Professional Documents

Culture Documents

C Suv Enfin 6305

Uploaded by

hserus0072184Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C Suv Enfin 6305

Uploaded by

hserus0072184Copyright:

Available Formats

CSU East Bay-Hayward Campus New Venture Financing #6305

Instructor: Paul Emery Email: paul.emery@csueastbay.edu Office Hours: Mondays 5:30-6:30pm Office: VBT 336, Tel 510-885-4175

CLASS MEETING: MONDAYS 6:30-10:00PM, A&E #379 COURSE DESCRIPTION This graduate course covers the approximately 40 year-old financing technique of venture capital financing for start-up, high-risk, high-growth, entrepreneurial ventures particularly start-up and early stage ventures. We approach this relatively new and unique financing practice from both the venture investors and the entrepreneurs perspective. Our focus is on blending traditional financial and management theory with current venture investing practices as experienced today, particularly in the Silicon Valley, the worlds leading source of venture capital sourcing. INTENDED AUDIENCE This course is designed for the graduate student seeking a specialization in finance and/or entrepreneurialism. Students seriously considering launching a company to pursue an innovative service or product concept, to work with an entrepreneur in such an endeavor, and students of finance who are seeking a career in the financial services sector specializing in entrepreneurial ventures will find this course especially useful. LEARNING OBJECTIVES and STUDENT OUTCOMES: Upon successful completion of this course, you will be able to: Understand the requirements for venture investments to finance new ventures from the investors and entrepreneurs standpoint Calculate valuation models and prepare deal structures Assess governance requirements, after the investment and with follow-on investment rounds Plan for liquidity events/exit strategies

REQUIRED TEXTBOOK: Venture Capital, Private Equity, and the Financing of Entrepreneurship; Lerner, Leamon, Hardymon; Copyright@2012 John Wiley & Sons, Inc. Recommended: Venture Capital and Private Equity A Casebook, Lerner, Leamon, Hardymon, 5th Edition, John Wiley & Sons, Inc. References: Venture Capital & the Finance of Innovation, Metrick & Yasuda, 2nd Edition, John Wiley & Sons, Inc.; Entrepreneurial Finance, Leach & Melcher, 4th Edition, SouthWestern Cengage Learning. Access to the Wall Street Journal, The Financial Times, Silicon Valley Business Journal, Business Week and other business periodicals is helpful. PREREQUISITE: All fundamental courses and Fin 6215

INSTRUCTIONAL METHODOLOGY Adult learning theory will be used to conduct the class. While a significant portion of the class time will consist of a lecture format, a significant amount of learning will consist of class discussion and group activities. Interactive and relevant class discussions from the students perspective are essential for enhancing the comprehension of material and for fostering greater critical thinking and application skills. The classroom setting is informal your questions and contributions are always welcomed and encouraged. Students are also encouraged to keep in mind that we are a learning community, and each individual student should be given the opportunity to express their thoughts, ask questions, and participate fully while being respectful of the views of others. Academic and inquisitive questioning is more than welcome. Utilizing enabling technology, this course provides an effective blend of interactive discussion where we learn from the experiences of each other, outside speakers, and our instructors practical experiences and academic training.. Our course will utilize the following formats during the course: Lecture Interactive discussion Small group project presentation

PHILOSOPHY OF CLASS Utilizing a unique combination of academic theory, practical business experience, and a sharing of views and experiences among class members, and outside speakers, this course is designed to give you a perspective on how to successfully obtain venture financing and work with venture investors for the benefit of all shareholders. STUDENT SUCCESS What does it take to succeed in a CSU East Bay course? As such, in is strongly urged to:

There is a lot of material to cover and much of it may be unfamiliar to you. order to successfully accomplish the course objectives, each student

Complete all assignments on time, move through the course as assigned, and make a firm commitment for completion of the course. Develop a study plan that will work for each individual. You need to budget your time in order to organize your work efforts to cover scheduled readings and assignments on a timely basis. Be an active learner. Take responsibility for your learning. Education is a combination of working independently on assignments, learning from lectures and classroom discussion and out of class interaction with classmates. This style of learning allows an individual a greater opportunity to learn the material presented and a freedom in terms of the amount of effort you put into the course. With this freedom comes the need for an even higher level of personal responsibility and discipline in terms of completing your work on time, monitoring your progress and ultimately achieving your own grade. Ask questions when you do not understand the material or have experienced events seemingly contrary to the discussion or text material. Be assertive in seeking out help. Students are encouraged to read the chapters prior to class discussion. In this way they will be able to participate in and benefit fully from class discussions. Due to the complexity of material, students are also encouraged to read assignments more than once; often a second reading is extremely helpful in developing a basic grasp of the underlying principles and concepts. Familiarize yourself with and follow the Universitys policy on Academic Integrity.

