Professional Documents

Culture Documents

Er20120413BullPhat Dragon A

Uploaded by

ChrisBeckerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Er20120413BullPhat Dragon A

Uploaded by

ChrisBeckerCopyright:

Available Formats

Phat dragon

13 April 2012

# 103a

a weekly chronicle of the Chinese economy

Phat Dragons forecast - put forward with the usual amount of

trepidation and a lavish helping of caveats - wasnt too far from the money in the end. The economy reportedly expanded 8.1% from a year ago in Q1 (consensus 8.4%, Phat Dragon 8.2%, lower bound of the credible forecast range 7%) down from 8.9% in Q4 and 9.7% at this time in 2011. The slowdown in real GDP is significantly milder than that observed across a broad range of other indicators of activity, but a volume deceleration of 1.8ppt over a year is certainly not a trivial one. In nominal terms the scale of deceleration is much larger, reflecting the disinflationary state imposed by the austere policy environment through 2011. Nominal GDP reportedly expanded by 11.2%yr in Q1, a steep decline from 16.6% in Q4 and 17.5% a year ago. The implicit price deflator is now just 3.1%yr, having been as high as 9% just two quarters ago. A sharp downward move in the fixed investment deflator (from 5.7% in Q4 to just 2.3% in Q1) was a key contributor there. In the quarter itself, the NBS estimates that the seasonal adjusted growth rate was 1.8%. Phat Dragon has historically tended to be dismissive of these estimates. Some things never change.

16 14 12 10 8

Chinese GDP & the money supply

%yr

Sources: Westpac Economics, CEIC

%yr

30

GDP (lhs) M2 (rhs)

25

20

15

6 10 Dec-99 Dec-01 Dec-03 Dec-05 Dec-07 Dec-09 Dec-11 Dec-13

Various measures of inflation

15 10 5 0

Fixed investment price index

%yr

Sources: CEIC, Westpac Economics.

%yr

15 10 5 0

On the broadest sectoral basis, Phat Dragon notes that primary,

secondary and tertiary activity are all now expanding at single digit paces. That was the case for five quarters beginning in Q3 of 2008 and it was the norm for the bulk of the Asian Crisis-banking crisis-tech wreck phase either side of the turn of the millennium. Otherwise, it just hasnt happened. While one can certainly argue that the slowdown is not deep it is certainly broad.

-5

Consumer price index GDP implicit price deflator

-5 -10

As noted above, the deflator for capex slowed quite abruptly in

Producer price index

Q1. Phat Dragon puts real fixed investment at 18.8%yr in March, against a nominal pace of 21.1%. The nominal value of projects under the auspices of local government have slowed from above 30% last November to 23% in March while central projects remain in negative growth territory. In terms of sectoral trends, manufacturing slowed, utilities firmed and transport narrowed the rate of contraction carried from last year. Residential real estate slowed, with the nominal ytd rate below 20% for the first time since December 2009. The volume of construction starts are now contracting year-over-year (4%), joining sales (13%), while completions are up (rhetorical pause) 32%.

-10 Mar-04Mar-05Mar-06Mar-07Mar-08Mar-09Mar-10Mar-11Mar-12

Key indicators: pace of slowdown easing

30 25 20 15 10 5 0 -5 -10 -15

Sources: Westpac, CEIC. All indicators in volume terms except for imports and exports, which are nominal USDs.

%yr

Dec-10 Dec-11

%yr

30 25 20 15 10 5 0 -5 -10 -15

Industrial production was basically steady at 11.9%yr in March,

while Phat Dragons core index is showing signs of consolidating in the mid to high single digit range, with a 5.8% outcome across Q1. Steel, energy and cement volumes have steadied around 7-8%. Automobile output is bouncing around in the low single digits while sales are basically flat in terms of unit growth, while the annualised level of sales is around 17 million, which is a touch below the average of 2011H2. Retail sales, a series that does not have Phat Dragons seal of approval, came in at 14.8%ytd, a moderate firming from February. Given that food prices accelerated in March, it is safe enough to allocate the gain to a nominal effect on the price of staples, rather than a discretionary rise in spending.

Economic Research

Real GDP Core IVA

Steel

Cement

Exports

Imports

Real fixed Housing Auto sales investment sales

The overall picture is of an economy that is in need of a more

accommodative policy stance - the new evidence in favour of Phat Dragon expounded in this mornings chronicle.

