Professional Documents

Culture Documents

Excessive Regulatory Risk Adverseness Caused The Crisis 5912

Uploaded by

Per KurowskiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excessive Regulatory Risk Adverseness Caused The Crisis 5912

Uploaded by

Per KurowskiCopyright:

Available Formats

Excessive regulatory risk-adverseness caused the crisis Per Kurowski This draft May 9, 2012 Abstract Data will

not disclose the truth if analyzed under the lens of a wrong hypothesis. This paper agues the inapplicability of most popular hypothesis in explaining the current ongoing financial crisis, the usually accused, and proposes, as an alternative hypothesis, that it was caused by an excessive regulatory risk-adverseness, introduced by means of capital requirements for banks based on the perceived risks of default which were already cleared for by the market. Much lower capital requirements for what was officially perceived as not risky allowed the riskadjusted rate of return set in the market for what was perceived as not-risky to be leveraged much more and thereby produce a much higher expected return on bank equity than what was officially perceived as risky.

Authors email: perkurowski@gmail.com

INTRODUCTION The possible Big Bang that scares me the most, is the one that could happen the day those genius bank regulators in Basel, playing Gods, manage to introduce a systemic error in the financial system, which will cause its collapse An Op-Ed in the Daily Journal, Caracas, Venezuela, 1999. Everyone knows that, sooner or later, the ratings issued by the credit agencies are just a new breed of systemic errors, about to be propagated at modern speeds A letter published 2003 in the Financial Times. We believe that much of the worlds financial markets are currently being dangerously overstretched through an exaggerated reliance on intrinsically weak financial models that are based on very short series of statistical evidence and very doubtful volatility assumptions A formal statement delivered in 2004 as an Executive Director of the World Bank. And then, in 2008, the AAA-bomb exploded! And in May 2009, The Global Development Report of the World Bank explained The origins of the financial crisis in the following way: The decline in risk-free interest rates precipitated a search for a yield that sharply increased the demand for more risky assets regulators failed to rein in the rise in financial sector leverage 1 Page 94. And that completely ignored the fact that the search was for assets that were officially deemed as not-risky and for which the regulators required the banks to hold minimum equity and by which the regulators authorized, and stimulated, the increase of leverage. Data will not disclose the truth if analyzed under the lens of a wrong hypothesis and the chances of getting out of the hole are immensely reduced by not knowing how you landed in it. This paper agues the inapplicability of all most popular hypothesis in explaining the current ongoing financial crisis, the usually accused, and proposes, as an alternative hypothesis, that it was caused by an excessive regulatory risk-adverseness, introduced by means of capital requirements for banks based on the perceived risks of default which were already cleared for by the market. Much lower capital requirements for what was officially perceived as not risky allowed the risk-adjusted rate of return set in the market for what was perceived as not-risky to be leveraged much more and thereby produce a much higher expected return on bank equity than what was officially perceived as risky.

THE USUALLY ACCUSED HYPOTHESIS The following hypotheses, arguments or narratives, in their narrow or wide forms, might effectively cover more than 99.9 percent of the explanations given by the experts for the current and ongoing bank and financial crisis in Europe and the US. 1. Banks and bankers took on excessive risks. 2. Badly aligned incentives present in the excessive bonuses paid to bankers caused bad decisions. 3. Malice, corruption and other evils! 4. Banks were deregulated, like for instance by the repeal of the Glass-Steagall Act; and as the result of regulators relying increasingly on the invisible hand of the market. 5. The shadow banks! 6. Governments intervened excessively in the housing market, like for instance through Ginnie and Fanny Mae. 7. Cronyism: Regulators were captured. 8. Credit Rating Agencies were captured or failed to perform. 9. The excessive financial flows, resulting from excessive macro-economical imbalances, on a global basis, and within Europe, were unmanageable. 10. Mark to market accounting deepened the crisis 11. Flawed originate-to-distribute securitization caused the crisis 12. A bubble in the housing market 13. The financial risk models used by the banks were flawed. 14. Derivatives and other sophistications. 15. Its all the fault of the too big to fail.

