Professional Documents

Culture Documents

Myanmar:Asian Development Outlook 2012: Confronting Rising Inequality in Asia

Uploaded by

Pugh JuttaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Myanmar:Asian Development Outlook 2012: Confronting Rising Inequality in Asia

Uploaded by

Pugh JuttaCopyright:

Available Formats

Myanmar

Economic growth picked up in FY2011, based largely on foreign investment in energy and exports of

commodities and natural gas. That trend is forecast to continue, assisted by policy reforms and higher gas

exports in 2013. Ination is expected to quicken, after receding in 2011. The government has taken steps

to revitalize the economy, but the agenda of required reforms is long.

Economic performance

GDP growth edged up to an estimated 5.5% in FY2011 (ended 31March

2012), from an average of 4.9% over the previous 4years, based mainly

on investment in hydropower, natural gas, and oil. Agriculture remained

subdued owing to fooding and currency appreciation that hurt exports.

International tourist arrivals rose by an estimated 26% (Figure3.27.1),

in part a response to initial political and economic reforms afer national

elections in November 2010.

(Ofcial GDP growth fgures, which are considerably higher than

these unofcial estimates, are inconsistent with variables that are closely

correlated with economic growth, such as energy use.)

Te exchange rate of the kyat on the unofcial market appreciated to

about MK/ in , maintaining an upward trend from MK,

in 2009. Te appreciation was driven largely by foreign investment. (Te

ocial exchange rate was maintained at MK./ in FY.)

One outcome of the stronger market exchange rate was to reduce rice

exports, which created a surplus in the domestic market and brought

down rice prices. Tat helped slow infation to 4.2% on average in FY2011,

from 7.3% in the previous fscal year.

Exports of gas increased by nearly to an estimated billion

(Figure3.27.2). Gemstone and jade exports, however, likely declined afer

doubling in FY2010. Higher levels of imports, particularly construction

materials and machinery, widened the current account defcit to an

estimated 2.7% of GDP in FY2011, from 0.9% in FY2010.

Increased foreign investment in energy and hydropower, estimated at

.billion in FY, helped li international reserves to about billion

by March 2012, equivalent to 9.4months of imports (Figure3.27.3).

Foreign investment in other industries is insignifcant owing to barriers

to entry and a poor business environment. Total external debt is

estimated at billion, with about half in arrears.

Te consolidated fscal defcitcovering the central government

and state economic enterprisesis estimated at 5.5% of GDP in FY2011

(Figure3.27.4). Revenue collection remained low because of weak tax

administration and a reduction of export taxes implemented to support

This chapter was written by Alfredo Perdiguero of the Thailand Resident Mission, ADB,

Bangkok.

3.27.1 Tourism indicators

0

150

300

450

0

150

300

450

Revenue from tourism International tourists

11 10 09 08 2007

Thousand persons $ million

Source: Ministry of Hotels and Tourism.

3.27.2 Gas exports

0

1

2

3

4

11 10 09 08 07 2006

$ billion

Note: In scal years.

Source: Department of Energy Planning, Ministry of Energy.

Economic trends and prospects in developing Asia: Southeast Asia Myanmar 207

agricultural exports. Te phasing down of construction of the new capital

Naypyidaw helped rein in growth of government spending.

Te monetary authorities lowered administered bank interest rates

by 4percentage points from 17% to 13% for lending and from 12% to 8%

for deposits in FY2011, though banks were also given some fexibility in

setting deposit rates. Yields on Treasury bonds made them attractive

investments for banks, which reduced central bank monetization of the

fscal defcit in FY2011.

Economic prospects

Te government that took ofce in March 2011 has an opportunity

to rejuvenate the economy afer more than 50years of stagnation.

In a promising start, the authorities took steps to unify the multiple

exchange rates and are preparing other reforms, including a new national

development plan.

