Professional Documents

Culture Documents

Notes of GFM

Uploaded by

mohanraokp2279Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes of GFM

Uploaded by

mohanraokp2279Copyright:

Available Formats

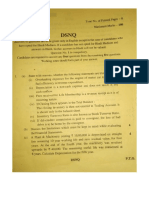

Global financial markets Unit I International Economic environment and International Monetary system Various environmental factors such

as economic environment, socio-cultural environment, political, technological, demographic and international, affect the business and its working. Out of these factors economic environment is the most important factor.

Meaning of Economic Environment:- Those Economic factors which have their affect on the working of the business is known as economic environment. It includes system, policies and nature of an economy, trade cycles, economic resources, level of income, distribution of income and wealth etc. Economic environment is very dynamic and complex in nature. It does not remain the same. It keeps on changing from time to time with the changes in an economy like change in Govt. policies, political situations. Elements of Economic Environment:- It has mainly five main components:1. Economic Conditions 2. Economic System 3. Economic Policies 4. International Economic Environment 5. Economic Legislations Economic Conditions:- Economic Policies of a business unit are largely affected by the economic conditions of an economy. Any improvement in the economic conditions such as standard of living, purchasing power of public, demand and supply, distribution of income etc. largely affects the size of the market. Business cycle is another economic condition that is very important for a business unit. Business Cycle has 5 different stages viz. (i) Prosperity, (ii) Boom, (iii) Decline, (iv) Depression, (v) Recovery. Following are mainly included in Economic Conditions of a country:I. Stages of Business Cycle II. National Income, Per Capita Income and Distribution of Income III. Rate of Capital Formation IV. Demand and Supply Trends V. Inflation Rate in the Economy VI. Industrial Growth Rate, Exports Growth Rate VII. Interest Rate prevailing in the Economy VIII. Trends in Industrial Sickness IX. Efficiency of Public and Private Sectors X. Growth of Primary and Secondary Capital Markets XI. Size of Market

Economic Systems:- An Economic System of a nation or a country may be defined as a framework of rules, goals and incentives that controls economic relations among people in a society. It also helps in providing framework for answering the basic economic questions. Different countries of a world have different economic systems and the prevailing economic system in a country affect the business units to a large extent. Economic conditions of a nation can be of any one of the following type:1. Capitalism:- The economic system in which business units or factors of production are privately owned and governed is called Capitalism. The profit earning is the sole aim of the business units. Government of that country does not interfere in the economic activities of the country. It is also known as free market economy. All the decisions relating to the economic activities are privately taken. Examples of Capitalistic Economy:- England, Japan, America etc. 2. Socialism:- Under socialism economic system, all the economic activities of the country are controlled and regulated by the Government in the interest of the public. The first country to adopt this concept was Soviet Russia. The two main forms of Socialism are: (a) Democratic Socialism:- All the economic activities are controlled and regulated by the government but the people have the freedom of choice of occupation and consumption. (b) Totalitarian Socialism:- This form is also known as Communism. Under this, people are obliged to work under the directions of Government. 3. Mixed Economy:- The economic system in which both public and private sectors co-exist is known as Mixed Economy. Some factors of production are privately owned and some are owned by Government. There exists freedom of choice of occupation and consumption. Both private and public sectors play key roles in the development of the country. Economic Policies:- Government frames economic policies. Economic Policies affects the different business units in different ways. It may or may not have favorable effect on a business unit. The Government may grant subsidies to one business or decrease the rates of excise or custom duty or the government may increase the rates of custom duty and excise duty, tax rates for another business. All the business enterprises frame their policies keeping in view the prevailing economic policies. Important economic policies of a country are as follows:1. Monetary Policy:- The policy formulated by the central bank of a country to control the supply and the cost of money (rate of interest), in order to attain some specified objectives is known as Monetary Policy. 2. Fiscal Policy:- It may be termed as budgetary policy. It is related with the income and expenditure of a country. Fiscal Policy works as an instrument in economic and social growth of a country. It is framed by the government of a country and it deals with taxation, government expenditure, borrowings, deficit financing and management of public debts in an economy. 3. Foreign Trade Policy:- It also affects the different business units differently. E.g. if restrictive import policy has been adopted by the government then it will prevent the domestic business units from foreign

competition and if the liberal import policy has been adopted by the government then it will affect the domestic products in other way. 4. Foreign Investment Policy:- The policy related to the investment by the foreigners in a country is known as Foreign Investment Policy. If the government has adopted liberal investment policy then it will lead to more inflow of foreign capital in the country which ultimately results in more industrialization and growth in the country. 5. Industrial Policy:- Industrial policy of a country promotes and regulates the industrialization in the country. It is framed by government. The government from time to time issues principals and guidelines under the industrial policy of the country. Global/International Economic Environment:- The role of international economic environment is increasing day by day. If any business enterprise is involved in foreign trade, then it is influenced by not only its own country economic environment but also the economic environment of the country from/to which it is importing or exporting goods. There are various rules and guidelines for these trades which are issued by many organizations like World Bank, WTO, United Nations etc. Economic Legislations:- Besides the above policies, Governments of different countries frame various legislations which regulates and control the business. International monetary system International monetary systems are sets of internationally agreed rules, conventions and supporting institutions that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic actors spread over several decades. A Brief History of International Monetary System The emergency of nation states as the predominant form of political and administrative organization is a fairly recent phenomenon. It is difficult to survey international monetary arrangements prior to 1800 except to point out that all sovereign states specified what form of money would constitute legal tender within their boundaries, and that most of them minted gold, silver, and/or base-metal (copper, tin, lead) coins for domestic circulation. Metallic-standard arrangements Gold standard and other commodity-money systems 1. 1797-1821 2. 1821-1875 3. 1875-1914 4. 1914-1945 5. 1947-1971 6. 1973-present Disruption due to Napoleonic wars England on gold standard; other nations on various commodity-money arrangements Worldwide gold standard Disruption from two world wars and intervening depression (brief return to gold standard, 1925-1931) Bretton Woods system of fixed exchange rates Floating exchange rates among leading nations

1. The Gold Standard Gold coins and bullion

Impure type of gold-standard, in which the actual circulating medium consisted largely or even entirely of paper claims (currency) to units of the monetary commodity (gold) -- Fractional reserves Par: officially stipulated rate 1900, for example, the US dollar price of an English pound was about 4.86(a dollar was equivalent to 0.0484 ounce of gold, whereas the figure was 0.2354 ounce for a pound sterling) How to see the relationship of the gold price and goods prices? $/good = ($/Gold) (Gold/good) = (price of monetary Gold) (price of commodity Gold) Under the gold standard, the first term in the right hand side is fixed. Therefore the goods price will be affected by the price of the commodity Gold, which will be determined by the supply (excavation) and demand of gold, or the supply and demand of goods. (See Cooper, 1982 in Brookings Papers on Economic Activity) Change of money demand or reserves requirement ratio have short term impact, but without long-term effect of the price level. Long- term effect: with pegged price of monetary gold, effect comes from price of commodity gold. (See McCallum, 1996, International Monetary Economics, 70-77) 2. From 1800 to 1914 1819-Britain started, after the Napoleonic Wars (1793-1815). 1879 USA adopted. *Under Gold Standard, inflation rate is low, except during the wars. Napoleonic wars kept England off any metallic standard. USAs Civic War of 1860-1865, and fully returned to a metallic basis

until 1878.