16. A Black Swan! The list of the usually accused has been accumulated from a variety of sources. One that gives a good introduction to the theme is Reading About the Financial Crisis: A 21-Book Review by Andrew W. Lo2 It is my contention that the following alternative hypothesis is more correct than any of the usually accused: THE EXCESSIVE REGULATORY RISK-ADVERSENESS OR THE DOUBLE CLEARING OF PERCEIVED RISK HYPOTHESIS This alternative hypothesis holds that since the banks and the markets already cleared for the perceived risk by means of interest rates, amounts of loans or investments, and other terms of contracts, when regulators also based their capital requirements much on the same perceived risks, the pillar of their regulations, they with their double clearing for perceived risks, doomed the banking system to overdose on perceived risks of default. This alternative hypothesis holds therefore that the expected risk-adjusted return on bank equity was tilted by the regulators in favor of what was perceived as not risky-and against what is perceived as risky. And as a consequence the banks developed excessive exposures to what was officially ex-ante perceived as not-risky and which caused the crisis, and insufficient exposures to what was officially perceived as risky, which in its turn makes it so difficult to solve the crisis. Though the original flaws with capital requirements for banks based on perceived risks can be traced way long back, these were given their truly distortive boost with the approval of Basel II in June 20043 which is when, in modern terminology, they went viral. Many have mentioned the smoking gun of the capital requirements based on perceived risks. For instance The Financial Crisis Inquiry Report from the National Commission created by the US Congress and Presidency 4mentions: Meeting in Basel, Switzerland, in 1988, the worlds central banks and bank supervisors adopted principles for banks capital standards, and U.S. banking regulators made adjustments to implement them. Among the most important was the requirement that banks hold more capital against riskier assets. Fatefully, the Basel rules made capital requirements for mortgages and mortgage-backed securities looser than for all other assets related to corporate and consumer loans Page 49.

After years of negotiations, international regulators, with strong support from the Fed, introduced the Basel II capital regime in June 2006, which would allow banks to lower their capital charges if they could show they had sophisticated internal models for estimating the riskiness of their assets. While no U.S. bank fully implemented the more sophisticated approaches that it allowed, Basel II reflected and reinforced the supervisors risk-focused approach. Spillenkothen said that one of the regulators biggest mistakes was their acceptance of Basel II premises, which he described as displaying an excessive faith in internal bank risk models, an infatuation with the specious accuracy of complex quantitative risk measurement techniques, and a willingness (at least in the early days of Basel II) to tolerate a reduction in regulatory capital in return for the prospect of better risk management and greater risksensitivity. Page 171 The new requirements put the rating agencies in the drivers seat. How much capital a bank held depended in part on the ratings of the securities it held. Tying capital standards to the views of rating agencies would come in for criticism after the crisis began. It was a dangerous crutch, former Treasury Secretary Henry Paulson testified to the Commission... Meanwhile, banks and regulators were not prepared for significant losses on triple-A mortgage-backed securities, which were, after all, supposed to be among the safest investments. Nor were they prepared for ratings downgrades due to expected losses, which would require banks to post more capital. And were downgrades to occur at the moment the banks wanted to sell their securities to raise capital, there would be no buyers. All these things would occur within a few years. Page 100 And the Dissenting Opinion puts forward: Regulatory capital standards, both domestically and internationally, gave preferential treatment to highly rated debt, further empowering the rating agencies and increasing the desirability of mortgage-backed structured products. Page 426 Just as a curiosity we need to mention that the Frank-Dodd Act5 in its 848 pages does not make one single reference to the Basel Committee for Banking Supervision, even though the US is a signatory of the Basel Accord, and though it mentions a couple of time risk-weighted assets it does not give any indications as to what principles are to be used when setting the risk-weights, nor for that matter which risks are to be covered. Unfortunately by focusing excessively on the ratings mistakes they fail to really connect the dots. That is so because while this alternative hypothesis holds that in the short term it is of course bad when the ex-ante perceptions of the risks, such as what is for instance reflected in credit ratings, turns out to be wrong; it also holds that even when the perceptions are correct, in the long term, their double clearance, will cause damages, because of the distortions they produce. In our words they will guarantee the dangerous overpopulation of the safe-haven and the, for the society equally dangerous under-exploration of the more risky but perhaps more fruitful havens.

