Professional Documents

Culture Documents

0430BUS Econsnapshot

Uploaded by

The Dallas Morning NewsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0430BUS Econsnapshot

Uploaded by

The Dallas Morning NewsCopyright:

Available Formats

Saving for the future

By PAMELA YIP

Staff Writer pyip@dallasnews.com

LOCAL ECONOMIC SNAPSHOT | RETIREMENT

KYLE ALCOTT

Staff Artist kalcott@dallasnews.com

Workers saving for retirement brought total retirement assets up 4.9 percent in the fourth quarter of 2011, but they were unchanged for the year, according to the Investment Company Institute. Retirement savings accounted for 36 percent of all household financial assets in the U.S. in 2011, compared with 13 percent in 1975.

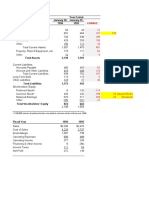

Retirement savings comparison

Assets in IRAs totaled $4.9 trillion at the end of 2011, up 4.6 percent from the end of the third quarter. Assets in defined contribution plans, such as 401(k)s, rose 4.8 percent in the fourth quarter to $4.5 trillion.

ANNUAL COMPARISONS (In trillions)

GOVERNMENT PENSION PLANS

5 4 3.8 3 1.4 1.5 1.6 1.4 1.5 2 1 0 05 06 07 08 09 05 06 07 08 09 4.3 4.5 3.6 4.1

PRIVATE PENSIONS

(defined benefit plans) 5 4 3 2 1 0 05 06 07 08 09 2.6 2.3 2.5 2.2

DEFINED CONTRIBUTION PLANS

(such as 401(k)s) 5 4 3.6 3 4.1 4.4 3.4 5 4 4 3 2 1 0 05 06 07 08 09 05 06 07 08 09

*Estimate

ANNUITIES

5 4 3 2 1 0

IRAs

4.7 4.2 3.4 3.7 4.4*

2 1 0

QUARTERLY COMPARISONS (In trillions)

ANNUITIES

5 4 3 2 1.6 1.6 1.6 1.6 1.6 1 0 Q4 Q1 Q2 Q3 Q4 2010 2011 5 4 3 2 1 0 Q4 Q1 Q2 Q3 Q4 2010 2011

GOVERNMENT PENSION PLANS

4.4 4.6 4.6 4.2 4.5

PRIVATE PENSIONS

5 4 3 2 1 0 Q4 Q1 Q2 Q3 Q4 2010 2011 2.4 2.5 2.5 2.3 2.4

DEFINED CONTRIBUTION PLANS

5 4 3 2 1 0 Q4 Q1 Q2 Q3 Q4 2010 2011 4.5 4.6 4.7 4.3 4.5 5 4 3 2 1 0

IRAs

5.1* 4.9* 4.8* 5* 4.7*

Q4 Q1 Q2 Q3 Q4 2010 2011 *Estimate

SOURCES: Investment Company Institute; Federal Reserve Board; National Association of Government Defined Contribution Administrators; American Council of Life Insurers; Internal Revenue Service

Asset control

Mutual funds manage most of the assets in defined contribution plans. Other investments consisted of company stock and guaranteed investment contracts sold by insurance companies.

(In trillions)

The top defined contribution plans in North Texas

North Texas companies are following the trend of moving toward defined contribution plans (such as 401(k)s) and away from traditional pensions. (In billions)

AT&T Exxon Mobil American Airlines GuideStone Financial Resources of the Southern Baptist Convention Southwest Airlines J.C. Penney Texas Instruments Fluor Burlington Northern Santa Fe Kimberly-Clark Tenet Healthcare Alcon Laboratories Southwest Airlines Pilots Association Energy Future Holdings Dean Foods Ericsson Comerica Texas Health Resources Baylor Health Care System 7-Eleven 3.0 2.7 2.6 2.2 2.2 2.0 1.6 1.3 0.9 0.9 0.9 0.8 0.8 0.8

SOURCE: Money Market Directory and Dimensional Fund Advisors

$22.2 19.3 10.5 7.1 4.8 3.7

MUTUAL FUNDS

3 2 1 0 Q1 Q2 Q3 2011 Q4 1.9 2 1.7 1.8

OTHER INVESTMENTS

3 2 1 0 1.2 1.2 1.2 1.2

Q1

Q2 Q3 2011

Q4

SOURCES: Investment Company Institute; Federal Reserve Board; U.S. Department of Labor

