Professional Documents

Culture Documents

Precedent Lev 2ukr 2012

Uploaded by

PrecedentILFCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Precedent Lev 2ukr 2012

Uploaded by

PrecedentILFCopyright:

Available Formats

Ukraine

A Level Two- General Country Report Petitioned by

www.precedent-ilf.com

Reference work completed by Iuliya Alexandrovna Ustimenko

This report was prepared as an account of work sponsored by Precedent ILF. Precedent ILF, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any trademark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favoring by Precedent ILF thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of Precedent ILF. The entire works contained in this report have been gained from the internet and other sources and work is cited where possible. If any work is not cited and you are the originator of said work please send a letter to Precedent ILF for reference.

April 2012

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

TABLE OF CONTENT...

Communication...................................................................................................................................................... 7 Transportation .................................................................................................................................................... 110 Banking System Services................................................................................................................................... 152 Medical Services ................................................................................................................................................ 204 Entry and Exit Visa Requirements for US & Non-US Citizens ........................................................................ 230 Required Steps to Create a Business.................................................................................................................. 270 Licensing of a Foreign Business ...................................................................................................................... 274 Labor Code/Law ................................................................................................................................................ 303 Revenue Department Tax Guidance .................................................................................................................. 319 Bibliography ...................................................................................................................................................... 346

Figure 1 Mobile operators (as of March 2008) ...................................................................................................... 8 Figure 2 Key telecom parameters - 2010-2012.................................................................................................... 10 Figure 3 Key Statistics ......................................................................................................................................... 11 Figure 4 Structure of Equipment for ATS Operating in Local Telephone Networks.......................................... 18 Figure 5 Teledensity compared with population ................................................................................................. 20 Figure 6 Rates for telecommunication services ................................................................................................... 20 Figure 7 CIS Member States (USD) .................................................................................................................... 20 Figure 8 Telecommunication Services Provided to Foreign States (USD) ......................................................... 21 Figure 9 Revenues from rendering telecommunication services in Ukraine, bln UAH ...................................... 24 Figure 10 Structure of the revenues from rendering telecommunication services in Ukraine. ........................... 24 Figure 11 Financial highlights of Ukrtelecom ..................................................................................................... 26 Figure 12 Market Value of 1 Ukrtelecom JSC share, UAH ................................................................................ 28 Figure 13 Ukrtelecoms share in the fixed telephony market and internet market in terms of the revenues earned .............................................................................................................................................................................. 29 Figure 14 Revenues from rendering telecom services ......................................................................................... 30 Figure 15 Structure of the revenues(Ukrtelecom) ............................................................................................... 30 Figure 16 Kye investment sectors, Ukrtelecom ................................................................................................... 31 Figure 17 Number of Ukrtelecom's Wi-Fi hot spots, pcs .................................................................................... 34 Figure 18 Number of mobile subscribers, ths ...................................................................................................... 34 Figure 19 Number&Revenues from the high-speed Internet access services, mln UAH.................................... 35 Figure 20Number of fixed telephone lines .......................................................................................................... 36 Figure 21 Core services: revenues, structure and total amount. .......................................................................... 38 Figure 22 Transport Telecommunication Network of Ukrtelecom JSC .............................................................. 40 Figure 23 Multiservice Packet Network of Ukrtelecom JSC............................................................................... 41 Figure 24 International Connections of Packet Network..................................................................................... 41 Figure 25 Trunking communication .................................................................................................................... 44

Page 2

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Figure 26 Subscription rate (without regard to traffic) ........................................................................................ 45 Figure 27 Regional levels of mobile penetration, Q3 2007 ................................................................................. 46 Figure 28 Effective mobile price per minute in a sample of Eastern and Central European countries, 2007 ..... 47 Figure 29 Mobile penetration and Total Outgoing Minutes of Use in Ukraine................................................... 47 Figure 30 Economic Impact of the mobile communications industry in Ukraine. .............................................. 48 Figure 31 Mobile value chain in Ukraine in 2007(UAHs millions) .................................................................... 49 Figure 32 Productivity impact of mobile communication ................................................................................... 50 Figure 33 Increasing Intangible benefits enjoyed by consumers in Ukraine. ..................................................... 50 Figure 34 Mobile operators' market shares over time.......................................................................................... 52 Figure 35 Mobile connections and mobile penetration in Ukraine over time. .................................................... 52 Figure 36 Percentage of prepaid and postpaid customers for each operator (2007)............................................ 53 Figure 37 ARPU levels over time, UAHs............................................................................................................ 53 Figure 38 Earnings and Subscriber base .............................................................................................................. 54 Figure 39 Operators Rating.................................................................................................................................. 56 Figure 40 Increase in subscribers, mobile market (January 2012) 56 Figure 41 Mobile Market shares .......................................................................................................................... 56 Figure 42 Mobile Industry and market trends...................................................................................................... 57 Figure 44 Ukrainian mobile market (revenue & share in nominal GDP) ............................................................ 57 Figure 43 Expected penetration Growth .............................................................................................................. 57 Figure 45 Mobile market revenue forecast .......................................................................................................... 58 Figure 46 Rates of Kievstar mobile operator ....................................................................................................... 59 Figure 47 Part 1 KyivStar's Analytical information 2008-2010 .......................................................................... 60 Figure 48 Figure 47 Part 2 KyivStar's Analytical information 2008-2010.......................................................... 61 Figure 49 Figure 47 Part 3 KyivStar's Analytical information 2008-2010.......................................................... 61 Figure 50 MTS Rates ........................................................................................................................................... 62 Figure 51 MTS strategy ....................................................................................................................................... 63 Figure 52 MTS Ukraine revenue dynamics ......................................................................................................... 63 Figure 53 MTS Ukraine capital investments in 2004 -2009E ............................................................................. 64 Figure 54 MTS Ukraine backbone network......................................................................................................... 64 Figure 55 Key strategic priorities for MTS Ukraine in 2010-2012 .................................................................... 65 Figure 56 MTS Strategy: Direction-tactics-benefits............................................................................................ 65 Figure 57 MTS Ukraine Highlights ..................................................................................................................... 66 Figure 58 Operating Income Before Depreciation and Amortization (OIBDA) and OIBDA margin of the MTC Ukraine................................................................................................................................................................. 66 Figure 59OIBDA margin ..................................................................................................................................... 66 Figure 60 MTS Ukraine financial highlights in 2011 .......................................................................................... 67 Figure 61 MTS Ukraine operating indicators ...................................................................................................... 68 Figure 62 MTS Ukraine revenue indicators......................................................................................................... 69 Figure 63 Internet and major social networks penetration in selected countries as of Q2 2011 ......................... 75 Figure 64 Vkontakte.ru overview. ....................................................................................................................... 78 Figure 65 Odnoklassniki.ru overview.................................................................................................................. 78 Figure 66 Twitter overview. ................................................................................................................................ 79 Figure 67 Facebook overview............................................................................................................................. 79 Figure 68 Ukr.net overview. ................................................................................................................................ 80

