Professional Documents

Culture Documents

Under A Variable Life Insurance Contract Chap2

Uploaded by

Ira CliftonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Under A Variable Life Insurance Contract Chap2

Uploaded by

Ira CliftonCopyright:

Available Formats

Under a variable life insurance contract, the guaranteed minimum death benefit is: the face amount of the

policy Which of the following is an example of a Limited-Pay Life policy? Life Paid-Up at Age 65 Joint Whole Life insurance is a form of which of the following? 3 year Modified whole Life Which of the following life insurance policies is representative of term insurance combined with investment choices? Variable Universal Life Life insurance policies do not contain many exclusions. However, they do exclude or limit benefits in the event of death resulting from special risk situations which are not anticipated in the normal risk selection process. Exclusions or restrictions are common in each of the following possible causes of death EXCEPT: death while a passenger on a public transportation system N decides to borrow one-half of the Cash Value available in a Whole Life policy. If N decides not to pay the interest when due, the company will: Add the interest to the loan balance R owns a 30-pay Life Policy that he purchased at the age of 30. When does the cash value equal the face value of this policy? 100 Which of the following statements are true about Universal Life Insurance policies? Premiums can be adjusted, but the payment due date cannot be changed An adjustable life insurance policy provides the flexibility to allow: the insured to change the face amount or the premium payments The cash value and death benefits increase on which of the following policies? Universal Life When the cash surrender value of a life insurance policy is used to purchase a policy marketed by another insurer, this is regarded as which of the following? External Replacement Z wants to buy Life Insurance that will allow Z to vary the premium payments and allow Z to determine how the Cash Value is invested. He should buy ______?Universal Variable Which of the following Term Insurance policies contains the lowest premium? Non-Renewable, Non-Convertible Term The face amount of a life insurance policy is the amount: to be paid upon the death of the insured person Which of the following statements is true about the premium payment schedule for a

Whole Life policy? Premiums are payable throughout the insured's lifetime, and coverage continues until the insured's death The cash value of a whole life insurance policy will equal the face amount of coverage: if the insured lives to be age 100 If a death claim is made while there is a loan against a life insurance policy: the loan amount plus interest will be deducted from the death benefit All of the following are true about term life insurance EXCEPT: term insurance is one of the least expensive forms of protection for older individuals An insurance prospect wants to purchase a policy that will accumulate the largest amount of cash by age 65. Which of the following policies would be most likely to satisfy the prospect's needs? Endowment at Age 65 policy Which of the following is NOT a feature of convertible term life insurance? Evidence of insurability is required at time of conversion A graded premium policy would do which of the following? Premium would increase each year for 5 years and then remain level

Term insurance pays benefits if the: insured dies during a specified time period For which of the following clients would you most likely recommend a modified whole life policy? A young couple wanting permanent coverage at a reduced premium Which characteristic makes Adjustable Life Insurance advantageous? Flexible premium policy Which of the following best describes a policy with a face amount that remains the same and requires a premium increase each year? Annual Renewable Term Individual life insurance may be written so that the cash value equals the face value of the policy before the insured reaches age 100. These policies with an accelerated cash value buildup are often used to accumulate funds for special purposes such as the education of the insureds children, or retirement. This type of policy is known as: endowment insurance Paid-up insurance is available under which of the following policies? Whole life Which of the following is NOT a characteristic of whole life or straight life insurance? The premiums are paid only until the insured reaches age 70 An insured has purchased a $100,000 whole life insurance policy. After a period of years, the cash value of the policy has grown to $42,000. If the insured dies at this time the beneficiary will receive:

$100,000 Which combines investment choices with Term Insurance? Universal Variable Whole Life If a policy is over funded according to IRS rules, it is known as a: MEC At age 30, A client wishes to purchase a Whole Life policy. The agent explains that payment may be made several ways. One method is called 20-Pay Life, and another, Straight Life. The client wishes to know which plan will accumulate cash value at a faster rate in the early years of the policy. Which of the following would be the agent's most appropriate response? 20-Pay Life will accumulate cash value faster A single parent is the primary support of three children and wishes to purchase as much insurance as possible and name the children as beneficiaries. Which would you suggest? Term A life insurance policy that begins with a low premium rate, which increases in steps over a period of years and then becomes a level premium policy, is known as a(n): graded premium policy Premium in Life Insurance is determined by: Risk classification What is Credit Life Insurance written as? Decreasing term The most significant characteristic of a single-premium whole life insurance policy is that the: entire cost of the policy is paid up at the time of purchase Credit Insurance must never: Exceed the limit of the debt. All of the following are true about a whole life insurance policy EXCEPT: premium payments increase with the age of the insured In a Universal life policy, all of the following permit tax-free access to the policy's cash value EXCEPT? Cash surrender M, age 27, is advised by an agent to purchase Life Insurance to cover a 20-year, $50,000 amortized business-improvement loan. Which of the following plans would adequately protect M at the minimum premium outlay? A $50,000 Decreasing Term policy for 20 years

Universal Life Insurance is which of the following? A flexible premium cash deposit and monthly renewable term coverage Mike wants to buy a life insurance policy that will cover premature death for his entire life.

