Professional Documents

Culture Documents

Corporate R&D and Productivity

Uploaded by

Rosa SemedoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate R&D and Productivity

Uploaded by

Rosa SemedoCopyright:

Available Formats

1

IPTS-2009-J03-16-NC

Corporate R&D and productivity:

Econometric tests based on microdata"

Final Report

IN

2

INDEX

Executive non-technical summary p. 7

1. Introduction: background, hypotheses and objectives of the study p. 15

2. Theoretical background and previous empirical evidence p. 18

2.1 The transatlantic productivity gap p. 18

2.2 The link between R&D and productivity at the firm and sectoral level p. 24

2.3 The role of embodied technological change and the peculiarities of the

medium and low-tech sectors p. 27

2.4 The business cycle and the regional peculiarities p. 30

3. Data and methodology p. 33

3.1 The data source p. 33

3.2 The construction of the dataset p. 34

3.3 The econometric specification and descriptive statistics p. 42

4. Econometric analysis p. 49

4.1 Overall results; EU vs. US p. 49

4.2 A sectoral breakdown p. 51

4.3 The US/EU comparison: crossing the geographical and the sectoral

dimensions p. 53

4.4 A regional breakdown p. 57

4.4.1 Macro-regions p. 58

4.4.2 R&D-intensive regions vs. non R&D-intensive ones p. 62

4.5 The business cycle p. 68

5. Conclusions and policy implications p. 72

References p. 79

Appendix p. 89

3

LIST OF FIGURES AND TABLES

List of figures

Fig. 1: Real GDP growth in the US and the EU15: 1990-2008 p. 19

Fig. 2: Labour productivity growth in the US and the EU15: 1990-2008 p. 20

Fig. 3: TFP growth in the US and the EU15: 1990-2004 p. 21

Fig. 4: GERD/GDP in the US and the EU15: 1990-2007 p. 22

Fig. 5: Private R&D (BERD)/GDP in the US and the EU15: 1990-2007 p. 23

4

List of tables

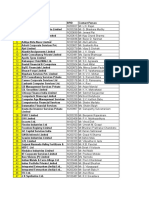

Tab. 1: Distribution of firms and observations across countries in the final

version of the dataset p. 41

Tab. 2: Correlation table: correlation coefficients p. 43

Tab. 3: VA/E (Value Added/Employees) p. 45

Tab. 4: K/E (R&D Stock/Employees) p. 46

Tab. 5: C/E (Physical Capital Stock/Employees) p. 47

Tab. 6: E (Employees) p. 48

Tab. 7: Whole sample, US and EU p. 50

Tab. 8: Sectoral decomposition: Manufacturing (High-tech + Other) and

Service sectors p. 51

Tab. 9: Sectoral decomposition: High-tech and Other manufacturing sectors p. 53

Tab. 10: US versus EU: Manufacturing sectors p. 54

Tab. 11: US versus EU: Service sectors p. 54

Tab. 12: US versus EU: High-tech manufacturing sectors p. 56

Tab. 13: US versus EU: Other manufacturing sectors p. 56

Tab. 14: European macroareas: North (Denmark, Finland, Sweden) + UK,

Other EU countries, Other EU countries without South p. 58

Tab. 15: European macroareas: Manufacturing sectors p. 60

Tab. 16: European macroareas: Service sectors p. 60

Tab. 17: European macroareas: High-tech manufacturing sectors p. 61

Tab. 18 : European macroareas: Other manufacturing sectors p. 61

Tab. 19: European NUTS R&D intensities (BERD/GDP) p. 63

Tab. 20: European NUTS: Innovative NUTS versus Weakly innovative NUTS

(Regional BERD/GDP >= 1.8% is the threshold) p. 65

Tab. 21: European NUTS: Innovative NUTS versus Weakly innovative NUTS

in High-tech manufacturing sectors p. 66

Tab. 22: European NUTS: Innovative NUTS versus Weakly innovative NUTS in

Other manufacturing sectors p. 66

Tab. 23: European NUTS: Innovative NUTS versus Weakly innovative NUTS in

Manufacturing sectors p. 67

Tab. 24: European NUTS: Innovative NUTS vs. Weakly innovative NUTS in

Service sectors p. 67

5

Tab. 25: Whole sample, Recessions and Expansions p. 69

Tab. 26: US versus EU: Recessions p. 69

Tab. 27: US versus EU: Expansions p. 70

6

Appendix

Tab. A7: Whole sample, US and EU (complete) p. 90

Tab. A8: Sectoral decomposition: Manufacturing (High-tech + Other) and

Service sectors (complete) p. 91

Tab. A9: Sectoral decomposition: High-tech and Other manufacturing

sectors (complete) p. 92

Tab. A10: US versus EU: Manufacturing sectors (complete) p. 93

Tab. A11: US versus EU: Service sectors (complete) p. 94

Tab. A12: US versus EU: High-tech manufacturing sectors (complete) p. 95

Tab. A13: US versus EU: Other manufacturing sectors (complete) p. 96

Tab. A14: European macroareas: North (Denmark, Finland, Sweden) + UK,

Other EU countries, Other EU countries without South (complete) p. 97

Tab. A15: European macroareas: Manufacturing sectors (complete) p. 98

Tab. A16: European macroareas: Service sectors (complete) p. 99

Tab. A17: European macroareas: High-tech manufacturing sectors (complete) p. 100

Tab. A18 : European macroareas: Other manufacturing sectors (complete) p. 101

Tab. A20: European NUTS: Innovative NUTS versus Weakly innovative NUTS

(Regional BERD/GDP >= 1.8% is the threshold) (complete) p. 102

Tab. A21: European NUTS: Innovative NUTS versus Weakly innovative NUTS

in High-tech manufacturing sectors (complete) p. 103

Tab. A22: European NUTS: Innovative NUTS versus Weakly innovative NUTS

in Other manufacturing sectors (complete) p. 104

Tab. A23: European NUTS: Innovative NUTS versus Weakly innovative NUTS in

Manufacturing sectors (complete) p. 105

Tab. A24: European NUTS: Innovative NUTS vs. Weakly innovative NUTS in

Service sectors (complete) p. 106

Tab. A25: Whole sample, Recessions and Expansions (complete) p. 107

Tab. A26: US versus EU: Recessions (complete) p. 108

Tab. A27: US versus EU: Expansions (complete) p. 109

7

Executive non-technical summary

8

Introduction

This summary presents the findings and conclusions of the project Corporate R&D and

productivity: Econometric tests based on microdata. The main project objective is understanding

the link between R&D and firms performance, taking into account possible implications in terms

of competitiveness and economic growth, and therefore, for European policy making.

With the exclusion of the short-term turbulence associated with the current recession,

starting from the early '90s, a persistent divide both in terms of economic growth, labour

productivity growth and total factor productivity growth can be found between the US and the EU.

The literature converges in pointing out the important role that R&D and innovation have in

explaining productivity differences within the industrialized countries. Indeed, the role of corporate

R&D has been recognized as an engine for productivity growth at the macro and microeconomic

level.

However, although the underinvestment in R&D plays a crucial role in the interpretation of

the transatlantic divide in terms of productivity performance and economic growth, the overall

European productivity delay might also be explained by a lower capacity by European firms to

translate R&D investment into productivity gains.

The report intends to analyze why European firms productivity reveals to be lower

comparing with their US counterparts. The project jointly investigates the two aspects that can

originate this gap: the lower level of public and corporate investment in Europe and the lower

capacity to translate R&D investment into productivity gains.

A second set of hypotheses of this work are related to sectoral comparisons and structural

differences. Following this approach, the comparison between the role of R&D and physical capital

in fostering productivity in high-tech and non-high-tech sectors is explored, as well as the

comparison among manufacturing and services.