Page 3

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Figure 69 Livejournal overview........................................................................................................................... 80 Figure 70 Number of Credit cards. ...................................................................................................................... 81 Figure 71 Web money.......................................................................................................................................... 81 Figure 72 Ukraine Subscriber Numbers for fixed, mobile and Internet services ................................................ 83 Figure 73 Ukraine Penetration Rates ................................................................................................................... 83 Figure 74 EC assistance to Ukraine ..................................................................................................................... 89 Figure 75 Total revenues from the broadband internet services in Ukraine, mln 3Q2010-3Q2011 ................. 100 Figure 76 Number of Subscribers and the level of penetration for the broadband internet, 2Q2010-4Q2011 . 100 Figure 77 Main broadband internet providers, ths 1Q2011 - 3Q2011............................................................... 101 Figure 78 Programming languages in Ukraine. ................................................................................................. 104 Figure 79 UkrPoshta key data......................................................................................................................... 105 Figure 80 Tariff indices for post and communication services for enterprises, institution, organizations in 2011 (to the corresponding month of the previous year,%)........................................................................................ 105 Figure 81 Tariff indices for post and communication services for enterprises, institution, organizations in 2011 ............................................................................................................................................................................ 106 Figure 82 Tariff indices for post and communication services for enterprises, institution, organizations in 2011 (to December of the previous year)(percent) ..................................................................................................... 106 Figure 83 Revenues from services provided by post and communication, 2011 .............................................. 107 Figure 84 Communication subscribers, 2011 .................................................................................................... 108 Figure 85 Ukraine Communication Sector - World Bank Report ..................................................................... 109 Figure 86 Mitigation policies/measures with high potential to deliver reductions in transport GHG emissions ............................................................................................................................................................................ 112 Figure 87 International contribution .................................................................................................................. 113 Figure 88 International LPI results .................................................................................................................... 114 Figure 89 Domestic LPI results, time and cost data. ......................................................................................... 114 Figure 90 LPI ranking and scores 2010 ............................................................................................................. 114 Figure 91 Clearance overview ........................................................................................................................... 115 Figure 92 Key indicators of transport sector (Part 1) ........................................................................................ 116 Figure 93 Key indicators of transport sector (Part 2) ........................................................................................ 117 Figure 94 Projects set in operation from the beginning of 2008........................................................................ 118 Figure 95 Innovation and investments perspectives. ......................................................................................... 118 Figure 96 Map of current, being under construction and designed warehouse projects in Kiev region. .......... 119 Figure 97 Freight and Passenger Transportation Statistics ................................................................................ 120 Figure 98 Transport Services (% of commercial services exports) ................................................................... 120 Figure 99 Cargo transportation, 2011 ................................................................................................................ 120 Figure 100 Passenger transportation, 2011 ........................................................................................................ 121 Figure 101 Railway map of Ukraine.................................................................................................................. 124 Figure 102 Railway transport performance separate indicators, 2011 .............................................................. 124 Figure 103 Tariff indices for cargo transportation by rail in 2011 (to the previous quarter) (percent) ............. 125 Figure 104 COMBINED STATEMENT OF FINANCIAL POSITION ........................................................... 127 Figure 105 Road corridors ................................................................................................................................. 130 Figure 106 Tariff indices for pipeline cargo transportation in 20032011....................................................... 131 Figure 107Road map of Ukraine........................................................................................................................ 132 Figure 108 Odessa port ...................................................................................................................................... 136

Page 4

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Figure 109 Ancillary transport services of sea and river ports and wharfs on freight processing, 2011 ........... 136 Figure 110 Turnover of Odessa in 1996 - 2011 years. ...................................................................................... 137 Figure 111 Import/Export Turnover of Odessa in 1996 - 2011 years, TEU...................................................... 137 Figure 112 The share of transit cargo in the port's container turnover, thousand tons ...................................... 138 Figure 113 Total Assets ..................................................................................................................................... 152 Figure 114 Ukrainian Banking System Assets Growth & Structure. ................................................................ 153 Figure 115 Western-Owned banks..................................................................................................................... 154 Figure 116 Banks under NBU Temporary Administration................................................................................ 155 Figure 117 Bank closed since 01-Oct-2008....................................................................................................... 155 Figure 118 Loans and Structure ......................................................................................................................... 156 Figure 119 Assets/Liabilities Imbalances .......................................................................................................... 157 Figure 120 Income and Expenses ...................................................................................................................... 158 Figure 121 Income and Expenses charts............................................................................................................ 159 Figure 122 The structure of income and expenditures of banks as of 01.03.2012 ............................................ 160 Figure 123 The structure of the Department for Financial Monitoring of the NBU ......................................... 161 Figure 124 Financial Monitoring in the Banking System of Ukraine ............................................................... 161 Figure 125 Financial monitoring in a Bank ....................................................................................................... 162 Figure 126 Gross External Debt, By Sectors ..................................................................................................... 167 Figure 127 Ukraine's External Debt Service Needs........................................................................................... 167 Figure 128 Non-performing Loans in Selected Emerging Markets................................................................... 168 Figure 129 Non-performing loans, right scale ................................................................................................... 168 Figure 130 Stock of Bank Credit ....................................................................................................................... 169 Figure 131 Dynamics of Income, expense and profit of the banking sector of Ukraine ................................... 171 Figure 132 Deposits by sectors of economy ...................................................................................................... 172 Figure 133 Deposits by types of currency ......................................................................................................... 173 Figure 134 Credits by sectors of economy ........................................................................................................ 175 Figure 135 Credits by types of currency............................................................................................................ 176 Figure 136 Number of initial payments and electronic settlement notices carried out ..................................... 178 Figure 137 Share of cash outside banks in narrow money ................................................................................ 178 Figure 138 Number of cardholders .................................................................................................................... 179 Figure 139 Number and value of operations on payment cards issued ............................................................. 180 Figure 140 Average turnover on one card ......................................................................................................... 181 Figure 141 Some indicators of the National System of Mass Electronic Payments .......................................... 181 Figure 142 Card payment infrastructure in Ukraine .......................................................................................... 182 Figure 143 Number of payment cards per capita............................................................................................... 183 Figure 144 Number of card payments per capita in several CEE and Central Asia .......................................... 184 Figure 145 Share of credit cards ........................................................................................................................ 184 Figure 146 Number and volume of payment card operations in Ukraine.......................................................... 185 Figure 147 Types of payment cards issued by Ukrainian banks ....................................................................... 185 Figure 148 Structure of payment card transactions ........................................................................................... 186 Figure 149 Ukrainian card market ..................................................................................................................... 187 Figure 150 Some indicators of settlement and cash servicing of customers ..................................................... 189 Figure 151 The dynamics and structure of first -time registered disease in Ukraine in 2010 ........................... 205 Figure 152 Medical insurance in Ukraine.......................................................................................................... 210

