Professional Documents

Culture Documents

History of Oil and Gas All Over The World

Uploaded by

Shani ChaudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

History of Oil and Gas All Over The World

Uploaded by

Shani ChaudharyCopyright:

Available Formats

HISTORY OF OIL AND GAS ALL OVER THE WORLD Petroleum is a naturally occurring liquid found in rock formations.

It consists of a complex mixture of hydrocarbons of various molecular weights, plus other organic compounds. It is generally accepted that oil is formed mostly from the carbon rich remains of ancient plankton after exposure to heat and pressure in the Earth's crust over hundreds of millions of years. Over time, the decayed residue was covered by layers of mud and silt, sinking further down into the Earths crust and preserved there between hot and pressured layers, gradually transforming into oil reservoirs. History The following are key events in the recent history of oil:

1951 Nationalization of the Iranian oil industry 1959 Formation of OPEC 1972 Nationalization of the Iraqi oil industry 1973 First oil price shock caused by Arab boycott of oil supplies to USA because of Arab Israeli war; price rises from US$ 2.50 to US$ 10 per bbl "

1975 Nationalization of the Kuwaiti oil industry " 1979 Nationalization of the Saudi Arabian oil industry " 1979 Second oil price shock cause by fall of the Shah of Iran; price rises from US$ 12 to US$ 30 per bbl "

1991 Third oil shock caused by Iraqi invasion of Kuwait; price rises from US$ 15 to US$ 35 "

1999 Agreement between Saudi Arabia, Mexico and Venezuela 2003 Iraqi war; price rises from US$ 30 to US$ 70

Introduction of the Sector Exploration for hydrocarbons (oil, gas, and condensate) is commonly acknowledged to have begun with the discovery at Oil Creek, Pennsylvania, by "Colonel" Edwin Drake in 1859. However, this was only the start of the modern global era of technology-driven advances in

exploration. Traditionally, oil exploration was conducted by recognizing seeps of hydrocarbons at the surface. The population of the world continues to grow, as does the average standard of living, increasing demand for food, water and energy and placing increasing pressure on the environment. The population of the world doubled from 3.2 billion in 1962 to 6.4 billion in 2005 and is forecast to grow to 9.2 billion in 2050. Supplies of oil, gas, coal and uranium are forecast to peak as reserves are depleted. At the same time, fear of climate change is putting pressure on the energy sector to move away from carbon burning to nuclear, solar and other environmentally friendly energy sources. Oil accounts for between 34% and 37% of the world's primary energy. Components of crude oil are feedstocks to the chemicals, plastics and fertilizer industries. Crude oil is extracted from the earth and refined to create a range of gas (liquified petroleum gas - LPG), liquid (gasoline, diesel, jet aviation fuel, paraffin, etc.) and solid (bitumen) petroleum products. The most sought after crudes are those that are "light" (i.e. contain a high proportion of short chain molecules) and "sweet" (i.e. low sulphur content) as they are easier and cheaper to refine. Exploration and Development In June 2007, OPEC announced plans to invest US$ 130 billion in expanded production between then and 2012. Excluding Iraq, production is forecast to increase from 35.7 million bpd to 39.7 million bpd in 2010. Between 2013 and 2020 OPEC plans to spend a further US$ 500 billion provided biofuels doesn't change economics. Saudi Arabia alone is investing US$ 50 billion to increase crude production capacity from 10.5 million barrels a day in 2007 to 12 million bpd in 2009 and 15 million bpd after 2025. A Harrison Lovegrove study of 200 non state-owned oil and gas companies found 2005 development costs rose 30% to US$ 159 billion, yet only yielded a 2% increase in proved reserves and a 1% increase in production. Part of the reason is that countries rich in oil are increasingly excluding foreign companies from participation. A later study showed spending by

