Professional Documents

Culture Documents

My Stabilize The Debt Results

Uploaded by

Matt FullerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

My Stabilize The Debt Results

Uploaded by

Matt FullerCopyright:

Available Formats

Congratulations!

You reduced the debt to below 60% of GDP in 2021, and kept it at a sustainable level through 2030.

Savings Relative to Current Law in Billions Savings Relative to Current Policy in Billions

$2260 $6210

Dollars in Billions that you need to cut to get under 60% of the GDP by 2021.

$0

See your list of choices on page 2.

CRFB.org Stabilize the Debt Simulator: Your choices in blue.

Choose Your Path

Iraq and Afghanistan Reduce Troops to 60,000 by 2015 Reduce Troops to 45,000 by 2015 Maintain Current Funding Levels 2001/2003 Tax Cuts Renew All the Tax Cuts Renew the Tax Cuts on Income Below $250k/200k $4,530B $3,430B -$580B -$840B $0

Defense, Diplomacy & Security

Replace the Joint Strike Fighter Program with F-16s and F/A-18s Foreign Aid Cut Foreign Economic Aid in Half -$90B Increase Foreign Economic Aid by 50% $90B Veteran Benefits Reduce Veteran Income Security Benefits Expand Veteran Income Security Benefits -$60B $40B -$80B

Renew Tax Cuts Available at Lower $2,660B Incomes and Continue AMT and Estate Tax at 2009 Level Allow All the Tax Cuts to Expire, Except for AMT Patches and Estate Tax at 2009 Level Alter the Sustainable Growth Rate Freeze the Sustainable Growth Rate Grow Sustainable Growth Rate at Medicare Economic Index Adopt the Bowles-Simpson Fiscal Commission Recommendations for the Sustainable Growth Rate $320B $380B $280B $1,130B

Reduce Spending Related to the Nuclear -$80B Arsenal Reduce US Navy Fleet to 230 Ships Increase Homeland Security Spending Troop Levels Increase Number of Troops by 46,000 Reverse 'Grow the Army' Initiative $80B -$110B -$170B $60B

CRFB.org Stabilize the Debt Simulator: Your choices in blue.

Domestic Social & Economic Spending

Restart the NASA Moon Mission and Create a $160B Moon Colony Enact New Jobs Bill Highway Funding Limit Highway Funding and Increase Fees for -$130B Aviation Security Enact Increased Transportation Funding $260B Block Grant Food Stamps and Reduce to 2008 -$180B Levels Cut Temporary Assistance to Needy Families (TANF) Program Cut Federal Funding of K-12 Education by 25% Eliminate the New Markets Tax Credit Cut School Breakfast Programs Increase Education Funding by $10 Billion Each Year -$30B -$80B -$50B -$40B $130B $300B

Social Security

Raise the Normal Retirement Age to 68 Slow Initial Benefit Growth Gradually Reduce Scheduled Benefits -$140B Progressively Reduce Benefits, Protecting Low -$40B and Middle Income Earners Progressively Reduce Benefits, Protecting Low -$90B Income Earners Use an Alternate Measure of Inflation for COLA -$110B Reduce Spousal Benefits from 50% to 33% Increase Years Used to Calculate Benefits Include All New State and Local Workers Institute a Minimum Benefit -$20B -$50B -$100B $200B -$160B

Double Funding on Adoption and Foster Care $80B

CRFB.org Stabilize the Debt Simulator: Your choices in blue.

Healthcare

Modify Health Care Reform Law Establish a Public Option in the Health Exchanges Repeal Insurance Mandate Repeal Entire Legislation Repeal Legislation, but Keep Medicare/Medicaid Cuts Increase Cost Sharing for Medicare Raise Medicare Premiums to 35% of Costs Require Manufacturers to Pay a Minimum Drug Rebate for Medicare Low-Income Beneficiaries Enact Medical Malpractice Reform Increase Medicare Retirement Age to 67 Replace Traditional Medicare with Premium Support Modify Federal Medicaid Funding to States Reduce the Floor on Federal Matching Rates for -$160B Medicaid Block Grant Medicaid and Grow With Inflation Plus Population Growth -$300B -$100B -$330B $80B -$700B -$130B -$190B -$110B -$50B -$140B -$150B

Other Spending

Use the Chained CPI for Other Indexed Programs Reduce Federal Civilian Employee Pay Increases and Cap Increases in Military Pay Introduce Minimum Out-of-Pocket Requirements Under TRICARE for Life Reform Federal Retiree Benefits Reform Fannie Mae and Freddie Mac Reduce Farm Subsidies Expand Spending on Federal Research & Development Reduce Funding for the Arts & Humanties Increase Mass Transit Funding -$70B -$60B -$50B -$70B -$30B -$100B $110B -$10B $60B

CRFB.org Stabilize the Debt Simulator: Your choices in blue.