New currency arrangements from 1 April 2012 involve a managed foat

of the kyat with a reference exchange rate of MK/. e government

plans to establish a formal interbank market and relax exchange

restrictions on current international payments and transfers. Fiscal policy

in FY2012 targets a modest fscal defcit equivalent to 4.6% of GDP.

Among planned reforms is a land law giving farmers the right to

own, sell, and mortgage their land. Credit to the farm sector remains

inadequate, even though the Myanmar Agriculture Development Bank

has doubled its funding for farmers in each of the past 2years. A

microfnance law was approved in November 2011 to expand microcredit

to farmers.

Te government is preparing a new foreign investment law that is

expected to ofer tax breaks to investors and allow them to lease private

land and repatriate investment proceeds using market exchange rates.

Special economic zones in Dawei in southern Myanmar, Tilawa near

Yangon, and Kyaukphyu on the west coast will be established to attract

industry.

While the government last year ordered that work be suspended on

the large Myitsone hydropower project owing to environmental concerns,

investment is picking up on other hydropower and coal-powered plants,

gas felds, and oil and gas pipelines.

Gas production and exports are scheduled to increase sharply in

FY2013 when the Shwe and Zawtika gas felds and pipelines to the Peoples

Republic of China (PRC) and Tailand, now under construction, come

on line. However, a market-determined exchange rate will threaten the

viability of state economic enterprises that long benefted from importing

inputs at the ofcial exchange rate, abolished on 1April this year.

GDP is forecast to grow by about 6.0% in FY2012 and 6.3% in FY2013

(Figure3.27.5). Infation is seen quickening to just over 6% (Figure3.27.6).

Te authorities raised administered electricity prices in late 2011 and fuel

prices in early 2012. A government plan to help farmers by supporting

rice prices is likely to lead to higher retail prices of rice.

Relaxing foreign exchange controls is expected to propel imports

upward and contribute to a widening of the current account defcit

(Figure3.27.7).

3.27.3 International reserves

0

2

4

6

8

10

0

2

4

6

8

10

Import cover Level

11 10 09 08 2007

$ billion Months

Source: Asian Development Outlook database.

3.27.4 Fiscal indicators

-10

0

10

20

Overall budget balance

Revenue

Expenditure and net lending

11 10 09 08 2007

% of GDP

Source: Asian Development Outlook database.

3.27.5 GDP growth

0

2

4

6

8

13 12 11 10 09 08 2007

Forecast

%

5-year moving average

Source: Asian Development Outlook database.

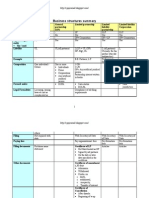

3.27.1 Selected economic indicators (%)

2012 2013

GDP growth 6.0 6.3

Ination 6.2 6.3

Current account balance

(share of GDP)

-4.8 -5.0

Source: ADB estimates.

208 Asian Development Outlook 2012

Easing of economic sanctions imposed on Myanmar by industrial

countries would lead to higher levels of trade and investment, as well as

the resumption of assistance and concessionary fnancing both from these

countries and from international fnancial institutions.

Policy challenge highlights

A key challenge is to maintain macroeconomic stability as the country

opens to increased fows of trade and investment.

As for policy reforms, the agenda is extensive, given the low level of

economic and social development. Per capita GDP is one of the lowest

in Southeast Asia at about (Figure..), and of the country's

60million people live in poverty. Myanmars ranking on the United

Nations Human Development Index is near the bottom of the list (149

of 187 countries). Te country needs to embark on a comprehensive and

well-sequenced program of reforms if it is to realize its potential.

Public institutions, the fnancial system, and workforce skills are

focuses for strengthening. Developing the private sector depends on

opening more areas to its participation and upgrading the regulatory,

legal, and policy environment.

Te government needs to generate adequate fscal resources to expand

infrastructure (75% of the population do not have access to electricity)

and improve health, education, and social protection systems. A simpler

and broader tax structure and greater emphasis on direct (rather than

indirect) taxes would bolster fscal resources and be fairer to the poor.

