Professional Documents

Culture Documents

Bridge Loans

Uploaded by

Juli JoshiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bridge Loans

Uploaded by

Juli JoshiCopyright:

Available Formats

Bridge Loans

A bridge loan is interim financing for an individual or business until permanent or the next stage of financing can be obtained. Money from the new financing is generally used to "take out" (i.e. to pay back) the bridge loan, as well as other capitalization needs. Bridge loans are typically more expensive than conventional financing to compensate for the additional risk of the loan. Bridge loans typically have a higher interest rate, points and other costs that are amortized over a shorter period, and various fees and other "sweeteners" (such as equity participation by the lender in some loans). The lender also may require crosscollateralization and a lower loan-to-value ratio. On the other hand they are typically arranged quickly with relatively little documentation. Bridge loans in business finance are a short term financing arrangement. When long-term loans have phase-by-phase sanctions, the amount in each phase might not be sufficient. Sometimes long term loans in infrastructure can be delayed. To support immediate business finance requirements, bridge loans or swing loans are taken.

Bridge loans are important business finance vehicles. Without it, businesses or individuals can find it difficult to keep their business continuity. One main drawback of bridge loans is that they are expensive. Interest rates are high. Given the fact that most bridge loans are taken in real need, the bridge loan vendor might even demand equity. Collateral for the larger loan is used for bridge loans. Tough to classify it as collateral mortgage, but bridge loans leverage this arrangement for quick cash. Bridge loans are common in India, given the nature of the Indian economy. Growing economies need flexible business finance options. News articles are abounding with companies taking bridge loans. Recently Sesa Goa took a bridge loan of around ` 2500 crores to fund its investment in Cairn India steel company. GMR infrastructure is another company that took a bridge loan of around $737 million to acquire equity presence in InterGen. The above two examples just highlight the corpus of amounts that companies take with regards to bridge loans.

Unlike other sectors, the real estate sector is often given a cold shoulder by bridge loan providers. Banks shy away from giving bridge loan business finance to this sector. Real estate in India is characterized by a lack of organization. Most real estate ventures are financially insecure, and not backed by fact. Banks face a tough time to convince its stakeholders to agree to giving bridge loans as business finance in this sector. Even if property developers manage to obtain a bridge loan, it attracts high interest rates. Property developers use bridge loans to -show the property and sell advance bookings. Banks would also consider business finance options to semi-completed properties. Once the developers obtain advance booking amounts or bank loans, they use this to close the bridge loans.

USE OF TERM LOANS:In Real EstateBridge loans are often used for commercial real estate purchases to quickly close on a property, retrieve real estate from foreclosure, or take advantage of a short-term opportunity in order to secure long-term financing. Bridge loans on a property are typically paid back when the property is sold, refinanced with a traditional lender, the borrower's creditworthiness improves, the property is improved or completed, or there is a specific improvement or change that allows a permanent or subsequent round of mortgage financing to occur. The timing issue may arise from project phases with different cash needs and risk profiles as much as ability to secure funding. A bridge loan is similar to and overlaps with a hard money loan. Both are non-standard loans obtained due to short-term, or unusual, circumstances. The difference is that hard money refers to the lending source, usually an individual, investment pool, or private company that is not a bank in the business of making high risk, high interest loans, whereas a bridge loan refers to the duration of the loan.

CHARACTERISTICSBridge loan interest rates are usually 1115%, with typical terms of up to 12 months 24 points may be charged. Loan-to-value (LTV) ratios generally do not exceed 65% for commercial properties, or 80% for residential properties, based on appraised value. A bridge loan may be closed, meaning it is available for a predetermined timeframe, or open in that there is no fixed payoff date (although there may be a required payoff after a certain time). A first charge bridging loan is generally available at a higher LTV than a second charge bridging loan due to the lower level of risk involved, many UK lenders will steer clear of second charge lending altogether. Lower LTV's may also attract lower rates again representing the lower level of underwriting risk although front-end fees, lenders legal fees, and valuation payments may remain fixed.

