Professional Documents

Culture Documents

S B ' F E P: Upervision of Anks Oreign Xchange Ositions

Uploaded by

rajesh vankadaraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S B ' F E P: Upervision of Anks Oreign Xchange Ositions

Uploaded by

rajesh vankadaraCopyright:

Available Formats

Foreign exchange positions

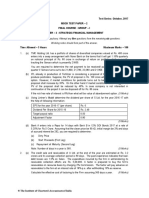

SUPERVISION OF BANKS FOREIGN EXCHANGE POSITIONS

(August 1980)

I.

General remarks

There are many activities of banks which involve risk-taking, but there are few in which a bank may so quickly incur large losses as in foreign exchange transactions. The risks inherent in foreign exchange business, particularly in running open foreign exchange positions, have been heightened in recent years by the increased instability of exchange rates. Consequently, the monitoring of these risks has become a matter of increased interest to supervisory authorities. The purpose of this note is to consider the prudential aspects of banks foreign exchange activities. It is not directly concerned with the restrictions that countries may place on their banks foreign exchange business for exchange control, monetary or other macroeconomic reasons. In exercising prudential control over this area of banks activities, however, supervisory authorities need to take into account the role of the banks as "market-makers" in foreign exchange. This role has two aspects. Firstly, banks have to quote rates to their customers (including other banks) at which they stand ready to buy and sell currencies. Secondly, by themselves taking open positions in currencies, banks (as well as non-banks) help to ensure that the foreign exchange markets are balanced at any point of time without excessive and erratic exchange rate fluctuations. In other words, supervisors have to weigh prudential considerations against the need to enable the banks to play their part in the smooth and efficient functioning of the exchange markets. Whatever may be the exact balance struck between these considerations, supervisory authorities must seek to ensure that the risks assumed by banks in their foreign exchange operations are never so large as to constitute a significant threat either to the solvency and liquidity of individual banks, or to the health and stability of the banking system as a whole. II. Types of prudential risks

While banks are exposed to a number of different types of risk in the conduct of their foreign exchange business, most of these risks also feature in domestic banking business. In principle, the only risk peculiar to foreign currency business is the exchange rate risk, i.e. the risk that a bank may suffer losses as a result of adverse exchange rate movements during a period in which it has an open position, either spot or forward, or a combination of the two, in an individual foreign currency. The other risks incurred by banks conducting foreign exchange operations arise more as a result of the international aspects of such business than because foreign currencies are involved. One such risk is the interest rate risk, which arises from the maturity

Foreign exchange positions

mismatching of foreign currency positions. Even when the spot-plus-forward positions in individual currencies are balanced, the pattern of forward contracts may produce a forward/forward mismatch. In such situations, a bank may suffer losses as a result of changes in interest rate differentials and concomitant changes in the forward exchange premiums, or discounts, of the two currencies concerned. Another type of risk is the credit risk, i.e. that of a defaulting counterparty to a foreign exchange contract, or a loan contract involving foreign exchange. In that case the bank, provided it originally had a balanced book, would find itself inadvertently left with an uncovered exchange position. Although this kind of credit risk potentially encompasses the total of a banks foreign exchange book, the bank would suffer an exchange loss only to the extent that the exchange rate had in the meantime moved in such a way that a cost would be involved in covering the position opened up by an unfulfilled foreign exchange contract. However, in the case of a loan contract a bank may be exposed for the full amount of the contract. A further risk is the time-zone risk, which arises because of the twenty-four hour nature of foreign currency markets. With time-lags frequently occurring between settlement in one currency in one centre and settlement in a different currency in another time-zone, banks may be exposed for the full amount of the contract if the counterparty or the payment agent defaults in the interim. Finally, most foreign exchange contracts involve counterparties who are resident in other countries, with the result that sovereign (or country) risk, e.g. the risk of a ban on the transfer of currency by the nationals of a particular country, will also be present. III. The role of bank management Primary responsibility for the safety of banks in their foreign exchange operations rests with the managements of banks. In particular, it is managements responsibility to set appropriate limits to the risks taken by a bank in its foreign exchange business and to ensure that there are proper internal control procedures covering this area of a banks activities. So far as internal controls are concerned, the banks should observe a clear-cut and well-defined division of responsibility between a) foreign exchange dealing, b) accounting, and c) internal supervision. A banks foreign exchange dealers should have clear and binding instructions both as regards general trading principles and as regards limits (by individual currencies and maturities) on open positions, on the size of individual contracts and on exposure (overnight and forward) with individual counterparties. Dealers should be strictly required to record each transaction on a dated and sequentially-numbered form and to pass it promptly to the accounting department. The instructions to the dealers should, moreover, prohibit the conduct of business (including business within the same banking group) at exchange rates which are unrepresentative of the prevailing level in the market and should

