Professional Documents

Culture Documents

HIO Tax FAQ

Uploaded by

QZQ444Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HIO Tax FAQ

Uploaded by

QZQ444Copyright:

Available Formats

Frequently Asked Questions

Filing 2011 Tax Returns

Please click on any question to access the answer. Click on the RESIDENCY STATUS 1. What is Windstar? 2. Why is my residency status for federal income tax purposes important? 3. How do I know if I am considered a resident or nonresident for federal income tax purposes? 4. Can I use Windstar to complete my tax return if I am a resident for federal income tax purposes? TAX RETURNS 1. Do I have to file a tax return? 2. I received no funding from a U.S. source in 2011. Do I still have to file a tax return? 3. I dont have to pay any tax in the U.S. because there is a tax treaty between the U.S. and my country. Do I still have to file a tax return? 4. Since I already had taxes withheld from my pay checks, do I need to file a tax return? 5. What documents do I need to complete my tax forms? 6. Do I have to file a Massachusetts State tax return? 7. Can I efile my tax return? 8. What happens if I fail to file my taxes? 9. What happens if I did not file taxes last year? TAX REPORTING DOCUMENTS to return to this content page.

HELP WITH TAXES 1. My immigration status is sponsored by Department of State/Fulbright/IIE. Can I use Windstar? 2. Where can I get the access code for Windstar? 3. I dont have a valid Harvard ID or PIN since I graduated or ended my teaching or research last year. Can I still use Windstar? 4. In other countries, people usually help you complete the tax forms, but in the U.S., if you ask what should I put in this box? you receive a description of the answer but not the answer itself. Why cant I get help with this? 5. I have a question about Windstar. What should I do? 6. Windstar asks me the name of my program director. Whom should l list? 7. Can my F-2 or J-2 dependents accompanying me use Windstar? 8. Wheres my refund? 9. What is the best method for receiving my tax refund? 10. Do I need to file a Form 8843 for my U.S. citizen child? 11. I am Canadian and I need information to complete a TL11A. 12. I overpaid Social Security and Medicare taxes, am I eligible for a refund of what I over paid? DUE DATES FOR TAX FORMS 1. When are my tax forms due? 2. I am not able to file taxes now. extension?

1. Should I receive any tax reporting documents?

2. I received funding from a U.S. source. What tax reporting document(s) should I expect to receive? 3. I did not receive any money from a U.S. source during 2011. Should I receive a W-2 or 1042S? 4. I received a W-2 or 1042-S that contains incorrect information (name, SSN, etc.). What should I do? 5. I received a 1099-HC. What is it? Does this mean I have to file a tax return? 6. I completed my tax return and already mailed it in. Now I have received a 1042S from Harvard. What should I do? 7. I have not received my W-2. What should I do? 8. I didnt get a 1042S. Should I have received one? 9. I received a tuition scholarship from Harvard. I have not received a W2 or 1042S from Harvard about this money. Should I have received any form? SSN/ITIN 1. Do I need an SSN or ITIN to complete my tax return? 2. There is a number on my 1042S that says Social Security Number. Is this the number I should use on my tax return? 3. Can I apply for an ITIN when I am not in the U.S.?

Revised 02/02/2012

Can I get an

RESOURCES 1. U.S. Tax Guide for Aliens (IRS Publication 519) 2. U.S. Tax Treaties (IRS Publication 901) 3. Address and helpline for Federal Taxes 4. Address and helpline for Massachusetts Taxes DISCLAIMER

By using these tax assistance programs, you acknowledge that Harvard University is not liable for any errors and incidental or consequential damages in connection with furnishing, performance or use of these on-line systems, on-line HELP and/or examples contained therein

