Professional Documents

Culture Documents

Lit Bank & Need Hierarchy

Uploaded by

Subha ShiniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lit Bank & Need Hierarchy

Uploaded by

Subha ShiniCopyright:

Available Formats

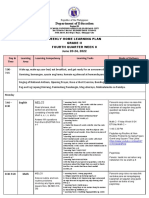

NEED HIERARCHY & FINANCIAL PLANNING

5. SELF ACTUALIZATION

5. TAX AND ESTATE/LEGAL PLANNING

4. SELF ESTEEM

4. RETIREMENT PLANNING

3. SOCIAL NEEDS

3. PLANNING FINANCIAL GOALS

2. SECURITY NEEDS

2. RISK MANAGEMENET

1. BASIC NEEDS

1. CONTINGENCY PLANNING

NEED HIERARCHY & FINANCIAL PLANNING 1. Contingency Planning: SB No Frills/Silver/ Gold CD Classic/ Super Online Banking/ SMS/Email Alerts Debit card/ Credit Card 2. Risk Management: Jeevan/ Vidya Suraksha/ Liability Insurance HealthCare Plus, Personal Accident Insurance, Asset Insurance, NRI Shield All LifeInsurance Products thro LIC: Life/ Endowment/Money Back/ Market Plus/ BimaGold All General Insurance Products thro USGI All Risk/ Fire/ Marine/Farmers/ Householders/ Shopkeepers/ Electrical Equipment/ Plant & Machinery DD/ Cheque/ NEFT/RTGS Utilities Payment/ Bill Payment Clean Loan

3. Planning for Financial Goals: a) Fixed Deposits: FD/SFD/ RD/ RD Gold/ RDP/ Easy deposit/ ED/ WD/VS/ Tax Saver b) Gold retail 4/8/20/50 gm c) Retail Loans: Pushpaka / Easy trade/ Sanjeevini/ Liquirent/ CC against jewellery Home dcor/ Home improvement Subhagruha/ NRI Home loans/ Sahayika/ Vidya Jyothi

d) Mutual funds/ ULIPs- SIP/ Bulk investment, Equity trading-Demat a/c

4. Retirement Planning: FD Schemes: Vardhan scheme/ varshik Aai Yojna PF/ Gratuity/ Pension Accounts Pensioners loan scheme Mutual funds and insurance related schemes

5) Tax and Estate Planning: IOB Tax saver TTD Deposit Charity/ Sponsorship facilitation Participation in CSR- Sampoorna/ Shakti/ Microfinance

Project Report "Banking System" in India Introduction of Banking

Banking regulation Act, 1949, defines banking as accepting for the purpose of lending or investment, of deposits of money from the public, repayable on demands or otherwise and with draw able on demand by cheques, draft or order otherwise.

Functions of Commercial Banks :

1. To change cash for bank deposits and bank deposits for cash. 2. To transfer bank deposits between individuals and or companies. 3. To exchange deposits for bills of exchange, govt. bonds, the secured and unsecured promises of trade and industrial units. 4. To underwrite capital issues. They are also allowed to invest 5% of their incremental deposit liabilities in shares and debentures in the primary and secondary markets. 5. The lending or advancing of money either upon securities or without securities.

6. The borrowing, raising or taking of money. 7. The collecting and transmitting of money and securities. 8. The buying and selling of foreign exchange including foreign bank notes.

Banking scene in India

The banking sector in India is passing through a period of structural change under the combined impact of financial sector reforms, internal competition, changes in regulations, new technology, global competitive pressure and fast evolving strategic objectives of banks and their existing and potential competitors. Until the last decade, banks were regarded largely as institutions rather akin to public utilities. The market for banking services were oligopolies and Centralized while the market place was regulated and banks were expected to receive assured spreads over their cost of funds. This phenomenon, which was caricatured as 36-3 banking in the united states, meaning that banks accepted deposits at 3%, lent at 6%, and went home at 3 p.m. to play golf, was the result of the sheltered markets and administrated prices for banking products. Existence of entry barriers for new banks meant that competition was restricted to existing players, who often operated as a cartel, even in areas where the freedom to price their products existed. The market place began to change for banks in India as a result of reforms of the financial sectors initiated in the current decade. On account of policy measures introduce to infuse greater competitive vitality in the system, the banking has entered in to a competitive phase. Competition has emerged not only from within the banking system but also from non-banking institutions. Lowering of entry barriers, deregulation of interest rates and growing sophistication of customers have made banking far less oligopolistic today. Introduction of capital adequacy and other prudential norms, freedom granted to enter into new turfs and greater overlap of functions between banks and non-banks have forced banks to get out of their cozy little world and think of the future of the banking.

