Professional Documents

Culture Documents

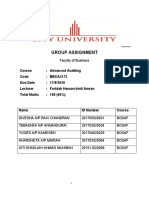

Hand Outs

Uploaded by

Jayson Berja de LeonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hand Outs

Uploaded by

Jayson Berja de LeonCopyright:

Available Formats

INTRODUCTION Good governance is perhaps the single most important factor in eradicating poverty and promoting development.

-UN Secretary-General Kofi AnnanGood governance has long been a subject of discussion in the international field, and particularly in the field of development assistance. Certainly, good governance is pivotal to the development process. The central significance of good governance to all sectors of the economy is now clearer than ever. The crisis which beleaguered our financial system has highlighted how perilous a tick-box approach can be. Truly good governance has to be lived. Each and every trustee and board member needs to embrace its values, and apply them to the particular needs and circumstances of their organization. Lately the terms governance and good governance are being increasingly used in development literature. Bad governance is being increasingly regarded as one of the root causes of all evil within our societies. Main donors and international financial institutions are increasingly basing their aid and loans on the condition that reforms that ensure "good governance" are undertaken. In this light, this paper explores the contention that the concept of good governance and corporate governance as well, how to improve credibility and explicitly discuss studies and relevant cases in local and international scene. GOOD GOVERNANCE Governance defined Definitions of governance by leading institutions and studies converge on the term as referring to a process by which power is exercised. Governance is the exercise of power or authority political, economic, administrative or otherwise to manage a country's resources and affairs. It comprises the mechanisms, processes and institutions through which citizens and groups articulate their interests, exercise their legal rights, meet their obligations and mediate their differences.( Wikipedia) UNDP: Governance is viewed as the exercise of economic, political and administrative authority to manage a countrys affairs at all levels. It comprises mechanisms, processes and institutions through which citizens and groups articulate their interests, exercise their legal rights, meet their obligations and mediate their differences. (UNDP 1997); World Bank: Governance is defined as the manner in which power is exercised in the management of a countrys economic and social resources. The World Bank has identified three distinct aspects of governance: (i) the form of political regime; (ii) the process by which authority is exercised in the management of a countrys economic and social resources for development; and (iii) the capacity of governments to design, formulate, and implement policies and discharge functions. (World Bank, 1997); OECD: The concept of governance denotes the use of political authority and exercise of control in a society in relation to the management of its resources for social and economic development. This broad definition encompasses the role of public authorities in establishing the environment in which economic operators function and in determining the distribution of benefits as well as the nature of the relationship between the ruler and the ruled. (OECD DAC, 1995); DFID: The Department for International Development adopts the same approach to governance as that provided by the OECD's Development Assistance Committee (DAC), which identifies four key elements in governance: Legitimacy of government (political systems) Accountability of political and official elements of government (public Evolving debates on GOVERNANCE Governance nowadays occupies a central stage in the development discourse but is also considered as the crucial element to be incorporated in the development strategy. However, apart from the universal acceptance of its importance, differences prevail in respect of theoretical formulations, policy prescriptions and conceptualization of the subject itself. Governance as a theoretical construct, separate from the theory of state, is not only in an embryonic stage, but its formulation also differs among researchers depending on their ideological convictions. Policy analysis based empirically on the historical experiences of governance gives prominence to government failures to deliver, leading to propositions for downsizing or rightsizing, while policy prescriptions for good governance take an evolutionary view of the matter questioning relevance of public sector management of certain activities in a changed context. Good governance is the term that symbolizes the paradigm shift of the role of governments. Moreover, governance is not only about the organs or actors as affirmed by Hasnat Abdul Hye. More importantly, it is about the quality of governance, which expresses itself through elements and dimensions, which will be listed in this study. Nevertheless, he states that: Just as the dancer cannot be separated from the dance, the organs or actors executing governance in their respective spheres cannot be relegated to the background. Good Governance defined Good governance means competent management of a countrys resources and affairs in a manner that is open, transparent, accountable, equitable and responsive to peoples needs. (Investopedia)

In general, good governance is perceived as a normative principle of administrative law, which obliges the State to perform its functions in a manner that promotes the values of efficiency, no corruptibility, and responsiveness to civil society. It is therefore a principle that is largely associated with statecraft. While the government is not obliged to substantively deliver any public goods, it must ensure that the processes for the identification and delivery of such goods are concrete in terms of i) being responsive to public demands; ii) being transparent in the allocation of resources and; iii) being equitable in the distribution of goods. The principle of good governance has also been espoused in the context of the internal operations of private sector organisations. In this way, corporate decision-making strategies integrate the principle of good governance and ensure that shareholder interests (i.e. public limited companies) and employees are taken into account. The legal meaning of the principle of good governance The concept of good governance as developed by the World Bank is essentially a touch stone upon which the prevailing administrative structure of a given country can be measured. Consequently, it provides ample evidence of the robustness of the structural suitability of donors as efficient vehicles of multilateral aid investment to developing countries. Good governance is therefore chiefly envisaged as a set of procedural tools to guarantee the efficacious improvement of the donor identified subject. Politically, however, the principle of good governance has not been very well received. For instance, governments may be reluctant to be held accountable to donor agencies, and they may sometimes display widespread hostility against such agencies (or other bodies) that are construed to be interfering in their (sovereign) domestic affairs.50 The real or imagined fears have stemmed mainly from the fact that the term good governance has largely been identified with liberalism and laissez-faire policies common in most developed countries. Further, the usage of the term good derives primarily from subjective interpretations especially in the context of large multicultural and diverse economies that characterize the developing world. The concept of good governance, as invented and applied by the World Bank, is a convenient term that refers to the entire gamut of political and economic frameworks. The term has been largely validated within political science and theories of economic prudence, albeit under a different rubric. Thus the rule of law, transparency and accountability represent indisputable principles of sound governance whose origin is steeped in the tradition of liberal political theory. Perhaps the rapid, widespread popularity and acceptance of the concept --- at least among donor agencies --- can be attributed to its historical roots. Notwithstanding the contemporary global and dynamic nature of the donor community, it is not surprising that the concept of good governance has largely been internalized as the principle criteria for extending international loans and aid investment. The origin of good governance, particularly with respect to its construction and application, has resulted in various legal repercussions. Good governance has primarily been constructed as an aid criterion, and has consequently been procedural in nature. For instance, good governance focuses on the presence of governmental institutions rather than on their performance. The Central Vigilance Commission in India per se is a good example of checking against corruption. It follows that the Commissions mandate would be to ensure that the mechanisms and systems of delivery are in place in order to facilitate the efficient disbursement of development assistance. In this instance, since good governance has generally been equated with aid criterion, nation States have been unduly burdened with loans in order to ensure that the delivery mechanisms are established prior to the release of the loan amount. This scenario illustrates how good governance that is primarily driven by donor interests will not be as deep-rooted as those circumstances involving domestic political imperatives per se. The example further highlights how linking the concept of good governance to mechanisms or systems exclusively can serve to undermine its substantive content and result in its diminished meaning.