Foreign exchange positions

include a general code of conduct for their relations with exchange brokers. As a matter of general principle, profit targets should not be imposed by a banks management on its dealing department, even though there may well be some presumption that income will be forthcoming from this source. The accounting department should receive without delay all the information from the dealers that is necessary to ensure that no deal goes unrecorded. All foreign exchange contracts, whether spot or forward, should be promptly confirmed in writing. Furthermore, dealers should never write their own outgoing confirmations; this should be the responsibility of the accounting department alone, which should also be the first to receive the corresponding incoming confirmations. If confirmations are not forthcoming, the counterparties should be contacted promptly and in the absence of satisfactory explanation the bank should inform its supervisory authority. In addition, foreign exchange accounting should be organised in such a way that the banks management is continuously in possession of a full and up-to-date picture of the banks position in individual currencies and with individual counterparties. This information should not only include the head office but also the positions of affiliates at home or abroad. Moreover, periodic and frequent revaluations at current market rates should permit the monitoring of the development of the banks profits or losses on its outstanding foreign exchange book. It will be the responsibility of the internal audit function to make sure that dealers observe their instructions and the code of behaviour required from them, and that accounting procedures meet the necessary standards of accuracy, promptness and completeness. For that purpose it will be advisable not only that internal audits and inspections take place at regular intervals, but that occasional spot checks are made. As a further safeguard against malpractices, the auditors, in co-operation with the central management, should from time to time seek an exchange of information on outstanding foreign exchange contracts with the counterparties to these contracts. Banks should inform their supervisory authority if there appears to be a lack of control or cooperation on the part of the counterparty. It should, moreover, be clear that the internal control procedures should cover not only the parent bank, but its total branch network and, as far as possible, also its subsidiaries. In order to facilitate internal supervision and monitoring of open exchange positions, branches should daily report their dealing positions to head office. While the extent to which individual branches are permitted to run open positions is a matter for a banks management to decide on the basis of geographical factors and the dealing expertise of the branch concerned, head office should strictly enforce the limits it sets in order to keep control of its worldwide exposure.

Foreign exchange positions

IV. The role of supervisors The role of supervisory authorities in monitoring and controlling banks foreign exchange activity may involve one or more of the following activities: the surveillance of banks internal control procedures; the setting of more or less formal guidelines for, or limits on, banks foreign currency exposure; the monitoring of banks foreign exchange positions. As regards the first of these, the supervisors job is to make sure that the banks have internal control systems as discussed in section III above, that these systems function effectively and that both internal and external reporting is as far as possible safeguarded against falsification. As regards guidelines for, or limits on, banks foreign exchange exposure, it is desirable to distinguish between a banks dealing position in foreign exchange and its infrastructure position in foreign exchange (participations, investment in property, etc.). Moreover, supervisors should distinguish between a banks total uncovered position in foreign currencies and its open positions in individual foreign currencies. Thus, it will make quite a difference whether a banks uncovered position results primarily from exposure in just one currency, or whether it is the sum of smaller exposures in several currencies. To take account of these qualitative differences, the authorities might apply a system of dual limits, one on a banks exposure in individual foreign currencies, and one on its overall foreign exchange exposure, i.e. the gross aggregate of its long and short positions in individual foreign currencies. It might also be desirable to restrict a banks net position in domestic currency, but this is more likely to be for monetary or exchange control purposes than for prudential reasons. A further point which the supervisory authorities have to consider in this context is whether it is desirable to monitor and/or to set limits on banks dealings in gold and precious metals. While in many countries banks dealings for their own account are either negligible or statutorily prohibited, higher prices and greater activity in precious metals markets have increased the possibility that banks may become over-exposed in their operations in these markets. To reduce this risk, banks could be required to include positions taken in gold or precious metals within any limits imposed on their foreign exchange positions, or alternatively separate limits might be imposed on these activities. In supervising banks foreign exchange business, the authorities will have to base themselves in large measure on bank managements own standards of prudence. They must, therefore, satisfy themselves that management adhere to some rational policies with respect to foreign exchange exposure, such as limiting open exchange positions to a certain proportion of the banks own funds. To avoid the risk of over-trading, it might also be desirable for a bank to keep its total foreign exchange turnover approximately in line with the size of its