EXAMPLES

A bridge loan is often obtained by developers to carry a project while permit approval is sought. Because there is no guarantee the project will happen, the loan might be at a high interest rate and from a specialized lending source that will accept the risk. Once the project is fully entitled, it becomes eligible for loans from more conventional sources that are at lower-interest, for a longer term, and in a greater amount. A construction loan would then be obtained to take out the bridge loan and fund completion of the project. A consumer is purchasing a new residence and plans to make a down payment with the proceeds from the sale of a currently owned home. The currently owned home will not close until after the close of the new residence. A bridge loan allows the buyer to take equity out of the current home and use it as down payment on the new residence, with the expectation that the current home will close within a short time frame and the bridge loan will be repaid. A bridging loan can be used by a business to ensure continued smooth operation during a time when for example one senior partner wishes to leave whilst another wishes to continue the business. The bridging loan could be made based on the value of the company premises allowing funds to be raised via other sources for example a management buy in. A property may be offered at a discount if the purchaser can complete quickly with the discount off setting the costs of the short term bridging loan used to complete. In auction property purchases where the purchaser has only 1428 days to complete long term lending such as a buy to let mortgage may not be viable in that time frame whereas a bridging loan would be

IN CORPORATE FINANCEBridge loans are used in venture capital and other corporate finance for several purposes:

To inject small amounts of cash to carry a company so that it does not run out of cash between successive major private equity financings To carry distressed companies while searching for an acquirer or larger investor (in which case the lender often obtains a substantial equity position in connection with the loan) As a final debt financing to carry the company through the immediate period before an initial public offering or an acquisition.

EXAMPLEIn December 2010, Kohlberg Kravis Roberts (KKR) and partners marketed a bridge loan for its upcoming acquisition of Del Monte Foods. As is common in such cases, KKR planned for the newly private company to borrow money by issuing corporate bonds. To ensure the money would be available, KKR sought $1.6B in bridge loan guarantees, for which it promised to pay 8.75% interest for 60 days and 11.75% thereafter. At KKR's option, these loans could then be replaced with eight-year corporate bonds (in effect, a put option) paying 11.75%. In return for the loans and guarantees, KKR was offering roughly 2% in fees.

You might also like

- Grand Summary BQDocument1 pageGrand Summary BQNorazmi Mohd NorNo ratings yet

- Project Innitiation Document: Configuration Signed-Off - End MarchDocument2 pagesProject Innitiation Document: Configuration Signed-Off - End MarchRogen Paul Gomez Geromo100% (1)

- Budgeting Cost ControlDocument26 pagesBudgeting Cost ControlRay CollierNo ratings yet

- ISO 9001:2000 Quality Productivity Society PakistanDocument90 pagesISO 9001:2000 Quality Productivity Society Pakistankashifbutty2kNo ratings yet

- ALUR Glass Wall Architectural ProductsDocument9 pagesALUR Glass Wall Architectural ProductsJeffrey MeltzerNo ratings yet

- 08 - Construction Projects Monitoring - Training ManualDocument28 pages08 - Construction Projects Monitoring - Training ManualGemechuNo ratings yet

- Harvey York 701-800Document594 pagesHarvey York 701-800Awanda MaulanaNo ratings yet

- Exercise 2 - Hotel Project FinanceDocument30 pagesExercise 2 - Hotel Project FinanceAtish Satam100% (1)

- Om Project ReportDocument59 pagesOm Project ReportMeenakshi BhatiNo ratings yet

- Human Resource Management: Prof. Debasish DuttaDocument64 pagesHuman Resource Management: Prof. Debasish DuttaTarush GoradiaNo ratings yet

- Updated Malaysian Housing Development ActDocument66 pagesUpdated Malaysian Housing Development ActEric Wee100% (1)

- Tender Masjid Al-Muhajirin - SumDocument25 pagesTender Masjid Al-Muhajirin - SumRizalFaizNo ratings yet

- Sources of Construction Project RiskDocument16 pagesSources of Construction Project RiskNoel Tagoe100% (1)

- Construction Finance Management and Cost AccountingDocument21 pagesConstruction Finance Management and Cost Accountingpoonam_ceNo ratings yet

- Bank Pembangunan Malaysia BerhadDocument5 pagesBank Pembangunan Malaysia BerhadkinNo ratings yet

- Project CharterDocument11 pagesProject CharterSarah RooneyNo ratings yet

- SI BQ SummaryDocument1 pageSI BQ SummaryIr Ahmad Afiq100% (1)

- C5 SurauDocument38 pagesC5 SurauAcai KiraNo ratings yet

- Assignment On Project Initiation ProcessDocument5 pagesAssignment On Project Initiation ProcessEkwubiri ChidozieNo ratings yet

- Project Risk ManagementDocument96 pagesProject Risk ManagementYudikaWisnuPratomo0% (1)

- Longxi Machinery Works - Mar 4Document1 pageLongxi Machinery Works - Mar 4Liby SantosNo ratings yet

- 057 - Bolivar Blueprint Project PlanDocument54 pages057 - Bolivar Blueprint Project PlanbeaumontenterpriseNo ratings yet

- Introduction to Project ManagementDocument186 pagesIntroduction to Project ManagementUdara GayanNo ratings yet

- Geometric Design Chapter SummaryDocument90 pagesGeometric Design Chapter SummaryANup GhiMire100% (1)

