Professional Documents

Culture Documents

Glaxo Smith Kline Case

Uploaded by

Ahmed TarekOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Glaxo Smith Kline Case

Uploaded by

Ahmed TarekCopyright:

Available Formats

Section C

International Issues: Questions of Social Responsibility

CASE 4

laxoSmithKline's Retaliation Against Cross-Border Sales of Prescription Drugs

Sara Smith Shull- and Rebecca J. Morris

WARWAS IMMINENT WITH IRAQ, THE RELENTLESS BEAR MARKET WAS ENTERING ITS FOURTH

year, personal savings were at an all-time low, and the American consumer was valiantly growing the economy at a meager 1.4% annually. Against this backdrop healthcare costs were spiraling upward year after year. The aging of the largest single population cohort in American history (the Baby Boomers) resulted in greater utilization of healthcare services. Concurrently, the cost of the services themselves (prescription drugs, physician visits, and hospitalizations) was increasing. Cumulatively, these services were responsible for a doubledigit increase (10% per capita) in healthcare costs in 2(()1, the first time in more than a decade that healthcare costs had accelerated so rapidly.' Reaching $1.4 trillion, healthcare costs escalated to 14.1% of the gross domestic product (GDP)." GlaxoSmithKline plc (GSK), a prescription drug and personal hygiene consumer products company based in Britain, found itself coping with a new challenge during this period as Americans, especially senior citizens, developed various tactics to deal with the rising drug costs. Discovering that prescription drugs could be acquired from Canadian pharmacies via the Internet at prices substantially lower than those available at pharmacies in the United States, resourceful Americans began to consistently adopt the practice.' The flow of drugs from Canadian pharmacies to American consumers captured the attention of GSK and their concern grew as the practice spread. Late in 2002 they attempted to curb the flow of prescription drugs out of Canada into the United States by limiting the drugs shipped to Canadian

Copyright 2003 by Professors Sara Smith Shull and Rebecca J. Morris, both of the University of Nebraska at Omaha. and The Business Case Journal. This case cannot be reproduced in any form without the written permission of the copyright holders Professors Sara Smith Shull and Rebecca J. Morris and Society for Case Research. Reprint permission is solely granted to the publisher, Prentice Hall, for the books, Strategic Management and Business Policy--10th Edition (and the International version of this book) and Cases in Strategic Management and Business Policy-40th Edition by the copyright holders. The copyright holders, are solely responsible for case content. Any other publication of the case (translation, any form of electronics or other media) or sold (any form of partnership) to another publisher will be in violation of copyright law, unless Professors Sara Smith Shull and Rebecca J. Morris, and the Society for Case Research have granted an additional written reprint permission. This case was published in The Business Case Journal, Volume II, Issue 2; Winter 2003/2004, pp. 32-55.

4-1

SECTION C International Issues: Questions of Social Responsibility pharmacies.' This challenged pharmacies to provide adequate prescription product for their Canadian customers while shipping product to American customers south of the border. However, GSK discovered Americans, especially seniors, to be loud, persistent, and effective protesters when they threatened to limit drug supplies to Canadian pharmacies. Kate Stahl, the 83- year-old metro president of the Minnesota Senior Federation was defiant: "People in America, including Minnesotans, pay the world's highest prices for drugs. Now, if they (GSK) are going to boycott us, we're going to boycott them."' Una Moore echoed support for sanctions against GSK. A retired licensed practical nurse with no pension, she had been coinpelled to purchase drugs from Canada for years. "I'm terrified that the other companies will follow Glaxo. We have to get together and find a way to beat these guys."'

The Basis for GlaxoSmithKline's Decision

The late 1990s and the early years of the 21st century set the stage for GSK's decision. Seeking relief from escalating healthcare costs, many Americans, especially senior citizens, sought alternate channels for acquiring the prescription medicines upon which they increasingly relied. Publicizing the increasing costs and promoting a political agenda, U.S. congressmen from states along the Canadian border be gan to host bus trips for senior citizens across the border in order to procure prescription drugs at costs as much as 80% lower than those available in the United States. Logistically, relatively small numbers could participate imthis practice and make savings on drugs . worth the Cost of the trip. Americans traveling in Europe, Canada, and Mexico might also acquire small ---, tints of prescription drugs for personal use at a cost much lower than that available in the United States. However, it was not until the Internet became routinely available in homes, public libraries, and kiosks that prescription drugs from around the world were available at the touch of a button to Americans. In a relatively simple process, seniors and others could take a prescription written by an American physician, send it to a Canadian pharmacy, and within days receive their drugs at home at a substantial discount to what that product cost in the United States.' The practice grew rapidly in the early years of the 21st century, as political agendas and budgetary constraints stalled a Medicare prescription drug benefit in the United States. By late 2002, over a million senior citizens indicated that they were seeking prescription drugs over the Internet from an estimated 123 Canadian pharmacies. Precise sales figures attributed to the practice were private record; however, Manitoba pharmacies alone claimed $250 million in sales from approximately 400,000 U.S. customers during 2002." Prices for GSK drugs from a variety of sources are provided in Exhibit 1. GlaxoSmithKline was beginning to feel the economic effects of American consumers acquiring prescription drugs from Canada at lower cost, circumventing the traditional preExhibit 1 Comparative Patient Drug Costs for GlaxoSmithKline Products (Dollar amounts in U.S. dollars)

Drugs

Insurance Copay

$103.18 $30.00-$45.00 $206.99 38.72 15.00-25.00 66.76 219.46 30.00-45.00 313.52 63.27 30.00-45.00 121.99 67.84 30.00-45.00 117.99 47.41 107.99 $30.00-$45.00 Note: U.S. prices wecetaken from a Walgreens Pharmacy in the Minneapolis, Minnesota, area on February 19, 21303. Prices for Augmentin and Avandia were taken from the RarlwaylxAssist web site (ietvw.RailwayR.r.Assistram). Canadian prices do not include shipping. The Canadian exchange rate for U.S. dollars on February 19, 2003, was 0.656938.

Advair 50/500mcg diskus Augmentin 875/125k X28 tabs Avandia 8mg X 100 tabs Flovent 250mcg inhaler hnitrex 50mg X6 injections Paill 30 mg X30 tabs

YOUR

GlaxoSinithiaine's Retaliation Against Cross-Border Sales of Prescription Drugs

seription drug market. Therefore, responding to the growing popularity of cheaper Canadian drugs among American consumers, GSK defended premium pricing in America. "Prescription drugs are generally cheaper in Canada (than the U.S.) primarily because prices are controlled and capped by Canada's Patented Medicines Prices Review Board (through a national health insurance plan)," reiterated the management of GSK on a corporate Website.' "But even without price controls, prescription medicines, like most other products, would probably still be cheaper in Canada due to lower wages and buying power there. A Dodge Caravan costs S31,(X)0 in the U.S. but just $21,000 in U.S. dollars in Canada, - the site continued. Also, in January 2(X)3 in an action GSK closely compared to that of other consumer good manufacturers, they threatened to stop supplying drug wholesalers and retailers in Canada, unless Canadian pharmacies ceased their cross-border sales. "In response to (U.S.) dealers importing cars from Canada to resell, some U.S. auto-makers threatened to void their warranties or hold back other incentives from the (offending) dealers," declared GSK,''' ostensibly providing a rationale for their own actions. GSK delayed the deadline once, allowing Canadian pharmacies more time to "self-certify" that they were not exportin g drugs to the United States. Then GSK finally cut off the product supply near the end of February 2003. GSK was the only pharmaceutical manufacturer that initiated such action, although all companies selling prescription drugs in America were affected." The reaction to the GSK decision was immediate and vocal, affecting the public image of the company worldwide. Perceived as mean-spirited, bullying, greedy, and insensitive, GSK faced angry consumers, who for years had tolerated double-digit price increases for their medicines.' Detroit resident William Finton, a 65-year-old semi-retired accountant who purchased chronic medications from Canadian pharmacies, remarked, "It really doesn't take a rocket scientist to figure out that they are making excessive profits. Of course they have a lot of expenses in producing these drugs, but once they make the cost back, it really shouldn't be this expensive."'' "They are beginning to make the tobacco companies look good," quipped Todd Lebor, an equity analyst for Morningstar.' Joe Graedon, an author of a syndicated column dedicated to drug issues, wrote of GSK's crackdown to limit Canadian drug supply, "It's like attacking apple pie, Mom, and Chevrolet." A coalition of ten leading American and Canadian healthcare and business organizations began a national advertising campai gn harshly criticizing the drug maker for its ban (Exhibit 2). The y maintained that GSK was keeping Americans, especially seniors, from accessing more affordable prescription medications than could be acquired in the United States.' Peter Wyckoff, executive director of the Minnesota Senior Federation, a coalition member, declared, "we see this as an issue of unbridled greed, hurting the health and safety of American citizens who have no choice but to look at less costly alternatives (than drugs available in the United States)."" The coalition members collectively purchased a full-page ad in the New York Times encouraging healthcare professionals and consumers to pressure GSK to reverse their decision. They insisted that GSK renew delivery of their products to Canadian pharmacies, despite a high likelihood of exportation across the border to the United States. The coalition encouraged readers to contact their legislators and the CEO of GSK, Jean Pierre Gamier, to complain about the ban. They also encouraged senior citizens to consult with their pharmacists and physicians to investigate whether comparable generic agents were available, or whether patients could be switched to drugs manufactured by GSK's competitors and achieve the same therapeutic goal. Consumers were encouraged to sell off GSK stock and boycott over-the-counter or personal hygiene products manufactured by GSK. Jimm Axline, president of the National Association of the Terminally III, a nonprofit organization serving families facing terminal illness said,