*Prices in the different nations tended to move together. 1840-50, prices fell because of shortage of gold. After 1900 the supply of gold and silver grew rapidly as the result of mining discoveries and improvements in refining technique, and price levels rose. *Japans yen became the nations currency unit in 1870, shortly after the Meiji Restoration. The bank of Japan was created in 1882. 3. From 1918 to 1945

1919, US restored the gold standard. 1922, met in Genoa, Italy, Britain, France, Italy, and Japan agreed to restore the gold standard.Partial gold exchange standard

1925, Britain restored the exchange rate between gold and its currency by the rate set before the war. (against Keynes advice) A monetary stringency caused a substantial deflation. During 1926-1932, nominal wage fell, and a high level of unemployment.

Downturn in economic activity developed into Great Depression in the end of 1929. Exchange rates did not adjust smoothly, using import restrictions.

1931, Britain abandoned the gold standardconfidence problem. 1933 US departed from gold standard, 1934 back again, and the price of gold increase from $20.67 to $35 per ounce. Most of the countries back to the gold standard but with competitive deprecations. 1930US, Smoot-Hawkey tariff.

Competitive deprecations: beggar-thy-neighbor policyfor obstructing the outflow of the gold and increasing domestic output (decrease the unemployment)--- provoked foreign retaliation

The turbulence persisted until 1939, WWII

4. Bretton Woods. 1947-1971 After the war, the world expected to build an international monetary system, which would foster full employment and price stability while allowing individual countries to attain external balance without imposing restrictions on international trade. (avoid the disadvantages of both the gold standard and the unsettled conditions of the 1930s, the breakdown in trade)

Keynes versus Harry Dexter White

IMF founded in 1944, 44 countries met at Bretton Woods. World Bank (or International Bank for Reconstruction and Development) was founded also. The establishment of International Trade Organization (ITO) was not passed by USs congress. 1947 GATT was founded.

IMF-gold exchange standard Gold for dollars at price of $35 per ounce.

Goals and Structure of the IMF

Objectives: convertible currencies, free of the exchange controls and create a mechanism for financing temporary balance-of-payments difficulties.

a. disciplinefixed to the dollar, which was tied to gold. b. flexibilityIMF lending facilities, under the IMF conditionality. adjustable parities whenever there is fundamental disequilibrium. The Changing Meaning of External Balance 1947 began Marshall Plan. The recovery after the war, needs CA deficit of the USA---dollar shortage. However, international trade was restricted on CA, KA was not allowed. transaction was dismantled, and the foreign exchange trading up. 1958, the restriction on KA

The External Balance Problem of the United States The role played by US under the Bretton Woods systemUS was required to trade gold for dollars with foreign central banks. US might face the external constraint. However, many countries still hold US dollars as foreign reserves because gold is limited, and there is interest for dollar deposits. One exception: France, Charles de Gaulle criticized that the Bretton Woods system gave US exorbitant privilege, and in 1956 France changed most of its dollars to gold 1960s, Robert Triffin of Yale University raised the issue of confidence problem. Economic growth will bring the need of US dollars, but the gold is growing slowly. Eventually, dollar is no longer as good as gold. The

solution lies on (a). Increase the price of gold, (b) SDR (1967). By October 1961, 7 European central banks and the United States had agreed to create a gold pool, that would hold the London market price at $35/oz. It broke down in 1967. Between 1968 and 1971, the price of gold fluctuated between $36 and $44. August 15, 1971 the USA unilaterally suspended gold sales to foreign central banks. December 1971, the Smithsonian agreement, price of gold increases to $38/oz. 5. Floating Exchange Rates, 1973-Present Predictions of small volumes of official reserves would be held by central banks and that BOP accounts would show very small official settlement balance were not found. Not pure floating-rate system, intervention of monetary authority is very often. After March 1973, European Community retained 2.25% band, but jointly floated against the dollar---snake. Over the years 1971-1979, the value of the US dollar declined considerably ------ Inflation plus current account in the USA. International cooperation in the stabilization of exchange rates October, 1979, Paul Volcker took the office of Fed, and tightened monetary policy, dollar began to rise. September, 1985 G-5 (France, Germany, Japan, the UK, and the USA)Plaza Accord, cooperative action to drive down the value of dollar. Early 1987, G-5 the Louvre Agreement, announced their belief that prevailing exchange rates were reasonably appropriate and their intention to cooperative stabilize these rates. The dollar was falling. The Fed tightened monetary policy. Perhaps one of the reason caused the stock market correction. Debt crisis: Mexico, August 1982 announced that it would be unable to pay its debt, followed by Venezuela, Chile, Peru, the Philippines, and a few African countries. Latin American debtors of 51 billion, nearly twice of the capital of the nine largest U.S banks. From debt rescheduling (of payments), and moving on to debt reduction, debt-equity swaps, buybacks, and complex plans devised by James Baker and Nicholas Brady. The Debt Crisis of the 1980s The great recession of the early 1980s sparked a crisis over developing country debt. The shift to contractionary policy by the U.S. led to: The fall in industrial countries' aggregate demand An immediate and spectacular rise in the interest burden debtor countries had to pay A sharp appreciation of the dollar A collapse in the primary commodity prices The crisis began in August 1982 when Mexicos central bank could no longer pay its $80 billion in foreign debt, followed by Venezuela, Chile, Peru, the Philippines, and a few African countries. Latin American debtors of 51 billion, nearly twice of the capital of the nine largest U.S banks. From debt rescheduling (of payments), and moving on to debt reduction, debt-equity swaps, buybacks, and complex plans devised by James Baker and Nicholas Brady. Is sovereign governments debt different?

By the end of 1986 more than 40 countries had encountered several external financial problems.

4. Reforms, Capital Inflows, and the Return of Crisis Latin America and Washington Consensus (John Williamson, 1989) a. b. c. d. e. f. g. fiscal discipline reordering public expenditure priorities tax reform liberalization of interest rates a competitive exchange rate trade liberalization liberalization of inward foreign direct investment

h. i. j.

privatization deregulation property rights Argentina 1970s It tried unsuccessfully to stabilize inflation through a crawling peg. 1980s It implemented successive inflation stabilization plans involving currency reforms, price controls, and other measures. 1990s It adopted a currency board (peso-dollar peg). 2001-2002 It defaulted on its debts and abandoned the peso-dollar peg. Brazil Chile 1980s It suffered runaway inflation and multiple failed attempts at stabilization accompanied by currency reforms. 1990s It introduced a new currency (the real pegged to the dollar), defended it with high interest rates, and decreased inflation under 10%. 1980s It implemented more reforms and used a crawling peg type of exchange rate regime to bring inflation down gradually. 1990-1997 It enjoyed an average growth rate of more than 8% per year and a 20% inflation decrease.

Mexico 1987 It introduced a broad stabilization and reform program and fixed its pesos exchange rate against the U.S. dollar. 1989-1991 It moved to a crawling peg and crawling band. 1994 It joined the North American Free Trade Area and achieved 7% inflation.

The East Asian Economic Miracle Until 1997 the countries of East Asia were having very high growth rates. What are the ingredients for the success of the East Asian Miracle? High saving and investment rates Strong emphasis on education Stable macroeconomic environment Free from high inflation or major economic slumps High share of trade in GDP Asian Weaknesses Three weaknesses in the Asian economies structures became apparent with the 1997 financial crisis: Productivity Rapid growth of production inputs but little increase in the output per unit of input Banking regulation Poor state of banking regulation Legal framework Lack of a good legal framework for dealing with companies in trouble The Asian Financial Crisis It stared on July 2, 1997 with the devaluation of the Thai baht. The sharp drop in the Thai currency was followed by speculation against the currencies of: Malaysia, Indonesia, and South Korea. All of the afflicted countries except Malaysia turned to the IMF for assistance. The downturn in East Asia was V-shaped: after the sharp output contraction in 1998, growth returned in 1999 as depreciated currencies spurred higher exports.