Good Governance, A Good Society and Development Good governance is an essential precondition for sustainable development. Various countries that are quite similar in terms of their natural resources and social structure have shown strikingly different performance in improving the welfare of their people. Much of this is attributable to standards of governance. Poor governance stifles and impedes development. In countries where there is corruption, poor control of public funds, lack of accountability, abuses of human rights and excessive military influence, development inevitably suffers. A landmark study by the World Bank, Assessing Aid What Works, What Doesnt and Why (1998), demonstrated the crucial role that good governance plays in enhancing the effectiveness of aid. The study found that where there is sound country management, an additional one per cent of GDP in aid translates into a one per cent decline in poverty and a similar decline in infant mortality whereas in a weak policy and management environment aid has much less impact. Findings like this clearly indicate that the returns from development assistance are generally Greater in developing countries characterized by good governance. One element of good governance that is needed for sustained development is an economy that operates in an ethical, accountable and appropriately regulated environment, which facilitates competition in the marketplace. Without this, there will be no driver for economic growth and sustainable development will not be possible. A dynamic private sector, operating in a properly functioning competitive market system, creates jobs and income, generates wealth and helps ensure that resources are used efficiently. (Good Governance Guiding principles for implementation, 2000) Good Governance through development Assistance While good governance can enhance the effectiveness of development assistance, development assistance can itself play a role in enhancing governance in developing countries. Specifically, donor assistance can support developing countries in:

improving economic and financial management strengthening law and justice increasing public sector effectiveness developing civil society.

The Elements of Good Governance A number of multilateral organizations including the United Nations Development Programme and the World Bank have reflected on the elements of good governance, and on their relation to development. As the experiences of these organizations vary, so, too, do their perceptions of what constitutes good governance. In its report, Governance for Sustainable Human Development, the UNDP acknowledges the following as core characteristics of good governance. Core Characteristics of Good Governance 1) Participation -All men and women should have a voice in decision-making, either directly or through legitimate intermediate institutions that represent their interests. Such broad participation is built on freedom of association and speech, as well as capacities to participate constructively 2) Rule of law - Legal frameworks should be fair and enforced impartially, particularly the laws on human rights 3) Transparency - Transparency is built on the free flow of information. Processes, institutions and information are directly accessible to those concerned with them, and enough information is provided to understand and monitor them 4) Responsiveness - Institutions and processes try to serve all stakeholders 5) Consensus orientation - Good governance mediates differing interests to reach a broad consensus on what is in the best interest of the group and, where possible, on policies and procedures 6) Equity - All men and women have opportunities to improve or maintain their wellbeing 7) Effectiveness and efficiency - Processes and institutions produce results that meet needs while making the best use of resources 8) Accountability - Decision-makers in government, the private sector and civil society organizations are accountable to the public, as well as to institutional stakeholders. This accountability differs depending on the organization and whether the decision is internal or external to an organization 9) Strategic vision - Leaders and the public have a broad and long-term perspective on good governance and human development, along with a sense of what is needed for such development. There is also an understanding of the historical, cultural and social complexities in which that perspective is grounded. The Tenets of Good Governance

