Professional Documents

Culture Documents

CASE PHB v. BBMB

Uploaded by

Iqram MeonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CASE PHB v. BBMB

Uploaded by

Iqram MeonCopyright:

Available Formats

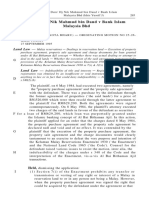

PERWIRA HABIB BANK (M) BHD v BANK BUMIPUTRA (M) BHD [1988] 3 MLJ 54 ORIGINATING MOTION NO F32-49-86 HIGH

COURT (KUALA LUMPUR) DECIDED-DATE-1: 18 MAY 1987 CHAN J CATCHWORDS: Land Law - Land charged to defendant bank - Charge registered under National Land Code Purchaser of apartment assigned all rights in apartment to plaintiff bank - Land Administrator ordered sale of land by public auction - Appeal by plaintiff bank against order - Whether actual or constructive fraud must be established to defeat title of first bank - National Land Code 1965, s 340(2) HEADNOTES: The registered owner of a piece of land on which an apartment block stood had charged the land to the defendant bank in September 1983. This charge was duly registered under the National Land Code. However, in June 1983, a purchaser of one of the apartment units had obtained a housing loan from the plaintiff bank and had assigned all her rights to the apartment to the plaintiff bank because there was no strata title issued yet. Subsequently, at the conclusion of an inquiry held under s 261 of the National Land Code , the Land Administrator ordered the land to be sold by public auction. The plaintiff appealed against the decision of the Land Administrator. Relying on s 340(2)(a) of the National Land [*54] Code , the plaintiff contended that the defendant was aware at the time it took the charge that there were purchasers of the flats in the building and, therefore, fraud or constructive fraud was to be inferred.

Held, dismissing the appeal: (1) There is ample authority that actual fraud must be proved in order to defeat the indefeasibility provision of the statute. It has to be actual fraud and not constructive fraud. (2) The chargee's knowledge that there were other people's prior beneficial interests in the land is not fraud. (3) The Land Administrator was right in the present case in ordering the sale because existence of cause to the contrary had not been shown to his satisfaction. Editorial Note

The plaintiff bank appealed against this decision to the Supreme Court vide Supreme Court Civil Appeal No 235 of 1987. The Supreme Court, comprising Abdul Hamid CJ (Malaya), Abdoolcader and Syed Agil Barakbah SCJJ, dismissed the appeal with costs on 10 November 1987. Cases referred to Public Finance Bhd v Narayanasamy [1971] 2 MLJ 32 Assets Co Ltd v Mere Roihi [1905] AC 176 Tai Lee Finance Co Sdn Bhd v Official Assignee & Ors [1983] 1 MLJ 81 Kheng Soon Finance Bhd v MK Retnam Holdings Sdn Bhd & Ors [1983] 2 MLJ 384 Legislation referred to National Land Code 1965 s 340(2)

Jennifer Cheong (Miss) for the plaintiff. James Puthucheary (Ng Leong Huat with him) for the defendant. Solicitors: Mah-Kok & Din; Skrine & Co. CHAN J: [1] This is an appeal brought under s 418 of the National Land Code 1965 from the decision made by the Land Administrator on 26 June 1986 whereby the land concerned was ordered to be sold by public auction. Section 263(1) of the National Land Code 1965 says that at the conclusion of an enquiry held under s 261, the Land Administrator shall order the sale of the land to which the charge in question relates unless he is satisfied of the existence of cause to the contrary. [2] The registered owner of the land on which the building (known as the Laxamana Apartments) stood charged the property to Bank Bumiputra (M) Bhd in September 1983. However, earlier in June 1983, a purchaser of one of the flats in the building had obtained a housing loan from Perwira Habib Bank (M) Bhd but, because there was no strata title for the flat, the purchaser assigned to Perwira Habib Bank all her rights in the flat. [3] As the charge has been registered under the National Land Code, the interest of Bank Bumiputra as chargee is indefeasible: see s 340(1) of the Code. The indefeasibility of the interest of the chargee bank shall not be extinguished except by reason of any of the circumstances specified in sub-s (2): 340.(2) The title or interest of any such person or body shall not be indefeasible (a) in any case of fraud or misrepresentation to which the person or body, or any agent of the person or body, was a