Crises in Other Developing Regions Russias Crisis 1989 It embarked on transitions from centrally planned economic allocation to the market. These transitions involved: rapid inflation, steep output declines, and unemployment. 1997 It managed to stabilize the ruble and reduce inflation with the help of IMF credits. 2000 It enjoyed a rapid growth rate.

Brazils 1999 Crisis It had a public debt problem. It devalued the real by 8% in January 1999 and then allowed it to float. The real lost 40% of its value against the dollar. It struggled to prevent the real from going into a free fall and as a result it entered into a recession. The recession was short lived, inflation did not take off, and financialsector collapse was avoided. Argentinas 2001-2002 crises Its rigid peg of its peso to the dollar proved painful as the dollar appreciated in the foreign exchange market. 2001 It restricted residents withdrawals from banks in order to stem the run on the peso, and then it stopped payment on its foreign debts. 2002 It established a dual exchange rate system and a single floating-rate system for the peso.

The lessons from developing country crises are summarized as: Choosing the right exchange rate regime The central importance of banking The proper sequence of reform measures The importance of contagion The Asian crisis convinced nearly everyone of an urgent need for rethinking international monetary relations because of two reasons: The fact that the East Asian countries had few apparent problems before their crisis struck The apparent strength of contagion through the international capital markets Capital Mobility and the Trilemma of the Exchange Rate Regime The macroeconomic policy trilemma for open economies: Independence in monetary policy Stability in the exchange rate Free movement of capital Only two of the three goals can be reached simultaneously. Exchange rate stability is more important for developing than developed countries. Proposals to reform the international architecture can be grouped as preventive measures or as expost measures. Prophylactic Measures Among preventive measures are: More transparency Stronger banking systems Enhanced credit lines Increased equity capital inflows relative to debt inflows The effectiveness of these measures is controversial. Coping with Crisis The ex-post measures that have been suggested include: More extensive lending by the IMF Chapter 11 bankruptcy proceeding for the orderly resolution of creditor claims on developing countries that cannot pay in full. A Confused Future In the years to come, developing countries will experiment with: Floating exchange rates Capital controls Currency boards Abolition of national currencies and adoption of the dollar or euro for domestic transactions

Unit 2 Foreign exchange market and exchange rate determination I. The Foreign Exchange Market A. The foreign exchange market is a market where one countrys currency can be exchanged for another countrys. It has three tiers of operations: i. Individuals and corporations buy and sell foreign exchange through their commercial banks.

II.

III.

Commercial banks trade in foreign exchange with other commercial banks in the same financial center. iii. Commercial banks trade in foreign exchange with commercial banks in other financial centers. 1. The first is the retail market; the last two are the interbank market. B. Major Participants i. Commercial Banks 1. They operate the payment mechanism meaning a collection system that transfers money by drafts, notes, etc. 2. They extend credit both secured and unsecured. 3. Help to reduce risk by using a letter of credit. a. A letter of credit is a document issued by a bank at the request of an importer and in the document the bank guarantees to honor a draft drawn on the importer. 4. Most banks do not have a large amount of currency trading, the market is dominated by a few large banks. ii. Global and National Market 1. Banks throughout the world serve as market makers in foreign exchange. 2. All foreign exchange banks are linked together using telecommunication. 3. Local banks may have an advantage trading their specific currency (e.g. Sterling in London), but all foreign exchange banks have global level activities. 4. The foreign exchange market is 24 hour. iii. Central Banks 1. They attempt to control the growth of the money supply within their jurisdictions. 2. They also attempt to control the value of their own currency against any foreign currency. a. For fixed exchange rates, this involves absorbing the difference between supply of and demand for foreign exchange to maintain the par value. b. For flexible exchange rates, this involves intervening to maintain orderly trading conditions. 3. Central bank activities include transaction with other central banks, various international organizations, and exchange rate intervention. 4. Serve as their governments banker for domestic and international payments. Foreign Exchange Rate Quotation A. The spot rate is the rate paid for delivery of a currency within two business days after the day of the trade. i. A few number of currencies have a different rate for financial or commercial transactions. ii. The direct quote is a home currency price per unit of a foreign currency. iii. The indirect quote is a foreign currency price per unit of a home currency. iv. A cross rate is an exchange rate between two non-home currencies. v. Percentage change is the ending rate minus the beginning rate then divided by the beginning rate. vi. The bid price is the price at which the bank is ready to buy a foreign currency and the ask price is the price at which the bank is ready to sell a foreign currency. 1. The bid-ask spread is the spread between the bid and ask rates. B. The forward rate is the rate to be paid for delivery of a currency at some future date. i. The rate is determined at the time the contract is made but payment and delivery are not required until maturity. ii. If the forward rate is less than the spot rate, this is a discount. iii. If the forward rate is more than the spot rate, this is a premium. iv. There are four participants types in the forward rate: 1. Arbitrageurs who seek to earn riskless profits by taking advantage of differences in interest rates among countries. 2. Traders who use forward contracts to eliminate possible exchange losses on export or import orders denominated in foreign currencies. 3. Hedgers who engage in forward contracts to protect the home-currency value of foreign-currency denominated assets and liabilities. 4. Speculators who expose themselves in risk by engaging in forward contracts to make a profit from exchange rate fluctuation. International Parity Conditions A. There is a relationship between the money market and the foreign exchange market and there are five major theories that can be used to determine exchange rate levels, which will be discussed below.

ii.

B.

An efficient exchange market exists when exchange rates reflect all available information and adjust quickly to new information. This removes all profits in excess of the minimum from the system. It depends on three hypotheses: i. Market prices, such as product prices, interest rates, spot rates, and forward rates, should reflect the markets consensus estimate of the future spot rate. ii. Investors should not earn unusually large profits from forward speculation. iii. It is impossible for any market analyst to beat the market consistently.

