Professional Documents

Culture Documents

Online Answer

Uploaded by

Yiru PanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Online Answer

Uploaded by

Yiru PanCopyright:

Available Formats

A) Is Mercury an appropriate target for AGI? Why or why not?

There are characteristics of Mercury that make it an appropriate target, and some that make it not. The different characteristics presented in the case are as follows: Acquisition appropriate: * Same industry/similar products, and Mercury does their manufacturing in China (Pg 4) like AGI, so Mercury would increase the leverage with contract manufacturers (Pg 1), which helps since AGI does most of its manufacturing in China, and China just had a recent wave of consolidation among Chinese contract manufacturers which gave the Chinese more leverage over AGI (Pg 3) * The merger would expand AGIs presence with key retailers and distributers (Pg 1) * Mercury would double AGIs revenue (Pg 1) * 42% of AGIs revenue comes from athletic shoes (Pg 2), which Mercury specializes in (Pg 5-6), which could add to AGIs athletic presence, rather than getting most of their revenue from the casual segment * Mercurys much higher rate of revenue growth, almost 3-4 times as much (Pg 12), could compensate for AGIs very low revenue growth as of late (Pg 3); making the company more palatable to the eyes of investors and shareholders * Mercurys low cost of shoe-making (Pg 5) could possibly synergize to further reduce the price of AGIs products to help with the lower profit margins that AGI has been experiencing due to continuing pressure from suppliers and competitors (Pg 3) * Because Mercury was quite autonomous, and maintained its own financial statements, databases, resource management systems, and distribution facilities (Pg 4), the transition to being owned by AGI instead of WCF would happen more smoothly * Mercurys mens casual segment is their highest profit margin product, despite the small size (Pg 6); which AGI could leverage and synergize off of as AGIs casual segment which brought in 58% of revenue (Pg 2) Acquisition not appropriate:

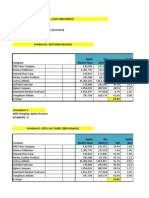

* AGI focused on classic products with longer lifestyles (Pg 2), rather than Mercury, who had to keep up with the times and constantly adapted to meet the changing demands and wants of the hip extreme sport, and global youth, culture (Pg 4) * Big difference in days in inventory between AGI and Mercury (Pg 2-3), which the differing inventory management styles will most likely interfere with each other rather than synergize; although Liedtke believed that AGIs inventory management system could be adopted by Mercury at little incremental cost and would reduce Mercurys DSI to the same level as AGIs (Pg 7) * Mercury concentration is on a different demographic than AGIs * The acquisition would most likely entail having to buy the womens casual line of Mercury, even though it will most likely have to be wound down and written off as a loss afterwards (Pg 6); although, it might be possible to fold the operation into AGI rather than discontinued (Pg 7) In conclusion, when analyzing the textual facts presented by the case, without running the DCF model, it appears that this acquisition should be undertaken, as there are a lot more positive possibilities that can come from the acquisition rather than the negative ones that were presented. B) Review the projections by Liedtke. Are they appropriate? How would you recommend modifying them? Liedkes projected revenue growth of 3% is not accurate I feel, as when I take an average of the revenue growth (2005/2004=5%, 2006/2005=20%; (5+20)/2~12.5%) it is 12.8%, which is much higher than Liedtkes extremely conservative forecast. Also, Liedtke says contradicting statements when he talks about keeping the womens casual line and folding it into AGIs womens casual line, but he also talks of writing off Mercurys womens casual line as well. In Liedtkes performance projection for 2007-2011 he writes off the womens line starting from 2008 and until 2011. Because of this, there is a drop in revenue that lowers the enterprise value. This might be done so Liedtke can get a better price on the initial acquisition purchase and then once he buys the company, he will then fold the womens line into AGIs, which will then have a higher rate of return than projected to the sellers. C) Estimate the value of Mercury using a discounted cash flow approach and Liedtkes base case projections.

