Professional Documents

Culture Documents

Position Brief - Airport Business

Uploaded by

Eduardo SilvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Position Brief - Airport Business

Uploaded by

Eduardo SilvaCopyright:

Available Formats

ACI position brief OCTOBER 2007

THE AIRPORT BUSINESS

ACI encourages its member airports to continuously improve operational and cost efficiency to moderate the cost of flying and to mitigate intensifying capacity shortfalls.

Airports are stable providers of infrastructure assets, even in the sometimes turbulent aviation industry. While airports and airlines are intrinsically linked and rely on one another to operate efficiently, they are based on different business models. Airlines are able to move quickly to respond to changes in traffic flows, by leasing or retiring capacity. Airports, on the other hand, must make long-term planning decisions to safeguard capacity sometimes 50 years into the future. In spite of this, through efficiency gains in operations, staff productivity and venturing into new revenue streams, airports have held user charges at a stable 4% of airline operating costs for over two decades. All the while, airports have invested to meet the needs of a burgeoning aviation industry and developed new business models. Over the past 30 years, airports have evolved from being simply municipal or Government infrastructure providers into sophisticated and business-oriented service providers. As in every industry the pressure to operate efficiently is constant and arises from customers and stakeholders alike. In recent years airports have played a critical role in keeping air traffic affordable and stablising operating costs for airlines. Or, as it was the case after 11 September, 2001 and SARS, have shown high flexibility in dealing with their airlines customers to relieve some of the financial pressure they came under.

Airport charges as a percentage of airline operating costs

1978 1989 1998 1999 2000 2001 2002 2003 2004 2005 4.0% 3.7% 4.4% 4.4% 4.2% 4.0% 4.0% 4.0% 4.0% 3.8%

www.aci.aero

User charges

Airports charge their airline customers for the facilities they use, following the UNs International Civil Aviation Organisation (ICAO) accepted standards. The landing and airport charges reported by the air carriers to ICAO include all charges and fees related to air transport operations that are levied against the air carrier for services provided at the airport. These include: landing charges; passenger and cargo fees; security, parking and hangar charges; and related traffic operation charges (excluding fuel and oil throughput charges) They exclude those airport passenger-related charges paid by the passengers, and which may be collected by the air carriers at the point of sale, as these are not included in the profit and loss statement of the air carriers concerned. Cost containment is challenging for airport operators as a result of their expensive asset base which must be maintained and even enhanced over time to adapt to a changing customer base. Indeed, depreciation and amortisation of airport assets account for up to 30% of expenses on the profit and loss statement. At the same time, airports are being required to pay extensive costs for enhanced security and the introduction of new technology.

In 1990, only about 30 percent of airport revenues were from non-aeronautical sources. In recent years, the global figure is closer to 50 percent, with a number of large airports deriving over 60 percent of gross revenues from non-aeronautical sources, including retail concessions, auto parking, rental car concessions and property income from leasing of airport land. Thanks to these revenues, airports have held user charges to a constant 4% of airline operating costs for 25 years, not something other airline suppliers can claim. - Robert J Aaronson

Charges on the decrease

Figures collected and analysed by ICAO demonstrate the airport industry is healthy and clearly committed to efficiency: In 2005, the income of 86% of airports worldwide covers or exceeds their expenses. Only 14% of airports generated a loss. Expenses on landing and associated airport charges incurred by air carriers have gone up by only 1.4% annually on average between 2000 and 2005.

From 2004 to 2005 total airline expenses incurred on airport charges rose by 6% remaining below the 6.6% increase in actual passenger traffic. In terms of unit costs (cents per available tonne / km) the average annual growth rate of airport charges since 2000 has been only 0.6% while total airline operating expenses increased by 1.7% annually during this period. That shows that airport charges have actually gone down. Consequently, airport charges as share of airline operating expenses have constantly decreased over the past 10 past years to 3.8% in 2005.