Exchange rate determination (From C to F) C. The Theory of Purchasing Power Parity (PPP) i. The absolute version of this theory states that the equilibrium exchange rate between domestic and foreign currencies equals the ratio between domestic and foreign prices. 1. The world is very complex with many impediments to the equalization of prices for identical goods worldwide. ii. The relative version of the theory states that in the long run, the exchange rate between the home currency and the foreign currency will adjust to reflect changes in the price levels of the two countries. iii. The PPP theory can be used to forecast exchange rates. iv. The weaknesses of the theory are that: 1. It assumes goods are easily traded. 2. It assumes tradable goods are identical across countries. 3. It is dependent on the use of price indexes. 4. Many other factors influence exchange rates beyond relative prices. D. The Fisher Effect i. The nominal interest rate of each country is equal to a real interest rate plus an expected rate of inflation. 1. The real interest is determined by the productivity in an economy plus a risk premium. It is relatively stable. 2. The nominal interest includes an inflation premium to compensate lenders or investors for a loss in purchasing power. ii. Real interest rates are equalized across countries through arbitrage. iii. The theory works well for short-term government securities. iv. The theory suffers from an increased financial risk inherent in fluctuations of a bond market value prior to maturity, by the unequal creditworthiness of the issuers, and from the fact that long-term rates are not the sensitive to price changes. E. The International Fisher Effect i. This states that the future spot rate should move in an amount equal to, but in the opposite direction from, the difference in interest rates between two countries. 1. When investors purchase the currency of country to take advantage of higher interest rates abroad, they must also consider any possible losses due to fluctuations in the value of the foreign currency prior to maturity of their investment. ii. It is also hold that the interest differential between two countries should be an unbiased predictor of the future change in the sport rate. 1. This is because, at least in terms of short-term behavior, the exchange rate moves in the same direction as the difference in interest rates between two countries. F. The Theory of Interest-Rate Parity i. This theory states that the spread between a forward rate and a spot rate should be equal, but opposite in sign, to the difference in interest rates between two countries. 1. In a free market, the currency with the higher interest rate will sell at a discount in the forward market and vice versa. 2. This outcome is a result of arbitrageurs who enter into forward contracts to avoid the exchange-rate risk. G. The Forward Rate and the Future Spot Rate i. If speculators think that a forward rate is higher than their prediction of a future spot rate, they will sell the foreign currency forward. 1. This transaction will bid down the forward rate until it equals the expected future spot rate. ii. These speculative transactions will bid up the forward rate until it reaches the expected future rate thereby removing any incentive to buy or sell a foreign currency forward. H. Synthesis of International Parity Conditions i. In the absence of predictable exchange market intervention by central banks, an expected rate of change in a spot rate, differential rates of national inflation and

interest, and forward premiums or discounts are all directly proportional to each other. 1. Due to efficient markets, these variables adjust very quickly to changes in any one of them. IV. Arbitrages A. Arbitrage is the purchase of something in one market and its sale in another market to take advantage of price differential. i. The goal is to profit on price differences. B. Geographic Arbitrage i. Exchange rates for a given currency are not the same in every geographic market and this creates the opportunity for arbitrage. C. Two-Point Arbitrage i. This is an arbitrage transaction between two currencies to take advantage of difference in exchange rates in different markets. D. Three-Point Arbitrage, also known as Triangle Arbitrage i. This is an arbitrage transaction among three currencies take advantage of unequal cross rates between markets. E. Covered-Interest Arbitrage i. This is the movement of short-term funds between countries to take advantage of interest differentials with exchange risk covered by forward contracts. ii. These activities lead to equilibrium, i.e. interest rate parity. iii. This arbitrage leads to four tendencies: 1. The spot rate of currency one against currency two will tend to appreciate as investors buy currency one against currency two. 2. The forward rate of currency one against currency two will tend to depreciate as investors sell currency one against currency two. 3. Interest rates will tend to rise in country two as investors borrow currency two. 4. Interest rates will tend to fall in country one as investors borrow currency one.

Key Terms and Concepts Spot Rate is the rate paid for delivery of a currency within two business days after the day of the trade. Direct Quote is a home currency price per unit of a foreign currency. Indirect Quote is a foreign currency price per unit of a home currency. Cross Rate is an exchange rate between two currencies when it is obtained from the rates of these two currencies in terms of a third currency. Bid Price is the price at which a bank is ready to buy a foreign currency. Ask Price is the price at which a bank is ready to sell a foreign currency. Bid-Ask Spread is the spread between bid and ask rates for a currency; this spread is the bank's fee for executing the foreign exchange transaction. Forward rate is the rate to be paid for delivery of a currency at some future date. Efficient Exchange Markets exist when exchange rates reflect all available information and adjust quickly to new information. Theory of Purchasing Power Parity (PPP) holds that the exchange rate must change in terms of a single currency so as to equate the prices of goods in both countries. Fisher Effect named after the economist Irving Fisher, assumes that the nominal interest rate in each country is equal to a real interest rate plus an expected rate of inflation. International Fisher Effect states that the future spot rate should move in an amount equal to, but in a different direction from, the difference in interest rates between two countries. Interest-Rate Parity Theory holds that the difference between a forward rate and a spot rate equals the difference between a domestic interest rate and a foreign interest rate Arbitrage is the purchase of something in one market and its sale in another market to take advantage of a price differential.

Two-Point Arbitrage is the arbitrage transaction between two currencies. Three-Point Arbitrage, also known as triangle arbitrage, is the arbitrage transaction among three currencies and can occur if any of the three cross rates is out of line. Covered Interest Arbitrage is the movement of short-term funds between countries to take advantage of interest differentials with exchange risk covered by forward contracts. Unit 3 Law of one price and management of foreign exchange exposure The law of one price suggests that in competitive markets free of transportation costs and trade barriers, identical products in different countries must sell for the same price when their price is expressed in terms of the same currency. A less extreme version of the PPP theory states that given relatively efficient markets that is, markets in which few impediments to international trade and investment exist the price of a basket of goods should be roughly equivalent in each country The International Fisher Effect states that for any two countries the spot exchange rate should change in an equal amount but in the opposite direction to the difference in nominal interest rates between two countries Currency Convertibility A currency is said to be freely convertible when a government of a country allows both residents and nonresidents to purchase unlimited amounts of foreign currency with the domestic currency. A currency is said to be externally convertible when non-residents can convert their holdings of domestic currency into a foreign currency, but when the ability of residents to convert currency is limited in some way. A currency is nonconvertible when both residents and non-residents are prohibited from converting their holdings of domestic currency into a foreign currency. Free convertibility is the norm in the world today, although many countries impose restrictions on the amount of money that can be converted. The main reason to limit convertibility is to preserve foreign exchange reserves and prevent capital flight. Countertrade refers to a range of barter like agreements by which goods and services can be traded for other goods and services. It can be used in international trade when a countrys currency is nonconvertible. Foreign exchange exposure and management

Basic Nature of Foreign Exchange Exposures A Foreign exchange exposure is the possibility that a firm will gain or lose because of changes in exchange rates. There are three types of exchange exposures: 1. Translation exposure, i.e. the account-based changes in consolidated financial statements caused by exchange rate changes. 2. Transaction exposure i.e. changes in exchange rates between the time that an obligation is incurred and the time that it is settled. This affects actual cash flows. 3. Economic exposure reflects the change in the present value of the firms future cash flows because of an unexpected change in exchange rates. Exposure management strategy involves four steps: I. Forecasting the degree of exposure in each major currency in which the MNC operates. II. Developing a reporting system to monitor exposure and exchange rate movements to assist in protecting the MNC from risk. III. Assigning responsibility for hedging exposure and determining whether to centralize or decentralize exposure management. IV. Selecting appropriate hedging tools including diversification of the MNCs operations, a balance sheet hedge, and exposure netting. Types of Exposure Translation exposure is caused by account-based changes in consolidated financial statements that are linked to exchange rate changes.