With this campaign, we're delivering our message loud and clear to Glaxo, that you cannot steal

access to affordable drugs from those who are dying and expect to get away with it. We're urging consumers and healthcare professionals to call their Senators and Congressmen and Glaxo's

U.S. CEO, and tell them to give our patients back their affordable drugs.'

11

01minisu

SECTION C International Issues: Questions of Social Responsibility

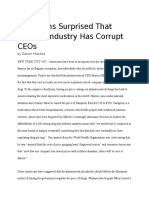

Exhibit 2 Coalition At Critical of C:laxo

Glaxo is taking away your right to affordable prescription drugs!

the worn, s second largest drug maker, GlaxoSmithKline, has stopped providing its drugs to Canadian p'iabnacinv and wholesalers who supply an estimated one million uninsured and underinsured American seniors with affordable, high quality medications. If Glare gets its way. all drugmakers will likely follow its lead and eventually strip seniors of their well-established right to access affordable drugs from altemabve sources.

Fight Back to Stop Giaxo Now:

Contact the U.S. Congress switchboard in Washington, DC at 1-202-224-3121, ask for the names and phone numbers of your House and Senate members, and call them to share your concerns. Or, visit www.congress.org to learn your legislators e-mail addresses and send them a note. 1 Call Glaro's toll-free consumer hotline at 1-888-825-5249, press 3, then press 2, and give your views to the live operator. 3 Write Glare s U.S. CEO and tell him to stop the restrictions being placed on Canadian drugs: Mr. Jean-Pierre Gamier, CEO, GSK U.S Pharmaceuticals, five Moore Drive, P.O. Box 13398, Research Triangle Park, NC. 27709 4 If you have been buying your Glaxo drugs from a Canadian pharmacy and cannot afford the high U.S. pharmacy prices, check with your doctor to see it there is a comparable drug made by another drugmaker that you can switch to. 5 Consider selling any Glare stock that you currently hold either directly or through a pension fund. Otero stock is listed as 'GSK" on the New York Stock Exchange. 6 You may want to consider switching from these Glaris over-the-counter treatments to those made by other manufacturers. The company's products include the following brands: Beano, Citrucel, Contac, Gordo', Sominex, Sensodyne, Polidenk Poligrip, Nytol, Nicoderm, Nicorette, Tegrin, Turns and Vivann.

iThy menageu dwell w yn0 lb, M y ron. Ind Conolon orpninnions oin wok lo non Aran* allenitive ynomed Aug, onnloblo ns auk, rchonie ed bncon meter (remool Aykad a ondcl nod Or photo seal forIllunronsr donor only no Scan IVivk yn.yoon

re.. nine...9 Sow. Aeln. Nehrmi

Ix all kornynns

==

canadmedscom

,1

Gal NEVE

M.4014 lomirlie.o.

,aneciarnes cam

MOW

tnishebl

CAARx

C.6.111. Acme ea V** Procnr.0 Dn.

=v

HEAMICARE

crossbordetpharmacy.COm

11.arn blows. NO *a

11, 1./(mark

11.IM17a Aneciame lased a Wm. wl.y raleyees. lac ..ems.

4.pw.yr. enonlennneylals

TeraiOli

...me ...yaw* poor.. ....ma

For more intomranon or if your organisation is interested n joining the sweetest cad 1-773-769-1616

t)8

alrmoSmithEline's Retaliation Against Cross-Border Sales of Prescription Drugs

OSK spokeswoman Nancy Pekarek maintained, This is not a financial issue for GlaxoSmithKline. The amount of money we estimate is involved

with Internet sales from Canada is less than one percent of our sales in the United States. But, obviously Internet sales are growing, and, as the business increases, so does the potential risk to patients."

Meanwhile, the press and coalition sought to portray GSK as a powerful company more concerned with profits than the health and well-being of American and Canadian consumers. Elizabeth Wennar, MD, spokesperson for the Coalition for Access to Affordable Prescription Drugs, a Vermont-based advocacy group said, Strong profit g rowth is Glaxo's chief concern, not the quality care and the well-being of seniors

who cannot pay the exorbitant American prices for their life-saving drugs. If patient care was a genuine worry, Glaxo would have come forward much earlier. They wouldn't have waited nearly three years (during Internet growth) while Canadian pharmacies have grown to serve millions of uninsured and underinsured Americans. Simply put, Glaxo wants a much bigger piece of the sales action.'

Glaxo insisted that the decision was simply a tactical maneuver to protect American patients' safety from risks attributed to quality assurance lapses in the reimportation process. However, the Minnesota Senior Federation believed that the drug company was really concerned with the "safety of its sales and profits." Barbara Kaufman, president of the senior group, declared, "The idea that shipping drugs north to Canada ... and throughout the United States ... is safe, while shipping drugs south to the U.S. is dangerous is ludicrous."" Joe Graedon, in his syndicated column, cast even further doubt on the patient safety rationale for the crackdown, calling it "smoke and mirrors" and emphasizing Canada's own interest in protecting its citizens. "Canadian authorities have rigorous federal supervision of medicines," he said. "You have to assume that if you shop for your Advair at a pharmacy in Toronto, it's going to be just as good as Advair in downtown Durham (North Carolina)."" Kris Thorkelson, representing the Manitoba International Pharmacists Association, agreed saying,

safe, ensuring product integrity, and Glaxo's claims about safety are without foundation. Drugs are shipped great distances in similar circumstances every day with no threat to their integrity. The same thing happens in the U.S. and elsewhere, yet the manufacturer is not raising the issue there. Glaxo uses the same shipping techniques to move its products to wholesalers and retailers all over North America."

The shipping of drugs across the border and elsewhere has always been and will continue to be

Industry watchers suggested that the most obvious motivation for the GSK action was the erosion of its American profit picture. A PR newswire out of St. l'aul, Minnesota, reinforced this notion by suggesting that Glaxo was attempting to take away the rights of senior citizens under the guise of safety." Formal legal implications were also raised." "What they are doing is restraint of trade,"" said Phil Mamber, president of the Massachusetts Senior Action Council. GlaxoSmithKline, while spending hundreds of millions of dollars annually to advertise its drugs, was losing control over something it couldn't buy: its image. The crackdown on reimportation of Canadian drugs. via the Internet had become a lightning rod of controversy, featuring vulnerable, typically elderly patients on one side and a large, multinational, and successful corporation on the other. "(Ironically) GSK is feeding a climate of antipathy toward drug companies that could, in the long term, result in new laws that could have an impact on their sales,"" warned Frances Cloud, a pharmaceutical analyst with London's Nomura Securities. Joe Graedon, co-hosting the public radio program, "The People's Pharmacy," agreed, (The crack-down) risks alienating a lot of Canadians, and it risks alienating Americans who are

fed up with subsidising the cost of drugs for the rest of the world. the only explanation I can

46.

SECTION C International Issues: Questions of Social Responsibility imagine for why GSK would be willing to risk that is because so num), people are now buying their medicines from Canada that GSK is starting to see the effect on the bottom line."