By contrast, a single till approach (whereby all revenues of an airport are directly considered for setting airport charges) is not advocated by ACI. Including nonaeronautical revenues in the cost base for airport charge calculations creates an artificial constraint on the airport company. The airport must then focus heavily on nonaeronautical revenue in order to meet reasonable returns. It also provides an unjustified subsidy for the aeronautical activities that effectively becomes a subsidy for the airlines. A dual-till structure also allows the monopolistic part of an airports business - the provision of core aeronautical activities - to be regulated, while ensuring that the other parts of the business can be run using the normal marketplace competition rules.

During the same period the global airport industry has invested over $US100 billion in its infrastructure and continues to plough money into existing and new facilities. ACI estimates that capital expenditure committed to at airports in 2007 will exceed $US40 billion.

Urgent need for further investment

The pressure on infrastructure will not let up as global air traffic is set to double within 20 years. Dozens of major international airports continuously operate at or over capacity. It is due to their efficiency, flexibility and innovations that the air transport system has been able to absorb ever growing passenger numbers. Sweeping requests to reduce or freeze airport user charges are short-sighted and ultimately do not promote efficient airport operations given the urgent need for investment in new infrastructure. They are also proving to be detrimental to airline and system efficiency as the continued and growing lack of airport capacity produces significant cost due to delays in the air and on the ground to the disadvantage of the wider economy.

Sources of revenue

There are two distinct forms of income and expenditure at an airport: aeronautical and non-aeronautical. In broad terms, the aeronautical side of the business is made up of fees paid for the traditional core airport-related activities such as the provision of runways, aircraft stands, facilitation and security areas and the associated staff to undertake such activities. The non-aeronautical revenues come from activities that are undertaken on top of this core business, such as retail, parking, other concessions and rentals. At medium and large airports this revenue may account for over 50% of the total income, growing at much faster pace than aeronautical income or traffic figures and producing greater profit margins. The additional income from non-aeronautical revenue is a key component in enabling airports to generate funds for the significant investment they must undertake in terminal and airfield expansion. The commercial revenue stream is essential for positive credit ratings and the airports ability to attract investors, private or public (and the associated financing of large infrastructure projects). Without this revenue, airports would be considered less attractive investments.

Privatisation in Londons airports acutally resulted in lower charges to the airlines. But that is not always the case, as an investor may find it necessary to raise charges to fund new capacity and other improvements that have been neglected by the public sector management. When revenues do increase, it is generally because the airport is performing at an enhanced level. - Robert J Aaronson

Dual till vs. single till

Broadly speaking, there are two approaches to the airport business model. One, the dual till system, splits the aeronautical and non-aeronautical business into distinct income and expenditure accounts. This ensures that income from the aeronautical side of the business (such as landing fees, security costs, passenger charges and departure fees) are used for aeronautical expenditure (such as runway repairs and terminal development), leaving the non-aeronautical income to provide for non-aeronautical expenditure (building new car parks and expanding retail sections of a terminal) and to make up company profits.

You might also like

- Revenue Generation For Airports New Ideas For Generating Revenues at Pakistani AirportsDocument12 pagesRevenue Generation For Airports New Ideas For Generating Revenues at Pakistani Airportsmuhammad100% (3)

- BAM Airport Thesis 2020.08 FINALDocument17 pagesBAM Airport Thesis 2020.08 FINALYog MehtaNo ratings yet

- ACI briefing paper on airport business modelsDocument13 pagesACI briefing paper on airport business modelsAzzreiz AzzarainNo ratings yet

- Relationship Between Revenue and Expense Profiles of AirportDocument25 pagesRelationship Between Revenue and Expense Profiles of AirportShijoNo ratings yet

- Management and Cost Accounting Insights for Airport ComplexDocument7 pagesManagement and Cost Accounting Insights for Airport ComplexKalyan VsNo ratings yet

- Week # 4Document6 pagesWeek # 4Akash AliNo ratings yet

- 07 PP Escobar eDocument7 pages07 PP Escobar eYashwant BhaveNo ratings yet

- Airport Privatization FinalDocument15 pagesAirport Privatization FinalSombwit KabasiNo ratings yet

- Globalization, Liberalization and Privatization of Aviation IndustryDocument20 pagesGlobalization, Liberalization and Privatization of Aviation Industryshekar20No ratings yet