Transaction exposure is the potential change in the value of outstanding obligations due to changes in the exchange rate between the beginning of a contract and the settlement of a contract. Transactions include credit purchases, credit sales, borrowed funds, loaned funds, receipts, payments, and uncovered forward contracts. All of these transactions may be exposed if they are denominated in foreign currencies. Economic exposure, also known as operating exposure, competitive exposure, or revenue exposure, measures the impact of an exchange-rate change on the new present value of expected future cash flows from a foreign investment project. iv. This type of exposure is broader and more subjective than either translation or transaction. Comparison of the three exposures: Management of translation exposure is static and historically oriented but management of transaction and economic exposure is more forward looking because both of these involve actual and potential cash flows. Transaction and economic risk are essentially the same, but they differ in degree. 1. Transaction exposure is objective because it depends on outstanding obligations that existed before changes in exchange rates but were settled after changes in exchange rates. 2. Economic exposure is subjective because it depends on estimated future cash flows for an arbitrary time horizon. Transaction Exposure Management An action that removes a transaction exposure is said to cover that risk. A forward exchange-market hedge involves that exchange of one currency for another at a fixed rate on some future date to hedge transaction exposure. This process substitutes a known cost for the uncertain future cost due to foreign exchange risk. This process does not guarantee the lowest cost due to foreign exchange rate change -- it just fixes the cost. A money-market hedge involves a loan contract and a source of fund to carry out that contract in order to hedge transaction exposure. The contract represents a loan agreement. The difference between this process and a forward exchange market hedge is that the cost of the money market hedge is determined by differential interest rates, not by the forward premium or discount. An options-market hedge involves the purchasing a call option or put option to cover exchange risk. A call option allows MNCs to cover currency risks for accounts payables. A put option allows MNCs to cover currency risks for accounts receivable. An options market hedge protects MNCs from adverse exchange rate movements, but also allows MNCs to benefit from favorable exchange rate movements. A forward contract is often an imperfect hedging instrument because it is a fixed agreement to buy or sell a foreign currency at a specific price in the future. There are practical situations where MNCs are not sure whether their hedged foreign-currency cash flows will materialize: An overseas deal may fall through. A bid on a foreign-currency contract may be rejected. A foreign subsidiaries dividend payments may exceed the expected amount. Options vs. forward contracts the following rules are suggested to choose between forward contracts and currency options: v. When the quantity of a foreign-currency cash outflow is known, buy the currency forward; when the quantity is unknown, buy a call option on the currency. vi. When the quantity of a foreign-currency cash inflow is known, sell the currency forward; when the quantity is unknown, buy a put option on the currency. vii. When the quantity of a foreign-currency flow is partially known and partially uncertain, use a forward contract to hedge the known portion and an option to hedge the maximum value of the uncertain remainder. A cross hedge is a technique designed to hedge exposure in one currency by the use of future or other contracts on another currency that is correlated with the first currency. viii. This is used when there are no futures or forward markets for the currency the MNC is trying to hedge. A swap-market hedge involves an exchange of cash flows in two different currencies between two MNCs. 1. A currency swap is an agreement between two parties to exchange local currency for hard currency at a specified future date. 2. A credit swap is an agreement that is a simultaneous spot and forward loan transaction between a private company and a bank of a foreign country. 3. An interest rate swap is an agreement between two parties to exchange cash flows of a floating rate for cash flows of a fixed rate, or exchange cash flows of a fixed rate for cash flows of a floating rate.

Back-to-back loans or parallel loans are loans between two parent companies in two different countries whereby parent company A in country A lends an agreed amount to the subsidiary of parent company B in country A and in return parent company B in country B lends an agreed amount to the subsidiary of parent company A in country B. This process completely avoids currency risk. Economic Exposure Management It is difficult, if not impossible, to hedge economic exposure. The scope of economic exposure is broad because it can change a companys competitiveness across many markets and products. The risks are long-term, hard to quantify, and cannot be dealt with solely through financial hedging techniques. Analysis of economic exposure should consider how exchange rate influence: A companys sales prospects in foreign markets. The costs of labor and other inputs to be used in overseas production. The home-currency value of financial assets and liabilities denominated in foreign currencies. Diversification production, marketing and financing is one of the main ways to cover economic exposure. Diversified production involves diversification of plant location, the input mix, product sourcing, and productivity increases. Diversified marketing involves diversification of product strategy, pricing strategy, promotional options, and market selection. Diversified financing involves diversification of the currency denomination of longterm debt, place of issue, maturity of structure, capital structure, and leasing versus buying. Currency Exposure Management Practices A survey of 25 U.S. MNCs found that transaction was the overwhelming choice of Chief Financial Officers (CFO) as the type of exposure that merits the most attention (64% ranked it #1). Economic exposure came in second with 26% of the CFOs raking it #1. Only 13% of CFO ranked translation exposure as their most important exposure. A different survey found that 65% of the sampled companies hedged their transaction exposure but only 26% hedged their translation exposure. Still another survey, this time of 110 CFOs, found that 38% percent of them considered foreign exchange risk as the important of all of the risks they faced. The next most important risks were interest rate risk (32%), political risk (10%), credit risk (9%), liquidity risk (7%), and inflation risk (4%). The most commonly used instrument to handle this foreign exchange risk was the forward contract (42%). 1. The other four hedging techniques discussed above (currency swaps, interest-rate swaps, currency options, and futures) were used almost equally. 2. Other surveys have also found that forward contracts are the most popular hedging instrument. Key Terms and Concepts Foreign Exchange Exposure refers to the possibility that a firm will gain or lose due to changes in exchange rates. Operational Techniques are operational approaches to hedging exchange exposure that include diversification of a companys operations, the balance sheet hedge, and exposure netting. Financial Instruments are financial contracts to hedging exchange exposure that include currency forward and futures contracts, currency options, and swap agreements. Transaction Exposure refers to the potential change in the value of outstanding obligations due to changes in the exchange rate between the inception of a contract and the settlement of the contract. Economic Exposure also called operating exposure, competitive exposure, or revenue exposure, measures the impact of an exchange rate change on the net present value of expected future cash flows from a foreign investment project. Forward Exchange-Market Hedge involves a forward contract and a source of funds to fulfill that contract. Money Market Hedge involves a loan contract and a source of funds to carry out that contract.

4.

Options Market Hedge protects the company from adverse exchange rate movements but allow the company to benefit from favorable exchange rate movements. Swap Market Hedge involves an exchange of cash flows in two different currencies between two companies. Cross Hedge is a technique designed to hedge exposure in one currency by the use of futures or other contracts on another currency that is correlated with the first currency. Currency Swap is an agreement between two parties to exchange local currency or hard currency at a specified future date. Credit Swap is a hedging device similar to the foreign currency swap. Interest Rate Swap is a technique where companies exchange cash flows of a floating rate for cash flows of a fixed rate, or exchange cash flows of a fixed rate for cash flows of a floating rate. Unit IV Multinational capital budgeting, like traditional domestic capital budgeting, focuses on the cash inflows and outflows associated with prospective long-term investment projects. Multinational capital budgeting techniques are used in traditional foreign direct investment (FDI) analysis, such as the construction of a manufacturing plant in another country, as well as in the growing field of international mergers and acquisitions. Capital budgeting for a foreign project uses the same theoretical framework as domestic capital budgetingwith a few very important differences. The basic steps are: a. Identify the initial capital invested or put at risk. b. Estimate cash flows to be derived from the project over time, including an estimate of the terminal or salvage value of the investment. c. Identify the appropriate discount rate for determining the present value of the expected cash flows. d. Apply traditional capital budgeting decision criteria such as net present value (NPV) and internal rate of return (IRR) to determine the acceptability of or priority ranking of potential projects. 2. Foreign Complexities. Capital budgeting for a foreign project is considerably more complex than the domestic case. What are the factors that add complexity? Capital budgeting for a foreign project is considerably more complex than the domestic case. Several factors contribute to this greater complexity: Parent cash flows must be distinguished from project cash flows. Each of these two types of flows contributes to a different view of value. Parent cash flows often depend on the form of financing. Thus we cannot clearly separate cash flows from financing decisions, as we can in domestic capital budgeting. Additional cash flows generated by a new investment in one foreign subsidiary may be in part or in whole taken away from another subsidiary, with the net result that the project is favorable from a single subsidiarys point of view but contributes nothing to worldwide cash flows. The parent must explicitly recognize remittance of funds because of differing tax systems, legal and political constraints on the movement of funds, local business norms, and differences in the way financial markets and institutions function. An array of nonfinancial payments can generate cash flows from subsidiaries to the parent, including payment of license fees and payments for imports from the parent. Managers must anticipate differing rates of national inflation because of their potential to cause changes in competitive position, and thus changes in cash flows over a period of time. Managers must keep the possibility of unanticipated foreign exchange rate changes in mind because of possible direct effects on the value of local cash flows, as well as indirect effects on the competitive position of the foreign subsidiary. Use of segmented national capital markets may create an opportunity for financial gains or may lead to additional financial costs. Use of host-government subsidized loans complicates both capital structure and the parents ability to determine an appropriate weighted average cost of capital for discounting purposes. Managers must evaluate political risk because political events can drastically reduce the value or availability of expected cash flows.

