Professional Documents

Culture Documents

Task 1: Managerial Planning and Decisions: Cost Schedule Variable Costs RM

Uploaded by

mazni2002Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 1: Managerial Planning and Decisions: Cost Schedule Variable Costs RM

Uploaded by

mazni2002Copyright:

Available Formats

Task 1: Managerial Planning and Decisions Plasticware Sdn Bhd manufactures quality plastic wares for refrigerated food

products. The company has experienced steady growth in sales for the past 5 years. However, increased competition has led Mr James, the managing director, to believe that to maintain the companys current growth, they need an aggressive advertising campaign next year. To prepare the next years advertising campaign, the companys management accountant has prepared and presented Mr James with the following data for the current year, Year 1. Cost schedule Variable costs Direct labour Direct materials Variable overhead Total variable costs Fixed costs Manufacturing Selling Administrative Total fixed costs Selling price per pipe Expected sales, Year 1 (20,000 pipes) Tax rate RM 16.00 6.50 5.00 27.50 RM 50,000 80,000 140,000 270,000 RM50 RM1,000,000 40%

Mr James has set the sales target for year 2 at a level of RM 1,100,000 (22,000 units) ANSWER A. Projected after tax operating profit for Year 1? Target Income (Expected sales, year 1) Tax Rate RM1, 000,000 40%

Net projected after tax operating profit (NOPAT) NOPAT = Operating Income x (1 - Tax Rate) = 1,000,000 x (1 0.4) = RM 600,000.00

B. Compute the break-even point and margin of safety in units for Year 1? Breakeven: Number of units required to be sold in order to produce a profit of zero. Total fixed costs Selling price per pipe Total variable costs Breakeven RM 270,000.00 RM 50.00 RM 27.50

= Fixed Cost / (Price per Unit - Variable Unit Cost) = RM 270,000.00 / (RM 50.00 - RM 27.50) = 12,000 Units

Margin of safety (MOS) is the excess of budgeted or actual sales over the break even volume of sales. It stats the amount by which sales can drop before losses begin to be incurred. The higher the margin of safety, the lower the risk of not breaking even. Expected sales, Year 1 (20,000 pipes) Margin of Safety = Total budgeted or actual sales Break even sales = 20,000 12,000 = 8,000 Pipes

C. Mr James believes that to attain the sales target requires an additional selling expense of RM22,500

for advertising in Year 2, with all other costs remaining constant. What will be the after tax operating profit for Year 2 if the firm spends the additional RM22, 500? Advertising (Discretionary fix costs) In two years = RM 22, 000.00 Tax rate = 40% Cost schedule Year 1 Year 2 Total variable costs 27.50 27.50 Total fixed costs 270,000 270,000 Advertising 11000 11000 Selling price per pipe RM50 RM50 Expected sales, 20,000 pipes 22,000 units RM1,000,000 RM 1,100,000 Tax rate 40% 40%

Task 2 Divisional Performance and Ethics Edward the newly appointed Management Accountant of High Tech Sdn Bhd was torn between conflicting emotions. His latest investment project was stressing him at work. His boss Jeff, had asked him to massage the figures on this project- named Mestec. The original investment estimates for the Mestec project was quoted at RM23.4 million. The projected annual income from this project is RM2.805 million. High Tech required a return on investment of at least 15 percent for new project approval. Edward noticed that the Mestec projects rate of return was nowhere near the cut-off rate. He duly reported his concern to his boss. Jeff however encouraged Edward to show increased sales and decreased expenses in order to increase the projected income to RM3.51 million. Edward, concerned over the long term feasibility of the project, called for a meeting with Jeff. The following conversation took place during their meeting:

Edward: Jeff, I have gone through the figures for the Mestec project with the sales department and the production department people. I cant find any way to increase the annual income above RM2.805 million. Jeff: Edward, the figures are mere estimates. Nobody - be it sales or production personnel can accurately tell you the actual amounts. I talked to the sales director and she thinks the sales could range from RM3 million to RM5 million. Just take the higher figure. I have confidence in this project. Edward: But, the sales director felt that the RM5 million sales is very unlikely- only a 5 percent chance that the sales will reach that high! Jeff: As I said before, nobody knows for sure. This is only an estimate. Lets be optimistic and take the higher figure. Edward we really need this project to give our division the chance to qualify for sales based bonuses. Remember, if this project goes through all of us will benefit. Edward: I dont think it is right Jeff. I feel bad signing off a project, that I have very little confidence in. Jeff: Just do it Edward. I will back you up if anything goes wrong. Required: a. What is the return on investment (ROI) of Project Mestec based on the initial estimates? [4 marks] b. What would the ROI be if the income of the project increases to RM3.51million? [4 marks] c. Identify an alternative method of measuring divisional investments and critically discuss the ROI method in with of your chosen alternative method. [8 marks] d. Do you agree that Edward has an ethical dilemma? Explain. Is there any way that Jeff could ethically justify raising the sales estimates and/or lowering expense estimates? [12 marks] e. What do you think Edward should do? Explain. [7 marks] [TOTAL: 35 MARKS]

Task 3 Activity based costing (ABC) and decision model a. ABC systems yield more accurate product costs than conventional systems because they use more cost drivers to assign support costs to products. Discuss this statement. [10 marks] b. Describe the short-term decision making model, and explain how cost behaviour affects the information used to make decisions. [10 marks] [TOTAL: 20 MARKS] (Marks would be allocated on clarity of argument and justification. Professional marks would be allocated for format and structure of presentation).

Task 4: Cash Budgeting and Control The controller of Fast Meals Sdn Bhd provided the following information for the month of March: a. Sales are budgeted to be RM628,000. About 85 percent of sales are cash; the remainder is on account. b. Of the credit sales, 70 percent are collected within the month of sale. 28 percent will be paid in the following month c. Food and supplies purchases, all on account, are expected to be RM464,000. Fast Meals pays 25 percent in the month of purchase and 75 percent in the month following purchase. d. Wages total RM12,000 each month and are paid in the month incurred. e. Utilities average RM3,,200 per month. Rent on building is RM6,400 per month. f. Insurance is paid quarterly, and the payment of RM2,800 is due in March.

g. February sales were RM726,000 and purchases of food and supplies in February equaled RM520,000. h. The cash balance on March 1 is RM8,588. Required: Prepare a cash budget for March. Show all workings. [TOTAL: 20 MARKS] Assignment Format: a. Use double space and 12-point of Times New Roman font. b. Provide references. References should use the American Psychological Association (APA) format c. References should be latest (year 2006 and onwards) Notes: Assignments should be submitted according to the fixed date. Plagiarism is not acceptable. If you are not sure what is meant by plagiarism, refer to the various websites which discuss this matter, e.g. owl.english.purdue.edu/handouts

You might also like

- Japanese Apparel DistributionDocument4 pagesJapanese Apparel Distributionsaumil parikh100% (1)

- Mock April 2021 Stephenson, Descoin, TaylorDocument8 pagesMock April 2021 Stephenson, Descoin, TaylorHaroon KhurshidNo ratings yet

- ch22 (Pricing and Profitability Analysis)Document36 pagesch22 (Pricing and Profitability Analysis)Ogie WijayaNo ratings yet

- Understanding Customer Relationship Management EmeraldDocument27 pagesUnderstanding Customer Relationship Management EmeraldJennifer AnthonyNo ratings yet

- Engineering Economics RevisionDocument43 pagesEngineering Economics RevisionDanial IzzatNo ratings yet

- COEB442 - Sem - 2 - 2015-2016 RevisionDocument37 pagesCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraNo ratings yet

- BMAC5203 Assignment Jan 2015 (Amended)Document6 pagesBMAC5203 Assignment Jan 2015 (Amended)Robert WilliamsNo ratings yet

- D Ltd. manufacturing budget analysis and cash flow forecastDocument3 pagesD Ltd. manufacturing budget analysis and cash flow forecastIzwan JamaluddinNo ratings yet

- A141 Tutorial 7Document8 pagesA141 Tutorial 7CyrilraincreamNo ratings yet

- All India Shri Shivaji Memorial Society's Institute of Management Question Bank 302 Management Control SystemsDocument5 pagesAll India Shri Shivaji Memorial Society's Institute of Management Question Bank 302 Management Control SystemsAadeel NooraniNo ratings yet

