Professional Documents

Culture Documents

Scribd Upload A Document Search Documents Explore Sign Up Log in Inshare

Uploaded by

Supun Chandana KumaraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scribd Upload A Document Search Documents Explore Sign Up Log in Inshare

Uploaded by

Supun Chandana KumaraCopyright:

Available Formats

Scribd Upload a Document

debtor con

Search Documents

Explore

Sign Up | Log In

inShare

Embed Doc Copy Link Readcast Collections 1 Comments

Download S . N o . P A R T I C N O . 1 . W O R C A P I T A L N Y P R O F I L E A N A L Y S T I V E S O F S T U D Y 5 . R E M E T H O D O L M I T I O A I N T E R P E R I N D I N G O S T U D Y 9 . T I O N S L U S I O N U L K 2 3 I T S O N T F S 1 0 A G H E A I . . S E A Y S T T U . 6 7 I O H Z C E Z O E N C R C . . N D 8 H L A . I T F R S N C S 4 G O W . O P A M O B G E P T E A

INTRODUCTION OF THE STUDYMeaningOfWorkingCapitalManagement:-

Working capital means the part of the total assets of the b usiness that change from one form toanother form in the ordinary course of business operations. The word working capital is a made of two words working and capital. The word working means day to day operation of the business, whereas the word capital means monetaryvalue of all assets of the business.Working capital may be regarded as the life blood of business. Working capital is of major importance to internal and external analysis because of its close relationship with thecurrent day to-day operations of a business. Every business needs funds for two purposes. 1 . L o n g t e r m 2.Short term 1. Long term funds are required to create production facilities through purchase of fixed assetssuch as plants, machineries, lands, buildings & etc2. Short term funds are required for the purchase of raw materials, payment of wages, and other day-to-day expenses.It is other wise known as revolving or circulating capitalIt is nothing but the difference between current assets and current liabilities. i.e. Working Capital = Current Asset Current Liability.

Businesses use capital for construction, renovation, furniture, software, equipment, or machinery.It is also commonly used to purchase inventory, or to make payroll. Capital is also used often by businesses to put a down payment down on a piece of commercial real estate. Working capital isessential for any business to succeed. It is becoming increasingly important to have access to more working capital when we need it. Concept of Working Capital Gross Working Capital = Total of Current Asset Net Working Capital = Excess of Current Asset over Current Liability Constituents of Working Capital:-C u r r e n t A s s e t s C u r r e n t L i a b i l i t i e s Cash in hand / at bank Bills Receivable Bills Payable Sundry Creditors

Sundry Debtors Short term loans Investors/ stock Temporary investment Prepaid expenses

Accrued incomes Outstanding expenses Accrued expenses Bank Over draft Working capital in terms of five components: 1. Cash and equivalents: T h i s m o s t l i q u i d f o r m o f w o r k i n g c a p i t a l r e q u i r e s c o n s t a n t supervision. A good cash budgeting and forecasting system provides answers to key questions s u c h a s : I s t h e c a s h l e v e l a d e q u a t e t o m e e t c u r r e n t e x p e n s e s a s t h e y c o m e d u e ? W h a t i s t h e timing relationship between cash inflow and outflow? When will peak cash needs occur? Whenand how much bank borrowing will be needed to meet any cash shortfalls? When will repayment be expected and will the cash flow cover it? 2. Accounts receivable: Many businesses extend credit to their custom ers. If you do, is theamount of accounts receivable reasonable relative to sales? How rapidly are receivables being collected? Which customers are slow to pay and what should be done about them? 3. Inventory: Inventory is often as much as 50 percent of a firm's current assets, so naturally itrequires continual scrutiny. Is the inventory level reasonable compared with sales and the natureof your business? What's the rate of inventory turnover compared with other companies in your type of business? 4. Accounts payable :Financing by suppliers is common in small business; it is one of themajor sources of funds for entrepreneurs. Is the amount of money owed suppliers reasonablerelative to what you purchase? What is your firm's payment policy doing to enhance or detractfrom your credit rating? 5. Accrued expenses and taxes payable: These are obligations of your company at any giventime and represent a future outflow of cash . Two different concepts of working capital are : Balance sheet or Traditional concept Operating cycle concept. Balance sheet or Traditional concept: -