- Curso Mod1 Airport Ramp ServiceDocument5 pagesCurso Mod1 Airport Ramp ServiceCarlos AugustoNo ratings yet

- Small Airports and The Bottom LineDocument6 pagesSmall Airports and The Bottom LineRoberto SimpsonNo ratings yet

- Airline EconomicsDocument36 pagesAirline Economicschuchuking100% (1)

- Non Aero Revenue - MBA ProjectDocument68 pagesNon Aero Revenue - MBA ProjectSuresh Kumar100% (2)

- ACI Policies and Recommended Practices Seventh Edition 1Document10 pagesACI Policies and Recommended Practices Seventh Edition 1Sechebe ShreyasNo ratings yet

- Micro Economics Assignment - Airline Industry - SanthoshDocument4 pagesMicro Economics Assignment - Airline Industry - SanthoshSanthosh TholpdayNo ratings yet

- Airport ResearchDocument17 pagesAirport ResearchCharineNo ratings yet

- AIRPORT FINANCING SOURCESDocument2 pagesAIRPORT FINANCING SOURCESJames ChuNo ratings yet

- Regulation and Financing 07Document9 pagesRegulation and Financing 07nandittoNo ratings yet

- Airline Economics Is There A Formula For SuccessDocument13 pagesAirline Economics Is There A Formula For SuccessAhmad RagabNo ratings yet

- Airport Econ PTRCDocument12 pagesAirport Econ PTRCGeorge ZahariaNo ratings yet

- Journal of Air Transport Management: John F. O 'Connell, David Warnock-SmithDocument10 pagesJournal of Air Transport Management: John F. O 'Connell, David Warnock-SmithMert BarbarosNo ratings yet

- Faqs For "Resolving The Crisis in Air Traffic Control Funding"Document5 pagesFaqs For "Resolving The Crisis in Air Traffic Control Funding"reasonorgNo ratings yet

- Managing Airports Chapter 7 SummaryDocument34 pagesManaging Airports Chapter 7 SummaryOrawan SangthongnirundornNo ratings yet

- Singapore Changi Airport - A Case Study of Its DevelopmentDocument8 pagesSingapore Changi Airport - A Case Study of Its Developmentjkennedy_34100% (1)

- (Airport) (JOURNAL) Airport Concessions PDFDocument10 pages(Airport) (JOURNAL) Airport Concessions PDFMuhammad Ilham. PrayogaNo ratings yet

- B J Atc U F:: Usiness Ets and Ser EesDocument40 pagesB J Atc U F:: Usiness Ets and Ser EesreasonorgNo ratings yet

- 2015 Aviation TrendsDocument5 pages2015 Aviation TrendsTran Viet HaNo ratings yet

- AIRPORT FINANCE: Sources & Management of Funds for Airport DevelopmentDocument18 pagesAIRPORT FINANCE: Sources & Management of Funds for Airport DevelopmentMalwa InstituteNo ratings yet

- Smarter Airport Systems Transform Travel - IBMDocument19 pagesSmarter Airport Systems Transform Travel - IBMIBMTransportationNo ratings yet

- Passenger Satisfaction in Airline IndustryDocument83 pagesPassenger Satisfaction in Airline IndustryAravindraj Ramachandran75% (4)

- Indian Aviation Industry Analysis and OutlookDocument27 pagesIndian Aviation Industry Analysis and OutlookDivya GirishNo ratings yet

- Airport Competition Remains LimitedDocument32 pagesAirport Competition Remains LimitedAyazBabu100% (1)

- State of Airport EconomicsDocument14 pagesState of Airport EconomicsGeorge RaduNo ratings yet

- The Future of AirportsDocument7 pagesThe Future of AirportsBrazil offshore jobsNo ratings yet

- Eu AirportsDocument6 pagesEu AirportsAnonymous Drqem9zxJNo ratings yet

- Aircraft Operating Costs and Profitability-Chapter12 TravelMarketingDocument16 pagesAircraft Operating Costs and Profitability-Chapter12 TravelMarketingAvinash Routray50% (2)