The bottom line

One of the most important trends is that over the period starting in January, 42 percent of [defined contribution] plans are looking at changing their investment lineup. Traditionally, only about one in 10 plans change their fund lineup. Folks appreciate having this special tax advantage and this special bucket or place where they can put money aside for retirement. As more and more companies in the private sector do away with traditional pension plans in favor of defined contribution plans, such as 401(k)s, workers should take advantage of education programs offered by their employers, as well as outside education, to improve their financial literacy. Pamela Yip, staff writer, The Dallas Morning News

Tim Kohn, head of Defined Contribution Services, Dimensional Fund Advisors

Sarah Holden, senior director of retirement and investor research, Investment Company Institute

You might also like

- Fast Facts Book 2011Document51 pagesFast Facts Book 2011The Partnership for a Secure Financial FutureNo ratings yet

- Government Accountability Office - Ensuring Income Throughout Retirement Requires Difficult ChoicesDocument79 pagesGovernment Accountability Office - Ensuring Income Throughout Retirement Requires Difficult ChoicesEphraim DavisNo ratings yet

- McKinsey Global Institute - Define Contributions MarketDocument37 pagesMcKinsey Global Institute - Define Contributions MarketHugh NguyenNo ratings yet

- The Process of Gathering and Analyzing Twitter Data To Predict Stock Returns EC115 EconomicsDocument16 pagesThe Process of Gathering and Analyzing Twitter Data To Predict Stock Returns EC115 EconomicspearlynpuayNo ratings yet

- Real Estate Quarterly Q1 2011Document20 pagesReal Estate Quarterly Q1 2011Pushpak Reddy GattupalliNo ratings yet

- Fast Facts: Retirement SecurityDocument2 pagesFast Facts: Retirement SecurityThe Partnership for a Secure Financial FutureNo ratings yet

- Cortex ReportDocument15 pagesCortex Reportjohnsm2010No ratings yet

- New York's Deficit Shuffle: April 2010Document23 pagesNew York's Deficit Shuffle: April 2010Casey SeilerNo ratings yet

- United States: Private Retirement Systems and SustainabilityDocument27 pagesUnited States: Private Retirement Systems and Sustainabilitykamit22No ratings yet

- RIN 1210-AB33 Page I of 10 PagesDocument10 pagesRIN 1210-AB33 Page I of 10 PagescheaussieNo ratings yet

- Home Commentary Current Events Spring 2010 SOI Bullen ReleasedDocument2 pagesHome Commentary Current Events Spring 2010 SOI Bullen ReleasedRuss WillisNo ratings yet

- The Right Mutual Funds For YouDocument2 pagesThe Right Mutual Funds For YouheinzteinNo ratings yet

- St. and Local PensionsDocument14 pagesSt. and Local PensionsJbrownie HeimesNo ratings yet

- Pitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionDocument18 pagesPitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionYA2301No ratings yet

- Accounting for Agency and Trust Funds in GovernmentDocument19 pagesAccounting for Agency and Trust Funds in Governmentmaylee0105No ratings yet

- The Impact of The Attachment of A Financial Product Adviser To A Retirement Savings Plan On The Investment Decisions of The MembersDocument34 pagesThe Impact of The Attachment of A Financial Product Adviser To A Retirement Savings Plan On The Investment Decisions of The MembersSsahil KhanNo ratings yet

- Get To Know Your Individual Account Plan (IAP) : December 2006Document4 pagesGet To Know Your Individual Account Plan (IAP) : December 2006IATSENo ratings yet

- Attacking The Fiscal Crisis - What The States Have Taught Us About The Way ForwardDocument7 pagesAttacking The Fiscal Crisis - What The States Have Taught Us About The Way ForwardDamian PanaitescuNo ratings yet

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by MelicherDocument18 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by MelicherLuisMurraymrzye100% (86)

- Sept Briefing National Institute For Retirement SecurityDocument37 pagesSept Briefing National Institute For Retirement Securitypcapineri8399No ratings yet

- Investment Plan - Orion FIDocument35 pagesInvestment Plan - Orion FIelieNo ratings yet

- Macroeconomics 12th Edition Michael Parkin Solutions Manual Full Chapter PDFDocument31 pagesMacroeconomics 12th Edition Michael Parkin Solutions Manual Full Chapter PDFJosephWebbemwiy100% (10)

- CHIP Annual Report 2011Document16 pagesCHIP Annual Report 2011State of UtahNo ratings yet