In 2003, the pharmaceutical industry introduced their products into a marketplace decidedly different than other industries. Individuals did not enter the healthcare services marketplace for discretionary purchases. Healthcare services, at one juncture or another, were essential in the lives of most people to maintain optimal health or to treat acute and chronic diseases. However, access to healthcare services and prescription drugs was variable, based on gender, geographic location, socioeconomic factors, and race. Complicatin g the data interpretation was the weak economy and the prolonged ennui of the American stock markets. While many seniors partook of an active, secure, and stimulating retirement, others, just years short from anticipating a secure retirement, were contemplating remaining at or returning to work, unwillingly, to make ends meet."

GlaxoSmithKline plc

GlaxoSinithKline plc (GSK) was a multinational concern formed from the acquisition of SmithKline Beecham by Glaxo in late 2000. Headquartered in London, England, the company employed more than 100,000 people and distinguished itself as the largest pharmaceutical rTompany in Europe and the second largest pharmaceutical company in the world. Seeing the United States as a key market, GSK stru ggled to establish itself as the fastestgrowing pharmaceutical company there. The 2000 merger resulted in a broad product line that included prescription drugs, vaccines, and consumer health products. Therapeutic targets for GSK products included depression, infectious disease, asthma and chronic obstructive pulmonary disease, mi g raine headaches, non-insulin dependent diabetes mellitus, chemotherapy-induced nausea and vomiting, and congestive heart failure. Blockbuster products (global sales > 1 billion per annum) included Paxil (depression), Augmentin (Gram positive aerobic bacterial infection), Advair (asthma), Flovent (asthma), Imitrex (migraine headache), and Avandia (non-insulin dependant diabetes mellitus). Consumer health products included Aquafresh toothpaste, Nicorette patches and gum (smoking cessation), and Turns (calcium supplement/ heartburn relief). GSK was in strong financial condition" as shown in Exhibit 3. In 2002, they experienced an increase of 7.8% in global sales of pharmaceutical products to nearly $27 billion. U.S. sales of pharmaceutical products increased by 13%. An essential market, the United States represented 54% of all GSK sales. GSK commanded 8.8% of the market share for prescription Exhibit 3 Profit and Loss Summary: GlaxoSmithKline, plc (Dollar amounts in millions, except per-share data)

Year Ending Dec. 31 Sales Pharmaceuticals Consumer health Total sales Gross profit Operating profit Profit beforetitication Earnings Earnings per share Shares outstanding

2002 $26,993 4,826 31,819 24,906 8,327 8,259 5,873 $1.99 5,912

2001

Change (%) 9.0 2.1 7.8 9.7 22.2 28.0 33.5 38.0 (2.5)

$24,775 4,729 29,504 22,688 6,817 6,504 4,396 $1.45 6,064

Source: GlaxoSmithKline Annual Report, 2002, released February 12. 2003.

(ilnxoSmithlUine's Retaliation Against Cross-Border Sales of Prescription Drugs

Global Sales Global Growth (

fill Nervous System 0,. tratory SystemAdvair :,.,Antiinfectives-MV .,. Metabolic/gastrointestinal vandia `9 OncologyZofran CardiovascularCoreg

$6.8 billion 3.1 billion 4.4 billion 2.4 billion 2/ billion 2.1 billion 1 billion 1.1 billion 459 million

17 15 (18% in U.S.) 25 96 13 1 19 (15% in U.S.) 22 (28% in U.S.) 27

dru gs in 2001." See GlaxoSmithKline's 2002 Annual Report for complete financial statements at wwgsk.com . Six therapeutic drug groups experienced significant global growth in 2002. Within categories, individual agents also demonstrated significant sales growth. Key figures for these drugs are shown in Exhibit 4. GlaxoSmithKline devoted $4.35 billion to research and development expenditures in 2002, an increase of 14% over 2001. The product "pipeline" included 123 products in clinical development, which consisted of 61 new chemical entities, 23 new vaccines, and 39 line extensions. One agent was in Phase III clinical trials for the prevention of prostate cancer. Five new products were expected to be launched for marketin g over the next two years. In a practice defined as "innovative lifecycle management," GSK's research organization also sou ght to extend the patent life of established agents by releasing sli ghtly altered forms of already marketed a gents. Wellbutrin, an antidepressant, was reformulated as a long-acting, once daily formulation, and was expected to be released in 2003. Research and development was also committed to extendin g product lines. Pharmaceutical manufacturers were allowed to resubmit dru g applications to the U.S. Food and Dru g Administration (FDA) for already marketed a gents in order to advertise the drug for expanded uses. GSK expected that new indications approved by the FDA for established ag ents would contribute to future growth. While physicians often prescribed dru gs for "offlabel" use, FDA approval legitimized such use and decreased attendant liability. Also, pharmaceutical manufacturers were prohibited by the FDA from encoura g in g the use of agents for non-approved indications, severely limiting marketing potential. Finally, acquiring new indications for older agents could effectively extend the period of patent protection and discourage generic competition. GSK ag gressively sought expanded indications for Paxil, Coreg, Augmentin, and Advair during 2002." Marketing and general administration costs decreased in 2002 to $12,062 million, a decrease of 0.4%. GSK continued to expand their sales force with a particular focus on new product launches. Emphasizing an international presence, GSK participated in community service initiatives around the world. Working with the United Nations, the company established fixed, notfor-profit pricing for anti-retroviral (HIV/AIDS) and anti-malarial drugs to public sector customers and nonprofit organizations in the least developed countries and in sub-Saharan Africa. GSK also established preferential pricing to employers that provided HIV/AIDS treatment to their employees in the sub-Sahara. In the United States, GSK initiated the Orange Card program in January 2002, in order to provide medications to the poor that did not have public or private prescription drug coverage. GSK reported worldwide community investment and charitable donations of $104 million in 2001, 2.3% of net income:

110011111=1 SECTION C International Issues: Questions of Social Responsibility

The Pharmaceutical Industry

In 2001, prescription dru g spending was the fastest growing component of national health. expenditures, totaling $141 billion, or 10%, of U.S. national health expenditures." Prescription drug spending had grown 15.7% from the $122 billion spent in 2000. In 2002, drug sales growth slowed but still rose 12%, essentially due to the industry's ability to raise drug prices in the United States by an average of 4%, nearly double the rate of inflation.' Two sectors comprised the industry: research-based pharmaceutical companies that developed new branded agents, and generic houses that marketed previously branded drugs that had lost patent protection. The average revenue growth for the branded pharmaceutical industry slowed from 9.5% in 2001 to 4.5% in 2002." The top ten companies accounted for 60% of all U.S. drug sales. Slowing revenue growth was primarily due to the entry into the market of generic formulations of previous blockbuster products," such as Prilosec (omeprazole) and Prozac (fluoxetine). Concurrent with eroding profits, research and development costs were rising, accelerating to nearly a 17% increase in 2001 up from 8% in 1999. Research and development spending increased 16.6% to $30.3 billion from 2000 to 2001, claiming 13% of revenues. However, the rate at which branded pharmaceutical manufacturers were launching blockbuster products appeared to be slowing." New molecular entities (unique active ingredients at their initial introduction to the pharmaceutical marketplace that had the potential to become blockbuster products) declined to 15 in 2002 compared with the 23 entities brought to market in 1990. Concerns developed that revenue loss to generic formulations was not being offset by the introduction of new a gents. Therefore, branded pharmaceutical companies sought strategies to sustain growth that were less research intensive. -Life cycle management - became a strategy to leverage the potential of existing, already marketed agents.' This strategy included line extension, the introduction of slightly altered formulations in order to gain patent protection. Aggressive protection of intellectual property through litigation against encroaching generic competitors was another strategy commonly used to manage the life cycle of existing agents. In 2001, the average branded pharmaceutical company committed 31% of revenues for selling, general, and administrative expenses. Few companies specified the advertising and promotion component of this expense; however, it was estimated to be as high as 12% of revenue in 2001. Marketing spending was divided into direct to consumer advertising (DTC). physician advertising and detailing, and provision of free drug samples as shown in Exhibit S. DTC grew the fastest of the three categories, at a rate of 33% between 1996 and 2000. Marketing dollars were committed to free samples in the hope that patients would not be switched to competing products when a formal prescription was written. Branded pharmaceutical manufacturers remained highly profitable throughout 2002, with an average 20% profit margin, and were predicted to experience accelerated growth in 2003. Analyst David Reisinger stated, -Despite earnings disappointments, the pharmaceutical

Exhibit S Promotional Activity Spending of Pharmaceutical Companies as a Percentage of Total Promotional Spending

Promotional Activity Free samples Physician detailing Direct-to:Consumer advertising (DTC) Ad ertising in professional journals Total promotional spending, in million,.