- PMBOK Project Management Body of Knowledge GuideDocument4 pagesPMBOK Project Management Body of Knowledge GuideEdna VilchezNo ratings yet

- Gerbang Nilai Presentation - Ir - HizamuldinDocument39 pagesGerbang Nilai Presentation - Ir - HizamuldinAiffah Mohammed100% (1)

- Risk Plan Shard London Team 3 Saniya Sabina Swapneel Pooja 2Document13 pagesRisk Plan Shard London Team 3 Saniya Sabina Swapneel Pooja 2محمد عثمانNo ratings yet

- 06 Emcm5203 T2Document23 pages06 Emcm5203 T2HASMANIRA100% (1)

- Executive SummaryDocument5 pagesExecutive SummaryjayNo ratings yet

- Cycle ProjekDocument10 pagesCycle ProjekTyla Tylala ReginaNo ratings yet

- Procurement & Supply Management: Notes Taken From Malaysia's Government Procurement Regime, Ministry of Finance, MalaysiaDocument41 pagesProcurement & Supply Management: Notes Taken From Malaysia's Government Procurement Regime, Ministry of Finance, MalaysiadddddNo ratings yet

- Bussines CaseDocument9 pagesBussines CaseNabil_Fikri_5915No ratings yet

- Value Management in Analyzing Project Brief: January 2007Document13 pagesValue Management in Analyzing Project Brief: January 2007nazmiNo ratings yet

- Highway InfrastructureDocument51 pagesHighway InfrastructureBiswarup GhoshNo ratings yet

- MERIT Report LoughboroughDocument19 pagesMERIT Report LoughboroughSamuel DoyleNo ratings yet

- Quality Control and Quality Assurance in Building ConstructionDocument9 pagesQuality Control and Quality Assurance in Building ConstructionAbdul JabbarNo ratings yet

- The Factors Influencing Procurement Strategy Construction EssayDocument5 pagesThe Factors Influencing Procurement Strategy Construction EssayDivina Teja Rebanal-GlinoNo ratings yet

- Rationale of The Comparative Method of ValuationDocument10 pagesRationale of The Comparative Method of ValuationRichard Simon KisituNo ratings yet

- M1. Fundamental of Project Management CompetencyDocument33 pagesM1. Fundamental of Project Management Competencykimura takuyaNo ratings yet

- HRM&D Some Issues and ChallengesDocument11 pagesHRM&D Some Issues and Challengesvbasilhans100% (1)

- Three Story Classroom ProjectDocument3 pagesThree Story Classroom ProjectMiyuranga W.H.D.D. en17081344No ratings yet

- BSNS 6351 Quality Management Assignment TwoDocument26 pagesBSNS 6351 Quality Management Assignment TwoKendal JohnsonNo ratings yet

- A2 1StrategicCorporatefinanceDocument187 pagesA2 1StrategicCorporatefinanceMANIRAGABA Alphonse100% (1)

- Procurement PolicyDocument61 pagesProcurement PolicyValber Santos SantosNo ratings yet

- ASER Construction Human Resource Management ProcessDocument6 pagesASER Construction Human Resource Management ProcessJohn Udo100% (1)

- HRM IntroDocument64 pagesHRM IntroDeepak KumarNo ratings yet

- NICMARDocument9 pagesNICMARMitra TammineniNo ratings yet

- Iso9001 2000Document43 pagesIso9001 2000Anura Senarathna100% (2)

- Dayang Sabriah Safri MFKA2009Document114 pagesDayang Sabriah Safri MFKA2009Muhammad AmirNo ratings yet

- Introduction to the Construction Industry and its SectorsDocument83 pagesIntroduction to the Construction Industry and its SectorsJOSEPH SALOSAGCOLNo ratings yet

- Project Risk ManagementDocument6 pagesProject Risk ManagementHalimNo ratings yet

- Risk Management Plan Preparation GuidelinesDocument17 pagesRisk Management Plan Preparation Guidelineszenagit123456No ratings yet

- Risk Assessment in Construction of Highway Project IJERTV5IS020515Document5 pagesRisk Assessment in Construction of Highway Project IJERTV5IS020515raja babuNo ratings yet

- Burj Khalifa ProcurementDocument9 pagesBurj Khalifa Procurementdenmanzano0426No ratings yet

- Procurement ReportDocument12 pagesProcurement ReportMwasNo ratings yet

- Bridge FinancingDocument11 pagesBridge Financingdimpleshetty100% (1)

- Term Loan Amortization Principal Amount Lump Sum: Common Types of Bank LoansDocument6 pagesTerm Loan Amortization Principal Amount Lump Sum: Common Types of Bank Loanssmriti-nNo ratings yet

