Professional Documents

Culture Documents

Macys 2011 10k

Uploaded by

apb5223Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macys 2011 10k

Uploaded by

apb5223Copyright:

Available Formats

Macy's, Inc.

10-K 03/28/2012 MANAGEMENTS DISCUSSION AND ANALYSIS

Total (millions) Short-term debt Long-term debt Interest on debt Capital lease obligations Operating leases Letters of credit Other obligations

Total (millions) 1,099 6,404 5,193 74 2,767 34 3,838 19,409

Obligations Due, by Period Less than 1 3 3 5 (millions) (millions) (millions) 1,099 582 1,823 455 812 674 6 10 6 255 468 355 34 2,251 563 256 4,100 2,435 3,114

od More than (millions) 3,999 3,252 52 1,689 768 9,760

Macy's, Inc. 10-K 03/28/2012 INCOME STATEMENT

INCOME STATEMENT In $ millions Net sales Cost of sales Gross margin SG&A Expense Loss on sale properties, impairments, and division consolidation costs Loss on Goodwill impairment Operating income Interest expense Interest income Income before income taxes Income tax expense Net income Basic earnings per share Diluted earnings per share 2011 2010 2009 2008 26,405 25,003 23,489 24,892 (15,738) (14,824) (13,973) (15,009) 10,667 10,179 9,516 9,883 (8,281) (8,260) (8,062) (8,481) 2011 Net Sales 100% 60% 31%

25 2,411 (447) 4 1,968 (712) 1,256 2.96 2.92

(25) 1,894 (579) 5 1,320 (473) 847 2.00 1.98

(391) 1,063 (562) 6 507 (178) 329 0.78 0.78

(398) (5,382) (4,378) (588) 28 (4,938) 163 (4,775) (11.34) (11.34)

2%

3% 5%

2011 (% Net Sales)

Cost of sales Interest expense Net income 2% 3% 5% SG&A Expense Income tax expense

2010 % (Net Sales)

Cost of sales Interest expense Net income 2% 2% 4%

31% 59%

33%

Loss on sale of propertie s, impairme nts, store closing costs and division consolida tion costs

2010 Net Sales 2009 Net Sales 2008 Net Sales 100% 100% 100% 59% 59% 60% 33% 34% 34%

2%

2% 22% 2%

2%

2%

2% 3%

1% 1%

1% -19%

010 % (Net Sales)

SG&A Expense Income tax expense

Cost of sales SG&A Expense Interest expense

2% 4%

59%

Pension Expense (In Millions) 2012 2011 2010 215 150 144

2009 110

2009 2010 2011 2012

250 200 150

2009 (% Net Sales)

Interest expense Income tax expense Net income Loss on sale properties, impairments, and division consolidation costs

100 50 0 2009

2%

1%

1%

2%

34% 60%

110 144 150 215

8282 8260 8062

Pension Expense

2010

2011

2012

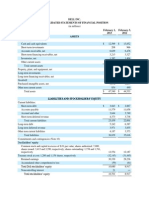

Macy's, Inc. 10-K 03/28/2012 BALANCE SHEET

January 28, 2012 ASSETS Current Assets: Cash and cash equivalents Receivables Merchandise inventories Prepaid expenses and other current assets Total Current Assets Property and Equipment net Goodwill Other Intangible Assets net Other Assets Total Assets LIABILITIES AND SHAREHOLDERS EQUITY Current Liabilities: Short-term debt Merchandise accounts payable Accounts payable and accrued liabilities Income taxes Deferred income taxes Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Liabilities Shareholders Equity: Common stock (414.2 and 423.3 shares outstanding) Additional paid-in capital Accumulated equity Treasury stock Accumulated other comprehensive loss Total Shareholders Equity Total Liabilities and Shareholders Equity 2,827 368 5,117 465 8,777 8,420 3,743 598 557 22,095

January 29, 2011

1,464 338 4,758 339 6,899 8,813 3,743 637 539 20,631

1,103 1,593 2,788 371 408 6,263 6,655 1,141 2,103 5 5,408 4,015 (2,434) (1,061) 5,933 22,095