To start with, this is a valuation done by Joel L. Heilprin for Mercury when the WACC is 11.06% and the long run growth rate is projected at 2.78%: However, my DCF that I calculated uses a WACC of 8.73% and a long-term growth rate of 3%. Though the difference from Heilrpin is substantial, it reflects the possible different values such as the treasury securities date that I chose, though I cant see what the values of Heilrpins are to compare. Here is my DCF, but please refer to the excel file for all the formulas and values I used to come up with this end result: Here are some of the other calculations I used to arrive to this enterprise value of Mercury: D) Do you regard the value you obtained as conservative or aggressive? Why? When comparing against Heilrpins enterprise value, my projection is obviously aggressive. From my lower WACC calculations, this drops the cost of capital down, which has the inverse effect of raising the price of the enterprise value. With my higher enterprise value, this creates a final cost to the buyer that is higher than Heilrpins, which would be considered aggressive, rather than conservative. E) How would you analyze possible synergies or other sources of value not reflected in Liedtkes base assumption? Accordingly to the acquisition appropriate/not appropriate section I previously wrote, the synergies can be distilled to: * Greater leverage with Chinese manufactures * Greater level of distribution since both companies can leverage off of each others networks * Greater (double) level of revenue, creating larger market share, which can be used as leverage for a variety of reasons * Mercurys womens line might possibly not go to waste (rather than how Liedke has it written off in the performance projection), and when folded into AGIs line, might add value to the total value of the acquisition, rather than subtract or have a neutral effect

* AGIs main product is the mens casual line; and when bringing in Mercurys high-profit but low-in-production mens line, Mercury and AGI might be able to synergize their mens casual lines together to create a big selling and high profit mens casual line * Instead, or also, Mercury could help AGI switch over from the mens casual line being the highest selling, to their mens athletic line, since Mercury specializes in mens athletic footwear, as it is their core business

You might also like

- Mercury Athletic Footwear - Valuing The OpportunityDocument55 pagesMercury Athletic Footwear - Valuing The OpportunityKunal Mehta100% (2)

- Mercury Athletic Footwear Case SolutionDocument3 pagesMercury Athletic Footwear Case SolutionDI WU100% (2)

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Mercury Athletic (Student Templates) FinalDocument6 pagesMercury Athletic (Student Templates) FinalGarland GayNo ratings yet

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Mercury Athletic Case PDFDocument6 pagesMercury Athletic Case PDFZackNo ratings yet

- Questions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Document5 pagesQuestions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Cuong NguyenNo ratings yet

- HBS Mercury CaseDocument4 pagesHBS Mercury CaseDavid Petru100% (1)

- Mercury Athletic SlidesDocument28 pagesMercury Athletic SlidesTaimoor Shahzad100% (3)

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDocument11 pagesSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisTheicon420No ratings yet

- 2 - Global Supply Chain Management Simulation v2Document2 pages2 - Global Supply Chain Management Simulation v2prashant309100% (1)

- Managerial Economics 11 Edition: by Mark HirscheyDocument30 pagesManagerial Economics 11 Edition: by Mark HirscheyFàrhàt Hossain100% (1)

- Mekail Sarwar - Module 1-2-3-4 PDFDocument45 pagesMekail Sarwar - Module 1-2-3-4 PDFB. M. Mekail Sarwar (192051056)No ratings yet

- M&ADocument7 pagesM&AAntónio CaleiaNo ratings yet

- Flash Memory CaseDocument6 pagesFlash Memory Casechitu199233% (3)

- Mercury Athletic FootwearDocument9 pagesMercury Athletic Footwearandy117950% (2)

- AirThread ConnectionDocument26 pagesAirThread ConnectionAnandNo ratings yet

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Mercury AthleticDocument17 pagesMercury Athleticgaurav100% (1)

- FABM2 - Q1 - Module 1 - Statement of Financial PositionDocument24 pagesFABM2 - Q1 - Module 1 - Statement of Financial PositionPrincess Salvador67% (3)

- Mercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentDocument9 pagesMercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentBharat KoiralaNo ratings yet

- Mercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinDocument7 pagesMercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinFaith AllenNo ratings yet

- Mercury Athletic G7Document11 pagesMercury Athletic G7Nanda PallerlaNo ratings yet

- Mercury Athletic QuestionsDocument1 pageMercury Athletic QuestionsRazi UllahNo ratings yet

- MercuryDocument5 pagesMercuryமுத்துக்குமார் செNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Mercury Athletic FootwearDocument9 pagesMercury Athletic FootwearJon BoNo ratings yet

- Mercury Athletic Case SectionBDocument15 pagesMercury Athletic Case SectionBVinith VemanaNo ratings yet

- Fin 321 Case PresentationDocument19 pagesFin 321 Case PresentationJose ValdiviaNo ratings yet

- Mercury AthleticDocument8 pagesMercury AthleticVaidya Chandrasekhar100% (1)

- Mercury QuestionsDocument6 pagesMercury Questionsapi-239586293No ratings yet

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearAbhishek KumarNo ratings yet

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDocument4 pagesDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaNo ratings yet

- Mercury - Case SOLUTIONDocument36 pagesMercury - Case SOLUTIONSwaraj DharNo ratings yet

- Mercury Case Report Vedantam GuptaDocument9 pagesMercury Case Report Vedantam GuptaVedantam GuptaNo ratings yet

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rNo ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- Group19 Mercury AthleticDocument11 pagesGroup19 Mercury AthleticpmcsicNo ratings yet

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidNo ratings yet

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- Flash Memory, Inc.Document2 pagesFlash Memory, Inc.Stella Zukhbaia0% (5)

- New Heritage DoolDocument9 pagesNew Heritage DoolVidya Sagar KonaNo ratings yet

- Valuation of Airthread April 2012Document26 pagesValuation of Airthread April 2012Perumalla Pradeep KumarNo ratings yet

- Valuation of Airthread Connections Questions TraductionDocument2 pagesValuation of Airthread Connections Questions TraductionNatalia HernandezNo ratings yet

- Wikler Case Competition PowerpointDocument16 pagesWikler Case Competition Powerpointbtlala0% (1)

- OceanCarriers KenDocument24 pagesOceanCarriers KensaaaruuuNo ratings yet

- Flash Memory IncDocument9 pagesFlash Memory Incxcmalsk100% (1)

- Airthread Valuation Group#2Document24 pagesAirthread Valuation Group#2Himanshu AgrawalNo ratings yet

- M&A Case StudyDocument2 pagesM&A Case StudyNoahNo ratings yet

- Gibson Ch05 SM 13eDocument19 pagesGibson Ch05 SM 13eSHAMRAIZKHANNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 9th Edition Wahlen Solutions ManualDocument31 pagesFinancial Reporting Financial Statement Analysis and Valuation 9th Edition Wahlen Solutions Manualginkgoforciblyw4p100% (19)

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Solutions ManualDocument32 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Solutions Manualmrsbrianajonesmdkgzxyiatoq100% (28)

- Financial Reporting Financial Statement Analysis and Valuation 8Th Edition Wahlen Solutions Manual Full Chapter PDFDocument53 pagesFinancial Reporting Financial Statement Analysis and Valuation 8Th Edition Wahlen Solutions Manual Full Chapter PDFanthelioncingulumgvxq100% (9)

- 2017 Acf - Revision1Document15 pages2017 Acf - Revision1Leezel100% (1)

- Contemporary Corporate Finance International Edition 12th Edition Mcguigan Solutions ManualDocument35 pagesContemporary Corporate Finance International Edition 12th Edition Mcguigan Solutions Manualunpickspermicus8d100% (17)

- Institute of Actuaries of India Subject CA1 - Paper I Core Applications ConceptsDocument23 pagesInstitute of Actuaries of India Subject CA1 - Paper I Core Applications ConceptsYogeshAgrawalNo ratings yet

