Professional Documents

Culture Documents

The Microfinance Industry in India

Uploaded by

Prashant Upashi SonuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Microfinance Industry in India

Uploaded by

Prashant Upashi SonuCopyright:

Available Formats

The Microfinance Industry in India

Abstract:

This industry report presents a detailed overview of the microfinance industry in India. The advent of new millennium witnessed significant developments in the Indian microfinance industry, which attracted the attention of several private sector and foreign banks. The report analyzes the potential of Indian microfinance industry and examines the recent polices of Indian government to boost the growth of the industry. It describes various microfinance models popular in India and includes a note on the leading players in the Indian microfinance industry. Finally, the report examines the challenges facing the industry in the near future.

Introduction:

India has one of most extensive banking infrastructures in the world. However, millions of poor people in India do not have access to basic banking services like savings and credit. In the mid-1990s, about 70% of India's population lives in rural areas which account for only 30% of the bank deposits. About 70% of the rural poor do not have bank accounts and 87% of them do not have access to credit from banks.3 In the same period, the share of non-institutional agencies including traders, money lenders, friends and relatives in the outstanding cash dues of rural households was 36%.4 In the past, both public and private commercial banks in India perceived rural banking as a high-risk, high-cost business i.e. a business with high transaction costs and high levels of uncertainty. Rural borrowers, on their part, felt that banking procedures were cumbersome and that banks were not very willing to give them credit. Commenting on the problems faced by the microfinance industry in India, YSP Thorat, managing director of National Bank for Agriculture and Rural Development (NABARD), and Graham AN Wright, an international expert in microfinance, wrote, "Poor credit-deposit ratios, unsustainable lending and highlevels of non-performing assets often cripple much of this infrastructure."

In 1954, All India Rural Credit Survey Committee recommended expansion of the cooperative credit system to cater to the credit needs of the rural poor. The regional rural banks (RRBs) were incorporated in 1976. By the mid-1970s, the banking sector was operating as a three-tier system. The first tier consisted of commercial banks, RRBs formed the second tier, and cooperative banks formed the third tier. About 49% of all scheduled commercial banks operated from rural areas. In the early 1980s, the Indian government realized the need for microfinance to provide the rural poor with savings and microcredit services. Loans available through microcredit schemes were more accessible to the poor people as compared to bank loans. It also compared favorably with non-institutional money lenders in terms of cost. In the late 1990s, the microfinance business was boosted by the innovative initiatives take up by microfinance institutions (MFIs), non-governmental institutions (NGOs) and banks.

They offered micro-credit i.e. credit provided to poor people for financial and business services and for self employment in rural areas. It fulfilled their basic needs and emergency requirements. The microfinance business had the ability to reach the most deserving people and also increased the repayment rates for banks, which were, at the time, burdened by mounting non-performing assets (NPAs) on the rural credit extended by them.

Background Note:

In the early 1980s, NABARD study found that though the network of rural bank branches had been trying to create self employment opportunities by providing bank credit for over two decades, many poor people remained outside the purview of the formal banking system. The existing banking policies, procedures and systems including deposit and loan products were not tailored to the requirements of the poor. They required better access to services and products rather than subsidized credit. The study concluded that there was a pressing need to improve access to microfinance. It therefore recommended that alternative policies, systems and procedures be put in place in order to boost the growth of microfinance in India. The Reserve Bank of India (RBI) and NABARD were actively involved in spreading the network of commercial banks in rural areas, especially after nationalization. RBI had made it compulsory for all private sector banks to open at least 25% of their branches in rural and semi-urban areas. It had also stipulated that 40% of the net bank credit should be allotted to sectors categorized as priority sectors, like housing, rural development and agriculture. With these measures, commercial banks did move into rural areas but the advances given to the poor remained very low. To improve the accessibility of the existing banking network to the poor, the Self Help Group (SHG) - Bank Linkage Model was launched in 1992 with a pilot project for promoting 500 SHGs. The objective of the microfinance initiatives was to facilitate empowerment of the poor, while pursuing the macro economic objective of overall economic growth. In 1995, the RBI set up a working group to study the possibility of linkages between informal SHGs and banks.