When mentioning the capital requirements of Basel II, we will be referring to The Standardized Approach in The First Pillar Minimum Capital Requirements pages 15 to 22 of Basel II. Though an Internal Ratings Based Approach was permitted for some of the bigger international banks, it is clear that the Standardized Approach set the tone, and the floor, for the risk-modeling implied in Basel II. For all practical purposes the following 2 tables suffices to illustrate those capital requirements. Table 1. Basel II capital requirements for banks: Claims on sovereigns Credit Rating Risk Weight Capital Required Allowed Leverage AAA to AA 0% 0.0% A+ to A 20% 1.6% 62.5 to 1 BBB+ to BBB50% 4.0% 25.0 to 1 BB+ to B100% 8.0% 12.5 to 1 Below B150% 12.0% 8.3 to 1 Unrated 100% 8.0% 12.5 to 1 Table 2. Basel II capital requirements for banks: Claims on corporates Credit Rating Risk Weight Capital Required Allowed Leverage AAA to AA 20% 1.6% 62.5 to 1 A+ to A 50% 4.0% 25.0 to 1 BBB+ to BB100% 8.0% 12.5 to 1 Below BB150% 12.0% 8.3 to 1 Unrated 100% 8.0% 12.5 to 1 Some have mentioned that Basel II never entered into effect in the US and so therefore it could have nothing to do with creating the crisis. That is not the case. Once Basel II was approved in June 2004, most US banks counted on it being implemented, and started, naturally, to build up their assets accordingly. Also, already on April 28, 2004 in an Open Meeting, the SEC already delegated part of the calculations of the capital charges for broker dealers and investment banking holding companies to the Basel Committee for Banking Supervision.6 The excessive regulatory risk-taking hypotheses which is the same as an insufficient regulatory risk-taking hypotheses is of course hard to understand and accept by all those looking exclusively at the crisis with an ex-post lens or as Monday morning quarterbacks. In this respect we have over time needed to develop some narratives that allows the message to sink in. I here include a couple of these: The empirical evidence All bank crises ever have resulted from excessive lending to or investments in what was perceived as not risky but turn out to be risky, and no crisis ever has resulted from excessive

bank lending to what was, ex-ante, perceived as risky. All in accordance with Mark Twains expectations of A banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain. Based on the empirical evidence, if forced, one could even make a case for capital requirements for banks based on perceived risk that were 180 degrees opposite the current one, namely one of higher capital requirements the lower the perceived risks. Where are the real systemic risks and where did regulators go? In its most simplified terms the following quadrangle represents the ex-ante/and ex-post result possibilities for bank lending with reference to perceived risk Ex-ante: Not-Risky - Ex-post: Not Risky:- Poses little risk of any major upset, as the outcome should be quite aligned with what was expected. Ex-ante: Not Risky - Ex-post: Risky:- This group poses a real systemic threat, in terms of possible huge exposures gone wrong. Ex-ante: Risky - Ex-post: Risky:- Having been perceived as risky these not only probably do not signify a major exposure, and would also have been priced in accordance with a higher perceived risk, which helps to compensate for the losses of those in the group Ex-ante: Risky - Ex-post: Not Risky:- Only pleasant surprises. Unfortunately, the regulators set up a system that disregarded completely the existence of the systemic risk present in number 2 and the benefits for society present in number 4. Golf! What would happen to the game of golf if handicap officers allowed the good players (like you) to use more strokes and penalized the bad players (like me) taking away strokes? Horse-races! What would happen to horse racing if the good winning horses were allowed to carry less and less weights than the not so good losing horses?