RESIDENCY 1. What is Windstar? Windstar is a software program that assists foreign nationals in determining their U.S. federal tax status. It will also prepare the appropriate federal and Massachusetts tax forms required for filing non-resident tax returns. In addition, Windstar provides a rich source of information about U.S. taxation for foreign nationals. 2. Why is my residency status for federal income tax purposes important? Since residents and non-residents for tax purposes are taxed differently, it is important for you to determine your status. Residents are taxed like U.S. citizens on their world-wide income while non-residents are only taxed on income effectively connected with their stay in the U.S. Please review the information at http://vpf-web.harvard.edu/ofs/tax_services/pdf/tax_info_nras.pdf. 3. How do I know if I am considered a resident or non-resident for federal income tax purposes? Windstar will help you determine your tax residency status. If you are determined to be a non-resident you will be able to use Windstar to complete your federal non-resident tax forms. 4. Can I use Windstar to complete my tax return if I am a resident for federal income tax purposes? No, you cannot. You can purchase an individual license for tax software such as TurboTax, TaxAct, etc.

TAX RETURNS 1. Do I have to file a tax return? If you were present in the United States during any part of 2011 on a visa other than B1/B2, there is at least one tax form you must complete. If you have F-2 or J-2 dependents accompanying you, they may have to file tax forms as well. Federal tax forms are due to the Internal Revenue Service (IRS) by April 17, 2012. Massachusetts state tax forms (if necessary) are also due to the Department of Revenue by April 17, 2012. If you were not in the United States at all during calendar year 2011 you do not need to complete any tax forms at this time. Please review the information at http://vpf-web.harvard.edu/ofs/tax_services/pdf/tax_info_foreign_nationals.pdf. 2. I received no funding from a U.S. source in 2011. Do I still have to file a tax return? Non-residents for tax purposes do not have to complete an actual tax return (1040 NR, etc) but you do have to complete Form 8843. This can be done through Windstar and there is no need for either an SSN or an ITIN (see below) if the only form that has to be filed is the Form 8843. There is no need to complete any state tax forms if you only need to file Form 8843 for your federal tax return. 3. I dont have to pay any tax in the U.S. because there is a tax treaty between the U.S. and my country. Do I still have to file a tax return? Yes. 4. Since I already had taxes withheld from my pay checks, do I need to file a tax return? Yes. The U.S. tax system is a pay as you go system. Therefore, taxes are withheld from your pay checks as you earn them (based on information you give to your employer at the time of hire). You file a federal income tax return after the end of the calendar year to determine if you paid too much tax and are due a refund. If you did not pay enough tax during the year, you may owe tax. 5. What documents do I need to complete my tax forms? a. Your passport b. Your visa document (Form I-20, DS-2019, etc.) c. SSN or ITIN (if you have one see section below on SSN/ITIN) d. Tax reporting documents (only if you received U.S. source income in 2011). For additional information on tax reporting documents, see below. 6. Do I have to file a Massachusetts State tax return? Not everyone has to file a state tax return. It depends on the source and amount of income you received in 2011. You do not have to file a Massachusetts tax return if you only have to file federal Form 8843. You should go to the Windstar Foreign National Tax Resource (available through www.hio.harvard.edu) to determine if it is necessary for you to file a state form.

Revised 02/02/2012

7. Can I efile my tax return? It is not possible to efile non-resident tax forms. Windstar will prepare your non-resident federal form(s) for you to print out, sign, make a copy, and mail to the Internal Revenue Service at the Austin, Texas address listed on the instructions printed out with your tax form. 8. What happens if I fail to file my taxes? There may be immigration consequences for failing to file taxes. Also, if you owe taxes and do not file, you may be assessed penalties and interest. You can obtain information on submitting prior year returns from the Internal Revenue Service at http://www.irs.gov/formspubs/article/0,,id=98339,00.html. 9. What happens if I didnt file taxes last year? If you realized that you failed to file a tax return in the past, you must file a late tax return as soon as possible. Go to the IRS Prior Year Forms and Publications (http://www.irs.gov/formspubs/article/0,,id=98339,00.html) and print a Form 1040NR or Form 1040NR-EZ for the tax year you need to file. Be sure to also get the instructions for the preparation of that year's Forms 1040NR or 1040NR-EZ as the tax rates and exemption amounts are different for each tax year. You may not simply include the amounts from a previous tax year onto this year's tax return.