Stats of the week: The share of Chinas oil imports coming

from Africa rose by 23ppts in the ten years from 1995.

www.westpac.com.au economics@westpac.com.au

Westpac Institutional Banking Group

Westpac Institutional Bank is a division of Westpac Banking Corporation ABN 33 007 457 141. Information current as at date above. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs. Westpacs financial services guide can be obtained by calling 132 032, visiting www.westpac.com.au or visiting any Westpac Branch. The information may contain material provided directly by third parties, and while such material is published with permission, Westpac accepts no responsibility for the accuracy or completeness of any such material. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice and Westpac is under no obligation to update the information or correct any inaccuracy which may become apparent at a later date. Westpac Banking Corporation is registered in England as a branch (branch number BR000106) and is authorised and regulated by The Financial Services Authority. Westpac Europe Limited is a company registered in England (number 05660023) and is authorised and regulated by The Financial Services Authority. Westpac operates in the United States of America as a federally chartered branch, regulated by the Office of the Controller of the Currency and is not affiliated with either: (i) a broker dealer registered with the US Securities Exchange Commission; or (ii) a Futures Commission Merchant registered with the US Commodity Futures Trading Commission. If you wish to be removed from our e-mail, fax or mailing list please send an e-mail to economics@westpac.com.au or fax us on +61 2 8254 6934 or write to Westpac Economics at Level 2, 275 Kent Street, Sydney NSW 2000. Please state your full name, telephone/fax number and company details on all correspondence. 2012 Westpac Banking Corporation. Past performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

You might also like

- Er 20111026 Bull PhatdragonDocument1 pageEr 20111026 Bull Phatdragondavid_llewellyn3788No ratings yet

- Er 20120426 Bull Phat DragonDocument1 pageEr 20120426 Bull Phat DragonCourtney PowellNo ratings yet

- Er 20120312 Bull PhatdragonDocument1 pageEr 20120312 Bull PhatdragonChrisBeckerNo ratings yet

- Er 20130415 Bull Phat DragonDocument3 pagesEr 20130415 Bull Phat DragonBelinda WinkelmanNo ratings yet

- Er 20130228 Bull Phat DragonDocument2 pagesEr 20130228 Bull Phat DragonBelinda WinkelmanNo ratings yet

- 1Q12 GDP - Hurdles Along The Way: Economic UpdateDocument9 pages1Q12 GDP - Hurdles Along The Way: Economic UpdateenleeNo ratings yet

- Er 20111124 Bull PhatdragonDocument1 pageEr 20111124 Bull Phatdragonftforee2No ratings yet

- Er 20130513 Bull Phat DragonDocument3 pagesEr 20130513 Bull Phat DragonBelinda WinkelmanNo ratings yet

- Er 20111006 Bull PhatdragonDocument1 pageEr 20111006 Bull Phatdragondavid_llewellyn9140No ratings yet

- Phat Dragons (Westpac) Weekly Chronicle of The Chinese Economy 16.01.2013Document2 pagesPhat Dragons (Westpac) Weekly Chronicle of The Chinese Economy 16.01.2013leithvanonselenNo ratings yet

- er20130409BullPhatDragon PDFDocument3 pageser20130409BullPhatDragon PDFCatherine LawrenceNo ratings yet

- Full S&P Rating StatementDocument13 pagesFull S&P Rating StatementFadia SalieNo ratings yet

- er20130130BullPhatDragon PDFDocument2 pageser20130130BullPhatDragon PDFBelinda WinkelmanNo ratings yet

- How Countries CompeteDocument137 pagesHow Countries CompeteJim Freud100% (3)

- F F y Y: Ear Uls MmetrDocument4 pagesF F y Y: Ear Uls MmetrChrisBeckerNo ratings yet

- Report of Economic CommitteeDocument13 pagesReport of Economic CommitteekathyskwoNo ratings yet

- Er 20111027 Bull PhatdragonDocument1 pageEr 20111027 Bull Phatdragondavid_llewellyn9804No ratings yet

- er20130624BullPhatDragon PDFDocument3 pageser20130624BullPhatDragon PDFJesse BarnesNo ratings yet

- Economy Update 121211Document3 pagesEconomy Update 121211raviudeshi14No ratings yet

- er20130322BullPhatDragon PDFDocument3 pageser20130322BullPhatDragon PDFHeidi TaylorNo ratings yet

- Er 20130311 Bull Phat DragonDocument2 pagesEr 20130311 Bull Phat DragonBelinda WinkelmanNo ratings yet

- GDP Fy14 Adv Est - 7 Feb 2014Document4 pagesGDP Fy14 Adv Est - 7 Feb 2014mkmanish1No ratings yet