454 1,421 2,525 182 409 4,991 6,971 1,200 1,939 5 5,696 2,990 (2,431) (730) 5,530 20,631

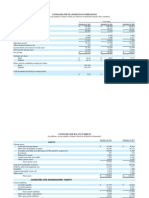

Macy's, Inc. 10-K 03/28/2012 SHAREHOLDERS EQUITY STATEMENT

January 28, 2012 ASSETS Current Assets: Cash and cash equivalents Receivables Merchandise inventories Prepaid expenses and other current assets Total Current Assets Property and Equipment net Goodwill Other Intangible Assets net Other Assets Total Assets LIABILITIES AND SHAREHOLDERS EQUITY Current Liabilities: Short-term debt Merchandise accounts payable Accounts payable and accrued liabilities Income taxes Deferred income taxes Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Liabilities Shareholders Equity: Common stock (414.2 and 423.3 shares outstanding) Additional paid-in capital Accumulated equity Treasury stock Accumulated other comprehensive loss Total Shareholders Equity Total Liabilities and Shareholders Equity 2,827 368 5,117 465 8,777 8,420 3,743 598 557 22,095

January 29, 2011

1,464 338 4,758 339 6,899 8,813 3,743 637 539 20,631

1,103 1,593 2,788 371 408 6,263 6,655 1,141 2,103 5 5,408 4,015 (2,434) (1,061) 5,933 22,095

454 1,421 2,525 182 409 4,991 6,971 1,200 1,939 5 5,696 2,990 (2,431) (730) 5,530 20,631

Macy's, Inc. 10-K 03/28/2012 SHAREHOLDERS EQUITY STATEMENT (1)

Balance at January 31, 2009 Net income Actuarial loss on post employment and postretirement benefit plans, net of income tax effect of $166 million Unrealized gain on marketable securities, net of income tax effect of $3 million Reclassifications to net income: Net actuarial gain on postretirement benefit plans, net of income tax effect of $3 million Prior service credit on post employment benefit plans, net of income tax effect of $1 million Total comprehensive income Common stock dividends ($.20 per share) Stock repurchases Stock-based compensation expense Stock issued under stock plans Deferred compensation plan distributions Balance at January 30, 2010 Net income Actuarial loss on post employment and postretirement benefit plans, net of income tax effect of $4 million Unrealized gain on marketable securities, net of income tax effect of $3 million Reclassifications to net income: Net actuarial loss on postretirement benefit plans, net of income tax effect of $23 million Prior service credit on post employment benefit plans, net of income tax effect of $1 million Total comprehensive income Common stock dividends ($.20 per share) Stock repurchases Stock-based compensation expense Stock issued under stock plans Deferred compensation plan distributions Balance at January 29, 2011 Net income Actuarial loss on post employment and postretirement benefit plans, net of income tax effect of $241 million Unrealized loss on marketable securities, net of income tax effect of $1 million Reclassifications to net income: Realized gain on marketable securities, net of income tax effect of $4 million Net actuarial loss on postretirement benefit plans, net of income tax effect of $35 million Prior service credit on post employment benefit plans, net of income tax effect of $1 million Total comprehensive income Common stock dividends ($.55 per share) Stock repurchases Stock-based compensation expense Stock issued under stock plans Retirement of common stock Deferred compensation plan distributions

Balance at January 28, 2012

Common 5

Additional 5,663

Accumulated 1,982 329

Treasury (2,544)

Accumulated (486) (266) 5 (4) (2)

Total 4,620 329 (266) 5 (4) (2) 62 (84) (1) 50 5 1 4,653 847 (17) 5 36 (1) 870 (84) (1) 47 42 3 5,530 1,256 (376) (2) (8) 56 (1) 925 (231) (502) 48 161 2

(84) (1) 50 (24) 5 5,689 2,227 847 29 1 (2,515)

(753) (17) 5 36 (1)

(84) (1) 47 (40) 5 5,696 2,990 1,256 82 3 (2,431)

(730) (376) (2) (8) 56 (1)

(231) (502) 48 (81) (255) 242 255 2

5,408

4,015

(2,434)