- Ontario New Democrat Fiscal FrameworkDocument16 pagesOntario New Democrat Fiscal FrameworkontarionewdemocratNo ratings yet

- Effect of Pension Funds Characteristics On Financial Performance of Pension Administrators Chapter OneDocument39 pagesEffect of Pension Funds Characteristics On Financial Performance of Pension Administrators Chapter OneUmar FarouqNo ratings yet

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- Tax Checkoff 2014Document26 pagesTax Checkoff 2014Celeste KatzNo ratings yet

- Market Commentary 1.28.2013Document3 pagesMarket Commentary 1.28.2013CLORIS4No ratings yet

- Capital Spending in Local Government: Providing Context Through The Lens of Government-Wide Financial StatementsDocument14 pagesCapital Spending in Local Government: Providing Context Through The Lens of Government-Wide Financial StatementsMahbub AlamNo ratings yet

- Iraq Construction January - 2012Document7 pagesIraq Construction January - 2012Kim HedumNo ratings yet

- Quick Start Report - 2011-12 - Final 11.5.10Document50 pagesQuick Start Report - 2011-12 - Final 11.5.10New York SenateNo ratings yet

- Aetna Inc.: (Source S&P, Vickers, Company Reports)Document10 pagesAetna Inc.: (Source S&P, Vickers, Company Reports)sinnlosNo ratings yet

- Pimco Corp. Opp Fund (Pty)Document46 pagesPimco Corp. Opp Fund (Pty)ArvinLedesmaChiongNo ratings yet

- Singapores Pension SystemDocument15 pagesSingapores Pension SystemIVAN LOZANONo ratings yet

- Constellation Energy Group Inc: FORM 425Document19 pagesConstellation Energy Group Inc: FORM 425Anonymous Feglbx5No ratings yet

- How America Saves - Vanguard Industry Report - July 2011Document92 pagesHow America Saves - Vanguard Industry Report - July 2011schultzdavidNo ratings yet

- Public Pensions: Emerging TrendsDocument2 pagesPublic Pensions: Emerging TrendsThe Council of State GovernmentsNo ratings yet

- The Canada Pension Plan Investment Board: HistoryDocument8 pagesThe Canada Pension Plan Investment Board: Historyvedant badayaNo ratings yet

- Focus On The Fisc - July 2013Document9 pagesFocus On The Fisc - July 2013RepNLandryNo ratings yet

- Alice PortafolioDocument17 pagesAlice PortafoliofannnyNo ratings yet

- The Annapolis Report: A Review of The 2012 Legislative Session and Special SessionsDocument14 pagesThe Annapolis Report: A Review of The 2012 Legislative Session and Special SessionsmarknewgentNo ratings yet

- One World - One Accounting: Devon Erickson, Adam Esplin, Laureen A. MainesDocument7 pagesOne World - One Accounting: Devon Erickson, Adam Esplin, Laureen A. MainesAdriana CalinNo ratings yet

- A Critical Assessment of Lifecycle InvestmentDocument70 pagesA Critical Assessment of Lifecycle InvestmentpropagandaentranteNo ratings yet

- India unlikely to achieve full capital account convertibility in next few yearsDocument52 pagesIndia unlikely to achieve full capital account convertibility in next few yearsHimanshu GuptaNo ratings yet

- Form 11-K: United States Securities and Exchange CommissionDocument15 pagesForm 11-K: United States Securities and Exchange CommissionSurya PermanaNo ratings yet

- 2011 Cfo Comp SurveyDocument31 pages2011 Cfo Comp SurveysinarahimiNo ratings yet

- White Paper On PensionDocument15 pagesWhite Paper On PensiontirthanpNo ratings yet

- The $21 Billion State Budget: South Carolina's Three Spending CategoriesDocument25 pagesThe $21 Billion State Budget: South Carolina's Three Spending CategoriesSteve CouncilNo ratings yet

- Thesis On Pension FundsDocument6 pagesThesis On Pension Fundsmichellealexanderminneapolis100% (2)

- Keeping The Promise: State Solutions For Government Pension ReformDocument45 pagesKeeping The Promise: State Solutions For Government Pension ReformALECNo ratings yet

- 2011 Preqin Private Equity Report Sample PagesDocument11 pages2011 Preqin Private Equity Report Sample PagesMichael GuoNo ratings yet

- Accounting Textbook Solutions - 67Document19 pagesAccounting Textbook Solutions - 67acc-expertNo ratings yet

- FederalFunds2010 2012Document1,166 pagesFederalFunds2010 2012Brett CooperNo ratings yet