Extending transport networks to link Myanmar more closely with

neighbors would enable its businesses to participate in East and Southeast

Asian, as well as global, production chains.

Unifying the exchange rate will expose the inefciencies and losses

of state enterprises, which dominate parts of the economy. Tat is likely

to require reforms to put state enterprises on a more commercial basis,

including privatizing some and possibly closing others. Tus, temporary

and transparent subsidies will have to be introduced to minimize the

impact on the poor as state enterprises raise prices and lay of employees.

Expanded access to formal fnance is another key challenge that will

require a phasing out of bank deposit-to-capital ratios and an easing

of collateral requirements. Upgrading the central bank would involve

granting it operational autonomy and strengthening its capacity to

supervise the fnancial sector. Consolidating the domestic banking sector

and developing partnerships with foreign banks would strengthen the

banking system.

Agriculture, which employs over half the population, has great

potential for improvement. Te distribution of land ownership certifcates

under the new land law is a step forward, but will require careful

implementation to ensure that the poor beneft. Tis measure should be

complemented by an expansion of credit to farmers, increased public

investment in rural infrastructure, and better seeds, fertilizers, extension

services, and post-harvest facilities.

3.27.6 Ination

0

6

12

18

24

13 12 11 10 09 08 2007

%

5-year moving average

Forecast

32.9 30

Sources: Asian Development Outlook database; ADB

estimates.

3.27.7 Current account balance

-6

-4

-2

0

2

13 12 11 10 09 08 2007

% of GDP

Forecast

Sources: Asian Development Outlook database; ADB

estimates.

3.27.8 Per capita income, 2011

400

800

1,200

1,600

VIE LAO CAM BAN MYA

$

BAN=Bangladesh; CAM=Cambodia; LAO=Lao Peoples

Democratic Republic; MYA=Myanmar; VIE=VietNam.

Source: Asian Development Outlook database.

You might also like

- MNHRC REPORT On Letpadaungtaung IncidentDocument11 pagesMNHRC REPORT On Letpadaungtaung IncidentPugh JuttaNo ratings yet

- #Myanmar #Nationwide #Ceasefire #Agreement #Doc #EnglishDocument14 pages#Myanmar #Nationwide #Ceasefire #Agreement #Doc #EnglishPugh JuttaNo ratings yet

- HARVARD:Crackdown LETPADAUNG COPPER MINING OCT.2015Document26 pagesHARVARD:Crackdown LETPADAUNG COPPER MINING OCT.2015Pugh JuttaNo ratings yet

- #NEPALQUAKE Foreigner - Nepal Police.Document6 pages#NEPALQUAKE Foreigner - Nepal Police.Pugh JuttaNo ratings yet

- Justice For Ko Par Gyi Aka Aung Kyaw NaingDocument4 pagesJustice For Ko Par Gyi Aka Aung Kyaw NaingPugh Jutta100% (1)

- SOMKIAT SPEECH ENGLISH "Stop Thaksin Regime and Restart Thailand"Document14 pagesSOMKIAT SPEECH ENGLISH "Stop Thaksin Regime and Restart Thailand"Pugh JuttaNo ratings yet

- HARVARD REPORT :myanmar Officials Implicated in War Crimes and Crimes Against HumanityDocument84 pagesHARVARD REPORT :myanmar Officials Implicated in War Crimes and Crimes Against HumanityPugh JuttaNo ratings yet

- BURMA Economics-of-Peace-and-Conflict-report-EnglishDocument75 pagesBURMA Economics-of-Peace-and-Conflict-report-EnglishPugh JuttaNo ratings yet

- KNU and RCSS Joint Statement-October 26-English.Document2 pagesKNU and RCSS Joint Statement-October 26-English.Pugh JuttaNo ratings yet

- United Nations Office On Drugs and Crime. Opium Survey 2013Document100 pagesUnited Nations Office On Drugs and Crime. Opium Survey 2013Pugh JuttaNo ratings yet