Excerpts:

Types of Microfinance institutions: Microfinance institutions develop and deliver a range of financial products for the poor. There are three categories of microfinance institutions. They are:

NON-PROFIT MFIS/NGO MFIS

These are Societies under the Societies Registration Act, 1860 or corresponding State Acts. Others in this category are Public Trusts under the Indian Trust Act 1882, and non-profit companies under Section 25 of the Companies Act, 1956. There are several NGOs which are registered as trust/society and have helped the SHGs form into federations. Federations are formal institutions and carry out both nonfinancial and financial activities including social and capacity building activities, SHG training, and promotion of new groups, apart from financial intermediation.

These institutions cannot undertake financial intermediation activities on a large scale, as they are prohibited from carrying out any commercial activities.

Microfinance - Major Players

The major players which were instrumental in the growth of microfinance industry in India included NABARD, SIDBI, Rashtriya Mahila Kosh, FWWB and SHARE Microfin Limited.

NABARD

NABARD was established in 1982 to provide credit to the rural sector. NABARD was a pioneer in microfinance programs in India. The bank's vision is "to facilitate sustained access to financial services for the unreached poor in rural areas through various microfinance innovations in a cost effective and sustainable manner." By 2005, NABARD's SHG-Bank Linkage program had emerged as one of the largest microfinance programs in the world. NABARD also collaborated with NGOs, MFIs, banks and governmental agencies in order to use other models of rural credit like the Grameen Model and the individual banking model. Encouraged by the success of the SHG program, NABARD planned to link 1 million SHGs by 2007 and reach 100 million rural poor.

The Future: Many private and foreign banks have unveiled their plans to enter the Indian microfinance sector because of its very low NPAs and high repayment rate of more than 95% in spite of offering loans without any collateral security. The main reason for high repayment rates was that the loans were managed at the community level. Borrowers took loans to improve their standard of living and start a small business. If the repayment was done in time, only then were more loans given. According to Udaia Kumar, Chairman and Managing Director, SHARE Microfin Limited, "In all cases there is no security taken. We don't have a legal system. We build a relationship with the client. We motivate them, train them, and give them the confidence that they have the capacity to handle. We ensure that the money is used for the purpose that they have taken. We ensure that they make profits. Then definitely they will come back with the repayment. Our repayment rates are 100%. Issue:

Evaluate and analyze the trends and new developments in microfinance industry in India. Do you think Microfinance has a better future in India?

You might also like

- Micro Finance - Keys & Challenges:-A Review Mohit RewariDocument13 pagesMicro Finance - Keys & Challenges:-A Review Mohit Rewarisonia khuranaNo ratings yet

- The Role of Micro Finance in SHGDocument12 pagesThe Role of Micro Finance in SHGijgarph100% (1)

- Amity UniversityDocument7 pagesAmity Universityrsrpk27No ratings yet

- Microfinance in India Scopes and LimitationsDocument41 pagesMicrofinance in India Scopes and Limitationsspy67% (3)

- Topic of The Week For Discussion: 12 To 18 March: Topic: Microfinance Sector in IndiaDocument2 pagesTopic of The Week For Discussion: 12 To 18 March: Topic: Microfinance Sector in Indiarockstar104No ratings yet

- Status of Microfinance and Its Delivery Models in IndiaDocument13 pagesStatus of Microfinance and Its Delivery Models in IndiaSiva Sankari100% (1)

- Micro Finance: Emerging Challenges and Opening Vistas: Dr. Anupama Sharma, Ms. Sumita Kukreja, DR - Anjana SharmaDocument9 pagesMicro Finance: Emerging Challenges and Opening Vistas: Dr. Anupama Sharma, Ms. Sumita Kukreja, DR - Anjana SharmaInternational Organization of Scientific Research (IOSR)No ratings yet

- Micro-Finance in The India: The Changing Face of Micro-Credit SchemesDocument11 pagesMicro-Finance in The India: The Changing Face of Micro-Credit SchemesMahesh ChavanNo ratings yet

- Picturing Micro Finance: S. Arun Kumar Dhanamjaya Bhupathi E.Mohanraj - PresentDocument23 pagesPicturing Micro Finance: S. Arun Kumar Dhanamjaya Bhupathi E.Mohanraj - PresentjeyaselwynNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Journal - Nikita 2jul14mrrDocument7 pagesJournal - Nikita 2jul14mrrRohit KumarNo ratings yet

- Customer Satisfaction and Microfinance in UnaccoDocument21 pagesCustomer Satisfaction and Microfinance in UnaccoOmita ChanuNo ratings yet

- Microfinance in India and Porters Five Forces AnalysisDocument19 pagesMicrofinance in India and Porters Five Forces AnalysisCharismagicNo ratings yet