- Domestic Capital To Target Office AssetsDocument2 pagesDomestic Capital To Target Office AssetsAravind SankaranNo ratings yet

- Investment Outlook and Asset Allocation in US Pension FundsDocument4 pagesInvestment Outlook and Asset Allocation in US Pension FundsBOHR International Journal of Financial market and Corporate Finance (BIJFMCF)No ratings yet

- Private EquityDocument13 pagesPrivate EquityektarawalNo ratings yet

- Kelcy Warren v. Beto O'RourkeDocument16 pagesKelcy Warren v. Beto O'RourkeThe Dallas Morning News100% (1)

- NorthDallasTrouncesNorthSideDocument2 pagesNorthDallasTrouncesNorthSideThe Dallas Morning NewsNo ratings yet

- Robb Elementary School Attack Response Assessment and RecommendationsDocument26 pagesRobb Elementary School Attack Response Assessment and RecommendationsThe Dallas Morning NewsNo ratings yet

- 001 Us Complaint Texas 0Document45 pages001 Us Complaint Texas 0The Dallas Morning NewsNo ratings yet

- 2021 State Track and Field ScheduleDocument6 pages2021 State Track and Field ScheduleThe Dallas Morning NewsNo ratings yet

- BulldogsMaulWolvesDocument2 pagesBulldogsMaulWolvesThe Dallas Morning NewsNo ratings yet

- Clips North DallasDocument1 pageClips North DallasThe Dallas Morning NewsNo ratings yet

- CollideTonightDocument1 pageCollideTonightThe Dallas Morning NewsNo ratings yet

- 2021 State 7on7 PoolsDocument2 pages2021 State 7on7 PoolsThe Dallas Morning NewsNo ratings yet

- BulldogsDrillHardDocument1 pageBulldogsDrillHardThe Dallas Morning NewsNo ratings yet

- Supreme Court Ruling On NCAA AthleticsDocument45 pagesSupreme Court Ruling On NCAA AthleticsThe Dallas Morning NewsNo ratings yet

- GoThroughDrillsDocument1 pageGoThroughDrillsThe Dallas Morning NewsNo ratings yet

- Letter To DNIRatcliffe Election BriefingsDocument2 pagesLetter To DNIRatcliffe Election BriefingsThe Dallas Morning NewsNo ratings yet

- SchoolboySlantDocument1 pageSchoolboySlantThe Dallas Morning NewsNo ratings yet

- BulldogsRiskPerfectRecordDocument1 pageBulldogsRiskPerfectRecordThe Dallas Morning NewsNo ratings yet

- BidsDocument1 pageBidsThe Dallas Morning NewsNo ratings yet

- LubbockSwampsNorthDallasDocument2 pagesLubbockSwampsNorthDallasThe Dallas Morning NewsNo ratings yet

- FormidableFoesDocument2 pagesFormidableFoesThe Dallas Morning NewsNo ratings yet

- FaceChallengeDocument1 pageFaceChallengeThe Dallas Morning NewsNo ratings yet

- BulldogsConfidentDocument1 pageBulldogsConfidentThe Dallas Morning NewsNo ratings yet

- NewFacesDocument1 pageNewFacesThe Dallas Morning NewsNo ratings yet

- Independent Wrestling Expo COVID-19 PlanDocument2 pagesIndependent Wrestling Expo COVID-19 PlanThe Dallas Morning NewsNo ratings yet

- The Dallas Morning News' Texas Golf Panel Ranks Texas' Best and Most Beautiful Golf Holes For 2020Document2 pagesThe Dallas Morning News' Texas Golf Panel Ranks Texas' Best and Most Beautiful Golf Holes For 2020The Dallas Morning NewsNo ratings yet

- UIL's Updated Strength & Conditioning Guidelines (7/7/2020)Document7 pagesUIL's Updated Strength & Conditioning Guidelines (7/7/2020)The Dallas Morning NewsNo ratings yet

- Fighting Words Promotions COVID-19 PlanDocument2 pagesFighting Words Promotions COVID-19 PlanThe Dallas Morning NewsNo ratings yet

- The Top 25 Nine-Hole Golf Courses in Texas, Ranked (2020)Document2 pagesThe Top 25 Nine-Hole Golf Courses in Texas, Ranked (2020)The Dallas Morning NewsNo ratings yet

- The Top 25 Economy Golf Courses in Texas That Cost $54 and Under (2020)Document3 pagesThe Top 25 Economy Golf Courses in Texas That Cost $54 and Under (2020)The Dallas Morning NewsNo ratings yet

