligations under the Transaction Documents to which it is a party), the Joint Lead Managers, the Agents, the Delegate or any affiliate of any of the foregoing entities in respect of any shortfall in the expected amounts from the Trust Assets. Tamweel is obliged to make payments under the Transaction Documents to which it is a party directly to the Trustee, and the Trustee or the Delegate, as the case may be, on behalf of the Certificateholders, will have direct recourse against Tamweel to recover payments due to the Trustee from Tamweel pursuant to the Transaction Documents to which Tamweel is a party. There can be no assurance that the net proceeds of the realisation of, or enforcement with respect to, the Trust Assets will be sufficient to make all payments due in respect of the Certificates. In the event that the proceeds of the Trust Assets are not sufficient to satisfy the payments under the Certificates, the Certificateholders shall have no recourse against any other assets of the Issuer or the Trustee or against any director, shareholder, officer or employee of the Issuer or Trustee. Furthermore, under no circumstances shall any Certificateholder or the Trustee or the Delegate, as the case may be, have any right to cause the sale or other disposition of any of the Trust Assets except pursuant to the Purchase Undertaking and the sole right of the Trustee and the Certificateholders against Tamweel shall be to enforce the obligation of Tamweel to pay the Exercise Price under the Purchase Undertaking. The Delegate is not obliged to take any action following the occurrence of a Dissolution Event unless it has been directed to do so and has been indemnified and/or secured to its satisfaction. RISKS RELATING TO TAMWEEL Tamweels business requires reliable funding sources Tamweel will require additional funds to support home financing outlays and to support the future growth of its business. Tamweels ability to obtain external financing and the cost of such financing are dependent on numerous factors including general economic and capital market conditions, international financing

11

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 03 : 3989 Section 03

rates, credit rating, credit availability from banks or other lenders, investor confidence in Tamweel, and the success of Tamweels business. There can be no assurance that additional financing, either on a short-term or long-term basis, will be made available or, if available, that such financing will be obtained on terms favourable to Tamweel. Any failure to obtain financing in the amounts required, at rates that are appropriate to Tamweels business operations or at all could have a material adverse effect on the business, results of operations, financial condition or prospects of Tamweel. Tamweels funding sources are generally short term while its financing products are long term Tamweels ability to provide long term home financing is dependent on its ability to adequately source appropriate funds to provide financing to customers. Tamweel has historically relied upon capital contributions from founding members, public markets, bank financing and corporate investment deposits. Some of these sources of funds are short-term in nature. To manage liquidity risk, Tamweel must seek longterm funding sources congruent in duration to the financing provided to its customers. Tamweel may at times be required to obtain funding under unfavourable financial market conditions. Market conditions are dependent upon, amongst other things, the overall condition of the global and regional asset backed securities markets, the credit assessment criteria of credit rating agencies, the quality of Tamweels assets, and Tamweels performance on past securitisations. There is no guarantee that Tamweel will be able to source long term funding on viable terms so as to match its home finance product offering. A limitation on the part of Tamweel to adequately source funds with appropriate maturities could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Tamweels business is subject to customer credit risk Tamweel employs formal procedures to assess and monitor credit risk. The management of Tamweel is of the opinion that these procedures are in line with applicable international standards and in accordance with regulations applicable to Tamweel. In addition, management regularly reviews the state of financing receivables and provision is made for any specific balances where recovery is doubtful. As at 31 March 2008, Tamweel did not have any payments in excess of 180 days overdue and less than 2 per cent. of its payments were overdue. Notwithstanding efforts on the part of Tamweel to manage credit exposure, no assurance can be given that Tamweels credit procedures will protect it against future defaults and such defaults could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Tamweel generally owns the property against which it provides home financing. In the event of customer default, Tamweels ability to realise its collateral will be subject to conditions in the real estate market at that time. The real estate market is affected by many factors, including general economic conditions, availability of financing, interest rates and other factors, including supply and demand, that are beyond Tamweels control. No assurance can be given that Tamweel will be able to realise any property in amounts that exceed the debt due to it on a timely basis or at all. These factors could have a material adverse effect on Tamweels business, results of operations, financial condition or prospects. Tamweels business is subject to operational risks Operational risks and losses can result from fraud, error by employees, failure to document transactions properly or to obtain proper internal authorisation, failure to comply with regulatory requirements or conduct of business rules, failure of internal systems, equipment and external systems (including those of Tamweels counterparties or vendors) and the occurrence of natural disasters. Management is responsible for establishing an effective and efficient operational control environment in accordance with Tamweels standards so that Tamweels assets are adequately protected and operational risks are sufficiently mitigated. Although Tamweel has implemented risk controls and loss mitigation strategies it is not possible to entirely eliminate operational risks. Tamweel will, when appropriate, insure itself against operational risks. Notwithstanding insurance against operational risks, Tamweel might nonetheless be subject to losses arising from operational risk as a result of inadequate insurance coverage and delay in claim settlement. No assurance can be given that Tamweel will be successful in managing operational risk and any failure to manage such risk could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects.