Page 5

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Figure 153 Overview of the health system ........................................................................................................ 215 Figure 154 Health care financing flowchart ...................................................................................................... 220 Figure 155 Health expenditures as a share (%) if GDP ..................................................................................... 222 Figure 156 Health expenditures in US$ PPP per capita in the WHO ................................................................ 223 Figure 157 Percentage of total expenditure on health according to source of revenue ..................................... 225 Figure 158 Vaccination Coverage Trends ......................................................................................................... 242 Figure 159 Estimated Total Fertility Rate per Woman...................................................................................... 243 Figure 160 Infant mortality rates ....................................................................................................................... 244 Figure 161 Picture of visa ................................................................................................................................. 264 Figure 162 Ranks ............................................................................................................................................... 270 Figure 163 How Ukraine ranks on Doing Business topics ................................................................................ 270 Figure 164 What it takes to start a business in Ukraine..................................................................................... 271 Figure 165 How Ukraine and comparator economies rank on the ease of starting a business .......................... 272 Figure 166 The ease of starting a business in Ukraine ...................................................................................... 272 Figure 167 Has starting a business become easier over time? (part 1) ............................................................. 273 Figure 168 Has starting a business become easier over time? (part 2) ............................................................. 274 Figure 169 How has Ukraine made starting a business easier - or not? ............................................................ 275 Figure 170 Standardized company..................................................................................................................... 275 Figure 171 Summary of procedures for starting a business in Ukraineand the time and cost....................... 277 Figure 172 The differences between two types of AT....................................................................................... 287 Figure 173 Capital structure dynamics .............................................................................................................. 293 Figure 174 JSC requirements............................................................................................................................ 294 Figure 175 Quick comparison of joint stock companies and limited liability companies ................................. 295 Figure 176 Type of mandatory social security .................................................................................................. 308 Figure 177 Tax collection. ................................................................................................................................. 319 Figure 178 How Ukraine and comparator economies rank on the ease of paying taxes ................................... 321 Figure 180The ease of paying taxes in Ukraine over time ................................................................................ 322 Figure 181 Has paying taxes become easier over time?(part1) ......................................................................... 323 Figure 182 Has paying taxes become easier over time?(part2) ......................................................................... 324

Page 6

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Communication

Basic Facts Telephones - main lines in use: 13.026 million (2009) country comparison to the world: 20 Telephones - mobile cellular: 55.333 million (2009) country comparison to the world: 20 Telephone system: general assessment: Ukraine's telecommunication development plan emphasizes improving domestic trunk lines, international connections, and the mobilecellular system domestic: at independence in December 1991, Ukraine inherited a telephone system that was antiquated, inefficient, and in disrepair; more than 3.5 million applications for telephones could not be satisfied; telephone density is rising and the domestic trunk system is being improved; about onethird of Ukraine's networks are digital and a majority of regional centers now have digital switching stations; improvements in local networks and local exchanges continue to lag; the mobile-cellular telephone system's expansion has slowed, largely due to saturation of the market which has reached 120 mobile phones per 100 people international: country code - 380; 2 new domestic trunk lines are a part of the fiber-optic Trans-Asia-Europe (TAE) system and

3 Ukrainian links have been installed in the fiberoptic Trans-European Lines (TEL) project that connects 18 countries; additional international service is provided by the Italy-Turkey-Ukraine-Russia (ITUR) fiber-optic submarine cable and by an unknown number of earth stations in the Intelsat, Inmarsat, and Intersputnik satellite systems Broadcast media: TV coverage is provided by Ukraine's state-controlled nationwide broadcast channel (UT1) and a number of privately-owned television broadcast networks; Russian television broadcasts have a small audience nationwide, but larger audiences in the eastern and southern regions; multi-channel cable and satellite TV services are available; Ukraine's radio broadcast market, a mix of independent and state-owned networks, is comprised of some 300 stations (2007) Internet country code: .ua Internet hosts: 1.098 million (2010) country comparison to the world: 42 Internet users: 7.77 million (2009) country comparison to the world: 38 Page 7

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

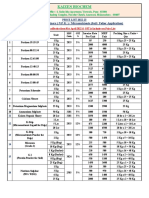

Mobile Operators (as of March 2008)

Rank Operator Technology GSM GSM, CDMA GSM GSM UMTS CDMA CDMA CDMA CDMA GSM Subscribers (in millions) 23 19 9 2 0.3 0.3 0.3 0.3 ? 0.05 Ownership Telenor (56.51%), Alfa Group (43.49%) MTS (100%) Turkcell (54.2%), SCM Holdings (45.8%) VimpelCom Ukrtelecom Telesystems of Ukraine Intertelecom company International Telecommunication Company (ITC) Velton Telecom Golden Telecom Inc. (GLDN)

1 Kyivstar 2 MTS 3 life:) 4 Beeline 5 Utel 6 PEOPLEnet 7 Intertelecom 8 CDMA Ukraine

is expanding at a high rate. Two new domestic trunk lines are a part of the fiber-optic Trans-Asia-Europe (TAE) system and three Ukrainian links have been installed in the fiber-optic Trans-European Lines (TEL) project that connects 18 countries; additional international service is provided by the Italy-TurkeyUkraine-Russia (ITUR) fiber-optic submarine cable and by earth stations in the Intelsat, Inmarsat, and Intersputnik satellite systems. Telecom Trade Agreements WTO Ukraine is currently in negotiations to join the WTO, but is not a signatory to the Information Technology Agreement (ITA).

9 Velton 10 Golden Telecom

Figure 1 Mobile operators (as of March 2008)

Radio broadcast stations: 524, station types not available (2006) Radios: 45.05 million (1997) Television broadcast stations: 647 (plus 21 repeater stations that relay broadcasts from Russia) (2006) Televisions: 18.05 million (1997) Telephone system: Ukraine's telecommunication development plan, running through 2005, emphasizes improving domestic trunk lines, international connections, and the mobile cellular system. At independence in December 1991, Ukraine inherited a telephone system that was antiquated, inefficient, and in disrepair; more than 3.5 million applications for telephones could not be satisfied; telephone density is now rising slowly and the domestic trunk system is being improved; the mobile cellular telephone system

Leading Service Providers Ukrtelekom http://www.ukrtelecom.ua Ukrainian Mobile Communications (UMC) http://www.umc.ua Golden Telecom Ukraine http://www.goldentele.com Kyivstar http://www.kyivstar.net/en/ Astelit (Digital Cellular Communications) Contacts Regulatory Ukraine National Commission for Communications Regulations http://www.nkrz.gov.ua/