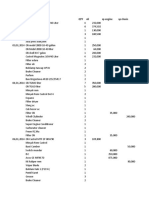

ATTENDANCE Students should make a determined effort to attend all classes. Missing even one class may mean that you have missed a critical element for the understanding of later materialas much of what you will learn is contemporaneous in the classroom. Some of the material literally evolves from classroom discussions and unique experiences discussed in the classroom. You should also try to be punctual because late arrival tends to be disruptive. Excused absences are those situations that are brought to the instructor before the absence with a legitimate reason for missing and instructor approval in advance of the absence. If you do miss a class your absence will have an effect on your final grade as lecture material, speaker discussions, and class discussions are not always found in a text or on a website. Students should be sure to read relevant sections of the text for the session that is missed. GRADING/MARKING All assignments must be turned when due for credit no late assignments are accepted. Final grades are dependent upon: Attendance/Participation Case Assignment Shark Tank Assignment Group Case Assignment Group Project Completion 20% 10% 20% 20% 30%

GRADING SCALE: 90-100 A 80-89 B 70-79 C COURSE PERSPECTIVES: Uniquely, this course incorporates both traditional quantitative and qualitative analyses. This includes analysis of VCs decisions whether to fund a start-up company and a boards decision how to optimally raise funding. The nature of the subject matter is such that you will encounter ambiguities which defy formulaic solutions. Making sound judgments under such conditions requires an analytic understanding of the situation.

COURSE/CHAPTER COVERAGE: Week One Introduction Discussion of class background, expertise, and future plans; instructor background and experience Text Chapters 1-2 Private Equity Sector Yashuda Chapters 1,2,3,5 Week Two Deal Sourcing Structure, Due Diligence Requirements Text Chapter 3 Its Not as Easy as it Looks Yashuda Chapters 7, 19 **Assignment Due: Case Studies: Firm Strategy Vignettes-What would you do? Why? Week Three Developing Business Plans & Approaches Melicher Chapter 2 The Executive Summary: Mobile Company, Telecom Company What do Investors Want to Know? Week Four Assigning Value Valuation Techniques Text Chapter 4 Valuation Yashuda Chapters 10, 11, 12, 13 Proposed Speaker: Private Equity Investment Bankers Role **Assignment Due: Review Aswath Damodaran, Valuing Young, Start-up and Growth Companies: Estimation Issues and Valuation Challenges (adamodar@stern.nyu.edu) paper. What major challenges citedhow would you overcome? Week Five Deal Structuring Term Sheets Text Chapter 5 Deal Structuring Private Equity Securities and Their Motivation Yashuda Chapters 8, 9 **Shark Tank Assignment: From Friday night (if show is cancelled Friday night, Saturday night) What worked and what did not work? Week Six High Growth Strategies: Management, Governance, Follow-on Investments Text Chapter 6 After the Money Arrives Yashuda Chapter 15 **Assignment Due: Case Study: Metapath Software

Week Seven Liquidity Events/Exit Planning Text Chapters 7, 9 Achieving Liquidity/Risk and Return Melicher Chapter 14 Proposed Speaker: Bank Financings Role Week Eight Globalization of VC and Private Equity Text Chapter 8 The Globalization of Venture Capital and Private Equity Yashuda Chapter 6 References: Founders Institute, Green Momentum, Chile VC Consortium **Shark Tank Assignment: From Friday night (If show is cancelled Friday night, then Saturday night) What worked and what did not work? Week Nine Private Equity How it Impacts Society Text Chapters 10, 13 Societal Impacts/Booms and Busts Proposed Speaker: Outside Corporate Counsels Role Week Ten Project Presentations GENERAL GRADING COMMENTS: All assignments are taken seriously as they tell me how well you are comprehending and processing the information discussed in the classroom. The educational emphasis throughout the course is on learning how to make good judgments about companies and investment opportunities under high degrees of uncertainty and potential conflicts of interest, and understanding the processes and techniques involved in financing start-up and early-stage ventures. Each assignment is to be typewritten, double-spaced and turned in on or before the class date/time due in accordance with this course syllabus. Shark Tank assignments are based upon watching and critiquing the ideas pitched to the venture capitalist panel. Shark Tank appears on the ABC network on Friday nights at 8:00PM. Each show features four entrepreneurs seeking funding for their businesses. Your assignment is to critically review and analyze their presentations identifying the strengths and weaknesses in their delivery and products or services. Also, state what questions you have that the sharks did not ask and the entrepreneurs did not cover in their presentations. Group Course Project assignment will be due, in written form and orally presented at our last meeting. Group size and membership will be determined based on the total class size. Your written reports should be no longer than 20 pages (plus schedules/appendices), double-spaced with a #12 font. Your grade for this project will be comprised of my

assessment of your oral and written presentation which will be based upon your research conducted and cited, the reality of your market(s) size and growth, the probability of your revenue growth projections, and your financial forecasts, your valuation judgments and rationale, the professionalism of your presentation and the projects probability for attracting and achieving venture capital funding. Also, the class will be asked to rank each oral presentation using a 1-5 scale and you will each rank each team members contribution and performance for the team project. You will have team points totaling the number of members, less yourself (in example, you would be granted 5 points for a 6-person team and you are to allocate the 5 points x2, or 10 points over your team members as you evaluate their efforts and contribution to the projects success. You will allocate 10 points over your team members in this instance)