- The Abidjan Airport Concession Facing Regional Aviation LiberationDocument12 pagesThe Abidjan Airport Concession Facing Regional Aviation LiberationOmotola AwojobiNo ratings yet

- How Covid could reshape aviationDocument6 pagesHow Covid could reshape aviationSanjeevani HanjuraNo ratings yet

- Easy JetDocument7 pagesEasy Jetsha_narenNo ratings yet

- Managerial Decisions & Business Strategy of Emirates Airline /TITLEDocument12 pagesManagerial Decisions & Business Strategy of Emirates Airline /TITLEyash jhunjhunuwalaNo ratings yet

- Canada'S Regional Airports: Getting The Funding Balance RightDocument4 pagesCanada'S Regional Airports: Getting The Funding Balance RightAminul IslamNo ratings yet

- Micro Economics Assignment Airline Industry SanthoshDocument4 pagesMicro Economics Assignment Airline Industry SanthoshSagar HindoriyaNo ratings yet

- Detailed Project Report For Airport Project 1Document3 pagesDetailed Project Report For Airport Project 1Nithin Santhosh80% (5)

- Bhakti Bagla-SM ReportDocument3 pagesBhakti Bagla-SM Reportkeshav BaglaNo ratings yet

- 2015 ACI Airport Economics Report - Preview - FINAL - WEBDocument12 pages2015 ACI Airport Economics Report - Preview - FINAL - WEBEloy Mora VargasNo ratings yet

- 10 - Economic Political and Social Role of AirportsDocument29 pages10 - Economic Political and Social Role of AirportsS A M E E U L L A H S O O M R ONo ratings yet

- Examen RyanairDocument5 pagesExamen Ryanairmiriamgonmar27No ratings yet

- Mini Project 2 Tushar IndustryDocument11 pagesMini Project 2 Tushar IndustryTusharNo ratings yet

- Airport FinanceDocument39 pagesAirport FinanceNessa NesschtNo ratings yet

- Aviation Industry in SADocument7 pagesAviation Industry in SADimakatsoNo ratings yet

- AVA10004 - PPT 9 - Airport Airline RelationshipDocument23 pagesAVA10004 - PPT 9 - Airport Airline RelationshipDavidChenFangHongNo ratings yet

- Measuring Airport Non-Aviation PerformanceDocument20 pagesMeasuring Airport Non-Aviation PerformanceciciaimNo ratings yet

- Presentation of Introduction To Airline Operations Lecture 2 Dated 16 Sep 2020Document39 pagesPresentation of Introduction To Airline Operations Lecture 2 Dated 16 Sep 2020Rumaisa HamidNo ratings yet

- Taufiq Bin Rosli DAM2006658 July Semester Airport Operation (Aop1203)Document16 pagesTaufiq Bin Rosli DAM2006658 July Semester Airport Operation (Aop1203)taufiq rosliNo ratings yet

- Aviation ManagementDocument10 pagesAviation ManagementHamza MughalNo ratings yet

- Airport Performance Indicators 2006Document165 pagesAirport Performance Indicators 2006capanao100% (2)

- Reducing Airlines’ Carbon Footprint: Using the Power of the Aircraft Electric Taxi SystemFrom EverandReducing Airlines’ Carbon Footprint: Using the Power of the Aircraft Electric Taxi SystemNo ratings yet

- Foundations of Airport Economics and FinanceFrom EverandFoundations of Airport Economics and FinanceRating: 5 out of 5 stars5/5 (1)

- Practical Airport Operations, Safety, and Emergency Management: Protocols for Today and the FutureFrom EverandPractical Airport Operations, Safety, and Emergency Management: Protocols for Today and the FutureRating: 4 out of 5 stars4/5 (5)

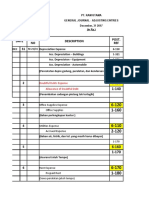

- Chart of Accounts GuideDocument3 pagesChart of Accounts GuideThea LicupNo ratings yet

- Indian Salon Industry ReportDocument26 pagesIndian Salon Industry ReportReevolv Advisory Services Private Limited0% (1)

