Professional Documents

Culture Documents

Corporate Governance

Uploaded by

Jkbhatia19Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Governance

Uploaded by

Jkbhatia19Copyright:

Available Formats

Concept and Objectives Corporate Governance may be defined as a set of systems, processes and principles which ensure that

a company is governed in the best interest of all stakeholders. It is the system by which companies are directed and controlled. It is about promoting corporate fairness, transparency and accountability. In other words, 'good corporate governance' is simply 'good business'. It ensures:

Adequate disclosures and effective decision making to achieve corporate objectives; Transparency in business transactions; Statutory and legal compliances; Protection of shareholder interests; Commitment to values and ethical conduct of business.

In other words, corporate governance is the acceptance by management of the inalienable rights of shareholders as the true owners of the corporation and of their own role as trustees on behalf of the shareholders. It deals with conducting the affairs of a company such that there is fairness to all stakeholders and that its actions benefit the greatest number of stakeholders. In this regard, the management needs to prevent asymmetry of benefits between various sections of shareholders, especially between the owner-managers and the rest of the shareholders. It is about commitment to values, about ethical business conduct and about making a distinction between personal and corporate funds in the management of a company. Ethical dilemmas arise from conflicting interests of the parties involved. In this regard, managers make decisions based on a set of principles influenced by the values, context and culture of the organization. Ethical leadership is good for business as the organization is seen to conduct its business in line with the expectations of all stakeholders. The aim of "Good Corporate Governance" is to ensure commitment of the board in managing the company in a transparent manner for maximizing long-term value of the company for its shareholders and all other partners. It integrates all the participants involved in a process, which is economic, and at the same time social. The fundamental objective of corporate governance is to enhance shareholders' value and protect the interests of other stakeholders by improving the corporate performance and accountability. Hence it harmonizes the need for a company to strike a balance at all times between the need to enhance shareholders' wealth whilst not in any way being detrimental to the interests of the other stakeholders in the company. Further, its objective is to generate an environment of trust and confidence amongst those having competing and conflicting interests. It is integral to the very existence of a company and strengthens investor's confidence by ensuring company's commitment to higher growth and profits. Broadly, it seeks to achieve the following objectives:

A properly structured board capable of taking independent and objective decisions is in place at the helm of affairs; The board is balance as regards the representation of adequate number of nonexecutive and independent directors who will take care of their interests and wellbeing of all the stakeholders;

The board adopts transparent procedures and practices and arrives at decisions on the strength of adequate information; The board has an effective machinery to subserve the concerns of stakeholders; The board keeps the shareholders informed of relevant developments impacting the company; The board effectively and regularly monitors the functioning of the management team; The board remains in effective control of the affairs of the company at all times.

The overall endeavour of the board should be to take the organisation forward so as to maximize long term value and shareholders' wealth.

Prerequisites and Constituents

Today adoption of good Corporate Governance practices has emerged as an integral element for doing busine not only a pre-requisite for facing intense competition for sustainable growth in the emerging global market s but is also an embodiment of the parameters of fairness, accountability, disclosures and transparency to maxim value for the stakeholders.

Corporate governance is beyond the realm of law. It cannot be regulated by legislation alone. Legislation can lay down a common framework the "form" to ensure standards. The "substance" will ultimately determine t credibility and integrity of the process. Substance is inexorably linked to the mindset and ethical standards of management.

Studies of corporate governance practices across several countries conducted by the Asian Development Bank International Monetary Fund, Organization for Economic Cooperation and Development and the World Bank that there is no single model of good corporate governance.

The OECD Code also recognizes that different legal systems, institutional frameworks and traditions across c have led to the development of a range of different approaches to corporate governance. However, a high deg priority has been placed on the interests of shareholders, who place their trust in corporations to use their inve funds wisely and effectively is common to all good corporate governance regimes.

Also, irrespective of the model, there are three different forms of corporate responsibilities which all models d respect:

Political Responsibilities: the basic political obligations are abiding by legitimate law; respect for the of rights and the principles of constitutional state. Social Responsibilities: the corporate ethical responsibilities, which the company understands and pr either as a community with shared values or as a part of larger community with shared values. Economic Responsibilities: acting in accordance with the logic of competitive markets to earn profit basis of innovation and respect for the rights/democracy of the shareholders which can be expressed in of managements' obligation as 'maximizing shareholders value'.

In addition, business ethics and corporate awareness of the environmental and societal interest of the commun within which they operate, can have an impact on the reputation and long-term performance of corporations.

The three key constituents of corporate governance are the Board of Directors, the Shareholders and the Management.