ADMINISTRATIVE MATTERS: University Policy on Academic Dishonesty and CheatingBy enrolling in this class, the student agrees to uphold the standards of academic integrity described in the catalog at http://www.csueastbay.edu/ecat/current/i-120grading.html#section12 Accommodations for students with disabilities If you have a documented disability and wish to discuss academic accommodations, or if you would need assistance in the event of an emergency evacuation, please contact me as soon as possible. Students with disabilities needing accommodation should speak with Accessibility Services. Emergency InformationInformation on what to do in an emergency situation (earthquake, electrical outage, fire, extreme heat, severe storm, hazardous materials, terrorist attack) may be found at http://www.aba.csueastbay.edu/EHS/emergency_ mgnt.htm. Please be familiar with these procedures. Information is updated as required and should be reviewed on a regular basis.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fact Sheet Rocket StovesDocument2 pagesFact Sheet Rocket StovesMorana100% (1)

- FZ16 9B 1KD2 (Patada) PDFDocument62 pagesFZ16 9B 1KD2 (Patada) PDFPanthukalathil Ram100% (1)

- 10 Consulting Frameworks To Learn For Case Interview - MConsultingPrepDocument25 pages10 Consulting Frameworks To Learn For Case Interview - MConsultingPrepTushar KumarNo ratings yet

- Anthony Flagg's Complaint Against Eddie LongDocument23 pagesAnthony Flagg's Complaint Against Eddie LongRod McCullom100% (1)

- Superior University: 5Mwp Solar Power Plant ProjectDocument3 pagesSuperior University: 5Mwp Solar Power Plant ProjectdaniyalNo ratings yet

- Presentation of The LordDocument1 pagePresentation of The LordSarah JonesNo ratings yet

- Verifyning GC MethodDocument3 pagesVerifyning GC MethodHristova HristovaNo ratings yet

- Final Project Report: Uop, LLCDocument165 pagesFinal Project Report: Uop, LLCSiddharth KishanNo ratings yet

- Parasim CADENCEDocument166 pagesParasim CADENCEvpsampathNo ratings yet

- Embedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDocument27 pagesEmbedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDhirenKumarGoleyNo ratings yet

- Perbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraDocument9 pagesPerbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraRendy SuryaNo ratings yet

- Youtube AlgorithmDocument27 pagesYoutube AlgorithmShubham FarakateNo ratings yet

- Why Companies Choose Corporate Bonds Over Bank LoansDocument31 pagesWhy Companies Choose Corporate Bonds Over Bank Loansতোফায়েল আহমেদNo ratings yet

- Upgrade DB 10.2.0.4 12.1.0Document15 pagesUpgrade DB 10.2.0.4 12.1.0abhishekNo ratings yet

- Continuous torque monitoring improves predictive maintenanceDocument13 pagesContinuous torque monitoring improves predictive maintenancemlouredocasadoNo ratings yet

- Presentation Pineda Research CenterDocument11 pagesPresentation Pineda Research CenterPinedaMongeNo ratings yet

- Company's Profile Presentation (Mauritius Commercial Bank)Document23 pagesCompany's Profile Presentation (Mauritius Commercial Bank)ashairways100% (2)

- I-Parcel User GuideDocument57 pagesI-Parcel User GuideBrian GrayNo ratings yet

- UKBM 2, Bahasa InggrisDocument10 pagesUKBM 2, Bahasa InggrisElvi SNo ratings yet

- How To Open and Convert An .SCM FileDocument5 pagesHow To Open and Convert An .SCM FilejackNo ratings yet

- 1 N 2Document327 pages1 N 2Muhammad MunifNo ratings yet

- The Punjab Commission On The Status of Women Act 2014 PDFDocument7 pagesThe Punjab Commission On The Status of Women Act 2014 PDFPhdf MultanNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesAdonis BesaNo ratings yet

- 01 NumberSystemsDocument49 pages01 NumberSystemsSasankNo ratings yet

- Exercise No. 7: AIM: To Prepare STATE CHART DIAGRAM For Weather Forecasting System. Requirements: Hardware InterfacesDocument4 pagesExercise No. 7: AIM: To Prepare STATE CHART DIAGRAM For Weather Forecasting System. Requirements: Hardware InterfacesPriyanshu SinghalNo ratings yet

- Recommended lubricants and refill capacitiesDocument2 pagesRecommended lubricants and refill capacitiestele123No ratings yet

- Jenga Cash Flow Solution: InstructionsDocument1 pageJenga Cash Flow Solution: InstructionsPirvuNo ratings yet

- Specialized Government BanksDocument5 pagesSpecialized Government BanksCarazelli AysonNo ratings yet

- Ridge Regression: A Concise GuideDocument132 pagesRidge Regression: A Concise GuideprinceNo ratings yet

- Hillingdon Health Visiting ServiceDocument12 pagesHillingdon Health Visiting ServiceAnnikaNo ratings yet