party or privy; or (b) where registration was obtained by forgery, or by means of an insufficient or void instrument; or (c) where the title or interest was unlawfully acquired by the person or body in the purported exercise of any power or authority conferred by any written law. [4] Perwira Habib Bank's contention (relying on s 340(2)(a)) is that Bank Bumiputra was aware at the time it took the charge that there were purchasers of the flats in the building and, therefore, fraud or constructive fraud is to be inferred. Counsel relied on Public Finance Bhd v Narayanasamy [1971] 2 MLJ 32. This is what Ong CJ, in giving the judgment of the court, said at p 33: The appellants' insistence that the interveners had no rights whatsoever except a right to damages against the respondent for breach of contract is so plainly unconscionable that we are not at all surprised that the judge was driven to find fraud and collusion. We would have done the same. [5] In that case, the Chief Justice (to use the apt language of Mr James Puthucheary) was stretching the facts to fit into Procrustes' bed by saying that if it is unconscionable it is fraud. There is ample authority, starting with Assets Co Ltd v Mere Roihi [1905] AC 176, which laid down that actual fraud must be proved in order to defeat the indefeasibility provision of the statute. It has to be actual fraud and not constructive fraud. It is also held by the Federal Court in Tai Lee Finance Co Sdn Bhd v Official Assignee & Ors [1983] 1 MLJ 81 that the chargee's knowledge that there were other people's prior beneficial interests in the land is not fraud. [6] In my judgment, the law is that as laid down in Tai Lee Finance. The Land Administrator was right in the present case in ordering the sale because existence of cause to the contrary has not been shown to his satisfaction. Accordingly, I would dismiss the appeal with costs. [7] As for the case of Kheng Soon Finance Bhd v MK Retnam Holdings Sdn Bhd & Ors [1983] 2 MLJ 384, I find it difficult to reconcile it with Tai Lee Finance but perhaps it could be explained by this passage from the judgment of Salleh Abas CJ (as he then was) at p 390: We think that the default of the appellant to release the loan alone would be sufficient to dismiss its appeal, but when it is coupled with the equity of the purchasers and the appellant's own unreasonable conduct and attitude, we have no hesitation to dismiss this appeal altogether. ORDER:

Appeal dismissed. LOAD-DATE: 07/28/2011

You might also like

- Case Diamond Peak V UmfDocument10 pagesCase Diamond Peak V UmfIqram MeonNo ratings yet

- Kim Lin CaseDocument18 pagesKim Lin CaseJai Juet Phang100% (3)

- Gan Chee Hui - Approval Before or After SPA Void - Ang Ming LeeDocument15 pagesGan Chee Hui - Approval Before or After SPA Void - Ang Ming LeeHanenFamNo ratings yet

- Registrar's CaveatDocument25 pagesRegistrar's CaveatRachel NgNo ratings yet

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- Case Solicitor NegligentDocument7 pagesCase Solicitor NegligentIqram Meon100% (2)

- Case Lad Claim LateDocument10 pagesCase Lad Claim LateIqram MeonNo ratings yet

- Sheree Cosmetics v. Jenner - ComplaintDocument23 pagesSheree Cosmetics v. Jenner - ComplaintSarah BursteinNo ratings yet

- HONG LEONG FINANCE BHD V STAGHORN SDN BHDDocument18 pagesHONG LEONG FINANCE BHD V STAGHORN SDN BHDS N NAIR & PARTNERS NAIRNo ratings yet

- Bank Pembangunan Dan Infrastruktur MalaysiaDocument8 pagesBank Pembangunan Dan Infrastruktur Malaysia=paul=No ratings yet

- Hong Leong Finance BHD V Staghorn SDN BHDDocument15 pagesHong Leong Finance BHD V Staghorn SDN BHDAmelda Mohd YusofNo ratings yet

- Case Review SampleDocument5 pagesCase Review SampleChubyNo ratings yet

- Kehakiman - Gov.my - Sites - Default - Files - Document3 - Buku Panduan - Bench Book 5.1.10 (2) - Sivil (Latest) - Bench Book 5.1.10 - 15. ORDER For SALEDocument4 pagesKehakiman - Gov.my - Sites - Default - Files - Document3 - Buku Panduan - Bench Book 5.1.10 (2) - Sivil (Latest) - Bench Book 5.1.10 - 15. ORDER For SALEVieanne ChristensenNo ratings yet