- Assignment October BatchDocument3 pagesAssignment October BatchVimmal MysterioNo ratings yet

- Maf201 - Test 2 - Jan2023 - QDocument5 pagesMaf201 - Test 2 - Jan2023 - Qsajidah0703No ratings yet

- Objectives of BudgetingDocument13 pagesObjectives of BudgetingChandanN81No ratings yet

- Target Costing L Cycle So LNDocument8 pagesTarget Costing L Cycle So LNParesh SwamiNo ratings yet

- 4587 2261 10 1487 54 BudgetingDocument46 pages4587 2261 10 1487 54 BudgetingDolly BadlaniNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Faculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019Document3 pagesFaculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019bananaNo ratings yet

- ConfidentialDocument6 pagesConfidentialabel khuloane nhlapoNo ratings yet

- 5.0 Financials: 5.1 Break Even AnalysisDocument3 pages5.0 Financials: 5.1 Break Even AnalysisFahim AhmedNo ratings yet

- Topic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IIDocument4 pagesTopic 1: Cost-Volume-Profit (CVP) Analysis Exercise 1: BKAM3023 Management Accounting IINur WahidaNo ratings yet

- Budgetary Control and Responsibility Accounting ChapterDocument36 pagesBudgetary Control and Responsibility Accounting ChapterVipra BhatiaNo ratings yet

- Budgeting ToolsDocument55 pagesBudgeting ToolsSozia TanNo ratings yet

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisMobin NasimNo ratings yet

- MGT 115 Case Problem Exercises - Sec4Document3 pagesMGT 115 Case Problem Exercises - Sec4Maryrose SumulongNo ratings yet

- Bafb3013 - Financial Management - Assignment - Group 7Document13 pagesBafb3013 - Financial Management - Assignment - Group 7Koay Mei ChuenNo ratings yet

- Break-Even Analysis: Calculating Key MetricsDocument6 pagesBreak-Even Analysis: Calculating Key MetricskantarubanNo ratings yet

- Humber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsDocument5 pagesHumber College The Business School Financial Management Fin 2500-Individual Project Grade Value: 7% Submission RequirementsAnisaNo ratings yet

- Cost analysis project optionsDocument5 pagesCost analysis project optionsJinlia SakalamNo ratings yet

- Decision Regarding Sales Force Size-IIDocument17 pagesDecision Regarding Sales Force Size-IIShivendu SinghNo ratings yet

- Lesson 4 EntrepDocument20 pagesLesson 4 EntrepGwenn PabonaNo ratings yet

- BAFB3013 Financial ManagementDocument9 pagesBAFB3013 Financial ManagementSarah ShiphrahNo ratings yet

- ALl Questions According To TopicsDocument11 pagesALl Questions According To TopicsHassan KhanNo ratings yet

- G1 - CIMA Management Accountant Gateway Assessment 20 November 2012 - Tuesday Afternoon SessionDocument20 pagesG1 - CIMA Management Accountant Gateway Assessment 20 November 2012 - Tuesday Afternoon Sessionsalmanahmedkhi1No ratings yet

- Incremental Analysis for Engineering Project DecisionsDocument25 pagesIncremental Analysis for Engineering Project DecisionsDejene HailuNo ratings yet

- Group & Individual AssignmentDocument4 pagesGroup & Individual AssignmentKinetibebNo ratings yet

- Mid Term Exam Dec 2020Document5 pagesMid Term Exam Dec 2020tiraNo ratings yet

- N1227106 Busi48901 261123Document11 pagesN1227106 Busi48901 261123malisiddhant2602No ratings yet

- Key MBA QuizDocument6 pagesKey MBA Quizs41emNo ratings yet

- Tutorial 4 QDocument2 pagesTutorial 4 QDashania GregoryNo ratings yet

- LIMTECH BBA 5th Sem Cost & Management Accounting ExamDocument2 pagesLIMTECH BBA 5th Sem Cost & Management Accounting ExamIndu GuptaNo ratings yet

- Management Accounting MCQs and Break-Even Analysis ProblemsDocument4 pagesManagement Accounting MCQs and Break-Even Analysis Problemsmohanned salahNo ratings yet