228 oil and gas companies increased 45% in 2006 to US$ 400 billion but again only increased reserves by 2%. A March 2007 report by Harrison Lovegrove estimated that state owned oil and gas companies invested US$ 75 billion in oil and gas asset acquisitions in 2006, 33% of the total of US$ 166 billion. Average 2006 prices paid were US$ 12.86 per barrel of proved oil / gas reserves, an increase of 34% on 2005. Only three major fields have been discovered worldwide since 1969 and none since 1976. A study by Simmons found that since 1980, only three fields out of all of the new discoveries are producing over 200,000 barrels a day. In the 1990's, over 420 fields were discovered, but only 11 have production that exceeds 100,000 barrels per day. The largest fields discovered in the past decade or so are: Field Country Date Reserves billion) Carioca Kashagan Tupi Niban Azadegan Yadavaran Shah Deniz Dolginskoye North Samburgskoye Brazil Kazakhstan Brazil Saudi Arabia Iran China Azerbaijan Russia Russia 2007 2000 2006 1999 1998 2000 1999 1999 1998 33? 14.6 4.0 4.0 3.5 3.0 2.1 1.9 1.8 (boe

Nanpu Dalia

China Angola

2005 1997

1.3 0.9

To put this in perspective, note that the world consumes 29 billion barrels of oil per year. Oil Trading On average, 52 mbpd of oil were moved internationally in 2006. The USA, Europe and Japan were responsible for more than 60% of world oil imports, while the Middle East, Africa and former Soviet Union accounted for more than 65% of world oil exports. The crude oil spot price averaged $US 72 per barrel in 2007, more than triple the average price in 2002. Towards the end of 2007, the price of crude oil breached US$ 100 per barrel and, in May 2008, US$ 120 per barrel. Consumption World demand for oil reached 85.7 mbpd in 2007, 1% up on the 84.9 mbpd in 2006. The major oil consuming nations were, in order, the USA, China, Japan, Russia, Germany, India, South Korea, Canada, Brazil and Saudi Arabia. Although US consumption has remained static over the past four years, China increased its petroleum consumption by 5.5 percent in 2007. China and India accounted for some 70% of the increase in oil demand during 2006 and 2007, with oil producing countries responsible for much of the balance. Between 1996 and 2006, USA domestic production reduced from 45% to 33% of demand. Net imports were larger than the combined production of Saudi Arabia and Kuwait. The US government launched its 20 in 10 initiative to reduce gasoline demand by 20% in 10 years, through improve engine emission standards and the use of ethanol. The IEA forecasts that oil demand will increase by 10 mbpd to 94.8 mbpd in 2015. Demand for OPEC oil is forecast to increase from current 31 mbpd to 38.8 mbpd in 2015. It is not clear that the additional demand is going to be met through a combination of new sources of conventional oil, gas to liquids, unconventional oil and biofuels.

Introduction to supply chain management: A supply chain is a network of facilities and distribution options that performs the functions of procurement of materials, transformation of these materials into intermediate and finished products, and the distribution of these finished products to customers. Supply chains exist in both service and manufacturing organizations, although the complexity of the chain may vary greatly from industry to industry and firm to firm. History of Oil and Gas in Pakistan In 1986, the Government of Pakistan introduced new Pakistan Petroleum (Exploration and Production) Rules clearly defining the rights, obligations and authorities which were aimed at streamlining and accelerating the hydrocarbon exploration and production in Pakistan. Subsequently a number of independent foreign oil companies entered into joint venture agreements with Government of Pakistan and OGDCL including crescent Petroleum, Canada Northwest, Anglo Suisse, Lasmo Oil and Ranger oil Ltd. None of them, however, were successful except Lasmo Oil which discovered gas at Kandanwari in their Tajjal Block. Later Amoco, Petro-Canada and Phillips were also granted Exploration Licences in Kohat Bannu and Lower Indus Basin. POL acquired petroleum concession rights over Khushalgarh Block with OGDC in northern Potwar and Kohat region. POL also entered into Joint Venture agreements with OGDCL, Petro Canada and Occidental for exploration in various blocks including offshore region. Oxy discovered oil at Bhangali and Pindori during 1989-90 in their Soan Concession. Pindori-1 during recompelation blow out and the well had to be abandoned. OGDC discovered heavy crude at Chak Naurang, retested old Qazian Structure and found oil at Missa Kaswal-1. During early nineties OGDC also made several oil discoveries in Missan Concession just to the north of UTPs Badin Block. Oil was also discovered by OGDC in Potwar at Sadkal near Fatehjang, Rajian and Kal near Chakwal. During the same period AMOCO drilled number of dry holes in Kohat region and closed their operations second time in Pakistan.