Page 8

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Overview One of Eastern Europes largest countries, Ukraine enjoyed strong economic growth in the early part of the century, though in common with its neighbors the country has been adversely impacted by the global economic turmoil. It was obliged to turn to the IMF for assistance in late 2008, and has since worked to restore economic health. The telecoms sector has not fared as badly as other areas, but since 2008 revenue growth has been minimal. This is likely to continue into 2012 at least though thereafter the prospects are likely to improve as liquidity issues lessen and the economy as a whole improves. Although Ukraine has important economic ties with Russia, reflected in Russian investment in the countrys telcos, it has sought an increasingly close relationship with the EU, and the government actively pursues a policy of EU integration. This would have significant implications for Ukraines telecom sector, not only in terms of tighter regulation but also in its capacity to cope with competitive pressure and market forces within the Union. Ukraines large population supports a significant telecom market which has grown steadily in recent years, weathering the economic demise better than almost all other market sectors. The market grew more than 6% in 2011, to some UAH50.3 billion, but growth in 2012 may reach only 4%, partly due to saturation in the mobile market and low growth in fixed-line services. The telecom market and regulatory regime will be influenced by the countrys prospective membership to the EU. However, recent internal political events have been criticized by Europes political leaders. This may jeopardize the free-trade agreement between Ukraine and the Union, and delay further progress towards accession. As for telecoms, the sector desperately needs the regulatory clarity which the ECs telecom framework can deliver. The influence of the EU, as well as the regulatory conditions which Ukraine must meet, would go far to promoting market competition. Until recently, the lack of an independent regulator and transparent regulatory system had discouraged investment from the major Western European telcos looking for opportunities beyond their highly competitive domestic markets, and thus contributed to market stagnation. The EU, as well as Western European and Russian telcos, will be looking for some political, judicial and regulatory certainties to encourage them to make further ties to the country. Fixed broadband take up in Ukraine is growing quickly on the back of increased competition and the flexibility of cross-platform availability. FttBbased broadband services are increasingly available, though thus far restricted to the main towns. Kyivstars fibre network now connects a large number of apartment buildings in over 100 towns, serving more than 3.8 million units. Ukraines competitive mobile market is looking to develop mobile broadband services as the next growth opportunity in the wake of operator investment in newer technologies such as HSPA. Demand for content is expected to grow significantly in coming years as falling mobile data tariffs lead to increased numbers of mobile Internet users. However, thus far the major GSM operators have been hampered by lack of licences to offer 3G services. However, the sale of the incumbent Ukrtelecom has meant that the companys unprofitable mobile unit will be offloaded, with its spectrum likely to be reassigned. Page 9

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Key telecom parameters 2010 2012

2010 Broadband: Fixed broadband subscribers (million) 3.66 Fixed-line telephony (million) 12.2 Mobile phone (million) 52.5 Subscribers to telecoms services: Fixed-line penetration 26% Broadband penetration 9.9 Mobile SIM penetration (population) 112%

Figure 2 Key telecom parameters - 2010-2012

Sector

2012 (e) 3.90 12.1 54.9 25% 10.4 118%

Key Highlights

Broadcasting revenue reached UAH2.1 billion in 2011 as DTTV services achieved national coverage. However, the sector continues to suffer from poor channel line-up, to the advantage of the CATV and satellite sectors. Ukrtelecom transferred mobile assets to a new unit, TriMob, in preparation for its sale later in 2012. In mid-2011 Kyivstar began selling excess base stations decommissioned as a result of its integration with Beeline Ukraine: Kyivstar planned to remove two-thirds of Beelines former base stations. During 2011 Datagroup increased the capacity of its network in the Western direction to from 36Gb/s to 58Gb/s and in the Eastern direction from 139Gb/s to 229Gb/s. By the beginning of 2012 Kyivstar had expanded its FttH network to more than 100 cities, covering some 3.8 million households.

Military and civilian government departments have agreed on a compromised version of a plan to convert a 100MHz block of spectrum in the 2.1GHz band, costing UAH2.5 billion, of which a third is to come from the private sector mobile network operators and two-thirds from government funds. The move will fast-track mobile broadband availability in remote areas in coming years. Ukraines possesses a significant telecoms market due to its large population. Competition is improving as alternative operators engage in infrastructurebased competition due to lack of an effective last mile network access regime. Wireless local loop and fibre operators have been most active in this area. However the incumbent remains the dominant player, with the regulatory environment more likely to improve once privatization of the incumbent is completed. Drawing upon numerous statistics, this report provides a concise overview of the Ukrainian telecoms market, including brief profiles of major operators, telecom network infrastructure in the country and network developments which are underway. Unfortunately, with the second largest population in Europe, Ukraine is one of the most underdeveloped markets for information and communications technology (ICT) in Europe. According to the Ukrainian Ministry of Transport and Telecommunications (MTT), by the midpoint of 2006, total revenues for the telecommunications market were approximately $3.2 billion. One of the main impediments to the markets development and growth has been the delayed privatization of the government owned incumbent operator Ukrtelekom. Mainly a result of political instability, the slow process to fully privatize the incumbent operator has delayed the upgrading of the fixed-line network infrastructure, and inhibited the mass deployment of wirePage 10

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

line telephone and data services. The highlight of the Ukraine telecom industry is the mobile and wireless sector. There are over 41 million mobile phone subscribers in Ukraine. The mobile market is a highly competitive and quickly evolving environment. Most of the coverage is still concentrated in major urban centers, but wireless carriers are aggressively investing in infrastructure to achieve countrywide service coverage and deliver value added services over next generation networks. Additionally, merger and partnership activity has been high throughout 2005 and 2006 as domestic and foreign investors attempt to establish stronger competitive positions. If the government of Ukraine can achieve sustainable stability, the Ukrainian telecom market should emerge as one of the most attractive in Europe. As the investment in new equipment continues, and the remaining government shares of Ukrtelekom are eventually sold, Ukraine presents significant business opportunities throughout the ICT industry. The Ukrainian communications sector reported total revenues at UAH 47.4 billion in 2010, up by 2.4 percent, year-on-year, according to the information from state communications agency Gossvyaz. Fixed telephony revenues declined by 6.8 percent to UAH 8.364 billion, BizLigaNet reported. Local telephony revenues increased by 1.7 percent to UAH 4.234 billion while DLD/ILD telephony revenues dropped 14.1 percent to UAH 4.130 billion. Mobile connection revenues reached UAH 28.837 billion, up 1.1 percent year-on-year, while internet access revenues grew 32.6 percent to UAH 3.799 billion and cable-TV revenues lifted 5.7 percent to UAH 1.358 billion. Key Statistics

Population GDP Per capita GDP Telecom revenue Main lines Main line Penetration Mobile subscribers Mobile penetration Internet users Internet User Penetration Broadband Subscribers U.S. equipment exports to market