Emerging Environment of Banking in India

Full convertibility of rupee leading to free mobility of capital, which will mean virtual collapse of the national borders for trade and capital flows. Greater coordination between monetary, fiscal and exchanged rate policies for achieving the goals of faster and sustainable economic growth, macro-economic stability and export promotion. Close integration of various financial markets such as money market, capital market and forex market. Removal of lowering of existing barriers of competitiveness, which are present today in the form of quantitative instructions on certain imports protective custom duties, reservation of certain utilities for the public sector.

Growing privatization and commercialization infrastructure sector. Today, Banks customers are better informed, more sophisticated and discerning. They also have a wide choice to choose from various banks and non-bank intermediaries. Their expectations are soaring. This is particularly true for banks corporate clientele but also applies to customers from personal segment. This is changing profile of customers call for a shift from product-based approach to customers-based approach. A bank aiming at maximizing customer value must, of necessity, plan for customized products. A combination of marketing skills and state-of-the-art technology should enable to bank in maximizing its profits through customer satisfaction. In the next millennium banks will have to be more and more cautions about customer service, profitability, increased productivity, to keep face with changing banking scenario. As banks in India prepare themselves for the millenium these are the shifts in the paradigm they are likely to experience. The 21st century may see the dawn of DARWINIAN BANKING. Only the banks could fulfill the demands of markets and changing items would survive and prosper.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Oblicon SampleDocument1 pageOblicon SamplelazylawatudentNo ratings yet

- Lecture 4Document25 pagesLecture 4ptnyagortey91No ratings yet

- Lanegan (Greg Prato)Document254 pagesLanegan (Greg Prato)Maria LuisaNo ratings yet

- The Changing Face of War - Into The Fourth GenerationDocument5 pagesThe Changing Face of War - Into The Fourth GenerationLuis Enrique Toledo MuñozNo ratings yet

- Failure Analysis Case Study PDFDocument2 pagesFailure Analysis Case Study PDFScott50% (2)

- Application of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesDocument14 pagesApplication of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesWilson VargasNo ratings yet

- Binomial ExpansionDocument13 pagesBinomial Expansion3616609404eNo ratings yet

- Philips DVD Player SpecificationsDocument2 pagesPhilips DVD Player Specificationsbhau_20No ratings yet

- Department of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Document8 pagesDepartment of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Evelyn DEL ROSARIONo ratings yet

- Laws of MotionDocument64 pagesLaws of MotionArnel A. JulatonNo ratings yet

- Benjie Reyes SbarDocument6 pagesBenjie Reyes Sbarnoronisa talusobNo ratings yet

- Employee Engagement A Case Study at IVRCL-1Document7 pagesEmployee Engagement A Case Study at IVRCL-1Anonymous dozzql7znKNo ratings yet

- EASA TCDS E.007 (IM) General Electric CF6 80E1 Series Engines 02 25102011Document9 pagesEASA TCDS E.007 (IM) General Electric CF6 80E1 Series Engines 02 25102011Graham WaterfieldNo ratings yet

- Development of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993Document14 pagesDevelopment of Rsto-01 For Designing The Asphalt Pavements in Usa and Compare With Aashto 1993pghasaeiNo ratings yet

- Ana White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Document20 pagesAna White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Ahmad KamilNo ratings yet

- Deluxe Force Gauge: Instruction ManualDocument12 pagesDeluxe Force Gauge: Instruction ManualThomas Ramirez CastilloNo ratings yet

- WhatsoldDocument141 pagesWhatsoldLuciana KarajalloNo ratings yet

- Daftar PustakaDocument4 pagesDaftar PustakaRamli UsmanNo ratings yet

- ASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsDocument20 pagesASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsEng. Emílio DechenNo ratings yet

- B. Ing Kls 6Document5 pagesB. Ing Kls 6siskaNo ratings yet

- Self Team Assessment Form - Revised 5-2-20Document6 pagesSelf Team Assessment Form - Revised 5-2-20api-630312626No ratings yet

- NOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationDocument10 pagesNOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationNur AfiqahNo ratings yet

- Individual Assignment ScribdDocument4 pagesIndividual Assignment ScribdDharna KachrooNo ratings yet

- FBCA Biomarkers and ConditionsDocument8 pagesFBCA Biomarkers and Conditionsmet50% (2)

- Fong vs. DueñasDocument2 pagesFong vs. DueñasWinter Woods100% (3)

- IntroductionDocument34 pagesIntroductionmarranNo ratings yet

- NGPDU For BS SelectDocument14 pagesNGPDU For BS SelectMario RamosNo ratings yet

- Cianura Pentru Un Suras de Rodica OjogDocument1 pageCianura Pentru Un Suras de Rodica OjogMaier MariaNo ratings yet

- Miami Police File The O'Nell Case - Clemen Gina D. BDocument30 pagesMiami Police File The O'Nell Case - Clemen Gina D. Barda15biceNo ratings yet

- Clean Agent ComparisonDocument9 pagesClean Agent ComparisonJohn ANo ratings yet