- EAC Highlights 2011 12Document5 pagesEAC Highlights 2011 12Ishaan GoelNo ratings yet

- Er 20130612 Bull Phat DragonDocument3 pagesEr 20130612 Bull Phat DragonDavid SmithNo ratings yet

- Rs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundDocument23 pagesRs. 1 Crore Rs. 4.5 Crores: NAFA Stock FundSohail HanifNo ratings yet

- Equity Research: Earnings TrackerDocument5 pagesEquity Research: Earnings Trackertrend2trader2169No ratings yet

- Australian CAPEX: Investment Plans Scaled BackDocument3 pagesAustralian CAPEX: Investment Plans Scaled BackAdam JonesNo ratings yet

- ALL - Lack of ST TriggersDocument8 pagesALL - Lack of ST TriggersClarisa SepliarskyNo ratings yet

- International Monetary Fund: Hina Conomic UtlookDocument10 pagesInternational Monetary Fund: Hina Conomic UtlooktoobaziNo ratings yet

- er20130306BullPhatDragon PDFDocument2 pageser20130306BullPhatDragon PDFBrian FordNo ratings yet

- Investment and Growth: 1.1 Contribution AnalysisDocument5 pagesInvestment and Growth: 1.1 Contribution AnalysisaoulakhNo ratings yet

- Stock Analysis of PLDT CompanyDocument37 pagesStock Analysis of PLDT CompanyRon Jason100% (1)

- Material Evidence: ResearchDocument12 pagesMaterial Evidence: Researchfreemind3682No ratings yet

- Fearful Symmetry Nov 2011Document4 pagesFearful Symmetry Nov 2011ChrisBeckerNo ratings yet

- Myanmar Business GuideDocument40 pagesMyanmar Business GuideAlessandra ValentiNo ratings yet

- Myanmar Business GuideDocument40 pagesMyanmar Business GuideKo Nge100% (2)

- F F y Y: Ear Uls MmetrDocument5 pagesF F y Y: Ear Uls MmetrBelinda WinkelmanNo ratings yet

- International Marketing ComparisonDocument8 pagesInternational Marketing ComparisonNapa ChuenjaiNo ratings yet

- Country Report Zimbabwe 4th Quarter 2018Document26 pagesCountry Report Zimbabwe 4th Quarter 2018Marcus HowardNo ratings yet

- KPMG Zimbabwe 2012Q2Document4 pagesKPMG Zimbabwe 2012Q2Arvind ChariNo ratings yet

- Phat Dragons Weekly Chronicle of The Chinese Economy (28 August 2013)Document3 pagesPhat Dragons Weekly Chronicle of The Chinese Economy (28 August 2013)leithvanonselenNo ratings yet

- Fixed Income With All The Risk Is There ValueDocument7 pagesFixed Income With All The Risk Is There ValueTimNo ratings yet

- Er 20130222 Bull Phat DragonDocument2 pagesEr 20130222 Bull Phat DragonBelinda WinkelmanNo ratings yet

- US Economic Update - July11Document3 pagesUS Economic Update - July11timurrsNo ratings yet

- Er 20120911 Bull Phat DragonDocument2 pagesEr 20120911 Bull Phat DragonLuke Campbell-SmithNo ratings yet

- Delarue ErDocument98 pagesDelarue ErShawn PantophletNo ratings yet

- Frontier Markets HighlightsDocument4 pagesFrontier Markets HighlightsVivian HoNo ratings yet

- 11 Finance and DevelopmentDocument6 pages11 Finance and DevelopmentM IshaqNo ratings yet

- HSBC 12072010 Vietnam MonitorDocument16 pagesHSBC 12072010 Vietnam MonitorNguyen Xuan QuangNo ratings yet

- 2012 05 MacroEcoDocument3 pages2012 05 MacroEcoSunny SinghNo ratings yet

- The Impact of Lower RatesDocument17 pagesThe Impact of Lower RatesSoberLookNo ratings yet

- Barclays - The Emerging Markets Quarterly - Vietnam - Sep 2012Document3 pagesBarclays - The Emerging Markets Quarterly - Vietnam - Sep 2012SIVVA2No ratings yet

- 2016 Nov 7 DailyDocument3 pages2016 Nov 7 DailyshadapaaakNo ratings yet

- Interpretation of Key Economic Indicators: IIP IndexDocument4 pagesInterpretation of Key Economic Indicators: IIP IndexAARTI SINGHNo ratings yet

