Professional Documents

Culture Documents

Reimbursement Form Medical Expenses

Uploaded by

emi2012Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reimbursement Form Medical Expenses

Uploaded by

emi2012Copyright:

Available Formats

Copyright Envision SBS. 2007. All rights reserved.

Protected by the copyright laws of the United States & Canada and by international treaties. IT IS ILLEGAL AND STRICTLY PROHIBITED TO DISTRIBUTE, PUBLISH, OFFER FOR SALE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR DIGITAL FORM. ALL OFFENDERS WILL BE SUED IN A COURT OF LAW.

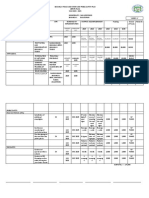

HEALTH EXPENSES REIMBURSEMENT FORM

IDENTIFICATION Employee Name: Social Security Number: Employee Number: Position/Title: Phone: Date: Email: Dept:

Copyright BizTree. 2006. All rights reserved. Protected by the copyright laws of the United States and Canada and by international treaties. IT IS ILLEGAL AND STRICTLY PROHIBITED TO DISTRIBUTE, PUBLISH, OFFER FOR SALE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR DIGITAL FORM. ALL OFFENDERS WILL AUTOMATICALLY BE SUED IN A COURT OF LAW.

MEDICAL EXPENSES Date of Service Physician or other Provider Amount

TOTAL MEDICAL EXPENSES TO BE REIMBURSED

I have HEALTH insurance: Yes No DENTAL insurance: Yes No VISION Insurance: Yes No

DEPENDENT/CHILD CARE EXPENSES Name of Dependent Care Provider: Address of Provider: Name of Dependent(s): Services Amount: TOTAL DEPENDENT EXPENSES TO BE REIMBURSED Signature of Care Provider Date: From: From: From: To: To: To: Amount: Amount: Providers Taxpayer ID#

I certify that the statement and information on this reimbursement form are accurate and true. I also certify that I am claiming reimbursement for only eligible expenses incurred during the plan year and only for eligible plan participants. I certify that these expenses have not been or will not be reimbursed under this or any other benefit plan. I further certify I will not claim these, or any other expenses reimbursed through this plan, as an income tax deduction and I assume all liability for taxes and penalties out of any disallowed deduction/credit. Employee Signature: Date:

*If you DO NOT have a receipt your claim will not be reimbursed unless your daycare provider has signed this form.

FOR ADMINISTRATIVE USE ONLY Reviewed By: Date: Plan Year: Approved: $ Denied: $

Copyright Envision SBS. 2007. All rights reserved. Protected by the copyright laws of the United States & Canada and by international treaties. IT IS ILLEGAL AND STRICTLY PROHIBITED TO DISTRIBUTE, PUBLISH, OFFER FOR SALE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR DIGITAL FORM. ALL OFFENDERS WILL BE SUED IN A COURT OF LAW.

Reason for Denial:

Action:

Copyright BizTree. 2006. All rights reserved. Protected by the copyright laws of the United States and Canada and by international treaties. IT IS ILLEGAL AND STRICTLY PROHIBITED TO DISTRIBUTE, PUBLISH, OFFER FOR SALE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR DIGITAL FORM. ALL OFFENDERS WILL AUTOMATICALLY BE SUED IN A COURT OF LAW.

INSTRUCTIONS FOR MEDICAL AND DEPENDENT CARE REIMBURSEMENT ACCOUNTS

Only employees participating in the plan can submit a reimbursement form; employees may be reimbursed from the plan at any time during the plan year. Reimbursements may only be made for eligible expenses incurred during the plan year. Complete the information on the reimbursement form for each amount claimed. If you receive reimbursement for expenses, you may not claim these expenses for income tax purposes. You must sign the form, thereby swearing that you have not and will not submit these expenses for reimbursement from another plan.

MEDICAL REIMBURSEMENT ACCOUNT

Documentation must be invoices or other written statements from the third parties that provided the services. The documentation must show the providers name and address, the dates the services were provided, the amounts charged for the services, and a brief description of the services. For services that you have insurance coverage, you MUST submit the Explanation of Benefits from your insurance company. In general, the types of expenses for medical services that can be reimbursed by the Plan are the same types of expenses that the Internal Revenue Service would allow for the health expense deduction under Internal Revenue Code Section 213. Further information can be found by obtaining IRS Publication 502 by calling 1-800-829-3676.

DEPENDENT CARE REIMBUSEMENT ACCOUNT

You may have your provider sign the claim form in the appropriate place or attach a separate receipt from you provider. You must show the name, address, and tax identification number of the provider, the dates the services were provided and the amounts charged for the services. If your expenses qualify for reimbursement from the Plan, you will be reimbursed for the total of your expenses, but not more than your account balance in the Plan. Your account balance is the total of the deposits youve made into your Dependent Care Flexible Spending Account minus the reimbursements youve received.

Copyright Envision SBS. 2007. All rights reserved. Protected by the copyright laws of the United States & Canada and by international treaties. IT IS ILLEGAL AND STRICTLY PROHIBITED TO DISTRIBUTE, PUBLISH, OFFER FOR SALE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR DIGITAL FORM. ALL OFFENDERS WILL BE SUED IN A COURT OF LAW.