INTRODUCTION OF PAKISTAN STATE OIL

Pakistan State Oil (PSO) is the oil market leader in Pakistan enjoying over 79% share of Black Oil market and 58% share of White Oil market.

The history of Pakistan State Oil starts from mid-70s when the Government of Pakistan amalgamated three OMCs: Esso Eastern, Pakistan National Oil (PNO) and Dawood Petroleum as part of its reorganization plan. It is considered as one of the most successful mergers in the history of Pakistan. The main objective of the Nationalization of POL Giant was backed by the facilitation of the sensitive national issue of providing fuel to Defense forces. Because, during the war of 1971, the nation suffered from the problem that no fuel company was interested to provide fuel to the Armed forces at that and the sensitivity of the nation was in very crucial condition. The than Federal government decided to nationalize three petroleum companies along with management control.

The company is the only public sector entity in Pakistan that has been competing effectively with three multinationals companies which are supported technically by their parent organization.

Pakistan State Oil Company Ltd; is the largest oil marketing company (OMC) of Pakistan. It is engaged in the Storage, Import, Distribution and Marketing of Petroleum Products, Petrochemicals, Aviation & Bunker Fuels, LPG and CNG Dominates the Countrys Fuel and Energy Need. Since its inception in 1976 the company has been meeting more than 70% of the countrys fuel needs. PSOs 3805 outlets all across the country markets more than 12 million tons of fuel products annually. This network is supported by PSOs 28 storage facilities with a capacity of more than 800,000 tons. PSO took a major step in improving its distribution facilities by acquiring 12% equity in the 800km long Karachi-Mehmoodkot White Oil Pipeline.

As part of PSOCLs policy of providing better customer service, it has embarked upon its New Vision of retail development program. Equipped with the most modern facilities like electronic dispensing units, auto car wash, convenience stores, internet facilities and business centers. These state of the art designed stations provide greater customer confidence and a friendlier environment. As a manifestation of PSOCLs greater customer focus a PSO 24hr Customer Service has been launched where customers can lodge their queries and suggestions about various PSO products and services. Alongside its retail network, PSO is playing an equally important role in the industrial sector. From the locomotives of Pakistan Railways to the giant turbines of Power Projects, all are fuelled by PSO. Being fully alive to its responsibilities towards the agriculture sector PSOs 700 strong agency network helps keep the farm machinery running. Further, its kerosene sales are a major source of energy for the rural and lacking gas facilities. Pakistan State Oil Company Limited remains equally strong in Aviation and Bunker Sales. PSO has been constantly upgrading its facilities to serve a wide range of commercial aircrafts. Through a chain of eight Aviation Service Stations scattered all across the country PSO fuels the aircrafts of many local and international airlines. Acquisition of new Lahore Terminal Complex at the Allama Iqbal International Airport has enabled PSO to serve the busiest corridor of East/West bound flights benefiting the airlines in shape of time saving and lesser fuel burn off. While its bunkering facilities at all the major ports of country fill up the ocean liners of many nationalities facilitating the nations international trade. In its endeavor to provide quality lubricants, PSO has started the agency trade and distribution system of the Lubricants all across the Pakistan. More cordial relationship with its dealers is one of the important objectives of PSOs New Vision Program. To give them a sense of participation PSO has instituted TOP DEALER AWARDS and MILLION LITER AWARDS whereby efforts of the high performing dealers are recognized. Emergence of Health Safety & Environment (HSE) as the corner stone of PSOs corporate governance testifies to its commitment to environmental protection.