1996_( %)

2000 (%) 50.6% 30.6 15.7 $15.708.1,

53.5%.

32.8 5.6 5.0 $9,164.3

Note: As estimated by IMS Health. The 1996 figures add to 99.9%.

GlaxoSmithXline's Retaliation Against Cross-Border Sales of Prescription Drugs '_industry maintains a very healthy financial position and generates healthy cash flow."" 'i Variance in financial performance of individual companies was predicted to continue, however. ultimately separatin g winners and losers. The generic drug industry enjoyed explosive growth of 55% in 2001, to nearly $6 billion. and benefited from the patent expirations on several blockbuster branded agents. Although growth slowed in 2002, the fundamentals of the industry remained strong. Cost containment efforts by insurance plans and healthcare systems routinely encouraged the utilization of generic products. In order to encourage use of generic products, such plans offered low outof-pocket co-payments for these a gents, significantly lower than the out-of-pocket cost for comparable, branded agents. However, no generic manufacturer had yet to be included in the top ten U.S. drug companies as of 2001. Indeed, generic drugs accounted for 47% of the dispensed prescriptions in the United States, but only 8% of dollar sales, highlighting the cost differential between generic and branded agents. Both sectors continued to experience high profits and healthy cash flows. Both outperformed the S&P during the period 1998-2002. While the average stock price to earnings (P/E) multiple for the S&P 500 during that period was 24 times, the averaae P/E multiple for branded companies was 28 times, while generic manufacturers experienced a stock price that was 29 times earninas.

alth Insurance Coverage in America

The vast majority of Americans in 2003 relied on healthcare insurance benefits to shield them from the major financial impact of illness or accident. In general, Americans that had access to prescription drug coverage during this period did so as part of general healthcare insurance coverage. The Henry Kaiser Family Foundation tracked annual changes in health insurance coverage for all Americans, and in January 2003 released annual statistics for 2001." On average, one in six non-eklerly Americans was uninsured during the year. Also, the probability of becoming uninsured varied depending on age, income, work status, race, ethnicity, and other demographic factors. Despite the economic boom of the 1990s, approximately one million adults joined the ranks of the uninsured each year during the decade. The rate slowed perceptibly, even decreased in 1999 and 2000, but began to increase again with the economic downturn in 2001, as the percentage of Americans with employer-sponsored health insurance decreased for the first time since 1993. At the end of 2001, the number of uninsured individuals reached 40.9 million. while the total of uninsured was estimated to be over 43 million in 2003. The 2001 census counted 281.4 million Americans. Hence. 15.3% of Americans were uninsured in 2003. Meanwhile, family incomes for the poor (< 100% of poverty level) and near-poor (between 100%-200% of poverty) shifted downward after 2000. Non-elderly adults with low incomes were the least likely to have job-based insurance during 2001. Less than half of the persons in low-income families that had two full-time workers had job-based coverage and over 25% were completely uninsured. As a group, only 17% of the poor and 43% of the near poor received a health insurance benefit. Finally, employees in service and labor jobs were far more likely tope uninsured than those with technical, professional, sales, and managerial jobs, even within the same industry and employer. While Medicaid eligibility requirements for children were more relaxed, adults faced higher hurdles. Therefore, nearly 20% of American adults under the age of 65 were uninsured during 2001, compared to only 12% of children. Racial and ethnic disparities were also detected in patterns of healthcare coverage. Even after adjusting for income differences, minority groups were less likely to have access to health insurance. While minority groups

)01

4-10

SECTION C International Issues: Questions of Social Responsibility comprised 30% of the non-elderly population in America, they represented nearly 53% of the uninsured.

The Weak Economy Affects Healthcare Benefits

Employers succeeded in modifying insurance benefits during the stagnant economy by transferring greater out-of-pocket costs to employees, or simply declining to contribute to a premium for health insurance at all. More than 43 million Americans were essentially without healthcare insurance. Many of these people were working but unable to afford their contribution to the insurance premium. Caught in a paradox, they had incomes too high to be eligible for public healthcare coverage, such as Medicaid. At the same time, middle class senior citizens that relied on Medicare supplemental insurance benefits as part of a pension package watched as one company after another, old-guard and new, discontinued such coverage. In 1998, 66% of large employers offered retiree health and prescription benefits to retirees. By 2000, less than 40% of such employers did so. Of those that continued to provide health benefits, only 79% offered any type of prescription coverage.' By 2003, only 30% of retired seniors carried Medicare supplemental health insurance provided by a former employer." At the same time, 9% of large employers reported in a 2003 survey that they were very likely to eliminate retiree benefits by 2004 for new and current employees that had not yet retired and 6% reported that they would eliminate employee health benefits entirely." A study by the Employee Benefit Research Institute published in 2003 provided some insight into the financial ramifications of being elderly and insured only by M.Aicare.' They estimated that individuals retiring at 65 in 2003 and living until age 85 could expect to pay $100,000 per person out-of-pocket for healthcare over that period. Those that would retire in 2013 (at 65 years and surviving 20 years) could expect to pay at least twice that amount when including Medicare premiums, drugs, and all other out-of-pocket costs.

Prescription Drug Utilization and Spending for Prescription Drugs

Prescription drug use accounted for only 5% of national health expenditures as late as the 1970s. Most insurers did not cover the prescription drug costs. Individuals paid for the relatively few agents that were available out of their own pocket. Perhaps ironically, prescription dru g coverage was introduced as a benefit with the advent of managed care in the 1980s. In fact, many beneficiaries of managed care health benefits received pharmaceutical product for no cost. Others paid nominal co-payments of $5$10 per prescription. Under this system, the out-of-pocket costs contributed by individuals to acquire prescriptions remained low,. resulting in burgeoning demand for and utilization of prescription drug products. Private insurance pay-out for prescription drugs was $45 billion in 1991, or 26% of retail drug rev. clines. By 2001 this figure had ballooned to $141 billion, now 47% of retail drug revenues!': The average individual spent $449 out of his or her own pocket for prescription drugs lit 2001, representing 0.9% of personal income. However, the out-of-pocket cost increased Hi nificantly with increasing age as portrayed in the Exhibits 6 and 7.6 The AmeriClib. Association for Retired Persons estimated that 80% of Americans 65 years old or older u. at least one prescription drug every day. The typical Medicare beneficiary filled a prescript' eighteen times per year, a rate of one prescription every twenty days." A study published by the Department of Health and Human Services in 2001 indicated customers that paid out-of-pocket paid nearly 15% more for prescription drugs than custo

VitucoSmithKline's Retaliation Against Cross-Borde r

Sales of Prescription Drugs

7

300 700 600 r,.

All

consumers

Less than 25 yrs.

25-34

35-44

45-54

55-64

65 yrs. & older

Age

e." For the 25% of the most commonly prescribed with prescription drug insurance covera g drugs, this differential was even higher, over 20%. This differential was attributed to the bargaining potential of pharmacy benefit managers (PBMs) that represented prescription drug plans in negotiations with pharmaceutical manufacturers over drug prices. Intense competition between companies to control market share for common therapeutic drug classes resulted otiating prices for these commonl y used in even greater influence of the PBM when ne g g ly reinforced the value of prescription drug agents. The resultin g differential outcome stron insurance coverage. g hospitalizatio n Medicare was originally created to provide a safety net against risin costs for senior citizens. It had never included a benefit for prescription drugs used in the outpatient setting. Few prescription medications were available prior to 1965, the year Medicare resul ting from pharmaceutical was unveiled, and few envisioned the explosion in products research. While some Medicare beneficiaries enjoyed prescription drug benefits from other

Exhibit 7 Percentag e of Annual Income Spent on Drugs, by Age

C N

All consumers

Less than 25 yrs.

25-34

35-44

45-54

55-64

yrs. & older

65

Age

loom=

SECTION C International Issues: Questions

of Social

Responsibility 1999 30.4% 15.4% 11.1% 1 1.0% 1.7%

23.8%

Exhibit 8 Sources of Prescription Drug Coverage for Medicare Beneficiaries

Source of Coverage Employer sponsored Medicare managed care Medicaid Medigap (privately. purchased policies) Other public sourtes No drug coverage

public and private sources, 23.8% of Medicare beneficiaries lacked any type of prescription coverage in 1999. These seniors were more likely to live in rural areas, were 85 years of age or older, and were near poor (income between $10,000$20,000 per annum). Sources of prescription drug coverage for Medicare beneficiaries in 1999 are summarized in Exhibit 8. The beneficiaries with supplementary prescription coverage received an average of $1,131 worth of product, paying 31% or $352 Out of their own resources. In contrast, the beneficiary with no supplementary coverage received 45% less, or an average of $617 worth of product, 100% of it covered out of pocket. In 2002, 13% of Medicare beneficiaries enrolled in managed care programs had no drug coverage, 15% could elect drug coverage for an additional premium, and 72% had limited drug coverage included in the Medicare managed care plan. Almost 1/3 of these plans limited drug choice to generic formulations and enforced relatively low coverage limits. often less than $500.'