Another set of hypotheses are regarding the regional disparities in the EU; in this regard, the

potential differences in the R&D/productivity link across EU regions are explored in detail.

Hence, the aim of this report is to investigate the link between R&D and labour productivity,

taking into account the time, regional and sectoral dimensions of the phenomenon and the

9

interactions of R&D with other sources of innovation such as the embodied technological change

incorporated in physical capital.

The empirical analyses conducted in this report are based on a longitudinal unbalanced panel

of microdata extracted from a variety of sources, including companies annual reports. The sample

is constructed by companies that account R&D expenditures belonging to US and EU 27. The final

panel comprises 1,809 companies for the period 1990-2008. We used labour productivity (value

added over total employment) as dependent variable, while our pivotal impact variables are the

R&D stock per employee and the physical capital stock per employee.

Key Findings

The results of the project were obtained through an econometric analysis using panel

methodologies, taking into account the sectoral, country and time dimensions of the available

microdata. In particular, the following research issues were investigated.

1) To see whether significant differences emerge in the link between R&D and productivity

between the US and the EU, in order to shed some light on the interpretation of the transatlantic

productivity gap (Section 4.1).

Consistently with the previous literature, we found robust evidence of a positive and significant

impact of R&D on productivity.

However, although uniformly positive and statistically significant, the R&D impacts for the US

firms turn out to be consistently larger than the corresponding impacts for the European firms

(about 60% of their US counterparts). We interpreted these unambiguous results as a clear evidence

of the better ability of US firms in translating R&D investments into productivity gains and as a

signal of a gap of efficiency that European firms and European policy have to deal with.

2) To see whether further support can be found to the hypothesis that R&D should be clearly

and significantly linked to productivity in the high-tech sectors, while a weaker impact should

emerge in the other sectors of the economy (Section 4.2).

This hypothesis was also confirmed by the microeconometric estimates: the R&D impacts related to

the high-tech manufacturing sectors always turned out to be larger than the corresponding ones for

10

the other manufacturing sectors. Hence, high-tech sectors not only invest more in R&D and are

characterised by a higher productivity performance, but also achieve more in terms of productivity

gains from their own R&D activities.

3) To see whether physical capital emerges as an important second driver of productivity

gains, so confirming the hypothesis that embodied technological change is a crucial determinant

of productivity evolution. This relationship is expected to be particularly strong in the low-tech

sectors, where embodied technological change might be expected the main source of productivity

gains.

Overall, we found consistently with previous studies - a positive and significant impact of

physical capital over labour productivity.

Interestingly enough, the US revealed an advantage similar to the one emerged for the intangible

R&D investments; thus, US firms resulted more efficient in getting productivity gains both from the

R&D and the physical capital investments.

4) To see to what extent the transatlantic differences may be related to the different sectoral

structures and to the peculiar sectoral R&D/productivity relationships detectable in the US and in

the EU.

We differentiated the US/EU comparative empirical exercise by manufacturing vs service sectors: it

came out that both US manufacturing and US service firms were more efficient in translating their

investments (both in R&D and in physical capital) into productivity increases. In addition, the US

efficiency advantage in R&D activities is obvious both in the high-tech manufacturing sectors and

in the rest of the manufacturing sectors. On the whole, US firms are leading in terms of R&D

efficiency regardless of the sectors. Hence, the transatlantic productivity divide can be explained

not only by a lower level of corporate R&D investment, but also by a lower capacity to translate

R&D into productivity gains, and this seems to be obvious both within manufacturing (both high-

and medium/low-tech sectors) and within services.

Finally, productivity growth in the European non-high-tech firms is still heavily dependent on the

investment in physical capital (embodied technological change).

5) To see whether (and how much) the intensity of the R&D/productivity link is affected by

the sectoral composition and the institutional context characterising the different European

countries and regions.

11

On the whole, the EU economy appeared to be divided into two different macro-areas. On the one

hand, there is the Nordic and British world where R&D and productivity are strongly linked, with

exceptionally good results with regard to the high-tech manufacturing sectors. On the other hand,

there is the rest of Europe exhibiting quite lower R&D/productivity impacts. This is particularly

important in terms of European economic and innovation policy, since the European productivity

gains related to R&D activities seem to be largely driven by what is going to happen in the Nordic

countries and in the UK, with the rest of Europe lagging behind, especially with regard to the role of

the high-tech manufacturing sectors.

Turning the attention to the regional level, we grouped together the European regions into two

groups: the innovative regions and the weakly innovative ones, according to their R&D/GDP ratio.

As far as empirical results are concerned, a general conclusion was that those regions that invest

more in R&D are also characterised by a better ability to translate the R&D investment into an

increase in productivity. In particular, the strongest R&D/productivity links were displayed by the

firms belonging to the high-tech sectors and located in the most innovative regions. Symmetrically,

productivity growth in medium and low-tech sectors and in the less innovative regions was found

still heavily dependent on investment in physical capital (embodied technological change), with

corporate R&D playing a secondary role.

6) To see whether the coefficients linking R&D and productivity are stable over time or turn

out to be affected by the business cycle.

On the whole, the analysis of the business cycle revealed that the overall differences in the impacts

along the opposite phases of the cycle were not so significant, with a weak evidence of a larger

productivity impact of both R&D and capital during the recessionary periods. However - with

regard to the US/EU comparison the European gap in terms of lower productivity returns from

both R&D investment and capital formation was fully confirmed and found to be independent of the

business cycle.

12

Conclusions and policy implications

From a general policy point of view, European economies - compared with the US economy

- not only appear to invest less in R&D, but also get less returns from their R&D investment in

terms of productivity gains.

In terms of European industrial policy, high-tech manufacturing sectors appear to enjoy

more benefits in terms of productivity coming out from their company investments on R&D.

In terms of European regional policy, the particular nature of the relationship between R&D

and capital formation on the one hand and productivity evolution on the other hand might heavily

be affected by the industrial structure which characterises a single region.

On the basis of the reports results discussed above, , we can conclude that - at least in

Europe the R&D investment is strongly characterised by increasing returns in terms of its

productivity impact. In fact, this impact is higher in: 1) the high-tech manufacturing sectors; 2) in

the Nordic countries and in the UK; 3) in the most innovative European regions; that is: where more

is invested in R&D, more is achieved in terms of productivity gains. This outcome implies

important policy implications.

Firstly, the obtained results show that the US economy is uniformly more efficient in getting

productivity advantages from investments in R&D activities; while this is obvious for the whole

economy, the efficiency gap is confirmed separately in services and manufacturing and within

manufacturing both in the high-tech sectors and in the other industrial sectors. Hence, the

transatlantic divide is not only a matter either of a lower R&D investment in Europe or of an

European industrial structure specialised in middle and low-tech sectors. With the only exception of

UK and the Nordic Countries, European firms are structurally less able to translate R&D

expenditures into productivity gains. This conclusion has a first important policy implication: just

increasing R&D is a necessary but not sufficient policy if the overall increase in productivity is the

target.

Secondly, this study clearly shows that higher productivity gains from R&D investments can

be achieved in the high-tech manufacturing sectors. Here a second policy implication emerges: the

allocation of R&D efforts is as important as an increase in R&D and high-tech sectors should be

targeted by national and European R&D policies. Indeed, the results coming out from this report

offer a second reason to favour European high-tech sectors: in fact, they not only invest more in

13

R&D, but in these sectors corporate R&D efforts are more effective in achieving productivity gains.

In other words, the findings of this research support a targeted research policy rather than an erga

omnes (horizontal) type of public intervention.