Foreign exchange positions

balance sheet. Those authorities which go further and set guidelines or limits equally need to find some standard by which to judge what degree of flexibility banks should be given. In several major countries, the standard used is the size of the banks capital base. For the purpose of monitoring the banks foreign exchange business, the authorities need to make use of two types of information flows: statistical reports from the banks about their foreign exchange operations; and information about events and developments in the foreign exchange market. As regards statistical reports, it will be neither practicable nor necessary for the supervisory authorities to obtain the full range of information about the banks exchangemarket activities and exposure that should be available to the banks own management. The periodic reports to the authorities should, however, show, as a minimum and rather frequently, the banks open spot-plus-forward position in individual currencies and preferably also their gross positions. Limits on foreign exchange exposure will shield a bank from risk only when they are adhered to on a permanent basis. Therefore, the authorities will have to make sure, perhaps by means of unannounced on-the-spot examinations, that these periodic reports also provide a realistic picture of a banks foreign exchange activities between reporting dates. Where formal limits on exposure are applied, the periodic reports supplied by the banks might be required to include statements of each occasion on which the limits were exceeded. The authorities also need to guard against banks "parking" foreign exchange positions with their affiliates in other countries. Although this practice is difficult to detect where multinational groups are involved, supervisors should have access to banks dealing slips and should ensure that these are properly dated and sequentially numbered. General information about developments in the exchange market is available to the authorities through the contacts which central banks maintain with market participants. In that connection the authorities should encourage banks to keep them informed, for example, about requests by other banks to deal (or to carry over exchange contracts) at rates which are unrepresentative of the level prevailing in the market, confirmations not being forthcoming, an excessive volume of foreign exchange business transacted by another bank, or more generally about market rumours and anomalies. Where the central bank is not responsible for banking supervision, it should pass on information it obtains from its market contacts to the supervisory authorities. Similarly, on an international level the authorities should exchange on a confidential basis any market rumours concerning banks under their respective supervision.

Foreign exchange positions

You might also like

- Supervisory Guidance For Managing Settlement Risk in Foreign Exchange TransactionsDocument26 pagesSupervisory Guidance For Managing Settlement Risk in Foreign Exchange Transactionsshishir_nair_1No ratings yet

- Net Open PositionDocument8 pagesNet Open Positionshehzeds100% (1)

- Final Exam - International FinanceDocument59 pagesFinal Exam - International FinanceSusan ArafatNo ratings yet

- Fsibriefs 19Document13 pagesFsibriefs 19AnaNo ratings yet

- ALMDocument15 pagesALMGaurav PandeyNo ratings yet

- Asset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsDocument12 pagesAsset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsKevin VazNo ratings yet

- Treasury ManagementDocument14 pagesTreasury ManagementOmkar RohekarNo ratings yet

- Integrated Treasury Management in BanksDocument17 pagesIntegrated Treasury Management in Banksmasapu100% (1)

- Neoma How Is Climate Change Impacting The Financial System Oct 2022Document30 pagesNeoma How Is Climate Change Impacting The Financial System Oct 2022XX YYNo ratings yet

- International BankingDocument46 pagesInternational BankingPARMANANDNo ratings yet

- Asset Liability Management: in BanksDocument44 pagesAsset Liability Management: in Bankssachin21singhNo ratings yet

- Bank RegulationDocument6 pagesBank RegulationAndre WestNo ratings yet

- Treasury Management in Banking - Sem 4Document4 pagesTreasury Management in Banking - Sem 4payablesNo ratings yet

- Module 5 Aud SpecializedDocument7 pagesModule 5 Aud SpecializedAnonymityNo ratings yet

- International BankingDocument48 pagesInternational Bankingrajan2778No ratings yet

- Interest Rate RiskDocument8 pagesInterest Rate RiskP MajumderNo ratings yet

- International Business Management QBDocument12 pagesInternational Business Management QBAnonymous qAegy6GNo ratings yet

- OCC Interest Rate RiskDocument74 pagesOCC Interest Rate RiskSara HumayunNo ratings yet

- MineraDocument8 pagesMineraUriel Torres PeñaNo ratings yet

- ASI - Audit of Banks - Part 1Document12 pagesASI - Audit of Banks - Part 1Joshua LisingNo ratings yet

- A simple approach to bond trading: The introductory guide to bond investments and their portfolio managementFrom EverandA simple approach to bond trading: The introductory guide to bond investments and their portfolio managementRating: 5 out of 5 stars5/5 (1)

- Core Risks in BankingDocument9 pagesCore Risks in BankingVenkatsubramanian R IyerNo ratings yet

- Asset-Liability-Management FOR NBFCDocument7 pagesAsset-Liability-Management FOR NBFCDr. Prafulla RanjanNo ratings yet