- Asia Foundation "National Public Perception Surveys of The Thai Electorate,"Document181 pagesAsia Foundation "National Public Perception Surveys of The Thai Electorate,"Pugh JuttaNo ratings yet

- Davenport McKesson Corporation Agreed To Provide Lobbying Services For The The Kingdom of Thailand Inside The United States CongressDocument4 pagesDavenport McKesson Corporation Agreed To Provide Lobbying Services For The The Kingdom of Thailand Inside The United States CongressPugh JuttaNo ratings yet

- ACHC"social Responsibility" Report Upstream Ayeyawady Confluence Basin Hydropower Co., LTD.Document60 pagesACHC"social Responsibility" Report Upstream Ayeyawady Confluence Basin Hydropower Co., LTD.Pugh JuttaNo ratings yet

- Children For HireDocument56 pagesChildren For HirePugh JuttaNo ratings yet

- Modern Slavery :study of Labour Conditions in Yangon's Industrial ZonesDocument40 pagesModern Slavery :study of Labour Conditions in Yangon's Industrial ZonesPugh JuttaNo ratings yet

- UNODC Record High Methamphetamine Seizures in Southeast Asia 2013Document162 pagesUNODC Record High Methamphetamine Seizures in Southeast Asia 2013Anonymous S7Cq7ZDgPNo ratings yet

- Rcss/ssa Statement Ethnic Armed Conference Laiza 9.nov.2013 Burmese-EnglishDocument2 pagesRcss/ssa Statement Ethnic Armed Conference Laiza 9.nov.2013 Burmese-EnglishPugh JuttaNo ratings yet

- Laiza Ethnic Armed Group Conference StatementDocument1 pageLaiza Ethnic Armed Group Conference StatementPugh JuttaNo ratings yet

- Myitkyina Joint Statement 2013 November 05.Document2 pagesMyitkyina Joint Statement 2013 November 05.Pugh JuttaNo ratings yet

- Brief in BumeseDocument6 pagesBrief in BumeseKo WinNo ratings yet

- U Kyaw Tin UN Response by PR Myanmar Toreport of Mr. Tomas Ojea QuintanaDocument7 pagesU Kyaw Tin UN Response by PR Myanmar Toreport of Mr. Tomas Ojea QuintanaPugh JuttaNo ratings yet

- Poverty, Displacement and Local Governance in South East Burma/Myanmar-ENGLISHDocument44 pagesPoverty, Displacement and Local Governance in South East Burma/Myanmar-ENGLISHPugh JuttaNo ratings yet

- KIO Government Agreement MyitkyinaDocument4 pagesKIO Government Agreement MyitkyinaPugh JuttaNo ratings yet

- Ceasefires Sans Peace Process in Myanmar: The Shan State Army, 1989-2011Document0 pagesCeasefires Sans Peace Process in Myanmar: The Shan State Army, 1989-2011rohingyabloggerNo ratings yet

- TBBC 2013-6-Mth-Rpt-Jan-JunDocument130 pagesTBBC 2013-6-Mth-Rpt-Jan-JuntaisamyoneNo ratings yet

- Karen Refugee Committee Newsletter & Monthly Report, August 2013 (English, Karen, Burmese, Thai)Document21 pagesKaren Refugee Committee Newsletter & Monthly Report, August 2013 (English, Karen, Burmese, Thai)Pugh JuttaNo ratings yet

- MON HUMAN RIGHTS REPORT: DisputedTerritory - ENGL.Document101 pagesMON HUMAN RIGHTS REPORT: DisputedTerritory - ENGL.Pugh JuttaNo ratings yet

- The Dark Side of Transition Violence Against Muslims in MyanmarDocument36 pagesThe Dark Side of Transition Violence Against Muslims in MyanmarPugh JuttaNo ratings yet

- SHWE GAS REPORT :DrawingTheLine ENGLISHDocument48 pagesSHWE GAS REPORT :DrawingTheLine ENGLISHPugh JuttaNo ratings yet