Thirdly, this study shows that R&D investment is not the sole source of productivity gains;

technological change embodied in capital formation is of comparable importance. Also with regard

to the relationship between physical capital and productivity, the US economy exhibits an

advantage, similar to the one detected for the R&D activities. Finally, embodied technological

change appears to be crucial within European non-high-tech firms; hence, an European innovation

policy aiming to increase productivity in the medium/low-tech sectors should support overall capital

formation.

Fourthly, the European aggregate seems to be divided into two different worlds: on the one

hand, the UK and the Nordic countries which exhibit an R&D/productivity pattern similar to the US

one, and on the other hand the rest of the Continent lagging behind. This divide is also obvious

looking at the regional level, where the most R&D-based regions also show the better results in

terms of R&D/productivity elasticities. Overall, Europe is lagging behind the US and within

Europe the R&D/productivity link is clearly characterised by increasing returns both in terms of

countries, regions and sectors: where more is invested in R&D, more is achieved in terms of

productivity gains. An European regional policy targeted to fill the transatlantic productivity gap

should carefully take into account the presence of this strong heterogeneity across European

regions.

14

Corporate R&D and productivity:

Econometric tests based on microdata

15

1. Introduction: background, hypotheses and

objectives of the study

The understanding of the link between R&D, firms performance and competitiveness is one

of the major interests for European policy makers (see European Commission, 2002 and 2008).

A first hypothesis of this study is that the lower European economic performance in

comparison with the US can be explained not only by a lower level of public and corporate R&D

investment, but also by a lower capacity to translate R&D investment into productivity gains, which

in turn foster competitiveness and economic growth. A second hypothesis of this work is that R&D

may be crucial in fostering productivity in the high-tech sectors, while being less important in the

rest of the economy where alternative sources of productivity growth such as embodied

technological change may play a dominant role. The final hypothesis is that the relationship

between R&D and productivity may exhibit important differences across EU countries and regions

and may vary along the business cycle.

If these hypotheses were supported, together with macroeconomic policies based on

aggregate R&D targets, specific European industrial and innovation policies should be designed for

different microeconomic environments - according to the different industrial sectors and the

different national and regional contexts - in order to enforce the link between technological inputs

and productivity gains.

Hence, the aim of this report is to better investigate the link between R&D and labour

productivity, taking into account the time, regional and sectoral dimensions of the phenomenon and

the interactions of R&D with other sources of innovation such as the embodied technological

change incorporated in physical capital (see next section for a theoretical background).

In particular, the objectives of the project can be articulated as follows.

a. Conceptualising - building on the state of the art - the nature of the relationships

between R&D and embodied technological change on the one hand and labour productivity on the

other hand, at the national, sectoral and particularly the firms level (Section 2).

16

b. Building a new unique panel database obtained by elaborations using original IPTS

microdata and applying the methodology discussed in Section 3.

c. Investigating, through econometric analysis, the relationship between R&D and

embodied technological change on the one hand and labour productivity on the other hand; the

analyses will be carried out using panel methodologies (see Section 3), taking into account the

sectoral, country and time dimensions of the available microdata. In particular, the following

research issues will be investigated.

- c.1 To see whether significant differences emerge in the link between R&D and

productivity between the US and the EU, in order to shed some light on the interpretation of the

transatlantic productivity gap (Section 4.1).

- c.2 To see whether further support can be found to the hypothesis that R&D

should be clearly and significantly linked to productivity in the high-tech sectors, while a weaker

impact should emerge in the other sectors of the economy (Section 4.2).

- c.3 To see whether physical capital emerges as an important second driver of

productivity gains, so confirming the hypothesis that embodied technological change is a crucial

determinant of productivity evolution. This relationship is expected to be particularly strong in the

low-tech sectors, where embodied technological change might be expected the main source of

productivity gains (Section 4.2).

- c.4 To see to what extent the transatlantic differences may be related to the

different sectoral structures and to the peculiar sectoral R&D/productivity relationships detectable

in the US and in the EU (Section 4.3).

- c.5 To see whether (and how much) the intensity of the R&D/productivity link is

affected by the sectoral composition and the institutional context characterising the different

European countries and regions (Section 4.4).

17

- c.6 To see whether the coefficients linking R&D and productivity are stable over

time or turn out to be affected by the business cycle (Section 4.5).

d. Discussing the implications of the empirical findings in terms of European industrial,

innovation and regional policies (Section 5).

18

2. Theoretical background and previous empirical

evidence

This section will be devoted to a discussion of the current state of the art in the economic

literature, looking both at theories and previous empirical studies. First, some macroeconomic

trends will be commented on (Section 2.1), then attention will be turned to the microeconomic

level, focusing on the different avenues of research investigating the hypotheses listed in the

previous section (Sections 2.2; 2.3; 2.4).

2.1 The transatlantic productivity gap

With the exclusion of the short-term turbulence associated with the current recession,

starting from the early 90s, the US and the EU show a persistent divide both in terms of economic

growth (see Fig. 1), labour productivity growth (see Fig. 2) and total factor productivity growth (Fig

3).

In fact, the EU15s historical process of catching-up stops around the early 90s (see

OMahony and Van Ark, 2003; Blanchard, 2004): as can be seen in Fig. 1, since 1992 to 2006 the

US GDP growth constantly overcomes the EU15 figure (with only one exception). Moreover,

average annual labour productivity growth (measured as GDP per hour worked), in the US

accelerated from 1.2% in the 1973-95 period to 2.3% in the 1996-06 period (see Van Ark et al.

2008); conversely, in the EU15 labour productivity growth declined from 2.4% in the former period

to 1.5% in the latter one (resulting in the trends shown in Fig. 2). Hence, the labour productivity

slowdown in EU15 since the 90s has reversed what was once thought as a long-term pattern of

convergence.

Most of scholars agree that to explain the transatlantic productivity gap, one has to seriously

take into account the R&D and innovation divide which emerged between the two sides of the

Atlantic with the spread of the ICT technologies (see Daveri, 2002; Crespi and Pianta, 2008). In

particular, in the second half of the 90s there was a burst of higher productivity in ICT producer

19

industries (Jorgenson et al., 2008), while in the 00 there was also a productivity surge in user

industries, including market services such as large-scale retailing and the financial and business

services (see Triplett and Bosworth, 2004; Bosworth and Triplett, 2007; Jorgenson et al., 2008).

Fig. 1: Real GDP growth in the US and the EU15: 1990-2008

Gross Domestic Product, annual growth rates

-1.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

US EU15

Source: OECD (OECD Statistical Extracts: http://stats.oecd.org)

Indeed, these trends linked to the spread of new technologies were more marked and

accelerated in the US than in the EU (see Jorgenson et al., 2005) resulting into a widening gap in

the Total Factor Productivity (TFP) trends (see Fig. 3).

20

Fig. 2: Labour productivity growth in the US and the EU15: 1990-2008

GDP per hour worked, annual growth rates

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

US EU15

Source: OECD (OECD.Statistical Extracts: http://stats.oecd.org)

The TFP (the output growth not attributable to labour and capital growth) indicates the

efficiency with which inputs are used in the production process and so TFP differentials can be due

to intangible inputs such as R&D as well as human capital, scale economies and organizational

change (see Van Ark et al. 2008, McMorrow et al. 2009). Hence, although the underinvestment in

R&D cannot be considered the only culprit of the European delay, it plays a crucial role in the

interpretation of the transatlantic divide in terms of productivity performance and economic growth.

21

Fig. 3: TFP growth in the US and the EU15: 1990-2004

TFP, annual growth rates

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

2.5

3.0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

US EU15

Source: Timmer, M.P. et al., 2003, Appendix Tables, updated June 2005

In fact - as can be seen in Fig. 4 (GERD = Gross Domestic Expenditure on R&D

1

) as far

as the total private and public expenditures in R&D are concerned, the EU has persistently invested

around the 70% of the US economy all over the last two decades.