(1,061)

5,933

Macy's, Inc. 10-K 03/28/2012 CASH FLOW STATEMENT

2011 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Gain on sale of properties, impairments, store closing costs and division consolidation costs Depreciation and amortization Stock-based compensation expense Amortization of financing costs and premium on acquired debt Changes in assets and liabilities: (Increase) decrease in receivables) (Increase) decrease in merchandise inventories) (Increase) decrease in prepaid expenses and other current assets) (Increase) decrease in other assets not separately identified) Increase in merchandise accounts payable Increase (decrease) in accounts payable and accrued liabilities not separately identified Increase in current income taxes Increase in deferred income taxes Decrease in other liabilities not separately identified Net cash provided by operating activities Cash flows from investing activities: Purchase of property and equipment Capitalized software Disposition of property and equipment Proceeds from insurance claims Other, net Net cash used by investing activities Cash flows from financing activities: Debt issued Financing costs Debt repaid Dividends paid Increase (decrease) in outstanding checks Acquisition of treasury stock Issuance of common stock Net cash used by financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents beginning of period Cash and cash equivalents end of period Supplemental cash flow information: 1,256

2010 847

(25) 1,085 70 (15) (37) (359) (99) 8 143 109 188 153 (384) 2,093 (555) (209) 114 6 27 (617) 800 (20) (454) (148) 49 (502) 162 (113) 1,363 1,464 2,827

25 1,150 66 (25) (51) (143) (10) 2 91 (45) 115 241 (757) 1,506 (339) (166) 74 6 (40) (465)

(1,245) (84) 24 (1) 43 (1,263) (222) 1,686 1,464

Interest paid Interest received Income taxes paid (net of refunds received)

474 4 401

627 5 108

2009 329

391 1,210 76 (23) 7 154 3 (16) 29 (201) 40 123 (372) 1,750 (355) (105) 60 26 (3) (377)

(966) (84) (29) (1) 8 (1,072) 301 1,385 1,686

601 9 35

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS

Feminine Accessories, Intimate Apparel, Shoes and Cosmetics Feminine Apparel Men s Home/Miscellaneous

2011 37 % 25 23 15 100 %

2010 36 % 26 23 15 100 %

2009 36 % 26 22 16 100 %

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (1)

Gain on sale of properties Impairments of properties held and used Store closing costs: Severance Other Division consolidation costs

2011 (millions) (54) 22 4 3 (25)

2010 (millions) 18 1 6 25

2009 (millions) 115 2 4 270 391

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (2)

2011 (millions) Balance, beginning of year Charged to store closing costs Payments Balance, end of year 1 4 (1) 4

2010 (millions) 2 1 (2) 1

2009 (millions) 4 2 (4) 2

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (3)

2010 Balance, beginning of year Charged to division consolidation costs Payments Balance, end of year 69 (69)

2009 30 166 (127) 69

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (4)

Land Buildings on owned land Buildings on leased land and leasehold improvements Fixtures and equipment Leased properties under capitalized leases Less accumulated depreciation and amortization

January 28, 2012 (millions) 1,689 5,234 2,165 5,275 43 14,406 5,986 8,420

January 29, 2011 (millions) 1,702 5,148 2,227 5,752 33 14,862 6,049 8,813

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (5)

Capitalized (millions) Fiscal year: 2012 2013 2014 2015 2016 After 2015 Total minimum lease payments Less amount representing interest Present value of net minimum capitalized lease payments 6 5 5 3 3 52 74 35 39

Operating (millions) 255 244 224 187 168 1,689 2,767

Total (millions) 261 249 229 190 171 1,741 2,841

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (6)

2011 (millions) Real estate (excluding executory costs) Capitalized leases Contingent rentals Operating leases Minimum rentals Contingent rentals Less income from subleases Operating leases Personal property Operating leases

2010 (millions)

2009 (millions)

242 19 261 (18) 243 10

234 16 250 (15) 235 10

230 15 245 (16) 229 12

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (7)