CORPORATE GOVERNANCE In a more globalized, interconnected and competitive world, the way that environmental, social and corporate governance issu es are managed is part of companies overall management quality needed to compete successfully. Companies that perform better with regard to these issues can increase shareholder value by, for example, properly managing risks, anticipating regulatory actio n or accessing new markets while at the same time contributing to the sustainable development of the societies in which they operate. Moreover these issues can have a strong impact on reputation and brands, an increasingly important part of company value. --Who Cares Wins: Connecting Financial Markets to a Changing World, p. i, UN Global Compact, 2004. Corporate governance reform has emerged as a critical business issue, thrust on the world stage by a number of high profile corporate failures. While many regulatory efforts are underway to identify and codify good governance practices to rebuild public and market trust, there are a parallel number of efforts to map out the social and environmental non-financial boundaries of corporate governance. The UN Global Compacts 2004 report, Who Cares Wins, which looks at the social, environmental and governance issues that can have a material impact on corporate financial performance, is one of many recent reports investigating the links between social, environmental and governance practices. Corporate governance is going beyond the traditional core governance functions to incorporate the values dimension. Part of the governance process is determining what kind of corporate citizen the company seeks to be; CSR is part of this exercise. According to this group, governance has largely been a box-ticking exercise to date. However, there is an emerging paradigm of governance that perceives CSR and corporate governance to be one and the same at the level of values: an ethical strand joins governance with CSR thinking. Governance must have an ethical backbone because good governance practiced as a technical exercise results in Enron, considered by many to be a shining star in terms of technical governance. Ethical or values-based governance considers such issues as the kind of product and Corporate Governance defined The framework of rules and practices by which a board of directors ensures accountability, fairness, and transparency in a company's relationship with its all stakeholders (financiers, customers, management, employees, government, and the community). The corporate governance framework consists of (1) explicit and implicit contracts between the company and the stakeholders for distribution of responsibilities, rights, and rewards, (2) procedures for reconciling the sometimes conflicting interests of stakeholders in accordance with their duties, privileges, and roles, and (3) procedures for proper supervision, control, and information-flows to serve as a system of checks-and-balances. (Business-dictionary) Evolution of Corporate Governance Corporate Governance Evolution 2010 Updated version of the Ethical Code has been distributed to all Group employees through a specific internal communication campaign, now available in 22 languages New By Laws 2009 Adopted a new "Risk assessment and risk management" model Adopted the Group's "Whistle-blowing" procedure, a key tool for enforcing compliance with the Code 2007 Adhesion to all the recommendations contained in the new Self-Regulation Code for Listed Companies, published in March 2006 New procedure regarding the flow of information to Directors and Statutory Auditors, which in renewing the previous procedure for carrying out of obligations as per art. 150, first paragraph, Legislative Decree no. 58 of 1998, has the objective of guaranteeing a coordinated flow of information to the boards of directors and auditors New code on insider dealing which aims to establish in a self-regulatory way above and beyond governing laws and regulations obligations for abstaining, in certain periods of the year ( so-called black-out periods ), from carrying out transactions on financial instruments of the Company, applying to directors, statutory auditors, and managers of Pirelli & C. or its main subsidiaries with strategic responsibility. 2006 Self-evaluation of the Board of Directors Performance (officially called a "Board performance evaluation"), thus adhering to international best practices and the provisions in the new Code of Conduct Adopted the Procedure for the Management and Public Disclosure of Inside Information for all the members of the corporate organs, the employees and the external collaborators of the Pirelli Group, who may access to inside information as well as to information which could become such 2005 Appointed a Lead Independent Director Appointed the new Board of Directors with one fifth of the members determined by the minorities and half of the Board members independent

2004 Amendment of the By Laws with the introduction of the Cumulative Vote and the possibility for minorities to appoint one fifth of the members of the Board of Directors Approved the "Regulations for Shareholders' Meetings" 2003 Conversion into Societ per Azioni (Public Limited Company) of Pirelli & C. Spa "Ethical Code" "231 Organizational Model" 2002 Adopted the "Code of Conduct for Insider Dealing" Adopted the "Procedure for compliance with the requirements of article 150 of the legislative decree 58/1998" Adopted of the "Rules of Conduct for effecting transactions with related parties" 1999 Adopted the "Corporate Governance Code" recommended by Borsa Italiana Established the "Committee for Internal Control and Corporate Governance" How to Improve Credibility Sustaining Corporate Credibility Preventing accidents before they occur is usually a topic that corporate management talks a great deal about but rarely implements any cohesive plan to help ensure that it happens. A firms corporate credibility is at stake when it outwardly promotes safety by posting signs that are within view of the public while behind the scenes, unreasonable pressure is placed on employees to get a job done as quickly as possible. Firms are finally beginning to realize that the double-talk is causing their insurance rates to rise. Companies with high levels of injuries are starting to see premiums go through the roof. To change a corporations safety practices, hence improving their corporate credibility, a company must address and change its training methods, equipment supplies and attitude. Training To implement a good training program, it must become clear to the employees that a firm is willing to give up productivity time to ensure safety. This is usually done in-house by hosting training sessions regularly. This can be an effective approach if the conferences are taken seriously and not done as a last minute, spontaneous event. Spur of the moment classes like this do not send a serious message. Another method is to bring in a third party or outside trainer. This adds to the appearance that the company is changing the way it views accidents on the job. Again, stress importance by having a well planned session. Equipment Spending the money on quality equipment is important. Not only is it more likely to actually prevent an accident, it again shows workers that the company is serious. Unfortunately, it is also important to have an adequate amount of equipment on hand. This does require investment in the short-term, but should result in cheaper insurance rates due to a reduced number of accidents on the job. Walk the Talk There is nothing more confusing to an employee than mixed messages. On Monday morning he sits in a safety meeting and is bombarded by safety signs all over the workplace and then by Monday afternoon he is asked by his superior to violate the rules in some way. This cannot happen. The firm must walk the talk. This means allow for the time to be safe. It may require things like adding an extra employee to a job or allowing enough time for an employee to implement expected safety practices. It is All About the Money The bottom line is that money is lost in various ways when your workplace safety practices dont result in a safer jobsite. Double-talk results in resentful employees, a lack of corporate credibility, and higher insurance rates. All three of these can cost your firm money one way or another. It is time to implement a new policy. Not only is it the right thing to do, it is also the smart thing to do. (http://www.dnbreputationmanagement.com/sustaining-corporate-credibility) The elements of Corporate Governance 1. 2. 3. 4. 5. 6. Honesty Trust and Integrity Openness Performance Orientation Responsibility and Accountability Mutual respect and Commitment to the organization Transparency versus Accountability