Terminal value is more difficult to estimate because potential purchasers from the host, parent, or third countries, or from the private or public sectors, may have widely divergent perspectives on the value to them of acquiring the project. 3. Project versus Parent Valuation. a. Why should a foreign project be evaluated both from a project and parent viewpoint? A strong theoretical argument exists in favor of analyzing any foreign project from the viewpoint of the parent. Cash flows to the parent are ultimately the basis for dividends to stockholders, reinvestment elsewhere in the world, repayment of corporate-wide debt, and other purposes that affect the firms many interest groups. However, since most of a projects cash flows to its parent, or to sister subsidiaries, are financial cash flows rather than operating cash flows, the parent viewpoint usually violates a cardinal concept of capital budgeting, namely, that financial cash flows should not be mixed with operating cash flows. Often the difference is not important because the two are almost identical, but in some instances a sharp divergence in these cash flows will exist. Evaluation of a project from the local viewpoint serves some useful purposes, but it should be subordinated to evaluation from the parents viewpoint. In evaluating a foreign projects performance relative to the potential of a competing project in the same host country, we must pay attention to the projects local return. Almost any project should at least be able to earn a cash return equal to the yield available on host government bonds with a maturity the same as the projects economic life, if a free market exists for such bonds. Host government bonds ordinarily reflect the local risk-free rate of return, including a premium equal to the expected rate of inflation. If a project cannot earn more than such a bond yield, the parent firm should buy host government bonds rather than invest in a riskier project. b. Which viewpoint, project or parent, gives results closer to the traditional meaning of net present value in capital budgeting? Multinational firms should invest only if they can earn a risk-adjusted return greater than locally based competitors can earn on the same project. If they are unable to earn superior returns on foreign projects, their stockholders would be better off buying shares in local firms, where possible, and letting those companies carry out the local projects. Apart from these theoretical arguments, surveys over the past 35 years show that in practice multinational firms continue to evaluate foreign investments from both the parent and project viewpoint. c. Which viewpoint gives results closer to the effect on consolidated earnings per share? The attention paid to project returns in various surveys probably reflects emphasis on maximizing reported consolidated net earnings per share as a corporate financial goal. As long as foreign earnings are not blocked, they can be consolidated with the earnings of both the remaining subsidiaries and the parent. As mentioned previously, U.S. firms must consolidate foreign subsidiaries that are over 50% owned. If a firm is owned between 20% and 49% by a parent, it is called an affiliate. Affiliates are consolidated with the parent owner on a pro rata basis. Subsidiaries less than 20% owned are normally carried as unconsolidated investments. Even in the case of temporarily blocked funds, some of the most mature MNEs do not necessarily eliminate a project from financial consideration. They take a very long-run view of world business opportunities. Cash Flow. Capital projects provide both operating cash flows and financial cash flows. Why are operating cash flows preferred for domestic capital budgeting but financial cash flows given major consideration in international projects? If reinvestment opportunities in the country where funds are blocked are at least equal to the parent firms required rate of return (after adjusting for anticipated exchange rate changes), temporary blockage of transfer may have little practical effect on the capital budgeting outcome, because future project cash flows will be increased by the returns on forced reinvestment. Since large multinationals hold a portfolio of domestic and foreign projects, corporate liquidity is not impaired if a few projects have blocked funds; alternate sources of funds are available to meet all planned uses of funds. Furthermore, a long-run historical perspective on blocked funds does indeed lend support to the belief that funds are almost never permanently blocked. However, waiting for the release of such funds can be frustrating, and sometimes the blocked funds lose value while blocked because of inflation or unexpected exchange rate deterioration, even though they have been reinvested in the host country to protect at least part of their value in real terms. 5. Risk-Adjusted Return. Should the anticipated internal rate of return (IRR) for a proposed foreign project be compared to (a) alternative home country proposals; (b) returns earned by local companies in the same industry and/or risk class; or (c) both of the above? Justify your answer. The key to distinction is risk-adjusted. Foreign projects will be, by most methodologies, be of higher risk than a domestic or home country project. The anticipated returns should therefore take this into consideration. At the same time, comparing expected returns with those earned by local companies in the target markets will not capture the cross-border risks (such as blocked funds) which a foreign investor may experience. In the end, the answer is (c), both of the above, and more.

4.

6.

Blocked Cash Flows. In the context of evaluating foreign investment proposals, how should a multinational firm evaluate cash flows in the host foreign country that are blocked from being repatriated to the firms home country? The impact of blocked funds on the rate of return from the investors perspective would depend on when the blockage occurs, what reinvestment opportunities exist for the blocked funds in the captive country, and when the blocked funds would eventually be released to the investor. As with all cash flow-based financial analyses, the critical element is when the parent investor will regain the ability to move the blocked funds freely.

7.

Host Country Inflation. How should a multinational enterprise (MNE) factor host country inflation into its evaluation of an investment proposal? Inflation is factored into the expected cash flows of the project rate of return. Relative inflation affects the expected exchange rate due to purchasing power parity.

8.

Cost of Equity. A foreign subsidiary does not have an independent cost of capital. However, in order to estimate the discount rate for a comparable host country firm, the analyst should try to calculate a hypothetical cost of capital. As part of this process, the analyst can estimate the subsidiarys proxy cost of equity by using the traditional equation: ke k rf (k m k rf). Define each variable in this equation and explain how the variable might be different for a proxy host country firm compared to the parent MNE.

The cost of capital and equity of a specific project or subsidiary such as this would be expressed in local currency terms, while the parent company will ultimately measure the projects expected returns and risks based on its own parent currency terms. Therefore, the risk free rate would be a local currency government bond or government bond yield. The market return would be the expected return on the market portfolio in the local market (typically based on recent historical returns). The local projects beta would be first based on other like firms in the local market and their historical covariance with the variance of the market. 9. Viewpoints. What are the differences in the cash flows used in a project point of view analysis and a parent point of view analysis? The project viewpoint focuses on the cash flows which are traditionally isolated and analyzed by any prospective investmentthe operational cash flows of the proposed project (initial investment, operating cash flows, terminal value). The parent viewpoint analysis, must however focus on those cash flows which flow between the parent and the project of any kindincluding operating cash flows (operating returns, intrafirm sales and margins, etc.) as well as financing cash flows (dividends as distributed to the parent from the project). There are many methods for evaluating the profitability of investment proposals. The various commonly used methods are: Traditional methods: (I) Payback period method (P.B.P) (II) Accounting Rate of return method (A.R.R) Time adjusted or discounting techniques: (I) Net Present value method (N.P.V) (II) Internal rate of return method (I.R.R) (III) Profitability index method (P.I) Pay-back period method: The pay back some times called as payout or pay off period method represents the period in which total investment in permanent assets pay back itself. This method is based on the principle that every capital expenditure pays itself back with in a certain period out of the additional earnings generated from the capital assets. Decision rule: A project is accepted if its payback period is less than the period specific decision rule. A project is accepted if its payback period is less than the period specified by the management and vice-versa. Pay Back Period Initial Cash Outflow = -----------------------------Annual Cash Inflows

Advantages: Simple to understand and easy to calculate. It saves in cost; it requires lesser time and labour as compared to other methods capital budgeting. In this method, as a project with a shorter pay back period is preferred to the one having a longer pay back period, it reduces the loss through obsolescence. Due to its short-term approach, this method is particularly suited to a firm which has shortage of cash or whose liquidity position is not good. Disadvantages:

It does not take into account the cash inflows earned after the pay back period and hence the true profitability of the project cannot be correctly assessed.