The Food and Drug Administration's Role

The U.S. Food and Drug Administration (FDA) was responsible for ensuring that drug products made available in the United States were safe and effective. The Division of Import Operations and Policy, a department of the FDA, administered the United States Federal Food, Drug, and Cosmetic Act," which prohibited the interstate shipment (including importation) of unapproved new drugs whether for personal use or otherwise. Unapproved drugs included foreign-made versions of U.S.-approved drugs that had not been manufactured in accordance with and pursuant to FDA approval. Under this act, the FDA could refuse to admit into the United States any drug that "appeared" to be unapproved, placing the burden of proof on the importer to prove that the drug sou ght to be imported was approved by the FDA. However, the FDA was cognizant of its limited resources in enforcing this act and, therefore, developed a policy regarding its enforcement priorities related to the personal importation of prescription drugs. Under the "Coverage of Personal Importation,"" the focus of the FDA was to confiscate only products obviously intended for the commercial resale market (determined by volume), fraudulent products, and those that posed obvious health risks. In other words, small amounts of prescription products (enough for ninety days) destined for personal use and personally carried across the border from outside the United States or mailed into the United States would not normally draw scrutiny as violating the Food, Drug, and Cosmetics Act. In fact, the FDA allowed their own and customs personnel to consider a more permissive policy when assessing such drug products for entry into the United States. In order to understand the impetus for the growth of imported drugs from Canada, one must read the careful wording of the FDA " general guidance" detailed in the "Personal Importation" subchapter of the Regulatory Procedures Manual: The statements in this chapter are intended only to provide operating guidance for FDA personnel and are not intended to create or confer any rights, privileges, or benefits on or for any private person.

GlaxoSmithKline's Retaliation Against Cross-Border Sales of Prescription Drugs FDA personnel may use their discretion to allow entry of shipments of violative FDA regulated products when the quantity and purpose are clearly for personal use, and the product does not present an unreasonable risk to the user. Even though all products that appear to be in violation of statutes administered by the FDA are subject to refusal (for entry), FDA personnel may use their discretion to examine the background, risk, and purpose of the product before makin g a final decision (to allow entry). Although FDA may use discretion to allow admission of certain violative items, this should not be interpreted as a license to individuals to bring in such shipments."

Under this guidance, the product and its intended use were to be identified, the intended use could not be for the treatment of a serious condition, and the product could not be known to represent a si gnificant health risk. Alternatively, dru gs imported for personal use could be used to treat more serious conditions as lon g as an effective treatment was not available domestically, there was no known commercialization or promotion of the product to those residing in the United States, the product was not considered to pose an unreasonable risk, the individual importing the drug verified that it was for personal use and included no more than a ninetr:day supply, and a U.S. physician was involved in the person's medical care. In such cases, "persons were still breakin g the law by acquiring drugs from outside the country, however, the FDA was letting them get away with it." according to an anonymous FDA attorney. Emphasizing that the personal use importation guidance was meant to save FDA resources, and to generally permit medical treatments sought by individuals that were not otherwise available in the United States, the FDA stated that "foreign-made chemical versions of dru gs available in the U.S. were not intended to be covered by the personal use policy."" Adopting a relaxed stance under the "personal use guidance," the FDA did little to dissuade the importation of prescription drug products throughout the period from 1995-2003. Despite the growing popularity of Internet pharmacies among Americans, (especially Canadian pharmacies) the FDA did little to inhibit the practice of purchasin g foreign drug products online, ostensibly because it did not want to appear unsympathetic to American consumers, especially the elderly." In fact, in the fall of 2002, when American employers and insurers began advocating the use of Canadian pharmacies by covering claims generated there, the FDA associate commissioner for policy and planning, William Hubbard, stated, "If they are not actually importing drugs, I don't know what enforcement role we (FDA) would have."" However, the FDA stance appeared to change dramatically in response to GlaxoSmithKline's retaliation to cross-border sales. Quickly, the FDA indicated it would change its regulatory stance and crack down on the importation of dru gs, even those clearly destined for personal use." Seekin g to distance the agency's harder line from the consumer, Mr. Hubbard implied that insurers that helped Americans import drugs might come under fire. In a February 2003 letter sent to address the questions of an attorney representing health plans, Mr. Hubbard stated, Those who aid and abet a criminal violation of the (Food, Drug, and Cosmetic) Act, or conspire

to violate the act can also be found criminally liable. Any party participating in an import plan in which a health insurer or claims processor helps arrange a purchase (of dru g s) from Canada, does so at its own legal risk."

At the same time, the FDA echoed GSK by citing safety reasons for enforcing the Food, Drug, and Cosmetic Act." Imported drugs might be less likely to be manufactured under exacting specifications and might be mislabeled or otherwise without specific directions for use. The FDA established that this was a public health risk, because Americans had little, if any, recourse if they were exposed to tainted dru g product. Sources at the FDA also expressed concern that Canadian pharmacies were diverting drugs from deserving Canadian citizens in order to capture a tidy profit by selling prescription products to Americans. The spread between acquisition cost from pharmaceutical companies and selling price to Americans was

TT

SECTION C International Issues: Questions of Social Responsibility enhanced by the attractive exchange rate between American and Canadian dollars at the time. This was true despite the fact that Americans were often purchasing products for as much as 80% less than they would pay for the products in the United States.

European Influence on Pharmaceutical Pricing

The European pricing for prescription drug products influenced pricing of the products in the United States. Due to the administration of national healthcare systems, the European governments set price controls for prescription drug products. In June 2002, the German Health Ministry attempted to cut by 4% the prices it would pay for prescription products to provide public health services." Drug companies balked, as the public health system purchased 80% of all drugs in the country. In a compromise, Chancellor Gerhardt Schroeder agreed to veto the price cut if major drug companies would establish a trust fund designed to finance Germany's soarin g healthcare costs. GlaxoSmithKline, along with 37 other multinational pharmaceutical companies, reluctantly agreed to the plan. Worried that other European countries that administer nationalized health systems would follow suit and make the same demands for price cuts, the drug companies had little levera ge in Germany and were highly motivated to accept the establishment of the trust fund in lieu of price cuts. Across the ocean, the outcome of these negotiations directly affected Americans and the prices they paid for prescription drug products. The United States was the only major industrialized country that did not administer some sort of governmental price control for drug products. Pharmaceutical manufacturers openly admitted that as European governments mandated price cuts and eroded the profitability of the European markets, they increased prescription prices in the United States. "Step-by-step, the profitability of European markets is decreasin g , and we're depending on the U.S. market more and more," said Jean-Francois Dehecq, chief executive of the French drug maker, Sanofi-Synthelabo." In each of the years prior to 2003, the cost of drugs in the United States had increased by 2%-3% annually, sometimes more, as European governments mandated price cuts in Europe. One company increased prices in the United States by 5.9% annually for three popular medications used to treat heart disease, asthma, and osteoporosis. The result was large differences in the prices that Americans paid for prescriptions versus those paid in other markets. While Europe accounted for the largest single market in the world for prescription drugs, it accounted for just 22% of the dollar sales in the global market. Meanwhile the United States, with fewer people. contributed more than 46% of global dollar sales, and more than 60% of profits. Donna Shalala, U.S. Secretary of Health and Human Services under President Clinton, commented on the situation. While pointin g out that U.S. taxpayers financed much of the basic research that supported the pharmaceutical industry, she remarked, "We have been subsidizing this research and in return we get to pay higher prices (than Europeans)? It's not fair.''

Employers and Insurers Join the Debate

Americans were not always acting independently when they acquired necessary prescription medications from Canadian pharmacies via the Internet. Various retirement plans and insurctl endorsed the practice to varying degrees. United Health Group, in conjunction with tlitt-: American Association of Retired Persons (AARP). announced in October 20()2 that it will waiving its policy requiring prescriptions eligible for Medicare supplemental insurance cover age to be purchased in the United States, or a U.S. territory." Therefore, it would cpver the of prescription drugs acquired from pharmacies not just in Canada, but also around the woild. While not explicitly encouraging the practice of shopping for prescriptions outside the count 4 the announcement educated more than 400,000 AARP beneficiaries to the possibility.