- Adidas Reebok Merger LBODocument2 pagesAdidas Reebok Merger LBOtiko bakashviliNo ratings yet

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Document38 pagesSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683verawarnerq5cl100% (14)

- Latihan Chapter 3 CVPDocument9 pagesLatihan Chapter 3 CVPS AdemNo ratings yet

- Costing NotebookDocument123 pagesCosting NotebookremarkuNo ratings yet

- Galanz Assignment 2Document16 pagesGalanz Assignment 2Richa ShahiNo ratings yet

- Absorption & Marginal Costing - Noor Alam (MC16-103)Document24 pagesAbsorption & Marginal Costing - Noor Alam (MC16-103)Ahmed Ali Khan100% (2)

- Rochmah Sucita Anggraini: Personal ProfileDocument1 pageRochmah Sucita Anggraini: Personal ProfileTia Yustika EnchancersNo ratings yet

- Multiple Choice Questions: EC1002 Introduction To EconomicsDocument3 pagesMultiple Choice Questions: EC1002 Introduction To EconomicsRicardo ValverdeNo ratings yet

- Method, Manpower, Machine and Materials. Design Process SequenceDocument5 pagesMethod, Manpower, Machine and Materials. Design Process SequenceMark Anthony OcampoNo ratings yet

- DSCMDocument2 pagesDSCMsonm272455No ratings yet

- Digital Marketing AssignmentDocument19 pagesDigital Marketing AssignmentKhushi KhareNo ratings yet

- Problem SetDocument61 pagesProblem SetEmily FungNo ratings yet

- Developing Marketing Strategies and Plans - Group 3Document26 pagesDeveloping Marketing Strategies and Plans - Group 3Angel CabreraNo ratings yet

- Sales and Distribution Management: Buyer - Seller DyadDocument6 pagesSales and Distribution Management: Buyer - Seller DyadDIVYAM BHADORIA100% (1)

- Basic Final AccountQuestions Part 2Document6 pagesBasic Final AccountQuestions Part 2Jahanzaib ButtNo ratings yet

- Brand Growth:: The Rules For SuccessDocument4 pagesBrand Growth:: The Rules For SuccessRashmi Gopalakrishnan100% (1)

- Test Series: August, 2018 Foundation Course Mock Test Paper - 1 Paper - 1: Principles and Practice of Accounting (Time Allowed: 3 Hours) (100 Marks)Document118 pagesTest Series: August, 2018 Foundation Course Mock Test Paper - 1 Paper - 1: Principles and Practice of Accounting (Time Allowed: 3 Hours) (100 Marks)Gaming king 02 officialNo ratings yet

- TS410 1909 QaDocument15 pagesTS410 1909 QaToyosi OlugbenleNo ratings yet

- CH 11Document40 pagesCH 11Corliss Ko100% (1)

- Managerial Accounting 5th Edition Wild Shaw Solution ManualDocument115 pagesManagerial Accounting 5th Edition Wild Shaw Solution Manualmarsha100% (23)

- Scarcity Is The Central Economic Problem in All Societies Irrespective of The Type of Economic System. DiscussDocument2 pagesScarcity Is The Central Economic Problem in All Societies Irrespective of The Type of Economic System. DiscussCarlitoNo ratings yet

- AFM - Module 3Document61 pagesAFM - Module 3Abhishek JainNo ratings yet

- Chik ShampooDocument3 pagesChik ShampooViŠhål Pätěl100% (1)

- Global Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Document9 pagesGlobal Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Rajkot academyNo ratings yet

- Solutions Solution Manual09Document109 pagesSolutions Solution Manual09RiaNo ratings yet

- PoM Case-Study FinalDocument13 pagesPoM Case-Study FinalArun VermaNo ratings yet

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- Bonnie'S Buds: Financial Worksheet MAY 21. 2012 Account Titles Unadjusted Trial BalanceDocument13 pagesBonnie'S Buds: Financial Worksheet MAY 21. 2012 Account Titles Unadjusted Trial BalanceMary Clare VinluanNo ratings yet