- (D) FC - Kheng Soon Finance BHD V MK Retnam HoldingsDocument9 pages(D) FC - Kheng Soon Finance BHD V MK Retnam HoldingsRita LakhsmiNo ratings yet

- Subhra Mookherjee SCDocument8 pagesSubhra Mookherjee SCArghyaNo ratings yet

- Ocbc Bank (M) BHD V Pendaftar Hakmilik, NegeDocument15 pagesOcbc Bank (M) BHD V Pendaftar Hakmilik, NegeRita LakhsmiNo ratings yet

- CaseDocument1 pageCaseserena6697No ratings yet

- CLJ 2008 6 626Document16 pagesCLJ 2008 6 626alliya natashaNo ratings yet

- Case 17 Nik Mahmud V BimbDocument14 pagesCase 17 Nik Mahmud V BimbFirdaus DarkozzNo ratings yet

- Wasim Property CasesDocument10 pagesWasim Property Casestahmoor ahmedNo ratings yet

- G.R. No. L-49568 October 17, 1979 (Banco de Oro vs. Bayuga) FactsDocument11 pagesG.R. No. L-49568 October 17, 1979 (Banco de Oro vs. Bayuga) FactsJoanna May G CNo ratings yet

- Raja Said (Defective)Document7 pagesRaja Said (Defective)Joey WongNo ratings yet

- UMBC V PHT Kota TinggiDocument2 pagesUMBC V PHT Kota TinggiAimnHkimi ZkriaNo ratings yet

- Inter Rally Motor Sdn. Bhd. v. Karupiah PalanisamyDocument6 pagesInter Rally Motor Sdn. Bhd. v. Karupiah PalanisamyJusween SatharNo ratings yet

- Perwira Habib Bank Malaysia BHD V Loo & Sons Realty SDN BHD (1996) 4 CLJ 171Document4 pagesPerwira Habib Bank Malaysia BHD V Loo & Sons Realty SDN BHD (1996) 4 CLJ 171Faizah Randeran100% (1)

- Summary of The CaseDocument2 pagesSummary of The CaseCarley GuanNo ratings yet

- LCK Industries Inc. vs. Planters Development BankDocument11 pagesLCK Industries Inc. vs. Planters Development BankLaurice PaderNo ratings yet

- Bayangan Sepadu SDN BHD V Jabatan Pengairan Dan Saliran Negeri Selangor & OrsDocument31 pagesBayangan Sepadu SDN BHD V Jabatan Pengairan Dan Saliran Negeri Selangor & OrsNaveenNo ratings yet

- Tan Boon Bak & Sons LTD V Government of The State of PerakDocument5 pagesTan Boon Bak & Sons LTD V Government of The State of Perakfarah atiqahNo ratings yet

- 351 of 2020Document21 pages351 of 2020prabhu pujarNo ratings yet

- Adorna PropertiesDocument6 pagesAdorna PropertiesChin Kuen YeiNo ratings yet

- LIPUTAN SIMFONI SDN BHD v. PEMBANGUNANDocument41 pagesLIPUTAN SIMFONI SDN BHD v. PEMBANGUNANEaster0% (1)

- Land LawDocument3 pagesLand Lawnoor athirahNo ratings yet

- 2005 08-10-2005 4 CLJ 345 Perwira Habib Bank Malaysia BHD V Lum Choon Relaty SDN BHD EdDocument29 pages2005 08-10-2005 4 CLJ 345 Perwira Habib Bank Malaysia BHD V Lum Choon Relaty SDN BHD EdKeshini ThanabaluNo ratings yet

- Lien Holders CaveatDocument30 pagesLien Holders Caveatadibah taherahNo ratings yet

- Hak Milik Kerajaan Malaysia: Order For SaleDocument4 pagesHak Milik Kerajaan Malaysia: Order For SaleSyafiq Ahmad100% (1)

- Perwira Affin Bank BHD (Formerly Known As Perwira Habib Bank Malaysia BHD) V Selangor Properties SDN BHD & OrsDocument11 pagesPerwira Affin Bank BHD (Formerly Known As Perwira Habib Bank Malaysia BHD) V Selangor Properties SDN BHD & OrsCold DurianNo ratings yet