The pivotal role in any system of corporate governance is performed by the board of directors. It is accountable to the stakeholders and directs and controls the management. It stewards the company, se strategic aim and financial goals and oversees their implementation, puts in place adequate internal co and periodically reports the activities and progress of the company in the company in a transparent ma all the stakeholders. The shareholders' role in corporate governance is to appoint the directors and the auditors and to hold board accountable for the proper governance of the company by requiring the board to provide them periodically with the requisite information in a transparent fashion, of the activities and progress of th company. The responsibility of the management is to undertake the management of the company in terms of the direction provided by the board, to put in place adequate control systems and to ensure their operation provide information to the board on a timely basis and in a transparent manner to enable the board to m the accountability of management to it.

The underlying principles of corporate governance revolve around three basic inter-related segments. These a

Integrity and Fairness Transparency and Disclosures Accountability and Responsibility

The Main Constituents of Good Corporate Governance are:

Role and powers of Board: the foremost requirement of good corporate governance is the clear identification of powers, roles, responsibilities and accountability of the Board, CEO and the Chairma board. Legislation: a clear and unambiguous legislative and regulatory framework is fundamental to effectiv corporate governance. Code of Conduct: it is essential that an organization's explicitly prescribed code of conduct are communicated to all stakeholders and are clearly understood by them. There should be some system in to periodically measure and evaluate the adherence to such code of conduct by each member of the organization. Board Independence: an independent board is essential for sound corporate governance. It means tha board is capable of assessing the performance of managers with an objective perspective. Hence, the m of board members should be independent of both the management team and any commercial dealings company. Such independence ensures the effectiveness of the board in supervising the activities of management as well as make sure that there are no actual or perceived conflicts of interests. Board Skills: in order to be able to undertake its functions effectively, the board must possess the nec blend of qualities, skills, knowledge and experience so as to make quality contribution. It includes ope or technical expertise, financial skills, legal skills as well as knowledge of government and regulatory requirements. Management Environment: includes setting up of clear objectives and appropriate ethical framewor establishing due processes, providing for transparency and clear enunciation of responsibility and accountability, implementing sound business planning, encouraging business risk assessment, having people and right skill for jobs, establishing clear boundaries for acceptable behaviour, establishing performance evaluation measures and evaluating performance and sufficiently recognizing individual group contribution. Board Appointments: to ensure that the most competent people are appointed in the board, the board

positions must be filled through the process of extensive search. A well defined and open procedure m in place for reappointments as well as for appointment of new directors. Board Induction and Training: is essential to ensure that directors remain abreast of all developmen are or may impact corporate governance and other related issues. Board Meetings: are the forums for board decision making. These meetings enable directors to disch their responsibilities. The effectiveness of board meetings is dependent on carefully planned agendas a providing relevant papers and materials to directors sufficiently prior to board meetings. Strategy Setting: the objective of the company must be clearly documented in a long term corporate including an annual business plan together with achievable and measurable performance targets and milestones. Business and Community Obligations: though the basic activity of a business entity is inherently commercial yet it must also take care of community's obligations. The stakeholders must be informed the approval by the proposed and on going initiatives taken to meet the community obligations. Financial and Operational Reporting: the board requires comprehensive, regular, reliable, timely, c and relevant information in a form and of a quality that is appropriate to discharge its function of mon corporate performance. Monitoring the Board Performance: the board must monitor and evaluate its combined performanc also that of individual directors at periodic intervals, using key performance indicators besides peer re Audit Committee: is inter alia responsible for liaison with management, internal and statutory audito reviewing the adequacy of internal control and compliance with significant policies and procedures, re to the board on the key issues. Risk Management: risk is an important element of corporate functioning and governance. There shou clearly established process of identifying, analysing and treating risks, which could prevent the compa effectively achieving its objectives. The board has the ultimate responsibility for identifying major ris organization, setting acceptable levels of risks and ensuring that senior management takes steps to det monitor and control these risks.

A good corporate governance recognizes the diverse interests of shareholders, lenders, employees, governme The new concept of governance to bring about quality corporate governance is not only a necessity to serve th divergent corporate interests, but also is a key requirement in the best interests of the corporates themselves a economy.