- 18-Arid-879 Managerial Accounting Final Ter Examination MGT-504 Syeda Tashifa Batool BBA 4th (B)Document9 pages18-Arid-879 Managerial Accounting Final Ter Examination MGT-504 Syeda Tashifa Batool BBA 4th (B)Syed Muhammed Sabeehul RehmanNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- Maf201 Test 2 July23Document5 pagesMaf201 Test 2 July232022624622No ratings yet

- Cost Estimation and CVP AnalysisDocument10 pagesCost Estimation and CVP AnalysisQudwah HasanahNo ratings yet

- Goals, Functions of Finance Manager, Working Capital RequirementsDocument3 pagesGoals, Functions of Finance Manager, Working Capital RequirementsISLAMICLECTURESNo ratings yet

- Ukam3043 Management Accounting IiiDocument9 pagesUkam3043 Management Accounting IiiBay Jing TingNo ratings yet

- Nfjpia Mockboard 2011 MasDocument14 pagesNfjpia Mockboard 2011 MasRhea SamsonNo ratings yet

- BBA 4002 BUDGETING AND CONTROL (INDUSTRIAL PROJECT PAPAERDocument14 pagesBBA 4002 BUDGETING AND CONTROL (INDUSTRIAL PROJECT PAPAERWindy TanNo ratings yet

- The Use of Budgets in Planning and Decision MakingDocument7 pagesThe Use of Budgets in Planning and Decision MakingKirito UzumakiNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentSYED MUHAMMAD MOOSA RAZANo ratings yet

- Devit Multimarket PlaceDocument4 pagesDevit Multimarket PlaceKunle AkingbadeNo ratings yet

- Imt 07Document4 pagesImt 07Prasanta Kumar NandaNo ratings yet

- ACT3110 - Introduction To CVP Analysis (S)Document30 pagesACT3110 - Introduction To CVP Analysis (S)Adani MustaffaNo ratings yet

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFSteven Mark MananguNo ratings yet

- Maf201 Test 2 Jan 2023 QDocument5 pagesMaf201 Test 2 Jan 2023 Qediza adhaNo ratings yet

- Quiz Management AccountingDocument8 pagesQuiz Management AccountingLouise Kyle NgoNo ratings yet

- Introduction To SFAD (Class1)Document17 pagesIntroduction To SFAD (Class1)Asmer KhanNo ratings yet

- CVP Analysis QuestionsDocument5 pagesCVP Analysis Questionsqadrih8638No ratings yet

- Ker Tasca Dang An Am Bang 07Document3 pagesKer Tasca Dang An Am Bang 07mazni2002No ratings yet

- Conditional Short EssayDocument2 pagesConditional Short EssayMohd Shahidan0% (1)

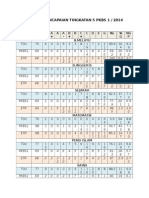

- Analisa Pencapaian Tingkatan 5 Pkbs 1 / 2014: Tov/Et R CAL ON T H A + A A - B + B C + C D E G %L % G NG P B.MelayuDocument3 pagesAnalisa Pencapaian Tingkatan 5 Pkbs 1 / 2014: Tov/Et R CAL ON T H A + A A - B + B C + C D E G %L % G NG P B.Melayumazni2002No ratings yet

- LPF4 09Document90 pagesLPF4 09mazni2002No ratings yet

- LPF4 09Document90 pagesLPF4 09mazni2002No ratings yet

- Hmef5103 0110Document4 pagesHmef5103 0110mazni2002No ratings yet

- LPF4 09Document90 pagesLPF4 09mazni2002No ratings yet

- 20121114171156seminar 3Document78 pages20121114171156seminar 3mazni2002No ratings yet

- Assignment OUMDocument2 pagesAssignment OUMmazni2002No ratings yet

- LPF4 09Document90 pagesLPF4 09mazni2002No ratings yet

- Hmef5023 Sept05Document6 pagesHmef5023 Sept05mazni2002No ratings yet

- Hmef5023 Sept05Document6 pagesHmef5023 Sept05mazni2002No ratings yet

- BSIC Code of Conduct Oct 2006Document3 pagesBSIC Code of Conduct Oct 2006Anonymous Var1ioJ1RNo ratings yet