- Supreme Court of India: Kayjay Industries (P) Ltd. - Appellant vs. Asnew Drums (P) Ltd. and Others - RespondentDocument7 pagesSupreme Court of India: Kayjay Industries (P) Ltd. - Appellant vs. Asnew Drums (P) Ltd. and Others - RespondentS Shabir HussainNo ratings yet

- CLJ - 2007 - 10 - 277 - BC01034 (Extra Case) - Maxim of EquityDocument12 pagesCLJ - 2007 - 10 - 277 - BC01034 (Extra Case) - Maxim of EquityJIA WENNo ratings yet

- CLJ 2002 2 621 Mmu1Document21 pagesCLJ 2002 2 621 Mmu1Pui SanNo ratings yet

- G.T. Girish v. Y. Subba Raju, 2022 SCC OnLine SC 60Document63 pagesG.T. Girish v. Y. Subba Raju, 2022 SCC OnLine SC 60nidhidaveNo ratings yet

- Prohibitory OrderDocument24 pagesProhibitory OrderSuhail SamsudinNo ratings yet

- Supreme Court Nazul OrdersDocument44 pagesSupreme Court Nazul OrdersSparkNo ratings yet

- 6997 2023 9 1504 44877 Judgement 04-Jul-2023Document18 pages6997 2023 9 1504 44877 Judgement 04-Jul-2023Harneet KaurNo ratings yet

- Azhar Sultana Vs B Rajamani and Ors 17022009 SCs090231COM121840Document8 pagesAzhar Sultana Vs B Rajamani and Ors 17022009 SCs090231COM121840ANUMULA GURU CHARAN 1750409No ratings yet

- Paramoo V Zeno LTD (1968) 2 MLJ 230Document2 pagesParamoo V Zeno LTD (1968) 2 MLJ 230Irdina Zafirah AzaharNo ratings yet

- Shivdev Singh and Ors Vs Sucha Singh and Ors 3101001s000600COM525680Document6 pagesShivdev Singh and Ors Vs Sucha Singh and Ors 3101001s000600COM525680ananya pandeNo ratings yet

- Segar Oil Palm Estate SDN BHD V Tay Tho BokDocument11 pagesSegar Oil Palm Estate SDN BHD V Tay Tho BokChin Kuen YeiNo ratings yet

- Research LienDocument13 pagesResearch LienLavernyaNo ratings yet

- Karuppiah Chettiar V Subramaniam - (1971) 2Document13 pagesKaruppiah Chettiar V Subramaniam - (1971) 2Oh HudaNo ratings yet

- 2004 S C M R 1530Document3 pages2004 S C M R 1530Movies World0% (1)

- Final Memorial)Document16 pagesFinal Memorial)Tushar Bhardwaj0% (1)

- Code of Civil Procedure Home Work-2 T.Kranthi Kiran 18LLB127 Sec: B FactsDocument3 pagesCode of Civil Procedure Home Work-2 T.Kranthi Kiran 18LLB127 Sec: B FactsKranthi Kiran TalluriNo ratings yet

- Perwira Habib Bank Malaysia BHD V Viswanathan SoDocument9 pagesPerwira Habib Bank Malaysia BHD V Viswanathan SoAmelda Mohd Yusof100% (1)

- Shivdev Singh and Ors V. Sucha Singh and OrsDocument6 pagesShivdev Singh and Ors V. Sucha Singh and OrsrohanNo ratings yet

- Petitioner Vs Vs Respondents Katigbak Dimailig Anosan and Associates Viola and GuadizDocument8 pagesPetitioner Vs Vs Respondents Katigbak Dimailig Anosan and Associates Viola and GuadizLucio GeorgioNo ratings yet

- Philippine National Bank v. Gateway PropertyDocument10 pagesPhilippine National Bank v. Gateway PropertyChantal Sue PalerNo ratings yet

- Credit Transactions Digested Cases ConsolidatedDocument158 pagesCredit Transactions Digested Cases ConsolidatedcrazybedanNo ratings yet

- Case DR Ti Teoh SeowDocument6 pagesCase DR Ti Teoh SeowIqram Meon100% (2)

- Affidavit in OppositionDocument27 pagesAffidavit in OppositionMd. Akmal HossainNo ratings yet

- Nathulal vs. PhoolchandDocument2 pagesNathulal vs. PhoolchandMohit BhagatNo ratings yet