It shows the position of the firm at certain point of time. It is calculated in the basis of balancesheet prepared at a specific date. In this method there are two type of working capital: Gross working capital Net working capital Gross working capital: It refers to the firms investment in current assets. The sumof the current assets is the working capital of the business. The sum of the current assetsis a quantitative aspect of working capital. Which emphasizes more on quantity than its quality, but it fails to reveal the true financial position of the firm because every increase in currentliabilities will decrease the gross working capital. Net working capital: It is the difference between current assets and current liabilities or the excess of total current assets over total current liabilities. Working capital= current assets - current liabilitiesNet working capital: - It is also can defined as that part of a firms current assets which isfinanced with long term funds. It may be either positive or negative. When the current assets exceed the current liability, the working capital is positive and vice versa. Operating cycle concept :-

The duration or time required completing the sequence of events right from purchase of raw material for cash to the realization of sales in cash is called theoperating cycle or working capital cycle. RawMaterial Debtors&BillsReceivables Cash Work InProcess FinishedGoods Sales KINDS OF WORKING CAPITAL Gross Working Capital Gross working capital refers to the amount of funds invested in current assets that are employedin the business process. This is a going concern concept, since it is these aspects that financial O p e r a t i n g C yc l e

Leave a Comment

You must be logged in to leave a comment. Submit Characters: 400

Janvi Kochar janvi 09 / 17 / 2011 4 Debtor Conversion Period for project report on oswal woolen mills Download or Print 3,231 Reads Uploaded by pabalapreet Follow TIP Press Ctrl-F to quickly search anywhere in the document. Sections

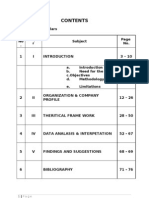

DECLARATION ACKNOWLEDGEMENT TABLE OF CONTENTS INTRODUCTION OF THE STUDY Meaning Of Working Capital Management :Concept of Working Capital Constituents of Working Capital:- Current Assets Current Liabilities Working capital in terms of five components: Two different concepts of working capital are :KINDS OF WORKING CAPITAL Temporary or Variable Working Capital:Temporary or variable And some special al is the amount of working capital which is required to meet the seasonal set IMPORTANCE OF ADEQUATE EXCESS OR INADEQUATE WORKING CAPITAL FACTORS DETERMINIG THE WORKING CAPITAL REQUIREMENTS SOURCES OF WORKING CAPITAL Permanent or Fixed Temporary or Variable Financing of Permanent/Fixed or Long-Term Working Capital Financing of Temporary/Variable or Short-Term Working Capital Statement of Working Capital Working Capital How to determine the working capital:G e n er al nature of bu siness Production cycle OSWAL WOOLEN MILLS LIMITED (OWM) MANAGEMENT OF THE COMPANY DETAILS OF DIRECTORS FEATURES OF NAHAR GROUP

ACHIEVEMENTS OF NAHAR GROUP MAJOR COMPETITORS OF OWM LENDER Strengths of the company Weakness of the company OPPURTUNITES THREATS OBJECTIVES OF THE STUDY RESEARCH METHODOLOGY Scope of Study Research Design Analysis and Interpretation 1) Raw Material Conversion Period: 2. Work in Progress Conversion Period: 3. Finished Goods Conversion Period 4 Debtor Conversion Period SUGGESTIONS CONCLUSION BIBLIOGRAPHY Books: Website

22 p. ethics in HRM

43 p. project report on oswal woolen mills Upload a Document

debtor con

Search Documents

Follow Us! scribd.com/scribd twitter.com/scribd facebook.com/scribd About Press Blog Partners Scribd 101 Web Stuff

Support FAQ Developers / API Jobs Terms Copyright Privacy

Copyright 2012 Scribd Inc. Language: English

You might also like

- Project Report On Working Capital Management: Wigan and Leigh College IndiaDocument53 pagesProject Report On Working Capital Management: Wigan and Leigh College Indiaamit_ruparelia28No ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- 1.1 Introduction To TopicDocument55 pages1.1 Introduction To Topickunal bankheleNo ratings yet

- Introduction To The Sports Goods IndustryDocument60 pagesIntroduction To The Sports Goods IndustryramkumarloiNo ratings yet

- Chapter - Ii Review of Literature Working Capital Management Meaning and Definition of Working CapitalDocument9 pagesChapter - Ii Review of Literature Working Capital Management Meaning and Definition of Working CapitalDavid jsNo ratings yet

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- Working Capital Management in Vardhman-Final ProjectDocument84 pagesWorking Capital Management in Vardhman-Final ProjectRaj Kumar100% (3)

- Shahbaaz T.Y BmsDocument35 pagesShahbaaz T.Y BmsSk EhjazNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementNeha KarleNo ratings yet

- FM ProjectDocument18 pagesFM ProjectRkenterpriseNo ratings yet

- Management Accounting - II: Presented by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedDocument30 pagesManagement Accounting - II: Presented by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedArvind RayalwarNo ratings yet