1

GERD = BERD (Business Enterprise Expenditure on R&D) + HERD (Higher Education Expenditure on R&D) +

GOVERD (Government Expenditure on R&D) + PNPRD (Private Non-profit Expenditure on R&D).

22

Fig. 4: GERD/GDP in the US and in the EU15: 1990-2007

GERD/GDP

1.00

1.20

1.40

1.60

1.80

2.00

2.20

2.40

2.60

2.80

3.00

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

United States EU15

Source: OECD - Main Science and Technology Indicators (2009 edition)

Indeed, R&D expenditures have been demonstrated to play an important role in explaining

the productivity differentials within the industrialised countries (see Jorgenson and Stiroh, 2000;

Oliner and Sichel, 2000; Stiroh, 2002; Turner and Boulhol, 2008). In particular, the role of private

R&D investment by corporate firms (Business Enterprise Expenditure on R&D: BERD) has been

recognised as a fundamental engine for productivity growth both at the macro and microeconomic

level (see Baumol, 2002; Jones, 2002). The EU15 lags considerably and persistently behind the US

in this respect, even more strikingly than in terms of total R&D (see Fig. 5).

Hence, the EU underinvestment in total R&D and particularly in BERD might be considered

one of the main determinants of the growth, productivity and technological transatlantic gaps

discussed above. Not surprisingly, increasing R&D investment is an issue of major concern for the

European long term policy strategy. This is the rationale of the Lisbon agenda 2000 to make

Europe the most dynamic knowledge economy in the world by 2010 and of the more specific

Barcelona target which - two years later - committed the EU to reach the objective of an

23

R&D/GDP level of 3%, two thirds of which accounted for the private sector (European Council,

2002; European Commission 2002).

Fig. 5: Private R&D (BERD)/GDP in the US and in the EU15: 1990-2007

BERD/GDP

0.5

0.7

0.9

1.1

1.3

1.5

1.7

1.9

2.1

2.3

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

United States EU15

Source: OECD Main Science and Technology Indicators (2009 edition)

However, the overall European productivity delay can be explained not only by a lower

level of total and private R&D investment, but also by a lower capacity to translate R&D

investment into productivity gains, in turn fostering competitiveness and economic growth. With

regard to the latter explanation, the European economies may be still affected by a sort of Solow's

(1987) paradox, i.e. by a difficulty to translate their own investments in technology into increases in

productivity.

24

This will be one of the major hypotheses that will be investigated in this study; in fact, it

might be well the case that European economies not only invest less R&D, but also get less from

their R&D investment because of a lower R&D-productivity elasticity in the EU compared with the

US. Indeed, previous literature has shown that the R&D-productivity link is positive and significant

at the microeconomic level, but also that this relationship is stronger in the high-tech sectors. Thus,

it might be the case that the EU industrial structure (disproportionally characterised by traditional,

middle and low-tech sectors) implies a lower capacity to translate R&D efforts in productivity gains

(structural effect). However, it might be also the case that even within the same sectors

European firms reveal a lower capacity of translating R&D investments into productivity gains

(intrinsic effect).

2.2 The link between R&D and productivity at the firm and sectoral

level

Zvi Griliches (1979) started a flourishing literature devoted to investigate the relationship

between R&D and productivity at the firm and sectoral level.

On the whole, previous economic literature has found robust evidence of a positive and

significant impact of R&D on productivity at the firm level. In this literature, the estimated overall

elasticity of productivity in respect to R&D is positive, statistically significant and with a magnitude

- depending on the data and the adopted econometric methodology - ranging from 0.05 to 0.25 (for

comprehensive surveys, see Mairesse and Sassenou, 1991; Griliches 1995 and 2000; Mairesse and

Mohnen, 2001).

It is interesting to notice that the consensus about the existence of a positive and significant

impact of R&D on productivity stands on different studies using different proxies for productivity

according to the data available: labour productivity measured as the ratio between value added and

employment; labour productivity as the ratio between value added and hours worked; total factor

productivity; Solows residual; etc. (see, for instance, Hall and Mairesse 1995; Klette and Kortum,

2004; Janz et al., 2004; Lf and Heshmati, 2006; Rogers, 2006). Hence, the legacy of the previous

microeconometric literature is clear in indicating the role of R&D in enhancing productivity at the

firm level.

25

However, the intensity of the R&D-productivity relationship may widely vary across the

different industrial sectors and this opens the avenue of research that is particularly important for

the aims of this study (see previous section). Indeed, technological opportunities and appropriability

conditions are so different across sectors (see Freeman, 1982; Pavitt, 1984; Winter, 1984; Aghion

and Howitt, 1996; Dosi, 1997; Greenhalgh et al., 2001; Malerba, 2004) as to suggest the possibility

of substantial differences in the specific sectoral R&D-productivity links.

For instance, a controversial hypothesis put forward in the current debate is the alleged

advantage of low-tech compared with high-tech sectors in achieving productivity gains from R&D

investments. The argument here is that catching-up low-tech sectors are investing less in R&D but

benefit from a late-comer advantage, while high-tech sectors should be affected by a sort of

decreasing returns effect (see Marsili, 2001; von Tunzelmann and Acha, 2005; Mairesse and

Mohnen, 2005). If such was the case, we would expect a weaker relationship between R&D and

productivity growth in high-tech sectors in comparison with their low-tech counterparts.

However, this hypothesis is strikingly in contrast with the previously-available empirical

evidence. Indeed, previous sectoral studies clearly suggest a greater impact of R&D investment on

productivity in the high-tech sectors rather than in the low-tech ones.

Examples are Griliches and Mairesse (1982) and Cuneo and Mairesse (1983), who

performed two companion studies using micro-level data and making a distinction between firms

belonging to science-related sectors and firms belonging to other sectors. They found that the

impact of R&D on productivity for scientific firms (elasticity equal to 0.20) was significantly

greater than for other firms (0.10).

By the same token, Verspagen (1995) tested the impact of R&D expenditures using OECD

sectoral-level data on value added, employment, capital expenditures and R&D in a standard

production function framework. The author singled out three macro sectors: high-tech, medium-

tech and low-tech, according to the OECD classification (Hatzichronoglou, 1997). The major

finding of his study was that the impact of R&D was significant and positive only in high-tech

sectors, while for medium and low-tech sectors no significant effects could be found.

Using the methodology set up by Hall and Mairesse (1995), Harhoff (1998) studied the

R&D/productivity link - using a slightly unbalanced panel of 443 German manufacturing firms over

the period 1977-1989 - and found a significant impact ranging from a minimum of 0.068 to a

26

maximum of 0.137, accordingly to the different specifications and the different econometric

estimators adopted. Interestingly, the effect of R&D capital was considerably higher for high-

technology firms rather than for the residual groups of enterprises. In particular, for the high-tech

firms the R&D elasticity always turned out to be highly significant and ranging from 0.125 and

0.176, while for the remaining firms the R&D elasticity resulted either not significant (although

positive) or lower (ranging from 0.090 to 0.096), according to the different estimation techniques.

More recently, Wakelin (2001) applied a Cobb-Douglas production function where

productivity was regressed on R&D expenditures, capital and labour using panel data (170 UK

quoted firms during the period 1988-1992). She found that R&D expenditures had a positive and

significant role in influencing a firms productivity growth; however, in firms belonging to sectors

defined as "net users of innovations" R&D activities turned out to have a significantly larger impact

on productivity.