- Current Market Size of Rs27 BillionDocument5 pagesCurrent Market Size of Rs27 BillionSiddhartha BothraNo ratings yet

- Microfinance and NgosDocument8 pagesMicrofinance and NgosFarhana MishuNo ratings yet

- IciciDocument3 pagesIciciOm PrakashNo ratings yet

- MFS PPT FinalDocument18 pagesMFS PPT FinalvijaybharvadNo ratings yet

- Outreach of Microfinance Services in India: By: Rajni KumariDocument5 pagesOutreach of Microfinance Services in India: By: Rajni Kumarihoney802301No ratings yet

- Rural Banking and Micro Finance: Unit: IVDocument17 pagesRural Banking and Micro Finance: Unit: IVkimberly0jonesNo ratings yet

- Inroduction: Microfinance Is A Category of Financial ServicesDocument23 pagesInroduction: Microfinance Is A Category of Financial ServicesNikilNo ratings yet

- Chapter 4 Rural Banking and Micro Financing 1Document16 pagesChapter 4 Rural Banking and Micro Financing 1saloniNo ratings yet

- Building Sustainable Microfinance Institutions in IndiaDocument18 pagesBuilding Sustainable Microfinance Institutions in IndiaAlok BhandariNo ratings yet

- Swot Analysis of Mfs HG Sin IndiaDocument13 pagesSwot Analysis of Mfs HG Sin IndiaHarsh KumarNo ratings yet

- Session 1 - Grameen BankDocument5 pagesSession 1 - Grameen BankagyeyaNo ratings yet

- Microfinance in India - Growth and Present StatusDocument16 pagesMicrofinance in India - Growth and Present StatusIJOPAAR JOURNALNo ratings yet

- Micro Finance Sector in India ModelDocument9 pagesMicro Finance Sector in India Modelswati singhNo ratings yet

- Term Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesDocument18 pagesTerm Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesSumit SinghNo ratings yet

- Microfinance in India - A Tool For Poverty ReductionDocument20 pagesMicrofinance in India - A Tool For Poverty ReductionVijay KumarNo ratings yet

- AMFPL Credit Appraisal PolicyDocument16 pagesAMFPL Credit Appraisal PolicyPranav GuptaNo ratings yet

- Sustainability of MFI's in India After Y.H.Malegam CommitteeDocument18 pagesSustainability of MFI's in India After Y.H.Malegam CommitteeAnup BmNo ratings yet

- Micro Finance in IndiaDocument59 pagesMicro Finance in IndiaApurva Bangera100% (1)

- Social Banking Under NationalisationDocument8 pagesSocial Banking Under NationalisationLiya ShajanNo ratings yet

- Rajni Sinha PDFDocument23 pagesRajni Sinha PDFshivani mishraNo ratings yet

- 7.P Syamala DeviDocument4 pages7.P Syamala DeviSachin SahooNo ratings yet

- Pillars of Financial Inclusion Remittances - Micro Insurance and Micro SavingsDocument27 pagesPillars of Financial Inclusion Remittances - Micro Insurance and Micro SavingsDhara PatelNo ratings yet

- Role of Microfinance in Women EmpowermentDocument25 pagesRole of Microfinance in Women EmpowermentDevansh MoyalNo ratings yet

- Banking and Microfinance - IIDocument24 pagesBanking and Microfinance - IIKoyelNo ratings yet

- Project On Rural Banking in India 15-01-2023Document74 pagesProject On Rural Banking in India 15-01-2023Praveen ChaudharyNo ratings yet

- 2014-VII-1&2 NilimaDocument13 pages2014-VII-1&2 NilimaAPOORVA GUPTANo ratings yet

- Micro Finance The Paradigm ShiftDocument24 pagesMicro Finance The Paradigm ShiftPrateek Goel100% (1)

- Mfi Obj.1Document13 pagesMfi Obj.1Anjum MehtabNo ratings yet

- Micro Finance (BankingDocument35 pagesMicro Finance (BankingAsim Waghu100% (1)

- Micro Finance Need of The HourDocument11 pagesMicro Finance Need of The HouramarsxcranNo ratings yet

- Microfinance 140113043356 Phpapp01Document40 pagesMicrofinance 140113043356 Phpapp01karanjangid17No ratings yet

- MICRPFINANCE IN INDIA WordDocument14 pagesMICRPFINANCE IN INDIA WordA08 Ratika KambleNo ratings yet