DISCUSSION The following discussions of The usually accused hypothesis will mostly be based on trying to ascertain: a.-How well each of the hypotheses can explain the specific detonation of what I have called the AAA-bomb, and which caused the crisis, namely a series of excessive lending to and investments in what was originally officially and ex-ante deemed as not-risky, but which, expost, turned out to be very risky among other as a result of dangerously overcrowding the safe havens. These obese and failed bank exposures includes: the triple-A rated securities collateralized with mortgages awarded to the subprime sector in the USA; infallible sovereign debts like that of Ireland and Greece; safe banks such as those of Iceland banks; safe real-estate sector exposure like that in Spain; and finally derivatives where the counterparty risk had not been adequately understood, or priced, like in the case of the AAA rated AIG. b.-How well each of the hypotheses stands up against the explicative power of our alternative hypothesis. 1. Banks and bankers took on excessive risks. When what we face are excessive outright obese bank exposures to what was officially perceived as absolutely not risky, and its sub-product of anorexic exposures to what was and is perceived as risky exposures, like lending to small businesses and entrepreneurs, the notion of excessive risk-taking being the cause of it all, is more than ludicrous, and it can only be explained as a natural ex post reaction to a crisis. The confusion between what is perceived ex-ante as risky and not risky, and between what turns out ex-post to be risky or not risky, permeates the whole debate.

2. Badly aligned incentives present in the excessive bonuses paid to bankers caused bad decisions. Bonuses were and are indeed badly aligned with the long term results of the financial sector, but, it was primarily the extremely low capital requirements which applied when banks lent to or invested in what was officially perceived as not risky, which produced the extremely high returns on equity, which in its turn allowed and justified the payment of the extravagant bonuses. Had for instance all risky bank lending or investing

required these to hold the basic Basel II capital of 8 percent, the returns on bank equity, and therefore the bonuses paid, would have been much smaller. 3. Malice, corruption and other evils! Indeed these human failures always exist and that is why it behooves the regulators not to offer the apples of temptation. To hit down primarily or exclusively on the bad mortgage originators, without considering the whole value chain of the business model, is a good way to allow the most guilty to escape any accountability.

4. Banks were deregulated, like for instance by the repeal of the Glass-Steagall Act; and as the result of regulators relying increasingly on the invisible hand of the market. The use of the word deregulated seems to be completely out of place when considering the fact that regulators, like never before, basically micromanaged the banks by setting their standard risk-weights in order to determine the capital requirements for each asset. What was unfortunately invisible for the markets was how the regulators were distorting the markets with this. Europe had nothing like the Glass-Steagall Act and yet it also suffered an explosion of the AAA-bomb, namely that of excessive bank exposures to what had been perceived as not risky. In fact, when for instance compared to the much lower leverages permitted by the markets to unregulated entities such as hedge-funds, it is possible to determine that had the banks been totally deregulated, and not officially authorized to leverage as much as they did, another crisis might have happened, but not this one and none this large and systemic.

The shadow banks! The shadow banks represent the theory that it all started in the not regulated area of banking Indeed though that area is often used to avoid regulations it has much less capability of leveraging bad business than the formal regulated sector. As an example the hedge funds, on their own, rarely exceed a 10 to 1 leverage calculated on gross not riskweighted assets, while Basel II led European banks to leverage way over 40 times to 1 similarly calculated.

5. Governments intervened excessively in the housing market, like for instance through Ginnie and Fanny Mae. There is no question that governments intervene the housing markets in many ways which distort, both in the US and Europe, but they have been doing so for a very long time, and in Europe, the US type of Government Sponsored Entities do not exist Therefore, though the issue is relevant in general, it is not useful to explain this crisis. More important for instance in Spain, were the low capital requirements allowed the banks when entering the real estate market again because it was officially perceived as safe.