Rincon and Vecchi (2003) also used a CobbDouglas framework in dealing with panel

micro-data extracted from the Compustat database over the time period 1991-2001. They found that

R&D-reporting firms were more productive than their non-R&D-reporting counterparts throughout

the entire time period. However, the positive impact of R&D expenditures turned out to be

statistically significant both in manufacturing and services in the US, but only in manufacturing in

the main three European countries (Germany, France and the UK). Their estimated significant

elasticities ranged from 0.15 to 0.20.

Kwon and Inui (2003) analysed 3,830 Japanese firms with no less than 50 employees in the

manufacturing sector over the period 1995-1998, also using the methodology set up by Hall and

Mairesse (1995). Using three different estimation techniques (within estimates, first difference and

3-years differences), they found a significant impact of R&D on labour productivity, with high-tech

firms systematically showing higher and more significant coefficients than medium and low-tech

firms.

Dealing with Taiwanese data, Tsai and Wang (2004) investigated the R&D-productivity

relationship using a stratified sample of 156 large firms quoted on the Taiwan Stock Exchange, over

the period 1994-2000. They found that R&D investment had a significant and positive impact on

the growth of a firms productivity (with an average elasticity equal to 0.18). However, this impact

was much greater for high-tech firms (0.3) than for other firms (0.07).

27

Finally, Ortega-Argils et al. (2010) have looked at the top EU R&D investors, using an

unbalanced longitudinal database consisting of 577 large European companies over the period

2000-2005, extracted from the UK-DTI Scoreboards. The authors found that the R&D-productivity

coefficient was significantly different across sectors. In particular, the coefficient increased

monotonically moving from the low-tech to the medium-high and high-tech sectors, ranging from a

minimum of 0.03/0.05 to a maximum of 0.14/0.17. This outcome has been interpreted as evidence

that firms in high-tech sectors are still far ahead in terms of the impact on productivity of their R&D

investments, at least as regards top European R&D investors.

On the whole, previous sectoral empirical studies using different datasets across different

countries - seem to suggest a greater impact of R&D investments on firm productivity in the high-

tech sectors rather than in the low-tech ones. This outcome will be tested again in this study.

2.3 The role of embodied technological change and the peculiarities of

the medium and low-tech sectors

R&D is not the sole determinant of productivity gains: while the R&D input is capturing that

portion of technological change which is related to the disembodied new knowledge, gross

investment is an alternative innovative input capturing the new knowledge embodied in physical

capital, mainly machinery introduced through additional investments or simply through scrapping.

This second input represents the so-called embodied technological change, with his great potential

to positively affect productivity growth.

The embodied nature of technological progress and the effects related to its spread in the

economy were originally discussed by Salter (1960) who underlined that technological progress

might be incorporated in new vintages of capital introduced either through additional investment or

simply by scrapping

2

.

2

On the theoretical side, the embodied nature of technological change was at the core of the controversy between

Robert Solow (1960) and Dale Jorgenson (1966) with Solow arguing that embodied technological change was

dominant, hence investment was the key mechanism of economic growth, while Jorgenson arguing that from the data

available then one could not provide a clear answer. Recent empirical macroeconomic estimates actually conclude

28

Later in the literature, vintage capital models have been used by neo-Schumpeterian

economists to describe an endogenous process of innovation in which the replacement of old

equipment and machinery is the main way through which firms update their own technologies (see

Freeman et al., 1982; Freeman and Soete, 1987). More recently, the role of capital accumulation in

fostering productivity growth and economic development has been also recognised by growth

theorists (see Hulten, 1992; Greenwood et al., 1997; Hercowitz, 1998).

Moving from the macroeconomic scenario to the microeconomic analysis at the level of

sectors and firms, the important role of embodied technological change in fostering innovation and

productivity growth is even more obvious.

For instance, the literature suggests that more complex and radical product innovation

generally relies on formal R&D, while process innovation (which is often incremental rather than

radical) is much more related to embodied technical change achieved by investment in new

machinery and equipment (see Parisi et al., 2005). If such is the case, in traditional low-tech sectors

which are focusing on process innovation productivity gains might be much more related to

capital accumulation rather than to R&D expenditures. This was also one of the main message of

the well-known Pavitt taxonomy (Pavitt, 1984), where firms in traditional sectors (Supplier

Dominated) innovate mainly through embodied technological change acquired from firms in the

Specialised Suppliers sector.

Moreover, not all innovative firms are large corporations in Science Based sectors (see again

Pavitt, 1984). Indeed, economic literature supports the hypothesis that firms in traditional sectors

(most of them SMEs) face a different technological and economic environment (see Acs and

Audretsch, 1988 and 1990; Acs et al., 1994). In particular, in the low and medium-tech sectors,

R&D does not represent the sole input through which firms can achieve innovative outcomes and

productivity gains; for these firms it seems much easier to rely on the market and choose to buy

embodied technical change rather than to make their own technology (see Acs and Audretsch,

1990).

that embodied technological change is the main transmission mechanism of new technologies into economic growth

(see Greenwood et al., 1997).

29

In this framework, Santarelli and Sterlacchini (1990 and 1994) put forward convincing

empirical evidence showing the crucial role of the embodied technological change in determining

process innovation and productivity gains, especially in SMEs and in firms belonging to the

traditional sectors (the supplier dominated sectors, according to the Pavitt,1984, terminology). By

the same token and more recently, Santamara et al. (2009) found that the use of advanced

manufacturing machinery incorporated in capital formation significantly affects the probability of

engaging in both product and process innovation in firms belonging to the low and medium-low

tech sectors.

Thus, the sector to which a firm belongs represents an important analytical level for

understanding the differences in innovative processes and productivity evolution. The two

alternative patterns of technological change originally figured out by Schumpeter (creative

destruction - see Schumpeter 1934 - vs. creative accumulation, see Schumpeter, 1942) are based on

the fact that firms face sector-specific technological opportunities and appropriability conditions

(Nelson and Winter, 1982; Winter, 1984; Dosi, 1988).

In particular, firms in the high-tech sectors are more R&D based, mainly dealing with

product radical innovation and facing a competition based on the performance of products;

differently, firms in traditional middle-low tech sectors are more based on embodied technological

change, mainly dealing with incremental process innovation and facing a competition based on

costs and prices reduction (Malerba and Orsenigo, 1996; Breschi et al., 2000; Malerba, 2002; Conte

and Vivarelli, 2005).

One of the hypotheses that will be tested in this study is therefore whether productivity gains

in sectors other than the high-tech ones depend more on capital formation rather than on formal in-

house R&D.

Unfortunately, previous literature dealing with the R&D-productivity relationship (see

previous section) has generally neglected the investigation of the possible different impacts of

embodied technological change across sectors. Within a production function framework (assumed

by most of previous studies), capital is assumed to have a positive impact on productivity,

independently by the peculiarities of the investigated sectors.

One exception is the already quoted contribution by Ortega-Argils et al. (2010), where the

authors had found that the R&D-productivity coefficient was higher and more significant in the

30

high-tech sectors rather than in the middle and low-tech ones. Interestingly enough, they found that

for capital formation the results were the opposite. The physical capital stock also increased a firm's

productivity, with an overall elasticity which turned out to be around 0.12/0.13; however, this effect

was stronger in the low-tech sectors, lower but still significant in the medium-tech sectors, while it

turned out to be not significant in the high-tech sectors. Consistently with what discussed in this

section, this evidence seems to suggest that embodied technological change is crucial in the low-

tech sectors, while in the high-tech sectors technological progress is mainly introduced through in-

house R&D investments.

2.4 The business cycle and the regional peculiarities

Differently from the issues discussed in the previous sections, there is not an established

literature devoted to investigate possible differences in the firms R&D/productivity elasticity along

the business cycle. The closer strand of literature is that one devoted to study the link between

output and innovation activity, proxied by R&D or other innovative indicators.