Introduction of Caltex History

Caltex is an Australian company with a long history. Our roots go back to 1900 when Texaco products were first marketed in Australia and the Caltex name has been in Australia for almost 70 years. The all-Australian Ampol was listed on the Australian Securities Exchange in the late 1940s. Each of Caltex and Ampol built refineries, Caltex in Sydney in 1956 and Ampol in Brisbane in 1965, and they competed fiercely in the service station arena and oil product marketing generally. As the industry started to rationalize, Ampol acquired Total, and Caltex acquired Golden Fleece two smaller oil companies. Caltex and Ampol merged in 1995 and the Caltex brand has now largely replaced the Ampol brand. Caltex only operates in Australia, with around 4,000 employees working across the country, and while our major shareholder is the US based Chevron, Caltex is listed on the Australian Securities Exchange and operates independently of Chevron, with all decisions made in Australia by its management and Board. This distinguishes Caltex from other refiner-marketers in Australia. PULL/PUSH VIEW OF PROCESS OF SUPPLY CHAIN Push/Pull View of PSO in Products for Institutions Supplier, Procurement, manufacturer and Consumer In this, PSO totally focus on push view because PSO produce products firstly and then distribute its POL products to its customers. In some cases PSO produce customized products while serving army, WAPDA and PIA. ACHIEVING THE STRATEGIC FIT Making a strategic fit requires integration among the activities. For that purpose the organization has to create a consensus among the competitive and supply chain strategy. IN CASE OF Pakistan State Oil 1. Competitive strategy of PSO

PSOs focuses on the stable prices for high quality of products. 2. Supply chain strategy of PSO PSO is the pioneer of Oil marketing companies in Pakistan and it is totally vertically integrated firm either the backward integrated of the forward integrated firm means it has its own supplier to supply the raw material and it has its own distributors and contract carriage fleet to provide products to the end consumers. The PSO is aligning the both strategies by focusing on their own resources. Making one stage more responsive allows the other stage to focus on being more efficient. The PSOs supply chain assigns different roles to its different stages; the company has to decide either to transfer the responsiveness to the supplier stage, manufacture stage or to the distributor stage. In case of products for institutions PSO focus to be more efficient manufacturer and distributor and it take supplier more responsive because there is demand totally certain in this type of products, because institutions ordered for the products to PSO immediately and they need more responsive supply of POL products. In case of products for individual consumers PSO focus to be more responsive manufacturer and distributor and it take supplier more efficient because there is demand totally uncertain in this type of products, because customer can order at any time and PSO have to fulfill their order at that time, so it make more responsive distributors but manufacturer hold inventory more than the distributors, so distributor is responsive too but less than the manufacturer i.e in case of lubricants the distributor is totally concerned with the customer dealing. PSO focus on the Intercompany Interfunctional Scope: The Maximize Supply Chain Surplus View, because it is totally vertically integrated firm having its own supplier and distributors. So it makes the overall supply chain strategy for supplier, manufacturer and distributor.

IN CASE OF Caltex 1. Competitive strategy of Caltex

Caltex focuses on the differentiation strategy, it means provide products of superior quality as compare to its competitors. 2. Supply chain strategy of Caltex Caltex is also dealing in the Oil marketing industry in Pakistan and it is not totally vertically integrated firm because it mostly focus on to provide products to the consumer through their own distributors as well as other retailers and wholesalers because the lubricants of Caltex are well renowned across the world, so they dont need to market the lubricants. The Caltex is aligning the both competitive and supply chain strategy. Caltex just deals in the products for individual consumer and targets the middle class as well as the upper class. So It focus to be more responsive manufacturer and distributor and it take supplier more efficient because there is demand totally uncertain in this type of products, because in summer the demand of lubricants as well as oil increase manifold due to the heat of engines and electricity shortfall. Caltex also focuses on the Intercompany Interfunctional Scope: The Maximize Supply Chain Surplus View, because it has its own supplier and distributors. So it makes the overall supply chain strategy for supplier, manufacturer and distributor.

