Professional Documents

Culture Documents

Simple Vs Comp

Uploaded by

Löshini Priscilla EgbunikeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simple Vs Comp

Uploaded by

Löshini Priscilla EgbunikeCopyright:

Available Formats

Simple Interest Simple Interest is the interest paid on the original principle only.

Simpe Interest ignore the time value of money. Simple interest is generally charged on short-term loans. The growth of interest with simple interest calculation is constant. Simple Interst Computed: Year 1 2 3 4 Deposit at Start RM 400 RM 400 RM 400 RM 400 Interest Earned 10% of RM 400 = RM 40 10% of RM 400 = RM 40 10% of RM 400 = RM 40 10% of RM 400 = RM 40 Total Interest = RM 160 Amount RM 440 RM 480 RM 520 RM 560

Compound Interest Compound interest is where the interest earned is added back to the previous principle. Compound interest is generally charged for long-term loans. Time value of money is important (can be compounded quarterly, semi-annually, or annually). The growth of interest with compound interest calculation is exponential because the principal is getting bigger each period. Compound Interest Computed: Year 1 2 3 4 Deposit at Start RM 400 RM 440 RM 484 RM 532.40 Interest Earned 10% of RM 400 = RM 40 10% of RM 440 = RM 44 10% of RM484 = RM 48.40 10% of RM 532.40 = RM 53.20 Total Interest = RM 185.60 Simple interest is an inappropriate way to measure interest that is paid directly into a saving account because it ignores the overall return on investments. The interest is paid only on the account's principal and not on any interest that has been already accrued.Compound interest may be directly charged to savings accounts by banks at different intervals, for example, some savings accounts apply daily interest at monthly, quarterly or annually intervals. The compounded interest that the bank is paying is calculated on the original principal plus all the interest that has been accumulated for that period. Simple payback fails to truly capture the date when a project or its investment costs are recouped because it ignores the time value of money. In this kind of calculation, the time value of money refers to the potential to earn interest in another manner such as a savings account. Simple Amount RM 440 RM 484 RM 532.40 RM 586.60

interest is a disadvantage to savings account as it is used for a shorter duration of time, as example, a period of less than a year, like 40 days or 60 days and this in result does not allow the growth of working money.Compounding amplifies the growth of the working money. The larger the savings and the longer a persons leave it to compound or reinvest, the potential of earnings will be more. It is common to see simple interest applied to transactions accounts such as loan products, mortgages and personal loans and not to savings accounts. A bank account that offers only simple interest, where money can freely and easily be withdrawn at ATM or debit machines from is unlikely, since withdrawing money and immediately depositing it again would be advantageous. Saving accounts discourages withdrawals and are not for daily use as most of them require a minimum balance and will offer incentives if a person stay above it.

(c) Given P = RM 8 000 r = 9 % = 9/100 = 0.09 t = 2 years Y, additional fees by lender = RM 160 Using Formula:

I = Prt + Y

I = ( 8 000 ) ( 0.09 ) ( 2 ) + 160 I = 1 440 + 160 I = 1 600 for 2 years 1 600 2 = RM 800 per year

800 = 0.1 = 10 % rate 8 000

or I = Prt 1 600 = ( 8 000 ) ( r ) ( 2) 1 600 = 16 000 r

r=

1600 16 000

r = 0.1 r = 10 % rate

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Payment Schedule: Computation Sheet Bank FinancingDocument3 pagesPayment Schedule: Computation Sheet Bank FinancingJam SarimosNo ratings yet

- Myjobmag-Banking-Entry Level-CVDocument1 pageMyjobmag-Banking-Entry Level-CVkassimmakoy05No ratings yet

- Credit RatingDocument18 pagesCredit Ratingrameshmba100% (10)

- Ayukoben AyambaDocument41 pagesAyukoben AyambaLoveline Manong FombeleNo ratings yet