- Treasury Management by Pranab NamchoomDocument16 pagesTreasury Management by Pranab NamchoomPranab NamchoomNo ratings yet

- Analysing Financial StatementDocument20 pagesAnalysing Financial StatementbijayrNo ratings yet

- ch14-Off-Balance Sheet ActivitiesDocument15 pagesch14-Off-Balance Sheet ActivitiesYousif Agha100% (3)

- Unit - 5 Banking Regulation and Central Bank Policy For Bank and Fis Meaning of RegulationDocument13 pagesUnit - 5 Banking Regulation and Central Bank Policy For Bank and Fis Meaning of Regulationsahil ShresthaNo ratings yet

- R M G D: ISK Anagement Uidelines For Erivatives (July 1994)Document17 pagesR M G D: ISK Anagement Uidelines For Erivatives (July 1994)loghanand_muthuramuNo ratings yet

- Treasury of A Commercial BankDocument4 pagesTreasury of A Commercial BankBerkshire Hathway coldNo ratings yet

- BBFH407 - Assignment 1Document15 pagesBBFH407 - Assignment 1Simba MashiriNo ratings yet

- Treasury Management Operations of BankDocument112 pagesTreasury Management Operations of BankNamrata JerajaniNo ratings yet

- Offshore Main ReportDocument29 pagesOffshore Main ReportAmanjotNo ratings yet

- What Is ALM and ALCO PDFDocument2 pagesWhat Is ALM and ALCO PDFmackjblNo ratings yet

- Ethical Practice in Correspondent BankingDocument35 pagesEthical Practice in Correspondent Bankingmahesh ojhaNo ratings yet

- 06 Banking CH 6Document8 pages06 Banking CH 6sabit hussenNo ratings yet

- Audit of Specialized Industry Banking PDFDocument7 pagesAudit of Specialized Industry Banking PDFLovely-Lou LaurenaNo ratings yet

- Reinsurance and Foreign Exchange RiskDocument24 pagesReinsurance and Foreign Exchange RiskGissela ManobandaNo ratings yet

- Draft Guidance Notes On Interest Rate Risk Management Policies For BanksDocument13 pagesDraft Guidance Notes On Interest Rate Risk Management Policies For BanksYelkeyNo ratings yet

- Type of Risk LessonDocument29 pagesType of Risk LessonpremseoulNo ratings yet

- Barclays' Strategic Position Regarding New Financial Market RegulationsDocument21 pagesBarclays' Strategic Position Regarding New Financial Market Regulationskatarzena4228No ratings yet

- BBFH407 - Assignment 1Document7 pagesBBFH407 - Assignment 1Simba MashiriNo ratings yet

- Guidance Note For Deposit Takers (Class 1 (1) and Class 1 (2) )Document13 pagesGuidance Note For Deposit Takers (Class 1 (1) and Class 1 (2) )aryait099No ratings yet

- Tutorial 1 - Introduction To Treasury ManagementDocument2 pagesTutorial 1 - Introduction To Treasury ManagementTACN-4TC-19ACN Nguyen Thu HienNo ratings yet

- 1a. MeaningDocument33 pages1a. MeaningalpeshNo ratings yet

- Audit of Forex TransactionsDocument4 pagesAudit of Forex Transactionsnamcheang100% (2)

- Asset Liability Management in BanksDocument29 pagesAsset Liability Management in Bankseknath2000No ratings yet

- Financial Globalization Lecture 10Document5 pagesFinancial Globalization Lecture 10nihadsamir2002No ratings yet

- Financial Statement Analysis and Performance Evaluation of The Banking Sector in MontenegroDocument55 pagesFinancial Statement Analysis and Performance Evaluation of The Banking Sector in MontenegroyubrajrautNo ratings yet

- Bank RegulationDocument3 pagesBank RegulationMhai PenolioNo ratings yet

- Gill Marcus: Issues For Consideration in Mergers and Takeovers From A Regulatory PerspectiveDocument12 pagesGill Marcus: Issues For Consideration in Mergers and Takeovers From A Regulatory PerspectiveTushar AhujaNo ratings yet

- Draft Guidelines On Interest Rate Risk in Banking Book Interest Rate RiskDocument28 pagesDraft Guidelines On Interest Rate Risk in Banking Book Interest Rate RiskPrasad MohanNo ratings yet

- Executive Summary: Growing Importance of Money and To Manage This Most Essential Item Is An Art, ScienceDocument63 pagesExecutive Summary: Growing Importance of Money and To Manage This Most Essential Item Is An Art, ScienceSushant NewalkarNo ratings yet