FRAMEWORK FOR STRUCTURING DRIVERS

Supply chain network can be a competitive edge for the company as compare to its competitors if it coordinates well and work efficiently and responsively, but is there is less coordination between this network and this can be the cause of the failure of the company. PSO manages its supply chain network more efficiently and it has competitive edge of better coordination of this network over its competitors like Menu.

Goal of a supply chain strategy is to strike the balance between responsiveness and efficiency that fits with the competitive strategy. To reach this goal company must structure the right combination of the Three Logistical and Three Cross Functional Drivers discussed.

Competitive Strategy Supply Chain Strategy Efficiency Supply chain structure Logistical Drivers Facilities Inventory Transportation Responsiveness

Information

Sourcing Cross Functional Drivers

Pricing

PSOs competitive strategy is to be a High Quality Product at a Reasonable Cost for a wide variety of mass consumption goods. This strategy dictates that the ideal supply chain will emphasize efficiency but also maintain an adequate level of responsiveness in terms of product availability. PSO uses three logistics and three cross functional drivers efficiently to achieve supply chain performance align with its competitive strategy. Logistical Drivers 1. INVENTORY DRIVER:

PSO maintains efficient supply chain by keeping high levels of inventory as well as the responsive because of the inventory/units provide as the demand forecasted. PSOs inventory of product for Institutions: PSOs products for the institutions (Railway, PIA, Army, IPPs etc.) while focusing on these PSOs focus of efficiency because it provides products as the order is received so more inventory in required to store. In order to meet customers demand immediately PSO has to maintain high inventory as it has 0.8 million tons oil storage depots all over Pakistan. Inventory of products for Individual Consumer: PSOs products for individual consumer, while focusing on these PSOs focus of responsiveness because it provide all type of products with their DCs to meet the customers order. And PSO produce product for individual consumer by anticipation of demand. Thats why it has to keep every type of product in its DCs and responsiveness automatically with increases. 2. TRANSPORTATION DRIVER: PSO runs its own contract carriage fleets to keep responsiveness high. This increase transportation cost, but the benefits in terms of reduced inventory and improved product availability justify this cost in PSOs case. Because as the electronic order received from its warehouses truck leave for delivery of products to the warehouses because all the 3805 pumps are linked with pump controller interface (PCI) so inventory of oil and lubes is observed at head office. 3. FACILITY DRIVER: PSO uses centrally located DCs within its network of stores to decrease the number of facilities and increase efficiency at each DC. PSO builds its own stores only where the demand is sufficient to justify having several of them supported by a DC. All over the Pakistan PSO have 28 storage depots in just big cities like Islamabad, Rawalpindi, Faisalabad, Lahore, Multan, Karachi, Sahiwal etc.

Cross Functional Drivers

1. INFORMATION DRIVER:

PSO is a leader in this use of the information driver to improve responsiveness and decrease inventory investment. PSO demanded information across the supply chain to suppliers who manufacture only what is being demanded. It uses Electronic Data Interchange ERP software in the computers of DCs and in the PCs of warehouses and in the PCs of manufacturing sites. As the inventory reaches the minimum level at DC automatically mail sent to nearly storage depot, and if the inventory reaches the minimum level at storage depot automatically mail sent to manufacturing site, and tank lorry leave for the providing the inventory to depots.

2. SOURCES DRIVER:

PSO increases the efficiency and responsiveness because it has its own refineries and the pipeline which is laid from Karachi to Mehmoodkot and furthermore PSO has its strong backup of sourcing. so K&Ns achieve economies of scale so efficiency increases. And the availability of material at any time increases the responsiveness.

3. PRICING DRIVER:

PSO focuses on the stable prices for high quality of products.

