Professional Documents

Culture Documents

AC315 Ch5 Homework

Uploaded by

kcreel2007Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AC315 Ch5 Homework

Uploaded by

kcreel2007Copyright:

Available Formats

Kelly Creel October 7, 2011 AC315 IA Chapter 5 Homework 5-1

a. b. c. d. e. f. g. h. i. j. k. l. m. n.

5-2 h d f f c a f g a a b f a h c b a a g f

Investment in Preferred Stock Treasury Stock Common Stock Cash Dividends Payable Accumulated Depreciation Warehouse in Process of Construction and equipment or current asset Petty Cash Accrued Interest on Notes Payable Deficit Trading Securities Income Taxes Payable Unearned Subscription Revenue Work in Process Accrued Vacation Pay

Current Asset Current Asset Stockholders equity Current Liability Property, plant and equipment could be classified as Property, plant Current Asset Current Liability Retained earnings Current Asset Current Liability Current Liability Current Liability Current Liability

creel

5-3 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 5-6 Balance Sheet Current Assets Accounts Rcv Less allowance For doubtful accounts Inventories Total Current Assets Long Term Investments Bond sinking fund Property Plant Equipment Equipment Less accum depr Intangible assets Patents Total Assets 112,000 28,000 60,000 46,700 3,500 43,200 65,300 168,500 a b f a f h i d a f a f a c f x f c

12,000

84,000 21,000 285,500

creel

Current Liabilities Notes and accounts payable Taxes payable Total current liabilities Long Term Liabilities Total liabilities Stockholders equity Total Liabilities and stockholders equity 5-8 1. 2. 3.

52,000 3,000 58,000 75,000 133,000 155,500 285,500

Dividend payable of 1,900,000 will be reported as a current liability 1,000,000-50,000 * 2.00 = 1,900,000

Advances of 17,000,000 will be reported as current liability 12,000,000+30,000,000-25,000,000=17,000,000

5-17 a. Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Loss on sale of equipment Depreciation expense Patent amortization Increase in current liabilities Increase in current Net cash provided by operating activities Cash flows from investing activities Sale of equipment Addition to building Investment in stock 55,000

2,000 13,000 2,500 13,000 (29,000)

1,500 56,500

10,000 (27,000) (16,000)

creel

Net cash used by investing activities

(33,000)

Cash flows from financing activities Issuance of bonds Payment of dividends Purchase of treasury stock Net cash provided by financing activities Net increase in cash

50,000 (30,000) (11,000) 9,000 32,500

b. Assets Current assets Long-term investments Property, plant, and equipment Land Building Less: Accum. Depreciation Equipment Less: Accum. Depreciation Total property, plant, and equipment Intangible assetspatents Total assets Liabilities and Stockholders Equity Current liabilities Long-term liabilities Bonds payable Total liabilities Stockholders equity Common stock Retained earnings Total paid-in capital and retained earnings Less: Cost of treasury stock Total stockholders equity Total liabilities and stockholders equity 163,000 150,000 313,000 180,000 69,000 249,000 (11,000) 238,000 551,000 296,500 16,000 30,000 147,000 (34,000) 70,000 (12,000) 113,000 201,000 37,500 551,000

creel

Problem 5-1 Current assets Cash on hand (including petty cash) Cash in bank Trading securities Accounts receivable Less: Allowance for doubtful accounts Interest receivable Advances to employees Inventory (ending) Prepaid rent Total current assets Long-term investments Bond sinking fund Cash surrender value of life insurance Land for future plant site Total long-term investments Property, plant, and equipment Land Buildings Less: Accum. Depreciationbuildings Equipment Less: Accum. Depreciationequipment Total property, plant, and equipment Intangible assets Copyright Patent Total intangible assets Total assets Liabilities and Stockholders Equity Current liabilities Notes payable Payroll taxes payable Accrued wages Dividends payable Unearned subscriptions revenue Total current liabilities Long-term debt Bonds payable

creel

Add: Premium on bonds payable Pension obligations Total long-term liabilities Total liabilities Stockholders equity Capital stock Preferred stock Common stock Additional paid-in capital Premium on preferred stock Total paid-in capital Retained earnings Total paid-in capital and retained earnings Less: Treasury stock Total stockholders equity Total liabilities and stockholders equity 5-3 Current assets Cash Accounts receivable Less: Allowance for doubtful accounts Inventoryat LIFO cost Prepaid insurance Total current assets Long-term investments Property, plant, and equipment Cost of uncompleted plant facilities Land Building in process of construction Equipment Less: Accum. Depreciation Intangible assets Patentsat cost less amortization Total assets Current liabilities Notes payable Accounts payable Accrued expenses Total current liabilities 94,000 148,000 49,200 291,200 36,000 1,354,200 85,000 124,000 400,000 140,000 41,000 163,500 8,700 154,800 308,500 5,900 510,200 339000

