Professional Documents

Culture Documents

Value Added Taxes

Uploaded by

Surendra Singh BhatiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Added Taxes

Uploaded by

Surendra Singh BhatiCopyright:

Available Formats

Value Added Taxes (VAT) in India

VAT will replace the present sales tax in India. Under the current single-point system of tax levy, the manufacturer or importer of goods into a State is liable to sales tax. There is no sales tax on the further distribution channel. VAT, in simple terms, is a multi-point levy on each of the entities in the supply chain with the facility of set-off of input tax - that is, the tax paid at the stage of purchase of goods by a trader and on purchase of raw materials by a manufacturer. Only the value addition in the hands of each of the entities is subject to tax. For instance, if a dealer purchases goods for Rs 100 from another dealer and a tax of Rs 10 has been charged in the bill, and he sells the goods for Rs 120 on which the dealer will charge a tax of Rs 12 at 10 per cent, the tax payable by the dealer will be only Rs 2, being the difference between the tax collected of Rs 12 and tax already paid on purchases of Rs 10. Thus, the dealer has paid tax at 10 per cent on Rs 20 being the value addition in his hands. Purchase price - Rs 100 Tax paid on purchase - Rs 10 (input tax) Sale price - Rs 120 Tax payable on sale price - Rs 12 (output tax) Input tax credit - Rs 10 VAT payable - Rs 2 VAT levy will be administered by the Value Added Tax Act and the rules made there-under. VAT can be computed by using either of the three methods detailed below The Subtraction method:- The tax rate is applied to the difference between the value of output and the cost of input. The Addition method: The value added is computed by adding all the payments that is payable to the factors of production (viz., wages, salaries, interest payments etc). Tax credit method: This entails set-off of the tax paid on inputs from tax collected on sales. India opted for tax credit method, which is similar to CENVAT. Note : Also look for MODVAT States such as Andhrapradesh, Kerala, Maharashtra, Madhyapradesh, Delhi and Haryana have experimented with VAT albeit in a limited manner, covering only limited goods. The experiments never had the full-fledged features of VAT and were only concoctions. These states have even called off their experiments owing to different reasons. If one analyses why VAT or its variant failed in Maharashtra, which was the only state to come closer to a true VAT regime, the following reasons emerge: 1. Dual methodologies of computation of VAT credit Error!, one for the Manufacturing stage

and the other for the trading stage, thus breaking the audit trail. It may be noted that one of the advantages of VAT system, as we would be dealing later on, is the audit trail that is created in the VAT chain. 2. Presence of a large number of tax deferral and holiday schemes, which resulted in a narrow base. It may again be noted that under VAT, which is multi-point, the tax rates have to be reasonably low, and lower tax rates presupposes that the tax base is wide. These two features were not present in the Maharashtra tax regime. 3. Low level of awareness among traders, and even administrators, giving rise to fears and apprehensions. Owing to this, there was considerable consternation among the trade, which gave rise to open revolt against the system. 4. Partial implementation of the ideal VAT with the existing system coexisting even under this regime. 5. Increased burden on retailers of Bookkeeping and compliance. 6. Multiplicity of rates of tax under the VAT regime. 7. Drop in revenue for the State Government, though there are no studies attributing such reduction to the system of taxation. Thus States had indeed tried some variations of VAT, but eventually gave up due to a variety of reasons. Value Added Tax (VAT) is nothing but a general consumption tax that is assessed on the value added to goods & services. It is the indirect tax on the consumption of the goods, paid by its original producers upon the change in goods or upon the transfer of the goods to its ultimate consumers. It is based on the value of the goods, added by the transferor. It is the tax in relation to the difference of the value added by the transferor and not just a profit. All over the world, VAT is payable on the goods and services as they form a part of national GDP. More than130 countries worldwide have introduced VAT over the past 3 decades; India being amongst the last few to introduce it. It means every seller of goods and service providers charges the tax after availing the input tax credit. It is the form of collecting sales tax under which tax is collected in each stage on the value added of the goods. In practice, the dealer charges the tax on the full price of the goods, sold to the consumer and at every end of the tax period reduces the tax collected on sale and tax charged to him by the dealers from whom he purchased the goods and deposits such amount of tax in government treasury.