FRAMEWORK FOR STRUCTURING DRIVERS Of Caltex

Caltex uses three logistics and three cross functional drivers efficiently to achieve supply chain performance align with its competitive strategy.

1. INVENTORY DRIVER:

Caltex maintains responsive supply chain by keeping high levels of inventory because of the inventory/units provide as the demand forecasted because it provide all type of products with their DCs to meet the customers order. And Caltex produce product for individual consumer by anticipation of demand. Thats why it has to keep every type of product in its DCs and responsiveness automatically with increases.

1. TRANSPORTATION DRIVER:

Caltex runs its own fleets to keep responsiveness high. Because Caltex is a multinational company and have heavy infrastructure with required resources. This increase transportation cost, but improved product. Because as the electronic order received from its warehouses truck leave for delivery of products to the warehouses.

2. FACILITY DRIVER:

MENU uses centrally located DCs within its network of stores to decrease the number of facilities and increase efficiency at each DC. MENU not just builds its own stores but also provide the products of big retail stores in the big cities like metro cash & carry and makro in Lahore etc, only where the demand is sufficient to justify having several of them supported by a DC.

Caltexs supply chain, comprising refining, supply and distribution, again provided a foundation for the success of the overall business. This robust, integrated system encompasses crude and product purchasing, refining and distribution to our terminals and ultimately to our customer. Caltexs supply chain is safe and reliable and continually being improved in response to the needs of our customers and to capture efficiency. REFINING Caltex owns two of the seven refineries in Australia and these two refineries account for almost a third of Australias total refining capacity. Caltexs Kurnell and Lytton refineries refine crude oil into petrol, diesel, jet fuel and base oils for lubricants and many specialty products, such as liquid petroleum gas and bitumen. Both refineries enjoyed strong operational performance during 2009 with no significant unplanned refinery shutdowns. Average refinery utilisation for the year was 75.3%, compared with 73.9% in 2008, and total production of petrol, diesel and jet fuel was 10.2 billion litres, compared with 9.8 billion litres in 2008. The second diesel hydrotreater at Lytton refinery, successfully commissioned in July 2009 without incident, was the key growth initiative for refining and supports Caltexs diesel growth strategy. It is producing Australian grade 10ppm sulfur diesel. In addition to improved reliability in 2009, refining also made significant improvements in environmental and safety performance. The health and safety of our employees, refinery reliability and operational excellence at all levels is paramount.

Caltex remains cognisant of the need to invest capital to address risk and reliability in refining. During 2009, two planned turnarounds and inspections were carried out. One major planned turnaround was undertaken at Lytton refinery. The second turnaround was conducted on the fluid catalytic cracking unit at the Kurnell refinery. Planned turnarounds and inspections are an essential risk mitigation tool for Caltex. Another major plant turnaround at Lytton refinery is planned for the second quarter of 2010. The Caltex Refiner Margin averaged US$5.95 per barrel in 2009, compared with US$10.27 per barrel in 2008. This equates to 5.05 Australian cents per liter in 2009, compared with 7.88 Australian cents per litre in 2008. The lower Caltex Refiner Margin is a result of the higher Australian dollar and the lower Singapore refiner margin in the second half of 2009. SUPPLY An effective and efficient source of supply is critical to Caltexs success as a fuel marketer. Caltex prides itself on its integrated supply chain from crude to customer and is committed to being a reliable and efficient supplier across Australia. The supply team is responsible for acquiring crude oil for the Caltex refineries and does this through strong relationships with Chevron and other Australian and international crude producers. The supply team has successfully developed a range of efficient shipping alternatives, including the economical importing of West African crude oils. Over 72 million barrels of crude were sourced by Caltex in 2009, in line with 2008. Australia is a significant net importer of finished petroleum products with more than one in four litres of fuel consumed in Australia currently imported. In addition to fuels produced by our own refineries, Caltex markets are also supplied by product purchased from other Australian refineries and international refineries, primarily those in Singapore and North Asia, although some cargoes have been sourced from refineries as far away as Europe. This requirement for international product is expected to grow as demand from existing and new Caltex customers increases. The product acquired from this diverse supply chain secures supply to Caltexs own marketing business and provides efficient supply to other major oil companies in New South Wales and Queensland.