Transparency Transparency means that decisions taken and their enforcement are done in a manner that follows rules and regulations. It also means that information is freely available and directly accessible to those who will be affected by such decisions and their enforcement. It also means that enough information is provided and that it is provided in easily understandable forms and media. Accountability Accountability is a key requirement of good governance. Not only governmental institutions but also the private sector and civil society organizations must be accountable to the public and to their institutional stakeholders. Who is accountable to whom varies depending on whether decisions or actions taken are internal or external to an organization or institution. In general an organization or an institution is accountable to those who will be affected by its decisions or actions. Accountability cannot be enforced without transparency and the rule of law. Accountability versus Responsibility

A literature search highlights the fact that there doesnt seem to be clear and unanimous definition for each of these terms. In fact, a cursory look at dictionary.com clearly demonstrates the confusion where the definition for Accountability is explained also in terms of Responsibility, and vice versa. In Responsibility vs. Accountability, the authors suggest that Responsibility may be bestowed, but accountability must be taken. In other words, responsibility can be given or received, even assumed, but that doesnt automatically guarantee that personal accountability will be taken. Which means that its possible to bear responsibility for something or someone but still lack accountability. A good summary document by Michael L Smith and James Erwin, titled Role & Responsibility Charting (RACI) provides the breakthrough I was looking for. The authors make the following excellent observation: Managers and supervisors are not accountable for everything in their organization. Responsibility charting ensures accountability is placed with the person who really can be accountable for specific work. Often this results in accountabilities for actions being moved down to the most appropriate level. This is an important point. Accountability does not necessarily live at the very top but rather it is positioned at the most appropriate level, with the person who can be accountable for the work. The authors provide further elaboration on the definitions of Responsible and Accountable, as follows: The Accountable person is the individual who is ultimately answerable for the activity or decision. This includes yes or no authority and veto power. Only one Accountable person can be assigned to an action. The Responsible person is the individual(s) who actually complete the task. The Responsible person is responsible for action/implementation. Responsibility can be shared. The degree of responsibility is determined by the individual with the Accountability. Corporate Governance in International Scene and Local Scene Corporate governance has greatly evolved in importance as well as style since the stock market boom during the 1990s. In a market where the economy was in an up-trend, corporate governance hardly affected the value of a company. However, when the market collapsed, the importance of good governance became clear. Companies with efficient boards of directors can better thrive during difficult times. In fact, based on Business Weeks inaugural ranking of the best and worst boards in 1996, the stocks of companies with the best boards outperformed those with the worst boards by two to one. However, as the economy slowed in 2000, companies with the best boards retained much more of their value at 51.7% compared with -12.7% for the worst board companies.(1) With the recent eruption of the Enron case, corporate governance issues were revisited the world over. As the list of flailing large corporations, such as Tyco and WorldCom, grows, corporations are looking at how they can make their respective boards of directors more effective. For instance, Computer Associates International, Inc. (CA) recruited the Securities and Exchange Commissions (SEC) former top accountant for its audit committee and prohibited directors from selling stock until they leave. In addition to having a tarnished reputation for having paid US$1.1 billion to top executives four years ago, CA is currently undergoing investigation for its accounting practices.(2) Sanjay Kumar, CAs CEO, plans to save the company by improving its relationship with customers, investors and employees. He has set-up a 650-person customer-care organization and launched annual customer-satisfaction surveys, tying pay of 500 senior executives to the results. Furthermore, the companys accounting policies was slightly changed to allow the depreciation of software-license revenues to occur over the life of the contract compared to having recognized earnings when the deal was concluded. Finally, changes on the board of directors shall include expansion from eight to eleven members as well as retiring several veteran members and adding seven new independent directors. A lead outside director shall also be appointed and term limits shall also be set in place.(3) Similarly, Ericsson is facing problems in its operations as well as its ownership structure. Ericssons revenues for this year are expected to be 40% less than the US$24 billion two years ago. In order to remedy these problems, Ericssons CEO, Kurt Hellstrom, shall engage in outsourcing activities for its manufacturing and research and development operations as well as the companys software labs. Ericsson has also entered into a joint venture with Sony Corp. to produce a new line of mobile handsets that will offer both Ericssons technology and its links to wireless networks as well as Sonys talents in consumer electronics and marketing.