January 28, 2012 (millions) Non-amortizing intangible assets Goodwill Accumulated impairment losses Tradenames Amortizing intangible assets Favorable leases Customer relationships Accumulated amortization Favorable leases Customer relationships 9,125 (5,382) 3,743 414 4,157 234 188 422 (117) (121) (238) 184

January 29, 2011 (millions) 9,125 (5,382) 3,743 414 4,157 250 188 438 (113) (102) (215) 223

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (8)

(millions) Fiscal year: 2012 2013 2014 2015 2016 37 34 31 21 8

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (9)

January 28, 2012 (millions) Short-term debt: 5.35% Senior notes due 2012 5.875% Senior notes due 2013 8.0% Senior debentures due 2012 6.625% Senior notes due 2011 7.45% Senior debentures due 2011 Capital lease and current portion of other long-term obligations Long-term debt: 5.9% Senior notes due 2016 7.875% Senior notes due 2015 * 3.875% Senior notes due 2022 6.375% Senior notes due 2037 5.75% Senior notes due 2014 6.9% Senior debentures due 2029 6.7% Senior debentures due 2034 7.45% Senior debentures due 2017 6.65% Senior debentures due 2024 7.0% Senior debentures due 2028 6.9% Senior debentures due 2032 5.125% Senior debentures due 2042 6.7% Senior debentures due 2028 6.79% Senior debentures due 2027 7.45% Senior debentures due 2016 7.625% Senior debentures due 2013 7.875% Senior debentures due 2036 7.5% Senior debentures due 2015 8.125% Senior debentures due 2035 8.75% Senior debentures due 2029 8.5% Senior debentures due 2019 9.5% amortizing debentures due 2021 10.25% Senior debentures due 2021 7.6% Senior debentures due 2025 9.75% amortizing debentures due 2021 7.875% Senior debentures due 2030 5.35% Senior notes due 2012 5.875% Senior notes due 2013 8.0% Senior debentures due 2012 Premium on acquired debt, using an effective Capital lease and other long-term obligations 616 298 173

16 1,103 977 612 550 500 453 400 400 300 300 300 250 250 200 165 123 109 108 100 76 61 36 33 33 24 18 18

216 43

6,655

January 29, 2011 (millions)

330 109 15 454 977 612 500 453 400 400 300 300 300 250 200 165 123 109 108 100 76 61 36 37 33 24 20 18 616 298 173 239 43

6,971

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (10)

Interest on debt Premium on early retirement of long-term debt Amortization of debt premium Amortization of financing costs Interest on capitalized leases Less interest capitalized on construction

2011 (millions) 467 (23) 8 3 455 8 447

2010 (millions) 535 66 (31) 11 3 584 5 579

2009 (millions) 587 (33) 10 3 567 5 562

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (11)

(millions) Fiscal year: 2013 2014 2015 2016 2017 After 2017 121 461 718 1,105 306 3,693

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (12)

6.625% Senior notes due 2011 7.45% Senior debentures due 2011 5.35% Senior notes due 2012 8.0% Senior debentures due 2012 5.875% Senior notes due 2013 7.625% Senior debentures due 2013 5.75% Senior notes due 2014 7.875% Senior notes due 2015 5.90% Senior notes due 2016 7.45% Senior debentures due 2016 10.625% Senior debentures due 2010 8.5% Senior notes due 2010 4.8% Senior notes due 2009 6.3% Senior notes due 2009 9.5% amortizing debentures due 2021 9.75% amortizing debentures due 2021 Capital leases and other obligations

2011 (millions) 330 109

2010 (millions) 170 41 484 27 52 16 47 38 123 2 150 76

2009 (millions)

4 2 9 454

4 2 13 1,245

600 350 4 2 10 966

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (13)

Accounts payable Gift cards and customer award certificates Accrued wages and vacation Taxes other than income taxes Lease related liabilities Current portion of workers compensation and general liability reserves Current portion of post employment and postretirement benefits Accrued interest Dividends payable Allowance for future sales returns Severance and relocation Other

January 28, 2012 (millions) 669 725 317 186 164 136 94 86 83 76 4 248 2,788

January 29, 2011 (millions) 559 654 311 195 168 144 88 98 67 1 240 2,525

Macy's, Inc. 10-K 03/28/2012 NOTES TO FINANCIAL STATEMENTS (14)