TAX REPORTING DOCUMENTS 1. Should I receive any tax reporting documents? If you had no U.S. source funding you will not receive any tax reporting documents. It is possible to receive more than one type of tax reporting documents if you received more than one type of funding from a U.S. source (wages plus a stipend, for example). The type of document you might receive depends on the type of funding you received. If the only funding you received from Harvard was a tuition fellowship that was applied directly to your term bill you will not receive any tax reporting documents. 2. I received funding from a U.S. source. What tax reporting document(s) should I expect to receive? Tax Reporting Document IRS Form W2 Type of Income Issued to those who had U.S.-based employment (including OPT/CPT employment); should have been mailed to you by January 31, 2012 All employees who claimed a tax treaty exemption; should be mailed to you by March 15, 2012. Sample copies of the W-2 and 1042-S are located at http://hio.harvard.edu/taxesandsocialsecurity/HIO_TaxReportingForms.pdf. OR All nonresident students/scholars who received a non-service scholarship/fellowship in excess of tuition/required fees/books and supplies regardless of whether or not tax was withheld; should be mailed to you by March 15, 2012 1099-HC Serves as proof of health insurance coverage and would be used to complete the Schedule HC form on a Massachusetts State tax return. Note that not all international students need to complete a state tax return. 1099-HC information is located at http://www.mass.gov/dor/tax-professionals/current-year-taxinformation/health-care-faqs-for-insurance-carriers/form-ma-1099-hcquestions.html.

IRS Form 1042-S

Please review the information at http://vpf-web.harvard.edu/ofs/tax_services/pdf/tax_info_foreign_nationals.pdf You might also receive a 1099-INT or 1099-MISC if you earned interest income from a U.S. account. Please do not prepare your tax return until you have received all the applicable tax reporting documents so you have all the information needed to accurately prepare your tax return. Windstar does not provide help with amended returns. 3. I did not receive any money from a U.S. source during 2011. Should I receive a W-2 or 1042S? If you did not receive any U.S. source money (scholarship, wages, etc) you will not receive any tax reporting documents.

Revised 02/02/2012

4. I received a W-2 or 1042-S that contains incorrect information (name, ITIN, SSN). What should I do? Contact your employer to request a corrected W-2 or 1042-S. If you dont have an SSN, you can apply for one and your employer can issue a corrected W-2 based on the application receipt. Please contact University Financial Services to correct W-2 or 1042-S forms issued by Harvard. Their contact information is 617-495-8500 (option 5) or nratax_ufs@harvard.edu. 5. I received a 1099-HC. What is it? Does this mean I have to file a state tax return? You may have received this form from your health insurance provider. It serves as proof of health insurance coverage and would be used to complete the Schedule HC form on a Massachusetts State tax return. If you do not need to file a state tax return, you should save the 1099-HC with your other tax records. Note that not everyone needs to complete a state tax return. See question #5 under Tax Returns on previous page. 6. I completed my tax return and already mailed it in. Now I have received a 1042S from Harvard. What should I do? You will have to file an amended tax return in order to include the income from 2011 listed on the 1042S. Windstar does not assist with amended returns. You will have to obtain the amended form from the Internal Revenue Service web site: http://www.irs.gov/pub/irs-pdf/f1040x.pdf. Instructions are at http://www.irs.gov/pub/irs-pdf/i1040x.pdf. 7. I have not received my W-2. What should I do? The HIO does not issue W-2s. These forms are issued by University Financial Services. If you were supposed to receive a W-2 from Harvard and did not, you should request a duplicate W-2 via this web site: http://vpfweb.harvard.edu/ofs/payroll/emp_w2_order.shtml. If you are submitting the request from abroad, please list your foreign address in the comments section of the form. If you were paid by one of the Harvard-affiliated hospitals, you should have received a W-2 from the hospitals payroll office. If you should have received a W-2 from another U.S. employer, you should contact their payroll office directly. 8. I didnt get a 1042S. Should I have received one? Not everyone receives a 1042S. It depends on your tax status and your income. The following situations describe when a 1042S would be issued. Please review the information at http://vpf-web.harvard.edu/ofs/tax_services/pdf/tax_info_foreign_nationals.pdf: Wages or Salary as an Employee You will receive Form 1042-S if you received wages or salary on which you claimed a tax treaty exemption. You will receive Form 1042-S if you received a scholarship or fellowship, regardless of whether tax was deducted or whether you claimed a tax treaty exemption. Please note that if you only received tuition, required fees or a book allowance applied to your term bill, you will not receive any tax reporting form. You will receive Form 1042-S if you received income from consulting or performance fees. You will receive Form 1042-S if you received income from prizes, awards, or participant payments.