Figure 3 Key Statistics Sources: CIA World Factbook, Primetrica, USITC, and Business Monitor International

45,994,288 (July 2008 est.) $140.5 billion (2007) $1,750 (2005) $ 3.2 billion (July 2006) 12.858 million (2007) 30% (2005) 55.24 million (2007) 88.3% (2006 est.) 10 million (2007) 12.2% (2005) 50,000 (2005) $4.5 million (2005)

Ukrainian Telecommunications Sector Overview The sector of telecommunications is one of the most essential fields of the infrastructure of the state, which is designed to satisfy public needs in the means and services of communications. The development of telecommunication networks in Ukraine proceeds with allowance for the world-wide tendency towards the integration of networks, systems and the service communications. This tendency requires to build and improve the networks on the basis of equipment, which meets international standards and recommendations and renders Page 11

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

the first quality services. The condition of the COMMUNICATIONS sector as of the end of 1997 and the extent to which it satisfies the needs of services in general is characterized by the following:

the greatest volume of services in the sector are provided by telephone communication, and on the whole the progress of telecommunications is determined by the level of telephony, which is defined by the density of phones. Currently this density is 18 telephones per 100 citizens, as against level 40-60 phones per 100 citizens in the developed economies; the technical condition of communication networks is suggested by the fact that existing telephone networks of communication are mainly analog and mainly built with utilization electromechanical (94%) commutation equipment, cables with copper wires and partly radio relay lines of communication, multiplexed analog systems of transmission; networks are insufficiently accommodated for transmitting discrete information, whose share in the overall interchange is persistently increasing; the transmission of documentary information is realized basically by means of telegraphic communication; international telex communication is implemented via the central international station, which is located in Kyiv, the capital of Ukraine; wire broadcasting covers all the country and ensures the voice transmission on three programs in the oblast centers and cities, and mainly on one program in the countryside; hardware in the COMMUNICATION sector is outdated and to an appreciable extent physically worn.

It is necessary to mention that the sector does not provide in full the scope of services that are commonly provided in advanced economies of the world and are extremely indispensable for the progress of the economy, such as: bureau fax, ISDN services; some services are in their infancy: e-mail, data transmission for computers, telefax, radiotelephone communication. In terms of the overall level of provision with telephone communication, Ukraine lags significantly behind advanced countries, and in terms of other types of communication (data transmission, cellular communication, etc..) the backlog is far greater. The sector operates nearly without loss-making enterprises, has no fiscal indebtedness and wage arrears. As per 1997, the consolidated balance profit of state-owned enterprises engages in communication totaled 619 mln UAH. Nearly 780 mln UAH was collected to the state budget and extra-budget funds. The state budget received 133.7 mln UAH as fees for the issuing of licenses authorizing to fulfill different types of activities and for the utilization of radio frequencies. Reasoning from the achieved volume of services and the development of the means of communication in 1997, one can conclude that associations and enterprises provided services to all consumers worth 2.5 billion UAH. This index exceeds 4.9% the last-year's volume in relative terms. This increment was achieved in the first place on account of the services of local telephone networks, distant and international telephone communications. The profitability of the principal activity in the domain was 27.3%.The program of the sector's development domain was implemented both for the account of own financial sources (first of all, of the sectoral development fund), banker's credits (nearly 60%) and the funds of legal and physical persons attracted on a contractual basis and sale of securities. Since 1996, the fulfillment of the second phase of the creation of the National Single Communication System of Ukraine has begun. In 1997, the "Concept of the Development of National Networks of Electrical and Postal Communication for Public Use and the Formation of the Market for communication services in Ukraine for the Period ending 2010" was developed. The Concept adjusts the goals of the sector development. This document defines also the sector's policy in restructuring and privatization. At present, 952 communication operators with different forms of ownership are present on the communication market of Ukraine; in many cases non-state-owned operators offer services of better quality and on more beneficial terms compared to state-owned enterprises. With the goal of adapting the state Page 12

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

communication associations to market conditions, a program for restructuring of UKRAINIAN TELECOM association is approved by the Cabinet of Ministers Resolution #1 of 4.04. 98. This is a very important phase of the sector's development, because about 78 per cent of earnings from all communication services in Ukraine falls to UKRAINIAN TELECOM. Development history Development of the Ukrainian telecommunications market can be divided into three major periods: before mobile communications, establishment of the mobile segment and finally replacement of traditional telephone services by mobile communications. It all started at the beginning of the 90s last century when after the collapse of the Soviet States Ukraine faced the need to build national telecommunications market. After Ukraine was recognized as an independent state in 1991 national government fixed three priorities in telecom sector: international and inter-city, mobile communication and access to Internet and data transmission. Later on these priorities materialized in three joint ventures: UTEL, UMC and INFOCOM respectively. In those times national legislation restricted foreign capital share to 49%, so major investors were regional telecoms that later on were incorporated into Ukrtelecom. During the past time all three segments passed their unique way. UTEL was founded by Ukrtelecom, major investor, and equally American AT&T, German Deutsche Telekom and Dutch KPN. After launch of the first international telephone station in Kiev in 1992 Ukraine received its own national code +380. To avoid growing competition between Ukrtelecom and Utel national government decided to buy out foreign investors stake. De facto Utel was incorporated with its parent-company in 2005 only after the decision was approved by Ukrtelecoms shareholders. 1991 Infocom was founded in by Ukrtelecom (51%) and German Controlware to build the first in Ukraine data transmission network UkrPack. After many years of co-exhistance during which Infocom built up the geography of its services based on Ukrtelecoms infrastructure time came when the conflict of interests appeared as Ukrtelecom started to develop its own network for Internet access and data transmission. Difficult to say what will be the future of Infocom, the government will hardly insist on 49% stake buy-out. 1992 A joint venture Ukrainian Mobile Communications, that started to provide services under the UMC brand, was founded Ukrainian- German-Dannish-Dutch. 51% was owned by the Ukrtelecom, remaining stake was equally divided between German Deutsche Telekom, Dannish TeleDanmark and Dutch KPN. On 1 July 1993 the first mobile call in NMT (Nordic Mobile Telephone) standard was made. At that time there was lack of funds for clearance of 900 MHetrz frequencies used by defense and other special services. This resulted in spread of the NMT standard in Ukraine. 1993 Bankomsvyaz (later on Golden Telecom) was set up; 1994 Kyistar was founded, 1995 Ukrainian Radiosysytems (WellCOM trade mark, Kiev) and Digital Cellular Communications (DCC, Donetsk). 1996 30 thousand UMC users could use advantage of the national coverage. DCC started development of fixed radio access network in Donetsk in fact providing mobile services in the D-AMPS standard. Golden Telecom started to develop GSM-1800 network in Kiev. Appearance of Telesystems of Ukraine, founded by American Quallcomm, that patented digital CDMA (Code Division Multiple Access) standard, 800 MHertz. 1997 GSM era in Ukraine. State Telecom Department held tender on the most popular standard in the world GSM licenses, which were won by UMC, Kyivstar and Ukrainian Radiosystems. UMC was first to launch its GSM-netiwork, Kievstar was second. After appearance of the GSM standard mobile users were not any longer tied to one phone, as with NMT, thanks to SIM-cards (Subscriber Identity Module) used in GSM phones. Page 13