VAT is a multi-stage tax, levied only on value that is added at each stage in the cycle of production of goods and services with the provision of a set-off for the tax paid at earlier stages in the cycle/chain. The aim is to avoid 'cascading', which can have a snowballing effect on the prices. It is assumed that because of cross-checking in a multi-staged tax; tax evasion would be checked, hence resulting in higher revenues to the government. Importance of VAT in India India, particularly being a trading community, has always believed in accepting and adopting loopholes in any system administered by State or Centre. If a well-administered system comes in, it will not only close options for traders and businessmen to evade paying their taxes, but also make sure that they'll be compelled to keep proper records of sales and purchases. Under the VAT system, no exemptions are given and a tax will be levied at every stage of manufacture of a product. At every stage of value-addition, the tax that is levied on the inputs can be claimed back from tax authorities. At a macro level, two issues make the introduction of VAT critical for India Industry watchers believe that the VAT system, if enforced properly, will form part of the fiscal consolidation strategy for the country. It could, in fact, help address issues like fiscal deficit problem. Also the revenues estimated to be collected can actually mean lowering of fiscal deficit burden for the government. International Monetary Fund (IMF), in the semi-annual World Economic Outlook expressed its concern for India's large fiscal deficit - at 10 per cent of GDP. Moreover any globally accepted tax administrative system would only help India integrate better in the World Trade Organization regime. Advantages of VAT 1. Coverage If the tax is considered on a retail level, it offers all the economic advantages of a tax of the entire retail price within its scope. The direct payment of tax spreads out over a large number of firms instead of being concentrated only on particular groups, such as wholesalers & retailers. 2. Revenue Security - Under VAT only buyers at the final stage have an interest in undervaluing their purchases, as the deduction system ensures that buyers at earlier stages are refunded the taxes on their purchases. Therefore, tax losses due to undervaluation will be limited to the value added at the last stage. Secondly, under VAT, if the payment of tax is avoided at one stage nothing will be lost if it is picked up at later stage. Even if it is not picked up later, the government will at least have collected the VAT paid at previous stages. Where as if evasion takes place at the final/last stage the state will lose only tax on the value added at that particular point.

3. Selectivity - VAT is selectively applied to specific goods & business entities. In addition, VAT does not burden capital goods because of the consumption-type. VAT gives full credit for tax included on purchases of capital goods. 4. Co-ordination of VAT with direct taxation - Most taxpayers cheat on sales not to evade VAT but to evade their personal and corporate income taxes. Operation of VAT resembles that of the income tax and an effective VAT greatly helps in income tax administration and revenue collection. To know more about advantages of VAT click here: Advantages of VAT Disadvantages of VAT 1. 2. 3. 4. VAT is regressive VAT is difficult to operate from position of both administration and business VAT is inflationary VAT favors capital intensive firms

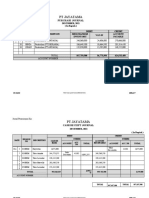

Items covered under VAT All business transactions that are carried on within a State by individuals/partnerships/ companies etc. will be covered under VAT. More than 550 items are covered under the new Indian VAT regime out of which 46 natural & unprocessed local products will be exempt from VAT Nearly 270 items including drugs and medicines, all industrial and agricultural inputs, capital goods as well as declared goods would attract 4 % VAT in India. The remaining items would attract 12.5 % VAT. Precious metals such as gold and bullion will be taxed at 1%. Petrol and diesel are kept out of the VAT regime in India. Tax implication under Value Added Tax Act Selling Price (Excluding Tax) 100

Seller

Buyer

Tax Rate

Invoice value (InclTax)

Tax Payable

Tax Credit

Net TaxOutflow

4% CST 12.5% VAT 12.5% VAT

104

4.00

114

128.25

14.25

0*

14.25

124

139.50

15.50

14.25

1.25

Consumer

134

12.5% VAT

150.75

16.75

15.50 VAT CST

1.25

Total to Govt.