Scholarship or Fellowship (no services performed)

Consulting, Performance Fees Prize or Award Participant Payment

9. I received a tuition scholarship from Harvard and I have not received a W2 or 1042S from Harvard about this money. Should I have received any form? No. Please note that if you only received tuition, required fees or a book allowance applied to your term bill, you will not receive any tax reporting form.

SSN/ITIN 1. Do I need an SSN or ITIN to complete my tax return? Yes, any individual who works in the U.S. as an employee should have an SSN (Social Security Number). Any individual who receives income from U.S. source(s) must file a tax return and must have either an SSN or ITIN (Individual Taxpayer Identification Number). Individuals who complete tax returns in Windstar and do not have an SSN or ITIN will be prompted to complete Form W-7 to apply for an ITIN in connection with the filing of the tax

Revised 02/02/2012

return. If you had no funding from a U.S. source the only form needed is the Form 8843 and you will not need an SSN or ITIN to file Form 8843. 2. There is a number on my 1042S that is located in the field for a Social Security Number. Is this the number I should use on my tax return? If you never applied for an SSN, or never reported your SSN to Harvard, this number should not be used on your tax return. It is most likely a number Harvard assigned for administrative purposes. If you now have an SSN you nd should report it to University Financial Services at 1033 Mass. Ave, 2 floor and use it on your tax return. If you are not eligible for an SSN, you should apply for an ITIN when you complete your tax return through Windstar. 3. Can I apply for an ITIN when I am not in the U.S.? Applicants outside the United States should contact an overseas IRS office (http://www.irs.gov/businesses/small/international/article/0,,id=96690,00.html) to find out if that office accepts Form W-7 applications. You can also apply for the ITIN when you file your tax return.

HELP WITH TAXES 1. My immigration status is sponsored by Department of State/Fulbright/IIE. Can I use Windstar? No, you can only use GRANTAX (another tax preparation system offered to Fulbright grantees) if you receive funding from Fulbright/IIE. IIE will provide you with information on how to access GRANTAX. You will need a notarized power of attorney authorizing IIE to work on your tax return.

2. Where can I obtain the access code for Windstar?

The HIO sends an email in mid-February and again in early April containing the access code. Access codes will also be available at the HIO beginning in February. 3. I dont have a valid Harvard ID or PIN since I graduated or ended my teaching or research last year. Can I still use Windstar? Yes, but you will need to e-mail your HIO advisor. You can review the HIO staff list at http://www.hio.harvard.edu/abouthio/contactus/contactyouradvisor/. 4. In other countries, people usually help you complete the tax forms, but in the U.S. if you ask what should I put in this box? you receive a description of the answer but not the answer itself. Why cant I get help with this? U.S. tax law is very complicated. Only authorized tax preparers are covered from possible liability if a tax form is not completed properly on behalf of an individual. The HIO has various resources available to help you with this process but HIO advisors cannot directly assist you with preparing your tax return. 5. I have a question about how to use Windstar. What should I do? You can email them at trr-support@windstar.com. In your email, please be as specific as possible. 6. Windstar asks for the name of my program director. Whom should l list? List your academic advisor or PI. If you dont have an academic advisor or PI you can list the contact information for the Harvard International Office, 1350 Massachusetts Avenue, Cambridge, MA 02138. 7. Can my F-2 or J-2 dependents accompanying me use Windstar to complete their tax forms? Yes. 8. I filed a refund of overpaid taxes, but havent received the payment yet. Wheres my refund? Go to the Where's My Refund? (https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp) online tool to track your refund. Where's My Refund? will usually have information about your refund three to four weeks after filing your paper return. Check weekly, on Wednesdays, for any updates to your refund information. https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp. 9. What is the best method for receiving my tax refund? You have the option of requesting a paper check or direct deposit into your bank account. Using direct deposit is quicker and eliminates the possibility of your refund check being misdirected if you move or leave the U.S.