In general, the types of expenses for dependent care services which can be reimbursed by the Plan are the same type of expenses which the Internal Revenue Service would consider for the dependent care tax credit as employment-related expenses under Internal Revenue Service Code Section 21(b)(2). Further information can be found by obtaining IRS Publication 503 by calling 1-800-829-3676.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Wilson Family Peach FarmDocument29 pagesWilson Family Peach Farmemi2012No ratings yet

- Employee Share Purchase PlanDocument8 pagesEmployee Share Purchase Planemi2012No ratings yet

- Salad GardensDocument26 pagesSalad Gardensemi2012No ratings yet

- Health Reimbursement Arrangement Plan-HraDocument7 pagesHealth Reimbursement Arrangement Plan-Hraemi2012No ratings yet

- Comp en Sable Work ChartDocument3 pagesComp en Sable Work Chartemi2012No ratings yet

- Executive Medical Reimbursement PlanDocument2 pagesExecutive Medical Reimbursement Planemi2012No ratings yet

- FynbosfarmDocument28 pagesFynbosfarmemi2012No ratings yet

- Farmers GroupDocument29 pagesFarmers Groupemi2012No ratings yet

- Checklist Workers Compensation ClaimsDocument8 pagesChecklist Workers Compensation Claimsemi2012No ratings yet

- Botanical BountyDocument29 pagesBotanical Bountyemi2012No ratings yet

- Botanical BountyDocument29 pagesBotanical Bountyemi2012No ratings yet

- Acceptance of ResignationDocument1 pageAcceptance of Resignationemi2012No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Science 6-Q1-M6Document14 pagesScience 6-Q1-M6John Philip LegaspiNo ratings yet

- Breading Guide To All FoodDocument1 pageBreading Guide To All FoodInno EspinaNo ratings yet

- Chronic Pain GuidelinesDocument56 pagesChronic Pain GuidelinesOporadhBiggan100% (1)

- Amnesia With Focus On Post Traumatic AmnesiaDocument27 pagesAmnesia With Focus On Post Traumatic AmnesiaWilliam ClemmonsNo ratings yet

- Annotated Bibliography Graphic OrganizerDocument4 pagesAnnotated Bibliography Graphic Organizerapi-348035481No ratings yet

- A Humanistic Approach To Medical PracticeDocument3 pagesA Humanistic Approach To Medical PracticeFilipos ConstantinNo ratings yet

- Greenhouse Effect: Greenhouse Gases and Their Impact On Global WarmingDocument9 pagesGreenhouse Effect: Greenhouse Gases and Their Impact On Global WarmingrabiulNo ratings yet

- Auxiliary Range: CLR - High Speed Trip Lockout RelayDocument2 pagesAuxiliary Range: CLR - High Speed Trip Lockout Relaydave chaudhuryNo ratings yet

- List of Personnel Benefits Granted by The SchoolDocument8 pagesList of Personnel Benefits Granted by The SchoolAspci Assumption Passi100% (1)

- A1 Tuv Dosimetry Application Form For Email (Effective 25 October 2019) 3Document2 pagesA1 Tuv Dosimetry Application Form For Email (Effective 25 October 2019) 3Shaira May Flores PalmaNo ratings yet

- Food Sample Test For Procedure Observation InferenceDocument2 pagesFood Sample Test For Procedure Observation InferenceMismah Binti Tassa YanaNo ratings yet

- Seizure Acute ManagementDocument29 pagesSeizure Acute ManagementFridayana SekaiNo ratings yet

- GP Series Portable Generator: Owner's ManualDocument48 pagesGP Series Portable Generator: Owner's ManualWilliam Medina CondorNo ratings yet

- Cabuyao Integrated National High School: The Problem and Its BackgroundDocument4 pagesCabuyao Integrated National High School: The Problem and Its BackgroundJohn Carlo MolinaNo ratings yet

- Barangay Peace and Order and Public Safety Plan Bpops Annex ADocument3 pagesBarangay Peace and Order and Public Safety Plan Bpops Annex AImee CorreaNo ratings yet

- Sample MCQ Mec201Document10 pagesSample MCQ Mec201UjjalKalitaNo ratings yet

- embragues-INTORK KBK14800 Erhsa2013 PDFDocument56 pagesembragues-INTORK KBK14800 Erhsa2013 PDFPablo RuizNo ratings yet

- Portfolio FOR ANADocument6 pagesPortfolio FOR ANAholdap toNo ratings yet

- Registration Hike2help 15Document2 pagesRegistration Hike2help 15api-275580337No ratings yet

- Strategies and Tactics for Collecting on Overdue AccountsDocument9 pagesStrategies and Tactics for Collecting on Overdue AccountsAkii WingNo ratings yet

- IEC60947 3 Approved PDFDocument3 pagesIEC60947 3 Approved PDFosmpotNo ratings yet

- Gas Booster Systems Brochure r7Document12 pagesGas Booster Systems Brochure r7ridwansaungnage_5580No ratings yet

- Design of Low Cost, Energy Efficient, IotDocument6 pagesDesign of Low Cost, Energy Efficient, IotRulemaker Studios OfficialNo ratings yet

- (Distracted Subjects) CHAPTER 2. Reading The Language of Distraction - Hamlet, Macbeth, King LearDocument23 pages(Distracted Subjects) CHAPTER 2. Reading The Language of Distraction - Hamlet, Macbeth, King LearLCAP ConsultingNo ratings yet

- CN LSHC The Future of Pharmacy en 031120Document8 pagesCN LSHC The Future of Pharmacy en 031120marina_netNo ratings yet

- DepEd Region I Summative Test in Cookery 9Document2 pagesDepEd Region I Summative Test in Cookery 9Jessel Mejia OnzaNo ratings yet

- Ganga Pollution CasesDocument3 pagesGanga Pollution CasesRuchita KaundalNo ratings yet

- Arthropods: A Guide to the Diverse PhylumDocument10 pagesArthropods: A Guide to the Diverse Phylumpkkalai112No ratings yet

- Agri & Food Processing - Biscuit Manufacturing UnitDocument6 pagesAgri & Food Processing - Biscuit Manufacturing Unitvijayind2006No ratings yet

- BrochureDocument2 pagesBrochureRajib DasNo ratings yet