- f9 Notes (Source of Finance)Document16 pagesf9 Notes (Source of Finance)CHIAMAKA EGBUKOLENo ratings yet

- Full Notes MBF22408T Credit Risk and Recovery ManagementDocument90 pagesFull Notes MBF22408T Credit Risk and Recovery ManagementSheetal DwevediNo ratings yet

- Unit I MBF22408T Credit Risk and Recovery ManagementDocument17 pagesUnit I MBF22408T Credit Risk and Recovery ManagementSheetal DwevediNo ratings yet

- Breaking The Time Barrier PDFDocument70 pagesBreaking The Time Barrier PDFCalypso LearnerNo ratings yet

- Access Database Examples Download Able Sample DatabasesDocument5 pagesAccess Database Examples Download Able Sample DatabasesNasha SaydNo ratings yet

- Annotated RulesDocument89 pagesAnnotated RulesjonathanoharaNo ratings yet

- Project Report SCOPE OF Brand Image of Shampoos As A Person Objectives of The StudyDocument10 pagesProject Report SCOPE OF Brand Image of Shampoos As A Person Objectives of The Studyxyz abcNo ratings yet

- BancassuranceDocument59 pagesBancassuranceSagar J. ChavanNo ratings yet

- 183601fb151b9f5741a7fe66505ccc3dDocument35 pages183601fb151b9f5741a7fe66505ccc3dLeonardo BritoNo ratings yet

- StatementDocument4 pagesStatementJeffrey100% (1)

- Genuine Agrarian Reform Program Vs Comprehensive Agrarian Reform ProgramDocument6 pagesGenuine Agrarian Reform Program Vs Comprehensive Agrarian Reform ProgramYeyen M. EvoraNo ratings yet

- Warehousing PDFDocument562 pagesWarehousing PDFAllyMae100% (2)

- Topic 1 Introduction To AccountingDocument14 pagesTopic 1 Introduction To AccountingSARAH SOFEA BINTI SOFIAN (BG)No ratings yet

- Payables Open Interface Import in Oracle Apps R12Document11 pagesPayables Open Interface Import in Oracle Apps R12sudharshan79No ratings yet

- Virtual Setup Jaya LakshmiDocument8 pagesVirtual Setup Jaya LakshmiAnu YaraganiNo ratings yet

- Chapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachDocument61 pagesChapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachBill BennttNo ratings yet

- Sample Questions:: Section I: Subjective QuestionsDocument7 pagesSample Questions:: Section I: Subjective QuestionsAmit Khilari PatilNo ratings yet

- Success Stories of Selected Frontrow Members.Document6 pagesSuccess Stories of Selected Frontrow Members.Jonna Riza BasayaNo ratings yet

- North India's first factory outlet mall Ansal PlazaDocument3 pagesNorth India's first factory outlet mall Ansal PlazadivyaNo ratings yet

- Strategy The Totality of DecisionsDocument11 pagesStrategy The Totality of DecisionsJerome FormalejoNo ratings yet

- Optimizing Masela Block Development Is Possible::7Jev! RDocument2 pagesOptimizing Masela Block Development Is Possible::7Jev! RAstrini PradyastiNo ratings yet

- Project TrademarkDocument17 pagesProject TrademarkAnantHimanshuEkka50% (2)

- Horngren ch03 PDFDocument40 pagesHorngren ch03 PDFNaveed Mughal AcmaNo ratings yet

- Totem Catalogue 1Document28 pagesTotem Catalogue 1RevanNo ratings yet

- 00 032C09Document28 pages00 032C09hillyoungNo ratings yet

- Family SettlementDocument3 pagesFamily Settlementsbos100% (1)

- Berger PaintsDocument4 pagesBerger PaintsShashank ShenoyNo ratings yet

- Multivariate Data Analysis Chapter 18 MCQDocument7 pagesMultivariate Data Analysis Chapter 18 MCQThùyy VyNo ratings yet

- Carvel AnswerDocument7 pagesCarvel AnswerlapbsNo ratings yet

- Employee EmpowermentDocument21 pagesEmployee EmpowermentLevent Guzel0% (1)

- 1.1. Giấy chứng nhận BRCDocument1 page1.1. Giấy chứng nhận BRCTran HungNo ratings yet

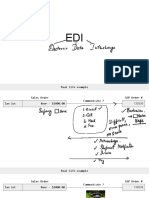

- EDI: The Foundation of Digital Business IntegrationDocument61 pagesEDI: The Foundation of Digital Business IntegrationYasmine ArabNo ratings yet

- Outline (LONG) Real Estate Trans. (Dewey, 2017 Spring)Document52 pagesOutline (LONG) Real Estate Trans. (Dewey, 2017 Spring)Larry Rogers100% (1)