- Financial Analysis Project FinishedDocument33 pagesFinancial Analysis Project Finishedapi-312209549No ratings yet

- EIB Investment Report 2018/2019: Retooling Europe's economyFrom EverandEIB Investment Report 2018/2019: Retooling Europe's economyNo ratings yet

- Telephone Answering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandTelephone Answering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- EIB Working Papers 2019/08 - Investment: What holds Romanian firms back?From EverandEIB Working Papers 2019/08 - Investment: What holds Romanian firms back?No ratings yet

- Forecasting Business Investment Using The Capital Expenditure SurveyDocument10 pagesForecasting Business Investment Using The Capital Expenditure SurveyChrisBeckerNo ratings yet

- GNW 1Q12 Australia IPO Announcement FinalDocument3 pagesGNW 1Q12 Australia IPO Announcement FinalChrisBeckerNo ratings yet

- Er 20120815 Bull Consumer SentimentDocument2 pagesEr 20120815 Bull Consumer SentimentChrisBeckerNo ratings yet

- Economics: Issues: Global Food Price Inflation Risks Rising Again?Document6 pagesEconomics: Issues: Global Food Price Inflation Risks Rising Again?ChrisBeckerNo ratings yet

- Land Report Media Release Dec 11 QTRDocument2 pagesLand Report Media Release Dec 11 QTRChrisBeckerNo ratings yet

- Wage Price Index: Chart Pack Updating The Latest Granular Information On Australia WagesDocument36 pagesWage Price Index: Chart Pack Updating The Latest Granular Information On Australia WagesChrisBeckerNo ratings yet

- ANZ Commodity Daily 631 250512Document5 pagesANZ Commodity Daily 631 250512ChrisBeckerNo ratings yet

- Er 20120418 Bull Leading IndexDocument1 pageEr 20120418 Bull Leading IndexChrisBeckerNo ratings yet

- Er 20120413 Bull Ausconhsepriceexpt AprDocument2 pagesEr 20120413 Bull Ausconhsepriceexpt AprChrisBeckerNo ratings yet

- ANZ April Rates Review FINAL - ZyxDocument2 pagesANZ April Rates Review FINAL - ZyxChrisBeckerNo ratings yet

- Presbe2012 9eDocument2 pagesPresbe2012 9eChrisBeckerNo ratings yet

- ANZ Commodity Daily 605 180412Document5 pagesANZ Commodity Daily 605 180412ChrisBeckerNo ratings yet

- ANZ Commodity Daily 603 130412Document5 pagesANZ Commodity Daily 603 130412ChrisBeckerNo ratings yet

- June 2011 Annual Superannuation BulletinDocument52 pagesJune 2011 Annual Superannuation BulletinChrisBeckerNo ratings yet

- 2012m03 Press ReleaseDocument10 pages2012m03 Press ReleaseChrisBeckerNo ratings yet

- ANZ Ag Morning Note - 120410Document4 pagesANZ Ag Morning Note - 120410ChrisBeckerNo ratings yet

- 0900 B 8 C 084 Eb 89 e 5Document18 pages0900 B 8 C 084 Eb 89 e 5ChrisBeckerNo ratings yet

- 2012m03 Press ReleaseDocument10 pages2012m03 Press ReleaseChrisBeckerNo ratings yet

- ANZ Job Ads March 2012Document17 pagesANZ Job Ads March 2012ChrisBeckerNo ratings yet

- ANZ Commodity Daily 600 100412Document8 pagesANZ Commodity Daily 600 100412ChrisBeckerNo ratings yet

- Economics: Update: Australian March PSIDocument4 pagesEconomics: Update: Australian March PSIChrisBeckerNo ratings yet

- ANZ Commodity Daily 599 050412Document5 pagesANZ Commodity Daily 599 050412ChrisBeckerNo ratings yet

- ANZ Commodity Daily 598 040412Document5 pagesANZ Commodity Daily 598 040412ChrisBeckerNo ratings yet

- Australian Economics Weekly 120330Document17 pagesAustralian Economics Weekly 120330ChrisBeckerNo ratings yet

- ANZ Rates Strategy Update 30 March 2012Document7 pagesANZ Rates Strategy Update 30 March 2012ChrisBeckerNo ratings yet

- March 2012 Manufacturing PMIDocument2 pagesMarch 2012 Manufacturing PMIChrisBeckerNo ratings yet

- Er 20120330 Bull April RBAMeetingDocument3 pagesEr 20120330 Bull April RBAMeetingChrisBeckerNo ratings yet