- Blank Quiz q2 WK 1 Written WorksDocument4 pagesBlank Quiz q2 WK 1 Written WorksDeanna Kate Balais100% (1)

- ICEA Annuity Proposal FormDocument2 pagesICEA Annuity Proposal Formkevin muchungaNo ratings yet

- Accounting ChapterDocument66 pagesAccounting ChapterBrisa MasiniNo ratings yet

- The Hydrogenics Case Is The First in A Series ofDocument2 pagesThe Hydrogenics Case Is The First in A Series ofAmit PandeyNo ratings yet

- Department of Education: Region IX, Zamboanga Peninsula Division of Zamboanga City Tolosa, Zamboanga CityDocument1 pageDepartment of Education: Region IX, Zamboanga Peninsula Division of Zamboanga City Tolosa, Zamboanga CityRay FaustinoNo ratings yet

- Account Statement: Generated On Sunday, April 16, 2023 6:05:49 AMDocument1 pageAccount Statement: Generated On Sunday, April 16, 2023 6:05:49 AMPatience AkpanNo ratings yet

- Account Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNarendra SaiNo ratings yet

- Resume Internal Audit and Enterprise GovernanceDocument6 pagesResume Internal Audit and Enterprise GovernanceAnnisa Rahman DhitaNo ratings yet

- Final Question Bank With Answers - Treasury Management-Final ExamDocument7 pagesFinal Question Bank With Answers - Treasury Management-Final ExamHarsh MaheshwariNo ratings yet

- IES-Template For Preparing Cover LetterDocument1 pageIES-Template For Preparing Cover LetterkizztarNo ratings yet

- State Bank of India: Application Form Atm Transaction DisputeDocument6 pagesState Bank of India: Application Form Atm Transaction DisputeSandeep YadavNo ratings yet

- Test Paper CA Final TpdtaaDocument3 pagesTest Paper CA Final TpdtaayeidaindschemeNo ratings yet

- Computations For Budgeted Figures in The Master Budget-Trading ConcernDocument2 pagesComputations For Budgeted Figures in The Master Budget-Trading ConcernZackie LouisaNo ratings yet

- ICDS - 9 Borrowing CostDocument15 pagesICDS - 9 Borrowing Costkavita.m.yadavNo ratings yet

- HUF FormatsDocument2 pagesHUF FormatsVinay TotlaNo ratings yet

- Sdlkfjasd LFKDocument66 pagesSdlkfjasd LFKTerryLasutNo ratings yet

- Statement 20230202Document10 pagesStatement 20230202philip balsomNo ratings yet

- Retail BankingDocument9 pagesRetail BankingBebin RoseNo ratings yet

- Risk and InsuranceDocument63 pagesRisk and InsuranceGuruKPO100% (2)

- Advocates For Truth in Lending, Inc. vs. Bangko Sentral Monetary BoardDocument2 pagesAdvocates For Truth in Lending, Inc. vs. Bangko Sentral Monetary BoardylourahNo ratings yet

- G Dividend PolicyDocument7 pagesG Dividend PolicySweeti JaiswalNo ratings yet

- ch9 1Document33 pagesch9 1Sai Karthik BaggamNo ratings yet

- Lecture Guide 15 - KeyDocument5 pagesLecture Guide 15 - KeyFrancis VirayNo ratings yet

- IFP From ScotiaDocument11 pagesIFP From ScotiaForexliveNo ratings yet

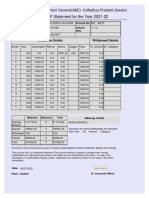

- GPF Statement For The Year 2021-22: O/o The Pr. Accountant General (A&E) - II, Madhya Pradesh, GwaliorDocument1 pageGPF Statement For The Year 2021-22: O/o The Pr. Accountant General (A&E) - II, Madhya Pradesh, GwaliorSHIVGOPAL KULHADENo ratings yet

- Balance StatementDocument4 pagesBalance StatementVitor BinghamNo ratings yet