- A Critical Analysis of Micro Finance in IndiaDocument54 pagesA Critical Analysis of Micro Finance in IndiaArchana MehraNo ratings yet

- Micro FinanceDocument5 pagesMicro FinancePayal SharmaNo ratings yet

- Awareness of MicrofinanceDocument34 pagesAwareness of MicrofinanceDisha Tiwari100% (1)

- Micro FinanceDocument17 pagesMicro FinanceAbhineet DhaliwalNo ratings yet

- Notes Micro FinanceDocument9 pagesNotes Micro Financesofty1980No ratings yet

- Microfinance 140113043356 Phpapp01Document40 pagesMicrofinance 140113043356 Phpapp01Manjula guptaNo ratings yet

- Micro Finance in IndiaDocument1 pageMicro Finance in IndiapethalammuNo ratings yet

- Micro CreditDocument9 pagesMicro Creditpalash dashNo ratings yet

- Growth of Micro Finance in India A Descriptive StudyDocument12 pagesGrowth of Micro Finance in India A Descriptive StudyBobby ShrivastavaNo ratings yet

- Growth of Micro Finance in India: A Descriptive StudyDocument12 pagesGrowth of Micro Finance in India: A Descriptive StudyAkhil Naik BanothNo ratings yet

- Project On Micro FinanceDocument68 pagesProject On Micro FinanceKapil RaoNo ratings yet

- A Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationDocument10 pagesA Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationjyotivermaNo ratings yet

- Microfinace Reading PDFDocument9 pagesMicrofinace Reading PDFCharles GarrettNo ratings yet

- Microfinance in India: A Critique by Rajarshi GhoshDocument9 pagesMicrofinance in India: A Critique by Rajarshi Ghoshpraveen_jha_9No ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- CMAT Application FormDocument2 pagesCMAT Application FormPrashant Upashi SonuNo ratings yet

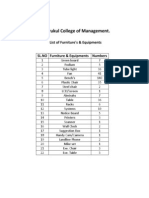

- Gurukul College of Management.: List of Furniture's & EquipmentsDocument1 pageGurukul College of Management.: List of Furniture's & EquipmentsPrashant Upashi SonuNo ratings yet

- AL Shjaray School (1) GJGJHDocument3 pagesAL Shjaray School (1) GJGJHPrashant Upashi SonuNo ratings yet

- Characterstics of Good Programming: Requires Less Space: The Program Must Consume Less Space in The MemoryDocument7 pagesCharacterstics of Good Programming: Requires Less Space: The Program Must Consume Less Space in The MemoryPrashant Upashi SonuNo ratings yet

- Grammar Through Tips (MBA) A4 (Booklet) 2011-12Document50 pagesGrammar Through Tips (MBA) A4 (Booklet) 2011-12Prashant Upashi SonuNo ratings yet

- Bus PassDocument1 pageBus PassPrashant Upashi SonuNo ratings yet

- Aryabhatta TutorialsDocument3 pagesAryabhatta TutorialsPrashant Upashi SonuNo ratings yet

- Product and Product MixDocument28 pagesProduct and Product MixPrashant Upashi SonuNo ratings yet

- Weekend Time Table For 1apr-2012Document2 pagesWeekend Time Table For 1apr-2012Prashant Upashi SonuNo ratings yet

- Addmen Campus AutomationDocument3 pagesAddmen Campus AutomationPrashant Upashi SonuNo ratings yet

- UiicDocument7 pagesUiicPrashant Upashi SonuNo ratings yet

- Advt PHD 201415Document4 pagesAdvt PHD 201415sashankchappidigmailNo ratings yet

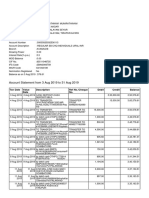

- Bank Loan NewDocument1 pageBank Loan NewPrashant Upashi SonuNo ratings yet

- 5darDocument2 pages5darPrashant Upashi SonuNo ratings yet

- AcknowledgementDocument3 pagesAcknowledgementPrashant Upashi SonuNo ratings yet

- Sensation of Wizardly DreamDocument3 pagesSensation of Wizardly DreamPrashant Upashi SonuNo ratings yet

- Latihan Soal Bab 9 - Kelompok 2Document17 pagesLatihan Soal Bab 9 - Kelompok 2Penduduk MarsNo ratings yet