Hellstrom plans to repackage the company image into a wireless specialist that depends on service more than manufacturing, on know how more than metal, shifting the value from hardware to software and services. Finally, Ericsson may face problems recruiting investors in the future with its current ownership structure. Investor and Idustrivarden are two of the companys major shareholders and they control close to 78% of the votes at the company with only 11% of the equity. They have majority votes through special A shares that have 1,000 times the votes of ordinary B shares. A reduction in voting ratio from 1,000:1 to 10:1 between the A and B shares are being considered. This would reduce the two major shareholders votes to 30%.(4) Other corporations across the U.S., such as Apple Computer, Inc. and Qwest Communications International, have prohibited outside auditors from performing non-audit work for their companies. At Xerox Corp., three out of eight directors are sitting on too many boards and two members of their audit committee had attendance problems last year. At American International Group (AIG), the CEO, Maurice R. Greenberg, sits at the board of a private company that got US$77 million of AIGs business last year.(5) Similarly in Europe, three major corporations involved in their respective financial scandals have affirmed the need for corporate governance reforms. One of which is Vivendi, which has acquisitions in Seagram, Canal Plus, mp3.com, and Vizzavi. Vivendi, which was originally formed as a water company under the name Compagnie General des Eaux, has been accused of trying to hide US$1.5 billion worth of losses. Its share price dropped by 40% when it was revealed that Andersen was also responsible for the companys accounts.(6) Other European companies with scandalous affairs include ABB, an engineering firm and Elan, a pharmaceutical company that recently diversified into biotechnology. ABB was forced to shift to generally accepted accounting principles in October 2001 after which, it was revealed that 28% of its reported operating income was in fact from one-off sales. Furthermore, the companys exchairman, Percy Barnevik, gave himself a severance package of US$78 million without board approval while another board member received a pension of US$160 million. Elan, on the other hand, was involved in dubious accounting techniques and was responsible for a 16% drop in the Irish ISEQ market index. The company entered into agreements with 50 Qualified Special Purpose Entities, allowing Elan to sell future royalties in return for cash to inflate revenues. The U.S. SEC subpoenaed Credit Suisse and Morgan Stanley for their involvement in the special purpose entities scheme. Its Chairman and CEO, Donal Geaney, gave himself a salary and bonus amounting to US$2.99 million.(7) In the Philippines, corporate scandals did not lag behind the global trend in governance mishaps. Well-established companies from sugar mills to banks to gambling enterprises have been facing various cases of bankruptcy and audit issues. Among these include Urban Bank, which was forced to service approximately Php2.5 billion in withdrawals within a span of two weeks brought about by its recent downgrade from a universal bank to a thrift bank as a result of its failure to meet increased capitalization requirements. In a notice to the Philippine Stock Exchange (PSE), the bank reported withdrawals reaching Php4.5 billion in addition to the Php1 billion prior to its closure. The Bangko Sentral ng Pilipinas (BSP) finally ordered that the bank be placed under receivership by the Philippine Deposit Insurance Corporation. Also included in the receivership are Urban Development Bank, a thrift bank subsidiary of Urban Bank. In addition, Urbancorp Investment Corporation declared a suspension of payments and has requested the BSP and the SEC to appoint a rehabilitation receiver for the company.(8) In August 2001, the Export and Industry Bank and Urban Bank merged into Export and Import Bank allowing the resumption of operations in its central office in Makati as well as 25 branches around the country.(9) Victorias Milling Co. (Vicmico) dealt with audit issues surrounding lost inventory accumulating to 400,000 bags of sugar. The difference from doctored sugar content reports was a result of a deliberate attempt at misrepresentation to make the miller appear more efficient. The firm guaranteed varying amounts for cane per ton knowing that their crops are substandard as part of its marketing ploy to attract enough planters to keep the mill running all year round. Furthermore, SyCip Gorres Velayo & Co. (SGV) admitted that its reports on the firm were based on false figures presented by the company officials.(10) However, the most devastating of these scandals was that of BW Resources. Dante Tan formed Best World Gaming and Entertainment Corporation (BWGE) in early 1998. At the same time, Greater Asia Resources, a leisure and tourism company headed by Eduardo Moonie Lim, changed its name to BW Resources. Tan became the major shareholder of BW Resources in 1999 when it acquired the Sheraton Marina Square complex near Manila Bay. Rumors of a merger between BW Resources and BWGE spread. Within a span of a couple of months, Pagcor announced its intention to operate a casino in Sheraton Marina Square. BW Resources also brought in Stanley Ho, Macaus casino mogul. The companys stock price rose from Php2 to Php107 during this time. However, shortly after Hos visit to Manila, wherein he faced strong opposition from the Catholic church and was accused of being a part of the triad gangsters, BW Resources share prices plunged to below Php30. The SEC and PSE, then, began investigations and uncovered heavy buying by Tan. He then sold shares at a discount to friends and clients. These transactions were reported on the PSE board at prices that were over twice the amount actually paid.(11) Furthermore, half of the daily turnover circulated around 10 brokerage firms. As a result, fines and penalties amounting to Php30.05 million from the infraction of the Securities Regulation Code (SRC), the Corporation Code, and related laws have been enforced. In addition, as of March, the Department of Justice has charged four brokers and five individuals in relation to this case.(12) Corporate America is responding to this mess through various corporate governance reforms. Boards of directors are firing CEOs left and right.(13) Other changes being implemented by various corporations include reducing the number of company executives included in the board, facilitating executive sessions of outside directors, increasing the meetings of the members, and requiring more time and know-how especially from the audit committee. Evidences of these include headhunters reports on greater demand for independent directors as well as a rising trend in training seminars for directors. More changes yet to be seen include the certification of financial statements by CEOs, a ban on loans to officers and directors, and faster reporting of insider trading.(14) Even the market is contributing to the effort with greater capital being fed to companies that have transparent, easy to understand