Revenue

Raise Tax Rates on Capital Gains Sell Certain Government Assets Impose a Financial Crisis Responsibility Fee Repeal LIFO Accounting Methods and Eliminate Oil and Gas Preferences in the Tax Code Enact Carbon Tax or Cap-and-Trade Increase Gas Tax by 10 Cents per Gallon Enact Five Percent VAT with Partial Rebate Eliminate Taxes on Capital Gains, Dividends and Interest for Families Earning Below $200,000 Impose a 5.6% Surtax on Income Above $1 Million Enact the Buffett Rule Raise Social Security Payroll Tax Cap Raise Cap to Cover 90% of Earnings -$410B Institute Two Percent Surtax on Earnings Above -$200B Cap Reduce Corporate Tax Rate to 30% Index Tax Code to Alternate Measure of Inflation Improve Tax Collection (Reduce Tax Gap) $410B -$50B -$10B -$60B -$80B -$80B -$150B

Tax Expenditures

Tax Fringe Benefits as Regular Income Gradually Phase Out Mortgage Interest Deduction Curtail State and Local Tax Deduction Eliminate Life Insurance Tax Benefits Curtail the Deduction for Charitable Giving -$410B -$120B -$490B $230B Make Research & Experimentation Tax Credit Permanent Cut the EITC and Child Tax Credit Expand the EITC and Child Tax Credit Extend American Opportunity Tax Credit -$540B -$160B Accelerate and Modify Excise Tax on HighCost Health Plans in 2013 Repeal Excise Tax on High-Cost Plans Replace Employer Health Care Exclusion with a Flat Credit (In Place of Excise Tax) -$80B -$240B -$590B -$280B -$180B $40B

Reinstate $400/person Making Work Pay Credit $530B -$80B $110B $50B -$60B $120B -$450B

Tax Treatment of Employer Sponsored Health Insurance

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Walmart, Amazon, EbayDocument2 pagesWalmart, Amazon, EbayRELAKU GMAILNo ratings yet

- DesalinationDocument4 pagesDesalinationsivasu1980aNo ratings yet

- An RambTel Monopole Presentation 280111Document29 pagesAn RambTel Monopole Presentation 280111Timmy SurarsoNo ratings yet

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingDocument75 pagesInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspNo ratings yet

- 1934 PARIS AIRSHOW REPORT - Part1 PDFDocument11 pages1934 PARIS AIRSHOW REPORT - Part1 PDFstarsalingsoul8000No ratings yet

- Catalog Celule Siemens 8DJHDocument80 pagesCatalog Celule Siemens 8DJHAlexandru HalauNo ratings yet

- Configuring Master Data Governance For Customer - SAP DocumentationDocument17 pagesConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNo ratings yet

- Condition Monitoring of Steam Turbines by Performance AnalysisDocument25 pagesCondition Monitoring of Steam Turbines by Performance Analysisabuhurairaqazi100% (1)

- Brand Positioning of PepsiCoDocument9 pagesBrand Positioning of PepsiCoAbhishek DhawanNo ratings yet

- Microwave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDocument28 pagesMicrowave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDominico Delven YapinskiNo ratings yet

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Document16 pagesOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoNo ratings yet

- TSR KuDocument16 pagesTSR KuAngsaNo ratings yet

- Subqueries-and-JOINs-ExercisesDocument7 pagesSubqueries-and-JOINs-ExerciseserlanNo ratings yet

- SND Kod Dt2Document12 pagesSND Kod Dt2arturshenikNo ratings yet

- Ces Presentation 08 23 23Document13 pagesCes Presentation 08 23 23api-317062486No ratings yet

- 48 Volt Battery ChargerDocument5 pages48 Volt Battery ChargerpradeeepgargNo ratings yet

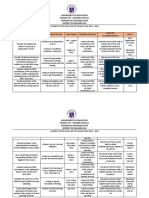

- Action Plan Lis 2021-2022Document3 pagesAction Plan Lis 2021-2022Vervie BingalogNo ratings yet

- Wiley Chapter 11 Depreciation Impairments and DepletionDocument43 pagesWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇No ratings yet

- CDKR Web v0.2rcDocument3 pagesCDKR Web v0.2rcAGUSTIN SEVERINONo ratings yet

- 6 V 6 PlexiDocument8 pages6 V 6 PlexiFlyinGaitNo ratings yet

- 1400 Service Manual2Document40 pages1400 Service Manual2Gabriel Catanescu100% (1)

- Basics: Define The Task of Having Braking System in A VehicleDocument27 pagesBasics: Define The Task of Having Braking System in A VehiclearupNo ratings yet

- Escario Vs NLRCDocument10 pagesEscario Vs NLRCnat_wmsu2010No ratings yet

- MRT Mrte MRTFDocument24 pagesMRT Mrte MRTFJonathan MoraNo ratings yet

- Vangood Quotation - Refrigerator Part - 2023.3.2Document5 pagesVangood Quotation - Refrigerator Part - 2023.3.2Enmanuel Jossue Artigas VillaNo ratings yet

- The Electricity Act - 2003Document84 pagesThe Electricity Act - 2003Anshul PandeyNo ratings yet

- As 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsDocument8 pagesAs 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsSAI Global - APACNo ratings yet

- Algorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésDocument298 pagesAlgorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésSerges KeouNo ratings yet

- COOKERY10 Q2W4 10p LATOJA SPTVEDocument10 pagesCOOKERY10 Q2W4 10p LATOJA SPTVECritt GogolinNo ratings yet

- Powerpoint Presentation: Calcium Sulphate in Cement ManufactureDocument7 pagesPowerpoint Presentation: Calcium Sulphate in Cement ManufactureDhruv PrajapatiNo ratings yet