- HASSAN V ISMAIL - (1970) 1 MLJ 210Document6 pagesHASSAN V ISMAIL - (1970) 1 MLJ 210Iqram MeonNo ratings yet

- 2 MLJ 330, (1987) 2 MLJ 330Document6 pages2 MLJ 330, (1987) 2 MLJ 330lionheart8888No ratings yet

- S Subramaniam & Ors V Inderjit Kaur Do KarnDocument6 pagesS Subramaniam & Ors V Inderjit Kaur Do KarnIqram MeonNo ratings yet

- Schedule G Sales and Purchase AgreementDocument21 pagesSchedule G Sales and Purchase AgreementNik ZalaniNo ratings yet

- Ku Yan Bte Ku Abdullah V Ku Idris Bin Ku AhmDocument3 pagesKu Yan Bte Ku Abdullah V Ku Idris Bin Ku AhmIqram Meon100% (1)

- KM S Kumarappan Chettiar V S Ramasamy So KMDocument4 pagesKM S Kumarappan Chettiar V S Ramasamy So KMIqram MeonNo ratings yet

- Case Garden CityDocument7 pagesCase Garden CityIqram Meon100% (1)

- Conveyancing - HD C& L ActDocument21 pagesConveyancing - HD C& L ActIqram MeonNo ratings yet

- HASSAN V ISMAIL - (1970) 1 MLJ 210Document6 pagesHASSAN V ISMAIL - (1970) 1 MLJ 210Iqram MeonNo ratings yet

- Golden Approach SDN BHD V Pengarah Tanah DanDocument9 pagesGolden Approach SDN BHD V Pengarah Tanah DanIqram MeonNo ratings yet

- Case - Lad & Payment - Set OffDocument15 pagesCase - Lad & Payment - Set OffIqram MeonNo ratings yet

- CASE - Phoenix V Lee Kay GuanDocument8 pagesCASE - Phoenix V Lee Kay GuanIqram MeonNo ratings yet

- Case SakinasDocument27 pagesCase SakinasIqram MeonNo ratings yet

- CASE - Syarikat Chang ChengDocument9 pagesCASE - Syarikat Chang ChengIqram MeonNo ratings yet

- CASE Mischief Rule Contract OutDocument11 pagesCASE Mischief Rule Contract OutIqram MeonNo ratings yet

- CASE - Chye Fook V Teh Teng SengDocument8 pagesCASE - Chye Fook V Teh Teng SengIqram MeonNo ratings yet

- CASE - Berjaya V MConceptDocument27 pagesCASE - Berjaya V MConceptIqram MeonNo ratings yet

- Case S& P Date of ContractDocument6 pagesCase S& P Date of ContractIqram MeonNo ratings yet

- CASE - Kang Yoon Mook XavierDocument10 pagesCASE - Kang Yoon Mook XavierIqram MeonNo ratings yet

- CASE - Expo Holdings V - Saujana TriangleDocument8 pagesCASE - Expo Holdings V - Saujana TriangleIqram MeonNo ratings yet

- Klrca Rules 2008Document4 pagesKlrca Rules 2008Kamal IshmaelNo ratings yet

- ART - LAD IN S& PADocument24 pagesART - LAD IN S& PAIqram MeonNo ratings yet

- Act 118 Housing Development Control and Licensing Act 1966Document56 pagesAct 118 Housing Development Control and Licensing Act 1966Adam Haida & CoNo ratings yet

- Chapter 3Document2 pagesChapter 3Iqram MeonNo ratings yet

- Act 646Document39 pagesAct 646Iqram MeonNo ratings yet

- Laws of Malaysia - A1289-2007 - Housing Development Act 2007Document17 pagesLaws of Malaysia - A1289-2007 - Housing Development Act 2007SimoncklohNo ratings yet

- Arbitrator AppointmentDocument34 pagesArbitrator AppointmentIqram Meon100% (1)

- Click To Edit Master Subtitle StyleDocument5 pagesClick To Edit Master Subtitle StyleIqram MeonNo ratings yet

- Soft LandscapeDocument45 pagesSoft LandscapeIqram Meon100% (1)

- Soft Landscape 3Document99 pagesSoft Landscape 3Iqram MeonNo ratings yet

- Salvador vs. ChuaDocument13 pagesSalvador vs. ChuaJune Karla LopezNo ratings yet