Balance, beginning of year Charged to costs and expenses Payments, net of recoveries Balance, end of year

2011 (millions) 488 144 (139) 493

2010 (millions) 478 148 (138) 488

2009 (millions) 495 124 (141) 478

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Office MaxDocument21 pagesOffice MaxBlerta GjergjiNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDocument9 pagesNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Condensed Consolidated Statements of IncomeDocument7 pagesCondensed Consolidated Statements of IncomevenkeeeeeNo ratings yet

- Net Sales: January 28, 2012 January 29, 2011Document9 pagesNet Sales: January 28, 2012 January 29, 2011장대헌No ratings yet

- Marchex 10Q 20121108Document60 pagesMarchex 10Q 20121108shamapant7955No ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Exchequer Final Statement March 2012Document5 pagesExchequer Final Statement March 2012Politics.ieNo ratings yet

- 2010 Ibm StatementsDocument6 pages2010 Ibm StatementsElsa MersiniNo ratings yet

- Unaudited Interim Consolidated Financial Statements and Footnotes October 2, 2011Document8 pagesUnaudited Interim Consolidated Financial Statements and Footnotes October 2, 2011Stefanie OchsNo ratings yet

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniNo ratings yet

- ITC Cash Flow StatementDocument1 pageITC Cash Flow StatementIna PawarNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- Actavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)Document3 pagesActavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)macocha1No ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Preeti 149Document16 pagesPreeti 149Preeti NeelamNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Ar 2005 Financial Statements p55 eDocument3 pagesAr 2005 Financial Statements p55 esalehin1969No ratings yet

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- Fina 004Document4 pagesFina 004Mike RajasNo ratings yet

- Accounting Clinic IDocument40 pagesAccounting Clinic IRitesh Batra100% (1)

- Dell IncDocument6 pagesDell IncMohit ChaturvediNo ratings yet

- In Thousands of Euros: Balance SheetDocument5 pagesIn Thousands of Euros: Balance SheetNguyễn Hải YếnNo ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- ITC Ten Years at GlanceDocument1 pageITC Ten Years at Glancevicky_maddy248_86738No ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Different: ... and Better Than EverDocument4 pagesDifferent: ... and Better Than EverViral PatelNo ratings yet

- Consol FY11 Annual Fin StatementDocument13 pagesConsol FY11 Annual Fin StatementLalith RajuNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Balance Sheet: Lending To Financial InstitutionsDocument10 pagesBalance Sheet: Lending To Financial InstitutionsAlonewith BrokenheartNo ratings yet

- Mercury Athletic - Student - 4054-XLS-EnGDocument17 pagesMercury Athletic - Student - 4054-XLS-EnGPranav AggarwalNo ratings yet

- AESCorporation 10Q 20130808Document86 pagesAESCorporation 10Q 20130808Ashish SinghalNo ratings yet

- Finally Report 2013Document144 pagesFinally Report 2013FatimaMalik100% (1)

- Financial Analysis of Islami Bank BangladeshDocument5 pagesFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- Financial ReportDocument35 pagesFinancial ReportDaniela Denisse Anthawer LunaNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Apple Inc Assignment, Financial ModuleDocument15 pagesApple Inc Assignment, Financial ModuleRahmati RahmatullahNo ratings yet

- Nu WareDocument22 pagesNu WaresslbsNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Problems 1-30: Input Boxes in TanDocument24 pagesProblems 1-30: Input Boxes in TanSultan_Alali_9279No ratings yet

- Cognizant 10qDocument53 pagesCognizant 10qhaha_1234No ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Mercury Athletic Case SectionBDocument15 pagesMercury Athletic Case SectionBVinith VemanaNo ratings yet

- Glenmark BalanceSheet CashflowDocument3 pagesGlenmark BalanceSheet CashflowRaina RajNo ratings yet

- Cost Accounting EVADocument6 pagesCost Accounting EVANikhil KasatNo ratings yet

- Rule 62-InterpleaderDocument3 pagesRule 62-InterpleaderSam LeynesNo ratings yet