209,000 260,000 469,000

creel

Long-term liabilities 8% bonds payable Less: Unamortized discount on bonds payable Total liabilities Stockholders equity Common stock Premium on common stock Retained earnings Total liabilities and stockholders equity 500,000 45,000

400,000 20,000

380,000 671,200

545,000 138,000

683,000 1,354,200

creel

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Philip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Document117 pagesPhilip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Mohamed Hussien100% (1)

- RBI Monetary Policy FinalDocument28 pagesRBI Monetary Policy FinaltejassuraNo ratings yet

- Risk Return AnalysisDocument108 pagesRisk Return AnalysisduraiworldNo ratings yet

- Xfar ReviewerDocument6 pagesXfar ReviewerAliyah Ishi UcagNo ratings yet

- Chapter 9 - The Capital Asset Pricing Model (CAPM)Document126 pagesChapter 9 - The Capital Asset Pricing Model (CAPM)Joydeep AdakNo ratings yet

- Ap 300q Quizzer Audit of Liabilities QuestionsDocument14 pagesAp 300q Quizzer Audit of Liabilities QuestionsLeinell Sta. MariaNo ratings yet

- Comparison of Banks in Pakistan As Per Their Market ShareDocument5 pagesComparison of Banks in Pakistan As Per Their Market ShareBahria noty100% (1)

- Interest Rate Derivatives: The Standard Market ModelsDocument31 pagesInterest Rate Derivatives: The Standard Market ModelsFlávio CostaNo ratings yet

- Funcodes ProdcodeDocument468 pagesFuncodes ProdcodeVikas SinghNo ratings yet

- BNR-National Bank of Rwanda - Exchange RatesDocument1 pageBNR-National Bank of Rwanda - Exchange RatesPaulo GóisNo ratings yet

- Columbia Business School - Investment Banking GuideDocument58 pagesColumbia Business School - Investment Banking Guideweeping.peaNo ratings yet

- M&A StudyDocument90 pagesM&A Studyapp04127No ratings yet

- A Maniac Commodity Trader's Guide To Making A Fortune (8837)Document5 pagesA Maniac Commodity Trader's Guide To Making A Fortune (8837)juan72No ratings yet

- TV3 AnalysisDocument3 pagesTV3 AnalysishotransangNo ratings yet

- AKPI - LK Audit 2012 PDFDocument87 pagesAKPI - LK Audit 2012 PDFMuhammad ArdiansyahNo ratings yet

- Compounding SpreadsheetDocument9 pagesCompounding SpreadsheetLucaNo ratings yet

- Presentation Part 1-1 The Global Captial MarketDocument59 pagesPresentation Part 1-1 The Global Captial MarketVI HỒ NGỌC TƯỜNGNo ratings yet

- Chapter 28RDocument29 pagesChapter 28RCFANo ratings yet

- Introduction To IPOsDocument1 pageIntroduction To IPOsaugusthrtrainingNo ratings yet

- Eniola InvoiceDocument1 pageEniola InvoiceADEMILUYI SAMUEL TOLULOPENo ratings yet

- Liabilitas Dan Pertumbuhan Perusahaan Terhadap Struktur Modal Pada Perusahaan Bumn Go PublicDocument8 pagesLiabilitas Dan Pertumbuhan Perusahaan Terhadap Struktur Modal Pada Perusahaan Bumn Go PublicQurrotu AiniNo ratings yet

- Synopsis On Capital StructureDocument11 pagesSynopsis On Capital StructureSanjay MahadikNo ratings yet

- Fabozzi Bmas8 PPT Ch01Document22 pagesFabozzi Bmas8 PPT Ch01Leslie RomeroNo ratings yet

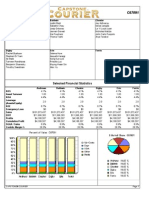

- Capstone Round 0 ReportDocument16 pagesCapstone Round 0 Reportcricket1223100% (1)

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiNo ratings yet

- Thesis Title For Banking and FinanceDocument7 pagesThesis Title For Banking and Financebsqfc4d5100% (2)

- 2023 Financial StatementsDocument27 pages2023 Financial Statementsdemo040804No ratings yet

- Analisis Penentuan Harga Jual Apartemen - CompressDocument14 pagesAnalisis Penentuan Harga Jual Apartemen - Compressriko andreanNo ratings yet

- Chap09 Tutorial QuestionsDocument7 pagesChap09 Tutorial QuestionsSong PhươngNo ratings yet

- Corporations: Organization and Capital Stock Transactions: Weygandt - Kieso - KimmelDocument54 pagesCorporations: Organization and Capital Stock Transactions: Weygandt - Kieso - Kimmelkey aidanNo ratings yet