In particular, a long standing debate (flourishing in the 80s and 90s) opposed the

proponents of the downturn as the optimal time to introduce innovations with those advocating that

expansionary periods were actually more likely to sustain innovation and diffusion.

The argument put forward by the formers (see Mensch, 1979 and Kleinknecht, 1987) was

that the value of profitability from existing products and processes falls in recessions and so, if this

decline is large enough in comparison with the potential returns to be gained from implementing

new products and processes, firms will implement innovations during cyclical downturns.

The argument put forward by the latter (Freeman et al, 1982 and Freeman and Soete, 1987)

was that the upswing conditions are those that facilitate the large scale introduction and diffusion of

innovation, since firms are confident in terms of sales expectations and less constrained from

financial perspectives. This view is fully consistent with the so called theory of the demand-pull

innovation. Indeed, that rising demand may induce an increase in the innovation effort is a rather

old issue (Schmookler, 1962 and 1966; Scherer, 1982): on the one hand, increasing sales permit the

31

financing of expensive and uncertain R&D activities and relax possible credit constraints, while on

the other hand optimistic sale expectations increase expected profitability from innovation.

Previous empirical studies are massively in favour of the second strand of literature both at

the macroeconomic and the microeconomic level. For instance, Geroski and Walters (1995), using

macroeconomic time series for the UK over the period 1948-83, found significant evidence that

major innovations and patents are pro-cyclical. By the same token, but at the microeconomic level,

Brouwer and Kleinknecht (1996) on Dutch data, Crpon et al. (1998) on French data, and Piva and

Vivarelli (2007) on Italian data found a significant confirmation of the demand-pull hypothesis at

the level of the firm.

However, as far as we know, previous literature has not investigated whether the upswings

are not only favourable to the introduction and diffusion of innovation, but also conducive of a

more effective impact of R&D and innovation on productivity; this will be the hypothesis that will

be tested in this study.

Turning the attention to the regional dynamics, we also find a lack of a previous literature

specifically addressed to the hypothesis that will be investigated in this study.

Our starting point is that regional peculiarities in the relationship between R&D and capital

formation on the one hand and productivity evolution on the other hand should heavily be affected

by the industrial structure which characterises the single region. Thus - according to what discussed

in the previous Section 2.3 - a region characterised by a large presence of high-tech sectors would

probably turn out to be very sensitive to R&D activities in getting productivity gains, while a region

characterised by a disproportionate presence of traditional sectors and SMEs would come out to be

particularly responsive to capital formation. To the best of our knowledge, the literature in regional

economics has not yet investigated possible inter-regional differences in the relationship between

local R&D stock and local labour productivity.

However, recent empirical works has shown how the endogenous growth approach can be

applied at the regional level, underlining the crucial role of knowledge stock (proxied by either

R&D or patents) and human capital in explaining the differences in TFP across regions (see, for

instance, Dettori et al., 2008, studying 199 European regions over the period 1985-2006; Fischer et

al., 2008, analysing 203 European regions over the period 1997-2002; Gumbau-Albert and Maudos,

32

2006, investigating 17 Spanish regions over the period 1986-96; Bronzini and Piselli, 2009,

studying 19 Italian regions over the period 1985-2001).

Going a step further, in this study we will try to see whether the size and significance of the

demonstrated link between knowledge and capital stocks on the one hand and productivity on the

other hand vary across different regions. This will be made possible by the availability of a large

micro-firm database which allows us to test possible significant differences across groups of firms

belonging to different European countries and macro-regions.

33

3. Data and methodology

This section will be organised in three parts; in Section 3.1 the data source will be described

and its characteristics and limitations discussed; in Section 3.2, attention will be devoted to the

process that was developed in order to build a consistent and reliable dataset; finally, Section 3.3

will introduce the econometric specification tested in the empirical part of the study, whose results

will be put forward in Section 4.

3.1 The data source

The microdata used in this study were provided by the JRCIPTS (Joint Research Centre-

Institute for Prospective Technological Studies) of the European Commission, extracted from a

variety of sources, including companies annual reports.

Available data includes:

- Company identification, name and address and industry sector;

- Financial data;

- Fundamental economic data, including the crucial information for this study,

namely: sales, cost of goods (the difference between the former and the latter allows to

obtain value added), capital formation, R&D expenditures, and employment.

Data are filed in current national currencies.

Given the crucial role assumed by the R&D variable in this study, it is worthwhile to discuss

in detail what is intended as R&D in companies' annual reports. This item represents all costs

incurred during the year that relate to the development of new products and services. It is important

to notice that this amount is only the companys contribution and exclude amortization and

depreciation of previous investments, so being a genuine flow of current in-house R&D

expenditures.

34

In particular the figure excludes customer or government-sponsored R&D expenditures, as

well as engineering expenses or market research and testing expenses. On the whole, the adopted

definition of R&D is quite restrictive and refers to the pure flow of current additional resources

coming from internal sources and devoted to the launch and development of entirely new products.

The number of years available for each company depends upon the companys history; thus,

the data source is unbalanced in nature.

3.2 The construction of the dataset

Once acquired the rough data from IPTS (defined and organised as reported in the previous

sub-section), we proceeded in the construction of a longitudinal database that would be adequate to

run panel estimations addressed to test the theoretical hypotheses discussed in the second section of

this report. For sake of simplicity, we will describe the adopted complex procedure by steps. Where

appropriate, some of the data managing analyses were carried out in close cooperation with IPTS

statisticians, whose feedbacks were extremely useful to shape the final panel dataset.

First step: data extraction

In guiding the individuation of R&D performers by IPTS, the following criteria have been

adopted:

- Selecting only those companies with R&D>0 in, at least, one year in a 20 years time

span;

- Selecting only those companies located in the US and in the EU 27 countries;

- Individuating information concerning R&D, sales, cost of goods (the difference between

sales and cost of goods allowed to obtain value added), capital formation, R&D

expenditures, and employment. In more detail, this is the list of the available information

for each firm included in the obtained workable dataset:

o Country (according to the location of the headquarter);

35

o Industry code at 2008;

o R&D expenses (defined as discussed in the previous sub-section);

o Capital expenditures;

o Net turnover;

o Cost of goods sold;

o Employees.

- All the value data were expressed in the current national currency in millions (for

instance: countries which are currently adopting Euro have values in Euro for the entire

examined period).

Second step: deflation of current nominal values

Nominal values were commuted into constant price values trough GDP deflators (source:

IMF) centred in year 2000. For a tiny minority of firms reporting in currencies different from the

national ones, we opted for deflating the nominal values through the national GDP deflator, as well.

Third step: values in PPP dollars

Once obtained constant 2000 prices values, all figures were converted into US dollars using

the PPP exchange rate at year 2000 (source: OECD)

3

. 9 companies from 4 countries (Lithuania,

3

This procedure is consistent with what suggested by the Frascati Manual (OECD, 2002) in order to correctly adjust

R&D expenditures for differences in price levels over time (i.e. intertemporal differences asking for deflation) and

among countries (i.e. interspatial differences asking for a PPP equivalent). In particular ...the Manual recommends the

36

Latvia, Malta and Romania) were excluded, due to the unavailability of PPP exchange rates from

the OECD. The 10 companies reporting in euro but located in non-euro countries (Denmark,

Estonia and the UK) were excluded as well

4

; while the 58 European companies reporting in US

dollars were kept as such.

Fourth step: the format of the final data string

The obtained unbalanced database comprises 2,777 companies, 2 codes (country and sector)

and 5 variables (see the bullet points above) over a period of 19 years (1990-2008).

