Professional Documents

Culture Documents

s328 Etc

Uploaded by

Ron Pang Su NguanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

s328 Etc

Uploaded by

Ron Pang Su NguanCopyright:

Available Formats

Loans to directors 162.

(1) A company (other than an exempt private company) shall not make a loan to a director of the company or of a company which by virtue of section 6 is deemed to be related to that company, or enter into any guarantee or provide any security in connection with a loan made to such a director by any other person but nothing in this section shall apply (a) subject to subsection (2), to anything done to provide such a director with funds to meet expenditure incurred or to be incurred by him for the purposes of the company or for the purpose of enabling him properly to perform his duties as an officer of the company; (b) to provide a loan to such a director who is engaged in the full-time employment of the company or of a corporation that is deemed to be related to the company, as the case may be, for the purpose of purchasing or otherwise acquiring a home occupied or to be occupied by the director, except that not more than one such loan may be outstanding from the director at any time; (c) to any loan made to such a director who is engaged in the full-time employment of the company or of a corporation that is deemed to be related to that company, as the case may be, where the company has at a general meeting approved of a scheme for the making of loans to employees of the company and the loan is in accordance with that scheme; or (d) to any loan made to such director in the ordinary course of business of a company whose ordinary business includes the lending of money or the giving of guarantees in connection with loans made by other persons if the activities of that company are regulated by any written law relating to banking, finance companies or insurance or are subject to supervision by the Monetary Authority of Singapore. [8/2003] (2) Subsection (1)(a) or (b) shall not authorise the making of any loan, or the entering into any guarantee, or the provision of any security except (a) with the prior approval of the company given at a general meeting at which the purposes of the expenditure and the amount of the loan or the extent of the guarantee or security, as the case may be, are disclosed; or (b) on condition that, if the approval of the company is not given as aforesaid at or before the next following annual general meeting, the loan shall be repaid or the liability under the guarantee or security shall be discharged, as the case may be, within 6 months from the conclusion of that meeting. (3) Where the approval of the company is not given as required by any such condition the directors authorising the making of the loan or the entering into the guarantee or the provision of the security shall be jointly and severally liable to indemnify the company against any loss arising therefrom. (4) Where a company contravenes this section any director who authorises the making of any loan, the entering into of any guarantee or the providing of any security contrary to this section shall be guilty of an offence and shall be liable on conviction to a fine not exceeding $20,000 or to imprisonment for a term not exceeding 2 years. [15/84] (5) Nothing in this section shall operate to prevent the company from recovering the amount of any loan or amount for which it becomes liable under any guarantee entered into or in respect of any security given contrary to this section. (6) For the purpose of subsection (1), a reference to a director therein includes a reference to the directors spouse, son, adopted son, step-son, daughter, adopted daughter and step-daughter. [15/84] [UK, 1948, s. 190; Aust., 1961, s. 125]

Priorities 328. (1) Subject to the provisions of this Act, in a winding up there shall be paid in priority to all other unsecured debts (a) firstly, the costs and expenses of the winding up including the taxed costs of the applicant for the winding up order payable under section 256, the remuneration of the liquidator and the costs of any audit carried out pursuant to section 317; (b) secondly, subject to subsection (2), all wages or salary (whether or not earned wholly or in part by way of commission) including any amount payable by way of allowance or reimbursement under any contract of employment or award or agreement regulating conditions of employment of any employee; (c) thirdly, subject to subsection (2), the amount due to an employee as a retrenchment benefit or ex gratia payment under any contract of employment or award or agreement that regulates conditions of employment whether such amount becomes payable before, on or after the commencement of the winding up; (d) fourthly, all amounts due in respect of work injury compensation under the Work Injury Compensation Act (Cap. 354) accrued before, on or after the commencement of the winding up; [5/2008 wef 01/04/2008] (e) fifthly, all amounts due in respect of contributions payable during the 12 months next before, on or after the commencement of the winding up by the company as the employer of any person under any written law relating to employees superannuation or provident funds or under any scheme of superannuation which is an approved scheme under the law relating to income tax; (f) sixthly, all remuneration payable to any employee in respect of vacation leave, or in the case of his death to any other person in his right, accrued in respect of any period before, on or after the commencement of the winding up; and