"OltutoSmithKline's Retaliation Against Cross-Border Sales of Prescription Drugs . :Meanwhile, some employers and insurers overtly encouraged their retired employees and :11eliciaries to purchase prescription drugs from Canadian Internet pharmacies in order to Aeke advantage of cost savings. The National Association of Retired and Veteran Railway Uniployees Inc." provided a hyperlink to a Canadian Internet pharmacy on its own Web site. The pharmacy site included a catalog of available medications (narcotics were not available) -11.nd the cost, in American dollars, of each agent. A selection of "frequently asked questions" - Instructed users how to use the site and reassured users of the similarity between drug agents available in the United States and Canada. Users were informed that, "prescription drugs coming from Canada are made by the same manufacturers, often at the same plants, as those sold in the U.S." In order to protect Canadian citizens, "Health Canada. the equivalent of the U.S. FDA, provides strict oversight of prescription drugs." The site continued by informing users that a report issued by the Congressional Research Service in Washington DC found that, "pharmaceutical manufacturing practices required by Health Canada and the U.S. FDA are equivalent." The site also informed users of the FDA "general guidance" on personal importation of medication. "While it is technically ille gal to purchase medicines from a Canadian pharmacy, the FDA exercises enforcement discretion to allow individuals to import up to a ninety-day supply of prescription drugs for personal use."

Ore Elected Officials Stood

Congress had made several attempts to legalize the personal importation of prescription drugs by early 2003, largely due to concern about rapidly risin g, drug costs for senior citizens.' However, the drug industry, applying an aggressive lobbyin g campaign, had succeeded in preventing the passage of such legislation. During 2002. the Senate voted to allow importation of prescription drugs from Canada, but the proposition never came to a vote in the House of Representatives. A bill legalizing importation from Canadian pharmacies passed both the Senate and the House in 2000. However, the Clinton administration declined to implement the legislation, ostensibly over worries about verifying product safety and little documentation that the practice would actually save money." Individual elected officials reacted quickly to GSK's policy of limiting drug product to Canadian pharmacies that exported to the United States. Russ Fein2old, U.S. Senator from Wisconsin, introduced a bill in Congress to deny tax breaks to pharmaceutical companies that restricted shipment of drugs to Canada." Vermont Representative Bernard Sanders also introduced a bill specifically penalizing GSK for its attempt to cut off U.S. consumer access to Canadian drugs, citing restriction of free trade." Congressman Gil Gutknecht, a Republican from the first district in Minnesota, responded to the shipment restriction, Glaxo's brazen attempt to prevent Americans from obtaining lower cost medications from Canada is a textbook example of brazen abuse of monopolistic power. Glaxo is attempting to fix prices. If this isn't a classic example of anti-trust abuse, it should be. It is time for our attorney general to dust off anti-trust laws and enforce them.' By April 2003, legislators were actively accusing the FDA and GlaxoSmithKline of "scaring seniors that are trying to get more affordable medicines." 6" In a raucous hearing, members of the recently formed House Subcommittee on Human Rights and Wellness said the FDA had no evidence of safety problems with drug rcimportation and that the agency was shifting its personal importation policy because of drug industry pressure. The committee insisted the FDA should use its efforts to find a way to allow safe importation of drugs from Canada instead. Vermont Representative Sanders criticized the FDA by saying, "You should be putting out pamphlets saying people have been going across the border ... and there hasn't been one problem.""'

411

SECTION C International Issues: Questions of Social Responsibility Meanwhile, busloads of constituents, with their elected officials on-board, continued to make the trip to Canada with the explicit purpose of acquiring prescription drugs at lower cost than was available in the United States. Most prominent, perhaps, was Minnesota Senator Mark . Dayton, who donated his annual Senate salary of $145,000 to subsidize monthly trips for senior citizens to purchase drugs in Canada.'

GlaxoSmithKline Attempted Discount Card

GSK, in cooperation with other large pharmaceutical manufacturers, began to offer a discount card in 2001 to provide assistance to low-income American families that earned less than $28,000 annually. The card, named Together RX, provided a variable discount for prescription products up to 40% off retail prices. However, in the autumn of 2002, GSK cut the discount, maintaining that the U.S. government would use the low retail prices to demand even lower prices for Medicaid beneficiaries." GSK referred to legislation enacted in 1990 which stipulated that drug manufacturers must treat the Medicaid program as a most-favored customer, meaning that no other buyer could have access to lower prices for prescription product than the Medicaid program. Anxious that the government would accuse GSK of sellin g prescription drugs to low-income families at a eost lower than that available to Medicaid, they decreased the program discounts to reflect Medicaid pricing. The result was a significant increase in prices for participants in the GSK discount program, while Medicaid beneficiaries continued to pay nominal co-payments to acquire drug products. (Federal and state administrators of the Medicaid program then reimbursed intermediaries for the cost of the prescription at most-favored pricing.) After that time, GSK encouraged concerned Americans to urge Congress to enact a Medicare prescription drug benefit in order to help resolve issues relating to the affordability of medicines." GSK also provided drugs to qualifying persons through a Patient Assistance Program. In 2002, the program provided free medications valued at $168 million to 400,000 Americans with incomes below $24,000 for a household of two."

Public Perception

The Wall Street Journal conducted a non-scientific, Web-based poll of its readers on March

II, 2003, in order to elicit opinion about Americans that acquired prescription drugs from Internet pharmacies in Canada.' The responses to the poll provided some insight into the pub, lie image of GSK and other pharmaceutical corporations. The Journal received 1,665 answers in response to the question, "Should regulators try to stop Americans from buying prescrip tion drugs from Canada?" Eighty-four percent of respondents said "No," while 16% said "Yes." The poll also provided respondents an opportunity to provide editorial comment on the question. Fifty-two written responses were generated in answer to the preceding question. All but two of the respondents referred negatively to the pharmaceutical industry in their editorial:, answer. Most respondents complained of -price fixing" by pharmaceutical companies, speak:: ically GSK, in the United States. Others referred to "restraint of free trade," when U.S. cid.zens were prevented from purchasing prescriptions from Canada. Other editorials suggest that the FDA had altered its stance regarding the personal importation of medications dueitlf political pressure from pharmaceutical companies. Campaign contributions to high-pronIe officials by pharmaceutical companies were suggested several times as one reason why I price differential for drugs remained between America and the rest of the world. In gene the safety rationale provided by GSK for more stringently regulating imports from Can was dismissed as rhetorical and not believed to be the authentic reason for GSK's actions,

UN laxSmithKline's Retaliation Against Cross-Border Sales of Prescription Drugs

447

Two respondents referred to the high cost of pharmaceutical research and Americans' Wily to pay higher prices as the primary reason for the cost differential. One respondent paled that the ultimate response by the pharmaceutical industry to the importation issue Would be to increase the costs of drugs in Canada, ultimately limiting access for that country 118 well. Meanwhile. The Wall Street Journal mocked the abrupt crackdown by the FDA with a -011aracterization of the typical "drug trafficker" bringing in medications from abroad.76 Dubbing elderly Americans as not your generic smu g glers," the y described a typical "pro--tie" as "white, elderly, often wearing Bermuda shorts, and American Legion_ baseball caps." Ostensibly, the detailed "profile" would make it easier for these "traffickers" to be spotted by the FDA. Adopting a serious tone, the author described the motivation of the traffickers. "For many elderly shoppers, cutting the cost of medications is a crucial part of bud g etin g for retirement." A 76-year-old woman was blunt about her need to leave the country to acquire medicine, "I live on less than $1,200 per month and I saw a $50,000 stock portfolio evaporate since 2000. If I couldn't get cheap coeds, I couldn't live."" Americans. especially the elderly, paid the highest prices in the world for prescription dru g s." Even thou g h they represented the bi g gest market for drugs, they had no ability to negotiate prices. Like the 76-year-old woman forced to leave the United States to acquire medicine, a large contin g ent of the elderly simply could not afford the medications they required to stay alive. But unlike most other developed countries, they received no help from their government to acquire necessary prescriptions.

e Tradeoffs: Health vs. Profits vs. Safety

What was the responsibility of GlaxoSmithKline to see that American patients, especially those with limited means, could have re g ular access to prescription drug products? Glaxo maintained that patient safety was their primary motivation for the retaliation against crossborder sales from Canada into the United States. Compan y officials stated, "GSK decided to block the reimportation from Canada out of concern for patient safety. Althou g h consumers may be gettin g the very same drugs they would buy in the U.S., the drugs may be damaged in transport, mislabeled, or otherwise adulterated."" But was. safety the most relevant issue when the product was not a consumer good but rather necessary for health, perhaps even life, but was too expensive for a significant portion of the American population? As University of Minnesota professor Barbara Kaufmann reiterated, "A dru g that is not affordable is neither safe nor effective."'" What sort of power differential separated GSK from their customers? Did GSK damage their public ima g e through their action'? If so, what strategic resources must be committed to repair the resulting dama g e and restore g ood public relations to the commerce of GSK?