Revised 02/02/2012

10. Do I need to file a Form 8843 for my U.S. citizen child? No. 11. I am Canadian and I need information to complete a TL11A. The information you need should be listed on your term bills. You can request a printout of your financial th transactions from the Student Receivables Office on the 9 floor of the Holyoke Center. You can download a TL11A at http://www.cra-arc.gc.ca/E/pbg/tf/tl11a/README.html. 12. I overpaid Social Security and Medicare taxes, am I eligible for a refund of what I overpaid? Maybe. Please refer to the Figuring Your Taxes section of IRS Publication 519, http://www.irs.gov/pub/irspdf/p519.pdf for general information. If you are eligible, you will need to file IRS Form 843: instructions http://www.irs.gov/pub/irs-pdf/i843.pdf, form - http://www.irs.gov/pub/irs-pdf/f843.pdf.

DUE DATES FOR TAX FORMS 1. When are my tax forms due? You should file your tax forms as soon as possible, once you have gathered all the necessary materials. Please note that your tax forms must be postmarked on or before the dates listed below. Do not wait until the last minute to file your taxes! Form 1040NR/1040NREZ April 17, 2012 Form NR/PYR April 17, 2012 Form 8843 June 15, 2012 2. I am not able to file taxes now. Can I get an extension? It is possible to file a form to request a six month extension from the Internal Revenue Service on Form 4868 if you do not owe tax to the government: http://www.irs.gov/pub/irs-pdf/f4868.pdf. The Windstar site is available year round. (Note that if you owe tax, you must pay any estimated tax liability by the standard filing deadline or you will incur significant penalties and interest.)

RESOURCES 1. U.S. Tax Guide for Aliens (IRS Publication 519) This document contains very useful information on a variety of issues affecting foreign nationals and their U.S. tax status. http://www.irs.gov/pub/irs-pdf/p519.pdf 2. U.S. Tax Treaties (IRS Publication 901) This document contains detailed information on U.S. tax treaties. http://www.irs.gov/pub/irs-pdf/p901.pdf 3. Address and helpline for Federal Tax Assistance Volunteer Income Tax Assistance (VITA) program - 1-800-829-1040 General Federal Tax Questions - 1-800-829-1040 Boston IRS Office: JFK Federal Building 15 New Sudbury Street Boston, MA 02203 (617) 316-2850 4. Address and helpline for Massachusetts Tax Assistance Massachusetts Department of Revenue 19 Staniford Street Boston, MA 02115 1-800-392-6089 or (617) 887-MDOR

Revised 02/02/2012

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- New Employee Onboarding Process in An OrganizationDocument3 pagesNew Employee Onboarding Process in An OrganizationNishan ShettyNo ratings yet

- LW Lamb Weston Investor Day Deck Final Oct 2016Document85 pagesLW Lamb Weston Investor Day Deck Final Oct 2016Ala Baster100% (1)

- Ba5107 TQMDocument2 pagesBa5107 TQMRagunath PalanichamyNo ratings yet

- Manual Accounting Practice SetDocument8 pagesManual Accounting Practice SetVincent RuanNo ratings yet

- Filetype PDF Applied Financial EconomicsDocument2 pagesFiletype PDF Applied Financial EconomicsMichelleNo ratings yet