DISTRIBUTION Caltex operates 12 storage terminals across Australia. We also have access to product supply at a further 12 terminals. From these 24 terminals at key locations around Australia, Caltex delivers product to customers via its own truck fleet and the fleets of approved and accredited third party contractors. In order to efficiently and sufficiently supply across Australia as demand increases, Caltex has been undertaking terminal upgrades. The upgrade project at Mackay was completed and the terminal now has an additional 27 million litres of tankage capacity and additional truck loading capability. This new infrastructure allows Caltex to improve both supply chain economics and flexibility and strengthens the link between North Queensland and the new diesel hydrotreater at Lytton. Other projects to strengthen the supply chain network and widen the Caltex product range in key growth areas, including expanded truck loading facilities in Gladstone and biodiesel and E10 distribution facilities and infrastructure for premium Vortex petrols and diesels, were completed in a number of Caltex terminals. During 2009, the Teekay-owned vessel, the Barrington, was replaced by theAlexander Spirit. The 20 year old Barrington, which was built for Caltex, had been managed by Teekay since Caltex sold the Caltex Tanker Company to Teekay in 1997. The new vessel, the Alexander Spirit, is a larger modern vessel and will carry more product for Caltex at higher speed. This, together with the expanded Lytton diesel production and the diesel tank at Mackay, provides further efficiencies, reliability and capability in the supply chain along the Queensland coast in support of our customers. The product vessels that operate for Caltex on the Australian coast play a vital role in linking our refineries in Sydney and Brisbane to Caltex markets around Australia, especially the North Queensland markets, increasing our capability to efficiently service the rapid growth in the Bowen Basin mining area. A reorganisation of the supply and distribution business area was completed in the first half of 2009. The reorganisation was designed to put greater emphasis on increasing the capability and efficiency of our operation while accelerating required progress on operational excellence. Within the wider supply and distribution business area, a dedicated supply chain optimisation team has been formed to drive future capability and efficiency improvements across the whole

supply chain to ensure that the Caltex supply chain is competitive in major markets and strategic growth areas. FUTURE FOCUS As Caltex continues to enhance and build upon the strengths of its integrated supply chain, operational excellence will remain a focus. We have an unwavering commitment to continually provide our customers with safe, reliable and environmentally sound product and services and our employees with a safe and secure working environment.

You might also like

- Shamim & Co. internship reportDocument26 pagesShamim & Co. internship reportShani ChaudharyNo ratings yet

- Logo BZ - UniversityDocument1 pageLogo BZ - UniversityShani ChaudharyNo ratings yet

- Guidelines For The Project The Integrated Marketing Communication PlanDocument4 pagesGuidelines For The Project The Integrated Marketing Communication PlanShani ChaudharyNo ratings yet

- Globalization Impact On Pak EconomyDocument5 pagesGlobalization Impact On Pak EconomyShani ChaudharyNo ratings yet

- Ethics in Military and Civilian Software DevelopmentDocument10 pagesEthics in Military and Civilian Software DevelopmentShani ChaudharyNo ratings yet

- Zhimin Mao AbstractDocument3 pagesZhimin Mao AbstractShani ChaudharyNo ratings yet

- Fauji Fertilizer CoDocument18 pagesFauji Fertilizer CoShani ChaudharyNo ratings yet

- Lda AdvertisementDocument2 pagesLda AdvertisementShani ChaudharyNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewShani ChaudharyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DBB2104 Unit-08Document24 pagesDBB2104 Unit-08anamikarajendran441998No ratings yet

- Retail MCQ ModuleDocument19 pagesRetail MCQ ModuleBattina AbhisekNo ratings yet

- Live Case Study - Lssues For AnalysisDocument4 pagesLive Case Study - Lssues For AnalysisNhan PhNo ratings yet