This method ignores the time value of the money and does not consider the magnitude and timing of cash inflows. It does not take into account the cost of capital, which is very important in making sound investment decisions. It is difficult to determine the minimum acceptable pay back period, which is subjective decision. It treats each asset individually in isolation with other assets, which is not feasible in real practice. Accounting Rate of Return Method This method takes into account the earnings from the investment over the whole life. It is known as average rate of return method because under this method the concept of accounting profit (NP after tax and depreciation) is used rather than cash inflows. According to this method, various projects are ranked in order of the rate of earnings or rate of return. Decision rule The project with higher rate of return is selected and vice versa. The return on investment method can be used in several ways, as

Average Rate of Return Method Under this method average profit after tax and depreciation is calculated and then it is divided by the total capital out lay. Average Annual profits (after dep. & tax) Average rate of return = ---------------------------------------------------x 100 Net Investment

Advantages:

It is very simple to understand and easy to calculate. It uses the entire earnings of a project in calculating rate of return and hence gives a true view of profitability. As this method is based upon accounting profit, it can be readily calculated from the financial data. Disadvantages:

profits.

It ignores the time value of money. It does not take in to account the cash flows, which are more important than the accounting

It ignores the period in which the profits are earned as a 20% rate of return in 2 years is considered to be better than 18% rate if return in 12 years. This method cannot be applied to a situation where investment in project is to be made in parts. Net Present Value Method The NPV method is a modern method of evaluating investment proposals. This method takes in to consideration the time value of money and attempts to calculate the return on investments by introducing time element. The net present values of all inflows and outflows of cash during the entire life of the project is determined separately for each year by discounting these flows with firms cost of capital or predetermined rate. The steps in this method are

1. Determine an appropriate rate of interest known as cut off rate. 2. Compute the present value of cash outflows at the above-determined discount rate. 3. Compute the present value of cash inflows at the predetermined rate.

4. Calculate the NPV of the project by subtracting the present value of cash outflows from present value of cash inflows. Decision rule Accept the project if the NPV of the project is 0 or +ve that is present value of cash inflows should be equal to or greater than the present value of cash outflows. Advantages: It recognizes the time value of money and is suitable to apply in a situation with uniform cash outflows and uneven cash inflows. It takes in to account the earnings over the entire life of the project and gives the true view of the profitability of the investment Takes in to consideration the objective of maximum profitability.

Disadvantages: More difficult to understand and operate. It may not give good results while comparing projects with unequal investment of funds. It is not easy to determine an appropriate discount rate. Internal Rate of Return Method The internal rate of return method is also a modern technique of capital budgeting that takes in to account the time value of money. It is also known as time-adjusted rate of return or trial and error yield method. Under this method the cash flows of a project are discounted at a suitable rate by hit and trial method, which equates the net present value so calculated to the amount of the investment. The internal rate of return can be defined as "that rate of discount at which the present value of cash inflows is equal to the present value of cash outflows". Decision Rule: Accept the proposal having the higher rate of return and vice versa. If IRR>K, accept project. If IRR<K, reject project. K = cost of capital.

Determination of IRR a) When annual cash flows are equal over the life of the asset. Initial Outlay Factor = --------------------------- x 100 Annual Cash Inflow b) When the annual cash flows are unequal over the life of the asset:

Pv of cash inflows at lower rate - Pv of cash outflows IRR = LR + ------------------------------------------------------------------------- (hr-lr) Pv of cash inflows at lower rate-Pv of cash inflows at higher rate

The steps are involved here are

1. Prepare the cash flow table using assumed discount rate to discount the net cash flows to the present value. 1. Find out the NPV, & if the NPV is positive, apply higher rate of discount. 1. If the higher discount rate still gives a positive NPV, increase the discount rate further. Until the NPV becomes zero. 1. If the NPV is negative, at a higher rate, NPV lies between these two rates. Advantages: It takes into account, the time value of money and can be applied in situations with even and even cash flows. It considers the profitability of the projects for its entire economic life. The determination of cost of capital is not a pre-requisite for the use of this method. It provides for uniform ranking of various proposals due to the percentage rate of return. This method is also compatible with the objective of maximum profitability. Disadvantages: It is difficult to understand and operate. The results of NPV and IRR methods may differ when the projects under evaluation differ in their size, life and timings of cash flows. This method is based on the assumption that the earnings are reinvested at the IRR for the remaining life of the project, which is not a justified assumption. Profitability index method: It is also a time-adjusted method of evaluating the investment proposals. PI also called benefit cost ratio or desirability factor is the relationship between present value of cash inflows and the present values of cash outflows. Thus PV of cash inflows Profitability index = -----------------------------------PV of cash outflows Advantages: Unlike net present value, the profitability index method is used to rank the projects even when the costs of the projects differ significantly. It recognizes the time value of money and is suitable to applied in a situation with uniform cash outflows and uneven cash inflows. It takes into an account the earnings over the entire life of the project and gives the true view of the profitability of the investment. Takes into consideration the objective of maximum profitability. Disadvantages: More difficult to understand and operate. It may not give good results while comparing projects with Unequal investment funds. It is not easy to determine and appropriate discount rate. It may not give good results while comparing projects with unequal lives as the project having higher NPV but have a longer life span may not be as desirable as a project having some what lesser NPV achieved in a much shorter span of life of the asset