What type of life insurance policy should he buy? Whole Life The distinguishing characteristic of variable life insurance is that the: amount of the death benefit changes, based on the performance of the investment account. A type of life insurance which is usually written for small amounts, and which requires frequent premium payments which are collected by the agent, is called: industrial life insurance A young married person is considering a permanent life insurance purchase. Which of the following types of policies would have the LOWEST premium rate per $1,000 of face value? Straight life whole life A Modified Endowment Contract is created when: The total premiums in the policys first seven years exceeds the net premiums of the seven-pay policy

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Foreign Trusts: Their Distinguishing Features and The Consequences of Their Use-An UpdateDocument15 pagesForeign Trusts: Their Distinguishing Features and The Consequences of Their Use-An UpdateChristopher S. Armstrong100% (2)

- IC Exam ReviewerDocument14 pagesIC Exam Reviewerfrancis75% (8)

- Sun Life App Form Reg SR02886713ALZHENDocument10 pagesSun Life App Form Reg SR02886713ALZHENEmmans Marco NaagNo ratings yet

- VUL Mock Exam 1 (October 2018)Document12 pagesVUL Mock Exam 1 (October 2018)Alona Villamor ChancoNo ratings yet

- Ic 38 MCQ 1Document23 pagesIc 38 MCQ 1ClassicaverNo ratings yet

- VUL Mock Exam 1Document10 pagesVUL Mock Exam 1NatoNo ratings yet

- Product Highlights: Sun Grepa Power Builder 10Document9 pagesProduct Highlights: Sun Grepa Power Builder 10Cyril Joy NagrampaNo ratings yet

- Insurance CompaniesDocument11 pagesInsurance CompaniesPricia AbellaNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Document10 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Jaymar Odtojan AbaloNo ratings yet

- Variable IC Mock Exam Version 2 10022023Document16 pagesVariable IC Mock Exam Version 2 10022023Jayr Purisima100% (1)

- VUL Simulated Exam PDFDocument2 pagesVUL Simulated Exam PDFNato50% (4)

- Which Statement Regarding The Risk of Investment in Variable Life Is TRUEDocument2 pagesWhich Statement Regarding The Risk of Investment in Variable Life Is TRUEFranz JosephNo ratings yet

- Assignment No: 02: Name: Irhaa HussainDocument19 pagesAssignment No: 02: Name: Irhaa HussainSaira KhanNo ratings yet

- ACE Variable IC Online Mock Exam - 08182021Document11 pagesACE Variable IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- Manulife Peso Affluence Builder's key featuresDocument8 pagesManulife Peso Affluence Builder's key featuresPenielle SaguindanNo ratings yet

- Proposal S Pmaximizer 14102023152732Document7 pagesProposal S Pmaximizer 14102023152732Jems Arcenal MendozaNo ratings yet

- Variable Exam ReviewerDocument7 pagesVariable Exam ReviewerMarielle Nicole BritaniaNo ratings yet

- Test Yourselfic38Document62 pagesTest Yourselfic38EMMANUEL S100% (1)

- Variable Examination Review Session (Verse) Mock ExamDocument12 pagesVariable Examination Review Session (Verse) Mock ExamArvinALNo ratings yet

- Layout - SALN FAQs (As of 29 April)Document18 pagesLayout - SALN FAQs (As of 29 April)Agatha AngelesNo ratings yet

- INS 22 Chapter 11Document26 pagesINS 22 Chapter 11dona007No ratings yet

- Life Insurance Is A Contract Between The Policy Owner and TheDocument27 pagesLife Insurance Is A Contract Between The Policy Owner and TheRicha JainNo ratings yet

- Swati 2022Document84 pagesSwati 2022Anil kadamNo ratings yet

- Axa - Module 1 Basics of InvestmentDocument22 pagesAxa - Module 1 Basics of InvestmentCrislyn Macapangal - CamellaNo ratings yet

- GE1202 Managing Your Personal Finance: InsuranceDocument41 pagesGE1202 Managing Your Personal Finance: InsuranceAiden LANNo ratings yet

- BST 1 - Variable Life Insurance v1.0Document42 pagesBST 1 - Variable Life Insurance v1.0Donna Mae Palabay MalasigNo ratings yet

- Group 5 - Variable Universal Life (Final)Document32 pagesGroup 5 - Variable Universal Life (Final)Pút ChoiNo ratings yet

- NC Life Insurance Practice Exam QuestionsDocument42 pagesNC Life Insurance Practice Exam QuestionsFabian NonesNo ratings yet

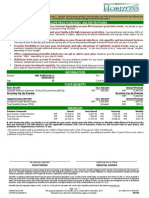

- Manulife Peso Horizons' Major FeaturesDocument7 pagesManulife Peso Horizons' Major Featuresgari_monsantoNo ratings yet

- Set For Life 5pay Sales IllustrationDocument6 pagesSet For Life 5pay Sales IllustrationAngel LapidezNo ratings yet