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

1998 Telesystems of Ukraine imported equipment for development of the CDMA network, however the launch didnt happen. Same year GSM-1800 license was acquired by a Ukrainian-Italian company Astelit that in the following 7 years fails to start commercial operations. At the end of 1998 the last GSM-operator Ukrainian RadioSystems - came to market with network coverage limited to Kiev in the several few years. SMS service became available to Ukrainian users. 1998 resulted in almost 150 thousand mobile users in Ukraine, more than 100 thousand among them were the UMC users. 1999 passed under the sign of prepaid mobile services: Sim-Sim by UMC, UNI by Golden Telecom GSM and Ace&Base by Kievstar. Mobile communications became mass and extremely popular, the number of mobile users doubled and reached 300 thousand. 2000 Ukrainian government launched privatization of Ukrtelecom, UMCs major shareholder. It took decision that Ukrtelecom should be offered for sale without its corporate stake in the mobile company. The year 2000 was marked by seconds-tariffication of mobile calls and cancellation of obligatory license from Ukrchastotnaglyad (Ukrainian Frequency Use Control Committee) for a mobile phone use. Mobile companies began to offer mobile internet access to their users with a help of WAP (Wireless Application Protocol) technology. The mobile harvest exceeded most optimistic expectations in 2000 - 800 thousand mobile users in Ukraine. 2001 Biggest Ukrainian operators switched to GSM-1800 standard, which differs from the previous GSM-900 by higher capacity ready to service 2,2 mln mobile users. CDMA operators Velton Telecom (Kharkiv), International Telecommunication Company (ITC, Kiev) and International Telecommunications (Intertelecom, Odessa) that appeared in 2001 got licenses for fixed access and use of fixed phones only. Biggest Turkish mobile company Turkcell took first attempt to enter Ukrainian market by registering its daughter company Novacell. Due to the conflict between Ukrainian and South Korean shareholders of Ukrainian Radiosystems in 2002 Daewoo stepped out of URS. Privat group and Optima Telecom got control over URS. 2002 Biggest CIS mobile operator Mobile Telesystems (MTS) announced its intention to buy out 100% shares of the UMC and received consent of the parties. DCC from Donetsk started to look for possibilities to enter GSM market and acquired Astelit together with GSM-1800 license. Both UMC and Kievstar started testing high-speed cordless data transmission technology called GPRS (General Packet Radio Service), providing other than voice services to their consumers. 2003 First mobile virtual network operator Jeans appears in Ukraine. Jeans used technical base and network of the UMC and was oriented at young people. The most important developments of the year introduction of free coming calls principle, which pushed further development of the national mobile market. 2004 The amount of mobile users exceeded number of fixed phones users. 2005 DCC managed to implement its GSM plans, when Astelit started providing services under Life:) brand. It was preceded by establishment of a joint venture between Turkish Turkcell and System Capital Management (before the venture was established SCM was major DCC owner). Number of users of the two market leaders UMC and Kievstar exceeded 10 mln each. Second biggest after MTS Russian mobile operator Vympelcom (Beeline), which bought out 100% shares of URS came to Ukraine. Norvegian Telenor, major shareholder of Kyistar and minority shareholder Page 14

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

of Vympelcom, opposed the acquisition. However Alpha Group (Altimo), shareholder of both Kyistar and Vympelcom succeeded to insist on URS acquisition. Disagreement between shareholders became reason of a long lasting international conflict that is not yet over. 2006 Beeline brand appeared in the Ukrainian market. Fierce competition caused by newcomers Life:) and Beeline, resulted in price wars in the mobile communications market. Number of mobile users exceeded the size of Ukrainian population, mobile penetration today is around 117%. Another important development was rescheduling by UMC of remaining from the NMT standard frequencies for CDMA-450 format which allows developing third generation (3G) mobile services. 2007 New market strategy was announced by UMC which set new development trend and saved the market from collapse. The company refused from price wars and shifted its policies to client retention, service excellence and stimulating consumption. Major telecommunication event in 2007 became rebranding of the UMC into MTS, UMC became part of one of the world biggest international mobile brands, uniting 79 mln users in 6 countries. Already under new brand MTS the company offered to the market not just new tariffs but such technologically new services as BlackBerry (immediate mobile e-mail that provides access to e-mail and corporate data banks) and high speed cordless internet access based on CDMA-450 standard which became the first step in Ukraine to introduction of 3G services. Network overview Ukrainian telephone network stayed practically undeveloped till recently. The situation is being changed within last years and old equipment has been updated. The results are noticeable in big cities and their suburbia, where new digital telephone exchanges have appeared. At the same time, the part of old equipment remains nonupgraded and quality of the connection can vary very much. In little towns and countryside the connection can be very poor. Some villages might have only one telephone to serve the whole built-up area. Phone usage charge at hotels is often 2-3 times higher than phone companies tariffs. With Ukrtelecom still a de facto state monopoly, the situation regarding interconnection is so heavily regulated that the cost of calls from fixed phones to mobile phones is decided by Government decree and the redistribution of incomes from such calls is based on agreements between Ukrtelecom and the mobile operators. This rate is currently 0.6UAH per minute (or approximately 0.10 Euro). These agreements between Ukrtelecom and mobile operators are signed on a yearly basis. At the present time, it is difficult to obtain data on interconnection between telephony operators because all sides have an interest in not revealing the actual conditions of their agreements. There is also no public information available regarding the existence of complaints regarding interconnection regulation. Interconnection is governed by Chapter IX of the 2003 Law on Communications and the subsequent draft NCCR Order on Interconnection and Calculation among Operators. The Law on Communications requires operators to provide other operators willing to conclude an interconnection agreement with the information required for negotiation and to offer interconnection terms that are at least equivalent to those proposed to other operators (Art. 58). The NCCR is authorized to intervene in cases of failure by parties to negotiate (paragraph 19, Art. 18). For fixed-to-mobile interconnection, the termination fee is 0.25 UAH (0.04 Euro) per minute. The price of call termination in the mobile-to-fixed market is decided by commercial agreement between the parties, but the tariff cannot be more than 0.25 UAH (0.04 Euro). Mobile to mobile interconnection is purely a matter for commercial negotiation. Charges for call origination and other telecommunication services are subject to the control of the Antimonopoly Committee (AMC) of Ukraine in cases where the charges are deemed to have a significant social impact. For instance, on 28 October 2005 the AMC adopted a decision recommending mobile operators abolish sign-up charges for users. The fact that the number of mobile Page 15