16.75 4.00

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Royal Bank of ScotlandDocument12 pagesRoyal Bank of ScotlandSurendra Singh BhatiNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Toyota FortunerDocument10 pagesToyota FortunerSurendra Singh BhatiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Tata & CorusDocument10 pagesTata & CorusSurendra Singh BhatiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Samsung ElectronicsDocument29 pagesSamsung ElectronicsSurendra Singh BhatiNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Liberty - March 7 2022Document1 pageLiberty - March 7 2022Lisle Daverin BlythNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- G.R. No. L-26911, L-26924 - Atlas Consolidated Mining & Development Corp. v. Commissioner of Internal RevenueDocument6 pagesG.R. No. L-26911, L-26924 - Atlas Consolidated Mining & Development Corp. v. Commissioner of Internal RevenueMegan AglauaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAyanna Sellers100% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 77Document2 pages77Arian AmuraoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- En 05 10031 2017 PDFDocument1 pageEn 05 10031 2017 PDFmichael caseyNo ratings yet

- Income Tax - RulesDocument18 pagesIncome Tax - RulesMathew YoyakkyNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Jawaban Siklus Manual Ukk 2022Document7 pagesJawaban Siklus Manual Ukk 2022irma nurmayantiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Nepal Open University Faculty of Management and Law Office of The Dean Mid Term Exam-2020 A.DDocument2 pagesNepal Open University Faculty of Management and Law Office of The Dean Mid Term Exam-2020 A.DDiksha PaudelNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Backup Withholding - What Is It and How Can I Obtain A RefundDocument35 pagesBackup Withholding - What Is It and How Can I Obtain A RefundAyodeji Badaki100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Source of Regular Input VATDocument1 pageSource of Regular Input VATMarie Tes LocsinNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Jurists Bar Review Center™: Tax 1 Pre-Week Notes Taxation 1Document2 pagesJurists Bar Review Center™: Tax 1 Pre-Week Notes Taxation 1nomercykillingNo ratings yet

- InvoiceDocument1 pageInvoiceAyushman Sagar JhaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- CGST CircularsDocument18 pagesCGST Circularsdinesh kasnNo ratings yet

- Capital Gains and LossesDocument7 pagesCapital Gains and LossesElaineJrV-IgotNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Excise TaxDocument50 pagesExcise TaxQuinnee VallejosNo ratings yet

- IRC Codes and RegulationsDocument34 pagesIRC Codes and RegulationsWilly BeaminNo ratings yet

- Print A XXXXDocument44 pagesPrint A XXXXSassy BitchNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 4-Depreciation and Tax IncomeDocument39 pagesChapter 4-Depreciation and Tax IncomeSaeed KhawamNo ratings yet

- Payment of Bonus Rules (Pt.-4)Document9 pagesPayment of Bonus Rules (Pt.-4)Anonymous QyYvWj1No ratings yet

- Creba v. Executive Secretary RomuloDocument1 pageCreba v. Executive Secretary RomuloJerry SerapionNo ratings yet

- Invoice 40Document1 pageInvoice 40itsyour vinESNo ratings yet

- Tax Invoice: Bharti Motors 999 5-Jul-2021Document1 pageTax Invoice: Bharti Motors 999 5-Jul-2021Rakesh guptaNo ratings yet

- RIT IndividualsDocument1 pageRIT IndividualsMary Jane MaralitNo ratings yet

- 2010 Commit AlphaDocument251 pages2010 Commit AlphaJoe CoffeyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- BIR Ruling (DA-005-07) (Travel Agencies) PDFDocument4 pagesBIR Ruling (DA-005-07) (Travel Agencies) PDFAl Marvin0% (1)

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMithlesh SharmaNo ratings yet

- The University of Lahore: Regular Fee VoucherDocument1 pageThe University of Lahore: Regular Fee VoucherWaseem Ajmal50% (2)

- Jurisdiction DetailsDocument229 pagesJurisdiction DetailsHarshvvardhan DagaNo ratings yet

- Absolute Assignment FormDocument5 pagesAbsolute Assignment FormEjen Faiz HafizNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)