- ANZ Commodity Daily 597 300312Document5 pagesANZ Commodity Daily 597 300312ChrisBeckerNo ratings yet

- State Economic Update - Mar 2012Document11 pagesState Economic Update - Mar 2012ChrisBeckerNo ratings yet

- Audit of Inventories: The Use of Assertions in Obtaining Audit EvidenceDocument9 pagesAudit of Inventories: The Use of Assertions in Obtaining Audit EvidencemoNo ratings yet

- SAFE National Test OutlineDocument17 pagesSAFE National Test Outlinejshen5No ratings yet

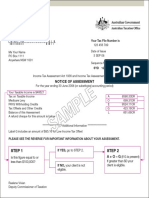

- Step 1 Step 2: Notice of AssessmentDocument1 pageStep 1 Step 2: Notice of Assessmentabinash manandharNo ratings yet

- Section 14 Unab Rid Dged Written VersionDocument17 pagesSection 14 Unab Rid Dged Written VersionPrashant TrivediNo ratings yet

- G.R. No. 201665Document11 pagesG.R. No. 201665ailynvdsNo ratings yet

- Invoice - Ali Abid - 000660485Document1 pageInvoice - Ali Abid - 000660485AliAbidNo ratings yet

- 10.digest. NG Cho Cio VS NG DiogDocument2 pages10.digest. NG Cho Cio VS NG DiogXing Keet LuNo ratings yet

- Eicher Motors BSDocument2 pagesEicher Motors BSVaishnav SunilNo ratings yet

- Continuous Futures Data Series For Back Testing and Technical AnalysisDocument6 pagesContinuous Futures Data Series For Back Testing and Technical AnalysisIshan SaneNo ratings yet

- PXP Energy Corporation (Formerly Philex Petroleum Corporation) ("PXP" or "The Company"), Is ADocument2 pagesPXP Energy Corporation (Formerly Philex Petroleum Corporation) ("PXP" or "The Company"), Is ABERNA RIVERANo ratings yet

- Marc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFDocument48 pagesMarc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFMaria Alejandra Malaver DazaNo ratings yet

- Reinstatement of Provision of Earnest Money Deposit (Er (D) in BidsDocument10 pagesReinstatement of Provision of Earnest Money Deposit (Er (D) in BidsDevesh Kumar PandeyNo ratings yet

- Hanlon Heitzman 2010Document53 pagesHanlon Heitzman 2010vita cahyanaNo ratings yet

- MyTW Bill 475525918821 12 12 2022Document1 pageMyTW Bill 475525918821 12 12 2022lapenbNo ratings yet

- Epc and Ppa ContractsDocument12 pagesEpc and Ppa ContractsCOT Management Training InsituteNo ratings yet

- 06 MaterialityDocument2 pages06 MaterialityMan Cheng100% (1)

- 14643post 819 WircDocument945 pages14643post 819 WircRonak ShahNo ratings yet

- Sherry Hunt Case - Team CDocument4 pagesSherry Hunt Case - Team CMariano BonillaNo ratings yet

- Trent's Mortgage & Finance BrokingDocument10 pagesTrent's Mortgage & Finance BrokingTrent FetahNo ratings yet

- Linear Programming FormulationDocument27 pagesLinear Programming FormulationDrama ArtNo ratings yet

- Working Capital Management Maruti SuzukiDocument76 pagesWorking Capital Management Maruti SuzukiAbhay Gupta81% (32)

- Assignment On MoneybhaiDocument7 pagesAssignment On MoneybhaiKritibandhu SwainNo ratings yet

- ADVANCED FA Chap IIIDocument7 pagesADVANCED FA Chap IIIFasiko Asmaro100% (1)

- PRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012Document4 pagesPRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012tilshilohNo ratings yet

- Auditing Finance and Accounting FunctionsDocument14 pagesAuditing Finance and Accounting FunctionsApril ManjaresNo ratings yet

- Assign 2 Cash Flow Basic Sem 1 13 14Document2 pagesAssign 2 Cash Flow Basic Sem 1 13 14Sumaiya AbedinNo ratings yet

- CAPE 2003 AccountingDocument13 pagesCAPE 2003 AccountingStephen WhiteKnight BuchananNo ratings yet

- Villaluz Repair ShopDocument5 pagesVillaluz Repair ShopJoy SantosNo ratings yet

- BSE SME Exchange - BusinessDocument53 pagesBSE SME Exchange - BusinessDeepak GajareNo ratings yet

- Finance InstrumentsDocument28 pagesFinance InstrumentsThanh Hằng NgôNo ratings yet