- Sample Assignment 1-1Document20 pagesSample Assignment 1-1Nir IslamNo ratings yet

- FMCG Sales Territory ReportDocument21 pagesFMCG Sales Territory ReportSyed Rehan Ahmed100% (3)

- Information Sheet For Real Estate Client Template-68109Document3 pagesInformation Sheet For Real Estate Client Template-68109Oscar Forradellas CasabonNo ratings yet

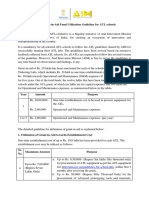

- Grant-In-Aid Fund Utilization GuidelineDocument5 pagesGrant-In-Aid Fund Utilization GuidelineBiswambharLayekNo ratings yet

- School Improvement Plan - Enabling MechanismsdocxDocument4 pagesSchool Improvement Plan - Enabling MechanismsdocxKilangi Integrated SchoolNo ratings yet

- Factors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryDocument17 pagesFactors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryaleneNo ratings yet

- ROSHNI RAHIM - Project NEWDocument37 pagesROSHNI RAHIM - Project NEWAsif HashimNo ratings yet

- TUTDocument2 pagesTUTNadia NatasyaNo ratings yet

- Introduction To Oil Company Financial Analysis - CompressDocument478 pagesIntroduction To Oil Company Financial Analysis - CompressRalmeNo ratings yet

- Assignment Ishan SharmaDocument8 pagesAssignment Ishan SharmaIshan SharmaNo ratings yet

- ACCA F5 Introduction To The PaperDocument4 pagesACCA F5 Introduction To The Paperalimran77No ratings yet

- BCG Matrix ModelDocument10 pagesBCG Matrix ModelGiftNo ratings yet

- Procurement Manager - Projects - Swiber Offshore Construction Pte LTDDocument2 pagesProcurement Manager - Projects - Swiber Offshore Construction Pte LTDparthibanemails5779No ratings yet

- Trade Discount and Trade Discount Series.Document31 pagesTrade Discount and Trade Discount Series.Anne BlanquezaNo ratings yet

- SERVICE QUALITY AND MEASUREMENT SEM 6 CH 1-Ilovepdf-CompressedDocument16 pagesSERVICE QUALITY AND MEASUREMENT SEM 6 CH 1-Ilovepdf-CompressedDj kakaNo ratings yet

- Practice 1Document5 pagesPractice 1huynhtronghieu060605No ratings yet

- Introduction To HRM (Supplementary Note) : (Type Text)Document11 pagesIntroduction To HRM (Supplementary Note) : (Type Text)Gajaba GunawardenaNo ratings yet

- Securities and Exchange Commission: Sec Form 17-QDocument3 pagesSecurities and Exchange Commission: Sec Form 17-QJamil MacabandingNo ratings yet

- Social Entrepreneurship Success Story of Project SukanyaDocument4 pagesSocial Entrepreneurship Success Story of Project SukanyaHimanshu sahuNo ratings yet

- The Scope and Method of EconomicsDocument23 pagesThe Scope and Method of EconomicsSyifa034No ratings yet

- School Year 2021 ScheduleDocument35 pagesSchool Year 2021 ScheduleThảo NgọcNo ratings yet

- Airbus A3XX PowerpointDocument31 pagesAirbus A3XX PowerpointRashidNo ratings yet

- Risk and Return 2Document2 pagesRisk and Return 2Nitya BhakriNo ratings yet

- Nepal COSDocument45 pagesNepal COSLeo KhkNo ratings yet

- Standard ISO Response Codes PDFDocument3 pagesStandard ISO Response Codes PDFwattylaaNo ratings yet

- Job Desc - Packaging Dev. SpecialistDocument2 pagesJob Desc - Packaging Dev. SpecialistAmirCysers100% (1)

- Review LeapFrogDocument2 pagesReview LeapFrogDhil HutomoNo ratings yet