6. Cronyism: Regulators were captured Regulators and credit rating agencies are of course always exposed to being captured by interested parties, but those risks are also the results of setting up a regulatory system which generates a market in capturables, like for instance by using a system of riskweights which depend on the credit ratings. In other words, had for instance the basic capital requirement of 8 percent of Basel II been applicable to all assets, there would have been so much less inventory available for regulatory capture. According to our alternative hypothesis, once the original intellectual regulatory capture had become a reality, installing the reign of the paradigm of more-perceived-risk-morecapital and less-perceived-risk-less-capital, everything was doomed to go downhill from there.

7. Credit Rating Agencies were captured or failed to perform. Of course the Credit Ratings Agencies failed, as they had to, sooner or later. In January 2003 I ended a letter to the editor published in the Financial Times with Everyone knows that, sooner or later, the ratings issued by the credit agencies are just a new breed of systemic errors, about to be propagated at modern speeds. But what caused the crisis was not the failure of human fallible rating agencies but the fact that the banks had been instructed to take their opinions into account excessively. The credit rating agencies have been around for ages but never ever before, did they cause such a systemic risk. The regulators should always be concerned with the credit ratings being wrong, but unfortunately, by using these ratings to establish the capital requirements for the banks, they basically bet the banking system on the credit ratings being correct.

And in an almost perverse way, the better the credit agencies perform and the more they are trusted, the greater systemic risk they constitute.

8. The excessive financial flows, resulting from excessive macroeconomic imbalances, on a global basis, and within Europe, were unmanageable. Clearly the flows from macroeconomic imbalances fed the crisis, but they do not explain why these flows ended up so much as feedstock of the AAA-bomb. One can also make a case that many of the macroeconomic imbalances would have been corrected were it not for regulations that permitted their easy financing. For instance if a German bank had to hold when lending to Greece the same 8 percent in equity it needed to hold when lending to a German small business, instead of the meager 1.6 percent, 5 times less, it is hard to visualize a German Bank lending to Greece as much as it did.

9. Mark to market accounting deepened the crisis Mark to market, just as credit ratings, acting as messengers of the bad news in a procyclical way, deepened the crisis, but never caused it, as that was done by the bad lending and the bad investments. 10. Flawed originate-to-distribute securitization caused the crisis. The explosive growth of badly awarded mortgages to the subprime sector to be repackaged in securities that were rated AAA, and which initially detonated the crisis had very little to do with the demand of mortgages and everything to do with the demand for AAA-rated securities, because these, according to Basel II, where going to be (US) or were allowed to be held (Europe) by the banks against only 1.6 percent in capital, implying and astonishing 62.5 to 1 permitted marginal leverage. And the demand for these securities was not only from banks. When lending to investors against these securities as collateral, these loans could be held by the banks against very little capital, and so that generated stimulated the over-leveraging in all financial markets. Over the years I have argued in many articles that, if the market is not capable of satisfying the demand of real AAA paper, then the market, being a market, will find a ways to supply fake Potemkin rated AAA paper.

11. A bubble in the housing market.

In Spain we can indeed talk about a bubble in the housing market, but one resulting primarily from our alternative hypothesis, namely the fact that banks were allowed to finance the housing and real estate market holding very little capital, which allowed for high leverages of equity, which in its turn allowed for very high returns on bank equity. But, in the USA, it could be more correct to attribute the crisis to a bubble in AAA rated securities backed by mortgages than to a bubble in the housing market. Those about a trillion of Euros coming in from abroad into the US housing market, were not looking for housing markets, they were exclusively looking for AAA ratings.

12. The financial risk models used by the banks were flawed. Indeed, in October 2004, in a formal written statement delivered at the Board as an Executive Director of the World Bank I warned We believe that much of the worlds financial markets are currently being dangerously overstretched through an exaggerated reliance on intrinsically weak financial models that are based on very short series of statistical evidence and very doubtful volatility assumptions But that is not really the issue here, since financial risk models, like credit ratings, prepared by fallible humans, can always turn out to be wrong. The real problem was that bank regulators, instead of preparing for the consequences of such financial risk models being wrong, bet our banking system on these models being right.