- Working Capital: Short-Term Assets Short-Term Liabilities OperationsDocument29 pagesWorking Capital: Short-Term Assets Short-Term Liabilities OperationsSUBODH DHONGADENo ratings yet

- Project Report1Document136 pagesProject Report1Anonymous NNTKn2No ratings yet

- FM Unit 5Document23 pagesFM Unit 5prasadarao yenugulaNo ratings yet

- Unit 5Document23 pagesUnit 5prasadarao yenugulaNo ratings yet

- Chapter 1.1 Working Capital Management 1.1 .1conceptDocument55 pagesChapter 1.1 Working Capital Management 1.1 .1conceptMAYUGAMNo ratings yet

- Working Capital OriginalDocument53 pagesWorking Capital Originalaurorashiva1100% (1)

- Project On Working Capital ManagementDocument59 pagesProject On Working Capital ManagementMotasim ParkarNo ratings yet

- Akanksha Project On WCMDocument112 pagesAkanksha Project On WCMAnurag MauryaNo ratings yet

- Siri Project On Working-Capital FinalDocument57 pagesSiri Project On Working-Capital FinalBillu GurunadhamNo ratings yet

- Working Capital ManagementDocument146 pagesWorking Capital Managementharishankaryadav1989100% (4)

- Working Capital ManagementDocument44 pagesWorking Capital ManagementAnjaliMoreNo ratings yet

- WCM of Cipla LTDDocument53 pagesWCM of Cipla LTDChanderNo ratings yet

- Deven Final ProjectDocument84 pagesDeven Final ProjectviralNo ratings yet

- Chapter - 1: Concept of Working CapitalDocument26 pagesChapter - 1: Concept of Working CapitalVarun JainNo ratings yet

- Summer Training Report: On "Training of Employees" ATDocument56 pagesSummer Training Report: On "Training of Employees" ATGauravNo ratings yet

- Project Report On Oswal Woolen MillsDocument43 pagesProject Report On Oswal Woolen Millspabalapreet50% (2)

- Introduction of TopicDocument46 pagesIntroduction of TopicsunilbghadgeNo ratings yet

- WCM ProjectDocument26 pagesWCM Projectskagrawal1987No ratings yet

- Project WCMDocument36 pagesProject WCMmohammedabdullah2162No ratings yet

- Working Capital ManagementDocument6 pagesWorking Capital Managementarchana_anuragiNo ratings yet

- Working Capital Management of L&TDocument18 pagesWorking Capital Management of L&TDeepak Jaiswal0% (1)

- Block-5 Unit-16Document24 pagesBlock-5 Unit-16Rushi RoyNo ratings yet

- Working CapitalDocument60 pagesWorking CapitaljubinNo ratings yet

- Need For The StudyDocument13 pagesNeed For The StudyHariKishanNo ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument17 pagesWORKING CAPITAL - Meaning of Working CapitalPriyanka AjayNo ratings yet

- WC Management 1Document10 pagesWC Management 1RonakNo ratings yet

- Working Capital ManagementDocument62 pagesWorking Capital ManagementSuresh Dhanapal100% (1)

- Demo ProDocument21 pagesDemo ProTara HoodNo ratings yet

- Working Capital Management (Finance) Unit - IDocument57 pagesWorking Capital Management (Finance) Unit - IVaibhav JainNo ratings yet

- A Project Report On Working Capital Management of Arss Infrastructure LimitedDocument82 pagesA Project Report On Working Capital Management of Arss Infrastructure LimitedBabu BalaNo ratings yet

- Power Point (Working Capital)Document71 pagesPower Point (Working Capital)Varun TayalNo ratings yet

- Business Finance IIDocument73 pagesBusiness Finance IIyakubu I saidNo ratings yet

- Working Capital Management Debendra ShawDocument6 pagesWorking Capital Management Debendra ShawRohit BajpaiNo ratings yet

- MBA - Madras Cement ProjectDocument83 pagesMBA - Madras Cement ProjectKrsna Mallu75% (4)

- Working Capital Mba ProjectDocument24 pagesWorking Capital Mba ProjectprincerattanNo ratings yet

- Working Capital Kesoram FinanceDocument56 pagesWorking Capital Kesoram FinanceRamana GNo ratings yet

- Principles of Working Capital Management-1Document29 pagesPrinciples of Working Capital Management-1margetNo ratings yet

- Working Capital Management Unit - IVDocument52 pagesWorking Capital Management Unit - IVthilagaashiv_43No ratings yet

- "Working Capital of Management": A Project Report ONDocument31 pages"Working Capital of Management": A Project Report ONRohit BhorNo ratings yet