- Kraft FoodDocument9 pagesKraft FoodCristy Jean LuminariasNo ratings yet

- Unit Test 6 Market Leader Intermediate Unit 6 Test Answer Key in PDF Market Leader IntermediateDocument3 pagesUnit Test 6 Market Leader Intermediate Unit 6 Test Answer Key in PDF Market Leader IntermediateSonia Del Val CasasNo ratings yet

- Module-2 Job AnalysisDocument40 pagesModule-2 Job AnalysispriNo ratings yet

- Study Id55490 FurnitureDocument161 pagesStudy Id55490 Furniturekavish jainNo ratings yet

- Paper2 HL G2 PDFDocument5 pagesPaper2 HL G2 PDFAntongiulio MiglioriniNo ratings yet

- ZDA Spotlight: Issue 1Document4 pagesZDA Spotlight: Issue 1Chola MukangaNo ratings yet

- SG Topic5FRQs 63e05ca0641463.63e05ca17faee7.84818972Document17 pagesSG Topic5FRQs 63e05ca0641463.63e05ca17faee7.84818972notinioNo ratings yet

- 2021 Cfa Liii Mockexam-Pm-NewDocument25 pages2021 Cfa Liii Mockexam-Pm-NewHoang Thi Phuong ThuyNo ratings yet

- Porter's Value Chain Model of NestleDocument13 pagesPorter's Value Chain Model of NestleYug SakariyaNo ratings yet

- Fundamental of Project Management: Midterm-ExamDocument9 pagesFundamental of Project Management: Midterm-ExamrajunomiNo ratings yet

- Adeyemi Adeola CV1 - 1620243247000Document2 pagesAdeyemi Adeola CV1 - 1620243247000abrahamdavidchukwuma1No ratings yet

- Solvay Group - International Mobility and Managing Expatriates SolutionDocument7 pagesSolvay Group - International Mobility and Managing Expatriates SolutionKushagra Varma0% (1)

- According To The GoalDocument5 pagesAccording To The GoalIsfahan ShaikhNo ratings yet

- 19 KPIsDocument54 pages19 KPIsNadia QuraishiNo ratings yet

- Economics Mcqs CH 1, 2, 3, 4: Compiled By: Ms Misbah ShahzadiDocument9 pagesEconomics Mcqs CH 1, 2, 3, 4: Compiled By: Ms Misbah Shahzadi亗๛『٭SAFI٭』๛No ratings yet

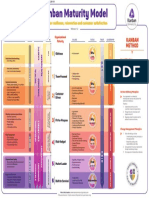

- OVERVIEW A3 v3 08032020Document1 pageOVERVIEW A3 v3 08032020Fernanda Máximo AlvesNo ratings yet

- Mpac522 GRP AssignmntDocument4 pagesMpac522 GRP AssignmntShadreck VanganaNo ratings yet

- S-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Document2 pagesS-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Von Andrei MedinaNo ratings yet

- (International Political Economy Series) Gopinath Pillai (Eds.) - The Political Economy of South Asian Diaspora - Patterns of Socio-Economic Influence-Palgrave Macmillan UK (2013)Document224 pages(International Political Economy Series) Gopinath Pillai (Eds.) - The Political Economy of South Asian Diaspora - Patterns of Socio-Economic Influence-Palgrave Macmillan UK (2013)Muhammad Ayyub AlfarazNo ratings yet

- Retail Operation Management PresentationDocument16 pagesRetail Operation Management PresentationJun LengNo ratings yet

- SAP Return On InvestmentDocument9 pagesSAP Return On InvestmentsrinivaspanchakarlaNo ratings yet

- The University of Cambodia: Project Management (BUS649)Document13 pagesThe University of Cambodia: Project Management (BUS649)Chheang Eng NuonNo ratings yet

- Showrooming at Best BuyDocument7 pagesShowrooming at Best BuyAnantha Bhairavi Mahendrakumaran0% (1)

- Fco GCV Adb 55-53 Nie-RrpDocument3 pagesFco GCV Adb 55-53 Nie-RrpZamri MahfudzNo ratings yet

- Training ReportDocument51 pagesTraining ReportShikhar SethiNo ratings yet