Unit 5 V. Internal Sources of Funds A Equity Contributions i. Every new foreign subsidiary must receive some funds in the form of equity to satisfy both authorities in the host country and outside creditors about its solvency. ii. Sometimes, MNCs use an equity investment for their own foreign subsidiary. 1. This gives the foreign subsidiary an increased capital base to support additional loans. iii. Equity contributions of cash are used for the following: 1. To acquire going concerns. 2. To buy out local minority interests. 3. To set up new foreign subsidiaries. 4. To expand existing subsidiaries. iv. Common stockholders have residual claims on earnings and assets in the event of liquidation. 1. This makes an equity investment not very flexible for the investors, but most acceptable to the host country and outside creditors. v. Dividends are the profit remittances derived from equity investments. 1. They are typically subject to local income taxes and withholding taxes. B. Direct Loans i. MNCs may provide investment funds through intracompany loans. 1. The intracompany loan usually contains a specified repayment period for the loan principal. 2. The intracompany loans usually earn interest income that is taxed relatively lightly. ii. Parent loans are more popular than equity contribution for the following reasons: 1. Parent loans give a parent company greater flexibility in repatriating funds from its foreign subsidiary. 2. The tax rate is typically lower than the rate on dividends, making the tax burden lower. 3. MNCs can provide credit to their subsidiaries not only by making loans, but also by delaying the collection of accounts receivable. C. Parent Guarantees i. When foreign subsidiaries have difficulty borrowing money, a parent may affix its own guarantees. ii. There are four type of parent guarantees: 1. The parent may sign a purchase agreement under which it commits itself to buy its subsidiarys note from the lender in the event of the subsidiarys default. 2. The lender may be protected on only a part of the specific loan agreement. 3. Another type of guarantee is limited to a single loan agreement between a lender and the subsidiary. 4. The strongest type requires that the lender be protected on all loans to the subsidiary without limits on amount or time. D. Funds Provided by Operations i. Internal funds flows, i.e. retained earnings and depreciation, are the major sources of funds for newly formed subsidiaries. 1. Typically, these internal funds, paired with local credits, leave small need for funds from the parent. ii. Foreign subsidiaries are not always free to remit their earnings in hard currency elsewhere. 1. Many developing nations, due to balance of payments problems, restrict repatriation of funds. E. Loans for Sister Subsidiaries i. The availability of intersubsidiary credit greatly expands the number of possibilities for internal funding. 1. Many countries impose exchange restrictions on capital movements and this limits the range of possibilities for intersubsidiary loans. ii. The use of many intersubsidiary financial links makes it extremely difficult for the parent company to control its subsidiaries effectively. iii. An MNC may wish to have its central staff handle all excess funds or to establish a central pool of these funds on worldwide basis under two conditions: 1. The number of financial relationships does not exceed the capability of the main office to manage them effectively. 2. A parent company does not want to lose control over its subsidiaries. External Sources of Funds

VI.

A.

B.

Subsidiaries borrow local for the following reasons: i. Local debts represent automatic protection against losses from a devaluation of local currency. ii. Subsidiary debts frequently do not appear on the consolidated financial statement issued by a parent as part of its annual report. iii. Some host countries limit the amount of funds that foreign companies can import from outside the host country. iv. Foreign subsidiaries often borrow locally to maintain good relations with local banks. Commercial Banks i. Commercial banks are the most important external source of financing for nontrade international operations. ii. Most of the local loans obtained by subsidiaries are short-term credits. 1. They are largely used to finance inventory and accounts receivable. 2. They are self-liquidating loans to the extent that sufficient cash flows are produced to repay the credits as inventories are sold on credit and receivables are collected. iii. There are variety of principal instruments used by banks to service an MNCs request for a loan: 1. Overdrafts are a line of credit that permits the customer to write checks beyond deposits. a. The bank establishes the maximum amount. b. The borrower agrees to pay the amount overdrawn and interest on the credit. 2. Unsecured short-term loans are loans to cover seasonal increases in current assets that are made on an unsecured basis. a. Most MNCs prefer to borrow on a n unsecured basis because the bookkeeping costs of secured loans are high and because these loans have a number of highly restrictive provisions. 3. Bridge loans are short-term bank loans used while a borrower obtains long-term fixed rate loans from capital markets. a. Bridge loans are repaid when the permanent financing arrangement is completed. 4. Currency swaps are agreements to exchange one currency with another for a specified period after which the two currencies are re-exchanged. a. Arbi loans are the best know example of these swaps. b. Swaps allow the MNCs to borrow in one market for use in another market and to avoid foreign exchange risks. 5. Link financing is an arrangement where banks in strong-currency countries help subsidiaries in weak-currency countries obtain loans by guaranteeing repayment on the loans. a. Banks is strong-currency countries typically require some sort of deposits from the borrowers parent company. iv. Interest rate on must business loan are determined through direct negotiations between the borrower and the bank. 1. The prevailing lending rate and the credit worthiness of the borrower are the two major factors. 2. Interest rate may be paid in two different ways: a. On a collect basis where interest is paid at the maturity of the loan. This makes the effective rate of interest equal to the satiated rate of interest. b. On a discount basis where interest is paid in advance. This increases the effective rate of interest. v. Compensating balances are those that borrowers are required by their bank to keep their account. These are used to: 1. Cover the cost of accounts. 2. Increase the liquidity position of the borrower that can be used to pay off the loan in case of default. 3. Increase the effective costs of borrowing. vi. In reality, the value of the currency borrowed changes over time and this change affects the actual cost of a bank credit. 1. The effective interest rate is computed using the equation -r= (1 + if)(1 + ie) 1 a. r = the effective interest rate in U.S. dollars. b. if = the interest rate of the foreign currency.

c.

ie = the percentage change in the foreign currency against the U.S. dollar.

vii.

viii.

Edge Act and Agreement corporations are subsidiaries of American banks that are physically located in the United States but engage in international banking operations. 1. The Edge Act of 1919 allows American banks to perform as holding companies and to own stock in foreign banks. a. These banks con provide loans and other banking services for American-owned companies in most countries. 2. Edge Act corporations are domestic subsidiaries of banking organized charter by the Federal Reserve Board. 3. Agreement corporations are Edge equivalents chartered by individual states. 4. Both of these corporations engage in three types of activities: a. International banking, which includes the following: i. Hold demand and time deposits of foreign parties. ii. Make loans but these loans to any single borrower may not exceed 10 percent of their capital and surplus. iii. Open and confirm letters of credit. iv. Make loans or advances to finance foreign trade. v. Create bankers acceptances. vi. Receive items for collection. vii. Remit funds abroad. viii. Buy or sell securities. ix. Issue certain guarantees. x. Engage in foreign exchange transactions. b. International financing, which includes the following: i. Invest in the stock of nonblank financial concerns, development corporations, or commercial and industrial companies. ii. The major purpose of such financing activities is to provide promising foreign companies with capital at an early or important stage. c. Holding companies, which includes the following: i. Own shares of foreign baking subsidiaries and affiliates. ii. Member banks of the Federal Reserve System are not permitted to own shares of foreign banking subsidiaries. iii. A subsidiary can more advantageous than a branch for two reasons 1) foreign branches are allowed to carry on only the activities allowed to their parent banks in the U.S. and 2) certain countries do not permit non-domestic banks to open branches in their territory. International banking facilities (IBFs) (allowed since December of 1981) are vehicles that enable bank offices in the Unites States to accept time deposits in either dollars or foreign currency from foreign customers free of reserve requirements and other limitations. 1. Some states have exempted IBFs from state and local income taxes. 2. In other words, the creation of IBFs means the establishment of offshore banking facilities in the U.S. similar to other Eurocurrency market centers. 3. Two qualify for IBFs, institutions must be depository institutions, Edge or Agreement corporations, or U.S. branch offices of foreign banks that are legally authorized to do business. 4. IBFs have a the following advantages over foreign locations: a. Small banks can enter into the Eurocurrency market easily. b. U.S. banks can reduce operating costs because they have more direct control and use existing support services. 5. IBFs have the following disadvantages over foreign locations: a. IBFs must receive writer acknowledgement from their customers that deposits do not support activities within the U.S. and that IBF loans finance only operations outside the U.S. b. IBFs are prohibited from offering demand deposits or transaction accounts that could possibly substitute for such accounts now held by nonresidents in U.S. banks. c. IBFs are prevented from issuing negotiable certificates of deposits or bankers acceptances through they can issue letters of credit and undertake repurchase agreements.

d. C.

Time deposits offered to nonbank foreign residents require minimum deposits and withdrawal of $100,00 to preserve the wholesale nature of the business.

D.