financial statements. As a result, more than 1,000 companies in the U.S. have restated their previous incomes and are trying to establish more credible financial base lines.(15) Furthermore, the SEC ordered the CEOs and CFOs of the 1,000 largest U.S. companies to attest personally to the accuracy of their financial statements. In addition, the New York Stock Exchange has put into place new rules on corporate governance that would require majority of board members to be independent and give the right to shareholders to vote on executive compensation.(16) More importantly, the Bush Administration recently passed the Sarbanes-Oxley Act that would require faster disclosures and directs the SEC to issue rules requiring the disclosure of information previously not asked for. The Act also establishes new rules for the composition and duties of audit committees, new rules affecting other areas of corporate governance with strong emphasis on officer and director compensation as well as stock trading, new crimes and increases in the maximum penalties for existing crimes, provisions affecting securities and other civil litigation as well as SEC administrative enforcement, establishment of the Public Company Accounting Oversight Board, and rules addressing conflicts of interest involving securities analysts.(17) The European Union (EU) has proposed a code of conduct on the independent auditors, which includes five-year auditor rotation. Member states also endorsed the Market Abuse Directive to harmonize and strengthen rules against insider dealing. It aims to address definitions of insider trading, requiring investment analysts to disclose share ownership, as well as comprehensive public disclosure issues and fair representation of investment research. In July, the British government released a white paper proposing reforms to the Company Law. These changes include harsher penalties for misleading auditors, redefining the roles of the directors, and creating standards for boards in accounting supervision and other disclosure issues. Furthermore, the British government is also reviewing the roles of non-executive directors and is considering the regulation of audit committees.(18) In the Philippines, various corporations have also made conscious efforts in the improvement of corporate governance. These steps include the appointment of independent directors to the board as well as ensuring the skills, knowledge and expertise of the members are at par with industry standards.(19)Furthermore, the private sector, headed by Jesus Estanislao, established the Institute of Corporate Directors (ICD) after the 1997 financial crash. The purpose of this World Bank-funded non-profit organization is to advocate corporate governance in the Philippines and in Asia.(20) The Philippine government adopted the Guidelines for Good Corporate Governance Practices endorsed by the Asia-Pacific Economic Cooperation (APEC) last October. These guidelines, drafted by the Pacific Economic Cooperation Council, stresses the importance of fairness, transparency and accountability.(21) These three principles have been incorporated in the SECs Code of Corporate Governance which was issued in April in its Memorandum Circular No. 2. The Code addresses issues dealing with the board of directors, the Audit Committee, the nomination and compensation of committees, the auditors, and the disclosure and transparency of the corporations. In particular, it requires public companies to have at least two independent directors or 20% of the members of the board, whichever is lesser. The Code also requires each corporation to document its corporate governance rules and principles in a manual and submit it to the SEC.(22) Directors who do not attend board meetings regularly, do not disclose the extent of their business interest, and do not meet other requirements may be disqualified or suspended from the board. Companies are also advised to rotate their auditors regularly. Finally, the code mandates the formation of four board committees i.e. the audit and compliance committee, the nomination committee, the compensation committee, and the risk management committee. At least three members of the Audit Committee should be board members. A performance evaluation system on the board as well as top management must also be put into place by the respective corporations.(23) Another action taken by the SEC involves the amendments made to the SRC Rule 68, the Special Accounting Rules, to conform to International Accounting Standards (IAS). This rule shall be fully compliant with the IAS by 2003. A special rating system called the SEC MILEAGE is also under development. It shall be implemented on listed companies to warn investors of firms that have poor corporate governance. The SEC is also preparing for an IT-driven risk-oriented monitoring device called I-Mode, which shall track corporations compliance to laws, policies, and rules and regulations including the Anti-Money Laundering Act of 2001, among others.(24) The Capital Market Development Council, a public-private sector policy group that includes the SEC and the BSP, launched the Corporate Governance Reform Program for 2002 to 2004. The Program cites various proposals for corporate governance reforms, such as better protection for minority shareholders rights, adherence to international auditing standards, and increased transparency and disclosure of public companies.(25) The Philippine response to the global problem of corporate governance is adequate, but it is yet to be concretized in the Filipino corporations everyday functions. In fact, a survey conducted by SGV involving 75 top executives showed that 70% of their companies do not have a code of conduct in place that defines the best practices of good governance. Furthermore, majority of the respondents are not confident that their internal audit functions are effective and efficient for internal controls. Processes involving risk management, succession planning and, investor relations and communication have yet to be improved.(26) In order to address this problem and improve implementation, regulatory institutions need to be reformed and strengthened and banking and financial sector standards upgraded. The concept of a single regulator must also be considered.(27) Corporations must also move towards increased accountability, transparency, integrity, and higher ethical standards. Disclosure of both financial and non-financial information material to stakeholders must be practiced extensively. Auditing bodies should continuously re-examine and raise standards to internationally accepted levels. Finally, global practices should also be revisited time and again.(28) With the

public and private sector each doing their share towards excellence in corporate governance, the Philippines will remain globally competitive and its corporations recognized and respected the world over. Footnotes 1 Lavelle, Louis. The Best and Worst Boards. Business Week. October 7, 2002. 2 Lavelle, Louis. The Best and Worst Boards. Business Week. October 7, 2002. 3 3Kafka, Evan. Under Fire. Business Week. September 30, 2002. 4 Reed, Stanley and Reinhardt, Andy. Saving Ericsson. Business Week. November 4, 2002. 5 Lavelle, Louis. The Best and Worst Boards. Business Week. October 7, 2002. 6 www.wsws.org/articles/2002/jul2002/vive-j16_prn.shtml 7 www.wsws.org/articles/2002/jul2002/vive-j16_prn.shtml 8 www.newsflash.org/2000/04/be/be001161.htm 9 www.philexport.ph/newsfeatures/august03/newspage1.html 10 www.manilatimes.net/national/2001/sept/06/business/20010906bus6.html 11 www.asiaweek.com/asiaweek/magazine/2000/0204/nat.phil.ho.html 13 Nussbaum, Bruce. Can Trust Be Rebuilt? Business Week. July 8, 2002. 14 Lavelle, Louis. The Best and Worst Boards. Business Week. October 7, 2002. 15 Nussbaum, Bruce. Can Trust Be Rebuilt? Business Week. July 8, 2002. 16 Nussbaum, Bruce. Can Trust Be Rebuilt? Business Week. July 8, 2002. 17 Corporate Governance, Audit Rules and Continuous Disclosure. Company Director. September 2002. 18 www.cfoeurope.com/200210e.html 19 20 RP Firms Trek the Hard Road Toward Corporate Governance. Philippine Daily Inquirer. September 16, 2002. 21 Hanrahan, Chris. A Saintly Banker. Asia-inc. October 2002. 22 www.inq7.net/bus/2002/may/18/text/bus_6-1-p.htm 23 A Directors Guide to Corporate Governance in the Philippines. SGV Bulletin 2002. 24 www.inq7.net/bus/2002/may/18/text/bus_6-1-p.htm 25 Bautista, Lilia. Country Report on the Philippines. Fourth Round Table on Capital Market Reform in Asia. April 9-10, 2002. Tokyo, Japan. 26 www.inq7.net/bus/2002/may/18/text/bus_6-1-p.htm 27 RP Firms Trek the Hard Road Toward Corporate Governance. Philippine Daily Inquirer. September 16, 2002. Bautista, Lilia. Country Report on the Philippines. Fourth Round Table on Capital Market Reform in Asia. April 9-10, 2002. Tokyo, Japan. 28 www.asiancorpgov.aim.edu.ph/issue5b.htm

