Professional Documents

Culture Documents

Lokpal

Uploaded by

ankitkumarinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lokpal

Uploaded by

ankitkumarinCopyright:

Available Formats

The following are some of the highlights of the Lokpal bill that the government will table before

the Parliament on Thursday: * Single legislation conferring constitutional status on Lokpal and Lokayukta. * Lokayukta will be a model law optional for states to adopt. * Lokpal chairperson will be selected by a panel of PM, Lok Sabha Speaker, leader of opposition in LS, CJI or his nominee (Supreme Court judge) and an eminent jurist nominated by President.

50% reservation for SCs, STs, OBCs, minorities and women among 8 members of Lokpal. * 50% of 8 members will have judicial background and the reservation clause will apply to them too. * Lokpal to receive complaints against ministers, MPs and all government servants. Similar provision relating to Lokayuktas * Lokpal to function as final appellate authority for grievances relating to delivery of public services. * Complaints against chairperson and members to be sent to President, who can remove them after obtaining the Supreme Court's opinion. * PM and all categories of government servants included within Lokpal's ambit. * Lokpal cannot look into PM's work relating to international relations, external and internal security, maintenance of public order, atomic energy and space. * Complaint of corruption against PM would be subject to in-camera preliminary inquiry by a full bench of Lokpal comprising not less than 75% of its members. * Lokpal will have supervisory control over CBI on investigations into corruption cases referred by it to the agency. Lokpal to have independent inquiry and prosecution wing. * CVC too will supervise the CBI in cases referred by it to the agency. * CBI director to be selected by a panel comprising PM, leader of opposition in Lok Sabha and the CJI or his nominee judge. * All NGOs receiving more than Rs 10 lakh donation per annum from foreign sources will come within the Lokpal's purview.

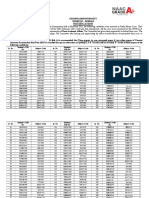

State Bank of India has announced the following Unaudited results for the quarter ended December 31, 2011: The Bank has posted a net profit for the period of Rs 32630.40 million for the quarter ended December 31, 2011 where as the same was at Rs 28280.60 million for the quarter ended December 31, 2010. Total Income is Rs 297873.70 million for the quarter ended December 31, 2011 where as the same was at Rs 247267.30 million for the quarter ended December 31, 2009. The Consolidated Results are as follows : The Unaudited consolidated results for the Quarter ended December 31, 2011 The Group has posted a net profit after minority interest of Rs 43180.80 million for the quarter ended December 31, 2011 where as the same was at Rs 37104.80 million for the quarter ended December 31, 2010. Total Income is Rs 431559.50 million for the quarter ended December 31, 2011 where as the same was at Rs 369668.70 million for the quarter ended December 31, 2010. Consequent to the notification of the "Acquisition of State Bank of India Commercial & International Bank Ltd Order, 2011" issued by the Govt. of India, the undertaking of State Bank of India Commercial & International Bank Ltd (SBICI) stands transferred to and vests in State Bank of India ("the Bank"), with effect from July 29, 2011, the effective date. The results for the quarter and nine months ended December 31, 2011 include the results of operations of the erstwhile SBICI for the period from July 29, 2011. Accordingly the figures of the previous period of the Bank are not comparable.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Project On HRM Strategies of Maruti Udyog LimitedDocument80 pagesProject On HRM Strategies of Maruti Udyog LimitedTANVI AGARWAL77% (22)

- The World'S 30 Best CeosDocument12 pagesThe World'S 30 Best CeosankitkumarinNo ratings yet

- Logo Main BodyDocument1 pageLogo Main BodyankitkumarinNo ratings yet

- 2 Purchasing MethodologiesDocument24 pages2 Purchasing MethodologiesankitkumarinNo ratings yet

- ErDocument2 pagesErankitkumarinNo ratings yet

- MIS RajasthanDocument23 pagesMIS RajasthanankitkumarinNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NOTIFICATION - UMC Decision Exam May-2021Document7 pagesNOTIFICATION - UMC Decision Exam May-2021Ak HilNo ratings yet

- Judicial Affidavit Respondent FriendDocument3 pagesJudicial Affidavit Respondent FriendRoge Ante DublinNo ratings yet

- People v. UmawidDocument8 pagesPeople v. UmawidJoy AfableNo ratings yet

- Pearson Family Foundation v. University of ChicagoDocument21 pagesPearson Family Foundation v. University of ChicagoThe Chicago Maroon100% (1)