12

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 03 : 3989 Section 03

Tamweels business is reliant on qualified personnel Tamweels operations depend, in part, on the continued service of senior executives and other qualified personnel as well as Tamweels ability to recruit and retain skilled employees. The competition for such employees in the UAE is intense. Tamweels failure to manage its personnel needs successfully could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Real estate valuation is inherently subjective and uncertain Property assets are inherently difficult to value. Tamweel provides financing based on market best estimates which are subject to substantial uncertainty and are made on the basis of assumptions which may not be correct. There can be no assurance that sales proceeds in the event of customer default would be sufficient to cover the finance provided by Tamweel. Multiple customer defaults could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Since the incorporation of Tamweel, the demand for residential and commercial property in Dubai has increased substantially. Part of current demand has been based on the assumption that there will be continued economic growth in the UAE and continued political and financial stability. If this demand were to decrease it could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Tamweels business is influenced by a principal beneficial shareholder Tamweels principal beneficial shareholder is the Government of Dubai, with an indirect shareholding of approximately 27.6 per cent. (while a further approximately 10.0 per cent. is held by Dubai Investment Group LLC, the majority of the shares of which are indirectly held by Dubai Holding LLC). By virtue of such shareholding, the Government of Dubai has the ability to influence Tamweels business significantly through its ability to control actions that require shareholder approval. Such influence by the Government of Dubai could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Furthermore, if circumstances were to arise where the interests of the Government of Dubai or any future significant shareholder conflict with the interests of the holders of Certificates, the holders of the Certificates could be disadvantaged. Tamweels business is regionally concentrated in the UAE Tamweel currently has all of its operating businesses in the UAE. Tamweels business may be affected by the financial, political and general economic conditions prevailing from time to time in the UAE or the Middle East generally. These markets are subject to greater risks than more developed markets, including in some cases significant legal, economic and political risks that could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Accordingly, investors should exercise particular care in evaluating the risks involved and must decide for themselves whether, in the light of those risks, their investment is appropriate. Generally, investment in such markets is only suitable for sophisticated investors who fully appreciate the significance of the risks involved. Tamweels business expansion strategy may not be successfully implemented and could lead to increased costs and lower profitability Tamweel intends to develop residential property financing businesses in Saudi Arabia and Egypt. Tamweels business and prospects must be considered in light of the inherent risks, uncertainties, expenses and difficulties encountered by companies such as Tamweel which are expanding geographically. There can be no assurance that the Tamweel will be successful in expanding its business in to these regions and any failure to do so could have a material adverse effect on Tamweels business, results or operations and financial condition. Competition represents a continuous pressure on Tamweels business High growth in the UAEs real estate market is attracting interest from local and international real estate companies. Barriers to entry are relatively low and Tamweel anticipates an increase in the number of home financiers entering the real estate market. The introduction of new laws regulating the real estate market and anticipated increased transparency of regulator frameworks and issuance of new title deeds are

13

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 03 : 3989 Section 03

expected to further remove barriers to entry and result in increased competition. An increase in competition could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Tamweels success depends on its ability to manage growth Tamweels ability to maintain and manage its growth effectively requires expansion of management information system capabilities and operational systems and controls. Tamweel will need to attract, train and retain senior executives, managers, technical professionals and other employees. Failure to meet resource expansion requirements could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Any acquisition made by Tamweel might expose Tamweel to integration risks associated with streamlining business activity, assets and personnel as well as servicing the debt obligations of the acquired company. The process of integrating an acquired business may involve unforeseen difficulties and may require a disproportionate amount of management attention and financial and other resources. At any point in time, Tamweel may be unable to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms, obtain financing for acquisitions on satisfactory terms or successfully acquire identified targets. Joint ventures may expose Tamweel to additional liabilities Tamweel is currently involved in, and may enter into further, joint venture arrangements with third parties. When entering into partnerships with other entities, Tamweel might be held liable for the actions of its partner. As such, joint venture partnerships could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects. Tamweels business is subject to political, economic and related considerations The UAE has enjoyed significant economic growth and relative political stability. There can be no assurance that such growth or stability will continue. Moreover, while the UAE governments policies have generally resulted in improved economic performance, there can be no assurance that such level of performance can be sustained. Tamweels business may also be materially adversely affected generally by political and economic developments in the UAE, the Middle East or the global market. Specific risks in the Middle East that may have a material impact on Tamweels business, operating results, cash flows, financial condition and prospects include: an increase in inflation and the cost of living; political, social and economic instability; any acts of warfare, civil clashes and terrorist activities; governments actions or interventions, including tariffs, protectionism and subsidies; regulatory, taxation and legal structure changes; difficulties and delays in obtaining new permits and consents for Tamweels operations or renewing existing ones; potential lack of reliability as to title to real property in certain jurisdictions where Tamweel operates; cancellation of contractual rights; lack of infrastructure; expropriation of assets; and inability to repatriate profits and/or dividends.