Benefits and Limitations The concept of corporate governance has been attracting public attention for quite some time. It has been find wide acceptance for its relevance and importance to the industry and economy. It contributes not only to the efficiency of a business enterprise, but also, to the growth and progress of a country's economy. Progressively have voluntarily put in place systems of good corporate governance for the following reasons:

Several studies in India and abroad have indicated that markets and investors take notice of well mana companies and respond positively to them. Such companies have a system of good corporate governan place, which allows sufficient freedom to the board and management to take decisions towards the pro their companies and to innovate, while remaining within the framework of effective accountability. In today's globalised world, corporations need to access global pools of capital as well as attract and re best human capital from various parts of the world. Under such a scenario, unless a corporation embra demonstrates ethical conduct, it will not be able to succeed. The credibility offered by good corporate governance procedures also helps maintain the confidence o investors both foreign and domestic to attract more long-term capital. This will ultimately induce m stable sources of financing. A corporation is a congregation of various stakeholders, like customers, employees, investors, vendor partners, government and society. Its growth requires the cooperation of all the stakeholders. Hence it

imperative for a corporation to be fair and transparent to all its stakeholders in all its transactions by a to the best corporate governance practices. Good Corporate Governance standards add considerable value to the operational performance of a com by:

1. improving strategic thinking at the top through induction of independent directors who bring in experience and new ideas; 2. rationalizing the management and constant monitoring of risk that a firm faces globally; 3. limiting the liability of top management and directors by carefully articulating the decision ma process; 4. assuring the integrity of financial reports, etc. It also has a long term reputational effects among key stakeholders, both internally and externally.

Also, the instances of financial crisis have brought the subject of corporate governance to the surface. have shifted the emphasis on compliance with substance, rather than form, and brought to sharper foc need for intellectual honesty and integrity. This is because financial and non-financial disclosures mad any firm are only as good and honest as the people behind them. Good governance system, demonstrated by adoption of good corporate governance practices, builds confidence amongst stakeholders as well as prospective stakeholders. Investors are willing to pay high prices to the corporates demonstrating strict adherence to internally accepted norms of corporate gove Effective governance reduces perceived risks, consequently reduces cost of capital and enables board directors to take quick and better decisions which ultimately improves bottom line of the corporates. Adoption of good corporate governance practices provides long term sustenance and strengthens stake relationship. A good corporate citizen becomes an icon and enjoy a position of respects. Potential stakeholders aspire to enter into relationships with enterprises whose governance credentials exemplary. Adoption of good corporate governance practices provides stability and growth to the enterprise.

Effectiveness of corporate governance system cannot merely be legislated by law neither can any system of c governance be static. As competition increases, the environment in which firms operate also changes and in s dynamic environment the systems of corporate governance also need to evolve. Failure to implement good governance procedures has a cost in terms of a significant risk premium when competing for scarce capital in public markets Future Prospects The issues of governance, accountability and transparency in the affairs of the company, as well as about the shareholders and role of Board of Directors have never been so prominent as it is today. The corporate govern has come to assume a centre stage in the Board room discussions.

India has become one of the fastest emerging nations to have aligned itself with the international trends in Co Governance. As a result, Indian companies have increasingly been able to access to newer and larger markets the world; as well as able to acquire more businesses. The response of the Government and regulators have al admirably quick to meet the challenges of corporate delinquency. But, as the global environment changing continuously, there is a greater need of adopting and sustaining good corporate governance practices for value creation and building corporations of the future.

It is true that the 'corporate governance' has no unique structure or design and is largely considered ambiguou is still lack of awareness about its various issues, like, quality and frequency of financial and managerial discl compliance with the code of best practice, roles and responsibilities of Board of Directories, shareholders righ

There have been many instances of failure and scams in the corporate sector, like collusion between compani their accounting firms, presence of weak or ineffective internal audits, lack of required skills by managers, lac proper disclosures, non-compliance with standards, etc. As a result, both management and auditors have com greater scrutiny.

But, with the integration of Indian economy with global markets, industrialists and corporates in the country a being increasingly asked to adopt better and transparent corporate practices. The degree to which corporation observe basic principles of good corporate governance is an increasingly important factor for taking key inve decisions. If companies are to reap the full benefits of the global capital market, capture efficiency gains, ben economies of scale and attract long term capital, adoption of corporate governance standards must be credible consistent, coherent and inspiring.

Quality of corporate governance primarily depends on following factors, namely:- integrity of the manageme ability of the Board; adequacy of the processes; commitment level of individual Board members; quality of co reporting; participation of stakeholders in the management; etc. Since this is an important element affecting th term financial health of companies, good governance framework also calls for effective legal and institutiona environment, business ethics and awareness of the environmental and societal interests.

Hence, in the years to come, corporate governance will become more relevant and a more acceptable practice worldwide. This is easily evident from the various activities undertaken by many companies in framing and enforcing codes of conduct and honest business practices; following more stringent norms for financial and n financial disclosures, as mandated by law; accepting higher and appropriate accounting standards; enforcing t reforms coupled with deregulation and competition; etc.