- Feasibility Study of Electric Vehicle Car Hire in South Africa PDFDocument23 pagesFeasibility Study of Electric Vehicle Car Hire in South Africa PDFTebogo Cooper MabiletsaNo ratings yet

- Discharge of ContractDocument22 pagesDischarge of ContractSyahir EzNo ratings yet

- 144 Guzman v. Bonnevie - DIGESTDocument2 pages144 Guzman v. Bonnevie - DIGESTAllen Windel Bernabe100% (1)

- Delpher Trades Corporation v. IACDocument2 pagesDelpher Trades Corporation v. IACMirellaNo ratings yet

- For Exam ReviewerDocument5 pagesFor Exam ReviewerGelyn Cruz67% (3)

- F.R Standards PDFDocument79 pagesF.R Standards PDFAnonymous ns1HpZKAf50% (2)

- Lessor Disclosure StatementDocument6 pagesLessor Disclosure StatementLuke BassNo ratings yet

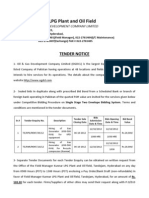

- Kunnar LPG Plant and Oil Field: Tender NoticeDocument2 pagesKunnar LPG Plant and Oil Field: Tender NoticeMalik SabNo ratings yet

- Mataas Na Lupa Tenants Assoc vs. DimayugaDocument3 pagesMataas Na Lupa Tenants Assoc vs. DimayugaClavel TuasonNo ratings yet

- The Art of PricingDocument1 pageThe Art of PricingAtef Mohsen El-BassionyNo ratings yet

- Netflix StrategyDocument3 pagesNetflix StrategyDownload100% (1)

- Scholarship Financial Aid Questionnaire Set SY1213Document6 pagesScholarship Financial Aid Questionnaire Set SY1213Kimberly Rose MallariNo ratings yet

- Transfer of Property ActDocument21 pagesTransfer of Property ActjiaorrahmanNo ratings yet

- Sample Lease COntractDocument8 pagesSample Lease COntractGerard Nelson ManaloNo ratings yet

- Classified 2014 10 30 000000Document3 pagesClassified 2014 10 30 000000sasikalaNo ratings yet

- Solutions Manual: Fundamentals of Corporate Finance (Asia Global Edition)Document8 pagesSolutions Manual: Fundamentals of Corporate Finance (Asia Global Edition)Silver Bullet100% (1)

- Transforming Elephant and Castle in BetweenDocument31 pagesTransforming Elephant and Castle in BetweenThe Bartlett Development Planning Unit - UCLNo ratings yet

- CozyHomes Brochure 230223Document5 pagesCozyHomes Brochure 230223jolynnNo ratings yet

- TB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesDocument24 pagesTB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesMarie Bernadette AranasNo ratings yet

- 2012 Instructions For Schedule C: Profit or Loss From BusinessDocument13 pages2012 Instructions For Schedule C: Profit or Loss From BusinessDunk7No ratings yet

- Owner Financing ApplicationDocument3 pagesOwner Financing ApplicationSam ParkinsNo ratings yet

- Neil Barr NEWcv Template3Document13 pagesNeil Barr NEWcv Template3Neil BarrNo ratings yet

- Business Model Plan: (Company Logo)Document19 pagesBusiness Model Plan: (Company Logo)Mence PendevskaNo ratings yet

- Exclusive Buyer Brokerage AgreementDocument4 pagesExclusive Buyer Brokerage AgreementTelmo Bermeo100% (1)

- Contract of Lease of Equipment EarthyardDocument5 pagesContract of Lease of Equipment EarthyardJess L. Malecdan0% (1)

- New Uses For Old Buildings PDFDocument28 pagesNew Uses For Old Buildings PDFSilvia BotezatuNo ratings yet

- Print Confirmation - Avis Rent A CarDocument5 pagesPrint Confirmation - Avis Rent A Car03. Đoàn Thái AnhNo ratings yet

- Rent Agreement FormatDocument2 pagesRent Agreement FormatSefiu JamiuNo ratings yet