- Land Title Ad Deeds Final Reviewer 2016 - Atty. Gimarino - EH 408Document30 pagesLand Title Ad Deeds Final Reviewer 2016 - Atty. Gimarino - EH 408alyza burdeosNo ratings yet

- TOSHIBA INFORMATION EQUIPMENT PHILS. INC. vs. CIRDocument2 pagesTOSHIBA INFORMATION EQUIPMENT PHILS. INC. vs. CIRakosiem100% (1)

- Beginner's Guide to Understanding the Stock MarketDocument7 pagesBeginner's Guide to Understanding the Stock MarketTaif KhanNo ratings yet

- KSDL ProjectDocument16 pagesKSDL ProjectAman BaranawalNo ratings yet

- Case of Coca Cola BPDocument28 pagesCase of Coca Cola BPShradha BiyaniNo ratings yet

- Unit 5 CrosswordDocument2 pagesUnit 5 Crosswordapi-356491391No ratings yet

- Sale Deed of Agricultural LandDocument1 pageSale Deed of Agricultural Landگلوبل کنسلٹنٹسNo ratings yet

- Gucci Marketing Report Analyzes Growth Under New LeadershipDocument25 pagesGucci Marketing Report Analyzes Growth Under New LeadershipMihai DohotariuNo ratings yet

- VMP College Management Studies ERP Report on Dudhsagar DairyDocument53 pagesVMP College Management Studies ERP Report on Dudhsagar DairyJayendra Patel86% (7)

- E Jeep Co.: Electronic Jeepney CorporationDocument30 pagesE Jeep Co.: Electronic Jeepney CorporationAshyyy123 GomezNo ratings yet

- GROUP 1 NEDP BATCH 2 DOCUMENTDocument132 pagesGROUP 1 NEDP BATCH 2 DOCUMENTElsa Qorirotul Aini Susilo100% (1)

- SERVICE MARKETING CHARACTERISTICSDocument20 pagesSERVICE MARKETING CHARACTERISTICSDomnic SavioNo ratings yet

- Profit Planning Master BudgetDocument67 pagesProfit Planning Master BudgetJade Ballado-TanNo ratings yet

- New Product Launch Report on Cox ShoesDocument13 pagesNew Product Launch Report on Cox ShoesrohitkgangotiaNo ratings yet

- BCAS 12: Kaizen Costing StandardsDocument7 pagesBCAS 12: Kaizen Costing StandardsAnjell ReyesNo ratings yet

- DEMAND AND REVENUE ANALYSISDocument34 pagesDEMAND AND REVENUE ANALYSISAdnan Aziz100% (1)

- Accounting for Materials QuestionsDocument2 pagesAccounting for Materials QuestionsMîñåk ŞhïïNo ratings yet

- Dissolution and winding up of partnership between Serra and MotaDocument3 pagesDissolution and winding up of partnership between Serra and MotaNLainie OmarNo ratings yet

- Smith, Bell & Co. vs. Vicente Sotelo MattiDocument6 pagesSmith, Bell & Co. vs. Vicente Sotelo Mattides_0212No ratings yet

- C 1Document1 pageC 1Ryan Martinez100% (1)

- USE OF IT IN MANAGING CUSTOMER RELATIONSHIPS AT EASTERN BANK LTDDocument21 pagesUSE OF IT IN MANAGING CUSTOMER RELATIONSHIPS AT EASTERN BANK LTDFatema Tuz JohooraNo ratings yet

- Fish Be With You Dried FishDocument57 pagesFish Be With You Dried FishJamie Bagundol100% (3)

- Strategic Analysis of TescoDocument23 pagesStrategic Analysis of TescolokeshNo ratings yet

- GST Pracital Class 2Document7 pagesGST Pracital Class 2Nayan JhaNo ratings yet

- PEST Analysis of IOCDocument4 pagesPEST Analysis of IOCArpkin_love100% (3)

- MBA Final PDFDocument92 pagesMBA Final PDFAnshu Lalit100% (1)

- ODN Configuration for GSTDocument14 pagesODN Configuration for GSTManoj BholaNo ratings yet