- WCM at Bevcon PVT LTD.Document65 pagesWCM at Bevcon PVT LTD.moula nawazNo ratings yet

- Working Capital Management PDFDocument238 pagesWorking Capital Management PDFdarshinidave21No ratings yet

- WORKING CAPITAL - Meaning of Working CapitalDocument26 pagesWORKING CAPITAL - Meaning of Working CapitalAnkit GuptaNo ratings yet

- UNIT-1 Conceptual FrameworkDocument17 pagesUNIT-1 Conceptual FrameworkKusum JaiswalNo ratings yet

- Top of Form: DocumentsDocument27 pagesTop of Form: DocumentsAyush Srivastav CoolNo ratings yet

- Working Capital ManagementDocument396 pagesWorking Capital ManagementpltNo ratings yet

- EOQ Model: Economic Order QuantityDocument21 pagesEOQ Model: Economic Order Quantityrzia809No ratings yet

- PRE572 OgbeideDocument22 pagesPRE572 OgbeideChukwudi DesmondNo ratings yet

- Acccob2-Chapter5-Inventories - ExercisesDocument65 pagesAcccob2-Chapter5-Inventories - ExercisesMelyssa Dawn GullonNo ratings yet

- Logistics KRADocument3 pagesLogistics KRAlogisticsNo ratings yet

- Chapter 11 TestbankDocument25 pagesChapter 11 TestbankBùi Thị Vân Anh 06No ratings yet

- Financial Management at Beacon Pharmaceuticals LimitedDocument24 pagesFinancial Management at Beacon Pharmaceuticals LimitedFarhanUddinAhmedNo ratings yet

- Standardized Sources of Marketing DataDocument23 pagesStandardized Sources of Marketing Datamehwishali72No ratings yet

- An Introduction To Cost Terms and PurposesDocument13 pagesAn Introduction To Cost Terms and PurposesHendriMaulanaNo ratings yet

- Hanel Lean LiftDocument58 pagesHanel Lean LiftbrantleymccannNo ratings yet

- Coursera Operation Management Final Exam Questions - Module 2Document4 pagesCoursera Operation Management Final Exam Questions - Module 2Water Man0% (2)

- Hotel PreOpening Accounting ChecklistDocument27 pagesHotel PreOpening Accounting ChecklistDeo Patria HerdriantoNo ratings yet

- Full File at Http://testbankinstant - CH/Test-Bank-for-Principles-of-Cost-Accounting,-16th-EditionDocument11 pagesFull File at Http://testbankinstant - CH/Test-Bank-for-Principles-of-Cost-Accounting,-16th-EditionAnne Marieline BuenaventuraNo ratings yet

- CH06Document26 pagesCH06Will TrầnNo ratings yet

- Inventories Reviewer - TheoriesDocument10 pagesInventories Reviewer - TheoriesArriety KimNo ratings yet

- Project On Inventory ManagementDocument65 pagesProject On Inventory ManagementAkarshit SharmaNo ratings yet

- Ipca LaboratoriesDocument22 pagesIpca LaboratoriesAbhishekAgrawalNo ratings yet

- CA&C 02 - Handout - 1 PDFDocument10 pagesCA&C 02 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Return On Equity Net Income/Shareholder's EquityDocument3 pagesReturn On Equity Net Income/Shareholder's Equitysamy7541No ratings yet

- Systems Approach To Marketing: by Lee AdlerDocument15 pagesSystems Approach To Marketing: by Lee AdlerRebeca CavalcantiNo ratings yet

- 3Document8 pages3Katrina Dela CruzNo ratings yet

- 01 Inventory Management IntroductionDocument22 pages01 Inventory Management Introductionkavish09No ratings yet

- Hype Cycle For Supply Chain Management 2010Document41 pagesHype Cycle For Supply Chain Management 2010spirit_abodeNo ratings yet

- DLP EIM Types of FormDocument5 pagesDLP EIM Types of FormJoel Magcamit CaoliNo ratings yet

- Short Problem#1: No Lost Units, Pure EUPDocument3 pagesShort Problem#1: No Lost Units, Pure EUPDerick FigueroaNo ratings yet

- Scanprint IMS enDocument8 pagesScanprint IMS enMarios DomoxoudisNo ratings yet

- ProjectDocument37 pagesProjectpriyankaNo ratings yet

- Business Research MethodologyDocument3 pagesBusiness Research Methodologyrh144798No ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- Supply Chain Management - Decision PhasesDocument2 pagesSupply Chain Management - Decision PhasesGajendra Singh RaghavNo ratings yet

- Chapter 13 ExamplesDocument24 pagesChapter 13 ExamplesUtsavNo ratings yet