Notes

B. Strunk, P. Ginsburg, and J. Gabel, "Tracking Health Care Costs: Growth Accelerates Again in 2001," Health Affairs (September 25, 2002), pp. W299W310. K. Levit, C. Smith, C. Cowan, et al., "Trends in U.S. Health Care Spending, 2001," Health Affairs Vol. 22, No. I (2003), pp. 154-164. 3. J. Baglole, "What's New at the Mall of America? Cheaper Drugs from Canada," The Wall Street Journal (November 8, 2002). S. Lueck and J. Baglole, "Glaxo Sa ys It Will Retaliate Against Cross-Border Sales," The Wall Street Journal (January 13, 2003); J. Baglole. "Glaxo Presses Canadian Firms Not to Resell Its Drugs to U.S.," The Wall Street Journal (January 22, 2003); J. Fisher, "GSK Fighting Border Battle," The News and Observer (February 13, 2003). W. Wolf, "Seniors Groups Boycott Glaxo over Canada Move," Star Tribune (February 23. 2003).

You might also like

- Sickening: How Big Pharma Broke American Health Care and How We Can Repair ItFrom EverandSickening: How Big Pharma Broke American Health Care and How We Can Repair ItRating: 4 out of 5 stars4/5 (9)

- Kpi Analysis: Reasons and SolutionsDocument50 pagesKpi Analysis: Reasons and SolutionsAvneesh DubeyNo ratings yet

- Prescribed: Writing, Filling, Using, and Abusing the Prescription in Modern AmericaFrom EverandPrescribed: Writing, Filling, Using, and Abusing the Prescription in Modern AmericaRating: 4 out of 5 stars4/5 (1)

- The Pharmaceutical-Industrial Complex by Dr. Gary NullDocument6 pagesThe Pharmaceutical-Industrial Complex by Dr. Gary NullGary NullNo ratings yet

- Research About Lemon GrassDocument19 pagesResearch About Lemon GrassMary Jane Olpindo0% (1)

- HydralazineDocument2 pagesHydralazineShermayne Mallapre HernandezNo ratings yet

- RX Research BillDocument14 pagesRX Research BillHopeNo ratings yet

- Connecting Adverse Health Events To Childhood Vaccines - Jeremy JamesDocument53 pagesConnecting Adverse Health Events To Childhood Vaccines - Jeremy JamesPollyana Furtado JunqueiraNo ratings yet

- The Price of Health: The Modern Pharmaceutical Enterprise and the Betrayal of a History of CareFrom EverandThe Price of Health: The Modern Pharmaceutical Enterprise and the Betrayal of a History of CareNo ratings yet

- GSK Strategic Analysis. by KIRAN JAMEEL.Document33 pagesGSK Strategic Analysis. by KIRAN JAMEEL.kjuw342980% (5)

- Essay 3 - Daivon BrownDocument6 pagesEssay 3 - Daivon Brownapi-644111810No ratings yet

- PrescriptionsDocument3 pagesPrescriptionsD_George258No ratings yet

- FDA Drug Safety Bill Passes in The U.S. Senate Health Freedom Advocates Outraged at Betrayal of American ConsumersDocument12 pagesFDA Drug Safety Bill Passes in The U.S. Senate Health Freedom Advocates Outraged at Betrayal of American ConsumersFlorsean Mae SalaNo ratings yet

- Final Assignement ECON120Document3 pagesFinal Assignement ECON120KendraNo ratings yet

- ReportDocument22 pagesReportapi-404973316No ratings yet

- UGSFinal PaperDocument6 pagesUGSFinal PaperCamryn SandovalNo ratings yet

- CP Draft 1 Kayla BricenoDocument8 pagesCP Draft 1 Kayla Bricenoapi-503305790No ratings yet

- Demonizing Drugmakers: The Political Assault On The Pharmaceutical Industry, Cato Policy Analysis No. 475Document56 pagesDemonizing Drugmakers: The Political Assault On The Pharmaceutical Industry, Cato Policy Analysis No. 475Cato InstituteNo ratings yet

- AidsDocument4 pagesAidsDyke Gita WirasisyaNo ratings yet

- Pharma Case StudyDocument3 pagesPharma Case StudyTayba AwanNo ratings yet

- 59-4 HansenDocument3 pages59-4 Hansenvoruganty_vvsNo ratings yet

- Ethical Dilemma QuestionDocument16 pagesEthical Dilemma QuestionJulius musembiNo ratings yet

- Uapp 110 Policy BriefDocument5 pagesUapp 110 Policy Briefapi-349900145No ratings yet

- Rally Resists Austerity: Miners Find Massive Solidarity in MadridDocument12 pagesRally Resists Austerity: Miners Find Massive Solidarity in MadridWorkers.orgNo ratings yet

- Workers World 29 July 2012Document12 pagesWorkers World 29 July 2012Workers.orgNo ratings yet

- Running Head: Shifting The BlameDocument6 pagesRunning Head: Shifting The BlameRayRay TuneChi DegrateNo ratings yet

- Senate Hearing, 108TH Congress - Prescription Drug Abuse and Diversion: The Role of Prescription Drug Monitoring ProgramsDocument61 pagesSenate Hearing, 108TH Congress - Prescription Drug Abuse and Diversion: The Role of Prescription Drug Monitoring ProgramsScribd Government DocsNo ratings yet

- Pharmaceutical Regulations - Essay 3Document8 pagesPharmaceutical Regulations - Essay 3Amanda100% (1)

- Pharmaceutical IndustryDocument27 pagesPharmaceutical IndustryAndres VelezNo ratings yet

- This new Public Citizen report reveals how major U.S. drug companies and their Washington, D.C. lobby group, the Pharmaceutical Research and Manufacturers of America (PhRMA), have carried out a misleading campaign to scare policy makers and the public.Document144 pagesThis new Public Citizen report reveals how major U.S. drug companies and their Washington, D.C. lobby group, the Pharmaceutical Research and Manufacturers of America (PhRMA), have carried out a misleading campaign to scare policy makers and the public.Joao SoaresNo ratings yet

- Manuscript For A Speech - Drugs in The USDocument3 pagesManuscript For A Speech - Drugs in The USnstaalkjaerNo ratings yet

- Conflicts of Interest: James G. Anderson, Ph.D. Department of Sociology & AnthropologyDocument31 pagesConflicts of Interest: James G. Anderson, Ph.D. Department of Sociology & AnthropologyPraveen KumarNo ratings yet

- Microfinancial VentureDocument18 pagesMicrofinancial VentureSarah KhanNo ratings yet

- Policy AnalysisDocument11 pagesPolicy Analysisapi-592404436No ratings yet

- Nejme 0806794Document2 pagesNejme 0806794إدريس أل أذهريNo ratings yet

- Health CareDocument5 pagesHealth Careteebone7470% (1)

- Michael Murchie Percription Drugs Policy Proposal EssayDocument6 pagesMichael Murchie Percription Drugs Policy Proposal Essayapi-621658511No ratings yet

- Pharmaceutical Marketing - Time For ChangeDocument8 pagesPharmaceutical Marketing - Time For ChangeFabio PellimNo ratings yet

- FinalargdraftDocument6 pagesFinalargdraftapi-356547596No ratings yet

- Drug Shortages: The Problem of Inadequate ProfitsDocument61 pagesDrug Shortages: The Problem of Inadequate ProfitsMona SalehNo ratings yet

- 1 Running Head: The Influences of The Pharmaceutical IndustryDocument10 pages1 Running Head: The Influences of The Pharmaceutical Industrydante013No ratings yet

- Value Report, Aug. 21: Angela WolfDocument6 pagesValue Report, Aug. 21: Angela WolfAngelaNo ratings yet

- Dear President TrumpDocument4 pagesDear President TrumpJordanTurnerNo ratings yet