(g) seventhly, the amount of all tax assessed and all goods and services tax due under any written law before the commencement of the winding up or assessed at any time before the time fixed for the proving of debts has expired. [15/84; 13/87; 22/93; 31/93; 42/2005] (2) The amount payable under subsection (1)(b) and (c) shall not exceed an amount that is equivalent to 5 months salary whether for time or piecework in respect of services rendered by the employee to the company or $7,500, whichever is the lesser. (3) The debts in each class, specified in subsection (1), shall rank in the order therein specified but as between debts of the same class shall rank equally between themselves, and shall be paid in full, unless the property of the company is insufficient to meet them, in which case they shall abate in equal proportions between themselves. (4) Where any payment has been made to any employee of the company on account of wages, salary or vacation leave out of money advanced by a person for that purpose, the person by whom the money was advanced shall, in a winding up, have a right of priority in respect of the money so advanced and paid, up to the amount by which the sum in respect of which the employee would have been entitled to priority in the winding up has been diminished by reason of the payment, and shall have the same right of priority in respect of that amount as the employee would have had if the payment had not been made. (5) So far as the assets of the company available for payment of general creditors are insufficient to meet any preferential debts specified in subsection (1)(a), (b), (c), (e) and (f) and any amount payable in priority by virtue of subsection (4), those debts shall have priority over the claims of the holders of debentures under any floating charge created by the company (which charge, as created, was a floating charge), and shall be paid accordingly out of any property comprised in or subject to that charge. [22/93] (6) Where the company is under a contract of insurance (entered into before the commencement of the winding up) insured against liability to third parties, then if any such liability is incurred by the company (either before or after the commencement of the winding up) and an amount in respect of that liability is or has been received by the company or the liquidator from the insurer the amount shall, after deducting any

expenses of or incidental to getting in such amount, be paid by the liquidator to the third party in respect of whom the liability was incurred to the extent necessary to discharge that liability or any part of that liability remaining undischarged in priority to all payments in respect of the debts referred to in subsection (1). Subdivision (3) Effect on other transactions Undue preference 329. (1) Subject to this Act and such modifications as may be prescribed, any transfer, mortgage, delivery of goods, payment, execution or other act relating to property made or done by or against a company which, had it been made or done by or against an individual, would in his bankruptcy be void or voidable under section 98, 99 or 103 of the Bankruptcy Act (Cap. 20) (read with sections 100, 101 and 102 thereof) shall in the event of the company being wound up be void or voidable in like manner. [15/95] (2) For the purposes of this section, the date which corresponds with the date of making of the application for a bankruptcy order in the case of an individual shall be (a) in the case of a winding up by the Court (i) the date of the making of the winding up application; or (ii) where before the making of the winding up application a resolution has been passed by the company for voluntary winding up, the date upon which the resolution to wind up the company voluntarily is passed, whichever is the earlier; and (b) in the case of a voluntary winding up, the date upon which the winding up is deemed by this Act to have commenced. [42/2005] (3) Any transfer or assignment by a company of all its property to trustees for the benefit of all its creditors shall be void. [UK, 1948, s. 320; Aust., 1961, s. 293]

Effect of floating charge 330. A floating charge on the undertaking or property of the company created within 6 months of the commencement of the winding up shall, unless it is proved that the company immediately after the creation of the charge was solvent, be invalid except to the amount of any cash paid to the company at the time of or subsequently to the creation of and in consideration for the charge together with interest on that amount at the rate of 5% per annum. [UK, 1948, s. 322; Aust., 1961, s. 294]

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Organic Evolution (Evolutionary Biology) Revised Updated Ed by Veer Bala RastogiDocument1,212 pagesOrganic Evolution (Evolutionary Biology) Revised Updated Ed by Veer Bala RastogiTATHAGATA OJHA83% (6)

- C ProgrammingDocument205 pagesC ProgrammingSrinivasan RamachandranNo ratings yet

- V Ships Appln FormDocument6 pagesV Ships Appln Formkaushikbasu2010No ratings yet

- Microscopes Open Up An Entire World That You Can't See With The Naked EyeDocument4 pagesMicroscopes Open Up An Entire World That You Can't See With The Naked EyeLouie Jane EleccionNo ratings yet