- 1569974603267g4SdkiBXnw22cLKZ PDFDocument4 pages1569974603267g4SdkiBXnw22cLKZ PDFSelvarathnam MuniratnamNo ratings yet

- C CCCCCCC CCCCC CC CCC CCCCCC C CC CC!"C CCCCCC C# C CCCC$!C CCCC%C C& C CC!C C' (CC$CC C) C C+ (CCC!Document6 pagesC CCCCCCC CCCCC CC CCC CCCCCC C CC CC!"C CCCCCC C# C CCCC$!C CCCC%C C& C CC!C C' (CC$CC C) C C+ (CCC!Jitesh TolaniNo ratings yet

- 23Document2 pages23Heaven HeartNo ratings yet

- Investing Tips: Lesson 18: Student Activity Sheet 1Document3 pagesInvesting Tips: Lesson 18: Student Activity Sheet 1GONZALO JIMENEZ MORALESNo ratings yet

- CH 03Document60 pagesCH 03Hiền AnhNo ratings yet

- 2.maks Energy Solutions - GIDDocument40 pages2.maks Energy Solutions - GIDLaxmikant RathiNo ratings yet

- Capital and Revenue Income and ExpenditureDocument31 pagesCapital and Revenue Income and ExpenditureMahesh Chandra Sharma100% (2)

- Creative Accounting, Ethics and Professional DevelomentDocument21 pagesCreative Accounting, Ethics and Professional DevelomentFaiz FaisalNo ratings yet

- Institutions and Corporate Capital Structure in The MENA RegionDocument32 pagesInstitutions and Corporate Capital Structure in The MENA RegionMissaoui IbtissemNo ratings yet

- Group-Assignment ACC101Document5 pagesGroup-Assignment ACC101Nguyen Duc Minh K17 HLNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFSudip MukherjeeNo ratings yet

- FM TestDocument5 pagesFM TestSamir JainNo ratings yet

- Ncert Solution Class 11 Accountancy Chapter 10Document68 pagesNcert Solution Class 11 Accountancy Chapter 10Prakal 444No ratings yet

- MIBE - Transcript - Credits by Area 2Document6 pagesMIBE - Transcript - Credits by Area 2Sohad ElnagarNo ratings yet

- Medida vs. CADocument1 pageMedida vs. CANiñoMaurinNo ratings yet

- Consolidated Statement: DepositsDocument6 pagesConsolidated Statement: DepositsVivekNo ratings yet

- Credit ActivityDocument2 pagesCredit Activityamo53No ratings yet

- Study Questions 12 Risk and Return SolutionsDocument4 pagesStudy Questions 12 Risk and Return SolutionsAlif SultanliNo ratings yet

- Paymore Products Places Orders For Goods Equal To 75 ofDocument1 pagePaymore Products Places Orders For Goods Equal To 75 ofAmit PandeyNo ratings yet

- T-Bills: Abhishek Sinha (CSM 1001) Anand Sachdeva (CSM 1002) Pramod Singh (CSM 1013) Saurabh Shukla (CSM 1019)Document14 pagesT-Bills: Abhishek Sinha (CSM 1001) Anand Sachdeva (CSM 1002) Pramod Singh (CSM 1013) Saurabh Shukla (CSM 1019)anandsachsNo ratings yet

- MODULE 7 BudgetingDocument6 pagesMODULE 7 BudgetingKatrina Peralta FabianNo ratings yet

- Horizontal & Vertical AnalysisDocument7 pagesHorizontal & Vertical AnalysisMisha SaeedNo ratings yet

- Account Statement For The Period01/05/2022to07/07/2022: Account Number Branch AddressDocument12 pagesAccount Statement For The Period01/05/2022to07/07/2022: Account Number Branch AddressMantuNo ratings yet

- Finance Module 1 Definition of Finance and Identifying The Roles in A Corporate OrganizationDocument31 pagesFinance Module 1 Definition of Finance and Identifying The Roles in A Corporate OrganizationCjNo ratings yet

- Foreign Currency HedgingDocument4 pagesForeign Currency HedgingBianca Iyiyi100% (4)

- Mers RulesDocument43 pagesMers RulessnrdadNo ratings yet

- IO Reading ListDocument3 pagesIO Reading ListDat NguyenNo ratings yet

- 1st Activity in ACCA104Document11 pages1st Activity in ACCA104John Rey BonitNo ratings yet

- SolutionsDocument5 pagesSolutionsSahil NandaNo ratings yet