However, inapt application of corporate governance requirements can adversely affect the relationship among participants of the governance system. As owners of equity, institutional investors are increasingly demandin decisive role in corporate governance. Individual shareholders, who usually do not exercise governance rights highly concerned about getting fair treatment from controlling shareholders and management. Creditors, espe banks, play a key role in governance systems, and serve as external monitors over corporate performance. Em and other stakeholders also play an important role in contributing to the long term success and performance o corporation. Thus, it is necessary to apply governance practices in a right manner for better growth of a comp

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DIGEST - BPI Vs CIR 2005Document2 pagesDIGEST - BPI Vs CIR 2005Mocha BearNo ratings yet

- Chapter 1 & 2: Entrepreneurship: Chapter 1: Definition and EvolutionDocument21 pagesChapter 1 & 2: Entrepreneurship: Chapter 1: Definition and EvolutionKey OnNo ratings yet

- Small 16Document264 pagesSmall 16Robin sahaNo ratings yet

- Note 20 Mobile BillDocument1 pageNote 20 Mobile Billakshaybasal jainNo ratings yet

- Objective of Financial Market RegulationDocument5 pagesObjective of Financial Market RegulationmoonaafreenNo ratings yet

- Jenga Jina Terms and Conditions 1Document8 pagesJenga Jina Terms and Conditions 1Kelly KiplagatNo ratings yet

- Incremental Analysis1Document4 pagesIncremental Analysis1michael odiemboNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- IR MCQS by JWT AghazetaleemDocument192 pagesIR MCQS by JWT AghazetaleemAliza NasirNo ratings yet

- Democracy and The Policy Preferences of Wealthy AmericansDocument53 pagesDemocracy and The Policy Preferences of Wealthy AmericansUmkc EconomistsNo ratings yet

- Law of Diminishing Returns: App & TPPDocument25 pagesLaw of Diminishing Returns: App & TPPAnandKuttiyanNo ratings yet

- Case 2 AuditDocument8 pagesCase 2 AuditReinhard BosNo ratings yet

- Audit in InventoriesDocument17 pagesAudit in InventoriesAldrin Arcilla SimeonNo ratings yet

- Ank Palermo Business Advisors Pty LTD Current & Historical Company ExtractDocument4 pagesAnk Palermo Business Advisors Pty LTD Current & Historical Company ExtractFlinders TrusteesNo ratings yet

- Oracle EBS R12 Payables R2 - TRAINDocument575 pagesOracle EBS R12 Payables R2 - TRAINappsloaderNo ratings yet

- PWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsDocument10 pagesPWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsSuman UroojNo ratings yet

- IB Economics SL8 - Overall Economic ActivityDocument6 pagesIB Economics SL8 - Overall Economic ActivityTerran100% (1)

- Project Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oDocument79 pagesProject Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oanreshaNo ratings yet

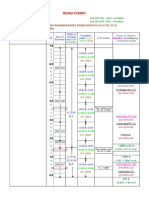

- Road Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Document4 pagesRoad Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Phani PitchikaNo ratings yet

- Code of Business Ethics PolicyDocument5 pagesCode of Business Ethics PolicyVIJAY SINGH RAGHAVNo ratings yet

- (Pieki Algo) Signals and Overlays (v.2.0)Document13 pages(Pieki Algo) Signals and Overlays (v.2.0)Rafael RubioNo ratings yet

- Extra Grammar Exercises Unit 3Document4 pagesExtra Grammar Exercises Unit 3Maria jose MendozaNo ratings yet

- Prescriptive AnalyticsDocument7 pagesPrescriptive AnalyticsAlfredo Romero GNo ratings yet

- Finance BIS MCQs & TF Ch7Document4 pagesFinance BIS MCQs & TF Ch7Souliman MuhammadNo ratings yet

- Alok Industries Final Report 2010-11.Document117 pagesAlok Industries Final Report 2010-11.Ashish Navagamiya0% (1)

- Mid Term-Introduction To English For BusinessDocument5 pagesMid Term-Introduction To English For BusinessSopheapHayNo ratings yet

- "The Curse of Cash" by Ken RogoffDocument21 pages"The Curse of Cash" by Ken RogoffOnPointRadio100% (1)

- Letter From Sacred Heart Cathedral Preparatory President To FacultyDocument4 pagesLetter From Sacred Heart Cathedral Preparatory President To FacultyNational Catholic ReporterNo ratings yet

- FIMA 30013 FS Analysis Premium Notes P1Document5 pagesFIMA 30013 FS Analysis Premium Notes P1dcdeguzman.pup.pulilanNo ratings yet

- Literature Review On Sbi Home LoanDocument8 pagesLiterature Review On Sbi Home Loanfvf69dxt100% (1)