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

subscribers exceeds the number of fixed subscribers in Ukraine was the basis for the argument that this intervention was needed. This issue of interconnection is being addressed by the NCCR as a matter of priority, in order to deal with non-transparency in the interconnection regime. According to Article 59 of the Law on Communications, the incumbent operator is required to publish an RIO annually in the official journal of the NCCR. The offer should include the current list of interconnection points, technical requirements and economic terms. However, Ukrtelecom has not yet published an RIO, as the Law on Communications requires it to, since the Rules on Interconnection have not been adopted yet by the NCCR. The NCCR is drafting the Rules of Interconnection and these are currently available for public discussion on the NCCR website (http://www.nkrz.gov.ua/ua/docs/pravila_v3.zip (Ukrainian language only)). Until Ukrtelecoms monopolies are weakened (and a decision on this issue is expected in the near future), there is little possibility of the introduction of carrier selection and carrier reselection. Running parallel to Ukrtelecoms monopoly are the illegal international voice services. As early as 2001, some estimates put the percentage of illegal international voice services in Ukraine as a percentage of total voice traffic as high as 10 percent. Such problems often indicate issues with regulation or competition in the marketplace. However, this situation is changing and there are now several private operators, such as Optima, that are in the process of developing their own infrastructure. Ukrtelecom revenues from the different services on offer were as follows: Long distance calls revenue 2,633.9 billion UAH (427.39 million Euro) or 49.86 percent of total revenue; local fixed calls revenue 1,317 million UAH (213.71 million Euro) or 24.3 percent of total revenue; international call revenue 950.7 million UAH (154.27 million Euro) or 18 percent of total revenue; IP 156.417 million UAH (25.38 million Euro), or 2.96 percent of total revenue.17 Other services such as paging made up the remainder. No attempt has been made to calculate losses from the illegal termination of voice calls in Ukraine. Ukrtelecom offers a termination rate for IP calls of 0.75/0.77 US$ (0.62/0.63 Euro). It is not known how many (if any) IP telephony companies avail of this offer. Ukrtelecom sold to Epic Services Ukraine for UAH10.57 billion; telecom revenue expected to grow 5% for 2011; EU concerns of independent judiciary; regulator market data to August 2011; operator data to June 2011.Fixed telephony penetration has been steadily rising, and currently stands at 23.2 percent, with mobile at 84.9 percent. As these figures are significantly lower than in developed countries, there appears to be significant growth potential. Ukrtelecom has been working extensively with Cisco to upgrade IP services on its network, including for VoIP functionality, and is developing a next generation network. Fixed line telephone density was 24.3 percent as of 1 January 2006. However, this figure conceals a large urban/rural digital divide. Tele densities range from 45 percent in Kyiv to 9 percent in villages and small towns, and even less in more remote regions. Numbering The Department of Communications and Informatisation (part of the Ministry of Transport and Communications) develops and manages technical policy for numbering allocation. The NCCR provides a management function for numbering policy through liaison with operators. Under the 2003 Law on Communications, administration of numbering resources is divided between the Central body of the executive government in the communications sphere, which is responsible for legislation and policy regarding numbering, and the NCCR, which is responsible for assessing requests for numbering resources and ensuring that the relevant rules on use of numbers are respected and has the power to withdraw numbers, if necessary. Planning work is currently underway to overhaul both the fixed and mobile numbering resources used in Ukraine in order to take account of increased use of both networks. The number allocation procedure is regulated by the Law on Communications. Page 16

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

According to Article 70, numbering resources are provided to [a] telecommunications operator for the period of validity of its licence without the right to sub-allocate these numbers to other operators. The sub-allocation of numbers has been used in other countries to facilitate the use of geographic numbers for VoIP, an option that is therefore not available in Ukraine. Nevertheless, telecommunications providers are able to exchange numbering resources amongst themselves, based on contractual agreements. Before the development of independent private telecommunications operators, Ukrtelecom had an exclusive right to telephone numbering resources. However, this situation is changing and now there are several private operators, such as Optima, that are in the process of developing their own infrastructure, and obtaining their own numbering resources directly through the NCCR. Neither fixed nor mobile number portability is currently available, although all of the main mobile operators have expressed support for mobile portability to be implemented. Non-geographic numbers, such as national local call or premium rate services, have not yet been developed in Ukraine. In the near future the subscribers of mobile operators will be able port their number between operators if Bill N 2047 is successful. This bill aims to amend the list of obligatory services provided in the context of the Law on Telecommunications. Whether or not consumers will be charged a fee to port their numbers is not yet clear. Telecommunication infrastructure The basis for telecommunication infrastructure of Ukraine is the primary network that ensures the organization of standard channels for interconnection of the commutation stations of the telephone network and the satisfaction of the users' needs. The primary network of Ukraine utilizes cable, radio relay and air links. Automatic telephone stations (ATS) apply air communication links (40%), cable links (58%), radio relay links (2%). The high priority direction of the progress of the primary network is the building of main fiber-optic communication links (FOCL). Now the share of these links is less than 1% of the overall volume of cable communication links (for comparison the share of symmetrical cable is 74%, and the share of coaxial cable is 25%). During 1997, 2,433 km of distant cable communication lines was built as against 1,118 km in 1996 year. The construction of the following FOCLs on the territory of Ukraine is accomplised: Kyiv-Lviv ("West"), Kyiv - state border with Byelorus (North), Kyiv-Odesa - coastal station ITUR "South" , Chernivtsi - state border with Moldova. When finished, these FOCLs will give a possibility to furnish a number of oblast and rayon centers of Ukraine with a sufficient number of qualitative digital channels. The main 'South-North" line of the international Italy-Turkey-Ukraine-Russia (ITUR) line is put into operation. In 1997, 425.9 km of zone cable communication lines was put into operation, 1,835,400 chan/km of operating communication lines were reconstructed. At present, the following FOCLs operate in the primary network:

Uzhhorod - Slovakian state border, Uzhhorod - Hungarian state border, Lviv - Polish state border, Kyiv - Chernihiv - Byelarussian state border ("North"), Kyiv - Odesa ("South"), Kyiv - Lviv ( "West" ), Chernivtsi - Romanian state border;

Page 17

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Chernivtsi - Moldovian state border, Sumy - Kharkiv.

Digital radio relay lines (DRRL) in operation include:

Kyiv - Zhitomir - Rivne - Lutsk - Lviv - Uzhhorod; Lviv Uzhhorod - Ivano-Frankivsk - Chernivtsi - Romanian state border, Kyiv - Cherkasy - Sumy.