Conclusion From the above discussion it should be clear that good governance is an ideal which is difficult to achieve in its totality. Very few countries and societies have come close to achieving good governance in its totality. However, to ensure sustainable human development, actions must be taken to work towards this ideal with the aim of making it a reality.

References Aglietta, Michel and Antoine Rebrioux (2005), Corporate Governance Adrift: A Critique of Shareholder Value, Cheltenham, UK, and Northampton, MA, USA: Edward Elgar. Arcot, Sridhar, Bruno, Valentina and Antoine Faure-Grimaud, "Corporate Governance in the U.K.: is the comply-or-explain working?" (December 2005). FMG CG Working Paper 001. Becht, Marco, Patrick Bolton, Ailsa Rell, "Corporate Governance and Control" (October 2002; updated August 2004). ECGI Finance Working Paper No. 02/2002. Bowen, William, 1998 and 2004, The Board Book: An Insider's Guide for Directors and Trustees, New York and London, W.W. Norton & Company, ISBN 978-0-393-06645-6 Brickley, James A., William S. Klug and Jerold L. Zimmerman, Managerial Economics & Organizational Architecture, ISBN

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Equipment ProcurementDocument18 pagesEquipment ProcurementBhawesh Stha100% (1)

- Accounting A Level Notes 9706Document45 pagesAccounting A Level Notes 9706shabanaNo ratings yet

- 16 Construction Internal Audit ProgramDocument16 pages16 Construction Internal Audit ProgramDrive4 BooksNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- AcctIS10E Ch11 CE1Document43 pagesAcctIS10E Ch11 CE1Jenny HermosadoNo ratings yet

- Fabm Ii - Bank ReconciliationDocument41 pagesFabm Ii - Bank ReconciliationAvril OlivarezNo ratings yet

- Chapter 1-Fundamentals of Financial AccountingDocument11 pagesChapter 1-Fundamentals of Financial AccountingBlezzher Marsie ValerioNo ratings yet

- Cgma Finance Business PartneringDocument24 pagesCgma Finance Business Partneringkalina hNo ratings yet

- Welding Inspection Execution Plan CDocument14 pagesWelding Inspection Execution Plan CIvan SanchezNo ratings yet

- Audit Command LanguageDocument12 pagesAudit Command LanguageFrensarah RabinoNo ratings yet

- Test Bank Ifa Part 3 2015 EditiondocxDocument287 pagesTest Bank Ifa Part 3 2015 EditiondocxRaca DesuNo ratings yet

- ACCA PER Filling SupportDocument8 pagesACCA PER Filling SupportranjithmraveendranNo ratings yet

- Pupsmbaai Non - Stock - Articles - of - IncorporationDocument6 pagesPupsmbaai Non - Stock - Articles - of - IncorporationJayson Berja de LeonNo ratings yet

- Despabiladeras, Jelo (Reflection)Document1 pageDespabiladeras, Jelo (Reflection)Jayson Berja de LeonNo ratings yet

- Pupsmbaai Non - Stock - Articles - of - IncorporationDocument6 pagesPupsmbaai Non - Stock - Articles - of - IncorporationJayson Berja de LeonNo ratings yet

- De Leon, Misha Laine (Reflection)Document1 pageDe Leon, Misha Laine (Reflection)Jayson Berja de LeonNo ratings yet

- Cruz, Aiyanna Gabrielle (Reflection)Document1 pageCruz, Aiyanna Gabrielle (Reflection)Jayson Berja de LeonNo ratings yet

- Group 3 - History of Science (Reflection)Document7 pagesGroup 3 - History of Science (Reflection)Jayson Berja de LeonNo ratings yet

- DelRosario, Kenneth (Reflection)Document1 pageDelRosario, Kenneth (Reflection)Jayson Berja de LeonNo ratings yet

- DE LEON, MISHA LAINE (Activity)Document7 pagesDE LEON, MISHA LAINE (Activity)Jayson Berja de LeonNo ratings yet

- July 2020 - ACCTG CEP 24362280Document2 pagesJuly 2020 - ACCTG CEP 24362280Jayson Berja de LeonNo ratings yet

- Microsoft Dynamics 365 For Property Management ScriptDocument4 pagesMicrosoft Dynamics 365 For Property Management ScriptJayson Berja de LeonNo ratings yet

- YAYADocument2 pagesYAYAJayson Berja de LeonNo ratings yet

- July 2020 - ACCTG CEP 24362280Document2 pagesJuly 2020 - ACCTG CEP 24362280Jayson Berja de LeonNo ratings yet

- July 2020 - ACCTG CEP 24362280Document2 pagesJuly 2020 - ACCTG CEP 24362280Jayson Berja de LeonNo ratings yet