- 'Imaginary My - Grations' by Richard BlancoDocument2 pages'Imaginary My - Grations' by Richard BlancoThe Dallas Morning NewsNo ratings yet

- The Top 25 Mid-Priced Golf Courses in Texas That Cost $55-$79 (2020)Document3 pagesThe Top 25 Mid-Priced Golf Courses in Texas That Cost $55-$79 (2020)The Dallas Morning NewsNo ratings yet

- The Top 25 High-Priced Golf Courses in Texas That Cost $80 and Above (2020)Document3 pagesThe Top 25 High-Priced Golf Courses in Texas That Cost $80 and Above (2020)The Dallas Morning NewsNo ratings yet

- Calculation: Net Interest Margin (NIM) Is A Measure of The Difference BetweenDocument3 pagesCalculation: Net Interest Margin (NIM) Is A Measure of The Difference Betweentopeq100% (2)

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- 2307Document3 pages2307JUCONS ConstructionNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSanjeev SharmaNo ratings yet

- Deloitte TestDocument19 pagesDeloitte TestTrà HươngNo ratings yet

- Real Estate InvestingDocument32 pagesReal Estate InvestingRudra SinghNo ratings yet

- Comprehensive Income Statement ExampleDocument1 pageComprehensive Income Statement ExampleAdil AliNo ratings yet

- Multiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)Document4 pagesMultiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)april bentadanNo ratings yet

- Philippine Tax Principles SummaryDocument12 pagesPhilippine Tax Principles SummaryRaLph Lopez BAyran100% (2)

- Audit Engagement LetterDocument6 pagesAudit Engagement LetterKaren Ailene Posada BenavidezNo ratings yet

- Annual Report 2022Document162 pagesAnnual Report 2022Kalaiselvi ManimaranNo ratings yet

- Robert Kiyosaki - Cashflow Management SecretsDocument23 pagesRobert Kiyosaki - Cashflow Management SecretsPrekash Menon100% (6)

- Hots Business StudiesDocument37 pagesHots Business StudiesDaniel RobertNo ratings yet

- Dell Case AnswersDocument13 pagesDell Case AnswersMine SayracNo ratings yet

- Government CompanyDocument4 pagesGovernment CompanyCA OFFICENo ratings yet

- Investment Appraisal TechniquesDocument4 pagesInvestment Appraisal TechniquesSarfraz KhalilNo ratings yet

- Foundation Accounts Suggested Jan21Document22 pagesFoundation Accounts Suggested Jan21Himanshu RayNo ratings yet

- Finance Functions: Investment, Financing, Dividend DecisionsDocument2 pagesFinance Functions: Investment, Financing, Dividend DecisionsMaynardMiranoNo ratings yet

- Calculating partners' capital balances and weighted average capital in a partnershipDocument2 pagesCalculating partners' capital balances and weighted average capital in a partnershipRhoiz100% (2)

- Business Plan Implementation ReportDocument52 pagesBusiness Plan Implementation ReportClaudine Cumaldi vOffice Philippines100% (2)

- Pearsons Federal Taxation 2017 Comprehensive 30Th Full ChapterDocument41 pagesPearsons Federal Taxation 2017 Comprehensive 30Th Full Chaptermargret.brennan669100% (27)

- Stocks and Their ValuationDocument48 pagesStocks and Their ValuationHafiz Abdullah Indhar100% (1)

- The Great Depression EssayDocument7 pagesThe Great Depression Essayapi-463452419No ratings yet

- CA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014Document16 pagesCA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014anupNo ratings yet

- Taxa 1Document17 pagesTaxa 1Cheenee Nuestro SantiagoNo ratings yet

- Chapter 13 Postponement BenettonDocument7 pagesChapter 13 Postponement BenettonAbhishek PadhyeNo ratings yet

- Analysis of NPAs in Public and Private BanksDocument56 pagesAnalysis of NPAs in Public and Private BanksKhalid HussainNo ratings yet

- Principles of Accounting and Financial StatementsDocument9 pagesPrinciples of Accounting and Financial Statementsahmed100% (1)

- Condensed Interim Financial Information For The Quarter/Six Months Ended December 31, 2007Document26 pagesCondensed Interim Financial Information For The Quarter/Six Months Ended December 31, 2007ajgondal1191366No ratings yet

- RA Manual 2015Document176 pagesRA Manual 2015anon_177396550No ratings yet