- Taunggyi Trust Building Conference Statement - BurmeseDocument1 pageTaunggyi Trust Building Conference Statement - BurmesePugh JuttaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- HandoutDocument14 pagesHandoutJuzer ShabbirNo ratings yet

- RMO No 19-2015Document10 pagesRMO No 19-2015gelskNo ratings yet

- Annexures Q2Document67 pagesAnnexures Q2Prasanth C JohnNo ratings yet

- Spin Sacco Members In-House TrainingDocument30 pagesSpin Sacco Members In-House TrainingSirengo MauriceNo ratings yet

- Securities (Lastman) - 2012-13Document69 pagesSecurities (Lastman) - 2012-13scottshear1No ratings yet

- Makati Leasing v. Wearever TextileDocument1 pageMakati Leasing v. Wearever TextileJoyce ManuelNo ratings yet

- CFA Sector Analysis BankingDocument10 pagesCFA Sector Analysis BankingTai NguyenNo ratings yet

- Rishabh Itt PPT On Financial MangmentDocument21 pagesRishabh Itt PPT On Financial MangmentRishabh AgrwalNo ratings yet

- Federal Reserve AffidavitDocument7 pagesFederal Reserve AffidavitChester A Arthur100% (2)

- Audit Data Analytics To Traditional Procedures Mapping DocumentDocument553 pagesAudit Data Analytics To Traditional Procedures Mapping DocumentDarma Bonar TampubolonNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- VOL. 153, AUGUST 31, 1987 435: Philippine National Bank vs. Court of AppealsDocument11 pagesVOL. 153, AUGUST 31, 1987 435: Philippine National Bank vs. Court of AppealsQuennie Jane SaplagioNo ratings yet

- C 03Document52 pagesC 03Lạc LốiNo ratings yet

- Financial AccountingDocument1,056 pagesFinancial AccountingCalmguy Chaitu96% (28)

- Collection of All Type of Documents Used in Banks and OfficeDocument9 pagesCollection of All Type of Documents Used in Banks and OfficeLISBONNo ratings yet

- Loyola PlansDocument6 pagesLoyola PlansBodybliss ManNo ratings yet

- Quiz 5Document115 pagesQuiz 5LEKHAN GAVINo ratings yet

- Bus 101 NotesDocument3 pagesBus 101 NotesNina YunNo ratings yet

- RESEARCH FinalDocument42 pagesRESEARCH FinalNesru Siraj100% (1)

- Chapter 2 FM ReportDocument56 pagesChapter 2 FM ReportMaricar PuraNo ratings yet

- NPA ManagementDocument18 pagesNPA ManagementVincy LuthraNo ratings yet

- Using Vocabulary in Business and EconomicsDocument13 pagesUsing Vocabulary in Business and EconomicsKashani100% (2)

- A Loan and Interest Problem: RepresentationsDocument2 pagesA Loan and Interest Problem: RepresentationsMarjorie ChavezNo ratings yet

- Defibering UnitDocument3 pagesDefibering UnitArie MambangNo ratings yet

- Banco Filipino v. Court of Appeals, G.R. No. 129227, May 30, 2000 - VALDocument55 pagesBanco Filipino v. Court of Appeals, G.R. No. 129227, May 30, 2000 - VALYodh Jamin OngNo ratings yet

- Financial InclusionDocument69 pagesFinancial InclusionthenosweenNo ratings yet

- Magma Fincorp LimitedDocument3 pagesMagma Fincorp LimitedArun P PrasadNo ratings yet

- Business Structures SummaryDocument5 pagesBusiness Structures SummaryMrudula V.100% (2)

- Loan Loss ProvisionDocument6 pagesLoan Loss Provisiontanim7No ratings yet

- Capital Reserves and Bank ProfitabilityDocument49 pagesCapital Reserves and Bank Profitabilityjen18612No ratings yet