- Business Ethics: Pharmaceutical Company Admits To Lying About The Health Risks of Its DrugsDocument4 pagesBusiness Ethics: Pharmaceutical Company Admits To Lying About The Health Risks of Its DrugsisitrajasekharNo ratings yet

- Lobbying: Prescription Drug CostsDocument5 pagesLobbying: Prescription Drug CostspurbasmileNo ratings yet

- The MHRA - Nothing ChangesDocument2 pagesThe MHRA - Nothing ChangesPaulNo ratings yet

- U.S. vs. International Prescription Drug PricesDocument77 pagesU.S. vs. International Prescription Drug PricesjosetelhadoNo ratings yet

- American Kratom Association January 2021 Press Conference StatementDocument3 pagesAmerican Kratom Association January 2021 Press Conference StatementMichael_Roberts2019No ratings yet

- Research Paper War On DrugsDocument5 pagesResearch Paper War On Drugsmgojgerif100% (1)

- Drugmakers' Alleged Scare Tactics May Hold Back Competition WaPo 01-10-19Document5 pagesDrugmakers' Alleged Scare Tactics May Hold Back Competition WaPo 01-10-19Ann DahngNo ratings yet

- 9 Cloudjack MarijuanaDocument6 pages9 Cloudjack Marijuanamark ceasarNo ratings yet

- War On Drugs in America Research PaperDocument8 pagesWar On Drugs in America Research Paperkxmwhxplg100% (1)

- Fsoc 05 540478Document5 pagesFsoc 05 540478tryan693No ratings yet

- Medical Marijuana Legalization Research PaperDocument8 pagesMedical Marijuana Legalization Research Papergz8pjezc100% (1)

- Fight For Your Health, Byron J. RichardsDocument15 pagesFight For Your Health, Byron J. RichardsanaluzinhaNo ratings yet

- Drug Goes From $13.50 A Tablet To $750, Overnight: (Andrew Pollack)Document3 pagesDrug Goes From $13.50 A Tablet To $750, Overnight: (Andrew Pollack)Lara Elize ItaoNo ratings yet

- CP Prospectus and Annotated Bibliography Kayla BricenoDocument5 pagesCP Prospectus and Annotated Bibliography Kayla Bricenoapi-503305790No ratings yet

- Essay 2 Rough DraftDocument5 pagesEssay 2 Rough Draftapi-339988292No ratings yet

- The Effects of A Government-Regulated Price Maximum On The Affordability of Life-Saving Prescription DrugsDocument13 pagesThe Effects of A Government-Regulated Price Maximum On The Affordability of Life-Saving Prescription Drugsapi-411776312No ratings yet

- MartinshreklisatireDocument2 pagesMartinshreklisatireapi-318994644No ratings yet

- Wrecking Ball: FDA Regulation of Medical Devices, Cato Policy AnalysisDocument34 pagesWrecking Ball: FDA Regulation of Medical Devices, Cato Policy AnalysisCato InstituteNo ratings yet

- Drug Pricing Report With Appendix v3Document269 pagesDrug Pricing Report With Appendix v3Divya SundarNo ratings yet

- Industry & Company ProfileDocument141 pagesIndustry & Company ProfileMike Peña100% (1)

- CQI Calibration in HSDPA NetworkDocument4 pagesCQI Calibration in HSDPA NetworkTong Yeah Yen100% (1)

- MIMO in HSPA: The Real-World ImpactDocument18 pagesMIMO in HSPA: The Real-World ImpacttannerkNo ratings yet

- Mock Casestudy enDocument20 pagesMock Casestudy enBagoes Tri SoebanggaNo ratings yet

- Asif Haider Habib AwanDocument52 pagesAsif Haider Habib AwanBhanu SinghNo ratings yet

- 3G Security Principles: - Build On GSM Security - Correct Problems With GSM Security - Add New Security FeaturesDocument21 pages3G Security Principles: - Build On GSM Security - Correct Problems With GSM Security - Add New Security FeaturesAhmed TarekNo ratings yet

- Excellentdocumentgsmoptimization 131001220244 Phpapp01Document58 pagesExcellentdocumentgsmoptimization 131001220244 Phpapp01SergeachatNo ratings yet

- HsdpaDocument106 pagesHsdpaHaresh JindalNo ratings yet

- OWHN-uou: 01,061SHLU 3nDocument14 pagesOWHN-uou: 01,061SHLU 3nAhmed TarekNo ratings yet

- DC Hspatechnology 120919125703 Phpapp01Document47 pagesDC Hspatechnology 120919125703 Phpapp01RobertTabutNo ratings yet

- SYS12Document617 pagesSYS12Ahmed TarekNo ratings yet

- Academic Calendar 2010-2011 (Mar 10,2011)Document4 pagesAcademic Calendar 2010-2011 (Mar 10,2011)Ahmed TarekNo ratings yet

- Marketing: Managing Profitable Customer Relationships: Principles of Marketing, Seventh Canadian EditionDocument37 pagesMarketing: Managing Profitable Customer Relationships: Principles of Marketing, Seventh Canadian EditionAhmed TarekNo ratings yet

- 1 PBDocument3 pages1 PBHaola andaniNo ratings yet

- Pellets 1Document11 pagesPellets 1Bhavya DhamijaNo ratings yet

- 903Document8 pages903getjenNo ratings yet

- Coffee Oil For Sun - FilterDocument17 pagesCoffee Oil For Sun - FilterayusuryaniNo ratings yet

- ACIProduct ListDocument27 pagesACIProduct ListFerdousNo ratings yet

- Applications of Toxicokinetics2 PDFDocument9 pagesApplications of Toxicokinetics2 PDFVasavi ChittemreddyNo ratings yet

- Venomous Marine InvertebratesDocument44 pagesVenomous Marine InvertebratesJahangir AlomNo ratings yet

- Bpharm Sem 6 Quality Assurance Ques PaperDocument3 pagesBpharm Sem 6 Quality Assurance Ques PaperNavam KumarNo ratings yet

- M.Pharm Dissertation Protocol Submitted To Dr. APJ Abdul Kalam Technical University, LucknowDocument10 pagesM.Pharm Dissertation Protocol Submitted To Dr. APJ Abdul Kalam Technical University, LucknowGaurav SinghNo ratings yet

- PHC 261Document2 pagesPHC 261Agape Ruth BaliloNo ratings yet

- Nano Spray Dryer B-90 - Literature Review and ApplicationsDocument8 pagesNano Spray Dryer B-90 - Literature Review and ApplicationsprinceamitNo ratings yet

- PBF KIBAR - Update Stock 1 Oktober 2021Document158 pagesPBF KIBAR - Update Stock 1 Oktober 2021Anonymous aaAQ6dgNo ratings yet

- Doses Carpenter: MamíferosDocument14 pagesDoses Carpenter: MamíferosBruna MoreiraNo ratings yet

- Module 4Document3 pagesModule 4Un knownnnNo ratings yet

- Methadone - DrugBankDocument13 pagesMethadone - DrugBankravaNo ratings yet

- Drug List 1: Over-The - Counter (OTC) MedicationsDocument3 pagesDrug List 1: Over-The - Counter (OTC) MedicationsAeron GayadanNo ratings yet

- PDocument21 pagesPRebecca ChenNo ratings yet

- SWOT Analysis of ACI Pharmaceuticals LimitedDocument3 pagesSWOT Analysis of ACI Pharmaceuticals LimitedSamiul Islam80% (5)

- PHARCHEM2 LIST Hormones To Cardiovascular DrugsDocument7 pagesPHARCHEM2 LIST Hormones To Cardiovascular DrugsLA BriguelaNo ratings yet

- Co Misomal PresentationDocument46 pagesCo Misomal PresentationsalmanNo ratings yet

- Square Pharmaceuticals LTDDocument32 pagesSquare Pharmaceuticals LTDMohiuddin6950% (2)

- Product CatalogDocument13 pagesProduct Catalogkleos70No ratings yet

- Eze Chidiebere 0207Document27 pagesEze Chidiebere 0207api-404356063No ratings yet

- Animal Testing Essential To Medical ProgressDocument7 pagesAnimal Testing Essential To Medical ProgressLayalNo ratings yet

- An Update On Perioperative Anaphylaxis (11!04!2016)Document6 pagesAn Update On Perioperative Anaphylaxis (11!04!2016)Maufer AlNo ratings yet

- Data Bu ShellaDocument114 pagesData Bu Shellaruri nur indahNo ratings yet

- tmp3741 TMPDocument8 pagestmp3741 TMPFrontiersNo ratings yet