- Microsoft Dynamics 365 For Property Management ScriptDocument4 pagesMicrosoft Dynamics 365 For Property Management ScriptJayson Berja de LeonNo ratings yet

- Statement of Account: Summary of Charges and CreditsDocument4 pagesStatement of Account: Summary of Charges and CreditsJayson Berja de LeonNo ratings yet

- INVOICE I-99999: CRONUS International Ltd. 5 The Ring Westminster W2 8HG London Electronics LTDDocument1 pageINVOICE I-99999: CRONUS International Ltd. 5 The Ring Westminster W2 8HG London Electronics LTDJayson Berja de LeonNo ratings yet

- July 2020 - ACCTG CEP 24362280Document2 pagesJuly 2020 - ACCTG CEP 24362280Jayson Berja de LeonNo ratings yet

- Setting up Eight Work AreasDocument2 pagesSetting up Eight Work AreasJayson Berja de LeonNo ratings yet

- Cronus International Ltd. Coolwood TechnologiesDocument1 pageCronus International Ltd. Coolwood TechnologiesJayson Berja de LeonNo ratings yet

- Certificate of Employment: To Whom It May ConcernDocument1 pageCertificate of Employment: To Whom It May ConcernJayson Berja de Leon0% (1)

- Statement of Account: 688329167 09-Jul-2020 2,998.00 PDocument2 pagesStatement of Account: 688329167 09-Jul-2020 2,998.00 PJayson Berja de LeonNo ratings yet

- Turnover - DennisDocument16 pagesTurnover - DennisJayson Berja de LeonNo ratings yet

- CRONUS International LTDDocument1 pageCRONUS International LTDJayson Berja de LeonNo ratings yet

- CRONUS International Ltd Invoice I-77777 to Electronics LtdDocument1 pageCRONUS International Ltd Invoice I-77777 to Electronics LtdJayson Berja de LeonNo ratings yet

- CRONUS International Ltd. 5 The Ring Westminster W2 8HG LondonDocument1 pageCRONUS International Ltd. 5 The Ring Westminster W2 8HG LondonJayson Berja de LeonNo ratings yet

- CRONUS International Ltd Invoice I-88888Document1 pageCRONUS International Ltd Invoice I-88888Jayson Berja de LeonNo ratings yet

- CRONUS International Ltd. warehouse restructure planning invoiceDocument1 pageCRONUS International Ltd. warehouse restructure planning invoiceJayson Berja de LeonNo ratings yet

- Mtap by SkillDocument10 pagesMtap by SkillJulie IsmaelNo ratings yet

- CRONUS International LTDDocument1 pageCRONUS International LTDJayson Berja de LeonNo ratings yet

- BOOKSPH Scholarship Registration (1-466)Document51 pagesBOOKSPH Scholarship Registration (1-466)Jayson Berja de LeonNo ratings yet

- Internal Auditing Ethics and StandardsDocument2 pagesInternal Auditing Ethics and StandardsTrung Nguyen NamNo ratings yet

- AF420 Session 3 - Accounting Analysis.2020pptxDocument25 pagesAF420 Session 3 - Accounting Analysis.2020pptxRahul NarayanNo ratings yet

- Municipality of Concepcion Financial Report and Audit SummaryDocument9 pagesMunicipality of Concepcion Financial Report and Audit SummaryJames SusukiNo ratings yet

- General Instruction - Domestic Vendors (For Service)Document5 pagesGeneral Instruction - Domestic Vendors (For Service)Ramu NallathambiNo ratings yet

- Measuring and Managing Process PerformanceDocument25 pagesMeasuring and Managing Process PerformanceMhmood Al-saadNo ratings yet

- Major Embezzlement Cases On The RiseDocument3 pagesMajor Embezzlement Cases On The RiseMike KarlinsNo ratings yet

- CHAPTER 11 With ExplanationDocument15 pagesCHAPTER 11 With ExplanationNika Ella SabinoNo ratings yet

- Transparency PDFDocument9 pagesTransparency PDFJoeNo ratings yet

- DCFS Annual Report 2016-2017 PDFDocument45 pagesDCFS Annual Report 2016-2017 PDFKimmy2010No ratings yet

- Govt AuditDocument6 pagesGovt AuditVenus B. MacatuggalNo ratings yet

- Tara-Vel Travel and Tours: Organizational ChartDocument4 pagesTara-Vel Travel and Tours: Organizational ChartArnel IgnacioNo ratings yet

- Advanced Auditing Group Assignment Final 2Document38 pagesAdvanced Auditing Group Assignment Final 2TebashiniNo ratings yet

- ACCT 560 - Quiz Chapter 1Document8 pagesACCT 560 - Quiz Chapter 1Yingjie XuNo ratings yet

- Ysch Oolg Ist.c Om: Principles of Accounts General ObjectivesDocument6 pagesYsch Oolg Ist.c Om: Principles of Accounts General ObjectivesGabriel UdokangNo ratings yet

- Assign 1Document5 pagesAssign 1Aubrey Camille Cabrera100% (1)

- Mandatory IFRS Adoption and The Effects On SMES in Nigeria: A Study of Selected SMEsDocument5 pagesMandatory IFRS Adoption and The Effects On SMES in Nigeria: A Study of Selected SMEsInternational Journal of Business Marketing and ManagementNo ratings yet

- CPA EXAMINATION SYLLABUS 2023 RevisedDocument216 pagesCPA EXAMINATION SYLLABUS 2023 RevisedByamukama RobertNo ratings yet

- Internal Audit Challenges in Malaysian GovernmentsDocument33 pagesInternal Audit Challenges in Malaysian GovernmentsUmmu ZubairNo ratings yet