No assurance can be given that the UAE government will not implement regulations or fiscal or monetary policies, including policies, regulations, or new legal interpretations of existing regulations, relating to or affecting taxation, interest rates or exchange controls, or otherwise take actions which could have a 14

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 03 : 3989 Section 03

material adverse effect on Tamweels business, financial condition, results of operations or prospects or which could adversely affect the market price and liquidity of the Certificates. Tamweels business may be affected if there are geo-political events that prevent Tamweel from delivering its services. It is not possible to predict the occurrence of events or circumstances such as or similar to a war or the impact of such occurrences and no assurance can be given that Tamweel would be able to sustain its current profit levels or continue to operate as a viable business if such events or circumstances were to occur. Therefore a downturn or instability in certain sectors of the UAE, regional or global economy could have an adverse effect on Tamweels business, financial condition, results of operations or prospects. Expectations of Tamweels performance depends on future projections The information contained in this Prospectus relating to Tamweel may contain forward-looking statements based on Tamweels forecasts, expectations, estimates and current public information. This Prospectus takes into account Tamweels strategy, plans and capital expenditure forecasts. Tamweel does not guarantee its future performance, which might be subject to unforeseen risks and other elements outside the control of Tamweel. Certain predictions are based on assumptions vis--vis future events and may not be accurate. Some factors which may lead to a discrepancy between the Tamweels predictions and actual results include, but are not limited to, changes in laws and policies in regions where Tamweel has or intends to have an active presence; increase in competition due to, amongst other things, new market entrants, existing market players and new products; fluctuations in exchange rates, financing rates and inflation rates; and changes in laws. See risk factor Tamweels business is subject to political, economic and related considerations. RISKS RELATING TO THE DEVELOPING MARKETS Investments in emerging markets are subject to greater risk than investments in more developed markets Investors in emerging markets should be aware that these markets are subject to greater risks than more developed markets, including in some cases significant legal, economic and political risks. Accordingly, investors should exercise particular care in evaluating the risks involved and must decide for themselves whether, in the light of those risks, their investment is appropriate. Generally, investment in emerging markets is only suitable for sophisticated investors who fully appreciate the significance of the risk involved. Legal and regulatory systems may create an uncertain environment for investment and business activities Many countries in the MENA region are in the process of developing institutions and legal and regulatory systems which are not yet as firmly established as they are in Western Europe and the United States. Some countries (such as those countries comprising the Gulf Cooperation Council (GCC)) are also in the process of transitioning to a market economy and, as a result, may experience changes in their economies and government policies (including, without limitation, policies relating to foreign ownership, repatriation of profits, property and contractual rights and planning and permit-granting regimes) that may affect Tamweels business. The MENA region has enjoyed significant economic growth and some countries (such as those in the GCC) have also enjoyed relative political stability. However, there can be no assurance that such growth or stability will continue. Moreover, while the governments policies in some MENA countries have generally resulted in improved economic performance to date, there can be no assurance that such level of performance can be sustained. No assurance can be given that the governments in the countries in which Tamweel maintains operations or owns assets will not implement regulations or fiscal or monetary policies, including policies, regulations, or new legal interpretations of existing regulations, relating to or affecting taxation, financing rates or exchange controls, or otherwise take actions which could have a material adverse effect on Tamweels business, financial condition, results of operations or prospects.

15

Level: 5 From: 5 Wednesday, July 16, 2008 11:29 eprint3 3989 Section 03 : 3989 Section 03

RISKS RELATING TO THE CERTIFICATES The Certificates may not be a suitable investment for all investors and the failure by an investor to understand their investment may result in losses Each potential investor in the Certificates must determine the suitability of that investment in light of its own circumstances. In particular, each potential investor should: have sufficient knowledge and experience to make a meaningful evaluation of the Certificates, the merits and risks of investing in the Certificates and the information contained in this Prospectus; have access to, and knowledge of, appropriate analytical tools to evaluate, in the context of its particular financial situation, an investment in the Certificates and the impact the Certificates will have on its overall investment portfolio; have sufficient financial resources and liquidity to bear all of the risks of an investment in the Certificates; understand thoroughly the terms of the Certificates and be familiar with the behaviour of any relevant financial markets; and be able to evaluate (either alone or with the help of a financial adviser) possible scenarios for economic and other factors that may affect its investment and its ability to bear the applicable risks.