- Tax Reform in India Achievements and Challenges PDFDocument17 pagesTax Reform in India Achievements and Challenges PDFrudra learning institute be the best100% (1)

- CPA REVIEW SCHOOL PHILIPPINESDocument9 pagesCPA REVIEW SCHOOL PHILIPPINESFrancis Vonn Tapang100% (1)

- FDNACCT - Quiz #2 - Problem Solving - Solutions-2Document4 pagesFDNACCT - Quiz #2 - Problem Solving - Solutions-2Ichi HasukiNo ratings yet

- Chap 18Document32 pagesChap 18ridaNo ratings yet

- MASB7 Construction Contract7Document3 pagesMASB7 Construction Contract7hyraldNo ratings yet

- Diamond Hills Feasibility StudyDocument59 pagesDiamond Hills Feasibility Studyメアリー フィオナNo ratings yet

- P2Mindmap (JoeFang)Document41 pagesP2Mindmap (JoeFang)Mubashar HussainNo ratings yet

- Cambridge IGCSE: Accounting 0452/22Document20 pagesCambridge IGCSE: Accounting 0452/22Valerine VictoriaNo ratings yet

- Merchandising Operations PreviewDocument25 pagesMerchandising Operations PreviewwtfNo ratings yet

- GAURAV Ratio AnalysisDocument60 pagesGAURAV Ratio AnalysisPoonam KolgeNo ratings yet

- PEC 1-Mohith .PPTX 123Document21 pagesPEC 1-Mohith .PPTX 123shekartacNo ratings yet

- PT Bintang Mitra Semestaraya TBK Dan Entitas AnakDocument114 pagesPT Bintang Mitra Semestaraya TBK Dan Entitas AnakMaulida WilandariNo ratings yet

- Career Paths Accounting SB-26Document1 pageCareer Paths Accounting SB-26YanetNo ratings yet

- Taxpayer Charter: Your Rights and ObligationsDocument15 pagesTaxpayer Charter: Your Rights and ObligationskevotooNo ratings yet

- PT RAM UTAMA GENERAL JOURNAL ADJUSTING ENTRIESDocument29 pagesPT RAM UTAMA GENERAL JOURNAL ADJUSTING ENTRIESEgi Rianto100% (1)

- Ym0654 Tax - PNL 2019 04 01 2020 03 31Document52 pagesYm0654 Tax - PNL 2019 04 01 2020 03 31Jayachandra JcNo ratings yet

- Working Capital Management Marathon Electric India Pvt. Ltd.Document63 pagesWorking Capital Management Marathon Electric India Pvt. Ltd.Leo SaimNo ratings yet

- Practical Guide To SAP FI-RA Revenue Accounting and ReportingDocument165 pagesPractical Guide To SAP FI-RA Revenue Accounting and ReportingBrinta K100% (8)

- CH 03Document48 pagesCH 03kevin echiverriNo ratings yet

- Problem 1: CAT LEVEL 3 - SET 4 QuestionsDocument4 pagesProblem 1: CAT LEVEL 3 - SET 4 QuestionsEliza BethNo ratings yet

- Accounting For Income TaxesDocument25 pagesAccounting For Income TaxesKulet AkoNo ratings yet

- Accounting Concepts and PrinciplesDocument36 pagesAccounting Concepts and PrinciplesNasir NadeemNo ratings yet

- Class No - 8, 9Document38 pagesClass No - 8, 9WILD๛SHOTッ tanvirNo ratings yet

- Hilton7e SM Ch06 Final RevisedDocument82 pagesHilton7e SM Ch06 Final RevisedJohn100% (4)

- Corporate Reporting Professional 1 Exam NotesDocument22 pagesCorporate Reporting Professional 1 Exam NotesJasonSpringNo ratings yet

- Form PDF 763181760311022Document88 pagesForm PDF 763181760311022safiNo ratings yet

- Financial AspectDocument3 pagesFinancial AspectPeachyNo ratings yet

- JurnalDocument20 pagesJurnalRohim Dian HadiNo ratings yet