- Auditing Financial InstitutionsDocument92 pagesAuditing Financial InstitutionsElena PanainteNo ratings yet

- Risks in Foreign Exchange ManagemnentDocument4 pagesRisks in Foreign Exchange ManagemnentNazmul H. PalashNo ratings yet

- Chapter 5Document5 pagesChapter 5Duy Anh NguyễnNo ratings yet

- Forward Rate Agreements and Interest Rate Swaps - GuidelinesDocument9 pagesForward Rate Agreements and Interest Rate Swaps - GuidelinesMakarand LonkarNo ratings yet

- Guideline On Liquidity Management CBKDocument6 pagesGuideline On Liquidity Management CBKmeric8669No ratings yet

- Final Examination: Test I. Multiple Choice TheoryDocument7 pagesFinal Examination: Test I. Multiple Choice TheoryLorry Fe A. SargentoNo ratings yet

- Chapter 5 Currency DerivativesDocument7 pagesChapter 5 Currency DerivativesYajie Zou100% (3)

- Derivatives: The Important Categories of DerivativesDocument10 pagesDerivatives: The Important Categories of DerivativesShweta AgrawalNo ratings yet

- BFM Treasury ManagementDocument11 pagesBFM Treasury ManagementH RajputNo ratings yet

- Valuation of ForwardDocument18 pagesValuation of ForwardbuviaroNo ratings yet

- Hedge Barrier OptionDocument6 pagesHedge Barrier OptionKevin ChanNo ratings yet

- Derivatives and Risk Management PDFDocument7 pagesDerivatives and Risk Management PDFYogesh GovindNo ratings yet

- Exercises in FOrexDocument71 pagesExercises in FOrexpakhtunNo ratings yet

- (SM) Financial Instruments Unit 5Document15 pages(SM) Financial Instruments Unit 5Mayank GoyalNo ratings yet

- MATERIALDocument23 pagesMATERIALPocari OnceNo ratings yet

- Assignment 2 AKL2Document7 pagesAssignment 2 AKL2ariefrahmaanNo ratings yet

- Derivatives ProjectDocument109 pagesDerivatives Project47198666100% (4)

- Solutions Chapters 10 & 11 Transactions and Economic ExposureDocument46 pagesSolutions Chapters 10 & 11 Transactions and Economic Exposurerakhiitsme83% (6)

- Options Futures and Other DerivativesDocument28 pagesOptions Futures and Other DerivativesAmir AuditorNo ratings yet

- Chapter 5 - Currency Derivatives - Currency Forward and FuturesDocument73 pagesChapter 5 - Currency Derivatives - Currency Forward and Futuresธชพร พรหมสีดาNo ratings yet

- FRM Financial Markets and Products Test 1Document9 pagesFRM Financial Markets and Products Test 1ConradoCantoIIINo ratings yet

- An Overview of Non-Deliverable Foreign Exchange Forward MarketsDocument6 pagesAn Overview of Non-Deliverable Foreign Exchange Forward MarketsRoland YauNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument16 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerJINENDRA JAINNo ratings yet

- Chapter 3 International Financial Markets (Self-Study)Document80 pagesChapter 3 International Financial Markets (Self-Study)SHREYANS PRASHANT ZAMBAD IPM 2020 -25 BatchNo ratings yet

- Managing Economic Exposure and Translation Exposure: South-Western/Thomson Learning © 2006Document16 pagesManaging Economic Exposure and Translation Exposure: South-Western/Thomson Learning © 2006KanchelskiTehNo ratings yet

- Financial DerivatiesDocument22 pagesFinancial DerivatiesA.r. PirzadoNo ratings yet

- Chapter 2 - An Introduction of Forward and OptionDocument38 pagesChapter 2 - An Introduction of Forward and Optioncalun12No ratings yet

- Domain Aptitude Quiz, Suprise TestDocument2 pagesDomain Aptitude Quiz, Suprise TestMesiya AnastasiabarusNo ratings yet

- ACT109 PQ4 StudentsDocument1 pageACT109 PQ4 StudentsthomasNo ratings yet

- INS3032 Chap 5Document55 pagesINS3032 Chap 5Lan Hương VũNo ratings yet

- MA4257Document102 pagesMA4257Stephen BaoNo ratings yet

- Sample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyDocument33 pagesSample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyPrathamesh ChawanNo ratings yet

- Prac 2Document10 pagesPrac 2Fery AnnNo ratings yet

- Interest Rate Models. Damir Filipović University of MunichDocument69 pagesInterest Rate Models. Damir Filipović University of MunichKhawla GougasNo ratings yet