- Tensile TestDocument23 pagesTensile TestHazirah Achik67% (3)

- Lease of Residential HouseDocument4 pagesLease of Residential HousedenvergamlosenNo ratings yet

- Racial Bias in Pulse Oximetry Measurement: CorrespondenceDocument2 pagesRacial Bias in Pulse Oximetry Measurement: CorrespondenceYony Gutierrez100% (1)

- XDM-300 IMM ETSI B00 8.2.1-8.2.2 enDocument386 pagesXDM-300 IMM ETSI B00 8.2.1-8.2.2 enHipolitomvn100% (1)

- AP Biology Isopod LabDocument5 pagesAP Biology Isopod LabAhyyaNo ratings yet

- I. Specifikacija Opreme Sa Ugradnjom R.Br. Opis JM KomDocument4 pagesI. Specifikacija Opreme Sa Ugradnjom R.Br. Opis JM KomAleksandar VidakovicNo ratings yet

- MRI Week3 - Signal - Processing - TheoryDocument43 pagesMRI Week3 - Signal - Processing - TheoryaboladeNo ratings yet

- Nidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)Document2 pagesNidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)jdchandrapal4980No ratings yet

- Job Interview CV TipsDocument2 pagesJob Interview CV TipsCarlos Moraga Copier100% (1)

- Sles-55605 C071D4C1Document3 pagesSles-55605 C071D4C1rgyasuylmhwkhqckrzNo ratings yet

- FALLSEM2019-20 STS4021 SS VL2019201000258 Reference Material I 11-Jul-2019 CAT1-4021-Integ-AS PDFDocument14 pagesFALLSEM2019-20 STS4021 SS VL2019201000258 Reference Material I 11-Jul-2019 CAT1-4021-Integ-AS PDFjahnavi rajuNo ratings yet

- Introduction To Machine Learning Top-Down Approach - Towards Data ScienceDocument6 pagesIntroduction To Machine Learning Top-Down Approach - Towards Data ScienceKashaf BakaliNo ratings yet

- Remembering Manoj ShuklaDocument2 pagesRemembering Manoj ShuklamadhukarshuklaNo ratings yet

- NT140WHM N46Document34 pagesNT140WHM N46arif.fahmiNo ratings yet

- MinistopDocument23 pagesMinistopAlisa Gabriela Sioco OrdasNo ratings yet

- Uses of The Internet in Our Daily LifeDocument20 pagesUses of The Internet in Our Daily LifeMar OcolNo ratings yet

- Chapter 5Document11 pagesChapter 5XDXDXDNo ratings yet

- Interviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonDocument8 pagesInterviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonSanjeev JayaratnaNo ratings yet

- Case Study OrthoDocument21 pagesCase Study Orthojoshua_santiago_5No ratings yet

- PP 12 Maths 2024 2Document21 pagesPP 12 Maths 2024 2Risika SinghNo ratings yet

- Instruction Manual PC Interface RSM 100: TOSHIBA Corporation 1999 All Rights ReservedDocument173 pagesInstruction Manual PC Interface RSM 100: TOSHIBA Corporation 1999 All Rights ReservedFarid HakikiNo ratings yet

- GF26.10-S-0002S Manual Transmission (MT), Function 9.7.03 Transmission 716.6 in MODEL 639.601 /603 /605 /701 /703 /705 /711 /713 /811 /813 /815Document2 pagesGF26.10-S-0002S Manual Transmission (MT), Function 9.7.03 Transmission 716.6 in MODEL 639.601 /603 /605 /701 /703 /705 /711 /713 /811 /813 /815Sven GoshcNo ratings yet

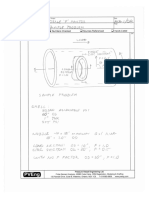

- Nozzle F Factor CalculationsDocument5 pagesNozzle F Factor CalculationsSivateja NallamothuNo ratings yet

- High Volume InstrumentDocument15 pagesHigh Volume Instrumentcario galleryNo ratings yet

- Blackmagic RAW Speed TestDocument67 pagesBlackmagic RAW Speed TestLeonardo Terra CravoNo ratings yet

- Data Structures LightHall ClassDocument43 pagesData Structures LightHall ClassIwuchukwu ChiomaNo ratings yet