Figure 4 Structure of Equipment for ATS Operating in Local Telephone Networks

These lines are portions of the international TAE (Tans-Asian-European) FOLC communication system that unites European countries with the countries of Asia, TEL (Trans-European line) and ITUR (Italy-TurkeyUkraine-Russia). In total, more then 3,500 km of distant main and zone cable communication lines are in operation in the primary network of Ukraine. Currently, digital communication ( FOLC and DRRL) cover 18 oblasts of Ukraine. Development and re-equipment of urban telephone communication networks on the basis of application of advanced technologies, digital systems of commutation determined the necessity to restrict the commutation telephone equipment manufacturers. Based in the results of a tender arranged by the Cabinet of Ministers of Ukraine, it was decided to utilize the following types of commutation equipment in publicly used networks:

5ESS (manufactured by "Chezara - Lusent Technologies") EWSD (Manufactured by "MKM TeleCom - Siemens") 1000E10 (manufactured be "Alkatel - NSU") DTS3100 (manufactured by "Dnieper - DAEWOO") C32 (manufactured by Dnipropetrovsk Machine-building Plant)

Since 1996, the networks of Ukraine has begun to apply new up-to-date signaling systems ZKS -7 on R2D. This allowed new kinds of services to be put into practice and to maintain them on the network level, upgrade the reliability and rapidity of the establishing of connections, etc. UTEL joint venture has put ISDN services into practice since 1997. Due to this, subscribers are provided with a number of accessory telephone and nontelephone services (conference-communication, data transmission, fax-messages, and others). On the basis of digital telephone stations, the publicly-used telephone network and ISDN networks, the rendering of the accessory intellectual communication services began, such as "service 800" and others. In accordance with the planned development of the sector's information potential and telecommunication infrastructure of enterprises in the regions and with the goal to provide the active development of information networks in Ukraine, the construction of many-purpose so-called "backbone" data transmission network began. Rights of Way and Facilities Sharing/Collocation Page 18

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Every three years, the Parliament of Ukraine approves the activities proposed under the National Program for Informatisation, which includes infrastructure development decisions taken at national and local levels. The Report of the Parliament No. 3075-IV, adopted on 4 November 2005, concerning the approval of tasks of the National Program for Informatisation for 2006-2008, obliged the Cabinet of Ministers to provide an economic analysis of the financial resources needed for the planned projects, so that the costs to the state could be included in the State Budget. The 2003 Law on Communications offers the NCCR a variety of tools to ensure competitive neutrality with regard to building communications infrastructure. According to current legislation, all telecommunications operators have the right to build telecommunications networks in accordance with a Plan that has been approved by the Ministry of Transport and Communications (MTC). The procedure for approving the Plan is the following: The telecommunications operator should develop a Plan for the building of the telecommunications network; The Plan should be sent to the MTC for review and approval; After the plan has been approved, the operator should ask the owner of the cable man-hole (Ukrtelecom or the local government) to approve the construction. The procedure applies equally to all communications companies regardless of size. However, as the requirements are somewhat complex, there is a risk that only larger companies, with the resources to tackle these requirements, are in a position to build telecommunications networks cost effectively. Once the procedure for approving the Plan has been completed, the telecommunications operator needs to secure building permission. The procedure for obtaining permission to build a network is set out in Article 10 of the Law on Telecommunications, and includes: Having the relevant communications license; Obtaining permission for land use; Obtaining permission from the local authority to build the network (based on the decisions approved by the local communications, architecture, and health authorities). Often, rather than rolling out their own networks, telecommunications operators and providers use the networks built by local community companies, particularly TV providers, which also provide low cost Internet services. Tariff Policy Article 67 of the 2003 Law on Communication sets clear rules regarding the cost orientation of services, meaning that the legal basis for bringing about a competitive market in the local call and international markets is in place. The Law states that: Tariff regulation on the telecommunication market of Ukraine shall be based on the following principles: Tariffs shall be based on the cost of these services and considering the profit earned; Tariffs shall depend on the quality of telecommunication[s] services; Telecommunication[s] operators/providers shall not set dumping or discriminatory prices; Cross funding of one telecommunication service [to the benefit] of another shall be avoided.

Page 19

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

NCCR has drafted extensive rebalancing measures, with a 70 percent reduction in the cost of international calls and an increase in local rates. Line rental is set to increase by between 200 and 300 percent (up to 18UAH/3 Euro to 28UAH/4.5 Euro).International tariffs are being reduced by between 17 and 69 percent, while national longdistance calls are being reduced by between 13 and 17 percent. Despite these price adjustments, tariff rebalancing per se has not been implemented in Ukraine.The incumbent telecommunications operator (Ukrtelecom) fulfils its universal service obligations through its low fixed prices (prices for local and regional calls are below cost for Ukrtelecom subscribers) and the development of its fixed network to cover the entire territory of the country. The profit from international calls covers losses from local and regional calls and ensures the companys viability. Mobile operators prices are not regulated, as the market is deemed to be competitive.

Figure 5 Teledensity compared with population

Cost Accounting In the absence of liberalization and requirements for cost-based access to the monopoly providers network, there is little need for an efficient cost accounting system at present, as Ukrtelecom calculates all costs. However, as mentioned above, the 2003 Law on Communications does require services to be based on cost orientation in order to ensure the possibility of fair competition in the market. Therefore, the NCCR will need to develop some form of consistent methodology to ensure that this aspect of the law is respected. However, nothing has yet been published at the time of writing. Rates for telecommunication services

Distant telephone calls per minute of call. (in hryvnias) within oblast within Ukraine Payable by enterprises, establishments and organizations 0.12 0.24

Figure 6 Rates for telecommunication services

Payable by the public 0.07 0.14

CIS Member States (USD)

Telephone calls beyond Ukraine Distance up to 3000 km Distance more than 3000 km Payable by the public 0.29 0.43 Payable by businesses 0.58 0.72 Payable by government agencies funded at the expense of the budget 0.36 0.60

Figure 7 CIS Member States (USD)

Page 20

Report Petitioned by International Legal Firm Precedent

Ukraine Level Two Report

Top

Telecommunication Services Provided to Foreign States (USD)

ordinary service provided on business days between 9:00 p.m. and 6.00 am (week-ends and holidays round-the-clock) 0.50 0.80 1.20 1.60 2.00 2.25 2.25 2.25 payable by government agencies 0.30 0.50 0.75 1.00 1.25 1.50 1.75 2.00

Rate area Eastern Europe Central/Northern Europe Western Europe Central Asia and Middle East North America Eastern Asia Africa, Southern and Central America Australia, Oceania Satellite communication network INMARSAT

ordinary service 0.60 1.00 1.50 2.00 2.50 2.80 2.80 2.80

top-quality service 1.00 1.90 2.50 2.90 3.10 3.30 3.50 3.80 9.20

Figure 8 Telecommunication Services Provided to Foreign States (USD)