- Begging ExtraDocument27 pagesBegging ExtrafkkfoxNo ratings yet

- SKF 593629 SpecificationDocument3 pagesSKF 593629 Specificationlei songNo ratings yet

- Dominion Insurance Vs CADocument3 pagesDominion Insurance Vs CAJMF1234No ratings yet

- Federal Law No. 244-Fz of December 29, 2006Document9 pagesFederal Law No. 244-Fz of December 29, 2006Matthieu EscandeNo ratings yet

- Hofstradamus Bar Exam ExperienceDocument24 pagesHofstradamus Bar Exam ExperienceClandestine Hamtaro0% (1)

- Constructive Notice of Conditional Acceptance TemplateDocument4 pagesConstructive Notice of Conditional Acceptance TemplateSwank100% (4)

- Infosys Technologies Vs Jack 'Jay' PalmerDocument13 pagesInfosys Technologies Vs Jack 'Jay' PalmerclevelandasianindianNo ratings yet

- 8 4 2017 Letter Vec RetrialDocument2 pages8 4 2017 Letter Vec Retrialcbs6albanyNo ratings yet

- S Hindustan Metal Industries, 1979 PDFDocument7 pagesS Hindustan Metal Industries, 1979 PDFujjwalNo ratings yet

- An ISO 9001:2008 Certified Quality Institute (Recognized by Govt. of NCT of Delhi, Affiliated To GGS Indraprastha University, Delhi)Document3 pagesAn ISO 9001:2008 Certified Quality Institute (Recognized by Govt. of NCT of Delhi, Affiliated To GGS Indraprastha University, Delhi)aditya guptaNo ratings yet

- وثيقة التأمين ضد الأخطاء الطبيةDocument3 pagesوثيقة التأمين ضد الأخطاء الطبيةAlsharif Ammar Alabdullah AlzaidNo ratings yet

- Chapter 11-CRIMINAL Law-UoLDocument5 pagesChapter 11-CRIMINAL Law-UoLVikash HingooNo ratings yet

- 2022 Non-Exclusive Copyright Licensing Agreement - The Millionaire S MistressDocument23 pages2022 Non-Exclusive Copyright Licensing Agreement - The Millionaire S MistressSyariffah NadyatusSyifaNo ratings yet

- Fourth Judicial Region Regional Trial Court Branch 46 San Jose, Occidental Mindoro Hon. Ulysses D. DelgadoDocument3 pagesFourth Judicial Region Regional Trial Court Branch 46 San Jose, Occidental Mindoro Hon. Ulysses D. DelgadoVILLAMAR LAW OFFICENo ratings yet

- MOF Company v. Shin YangDocument1 pageMOF Company v. Shin Yangkanari100% (1)

- 68-Madrigal & Co. Vs ZamoraDocument2 pages68-Madrigal & Co. Vs ZamoraMaryrose100% (1)

- Nacar v. Gallery FramesDocument2 pagesNacar v. Gallery FramesJave Mike AtonNo ratings yet

- Asset Privatization Trust vs. TJ EnterprisesDocument12 pagesAsset Privatization Trust vs. TJ EnterprisescharmdelmoNo ratings yet

- Succession DigestDocument5 pagesSuccession DigestMadelle PinedaNo ratings yet

- Morong National High School: Brigada Eskwela 2020: Morongueño CaresDocument2 pagesMorong National High School: Brigada Eskwela 2020: Morongueño CaresCecille Robles San Jose100% (1)

- Administrative Law Rough Draft Sem 5Document3 pagesAdministrative Law Rough Draft Sem 5Shubham TanwarNo ratings yet

- Mining Order 001Document9 pagesMining Order 001Vamshi Krishna Reddy KuchikullaNo ratings yet

- Emergency Mitigation and Rebuild Work AuthorizationDocument1 pageEmergency Mitigation and Rebuild Work Authorizationapi-237532246No ratings yet

- Domingo v. Sps. Molina - PUADocument1 pageDomingo v. Sps. Molina - PUAVince Llamazares LupangoNo ratings yet

- Boyko 2007 Foreclosure Decision - Deutsche Bank Nat'l Trust Co. v. Steele, 2008 WL 111227Document6 pagesBoyko 2007 Foreclosure Decision - Deutsche Bank Nat'l Trust Co. v. Steele, 2008 WL 111227Peter G. Miller100% (6)

- David V CADocument7 pagesDavid V CAArgel Joseph CosmeNo ratings yet