- Liong vs. Lee, 703 SCRA 240Document1 pageLiong vs. Lee, 703 SCRA 240Prince Cshanneil Surian TanNo ratings yet

- People V ContinenteDocument5 pagesPeople V Continenteharuhime08No ratings yet

- 15quisumbing V Rosales - Commission On Human RightsDocument2 pages15quisumbing V Rosales - Commission On Human RightsIanNo ratings yet

- Oct 20Document220 pagesOct 20Tim BuddsNo ratings yet

- (FC) (2015) 3 MLJ 609 - Syarikat Kemajuan Timbermine SDN BHD V Kerajaan Negeri Kelantan Darul NaimDocument27 pages(FC) (2015) 3 MLJ 609 - Syarikat Kemajuan Timbermine SDN BHD V Kerajaan Negeri Kelantan Darul NaimAlae KieferNo ratings yet

- People vs. JanjalaniDocument3 pagesPeople vs. JanjalaniKing BadongNo ratings yet

- SanlyDocument2 pagesSanlyimXinYNo ratings yet

- A Method For Writing Factual ComplaintsDocument47 pagesA Method For Writing Factual ComplaintsGerard Nelson ManaloNo ratings yet

- Criminal Procedure: RULE 110 Prosecution of OffensesDocument14 pagesCriminal Procedure: RULE 110 Prosecution of OffensesMariaHannahKristenRamirezNo ratings yet

- NHA v. RoxasDocument6 pagesNHA v. RoxasbrownboomerangNo ratings yet

- 88 Baliwag Transit V CADocument2 pages88 Baliwag Transit V CAJanlo FevidalNo ratings yet

- Florida Business Litigation Jury Instructions PDFDocument125 pagesFlorida Business Litigation Jury Instructions PDFSantiago Cueto100% (1)

- Leatherman Tool Group v. King Innovation - ComplaintDocument181 pagesLeatherman Tool Group v. King Innovation - ComplaintSarah BursteinNo ratings yet

- D - Ecourt Documents - Production - Family - 2019 - 11 - S - DR - 0057709 - 5911805 - S - DR - 0057709 - 11 - 16 - 2022 - Family - Minutes - v2Document1 pageD - Ecourt Documents - Production - Family - 2019 - 11 - S - DR - 0057709 - 5911805 - S - DR - 0057709 - 11 - 16 - 2022 - Family - Minutes - v2Christine SparksNo ratings yet

- Republic Vs de Borja Digest (Criminal)Document1 pageRepublic Vs de Borja Digest (Criminal)Justin IsidoroNo ratings yet

- Third Division (G.R. No. 217044, January 16, 2019)Document10 pagesThird Division (G.R. No. 217044, January 16, 2019)Tam ChuaNo ratings yet

- Lavides vs. CA Facts:: After His Arraignment"Document6 pagesLavides vs. CA Facts:: After His Arraignment"Caroline A. LegaspinoNo ratings yet

- 7.) Government of USA vs. Judge PurgananDocument3 pages7.) Government of USA vs. Judge PurgananFelix DiazNo ratings yet

- Right of The Accused - DigestDocument18 pagesRight of The Accused - DigestApril Toledo100% (1)

- United States v. Huebner, A.F.C.C.A. (2015)Document9 pagesUnited States v. Huebner, A.F.C.C.A. (2015)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument4 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument6 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Barrido Vs NonatoDocument1 pageBarrido Vs NonatoKristine MagbojosNo ratings yet

- ANUSAVICE Gary IndictmentDocument17 pagesANUSAVICE Gary IndictmentHelen BennettNo ratings yet

- General Banking Law: Banking Sia Vs Ca and Security Bank 1Document6 pagesGeneral Banking Law: Banking Sia Vs Ca and Security Bank 1Su Kings AbetoNo ratings yet

- Auditors Report PDFDocument39 pagesAuditors Report PDFMia Laurice Rubio - MarquezNo ratings yet

- CAT Versus Supreme Court On Spouse GroundDocument5 pagesCAT Versus Supreme Court On Spouse GroundJohn GroverNo ratings yet

- Extinction of Criminal LiabilityDocument2 pagesExtinction of Criminal LiabilityJustine M.No ratings yet