13. Derivatives and other sophistications. Sophistications, as derivatives, always roll pleasantly on the tongue of those trying to give an nice sounding explanation for the crisis, but, the fact is that standing on their own, independently from banking regulations, derivatives had very little to do with causing the crisis. As an example it is clear that AIG would never ever have been able to sell their credit default swaps at the volumes and the prices they sold these had it not been for the fact that AIG was AAA rated and therefore provided the buying banks the access to minimum minimorum capital requirements.

14. Its all the fault of the too-big-to-fail. Of course the too-big-to-fail-banks are an important component of our current crisis, but, the question that needs to be answered is more the one of how did they became too big to fail? In that respect it suffices with establishing that minimalistic capital requirements

for banks, which allows for maximum leverages, are the best imaginable growth hormones for too-big-to-fail banks. In May 2003, as an Executive Director of the World Bank I addressed over a hundred bank regulators, working on Basel II, in a risk management workshop at the World Bank, with the following words: There is a thesis that holds that the old agricultural traditions of burning a little each year, thereby getting rid of some of the combustible materials, was much wiser than todays no burning at all, that only allows for the buildup of more incendiary materials, thereby guaranteeing disaster and scorched earth, when fire finally breaks out, as it does, sooner or later. Therefore a regulation that regulates less, but is more active and trigger-happy, and treats a bank failure as something normal, as it should be, could be a much more effective regulation. The avoidance of a crisis, by any means, might strangely lead us to the one and only bank, therefore setting us up for the mother of all moral hazardsjust to proceed later to the mother of all bank crises. Knowing that the larger they are, the harder they fall, if I were regulator, I would be thinking about a progressive tax on size. But, then again, I am not a regulator, I am just a developer.7 15. A Black Swan! This is the catch all of what is left hypothesis an unpredictable event. And this is what regulators would most love us to believe as it that would free them of responsibilities. They wish! Forget it! This was no Black Swan it was a completely manmade Swan, by regulators who should have known better. I recently heard a video where Nassim Taleb mentioned that there is no word for antifragility.8 Wrong! Anti-fragility is risk-taking and that is why, in so many of our Western World churches, we can hear the prayer of God make us daring! Risk taking, a lot of it and of many different kinds, is not only the oxygen of growth it also provides our financial system with the Lebensraum it needs to grow sturdy. Our current problem is that our nanny bank regulators in the Basel Committee completely forgot all about it or perhaps they never knew.

POLICY PRESCRIPTIONS If accepting the alternative hypothesis, the following policy prescriptions would seem natural: There is a need for a more transparent, diversified and multidisciplinary regulatory approach. The wider the area of influence of regulations is, for instance when they are global, the more need there is to avoid regulating by means of a mutual admiration club of regulators which can foster degenerative incestuous prescriptions; and to guarantee the openness and the diversity in the public debate of those regulations. As an example, during discussions I have obtained the impression that the inclusion of an expert in contagious diseases in the Basel Committee for Banking Supervision would have been extremely useful in order to avoid some of the biggest flaws in current regulations. Hit reboot! Sometimes you need to start with a clean slate. When the mistakes in the regulations are too profound there is a need for a totally clean slate of regulators, so as not to lose time in the construction of excuses. In other words there is also a need for accountability among regulators. At this moment the producers of failed Basel II have either been promoted upwards or placed in charge of producing Basel III. Hollywood would never allow such a thing! The purpose of banks: Regulations must begin by defining and obtaining a consensual agreement on the purpose of the regulated entities. One of the most amazing things with current bank regulations is that nowhere can we find the mentioning of what the purpose of the banks is. In this respect it is like a regulator regulating the construction of a road without concerning himself with from where it comes and to where it goes and who will travel on it. In this respect we need to stop concentrating on the bust, the crisis, and start looking at what was produced by the whole boom-bust cycle. Though I do not favor regulatory distortions, to make illustrate the issue of purpose, I frequently mention the possibility of capital requirements for banks partly adjusted for perceived sustainability and job for youth creation values. Regulations are by itself the potential source of immense systemic risks. Any regulatory intervention must be defined as a potential systemic risk, and its possible consequences clearly need to be identified a priori and so that the required monitoring mechanisms can be set up. We need more counter-cyclical bank capital adjustments. If in a case like the current crisis banks were not required to have sufficient capital/equity when they placed the perceived low-risk assets on their books, there is no need to make pro-cyclicality worse by requiring an immediate adjustment of bank equity. New bank equity should support new needed lending not remedy old mistakes.