Since one of the main purposes of this study is to distinguish across high-tech and

medium/low-tech sectors (see Sections 2.2 and 2.3), a third code was added, labelling as High-tech

the following sectors

5

:

- SIC 283: Drugs (ISIC Rev.3, 2423: Pharmaceuticals);

- SIC 357: Computer and office equipments (ISIC Rev. 3, 30: Office, accounting and

computing machinery);

- SIC 36 (excluding 366): Electronic and other electrical equipment and components,

except computer equipment (ISIC Rev. 3, 31: Electrical machinery and apparatus);

- SIC 366: Communication equipment (ISIC Rev. 3, 32: Radio, TV and communications

equipment);

use of the implicit gross domestic product (GDP) deflator and GDP-PPP (purchasing power parity for GDP), which

provide an approximate measure of the average real opportunity cost of carrying out the R&D. (ibidem, p. 217).

4

Given the very small number of firms involved, it was decided not to take the arbitrary choice of using either the

national or the Euro PPP converter.

5

The standard OECD classification was taken (see Hatzichronoglou, 1997) and extended it including the entire

electrical and electronic sector 36 (considered as a medium-high tech sector by the OECD). We opted for this extension

taking into account that we just compare the high-tech sectors with all the other ones and that we need an adequate

number of observations within the sub-group of the high-tech sectors.

37

- SIC 372-376: aircraft and spacecraft (ISIC Rev. 3, 353: Aircraft and spacecraft);

- SIC 38: measuring, analyzing and controlling instruments (ISIC Rev. 3, 33: Medical,

precision and optical instruments)

Finally, since we are interested in investigating possible regional peculiarities within the EU

(see Section 2.4), a regional code was assigned to each firm according to the NUTS 1 classification.

Fifth step: computation of the R&D and capital stocks.

Consistently with the reference literature (see Section 2), the methodology adopted in this

study (see also next Section 3.3) requires to compute the R&D and capital stocks, accordingly with

the perpetual inventory method. In practice, the following two formulas have to be applied:

(1)

) (

&

0

0

o +

=

g

D R

K

t

t

and

t t t

D R K K & ) 1 (

1

+ =

o

where R&D = R&D expenditures

(2)

) (

0

0

o +

=

g

I

C

t

t

and

t t t

I C C + =

) 1 (

1

o

where I = gross investment

where g is generally computed as the ex ante pre-sample compounded average growth rate

of the corresponding flow variable and is a depreciation rate.

However, the reader has to be reminded that our dataset is spanning 19 years and it is

unbalanced in nature. This means that only a minority of firms display continuous information all

38

over the entire period, while many firms have information only for one or more spans over the

1990-2008 period and these spans may be either very short or even isolated data. In addition, many

firms display left-truncated data; for instance, the majority of European firms have data only for the

most recent years.

Given the unbalanced structure of the dataset, to strictly apply the formulas (1) and (2) to

compute initial stocks (using say the first three years to obtain the ex-ante growth rates) would

have implied to lose a huge amount of information. In the best case - say a firm with a complete set

of 19 data over the period - this methodology would have implied to lose 3 observations out of 19;

in the worst case - say a firm characterized by data available only for some spells of three years

each this computation would have implied to lose all the available information for that particular

firm.

In order to avoid this massive dropping of available data, we adopted the following criteria.

First, it was decided to compute a rate of growth using the initial three years of a given spell and

then apply it to the initial flow and not to the fourth year (that is our t0 is the very first year of the

spell and so g is an ex post 3-year compound growth rate). Second, it was iteratively applied this

methodology to all the available spans of data comprising at least three consecutive years

6

. The

combination of these two choices allowed us to keep all the available information, with the only

exceptions of either isolated data or pairs of data.

Although departing from the usual procedure, to rely on ex-post growth rates appears

acceptable in order to save most of the available information in the dataset; however, the impact of

this choice on the values assumed by the stocks is limited, since they are also affected by the flow

values and the depreciation rates. Finally, the chosen growth rate affects only the initial stock and

its impact quickly smoothes out as far as we move away from the starting year

7

.

6

This means that for firms characterised by breaks in the data we computed different initial stocks, one for each

available time span, consistently with what done by Hall (2007); however, differently from Hall (2007), we consider the

different spans as belonging to the same firm and so we will assign in the following econometric estimates a single

fixed or random effect to all the spans belonging to the same company history.

7

Options for the choice of g - different from the standard one - have been implemented by other authors, as well. For

instance, Parisi et al. (2006), assume that the rate of growth in R&D investment at the firm level in the years before the

first positive observation equals the average growth rate of industry R&D between 1980 and 1991 (the time-span

antecedent to the longitudinal micro-data used in their econometric estimates). In general terms, the choice of a feasible

g does not significantly affect the final econometric results of the studies. As clearly stated by Hall and Mairesse (1995,

39

Hence, - in order to be able to compute R&D and capital stocks according to the procedure

described above only R&D and capital expenditure flows data with at least 3 observations in

consecutive years were retained. This implied that 354 companies (mainly European) had to be

dropped because of lacking 3 R&D observations in successive years and 30 additional companies

for lacking 3 capital expenditures observations in successive years. Thus, a total of 2,393 firms were

retained at the end of this stage of the cleaning process.

Turning the attention to the depreciation rates (), we differentiated both between R&D and

capital and between the high-tech sectors vs. the other sectors, taking into account what is common

in the reference literature which assumes = 6% for computing the capital stock and = 15% for

computing the R&D stock (see Nadiri and Prucha, 1996 for the capital stock; Hall and Mairesse,

1995 and Hall, 2007 for the R&D stock).

Indeed, depreciation rates for the R&D stocks have to be assumed to be higher than the

corresponding rates for physical capital, since it is assumed that technological obsolescence is more

rapid than the scrapping of physical capital.

However, depreciation rates for the high-tech sectors have to be assumed to be higher than

the corresponding rates for medium and low-tech sectors under the assumption that technological

obsolescence both related to R&D efforts and to the embodied technologies incorporated in

physical capital - is faster in the high-tech sectors. Specifically, depreciation rates were assumed

equal to 6% and 7% with regard to physical capital in the low-medium and high-tech sectors

respectively, while the corresponding for R&D stocks were assumed equal to 15% and 18%

respectively.

Once computed according to the formulas (1) and (2) and the adopted g and rates, the

resulting stocks were checked and negative ones were dropped

8

. Moreover, we excluded a minority

of unreliable data such as those indicating negative sales and cost of goods equal to zero.

After these further drops of data, we ended up with 1,884 companies (1,210 US and 674 EU,

for a total of 17,064 observations).

p.270, footnote 9): In any case, the precise choice of growth rate affects only the initial stock, and declines in

importance as time passes,....

8

The occurrence of negative stocks happens when g turns out to be negative and larger in absolute value than .

40

Sixth step: outliers.

At this point, in order to check for the presence of outliers (i.e. observations that appear to

deviate markedly in terms of standard deviations from the relevant mean, possibly implying a bias

in the econometric estimates), the Grubbs test (Grubbs, 1969) was run on the two critical variables

in the analysis: the R&D stock (K) and the physical capital stock (C).

Since the outlier test has to be applied to the variables used in the regression analysis, the

test was run on the two normalised stock variables: K/E and C/E (see eq. 5 in Section 3.3).

In detail, the Grubbs test - also known as the maximum normed residual test, (Grubbs, 1969;

Stefansky, 1972) - is used to detect outliers in a dataset, either creating a new variable or dropping

outliers out of the data set. Technically, the Grubbs test detects one outlier at each iteration

9

: the

outlier is expunged from the data set and the test is iterated until no outliers remain.

The Grubbs test is defined under the null hypothesis (H

0

) that there are no outliers in the

dataset; the test statistic is:

(3)

s

Y Y

G

i

N i

=

= ,.., 1

max

with Y and s denoting the sample mean and standard deviation, respectively. Therefore, the

Grubbs test detects the largest absolute deviation from the sample mean in units of the sample

standard deviation

10

.

With a two-sided test, the null hypothesis of no outliers is rejected if:

9

The default number of iterations is 16,000.

10

The Grubbs test can also be defined as one of the following one-sided tests:

- test whether the minimum value is an outlier:

s

Y Y

G

min

= with Ymin denoting the minimum value;

- test whether the maximum value is an outlier:

s

Y Y

G

=

max

with Ymax denoting the maximum value.

41

(4)

( )

) 2 ), 2 /( (

2

) 2 ), 2 /( (

2

2

1

>

N N

N N

t N

t

N

N

G

o

o

with ) 2 ), 2 /( (

2

N N t o denoting the critical value of the t-distribution with (N-2) degrees of

freedom and a significance level of o/(2N).

After running the Grubbs test, 426 observations turned out to be outliers for the K/E variable

and 613 for the C/E variable (54 outliers turned out to be common to both the variables).

Therefore, at the end of the process, we ended up with a final dataset comprising 1,809

companies (1,170 US and 639 EU, for a total of 16,079 observations).

Table 1 reports the distribution of the retained firms and observations across countries.

Tab. 1: Distribution of firms and observations across countries in the final version of the dataset

COUNTRY FIRMS OBSERVATIONS

AUSTRIA 16 51

BELGIUM 20 82

CZECH REPUBLIC 1 4

DENMARK 21 152

ESTONIA 1 3

FINLAND 41 157

FRANCE 54 279

GERMANY 141 749

GREECE 11 41

HUNGARY 3 12

IRELAND 8 55

ITALY 5 19

LUXEMBOURG 3 9

NETHERLANDS 25 165

SLOVENIA 1 4

SPAIN 3 7

SWEDEN 62 386

UNITED KINGDOM 223 1,299

EU 639 3,474

USA 1,170 12,605

Total 1,809 16,079

42

3.3 The econometric specification and descriptive statistics

Consistently with the previous studies discussed in Section 2, we will test the following

augmented production function, obtainable from a standard Cobb-Douglas function in three inputs:

physical capital, labour and knowledge capital (see Hall and Mairesse, 1995, formulas 1-2-3, pp.

268-69)

11

.

(5) c | o + + + + = ) ln( ) / ln( ) / ln( ) / ln( E E C E K E VA

Our proxy for productivity is labour productivity (Value Added, VA, over total employment,

E); our pivotal impact variables are the R&D stock (K) per employee and the physical capital stock

(C) per employee.

As it is common in this type of literature (see Hulten, 1990; Jorgenson, 1990; Hall and

Mairesse, 1995; Parisi et al., 2006), stock indicators rather than flows were considered as impact

variables; indeed, productivity is affected by the cumulated stocks of capital and R&D expenditures

and not only by current or lagged flows.

Moreover, dealing with R&D stocks - rather than flows - has two additional advantages: on

the one hand, since stocks incorporate the cumulated R&D investments in the past, the risks of

endogeneity is minimised; on the other hand, there is no need to deal with the complex (and often

arbitrary) choice of the appropriate structure of lags for the R&D regressor.

In this framework, R&D and physical capital stocks were computed using the perpetual

inventory method, according to the formulas (1) and (2) introduced and discussed in the previous

sub-section (fifth step).

Finally, taking per capita values permits both standardisation of our data and elimination of

possible size effects (see, for example, Crpon et al., 1998, p.123). In this framework, total

11

As clearly stated and demonstrated in Hall and Mairesse (1995), the direct production function approach to measure

returns to R&D capital is preferred on other possible alternative specifications.

43

employment (E) is a control variable: if turns out to be greater than zero, it indicates increasing

returns.

All the variables are taken in natural logarithms.

While K/E (R&D stock per employee) captures that portion of technological change which

is related to the cumulated R&D investment, C/E (physical capital stock per employee) is the result

of the cumulated investment, implementing different vintages of technologies. So, this variable

encompasses the so-called embodied technological change, possibly affecting productivity growth

(see Section 2.3).

The following Table 2 reports the correlation matrix of the variables included in eq. 5. As

can be seen, a preliminary evidence of the expected positive impacts of both K/E and C/E upon

VA/E emerges. Moreover, no evidence of possible serious collinearity problems comes out, since

the three relevant correlation coefficients turn out to be less than 0.285 in absolute values.

Tab. 2: Correlation table: correlation coefficients

Log(Value

added per

employee)

Log(R&D

stock per

employee)

Log(Physical

stock per

employee)

Log(Employment)

Log(Value added

per employee)

1

Log(R&D stock

per employee)

0.451 1

Log(Physical stock

per employee)

0.278 0.252 1

Log(Employment)

-0.040 -0.284 0.209 1

Note: all correlation coefficients are 1% significant.

44

Specification (5) was estimated through different estimation techniques.

Firstly, pooled ordinary least squared (POLS) regressions were run to provide preliminary

reference evidence. Although very basic, these POLS regressions were controlled for

heteroskedasticity (we used the Eicker/Huber/White sandwich estimator to compute robust standard

errors) and for a complete set of three batteries of dummies, namely country (19 countries), time (19

years) and sector (52 two-digit SIC-sectors) dummies.

Secondly, fixed effect (FE) regressions were performed in order to take into account the firm

specific unobservable characteristics such as managerial capabilities. The advantage of the FE

estimates is that different firms are not pooled together but taken into account in their own

singularity. The disadvantage is that country and sector dummies are dropped for computational

reasons, since they are encompassed by the individual dummies.

Thirdly, random effect (RE) regressions were run to provide the more complete results,

where both individual (randomized) effects are taken into account together with the possibility to

retain all the entire batteries of dummies.

The following Tables 3, 4, 5 and 6 report means and standard deviations of the four relevant

variables in eq.5. We will refer to them when appropriate in the following Section 4 that is

devoted to discuss the econometric results.

45

Tab. 3: VA/E (Value Added/Employees)

Mean Standard

deviation

Whole sample (16,079) 102.781 91.008

US (12,605) 108.793 96.475

EU (3,474) 80.965 62.912

Manufacturing (12,876) 99.565 92.914

High-tech manufacturing sectors (7,693) 112.038 108.275

Other manufacturing sectors (5,183) 81.050 58.938

Service sectors (3,203) 115.709 81.648

US Manufacturing sectors (10,214) 104.18 98.355

EU Manufacturing sectors (2,662) 81.324 65.678

US High-tech manufacturing sectors (6,462) 116.125 112.525

EU High-tech manufacturing sectors (1,231) 90.583 79.089

US Other manufacturing sectors (3,752) 83.983 61.733

EU Other manufacturing sectors (1,431) 73.359 50.093

US Service sectors (2,391) 127.907 86.000

EU Service sectors (812) 79.789 52.858

North+UK EU (1,994) 79.252 65.449

Other EU (1,480) 83.274 59.265

Other EU (no south) (1,413) 83.380 60.147

North+UK EU Manufacturing sectors (1,534) 78.744 67.937

Other EU Manufacturing sectors (1,128) 84.833 62.332

Other EU (no south) Manufacturing sectors (1,097) 84.646 62.927

North+UK EU Service sectors (460) 80.947 56.399

Other EU Service sectors (352) 78.276 47.875

Other EU (no south) Service sectors (316) 78.984 49.130

North+UK EU High-tech manufacturing sectors (734) 92.236 80.394

Other EU High-tech manufacturing sectors (497) 88.141 77.136

Other EU (no south) High-tech manufacturing sectors (482) 87.578 78.090

North+UK EU Other manufacturing sectors (800) 66.365 51.044

Other EU Other manufacturing sectors (631) 82.227 47.439