Simplicity and transparency. The simpler and more transparent regulations are, the less prone they are to be captured. The market in regulatory capturables has to be minimized in order for the markets to work without distortions. Stop discrimination. The artificial regulatory discrimination against those perceived as risky, those already naturally discriminated against by the market, must end, lest the regulators have decreed a new class of untouchables. Simplified off-the-cuff calculations would show those unrated having to pay about 270bp more in interest rates than those rated AAA, just to make up for the regulatory discrimination.9 Let us never forget that no matter how large the costs of the current financial crisis are, the opportunity cost for the society of what was not financed because it was risky might be larger. Risk-taking. The importance of risk taking both as the oxygen of growth and as what provides the financial system with the Lebensraum it needs to be sturdy must be realized. The risky small businesses and entrepreneurs are the real sparkplugs to get the engine of economic growth going and we must see to that they are put back in the system.

FINAL COMMENT If this alternative hypothesis is true, and which would therefore point to the bank regulators having been 180 degrees wrong, as for instance one could make a case for capital requirements for banks which are higher when the borrower is perceived as absolutely not risky why has it not gained more traction? That is a question I often received and to which I responded: 1. There are many who are not that interested in explaining the crisis but are more looking to exploit it for their own ideological agendas. And there are of course also those interested in the truth not coming out. 2. It is truly mindboggling and hard to believe that those in charge of regulating the banks on a global basis can get it so wrong Theres got to be something that Kurowski has missed syndrome. To this I can only refer to Edward Dolnicks The forgers spell which provides some of the best clues as to how come expert regulators created the truly nutty bank regulations that slowly but surely is taking the Western world down. Dolnick does so by quoting Francis Fukuyama in a TV program saying that Daniel Moynihan opined There are some mistakes it takes a Ph.D. to make. And he also speculates, in the footnotes, that perhaps Fukuyama had in mind George Orwells comment, in Notes on Nationalism, that one has to belong to the intelligentsia to believe things like that: no ordinary man could be such a fool.

3. Bank regulations are not a sexy issue and most economists treat these with the same or even less respect they would give an IKEA bed-sofa assembly instruction. For instance in the whole CFA Program Curriculum Level II 2007, not a word could we find on the Basel Committee for Banking Supervision, Basel II, capital requirements for banks, or those risk-weights that at that moment were tearing the financial markets apart. And we assume that most financial courses on higher levels equally ignored the global standards.

http://siteresources.worldbank.org/INTGDF2009/Resources/gdf_combined_web.pdf

Reading About the Financial Crisis: A 21-Book Review by Andrew W. Lo, Draft of January 0, 2012 prepared for the Journal of Economic Literature.

2

Basel II: International Convergence of Capital Measurement and Capital Standards: a Revised Framework June 2004 http://www.bis.org/publ/bcbs107.pdf

4

http://fcic-static.law.stanford.edu/cdn_media/fcic-reports/fcic_final_report_full.pdf http://www.sec.gov/about/laws/wallstreetreform-cpa.pdf http://subprimeregulations.blogspot.com/2009/12/day-sec-delegated-to-basel-committee.html

Voice and Noise, Per Kurowski, Booksurge, 2006 http://www.amazon.com/Voice-Noise-PerKurowski/dp/1419620827

8

http://www.farnamstreetblog.com/2012/04/nassim-taleb-economic-recovery-perils-politics-and-possibilities/ http://subprimeregulations.blogspot.com/2011/11/basel-iis-regulatory-discrimination-of.html

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Problem Solving and Decision Making Analysis ToolsDocument12 pagesProblem Solving and Decision Making Analysis ToolsHassanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Self Assessment Sheet by VendorDocument60 pagesSelf Assessment Sheet by VendorAjayNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Investment Fundamentals Guide PDFDocument36 pagesInvestment Fundamentals Guide PDFShashank Gaurav100% (1)

- Net Smelter ReturnDocument7 pagesNet Smelter Returnsunpit100% (2)

- Pugh MatrixDocument4 pagesPugh Matrixsendil250381100% (1)

- MCQ On Plant LayoutDocument3 pagesMCQ On Plant LayoutMohan KumarNo ratings yet

- Role of Creative StrategiesDocument40 pagesRole of Creative StrategiesSunil Bhamu67% (3)

- HRM ImpDocument18 pagesHRM ImpPriyanka RajputNo ratings yet

- Performance Management-2023Document24 pagesPerformance Management-2023sammie celeNo ratings yet

- Project AppraisalDocument56 pagesProject AppraisalSunkari SrinivasNo ratings yet

- Clerk Evaluation PDFDocument1 pageClerk Evaluation PDFNieyta EytaNo ratings yet

- Fund Raising Options for Statutory AgenciesDocument5 pagesFund Raising Options for Statutory Agenciespranay boianapalliNo ratings yet

- Project Report 4th SemDocument54 pagesProject Report 4th Semsandeep aryaNo ratings yet

- Credit Policy & Procedures Guide287218220210415Document36 pagesCredit Policy & Procedures Guide287218220210415o'brianNo ratings yet

- Credit Rating AgencyDocument91 pagesCredit Rating AgencyAadesh ShahNo ratings yet

- Press Release: Arwade Infrastructure Limited D-U-N-S® Number: 86-414-9519Document4 pagesPress Release: Arwade Infrastructure Limited D-U-N-S® Number: 86-414-9519Ravi BabuNo ratings yet

- Credit Ratings: Understanding Need, Process & LimitationsDocument24 pagesCredit Ratings: Understanding Need, Process & LimitationsRupam Aryan BorahNo ratings yet

- From 90 Degree To 720 Degree Performance Appraisal: Sujith A SDocument7 pagesFrom 90 Degree To 720 Degree Performance Appraisal: Sujith A SVyom SaxenaNo ratings yet

- Q2 Long Quiz RDL2Document5 pagesQ2 Long Quiz RDL2Editha FernandezNo ratings yet

- Press Release: Refer Annexure For DetailsDocument4 pagesPress Release: Refer Annexure For DetailsAmit BelladNo ratings yet

- 1LCA000003-LTE SinglePh Overhead 10kVA 167kVA Rev01Document4 pages1LCA000003-LTE SinglePh Overhead 10kVA 167kVA Rev01thapa786mNo ratings yet

- "PLN") Is Preparing Fuel Gas Supply For Power Plants As BelowDocument1 page"PLN") Is Preparing Fuel Gas Supply For Power Plants As BelowAbdi NagaraNo ratings yet

- A Case Study Dissertation OnDocument44 pagesA Case Study Dissertation Onsachin mohanNo ratings yet

- CGO DASMARINAS CAVITE-Administrative Assistant I Bookbinder IIIDocument1 pageCGO DASMARINAS CAVITE-Administrative Assistant I Bookbinder IIIEllen CanjaNo ratings yet

- Performance ApprasialDocument42 pagesPerformance ApprasialAnshika NeemaNo ratings yet

- NikeDocument3 pagesNikeFĂrhẳn ŞĂrwẳrNo ratings yet

- Tax AuditDocument16 pagesTax AuditArifin FuNo ratings yet

- Basel II and Banks in PakistanDocument67 pagesBasel II and Banks in PakistanSadaf FayyazNo ratings yet

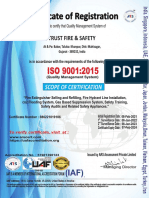

- Certificate of Registration: Trust Fire & SafetyDocument1 pageCertificate of Registration: Trust Fire & SafetyHetal PatelNo ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet